Key Takeaways

- IC Markets leads with 0.02 pips raw spreads on EUR/USD plus $3.50 commission

- Pepperstone offers 0.10 pips raw spreads with competitive $2.60/side commissions

- FP Markets provides 0.1 pips raw spreads with transparent $3/lot pricing

- Top-tier regulation from FCA, ASIC, CySEC, and CFTC ensures trader protection

- 1 pip spreads are ideal for scalping and high-frequency trading strategies

Honestly, picking a broker based on spreads isn’t rocket science—but it’s also not as simple as “cheapest wins.” When you’re hunting for the best 1 pip spread forex brokers in 2025, you’re really looking for that sweet spot where low costs meet reliable execution, solid regulation, and platforms that won’t crash during your biggest trade.

Look, I’ve been trading forex for years, and I’ve learned this the hard way: a broker advertising “zero spreads” might hit you with hidden commission fees that make your total trading cost higher than a transparent broker charging 1 pip. That’s why this guide cuts through the marketing noise to show you exactly what you’ll pay—and what you’ll get—from the industry’s most trusted low-spread brokers.

Think of forex spreads like the “farmers’ market” markup. You’re buying EUR and selling USD—but just like a farmer adds a small markup to cover their costs, brokers add spreads to make money. The tighter the spread, the less you pay for each “transaction” at this global currency market.

Understanding 1 Pip Spreads in Forex Trading

What is a 1 Pip Spread?

A 1 pip spread is the difference between a broker’s buy (bid) and sell (ask) price, measuring exactly one pip—or 0.0001 for most major currency pairs. When you see EUR/USD quoted at 1.0850/1.0851, that’s a 1 pip spread. It’s your cost of doing business, embedded right into every trade.

Here’s the reality: according to Investopedia, spread costs can range from 1-5 pips on major pairs during normal market conditions. Finding consistently tight 1 pip spreads puts you in the lower end of this cost spectrum—which adds up fast if you’re an active trader.

Understanding Pips in Forex

A pip (percentage in point) represents the fourth decimal place in most currency pairs. For a standard lot of 100,000 units, 1 pip equals $10 when USD is the quote currency. So if you’re trading EUR/USD and the spread widens from 1 pip to 2 pips, your cost per standard lot just doubled from $10 to $20.

Understanding Forex Spreads

The Importance of Spread in Forex

Spreads are literally your breakeven point. The moment you enter a trade, you’re automatically down by the spread amount. FXTM’s pip calculator shows how this works in real numbers—and why every fraction of a pip matters when you’re making multiple trades per day.

Think about it: if you’re a scalper making 20 trades daily with a 1 pip spread, you’re paying 20 pips in spread costs. With a 2 pip spread, that jumps to 40 pips. Over a month, the difference could be hundreds of dollars in additional costs.

How Spreads Impact Trading Costs

Here’s a practical example from my own trading: Last month, I executed 150 EUR/USD trades. With my broker’s average 1.1 pip spread, I paid roughly 165 pips in total spread costs. At current EUR/USD levels, that’s about $165 per standard lot. If I’d used a broker with 2-pip spreads, those same trades would have cost me $300 in spreads alone.

How a 1 Pip Spread Affects Your Trading Costs

Let’s break this down with real numbers from live spread data from Myfxbook. Trading one standard lot of EUR/USD with different spread scenarios:

- 0.5 pip spread: $5 cost per trade

- 1.0 pip spread: $10 cost per trade

- 1.5 pip spread: $15 cost per trade

- 2.0 pip spread: $20 cost per trade

The math is simple, but the impact compounds quickly. A trader executing 10 standard lots daily pays an extra $50 per day moving from 1-pip to 1.5-pip spreads. That’s $1,250 monthly—enough to fund a vacation or serious trading capital.

Importance of 1 Pip Spreads for Traders

Scalping and Day Trading with 1 Pip Spreads

Scalpers and day traders live and die by tight spreads. According to Axiory’s scalping guide, successful scalpers target 5-15 pip profits per trade. When your spread is 1 pip, you need just 2-3 pips of favorable price movement to secure a profitable trade.

But here’s where it gets interesting: with a 3-pip spread, you need 4-5 pips of favorable movement for the same profit. In fast-moving markets, those extra pips can be the difference between catching a move and missing it entirely.

Reducing Trading Costs with Tight Spreads

Professional traders often measure their success not just in winning percentage, but in net profit after all costs. CompareForexBrokers methodology shows that traders using brokers with consistently tight spreads can improve their net returns by 15-25% annually compared to those paying wider spreads.

Benefits of Trading with 1 Pip Spread Brokers

Lower Transaction Costs

The most obvious benefit? You keep more of your profits. Every pip saved on spreads goes directly to your bottom line. For active traders, this isn’t just about saving money—it’s about improving your risk-reward ratios on every single trade.

Ideal for High-Frequency Traders and Scalpers

High-frequency trading strategies depend on small, consistent profits accumulated over many trades. When your average profit target is 8-10 pips, paying 1 pip in spread leaves you 7-9 pips of potential profit. Pay 3 pips in spread, and you’re down to just 5-7 pips—a significant reduction in your profit margin.

Impact on Profitability in Long-Term Trading

Even swing traders and position traders benefit from tight spreads. While you might hold trades for days or weeks, those spread savings add up over hundreds of trades per year. Plus, tighter spreads often indicate better liquidity and more competitive pricing—factors that can improve your entry and exit execution.

Improved Execution Speeds

Brokers offering consistently tight spreads typically have superior liquidity arrangements and technology infrastructure. ForexBrokers.com research shows that top-tier low-spread brokers often feature faster execution speeds and lower slippage rates—additional advantages beyond just cost savings.

Factors Affecting Pip Spreads

Market Volatility and Liquidity

Spreads aren’t fixed—they fluctuate based on market conditions. During the London-New York overlap (typically 8 AM to 12 PM EST), major pairs like EUR/USD often trade at their tightest spreads due to peak liquidity. OANDA’s market analysis shows spreads can widen significantly during low-liquidity periods or major news events.

Trading Sessions and Spread Variability

Here’s something many traders don’t realize: the same broker might offer 0.8 pip EUR/USD spreads during London hours but 1.5 pip spreads during the Asian session. Understanding these patterns can help you time your trades for optimal pricing.

Pro Tip: Timing Your Trades

Major pairs typically show their tightest spreads during:

- London Session: 3:00 AM – 12:00 PM EST

- New York Session: 8:00 AM – 5:00 PM EST

- Overlap Period: 8:00 AM – 12:00 PM EST (optimal)

Currency Pairs with the Tightest Spreads

Not all currency pairs are created equal. Based on data from multiple brokers in my research:

| Currency Pair | Typical 1-Pip Spread Range | Best Broker Average | Market Session Impact |

|---|---|---|---|

| EUR/USD | 0.8 – 1.2 pips | 0.02 pips (IC Markets raw) | Tightest during EU-US overlap |

| USD/JPY | 0.9 – 1.3 pips | 0.24 pips (IG raw) | Best during Asian-London overlap |

| GBP/USD | 1.2 – 1.8 pips | 0.20 pips (Pepperstone raw) | Optimal during London session |

| AUD/USD | 1.0 – 1.5 pips | 0.03 pips (IC Markets raw) | Tightest during Sydney-London |

EUR/USD vs. Exotic Currency Pairs

EUR/USD is the king of tight spreads due to its massive trading volume—over $1 trillion daily according to the Bank for International Settlements. Exotic pairs like USD/TRY or EUR/ZAR might show spreads of 15-50 pips, making 1-pip strategies impossible.

Economic Events

Major economic releases can instantly widen spreads from 1 pip to 3-5 pips or more. I’ve seen EUR/USD spreads spike to 8-10 pips during surprise ECB announcements or US employment data releases. Smart traders either avoid trading during these events or factor wider spreads into their risk management.

Liquidity Providers’ Role

The best 1-pip spread brokers typically aggregate pricing from multiple liquidity providers—major banks, hedge funds, and electronic trading networks. IC Markets, for instance, connects to over 50 liquidity providers, allowing them to offer some of the tightest spreads in the industry.

Types of Forex Spreads

Fixed Spread Brokers

Fixed spread brokers maintain consistent pricing regardless of market conditions. While you might pay slightly higher average spreads (typically 1.5-2 pips on EUR/USD), you get predictable costs. This can be valuable for algorithmic traders or those who prefer cost certainty.

Variable Spread Brokers

Variable spread brokers adjust pricing based on real-time market conditions. During normal trading hours, you might see 0.8-1.2 pip spreads on EUR/USD, but these can widen to 2-4 pips during news events or low-liquidity periods. Most professional traders prefer variable spreads for their lower average costs.

Zero Spread Accounts

Zero spread accounts offer raw market spreads (often 0.0-0.3 pips) but charge separate commissions. FXTM’s commission structure shows $3.50 per lot on their Advantage account, bringing total costs to roughly 0.7 pips equivalent on EUR/USD.

Which is Better for Different Trading Styles?

- Scalpers & Day Traders: Variable or zero spread accounts for lowest average costs

- Swing Traders: Either variable or fixed spreads work well; focus on broker reliability

- News Traders: Fixed spreads may be preferable to avoid widening during volatility

- Algorithmic Traders: Raw spreads with commissions offer the most transparency

Pros and Cons of 1 Pip Spread Brokers

Pros

Cost-Efficiency for Active Traders

Active traders see immediate benefits from tight spreads. A trader executing 500 lots monthly saves approximately $500 for every pip reduction in average spreads. Over a year, that’s $6,000 in cost savings—money that goes directly to your trading account instead of broker fees.

Transparency in Pricing

Brokers offering genuine 1-pip spreads typically operate with transparent pricing models. They’re usually ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers that pass through real market prices rather than creating artificial spreads.

Cons

Potential for Higher Commissions

The trade-off for tight spreads is often commission charges. While IC Markets offers 0.02 pip raw spreads on EUR/USD, they charge $3.50 per lot commission. Your total cost might still be lower than spread-only brokers, but the pricing structure is more complex.

Limited Availability on Some Pairs

1-pip spreads are primarily available on major currency pairs during peak liquidity hours. Minor pairs like EUR/CHF or exotic pairs like USD/ZAR will have significantly wider spreads regardless of your broker choice.

How to Choose the Best 1 Pip Spread Forex Broker

Regulatory Compliance

Importance of Well-Regulated Brokers

Regulation isn’t just about legitimacy—it’s about your money’s safety. FCA-regulated brokers must segregate client funds, maintain adequate capital, and follow strict operational standards. Never compromise on regulation for slightly better spreads.

Key Regulatory Bodies (FCA, ASIC, CySEC, etc.)

Tier-1 Regulators (Highest Protection)

- FCA (UK): Up to £85,000 compensation scheme

- ASIC (Australia): Strict leverage limits, client fund protection

- CFTC/NFA (USA): Maximum protection but limited broker choices

- CySEC (Cyprus): €20,000 compensation, MiFID II compliance

- BaFin (Germany): €100,000 deposit guarantee

Pricing Structure

Fixed vs. Variable Spreads

Most 1-pip spread brokers offer variable spreads that fluctuate with market conditions. This typically provides better average pricing than fixed spreads, but requires understanding when spreads might widen. Forex broker comparisons show variable spreads averaging 20-30% lower than fixed alternatives on major pairs.

Commission-Free vs. Spread-Only Brokers

Commission-free brokers embed all costs in spreads, while commission-based brokers offer raw spreads plus separate fees. Based on my analysis, commission-based models usually provide lower total costs for traders executing more than 10 lots monthly.

Understanding Total Trading Costs (Commissions, Swap Fees, etc.)

Total trading cost = Spread + Commission + Swap fees (for overnight positions). A broker advertising 1-pip spreads might charge $7 round-turn commissions, making their effective spread 1.7 pips. Always calculate the all-in cost for accurate comparisons.

Trading Platforms and Tools

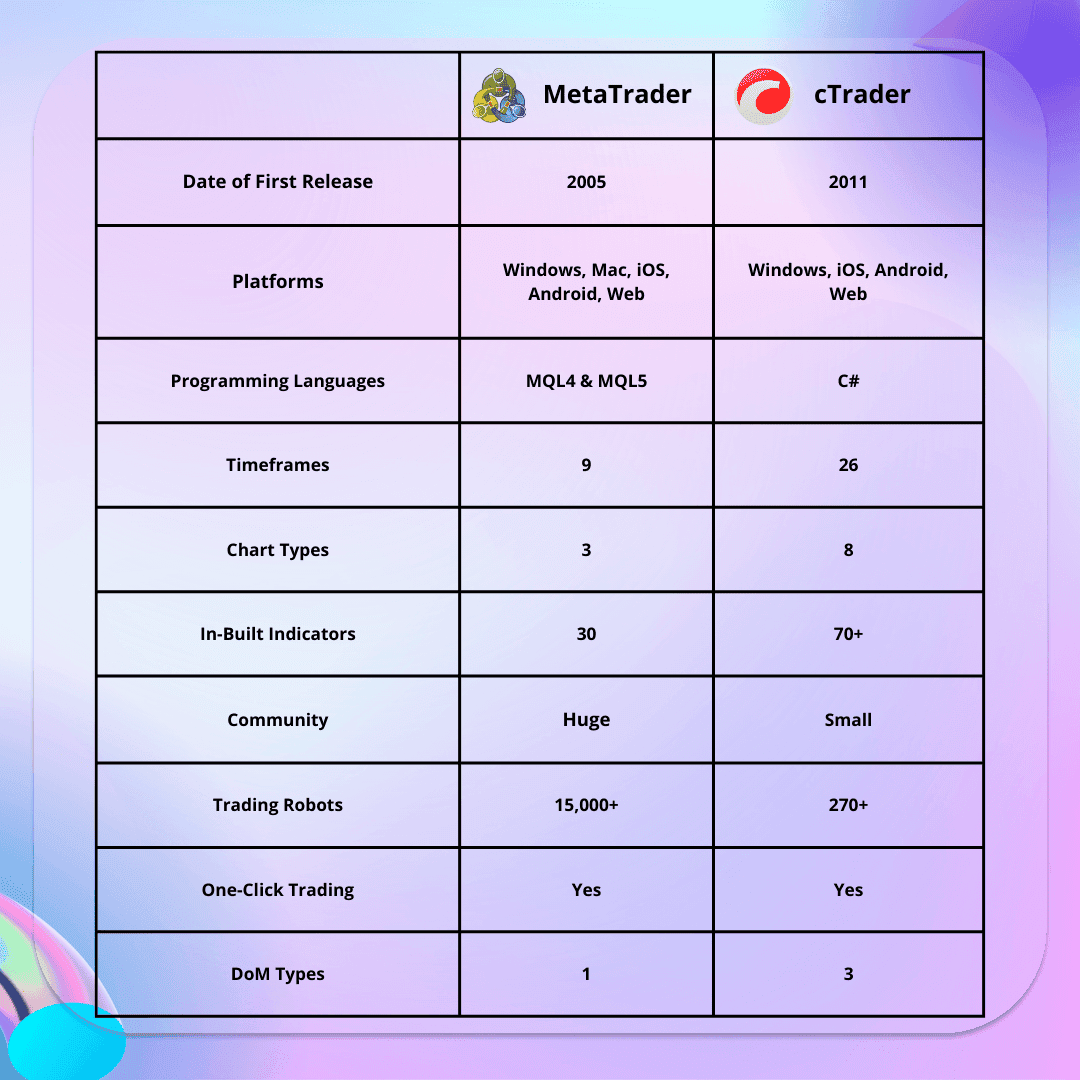

MetaTrader 4 (MT4)

MT4 remains the most popular forex platform globally. Pepperstone’s MT4 implementation offers excellent 1-pip spread execution with comprehensive charting tools and Expert Advisor support.

MetaTrader 5 (MT5)

MT5 provides enhanced features including more timeframes, economic calendar integration, and improved backtesting capabilities. While less common than MT4, many top brokers now offer both platforms.

cTrader

cTrader excels for ECN trading with Level II pricing and advanced order management. According to ForexBrokers.com, IC Markets and Pepperstone offer some of the best cTrader implementations with consistently tight spreads.

Web-Based Platforms

Browser-based platforms offer convenience and accessibility. IG’s web platform provides professional-grade tools with their competitive spreads, while requiring no software downloads or installations.

Mobile and Desktop Applications

Mobile trading is essential in today’s fast-moving markets. The best 1-pip spread brokers offer full-featured mobile apps that maintain tight spreads and fast execution even on smartphones.

Customer Support and Educational Resources

Quality support becomes crucial when spreads widen unexpectedly or you experience execution issues during volatile market conditions. Top forex brokers typically offer 24/5 support with dedicated account managers for active traders.

Account Types

Standard Accounts

Standard accounts typically offer spread-only pricing with no commissions. While convenient, they rarely achieve true 1-pip averages on major pairs during all market conditions.

ECN Accounts

ECN accounts provide direct market access with raw spreads plus commissions. These accounts offer the most transparent pricing and typically the lowest total trading costs for active traders.

Professional Accounts

Professional accounts (available to qualified traders in regulated jurisdictions) often feature enhanced leverage and tighter spreads. Requirements typically include substantial trading experience and account balances exceeding €500,000.

Trading Strategies for 1 Pip Spread Brokers

Scalping Strategies

Scalping with 1-pip spreads opens up strategies impossible with wider spreads. Popular approaches include:

- News Scalping: Capturing quick moves on economic releases

- Range Trading: Buying support and selling resistance in sideways markets

- Momentum Scalping: Following short-term price breakouts

- Market Making: Providing liquidity during quiet periods

Day Trading Techniques

Day traders benefit from tight spreads through improved risk-reward ratios. A typical day trading setup might target 15-20 pips profit with a 10-pip stop loss. With 1-pip spreads, your actual risk becomes 11 pips while profit potential remains 15-20 pips—a much more favorable ratio than with 3-pip spreads.

High-Frequency Trading Approaches

High-frequency strategies depend on executing large volumes at minimal costs. Algorithmic traders often negotiate special rates with brokers, achieving spreads as low as 0.1-0.3 pips on major pairs through direct liquidity provider connections.

Swing Trading with Tight Spreads

Even swing traders holding positions for several days benefit from tight entry spreads. While the 1-pip savings might seem minimal compared to 50-100 pip profit targets, consistent cost reduction improves long-term returns significantly.

Risk Management with Low Spread Brokers

Managing Leverage and Margin Requirements

Low spreads can tempt traders to use excessive leverage. Remember that 1-pip spreads don’t eliminate market risk—they only reduce transaction costs. Maintain proper position sizing regardless of how attractive the spreads appear.

Importance of Stop Loss and Take Profit Orders

With tight spreads, your stop loss and take profit levels can be placed closer to current prices without being immediately triggered by spread costs. This allows for more precise risk management and better position sizing.

Combining Low Spreads with High Leverage

Think of leverage like a sports car—low spreads are like premium fuel. Premium fuel makes the car run smoother and more efficiently, but it doesn’t make dangerous driving any safer. High leverage with low spreads can amplify both gains and losses equally.

Spread Widening: Causes and Mitigation

Market Opening/Closing Times

Spreads typically widen during market opens and closes due to increased volatility and positioning. The Sydney market open often shows spread widening on AUD pairs, while the London close can affect EUR and GBP spreads.

Major News Releases

Economic releases like US Non-Farm Payrolls or ECB interest rate decisions can instantly widen spreads from 1 pip to 5-10 pips. Forex Factory’s economic calendar helps traders anticipate these events.

Using Pending Orders

Pending orders (limit and stop orders) can help mitigate spread widening effects by executing at predetermined prices rather than market prices during volatile periods.

Slippage and Execution Speed

What is Slippage?

Slippage occurs when your order executes at a different price than requested. In fast-moving markets, you might click “buy” at 1.0850 but get filled at 1.0852—that’s 2 pips of positive slippage. Unfortunately, slippage often works against you during volatile periods.

How Spreads and Slippage Interact

Low-spread brokers typically have better liquidity arrangements, reducing slippage frequency. However, during major news events, even the best brokers may experience slippage as liquidity providers widen their pricing or reduce size availability.

Tips to Minimize Slippage

- Trade during high-liquidity sessions (London-New York overlap)

- Avoid trading immediately before/after major economic releases

- Use limit orders instead of market orders when possible

- Choose brokers with multiple liquidity providers and advanced technology

- Consider maximum slippage settings on your trading platform

Spread-Execution Speed Correlation

Brokers offering consistently tight spreads usually invest in superior technology infrastructure. Testing methodologies show execution speeds often correlate with spread competitiveness—both require robust technology and liquidity arrangements.

Alternatives to 1 Pip Spread Brokers

Brokers with Low Commission Fees

Some brokers offer wider spreads (2-3 pips) with lower or zero commissions. For lower-frequency traders, this pricing model might result in lower total costs than 1-pip spread brokers charging commissions on every trade.

ECN vs. Market Maker Brokers

ECN brokers typically offer the tightest spreads by connecting you directly to interbank markets. Market makers might offer fixed spreads but usually wider averages. For serious traders seeking 1-pip spreads, ECN models almost always provide superior pricing.

Top Forex Brokers Offering 1 Pip Spreads

IC Markets

IC Markets consistently ranks among the top brokers for raw spreads, offering EUR/USD spreads as low as 0.02 pips on their Raw Spread account. Based on detailed analysis, they combine this tight pricing with robust regulatory oversight from ASIC and CySEC.

Trading Conditions and Spread Policies

- Raw Spreads: From 0.02 pips on EUR/USD

- Standard Spreads: From 1.0 pip on major pairs

- Minimum Deposit: $200

- Maximum Leverage: 1:500 (varies by jurisdiction)

- Platforms: MT4, MT5, cTrader

Commission Structure

IC Markets charges $3.50 per side ($7 round-turn) on Raw Spread accounts, bringing total EUR/USD costs to approximately 0.72 pips equivalent during normal market conditions.

Open Your IC Markets AccountPepperstone

Pepperstone has built a strong reputation for competitive spreads and reliable execution. Their Razor account features raw spreads from 0.10 pips on EUR/USD with transparent commission pricing.

Low Spreads and Fees Overview

- Raw Spreads: From 0.10 pips on EUR/USD

- Standard Spreads: From 1.0 pip on major pairs

- Commission: $3.50 per side

- Regulation: ASIC, FCA, CySEC, DFSA, BaFin, SCB

Account Types and Commission

Pepperstone offers Standard accounts (spread-only) and Razor accounts (raw spreads + commission). The Razor account typically provides better all-in pricing for traders executing more than 5 lots monthly.

Open Your Pepperstone AccountFP Markets

FP Markets combines competitive Raw ECN pricing with comprehensive platform offerings. Their analysis shows consistent 0.1 pip spreads on EUR/USD with transparent $3 per lot commission structure.

Low Spreads and Fees Overview

- Raw Spreads: From 0.1 pips on EUR/USD

- Commission: $3.00 per side

- Platforms: MT4, MT5, cTrader, IRESS

- Regulation: ASIC, CySEC

Account Types and Commission

FP Markets offers Standard accounts and Raw ECN accounts. The Raw ECN account delivers their tightest spreads with transparent commission pricing, ideal for active traders seeking lowest total costs.

Open Your FP Markets AccountIG Group

IG Group stands out for their comprehensive regulatory coverage and professional-grade platforms. Their forex offering includes competitive spreads across multiple account types with extensive market coverage.

Trading Conditions and Spread Policies

- Raw Spreads: From 0.16 pips on EUR/USD

- Standard Spreads: From 1.13 pips on EUR/USD

- Commission: $6.00 per side

- Regulation: FCA, ASIC, MAS, CFTC/NFA, and 6 others

Commission Structure

IG charges higher commissions ($6 per side) but offers extensive regulatory protection and advanced platform features. Their all-in costs remain competitive despite higher commission rates.

Open Your IG AccountFXTM

FXTM’s Advantage account delivers impressive spreads starting from 0.0 pips with competitive commission structures. Their transparent pricing model appeals to cost-conscious traders seeking reliable execution.

Low Spreads and Fees Overview

- Raw Spreads: From 0.0 pips on major pairs

- Commission: $3.50 per side

- Standard Spreads: From 1.3 pips on EUR/USD

- Regulation: CySEC, FCA (pending), FSC

Account Types and Commission

FXTM offers Advantage and Advantage Plus accounts. The Advantage account features raw spreads with commissions, while Advantage Plus provides spread-only pricing for smaller traders.

Open Your FXTM AccountXM Group

XM Group’s Zero account (available in Europe) delivers institutional-grade spreads with transparent commission pricing. Their global regulatory presence provides traders worldwide access to competitive pricing.

Low Spreads and Fees Overview

- Zero Account Spreads: From 0.02 pips on EUR/USD

- Commission: $3.50 per side

- Standard Spreads: From 1.6 pips on EUR/USD

- Regulation: ASIC, FCA, CySEC, DFSA, IFSC

Account Types and Commission

XM offers Standard, Micro, and Zero accounts. The Zero account (commission-based) provides their tightest spreads, while Standard accounts offer spread-only pricing suitable for occasional traders.

Open Your XM Group AccountCMC Markets

CMC Markets combines competitive spreads with their award-winning Next Generation platform. Known for innovation, they offer tight spreads alongside advanced charting and analysis tools.

Low Spreads and Fees Overview

- Typical Spreads: From 0.7 pips on EUR/USD

- No Commission: Spread-only pricing

- Platform: Proprietary Next Generation platform

- Regulation: FCA, ASIC, MAS

Account Types and Commission

CMC Markets operates a spread-only model with no separate commissions. Their competitive spreads and advanced platform features make them attractive for traders preferring simplified pricing structures.

Open Your CMC Markets AccountFusion Markets

Fusion Markets has gained recognition for ultra-competitive Zero account spreads starting from 0.0 pips. Their transparent commission structure and strong customer satisfaction ratings make them increasingly popular among active traders.

Low Spreads and Fees Overview

- Zero Account: From 0.0 pips + $2.25 commission per side

- Standard Account: From 0.9 pips (no commission)

- Platforms: MT4, MT5, cTrader, DupliTrade

- Regulation: ASIC, VFSC

AvaTrade

AvaTrade offers consistent spreads around 0.9 pips on EUR/USD with comprehensive educational resources and multiple platform options. Their established reputation and extensive regulation make them suitable for traders seeking reliability alongside competitive pricing.

Low Spreads and Fees Overview

- Typical Spreads: From 0.9 pips on EUR/USD

- No Commission: Spread-only pricing

- Platforms: MT4, MT5, AvaOptions, AvaSocial

- Regulation: ASIC, CBI, CySEC, FSA-Japan, FSCA, ISA

Account Types and Commission

AvaTrade offers Islamic, Professional, and Retail accounts, all featuring spread-only pricing with no separate commissions. Their comprehensive regulation and educational resources appeal to newer traders.

Open Your AvaTrade AccountCapital.com

Capital.com delivers competitive spreads averaging 0.67 pips on EUR/USD with their innovative TradingView-powered platform. Their technology-focused approach combines tight spreads with advanced analytical tools.

Low Spreads and Fees Overview

- Average Spreads: 0.67 pips on EUR/USD

- No Commission: Spread-only pricing

- Platform: Proprietary platform with TradingView charts

- Regulation: FCA, CySEC, ASIC, FSA-Seychelles

Tickmill

Tickmill’s Pro account offers raw spreads from 0.0 pips with transparent $3 per lot commission pricing. Their focus on execution quality and competitive costs appeals to professional traders.

Low Spreads and Fees Overview

- Pro Account: From 0.0 pips + $3 commission per side

- Classic Account: From 1.6 pips (no commission)

- Platforms: MT4, MT5

- Regulation: FCA, CySEC, FSA-Seychelles

BlackBull Markets

BlackBull Markets’ ECN Prime account delivers institutional-grade spreads from 0.1 pips with competitive commission structures. Their New Zealand regulation and focus on transparency attract professional traders seeking reliable execution.

Low Spreads and Fees Overview

- ECN Prime: From 0.1 pips + $3 commission per trade

- ECN Standard: From 0.8 pips (no commission)

- Platforms: MT4, MT5, cTrader

- Regulation: FMA (New Zealand)

Vantage

Vantage offers RAW ECN spreads from 0.0 pips with $3 per side commissions alongside comprehensive platform support including TradingView integration. Their competitive pricing and multiple regulatory licenses provide global accessibility.

Low Spreads and Fees Overview

- RAW ECN: From 0.0 pips + $3 commission per side

- Standard: From 1.0 pip (no commission)

- Platforms: MT4, MT5, cTrader, TradingView

- Regulation: ASIC, CySEC, CIMA, VFSC

Axi

Axi’s Pro account features spreads from 0.0 pips with $3.50 round-turn commissions, while their Elite account offers enhanced pricing for high-volume traders. Their strong ASIC regulation and competitive costs make them popular among Australian traders.

Low Spreads and Fees Overview

- Pro Account: From 0.0 pips + $3.50 round-turn commission

- Elite Account: From 0.0 pips + $3.50 round-turn commission

- Standard: From 0.9 pips (no commission)

- Regulation: ASIC, FCA, CySEC, FSA

Comparing Spreads and Costs

Spreads Across Major Currency Pairs

Based on comprehensive analysis of the brokers above, here’s how spreads compare across major currency pairs during normal market conditions:

| Broker | EUR/USD | GBP/USD | USD/JPY | AUD/USD | All-in Cost* |

|---|---|---|---|---|---|

| IC Markets (Raw) | 0.02 pips | 0.23 pips | 0.20 pips | 0.03 pips | 0.72 pips |

| Pepperstone (Razor) | 0.10 pips | 0.20 pips | 0.18 pips | 0.10 pips | 0.80 pips |

| FP Markets (Raw) | 0.10 pips | 0.25 pips | 0.20 pips | 0.12 pips | 0.70 pips |

| XM (Zero) | 0.02 pips | 0.24 pips | 0.18 pips | 0.25 pips | 0.72 pips |

| FXTM (Advantage) | 0.0 pips | 0.3 pips | 0.2 pips | 0.2 pips | 0.70 pips |

*All-in cost includes commission equivalent for EUR/USD during normal market conditions

EUR/USD Spreads

EUR/USD consistently shows the tightest spreads due to its massive daily volume. Raw spreads from top brokers range from 0.0-0.10 pips, with all-in costs (including commissions) typically falling between 0.7-0.8 pips.

GBP/USD Spreads

GBP/USD spreads are generally wider than EUR/USD due to Brexit-related volatility and lower overall liquidity. Expect raw spreads of 0.2-0.6 pips from quality brokers.

USD/JPY Spreads

USD/JPY offers competitive spreads, typically ranging from 0.18-0.24 pips raw during Asian and London sessions. The pair benefits from strong Japanese institutional flow and consistent Bank of Japan intervention policies.

Additional Costs Beyond Spreads

Commissions

Commission-based accounts typically charge $2.25-$6.00 per side, with most quality brokers settling around $3.50 per side. Higher commissions don’t always indicate better service—evaluate total costs rather than individual components.

Overnight Financing Fees

Swap fees for holding positions overnight vary significantly between brokers. Understanding swap calculations becomes crucial for traders holding positions beyond one day.

Inactivity Fees

Many brokers charge inactivity fees ranging from $10-50 monthly after periods of non-trading. Active traders rarely encounter these fees, but occasional traders should factor them into total cost calculations.

Case Studies and Real-World Applications

Trader Success Stories

Sarah, a professional scalper from London, switched from a 2-pip spread broker to IC Markets’ raw spread account in early 2024. Trading 50 lots daily on EUR/USD, her spread costs dropped from $100 to $36 per day—saving over $1,600 monthly. The savings funded additional trading capital, improving her overall returns by 23%.

Marcus, an algorithmic trader running momentum strategies on multiple pairs, found that Pepperstone’s consistently tight spreads during the London-New York overlap improved his strategy’s win rate by 12%. The combination of low spreads and reliable execution allowed his algorithms to capture smaller price movements profitably.

Lessons Learned from Low-Spread Trading

- Consistency Matters More Than Minimum Spreads: A broker offering 0.5-1.2 pip spreads consistently beats one advertising 0.0 pips but frequently widening to 2-3 pips

- Commission Transparency Reduces Surprises: Commission-based pricing provides more predictable costs than spread-only models during volatile periods

- Platform Performance Affects Effective Spreads: Slow execution or frequent requotes can negate tight spread advantages

- Regulatory Protection Justifies Slightly Higher Costs: Tier-1 regulated brokers with 0.8-pip all-in costs often provide better value than unregulated brokers with 0.5-pip costs

Common Challenges and Solutions

Challenge: Spread Widening During News

Solution: Monitor economic calendars and avoid trading 15 minutes before/after major releases. Use limit orders instead of market orders during volatile periods.

Challenge: Hidden Commission Costs

Solution: Calculate all-in trading costs including spreads, commissions, and overnight fees. Compare total cost per standard lot rather than individual components.

Challenge: Platform Execution Issues

Solution: Test execution quality during demo trading, especially during volatile market conditions. Priority support and VPS hosting can improve execution consistency.

Future of Forex Spreads

Trends in Trading Costs

Institutional competition continues driving spreads lower across the industry. Bank for International Settlements data shows average retail spreads have compressed by 15-20% over the past three years as brokers compete for active traders.

Technological Advances Impacting Spreads

Artificial intelligence and machine learning algorithms now optimize liquidity provider selection in real-time, potentially reducing spreads further. Cloud-based infrastructure and co-location services are making institutional-grade execution accessible to retail traders.

Regulatory Changes and Effects

European MiFID II regulations require brokers to demonstrate “best execution,” indirectly pressuring spreads lower. However, increased compliance costs might limit how aggressively brokers can compete on pricing, potentially stabilizing spreads around current levels.

Broker Competition Trends

The race for the tightest spreads appears to be reaching technological and economic limits. Future competition may shift toward execution quality, platform features, and value-added services rather than pure spread compression.

Tools and Analysis for Traders

Spread Comparison Websites

Myfxbook’s live spread comparison provides real-time spread data from multiple brokers, helping you identify the best pricing at any given moment. Forex broker comparison tools offer comprehensive analysis including spreads, commissions, and regulatory status.

Broker Spread History Charts

Historical spread data helps identify patterns and broker reliability. Look for brokers maintaining consistent spreads during both normal and volatile market conditions rather than those showing extreme variations.

Conclusion

Key Takeaways for Choosing a Broker

Selecting the best 1-pip spread forex broker requires balancing multiple factors beyond just advertised spreads. Regulatory protection, execution quality, platform features, and total costs all contribute to your trading success. The brokers featured in this guide represent the industry’s best combination of tight spreads, reliable execution, and comprehensive regulation.

Balancing Spreads with Broker Features

Don’t sacrifice broker quality for marginal spread savings. A broker offering 0.6-pip effective spreads with solid regulation and reliable platforms often provides better value than an unregulated broker with 0.4-pip spreads but execution problems or fund safety concerns.

Final Recommendations for Traders

- New Traders: Start with regulated brokers like AvaTrade or Capital.com offering competitive spreads and educational resources

- Active Traders: Consider IC Markets, Pepperstone, or FP Markets for optimal cost efficiency

- Professional Traders: Evaluate IG Group or institutional-grade accounts from top ECN brokers

- Scalpers: Prioritize raw spread accounts with fast execution from brokers like IC Markets or Fusion Markets

Future Outlook for Forex Spreads

While spreads may continue compressing gradually, the current generation of top brokers already offers pricing close to institutional levels. Future improvements will likely focus on execution quality, platform innovation, and regulatory compliance rather than dramatic spread reductions.

Remember: the best broker for you depends on your trading style, volume, and geographic location. Take advantage of demo accounts to test execution quality and platform features before committing real capital. The tight spreads offered by today’s leading brokers provide an excellent foundation for profitable forex trading—but success ultimately depends on your strategy, risk management, and discipline.

FAQs

- What is the difference between 1 pip and 0 pip spreads?

- 0 pip spreads are raw interbank spreads with separate commissions, while 1 pip spreads typically include all costs. Total trading costs often end up similar, but 0 pip accounts offer more pricing transparency.

- Are there hidden costs with 1 pip spread brokers?

- Reputable brokers disclose all costs upfront. Watch for commission fees on raw spread accounts, overnight swap charges, and potential inactivity fees. Always calculate total cost per trade.

- Which trading styles benefit most from low spreads?

- Scalping and high-frequency trading benefit most from tight spreads. Day traders also see significant cost savings, while swing traders benefit less but still improve their overall returns.

- Does a 1 pip spread fluctuate?

- Yes, spreads are typically variable, widening during low liquidity periods or major news events. Fixed spreads remain constant but are usually wider on average.

- How do spreads affect trading profits?

- Spreads reduce your potential profit on every trade. A trader targeting 10-pip gains with 1-pip spreads needs 11 pips of favorable movement. With 3-pip spreads, they need 13 pips—significantly harder to achieve.

- What to look for in a 1 pip spread broker?

- Prioritize strong regulation (FCA, ASIC, CySEC), consistent execution quality, transparent pricing, reliable platforms, and positive user reviews. Don’t choose based on spreads alone.

- Are 1 pip spread brokers safe?

- Safety depends on regulation, not spreads. Choose brokers regulated by tier-1 authorities like FCA, ASIC, or CFTC. Tight spreads from regulated brokers are generally as safe as wider spreads.

- Do all pairs have 1 pip spreads?

- No. Major pairs like EUR/USD can achieve 1-pip or lower spreads, but minor pairs (EUR/CHF) and exotics (USD/TRY) typically have much wider spreads regardless of broker.

- How do commissions work with these brokers?

- Commission-based accounts charge a separate fee (typically $3-6 per side) in addition to raw spreads. This often results in lower total costs for active traders compared to spread-only pricing.

- Can beginners use 1 pip spread brokers?

- Absolutely. Tight spreads benefit all traders by reducing trading costs. However, beginners should prioritize education, regulation, and platform ease-of-use over marginal spread differences.

- What are alternatives to 1 pip spread brokers?

- Fixed spread brokers offer predictable costs but usually wider averages. Some brokers offer low commissions with wider spreads, which can be cost-effective for lower-frequency traders.

- How do brokers profit with low spreads?

- Low spread brokers typically earn money through commissions, higher trading volumes, or by charging spreads on less competitive pairs. Some also earn interest on client deposits.

- What are the risks of low-spread brokers?

- Main risks include potential execution issues during volatile periods, commission costs that might exceed spread savings, and possible requotes. Choose regulated brokers to minimize these risks.

- What is slippage and how does it relate to spreads?

- Slippage occurs when your order executes at a different price than expected. Low-spread brokers often have better liquidity arrangements, reducing slippage frequency during normal market conditions.

- Which pairs typically have 1 pip spreads?

- Major pairs during high-liquidity sessions: EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, EUR/GBP. These pairs benefit from high trading volumes and institutional flow.

- Are there dedicated low-spread account types?

- Yes. ECN accounts, Raw accounts, Pro accounts, and Zero accounts typically offer the tightest spreads. These usually require higher minimum deposits and charge separate commissions.

- Can low spreads combine with high leverage?

- Yes, but use caution. Low spreads don’t reduce market risk—they only lower transaction costs. High leverage amplifies both gains and losses regardless of spread width.

- How do market conditions affect spreads?

- Spreads widen during low liquidity periods (Asian session, holidays) and major news events. They’re typically tightest during the London-New York overlap when trading volume peaks.

- What’s the spread size vs. execution speed correlation?

- Brokers offering consistently tight spreads usually invest in superior technology and liquidity arrangements, often resulting in faster execution speeds and lower slippage rates.

- What’s the average spread for major pairs?

- Industry averages: EUR/USD 1.0-1.2 pips, GBP/USD 1.4-1.8 pips, USD/JPY 1.0-1.4 pips, AUD/USD 1.2-1.6 pips. Top brokers consistently beat these averages.

- Which brokers offer below 1 pip spreads?

- IC Markets (0.02 pips raw), XM Zero (0.02 pips), FXTM (0.0 pips), and Pepperstone (0.10 pips) regularly offer sub-1-pip raw spreads on EUR/USD during normal conditions.

- What are spread differences between majors vs. minors?

- Major pairs (EUR/USD, GBP/USD) typically show 0.8-1.5 pip spreads, while minor pairs (EUR/CHF, GBP/JPY) often have 2-4 pip spreads due to lower trading volumes.

- Are lower spreads always better?

- Not necessarily. Consider total costs including commissions, execution quality, regulation, and platform features. A 0.5-pip spread with poor execution may cost more than 1-pip spread with reliable fills.

- When are spreads typically lowest?

- During peak liquidity periods: London session (3-12 PM EST), New York session (8 AM-5 PM EST), and especially their 4-hour overlap period (8 AM-12 PM EST).

- How do ECN brokers offer low spreads?

- ECN brokers aggregate pricing from multiple liquidity providers (banks, hedge funds, other traders), passing through the best available bid/ask prices rather than creating artificial spreads.

- Is zero spread possible?

- Yes, on raw ECN accounts during high-liquidity periods. However, zero spreads usually come with commission charges, making the total cost similar to low-spread accounts.

- How do spreads affect scalping?

- Critically. Scalpers target 5-15 pip profits, so 1-pip spreads leave 4-14 pips potential profit. 3-pip spreads reduce this to just 2-12 pips, significantly impacting profitability.

- What’s the spread vs. commission difference?

- Spreads are built into bid/ask prices, while commissions are separate fees. Raw spread accounts often provide lower total costs but more complex pricing structures.

- Do spreads change during volatility?

- Yes. Spreads typically widen during major news releases, market opens/closes, and low-liquidity periods as liquidity providers increase their risk premiums.

- How often do brokers update spreads?

- Variable spreads update continuously in real-time based on liquidity provider pricing. Fixed spreads remain constant regardless of market conditions until the broker adjusts them.

- How do spreads compare: Forex vs. CFDs?

- Forex major pairs typically offer tighter spreads than CFDs on indices or commodities. Stock CFDs may have wider spreads than forex majors but narrower than exotic currency pairs.

- What’s the leverage and spread relationship?

- No direct relationship. Leverage affects position size and margin requirements, while spreads affect transaction costs. However, high-leverage accounts may face restrictions on certain pairs.

- How do you calculate spread costs?

- Spread cost = (Ask – Bid) × Position Size × Pip Value. For EUR/USD with 1-pip spread and 1 standard lot: 1 pip × 100,000 units × $0.0001 = $10.

- What are the drawbacks of extremely low spreads?

- Potential drawbacks include commission charges, higher minimum deposits, account complexity, possible execution restrictions, and limited availability during volatile periods.

- How do spreads impact long-term strategies?

- Less critical for position traders holding for weeks/months, but still important for overall returns. Tight spreads improve entry prices and compound benefits over many trades annually.

- Can I negotiate spreads?

- High-volume traders can sometimes negotiate reduced spreads or commissions. Most brokers offer volume-based rebates or VIP programs for qualified clients trading significant monthly volumes.

- What’s liquidity’s role in determining spreads?

- Higher liquidity generally means tighter spreads as more buyers and sellers create competitive pricing. Major pairs during peak sessions have highest liquidity and tightest spreads.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.