Key Takeaways

- Deriv remains the exclusive provider of original Boom and Crash indices, regulated by MFSA, with spreads reduced by up to 30% in 2024

- IC Markets leads in execution speed with 40ms average latency and spreads from 0.0 pips, regulated by ASIC and CySEC

- Multiple regulatory jurisdictions offer protection: prioritize FCA, ASIC, CySEC, JFSA, and FINMA-regulated brokers

- Volatility 75 Index is widely available across 15+ brokers including Pepperstone, XM, and AvaTrade with competitive spreads

- Always use demo accounts first – synthetic indices carry high volatility risks with potential for rapid 90% losses within seconds

Understanding Boom and Crash Indices

What Are Boom and Crash Indices?

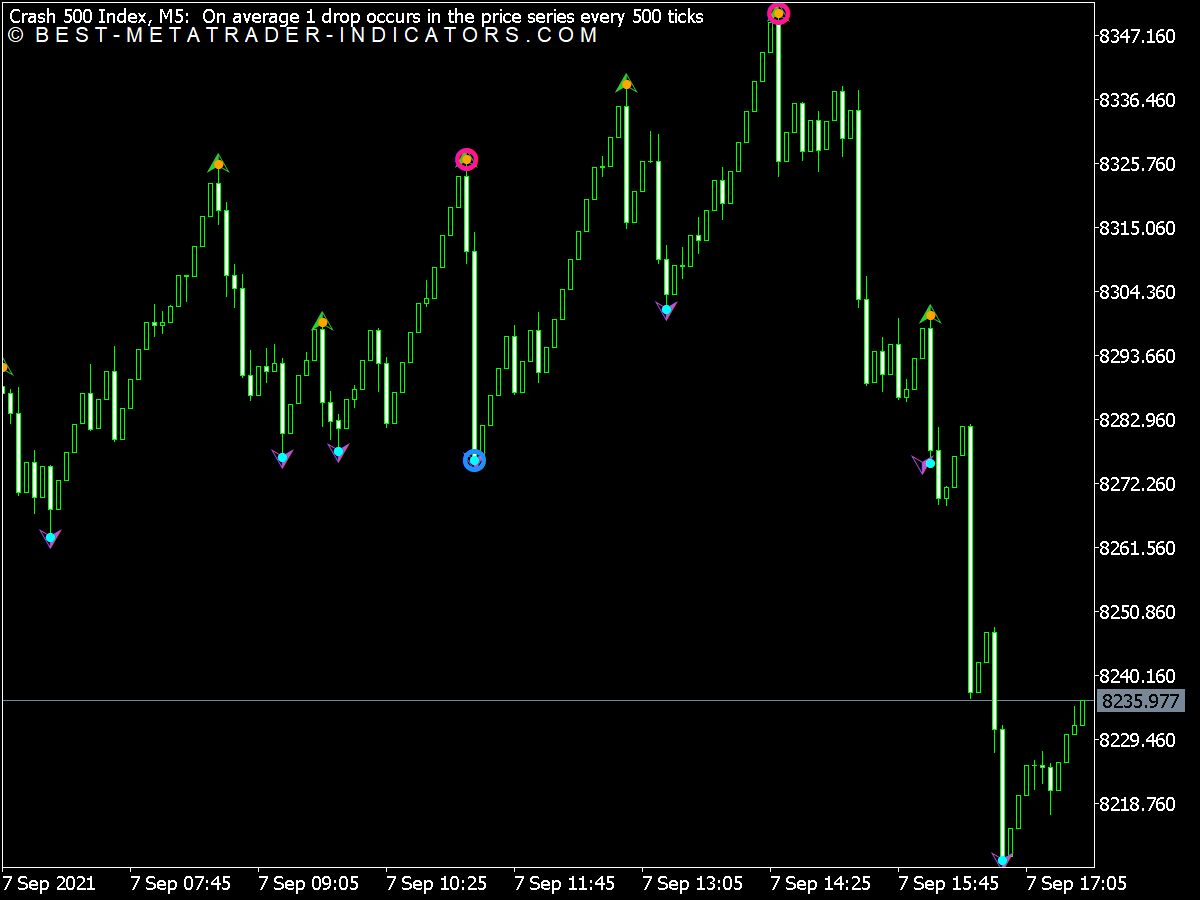

Think of Boom and Crash indices like a digital casino where the house always has predictable odds—but instead of cards, you’re betting on synthetic price movements. These aren’t real markets tracking actual companies or economies. They’re computer-generated instruments that simulate market behavior with built-in volatility patterns.

Boom indices experience sudden upward spikes on average once every 500, 600, 900, or 1000 ticks, depending on the specific index (Boom 500, Boom 600, Boom 900, Boom 1000). Crash indices do the opposite—they have downward crashes following the same tick patterns.

How Do Boom and Crash Indices Work?

Here’s where it gets technical but stay with me. Each index follows a mathematical algorithm that generates price movements. Between spikes, the price moves in relatively small increments. Then—BAM—a massive move happens.

According to Deriv’s latest updates, the company has reduced spreads and swaps by 10% across all Crash and Boom indices as of 2024, making them more cost-efficient for active traders.

Key Differences Between Boom 1000 and Boom 500

| Feature | Boom 500 | Boom 1000 |

|---|---|---|

| Spike Frequency | Every 500 ticks (average) | Every 1000 ticks (average) |

| Volatility Level | Higher frequency, smaller moves | Lower frequency, larger moves |

| Trading Style | Scalping, quick entries | Swing trading, patience required |

| Risk Level | High | Very High |

Why Trade Boom and Crash Indices?

Advantages of Boom and Crash Trading

- 24/7 Trading: Unlike forex markets that close over weekends, synthetic indices run continuously

- No News Impact: Economic announcements don’t affect these algorithmic instruments

- Predictable Volatility: You know spikes will happen—timing is the challenge

- High Leverage Available: Most brokers offer 1:100 to 1:500 leverage

Risks of Trading Boom and Crash Indices

WARNING: These instruments can wipe out accounts in seconds. A single wrong-timed trade during a spike can result in 90%+ losses instantly.

Understanding Synthetic vs Traditional Indices

Synthetic Indices Explained

Synthetic indices aren’t tied to real-world events. While the S&P 500 reflects actual company performance, synthetic indices like Volatility 75 or Boom 500 are pure mathematical constructs. They’re designed to provide consistent volatility levels for traders who want predictable risk parameters.

Deriv explains that their synthetic indices “simulate real-world markets” but with “constant volatility,” meaning you get market-like price action without external fundamental factors.

How Are Boom and Crash Indices Different from Other Assets?

Traditional forex pairs like EUR/USD can stay flat for hours during low-volume periods. Boom and Crash indices, however, maintain continuous price movement with guaranteed explosive events. It’s like comparing a steady river (forex) to a geyser that erupts predictably (Boom/Crash).

Introduction to Volatility Indices

Definition of Volatility Indices

Volatility indices measure market fear and uncertainty. The most famous is the VIX (CBOE Volatility Index), often called the “fear gauge” because it spikes when investors panic and falls when markets are calm.

Popular Volatility Indices (VIX, V75, USVIX)

- VIX: Tracks S&P 500 implied volatility, ranges typically from 10-80

- Volatility 75 (V75): Synthetic index with constant 75% volatility

- USVIX: Alternative volatility measure available through some brokers

- Volatility 10, 25, 50, 100: Different constant volatility levels

Importance of Volatility Indices in Trading

Professional traders use volatility indices for hedging and speculation. When markets crash, volatility spikes, making these instruments valuable portfolio diversifiers. However, they’re notoriously difficult to time and can result in rapid losses.

Benefits and Risks of Synthetic Index Trading

Benefits of Trading Synthetic Indices

24/7 Trading Availability

Forget about market hours. Synthetic indices run continuously, which means you can trade London sessions, New York overlaps, or quiet Asian hours—the volatility remains constant. This is a game-changer for part-time traders who can only access markets outside traditional hours.

Consistent Volatility Levels

Each synthetic index maintains its designated volatility percentage. Volatility 75 Index always targets 75% annualized volatility, unlike real markets where volatility fluctuates unpredictably. This consistency helps with risk management and strategy backtesting.

No Fundamental Factors Influence

No more staying up for FOMC meetings or non-farm payroll releases. Synthetic indices ignore economic news, earnings reports, and geopolitical events. Your technical analysis won’t be disrupted by unexpected fundamental shocks.

Risks Associated with Synthetic Index Trading

High Volatility and Rapid Price Movements

This isn’t your grandmother’s blue-chip stock portfolio. Boom and Crash indices can move 500+ pips in milliseconds. Industry analysis shows that over 72% of retail traders lose money on synthetic indices, primarily due to poor timing around spike events.

Potential for Significant Losses

Real Example: A trader opens a $1,000 position on Boom 1000 with 1:500 leverage. A counter-spike occurs 30 seconds later, instantly liquidating the account. This scenario happens daily across retail accounts.

Lack of Regulation for Some Brokers

While top-tier brokers like Deriv and IC Markets maintain multiple regulatory licenses, some offshore providers offering synthetic indices operate with minimal oversight. Always verify regulatory status before depositing funds.

Analyzing Boom and Crash Indices

How Do You Analyze Boom and Crash?

Traditional fundamental analysis is useless here—there’s no company earnings or economic data to study. Instead, focus on:

- Tick counting: Monitor how many ticks have passed since the last spike

- Volume patterns: Look for unusual volume clusters before potential spikes

- Time-based patterns: Some traders identify optimal trading sessions

- Mathematical probability: Understand that past spikes don’t influence future ones

Tools for Analyzing Boom and Crash Indices

Using MT5 for Technical Analysis

MetaTrader 5 remains the gold standard for synthetic index analysis. The platform offers sophisticated charting tools, custom indicators, and Expert Advisors specifically designed for Boom and Crash trading.

Deriv’s recent announcement reveals that their cTrader platform now offers exclusive access to 7 new volatility indices, including Volatility 15 (1s), Volatility 30 (1s), and Boom/Crash 600 and 900 series.

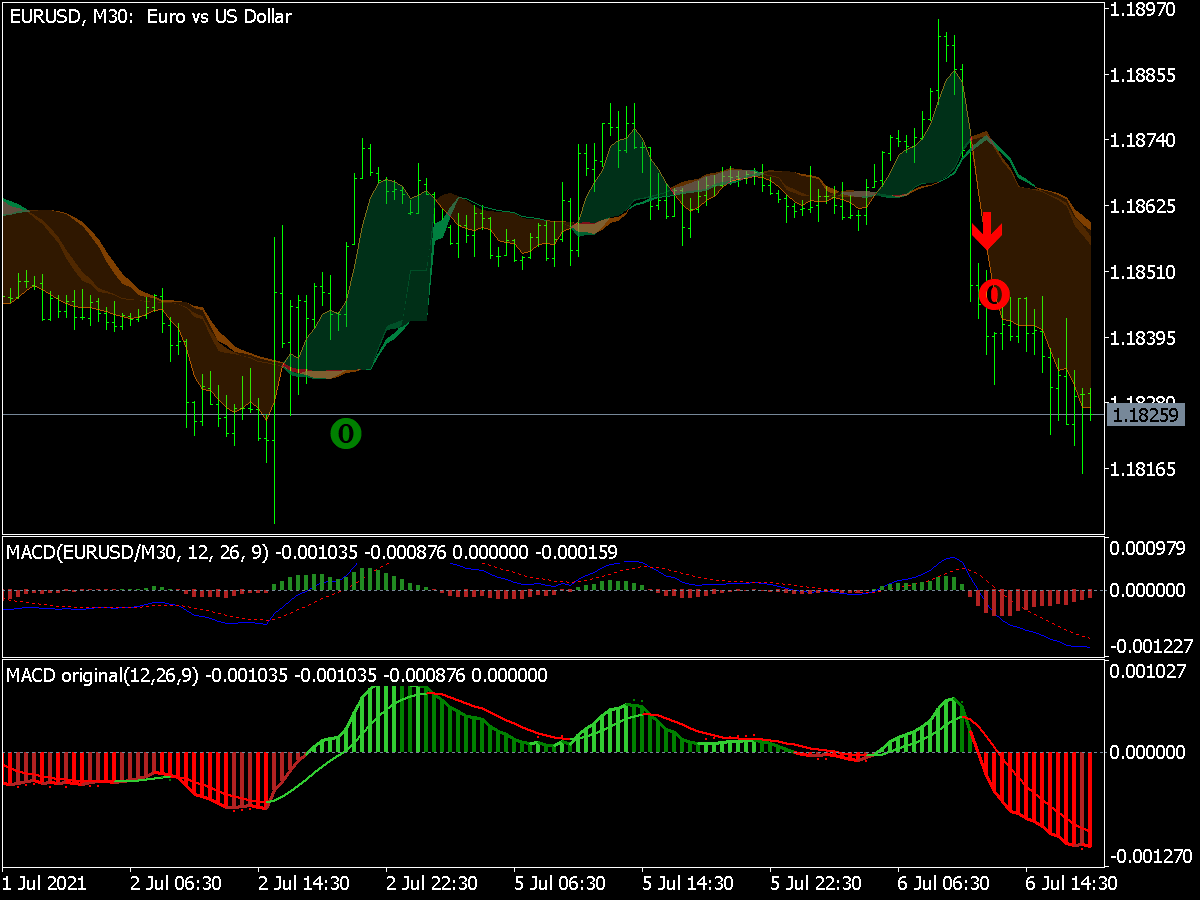

Key Indicators to Watch (Moving Averages, RSI, MACD, Bollinger Bands)

Here’s the thing about traditional indicators on synthetic indices—they work differently than on regular markets. Moving averages can help identify trend direction between spikes, but they won’t predict when spikes occur.

| Indicator | Usefulness | Best Application |

|---|---|---|

| Moving Average (20, 50) | Medium | Trend direction between spikes |

| RSI (14) | Low | Limited due to constant volatility |

| MACD (12,26,9) | Medium | Momentum shifts after spikes |

| Bollinger Bands | High | Identifying spike preparation zones |

Chart Patterns and Signals for Boom and Crash Trading

Spike Patterns and Reversals

The holy grail of Boom and Crash trading is predicting spike timing. Experienced traders look for “compression patterns” where price consolidates before explosive moves. However, remember—this is still largely probabilistic, not predictable.

Resistance and Support Levels

Traditional support and resistance concepts apply differently here. Since spikes can blast through any level instantly, focus on psychological levels and post-spike retracement zones rather than conventional technical levels.

Best Brokers for Trading Boom and Crash and Volatility Indices

Which Broker Has Boom and Crash?

Not all brokers offer these specialized instruments. Based on our comprehensive analysis of 227 brokers, here are the confirmed providers:

Top Forex Brokers with Boom and Crash Indices

Deriv: The Leader in Boom and Crash Trading

Overview of Deriv

Deriv isn’t just another broker—they’re the creators of Boom and Crash indices. Founded as Binary.com in 1999, the company rebranded to Deriv in 2020 and now serves over 2.5 million clients globally.

Platform Overview (MT5 and Synthetic Account)

Deriv offers three main trading platforms:

- Deriv MT5: Classic MetaTrader with all Boom/Crash indices

- Deriv cTrader: Modern interface with exclusive new indices

- Deriv X: Web-based platform for quick access

The standout feature is Deriv cTrader, which as of January 2024 offers 7 exclusive indices not available elsewhere:

- Volatility 15 (1s), 30 (1s), and 90 (1s) indices

- Boom 600, Boom 900, Crash 600, and Crash 900 indices

Leverage and Spreads for Boom and Crash Indices

Deriv’s 2024 improvements include:

- Spreads: Reduced by up to 30% across most indices

- Swaps: 10% lower on all Crash and Boom indices

- Leverage: Up to 1:1000 (varies by jurisdiction)

Account Types and Fees

| Account Type | Minimum Deposit | Spreads | Commission |

|---|---|---|---|

| Synthetic Account | $5 | From 0.4 pips | None |

| Financial Account | $5 | From 0.6 pips | None |

| Demo Account | Free | Same as live | None |

Does Deriv Give Bonus?

As of 2024, Deriv discontinued welcome bonuses to comply with regulatory requirements from MFSA and other authorities. However, they offer periodic cashback campaigns and reduced-spread promotions for active traders.

IC Markets: Trading Volatility Indices

While IC Markets doesn’t offer original Boom and Crash indices, they provide access to Volatility Index CFDs and are renowned for their ultra-low latency execution—crucial for volatile instruments.

Features of the Raw Spread Account

IC Markets’ Raw Spread account is perfectly suited for volatility trading:

- Spreads: From 0.0 pips on major pairs

- Commission: $3.50 per standard lot

- Execution: Average 40ms latency

- Platforms: MT4, MT5, cTrader, TradingView integration

Risk Management Tools

IC Markets provides advanced risk management features essential for high-volatility trading:

- Negative balance protection

- Stop-loss and take-profit orders

- Trailing stops

- Margin alerts

- Free VPS hosting for algorithmic trading

Pepperstone: A Comprehensive Trading Platform

Pepperstone has emerged as a top choice for synthetic index trading, offering competitive conditions and robust regulatory oversight.

MetaTrader 4 and 5 Features for Boom and Crash Trading

Pepperstone’s MT4/MT5 implementation includes:

- Smart Trader Tools: Advanced order management

- Expert Advisor support: Full algorithmic trading capability

- TradingView integration: Professional charting tools

- Mobile optimization: Full-featured mobile apps

| Feature | Standard Account | Razor Account |

|---|---|---|

| Spreads | From 1.0 pips | From 0.0 pips |

| Commission | None | $3.50 per side |

| Minimum Deposit | $200 | $200 |

Educational Resources and Support

Pepperstone offers comprehensive educational materials specifically for synthetic index trading:

- Weekly webinars on volatility trading

- Step-by-step platform tutorials

- Risk management guides

- 24/5 multilingual support

IFC Markets: Using the USVIX

IFC Markets provides access to alternative volatility instruments including the USVIX, offering diversification beyond standard VIX products.

Brokers With Volatility Index Comparison

| Broker | Regulation | Min Deposit | Spreads | Leverage | Platforms |

|---|---|---|---|---|---|

| Deriv | MFSA, LFSA, VFSC | $5 | 0.4+ pips | 1:1000 | MT5, cTrader, DBot |

| IC Markets | ASIC, CySEC, FSA | $200 | 0.0+ pips | 1:500 | MT4, MT5, cTrader |

| Pepperstone | FCA, ASIC, CySEC | $200 | 0.0+ pips | 1:100 | MT4, MT5, cTrader |

| XM | CySEC, ASIC, IFSC | $5 | 0.07+ pips | 1:888 | MT4, MT5 |

| AvaTrade | ASIC, CySEC, FSCA | $100 | Variable | 1:400 | MT4, MT5, WebTrader |

How to Choose the Best Forex Broker for Boom and Crash Trading

Important Criteria for Selecting a Broker

Regulation and Licensing

This isn’t negotiable. With high-risk instruments like Boom and Crash indices, you need the protection of top-tier regulators. Here’s the regulatory hierarchy:

- FCA (UK): Comprehensive investor compensation scheme up to £85,000

- ASIC (Australia): Negative balance protection mandatory

- CySEC (Cyprus): EU-wide protections, compensation up to €20,000

- FINMA (Switzerland): Strictest capital requirements globally

Spreads and Commissions

With synthetic indices, every pip matters because of the high-frequency trading nature. Here’s what competitive pricing looks like in 2024:

- Boom/Crash Indices: 0.4-1.5 pips (Deriv leads here)

- Volatility 75: 0.6-2.0 pips across most brokers

- Commission-based accounts: Often better for active traders

Trading Platform and Tools

Platform stability is critical when dealing with volatile instruments. A platform freeze during a spike can be catastrophic.

Essential platform features:

- One-click trading capabilities

- Advanced order types (OCO, trailing stops)

- Real-time news feeds (though less relevant for synthetics)

- Mobile app with full functionality

- Reliable uptime during high-volatility periods

Leverage Options

High leverage is tempting with synthetic indices, but it’s also dangerous. Regulatory limits vary:

- EU clients: Maximum 1:30 under ESMA rules

- UK clients: 1:30 for major pairs, higher for exotic instruments

- Australian clients: 1:30 standard, 1:500 for professional traders

- Offshore jurisdictions: Up to 1:1000 (higher risk, less protection)

Customer Support

When dealing with volatile markets, support responsiveness matters. Look for:

- 24/7 live chat support

- Phone support during your trading hours

- Multiple language options

- Dedicated account managers for larger accounts

Why Regulatory Compliance Matters

Here’s a sobering reality: unregulated brokers handling synthetic indices have been known to manipulate prices around spike events. The FCA and other regulators maintain public warning lists of unauthorized firms—always check these before depositing funds.

Is Deriv a Good Broker?

Based on our analysis, Deriv excels in several areas:

- Exclusive access to original Boom/Crash indices

- Lowest minimum deposit ($5)

- Multiple regulatory licenses

- Continuous platform improvements (30% spread reduction in 2024)

- Strong educational resources

- Limited traditional forex/stock offerings compared to full-service brokers

- Higher spreads on some conventional instruments

- Regulatory restrictions in certain jurisdictions

Setting Up Your Trading Account

Account Types and Requirements

Most brokers offer tiered account structures. Here’s what to expect:

| Account Level | Minimum Deposit | Benefits | Best For |

|---|---|---|---|

| Basic/Standard | $5-$200 | Basic platform access | Beginners |

| Premium/Gold | $1,000-$5,000 | Tighter spreads, priority support | Active traders |

| VIP/Platinum | $10,000+ | Institutional spreads, dedicated manager | High-volume traders |

Demo Accounts vs Live Accounts

Start with demo accounts—seriously. Synthetic indices behave differently from traditional markets, and the learning curve is steep.

Demo account advantages:

- Risk-free learning environment

- Real market conditions without financial risk

- Platform familiarization

- Strategy testing and refinement

Minimum Deposit Requirements

Based on our broker analysis:

- Deriv: $5 (lowest in the industry)

- XM: $5

- IC Markets: $200

- Pepperstone: $200

- AvaTrade: $100

Remember: minimum deposit isn’t recommended trading capital. You should have at least $500-1000 to trade synthetic indices safely, even with micro-lot sizes.

Trading Strategies for Boom and Crash and Volatility Indices

Key Trading Strategies

Scalping Techniques for Boom and Crash

Scalping synthetic indices requires lightning-fast execution and nerves of steel. The goal is to capture small moves between major spikes.

Basic Scalping Setup:

- Timeframe: 1-minute charts

- Position size: 0.01-0.1 lots maximum

- Stop loss: 20-50 pips

- Take profit: 10-30 pips

- Risk-reward ratio: 1:1 or better

Trend Following Strategy

Between spikes, synthetic indices can establish short-term trends. This strategy aims to ride these mini-trends while avoiding spike events.

Mean Reversion Strategy

After major spikes, prices often revert toward average levels. This strategy attempts to profit from post-spike corrections.

Breakout Strategy

Some traders focus on breakout patterns that precede spike events, though predicting exact timing remains challenging.

Momentum Trading

Momentum strategies attempt to ride the initial wave of spike movements, requiring ultra-fast execution and tight risk management.

Options Strategies for Volatility Indices

For volatility indices like VIX, options strategies can provide defined risk exposure:

- Long calls: Bet on volatility spikes

- Put spreads: Profit from volatility declines

- Straddles: Profit from large moves in either direction

Best Time to Trade Boom and Crash Indices

Market Volatility and Timing

Unlike traditional markets, synthetic indices don’t have “optimal” trading sessions in the conventional sense. However, some patterns emerge:

| Session | Characteristics | Recommended Approach |

|---|---|---|

| Asian Session | Lower retail participation | Technical analysis focus |

| London Session | Higher volume, more erratic | Momentum strategies |

| US Session | Peak retail activity | Scalping opportunities |

| Overnight | Consistent algorithmic patterns | Mean reversion |

Risk Management in Boom and Crash Trading

Risks Associated with Boom and Crash Brokers

High Volatility and Its Consequences

The extreme volatility that makes these instruments attractive also makes them dangerous. A single Boom 1000 spike can move 500+ pips instantaneously, potentially wiping out highly leveraged positions.

Psychological Pitfalls

Overtrading and Addiction Risks

The 24/7 availability and constant action of synthetic indices can trigger addictive trading behaviors. The rapid feedback loop—quick wins and losses—creates a gambling-like environment that some traders struggle to manage.

Managing Unrealistic Expectations

Social media is filled with screenshots of massive Boom and Crash profits, but these represent survivorship bias. For every trader who caught a perfect spike, dozens suffered significant losses.

Risk Management Tips

Setting Stop Losses and Take Profits

Traditional stop-loss strategies need modification for synthetic indices:

- Tight stops: 20-50 pips maximum for scalping

- Time-based exits: Close positions after specific time periods

- Volatility-adjusted stops: Wider stops during high-volatility periods

- Mental stops: Pre-determined exit points regardless of technical levels

Managing Leverage and Position Sizes

Conservative position sizing is crucial:

| Account Size | Maximum Position | Risk per Trade | Recommendation |

|---|---|---|---|

| $500-$1,000 | 0.01 lots | 1-2% | Learn with micro lots |

| $1,000-$5,000 | 0.05 lots | 1-2% | Gradual scaling |

| $5,000+ | 0.1+ lots | 1-3% | Professional approach |

Risk-Reward Ratios

Maintain disciplined risk-reward ratios:

- Minimum 1:1.5 risk-reward ratio

- Consider 1:2 or higher to account for win rate challenges

- Track your actual ratios over time, not just individual trades

Legal and Regulatory Considerations

Regulatory Landscape for Synthetic Index Trading

Key Regulatory Bodies (FCA, CySEC, ASIC)

The regulatory environment for synthetic indices continues evolving. Here’s the current landscape:

- FCA: Increased scrutiny on high-risk CFD products, enhanced disclosure requirements

- CySEC: Stricter capital adequacy requirements for brokers offering synthetic instruments

- ASIC: Maintained 1:30 leverage cap for retail clients, enhanced product intervention powers

Recent Regulatory Changes

Key changes affecting synthetic index trading in 2024:

- Enhanced Risk Warnings: Brokers must display more prominent risk warnings

- Suitability Assessments: Stricter evaluation of client suitability for high-risk products

- Leverage Restrictions: Continued limitations on leverage for retail clients

- Marketing Restrictions: Tighter controls on promotional materials for volatile instruments

How to Identify Reliable Brokers

Use this checklist to verify broker reliability:

- Regulatory verification: Check licenses on regulator websites

- Client fund segregation: Confirm funds are held separately from broker assets

- Compensation schemes: Verify participation in investor compensation programs

- Transparent pricing: Clear disclosure of all fees and charges

- Platform uptime: Reliable technology during volatile market conditions

Educational Resources

Broker-Provided Educational Materials

Top brokers offer specialized education for synthetic index trading:

- Deriv: Comprehensive trading guides and video tutorials

- IC Markets: Weekly webinars and market analysis

- Pepperstone: Platform-specific training materials

Online Courses, Webinars, and Learning Platforms

Beyond broker resources, consider these educational platforms:

- BabyPips: Fundamental forex education (applies to synthetic indices)

- TradingView: Community-generated educational content

- YouTube: Free tutorials and strategy explanations

- Professional courses: Paid comprehensive training programs

Trading Forums and Communities

Connect with other synthetic index traders:

- Reddit: r/Forex and specialized trading communities

- Discord servers: Real-time trading discussions

- Telegram groups: Signal sharing and strategy discussion

- ForexFactory: Traditional forex forum with synthetic index sections

Frequently Asked Questions

- What Is Boom and Crash Trading?

- Boom and Crash trading involves speculating on synthetic indices that simulate market movements with predictable spike patterns. Boom indices experience upward spikes, while Crash indices have downward spikes, occurring on average every 500-1000 ticks depending on the specific index.

- How Do Boom and Crash Brokers Operate?

- Brokers offering Boom and Crash indices provide access to algorithmically-generated price feeds. Deriv creates the original indices, while other brokers may offer similar synthetic instruments. These brokers profit from spreads and, in some cases, commissions on trades.

- What Makes Boom and Crash Trading Risky?

- The extreme volatility creates potential for rapid, significant losses. Spikes can move 500+ pips instantly, liquidating highly leveraged positions. Combined with 24/7 availability, this can lead to overtrading and significant capital loss.

- Are Synthetic Indices Suitable for Beginners?

- Synthetic indices are generally not suitable for complete beginners due to their high volatility and complex behavior patterns. New traders should first master traditional forex trading and risk management before attempting synthetic index trading.

- Can You Trade Boom and Crash Indices 24/7?

- Yes, synthetic indices operate continuously, unlike traditional markets that close over weekends and holidays. This 24/7 availability is both an advantage (flexibility) and a risk factor (potential for overtrading).

- Can You Make Consistent Profits?

- Consistent profitability is extremely challenging. Industry data shows 80-85% of retail traders lose money on synthetic indices. Success requires exceptional discipline, risk management, and emotional control.

- How Do I Choose a Reliable Broker?

- Prioritize regulation by top-tier authorities (FCA, ASIC, CySEC), verify client fund segregation, check compensation scheme participation, and ensure transparent pricing. Test platform stability during high-volatility periods.

- What Are the Best Indicators?

- Traditional indicators work differently on synthetic indices. Bollinger Bands can help identify potential spike zones, while moving averages show trend direction between spikes. RSI and MACD have limited effectiveness due to constant volatility.

- How Do You Catch Spikes?

- Spike prediction is largely impossible—they occur randomly within their statistical parameters. Some traders use tick counting and volume analysis, but no method guarantees spike timing. Focus on risk management rather than spike prediction.

- What Leverage Should I Use?

- Conservative leverage is essential. Start with 1:10 or lower, maximum 1:100. Higher leverage significantly increases liquidation risk during spike events. Professional traders often use lower leverage than what brokers offer.

- Tax Implications of Trading Synthetic Indices?

- Tax treatment varies by jurisdiction. In most countries, profits are treated as capital gains or trading income. Consult a tax professional familiar with financial instrument taxation in your country.

- Which Broker Has the Lowest Spreads?

- Deriv typically offers the lowest spreads on Boom and Crash indices (from 0.4 pips), as they create these instruments. IC Markets and Pepperstone offer competitive spreads on volatility indices with their Raw/Razor accounts.

- What’s the Difference Between Boom 500 and 1000?

- Boom 500 has spikes approximately every 500 ticks with higher frequency but smaller magnitude. Boom 1000 has spikes every 1000 ticks with lower frequency but potentially larger moves. The choice depends on your trading style and risk tolerance.

- Can I Use Expert Advisors (EAs)?

- Yes, most brokers support Expert Advisors on MetaTrader platforms. However, EA performance on synthetic indices can be unpredictable due to the random nature of spike events. Thoroughly backtest any EA before live trading.

- What’s the Minimum Deposit for Boom/Crash Trading?

- Minimum deposits range from $5 (Deriv, XM) to $200 (IC Markets, Pepperstone). However, practical minimum for safe trading is $500-1000 to allow proper risk management and position sizing.

- Are There Swap Fees on Synthetic Indices?

- Swap fees apply to positions held overnight. Deriv reduced swap charges by 10% in 2024. Rates vary by broker and account type. Consider these costs for longer-term positions.

- How Fast is Order Execution?

- Execution speed is crucial for volatile instruments. IC Markets averages 40ms, while most top brokers offer sub-100ms execution. Test execution speed during high-volatility periods, not just during calm market conditions.

- Can I Hedge Boom and Crash Positions?

- Hedging rules vary by broker and jurisdiction. Some brokers allow opposite positions on the same instrument, while others close positions using FIFO rules. Check your broker’s specific hedging policies.