Key Takeaways

- FSC BVI offers flexible regulation with leverage up to 1:1000 and 0% tax on trading profits

- Top FSC BVI brokers include MultiBank Exchange Group, Exness, FBS, AvaTrade, and easyMarkets

- BVI regulation provides streamlined processes but with limited investor protection compared to FCA/ASIC

- The 2024 Securities and Investment Business Act amendments now explicitly cover forex trading

- Always verify broker licenses through the official FSC BVI regulated entities list

Introduction

The British Virgin Islands (BVI) has emerged as a significant offshore financial hub, offering forex traders access to regulated brokers with unique advantages. With the Financial Services Commission (FSC) of BVI overseeing the territory’s financial services sector, traders can benefit from flexible leverage options, tax advantages, and streamlined processes while maintaining regulatory oversight.

In September 2024, the BVI government introduced important updates to its Securities and Investment Business Act, explicitly recognizing “contracts to exchange one currency for another” within the regulatory framework. This landmark change strengthens the legal foundation for forex trading in BVI and demonstrates the territory’s commitment to evolving with modern financial markets.

Think of FSC BVI regulation like a sports car: It offers high performance and flexibility (leverage up to 1:1000) with fewer safety restrictions compared to family sedans (FCA/ASIC regulation). You can go faster, but you need to be a more skilled driver.

Understanding the BVI Financial Services Commission (FSC) and Its Role

History and Establishment

The BVI Financial Services Commission was established in December 2001 under the Financial Services Commission Act, 2001, as the territory’s single regulatory authority for financial services business. As an autonomous body, the FSC operates independently while maintaining accountability to the BVI government and international regulatory standards.

The Commission’s mandate extends beyond traditional banking to include securities, investment business, insurance, and—following the 2024 amendments—explicit coverage of forex trading activities. This comprehensive approach positions BVI as a sophisticated offshore financial center with modern regulatory frameworks.

Regulatory Framework and Authority

The FSC BVI operates under a robust legal framework primarily governed by the Securities and Investment Business Act (SIBA) 2010. Key regulatory principles include:

- Licensing Requirements: All forex brokers must obtain appropriate licenses before operating

- Capital Adequacy: Minimum capital requirements based on business scope and risk profile

- Client Asset Protection: Mandatory segregation of client funds from broker’s operational capital

- Ongoing Supervision: Regular monitoring and compliance assessments

- Professional Standards: Requirements for qualified personnel and proper governance structures

2024 Regulatory Update

The Securities and Investment Business (Amendment of Schedule 1) Order, 2024, gazetted on September 5, 2024, explicitly added “contracts to exchange one currency for another” to the regulatory framework, providing clearer legal standing for forex trading operations in BVI.

Role in Forex Market Supervision

The FSC BVI’s approach to forex market supervision balances regulatory oversight with market flexibility. Unlike more restrictive jurisdictions, BVI regulation allows:

- Higher leverage ratios (commonly up to 1:1000)

- Flexible operational structures for international brokers

- Streamlined licensing processes compared to Tier-1 regulators

- Tax-efficient structures for both brokers and traders

FSC vs. Top-Tier Regulators

When comparing FSC BVI to major regulators like the FCA (UK), ASIC (Australia), and CySEC (Cyprus), several key differences emerge:

| Aspect | FSC BVI | FCA | ASIC | CySEC |

|---|---|---|---|---|

| Maximum Leverage | Up to 1:1000 | 1:30 | 1:30 | 1:30 |

| Negative Balance Protection | Not mandatory | Mandatory | Mandatory | Mandatory |

| Compensation Scheme | No | £85,000 FSCS | AU$500,000 | €20,000 ICF |

| Corporate Tax Rate | 0% | 25% | 30% | 12.5% |

| Licensing Timeline | 3-6 months | 6-12 months | 6-12 months | 4-8 months |

Benefits and Risks of FSC BVI Regulation

Benefits:

- Zero corporate tax and capital gains tax structure

- Higher leverage options for experienced traders

- Faster account opening and withdrawal processes

- Lower operational costs translating to better spreads

- International recognition and acceptance

Risks:

- Limited investor protection compared to Tier-1 regulators

- No compensation scheme for client losses

- Higher due diligence requirements for traders

- Potential restrictions from certain jurisdictions

Legal Framework for BVI Forex Brokers

Securities and Investment Business Act 2010

The Securities and Investment Business Act (SIBA) 2010 serves as the cornerstone legislation governing forex brokers in BVI. This comprehensive act establishes the framework for:

- Licensing Categories: Different license types based on business activities and client base

- Capital Requirements: Minimum financial resources brokers must maintain

- Operational Standards: Day-to-day business conduct and risk management requirements

- Client Protection: Measures to safeguard trader funds and interests

Key Regulatory Requirements

Under SIBA 2010, FSC BVI regulated forex brokers must comply with stringent operational requirements:

Financial Soundness: Brokers must maintain their business in a financially sound condition at all times, with assets sufficient to meet liabilities as they fall due. Any deterioration in financial condition must be immediately reported to the FSC.

Capital Adequacy: Each broker must maintain capital resources at or above the minimum prescribed for their license category. The FSC may direct additional capital requirements based on the broker’s risk profile and business scope.

Professional Standards: All brokers must maintain professional indemnity insurance and ensure that key personnel meet qualification and fitness standards set by the FSC.

Compliance Standards

FSC BVI brokers operate under comprehensive compliance frameworks covering:

Anti-Money Laundering (AML) Requirements

All FSC BVI brokers must implement robust AML procedures including customer due diligence (CDD), ongoing monitoring of business relationships, and suspicious transaction reporting. The 2025 National Strategic AML/CFT/CPF Action Plan has strengthened these requirements significantly.

- Know Your Customer (KYC): Comprehensive client identification and verification procedures

- Record Keeping: Detailed transaction records maintained for at least five years

- Reporting Obligations: Regular financial and operational reports to the FSC

- Corporate Governance: Proper board oversight and internal control systems

Licensing Requirements for BVI Forex Brokers

Application Process

Obtaining an FSC BVI forex license involves a structured process typically taking 3-6 months:

- Company Formation: Establish a BVI Business Company as the license holder

- Capital Injection: Deposit minimum required capital (typically $100,000-$250,000)

- Personnel Appointment: Designate qualified directors and key personnel

- Documentation Preparation: Compile comprehensive application materials

- FSC Review: Undergo regulatory assessment and due diligence

- License Issuance: Receive authorization to commence operations

Documentation Requirements

The application process requires extensive documentation including:

- Business plan and financial projections

- Organizational structure and ownership details

- Key personnel qualifications and background checks

- Risk management and compliance procedures

- Client asset protection arrangements

- Technology and security infrastructure details

Ongoing Compliance

Once licensed, brokers face continuous regulatory obligations:

- Prior Approvals: FSC consent required for director appointments, ownership changes, and business expansions

- Financial Reporting: Regular submission of audited accounts and regulatory returns

- Supervisory Cooperation: Full cooperation with FSC inspections and investigations

- Client Asset Management: Ongoing compliance with segregation and protection requirements

Why Choose an FSC BVI Regulated Forex Broker?

Advantages of FSC BVI Regulated Brokers

Tax Benefits

The BVI offers one of the world’s most attractive tax structures for forex trading:

- 0% Corporate Income Tax: No tax on company profits for BVI-incorporated entities

- 0% Capital Gains Tax: Traders keep 100% of their trading profits

- No Withholding Tax: Dividends and interest payments are not subject to withholding

- No Exchange Controls: Free movement of capital in and out of BVI

Tax analogy: Trading with an FSC BVI broker is like shopping in a tax-free zone at an airport—you get to keep more of what you earn because there are no local taxes eating into your profits.

Operational Flexibility

FSC BVI regulation provides significant operational advantages:

- High Leverage: Many FSC BVI brokers offer leverage up to 1:1000, allowing traders to maximize their market exposure

- Flexible Account Types: Brokers can offer diverse account structures including Islamic accounts, cent accounts, and professional trader accounts

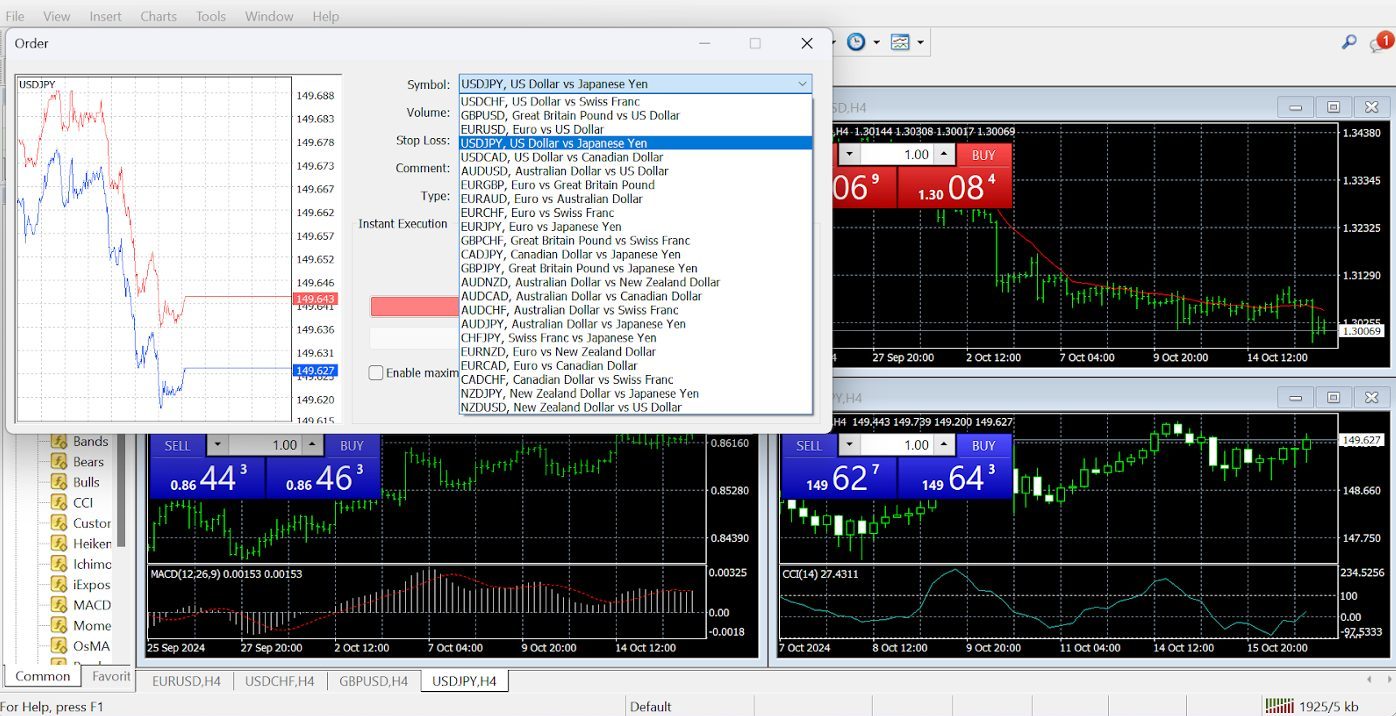

- Multiple Trading Platforms: Support for MetaTrader 4, MetaTrader 5, cTrader, and proprietary platforms

- Global Market Access: Trade across multiple asset classes including forex, commodities, indices, and cryptocurrencies

International Recognition

BVI’s regulatory framework enjoys international recognition due to:

- English Common Law System: Familiar legal framework for international clients

- Political Stability: Stable democratic government and established institutions

- International Compliance: Adherence to OECD and FATF standards

- Bilateral Agreements: Tax information exchange agreements with major jurisdictions

Lower Capital Requirements

Compared to major financial centers, BVI offers more accessible entry requirements:

- Minimum capital requirements starting from $100,000 for basic licenses

- Flexible corporate structures allowing for efficient capital allocation

- Lower ongoing regulatory fees compared to FCA or ASIC

- Reduced compliance costs due to streamlined reporting requirements

Potential Drawbacks of FSC BVI Regulation

Limited Investor Protections

While FSC BVI provides regulatory oversight, trader protections are more limited:

- No Compensation Scheme: Unlike FCA’s £85,000 FSCS or ASIC’s AU$500,000 coverage, BVI has no investor compensation fund

- Limited Negative Balance Protection: Not mandatory for all account types

- Reduced Regulatory Intervention: Less frequent market conduct monitoring compared to Tier-1 regulators

High Risk for Scams

The flexibility of BVI regulation can attract less scrupulous operators:

- Traders must conduct thorough due diligence on broker reputation

- Limited recourse options for disputes compared to major regulatory jurisdictions

- Potential for regulatory arbitrage by questionable operators

Client Fund Protection Limitations

While SIBA requires client asset segregation, protections may be less comprehensive:

- Insurance coverage levels may vary between brokers

- Resolution processes for broker insolvency may be more complex

- Limited regulatory resources for client asset recovery

Top FSC BVI Regulated Forex Brokers

Based on our comprehensive analysis of FSC BVI regulated entities and market research, here are the leading forex brokers operating under BVI regulation in 2025:

MultiBank Exchange Group — Best Overall Broker

Overview and Features

MultiBank Exchange Group stands as one of the most established names in FSC BVI regulated forex trading. Operating through MultiBank FX International Corporation, the company offers comprehensive trading services across multiple asset classes.

Key Features:

- Over 15,000 tradeable instruments including forex, commodities, indices, and cryptocurrencies

- Multiple trading platforms: MetaTrader 4, MetaTrader 5, and proprietary MultiBank Trader

- Leverage up to 1:500 for forex pairs

- Minimum deposit starting from $50

- 24/7 multilingual customer support

Regulation and Security

MultiBank Group maintains a robust regulatory presence with licenses across 5 continents from 17+ financial regulators, including:

- FSC BVI: MultiBank FX International Corporation

- BaFin (Germany): Full banking license

- CIMA (Cayman Islands): Investment business license

- ADGM (UAE): Category 4 license

Pros and Cons

Pros:

- Extensive regulatory coverage providing multiple jurisdictional protections

- Comprehensive trading instruments and advanced platforms

- Competitive spreads starting from 0.0 pips

- Strong institutional reputation with major banking partnerships

Cons:

- Higher minimum deposits for premium account types

- Complex account structure may confuse beginner traders

- Limited educational resources compared to retail-focused brokers

Exness — Best for Unlimited Leverage

Overview and Features

Exness operates in BVI through Exness (VG) Ltd with FSC registration number 2032226 and investment business license SIBA/L/20/1133. The broker has gained prominence for offering unlimited leverage and instant withdrawals.

Key Features:

- Unlimited leverage on major forex pairs for qualified clients

- Instant withdrawal processing

- Over 200 trading instruments

- MetaTrader 4, MetaTrader 5, and Exness Terminal platforms

- Minimum deposit from $1

| Account Type | Min Deposit | Spreads From | Max Leverage | Commission |

|---|---|---|---|---|

| Standard | $1 | 0.3 pips | Unlimited | $0 |

| Pro | $200 | 0.1 pips | Unlimited | $3.5/lot |

| Zero | $200 | 0.0 pips | Unlimited | $3.5/lot |

Regulation and Security

Exness maintains multiple regulatory licenses including:

- FSC BVI: License SIBA/L/20/1133

- CySEC: License 178/12

- FCA: License 730729

- FSCA: License 51024

easyMarkets — Best MT4 Broker

Overview and Features

easyMarkets has expanded its regulatory coverage to include FSC BVI licensing, allowing the broker to serve a broader international client base with flexible trading conditions.

Key Features:

- Fixed spreads with no slippage guarantee

- MetaTrader 4, MetaTrader 5, and proprietary platforms

- 135+ trading instruments

- Deal cancellation feature within 60 minutes

- Negative balance protection

Trading Platforms and Tools

easyMarkets offers comprehensive platform support:

- MetaTrader 4: Advanced charting with Expert Advisors support

- MetaTrader 5: Enhanced features for multi-asset trading

- easyMarkets Platform: Proprietary web and mobile trading interface

- TradingView Integration: Professional charting tools

FBS — Best for Beginners

Overview and Features

FBS operates under FSC BVI regulation, providing beginner-friendly trading conditions with comprehensive educational resources. The broker is known for its user-friendly interface and extensive learning materials.

Key Features:

- Multiple account types including cent accounts

- Leverage up to 1:3000

- Over 100 trading instruments

- Extensive educational resources

- Demo accounts with virtual funds

| Account Type | Min Deposit | Spreads From | Max Leverage | Features |

|---|---|---|---|---|

| Cent | $1 | 1.0 pips | 1:1000 | Perfect for beginners |

| Standard | $100 | 0.5 pips | 1:3000 | Most popular account |

| Zero Spread | $500 | 0.0 pips | 1:3000 | Commission-based pricing |

AvaTrade — Best Multi-Asset Broker

Overview and Features

AvaTrade operates through Ava Trade Markets Ltd, regulated by FSC BVI with license number SIBA/L/13/1049. The broker offers diverse trading instruments and innovative trading tools.

Key Features:

- Over 1,250 trading instruments

- Maximum leverage up to 1:400

- Multiple platform options including AvaTradeGO mobile app

- Copy trading and automated trading support

- Comprehensive educational resources

Regulation and Security

AvaTrade maintains regulatory licenses across multiple jurisdictions:

- FSC BVI: License SIBA/L/13/1049

- Central Bank of Ireland: License C53877

- ASIC: License 406684

- JFSA: License 1662

RoboForex — High Leverage Broker

Overview and Features

RoboForex offers some of the highest leverage ratios in the industry, with FSC BVI regulation providing the flexibility for leverage up to 1:2000. The broker caters to both retail and professional traders with diverse account options.

Key Features:

- Leverage up to 1:2000

- Over 12,000 trading instruments

- Multiple platform support: MT4, MT5, cTrader, R Trader

- CopyFX social trading platform

- Competitive spreads from 0.0 pips

High Leverage Trading Conditions

RoboForex’s high leverage offerings include:

- 1:1000 Leverage: Available on standard accounts

- 1:2000 Leverage: For qualified traders with substantial experience

- Flexible Margin Requirements: Adjusted based on account balance and trading history

- Risk Management Tools: Stop-out levels and margin call protections

Markets.com — Best Trading Education

Overview and Features

Markets.com operates under FSC BVI through Finalto (BVI) Ltd with license number SIBA/L/14/1067. The broker is renowned for its comprehensive educational resources and user-friendly trading environment.

Key Features:

- Over 2,100 trading instruments

- Advanced trading platforms with professional tools

- Comprehensive market analysis and research

- Multiple account types for different trading styles

- Robust mobile trading application

Educational Resources

Markets.com provides extensive learning materials:

- Daily market analysis and trading signals

- Video tutorials and webinars

- Trading eBooks and guides

- Economic calendar and news feeds

- Demo trading accounts with virtual funds

FXTM — Best Copy Trading

Overview and Features

FXTM (ForexTime) maintains FSC BVI regulation through Exinity Limited, offering innovative copy trading solutions and professional trading environments. The broker serves over 2 million clients worldwide.

Key Features:

- FXTM Invest copy trading platform

- Multiple account types: Micro, Advantage, Advantage Plus

- Minimum deposit from $10

- Award-winning mobile trading application

- Comprehensive educational center

Copy Trading Platform

FXTM’s copy trading features include:

- Strategy managers with verified track records

- Risk management controls for followers

- Performance analytics and reporting

- Flexible investment amounts and withdrawal options

HotForex (HFM) — Best Trading Conditions

Overview and Features

HotForex, now operating as HFM, maintains FSC BVI regulation and is recognized for providing excellent trading conditions with competitive spreads and fast execution speeds.

Key Features:

- Ultra-fast execution speeds

- Competitive spreads from 0.0 pips

- Multiple account types including Islamic accounts

- Professional trading platforms

- Comprehensive market research

InstaForex — Best Platform Variety

Overview and Features

InstaForex offers diverse trading platforms and account types, catering to traders with different experience levels and trading preferences. The broker provides access to multiple financial markets through various trading interfaces.

Key Features:

- Multiple trading platforms: MT4, MT5, Multi-terminal, WebTrader

- Diverse trading instruments across multiple asset classes

- Flexible account types including Islamic and cent accounts

- Educational resources and market analysis

- Demo trading accounts

XM Group — Best Customer Support

Overview and Features

XM Group operates under multiple regulatory jurisdictions including FSC BVI, serving over 5 million clients worldwide. The broker is known for its exceptional customer support and comprehensive trading services.

Key Features:

- 24/7 multilingual customer support

- Over 1,000 trading instruments

- Multiple account types with low minimum deposits

- Advanced trading platforms and tools

- Regular educational webinars and seminars

How to Verify FSC BVI Regulated Brokers

Steps to Verify a Broker’s FSC License

Verifying a broker’s FSC BVI license is crucial for trader safety. Follow these steps to confirm regulatory status:

- Visit the Official FSC BVI Website: Navigate to https://www.bvifsc.vg/regulated-entities

- Search the Regulated Entities Database: Use the search function to find the broker’s name or license number

- Verify License Status: Check that the license is “Currently Regulated” and not suspended or revoked

- Cross-Reference Information: Ensure the entity name matches the broker’s official documentation

- Check License Category: Verify the license covers forex/investment business activities

Quick Verification Tip

The FSC BVI maintains a downloadable CSV file with all regulated entities at https://www.bvifsc.vg/regulated-entities-data.csv. This comprehensive list contains over 11,990 entities and can be searched for specific broker names.

Importance of Cross-Regulation

Many reputable FSC BVI brokers maintain additional regulatory licenses:

- Enhanced Credibility: Multiple licenses demonstrate commitment to regulatory compliance

- Broader Protection: Additional jurisdictions may offer supplementary client protections

- Operational Flexibility: Multi-jurisdictional licensing allows serving diverse client bases

- Risk Mitigation: Regulatory diversification reduces single-jurisdiction regulatory risk

Avoiding Scam Brokers

Red flags to watch for when evaluating FSC BVI brokers:

- Unverifiable License Claims: Brokers claiming regulation but not appearing in official FSC databases

- Guaranteed Profits: No legitimate broker can guarantee trading profits

- Pressure Tactics: High-pressure sales tactics or unrealistic bonus offers

- Poor Communication: Lack of clear contact information or professional communication

- Withdrawal Issues: Reports of delayed or refused withdrawal processing

Factors to Consider When Choosing a BVI Regulated Forex Broker

Trading Platforms and Tools

Platform selection significantly impacts trading experience. Consider these factors:

MetaTrader Platforms:

- MetaTrader 4: Industry standard with extensive Expert Advisor support

- MetaTrader 5: Advanced features including level II pricing and economic calendar

- Mobile Compatibility: iOS and Android applications for trading on-the-go

- Web Trading: Browser-based platforms requiring no software installation

Advanced Trading Tools:

- Professional charting packages with technical indicators

- Automated trading capabilities and algorithmic trading

- Copy trading and social trading features

- Advanced order types and risk management tools

Leverage and Margin Requirements

FSC BVI regulation allows flexible leverage arrangements:

| Broker | Max Leverage | Margin Call Level | Stop Out Level | Negative Balance Protection |

|---|---|---|---|---|

| RoboForex | 1:2000 | 40% | 20% | Optional |

| FBS | 1:3000 | 40% | 20% | Yes |

| Exness | Unlimited | 60% | 0% | Yes |

| AvaTrade | 1:400 | 100% | 50% | Yes |

Customer Support and Educational Resources

Quality customer support is essential for successful trading:

- 24/7 Support: Round-the-clock assistance across multiple time zones

- Multiple Languages: Support in major international languages

- Communication Channels: Live chat, email, telephone, and social media support

- Response Times: Quick resolution of technical and account issues

Educational Resources:

- Comprehensive trading guides and tutorials

- Regular market analysis and trading signals

- Webinars and educational seminars

- Demo accounts for practice trading

- Economic calendars and news feeds

Fees and Spreads

Cost structure comparison among top FSC BVI brokers:

| Broker | EUR/USD Spread | Commission | Deposit Fee | Withdrawal Fee |

|---|---|---|---|---|

| MultiBank | From 0.0 pips | $3.5/lot | Free | Free |

| Exness | From 0.0 pips | $3.5/lot | Free | Free |

| easyMarkets | 0.7 pips (fixed) | $0 | Free | Free |

| FBS | From 0.0 pips | $6/lot | Free | Free |

Trading Conditions with BVI Brokers

Leverage Limits

FSC BVI regulation provides significant flexibility in leverage offerings compared to major regulatory jurisdictions:

Leverage comparison: If FCA regulation is like driving with a speed limit of 30 mph (1:30 leverage), FSC BVI is like an autobahn with much higher speeds (up to 1:1000+). More freedom, but you need better driving skills.

- Standard Accounts: Typically offer leverage from 1:100 to 1:500

- Professional Accounts: Can provide leverage up to 1:1000 or higher

- VIP/Institutional Accounts: May offer unlimited leverage for qualified clients

- Dynamic Leverage: Some brokers adjust leverage based on account balance and trading volume

Minimum Deposits

FSC BVI brokers typically offer accessible minimum deposit requirements:

- Micro Accounts: Starting from $1-$10

- Standard Accounts: Usually $50-$250

- Professional Accounts: $500-$2,500

- VIP Accounts: $10,000+

Trading Platforms

Most FSC BVI brokers support multiple trading platforms:

Regulatory Oversight and Supervision

Audit Requirements

FSC BVI regulated brokers must comply with regular audit requirements:

- Annual Audited Accounts: Submission of audited financial statements within 6 months of year-end

- Regulatory Returns: Quarterly and annual regulatory reporting

- Client Asset Audits: Regular verification of client fund segregation

- Systems Audits: Review of internal controls and risk management systems

Reporting Obligations

Licensed brokers must maintain comprehensive reporting to the FSC:

- Monthly financial position reports

- Quarterly business activity summaries

- Annual compliance certificates

- Incident reporting for significant operational events

- Large exposure and concentration risk reports

Enforcement Actions

The FSC BVI has enforcement powers including:

- License Suspension: Temporary suspension of trading authorization

- License Revocation: Permanent removal of regulatory permission

- Financial Penalties: Monetary sanctions for compliance failures

- Restrictions on Business: Limitations on specific trading activities

- Public Warnings: Public notification of regulatory concerns

Client Fund Protection Measures

Segregation of Funds

Under SIBA 2010, FSC BVI brokers must implement robust client asset protection:

- Separate Bank Accounts: Client funds held separately from broker operational funds

- Daily Reconciliation: Regular verification of client fund balances

- Trust Arrangements: Client assets held in trust where specified by regulations

- Third-Party Custody: Use of independent custodians for client asset safekeeping

Risk Management Protocols

Brokers must maintain comprehensive risk management frameworks:

- Real-time position monitoring and margin management

- Automated stop-out procedures to prevent negative balances

- Counterparty risk assessment and management

- Liquidity risk monitoring and contingency planning

- Operational risk controls and business continuity planning

Reporting Requirements

Client asset protection reporting includes:

- Monthly client money reconciliations

- Quarterly client asset audits

- Annual compliance attestations

- Immediate reporting of any client asset deficiencies

Safety Considerations for Traders

Due Diligence Checklist

Before trading with any FSC BVI broker, complete this comprehensive checklist:

Trader Safety Checklist

- ✅ Verify FSC BVI license through official website

- ✅ Check for additional regulatory licenses

- ✅ Review client fund segregation policies

- ✅ Test customer support responsiveness

- ✅ Analyze trading conditions and fee structures

- ✅ Read terms and conditions thoroughly

- ✅ Start with a demo account

- ✅ Begin with minimum deposits

- ✅ Test withdrawal processes

- ✅ Monitor regulatory status regularly

Risk Assessment

Evaluate these risk factors when choosing an FSC BVI broker:

Regulatory Risk:

- Limited compensation schemes compared to Tier-1 regulators

- Potential regulatory changes affecting operations

- Jurisdictional restrictions in some countries

Operational Risk:

- Technology infrastructure reliability

- Execution quality and slippage management

- Business continuity and disaster recovery capabilities

Financial Risk:

- Broker financial stability and capital adequacy

- Client fund protection arrangements

- Insurance coverage levels and scope

Dispute Resolution Process

Filing Complaints

If issues arise with an FSC BVI broker, follow these steps:

- Direct Contact: Address concerns directly with the broker’s customer service

- Formal Complaint: Submit written complaints to broker management

- Escalation: Escalate unresolved issues to senior management

- Regulatory Complaint: Contact FSC BVI for regulatory intervention

- Legal Consultation: Seek legal advice for complex disputes

Mediation Procedures

The FSC BVI may facilitate dispute resolution through:

- Mediation between traders and brokers

- Investigation of regulatory violations

- Enforcement action against non-compliant brokers

- Coordination with international regulatory bodies

Legal Recourse

Legal options for unresolved disputes include:

- BVI court proceedings under English common law

- International arbitration procedures

- Cross-border legal enforcement mechanisms

- Asset recovery proceedings where applicable

How Does FSC BVI Regulation Compare to Other Major Regulators?

Comparison with FCA (UK), ASIC (Australia), and CySEC (Cyprus)

This comprehensive comparison reveals the trade-offs between different regulatory approaches:

FSC BVI Strengths:

- Exceptional leverage flexibility (10/10)

- Outstanding tax benefits with 0% corporate and capital gains tax (10/10)

- High cost efficiency through lower operational expenses (9/10)

- Fast processing for licenses and account operations (9/10)

FSC BVI Limitations:

- Moderate investor protection compared to Tier-1 regulators (4/10)

- Limited international recognition in some jurisdictions (6/10)

Pros and Cons of Trading with FSC BVI Brokers

Pros: Flexibility and Accessibility

Key Advantages

- Tax Efficiency: 0% tax on trading profits and corporate income

- High Leverage: Access to leverage ratios up to 1:1000 or unlimited

- Operational Speed: Faster account opening, execution, and withdrawal processes

- Cost Effectiveness: Lower fees, tighter spreads, and attractive bonuses

- Trading Flexibility: Fewer restrictions on trading strategies and instruments

- International Access: Ability to serve global clients with minimal restrictions

- Innovation Friendly: More receptive to new trading technologies and instruments

Cons: Limited Oversight and Protection

Key Disadvantages

- Investor Protection: No compensation schemes or deposit insurance

- Regulatory Oversight: Less stringent monitoring compared to FCA/ASIC

- Dispute Resolution: Limited recourse options for trader grievances

- Negative Balance Risk: Potential for losses exceeding account balance

- Due Diligence Burden: Traders must conduct more thorough broker research

- Jurisdictional Restrictions: Some countries may restrict access to FSC BVI brokers

- Market Conduct: Potentially less oversight of broker trading practices

Future of BVI Forex Regulation

Upcoming Reforms

The FSC BVI continues to evolve its regulatory framework to meet international standards:

- Enhanced AML/CFT Measures: Implementation of the 2025 National Strategic AML/CFT/CPF Action Plan

- Technology Integration: Digital transformation initiatives for licensing and supervision

- Cross-Border Cooperation: Strengthened information sharing with international regulators

- Risk-Based Supervision: More sophisticated risk assessment and monitoring frameworks

Industry Trends

Several trends are shaping the future of FSC BVI forex regulation:

- Cryptocurrency Integration: Developing frameworks for crypto-forex trading

- ESG Compliance: Environmental, social, and governance considerations in regulation

- RegTech Adoption: Regulatory technology for enhanced supervision and compliance

- Client Protection Enhancement: Balancing flexibility with improved trader safeguards

Regulatory Evolution

The FSC BVI is positioning itself for continued relevance in the global financial services landscape:

- Maintaining competitive advantages while enhancing regulatory standards

- Adapting to international regulatory harmonization efforts

- Embracing technological innovation in financial services

- Strengthening relationships with major financial centers

Conclusion

Key Considerations for Choosing an FSC BVI Regulated Forex Broker

Selecting the right FSC BVI regulated forex broker requires careful evaluation of multiple factors. The territory’s regulatory framework offers unique advantages including tax efficiency, high leverage options, and operational flexibility, making it attractive for experienced traders seeking advanced trading conditions.

However, these benefits come with trade-offs in terms of investor protection and regulatory oversight compared to Tier-1 jurisdictions like the UK’s FCA or Australia’s ASIC. Traders must conduct thorough due diligence, verify regulatory status, and understand the risk-return profile of FSC BVI regulation.

The Role of FSC BVI in Ensuring Safe Trading Environments

The FSC BVI continues to strengthen its regulatory framework while maintaining the competitive advantages that make BVI an attractive offshore financial center. The 2024 amendments to the Securities and Investment Business Act demonstrate the Commission’s commitment to adapting regulations to modern market realities.

Through comprehensive licensing requirements, ongoing supervision, and client asset protection measures, the FSC BVI provides a regulated environment that balances market access with appropriate oversight. The Commission’s focus on international cooperation and compliance with global standards enhances the credibility of BVI-regulated entities.

Final Recommendations

For traders considering FSC BVI regulated brokers, we recommend:

- Start Conservative: Begin with demo accounts and small deposits to test broker services

- Verify Thoroughly: Always confirm regulatory status through official FSC BVI channels

- Diversify Brokers: Consider using multiple brokers to spread risk

- Monitor Regularly: Stay informed about regulatory changes and broker performance

- Understand Risks: Fully comprehend the limitations of FSC BVI protection compared to Tier-1 regulators

The FSC BVI regulatory framework offers compelling advantages for sophisticated traders who understand its risk-reward profile. By choosing reputable, well-established brokers with strong track records and additional regulatory licenses, traders can benefit from BVI’s flexibility while maintaining reasonable safety standards.

FAQs

- What is FSC Certified Broker?

- An FSC certified broker is a forex or investment firm licensed and regulated by the Financial Services Commission of the British Virgin Islands. These brokers must comply with BVI’s Securities and Investment Business Act and maintain specific capital, operational, and client protection standards.

- Are FSC BVI Regulated Brokers Safe?

- FSC BVI regulated brokers operate under legitimate regulatory oversight, but offer less investor protection than Tier-1 regulators like FCA or ASIC. Safety depends on the individual broker’s reputation, additional licenses, and operational practices. Traders should conduct thorough due diligence.

- Is BVI FSC regulation reliable?

- BVI FSC regulation is legitimate and operates under established legal frameworks based on English common law. However, it’s considered a Tier-2 or offshore regulator with less stringent requirements than major financial centers. The reliability varies by individual broker.

- What Are the Minimum Requirements for FSC BVI Brokers?

- FSC BVI brokers must maintain minimum capital resources (typically $100,000-$250,000), segregate client funds, maintain professional indemnity insurance, employ qualified personnel, and comply with ongoing reporting and supervision requirements under SIBA 2010.

- Can FSC BVI Brokers Offer High Leverage?

- Yes, FSC BVI regulation allows brokers to offer high leverage ratios, commonly up to 1:1000 or even unlimited leverage for qualified clients. This flexibility is one of the key advantages of BVI regulation compared to restrictive jurisdictions like the EU.

- What leverage limits apply to BVI brokers?

- FSC BVI does not impose strict leverage limits like ESMA’s 1:30 restriction. Brokers can offer leverage up to 1:1000, 1:2000, or even unlimited leverage, depending on their risk management policies and client qualification criteria.

- Is There a Risk in Trading with FSC BVI Brokers?

- Yes, risks include limited investor compensation schemes, potentially less regulatory oversight, higher leverage exposure, and the need for greater trader due diligence. However, reputable FSC BVI brokers with strong track records can provide legitimate trading services.

- How to Choose the Best FSC BVI Broker?

- Consider factors including regulatory verification, additional licenses, trading conditions, platform quality, customer support, fund security measures, company reputation, withdrawal policies, and fee structures. Always verify licenses through official FSC BVI channels.

- What Trading Platforms Do FSC BVI Brokers Offer?

- Most FSC BVI brokers support MetaTrader 4, MetaTrader 5, and often additional platforms like cTrader, proprietary platforms, and web-based trading interfaces. Platform availability varies by broker and account type.

- Can International Traders Use FSC BVI Brokers?

- Yes, FSC BVI brokers typically accept international clients from most countries. However, some jurisdictions may restrict access to offshore brokers, and individual brokers may have their own country restrictions based on compliance policies.

- Do FSC BVI Brokers Provide Negative Balance Protection?

- Negative balance protection is not mandatory under FSC BVI regulation, unlike in the EU. Some brokers offer this feature voluntarily, but it’s not guaranteed. Traders should verify this protection before opening accounts.

- How Does FSC Regulation Benefit Offshore Brokers?

- FSC BVI regulation offers benefits including 0% corporate tax, flexible operational requirements, higher leverage permissions, streamlined licensing processes, international recognition, and the ability to serve global clients with fewer restrictions.

- Why Do Some Brokers Choose FSC BVI Over Other Regulators?

- Brokers choose FSC BVI for tax efficiency (0% corporate tax), regulatory flexibility, higher leverage allowances, lower compliance costs, faster licensing procedures, and the ability to offer competitive trading conditions to international clients.

- Is It Legal to Trade with FSC BVI Brokers in My Country?

- Legality depends on your country’s regulations. Most countries allow residents to trade with offshore brokers, but some (like the US) have restrictions. Check with local financial authorities or legal advisors for country-specific guidance.

- Do FSC BVI Brokers Offer Segregated Accounts?

- Yes, SIBA 2010 requires FSC BVI brokers to segregate client assets from their operational funds. Client money must be held in separate bank accounts and protected from broker insolvency, though protection levels may vary.

- Are Client Funds Protected Under BVI Regulation?

- FSC BVI regulation requires client fund segregation and protection arrangements, but there’s no compensation scheme like the UK’s FSCS. Protection depends on the broker’s specific arrangements, insurance coverage, and compliance with segregation requirements.

- Are FSC BVI Brokers Suited for Beginners?

- FSC BVI brokers can suit beginners who understand the regulatory trade-offs. Many offer educational resources, demo accounts, and low minimum deposits. However, beginners should be extra cautious about broker selection and risk management due to limited investor protections.

- What Are the Costs of Trading with FSC BVI Brokers?

- Costs typically include spreads, commissions (for ECN accounts), overnight swap fees, and potential withdrawal fees. FSC BVI brokers often offer competitive pricing due to lower operational costs and tax advantages, with many providing zero-commission options.

- Do FSC BVI Brokers Support MetaTrader 4 and MetaTrader 5?

- Most FSC BVI brokers support both MT4 and MT5 platforms, along with mobile versions and web trading interfaces. These platforms are industry standards and widely available among BVI-regulated brokers.

- Are FSC BVI Brokers Transparent?

- Transparency varies by broker, but reputable FSC BVI brokers provide clear information about trading conditions, fees, regulatory status, and risk disclosures. Always verify transparency through official documentation and regulatory filings.

- How Does FSC Handle Broker Complaints?

- The FSC BVI investigates complaints against licensed entities and can take enforcement action including license suspension, penalties, or revocation. However, individual dispute resolution may be more limited compared to major regulatory jurisdictions.

- How to File a Complaint Against a BVI Broker?

- File complaints directly with the broker first, then escalate to FSC BVI if unresolved. Provide detailed documentation of the issue, correspondence, and evidence. The FSC can investigate regulatory violations and take appropriate action.

- Are FSC BVI Brokers Insured for Client Losses?

- Professional indemnity insurance is required under FSC BVI regulation, but coverage levels and scope vary by broker. There’s no universal deposit insurance scheme, so traders should verify each broker’s specific insurance arrangements.

- Are There Any Compensation Schemes?

- No, FSC BVI regulation does not include investor compensation schemes like the UK’s FSCS (£85,000) or Australia’s FCS (AU$500,000). Client protection relies on segregation requirements, insurance, and individual broker policies.

- What Documentation Is Needed to Open an Account?

- Typically required documents include government-issued ID (passport or driver’s license), proof of address (utility bill or bank statement), and potentially additional verification documents depending on the broker’s KYC requirements and account type.

- How to Verify a BVI FSC License?

- Visit the official FSC BVI website at www.bvifsc.vg/regulated-entities and search for the broker by name or license number. Verify the license is “Currently Regulated” and covers the appropriate business activities. Download the complete entities list for comprehensive verification.

- What Are the Minimum Capital Requirements?

- Minimum capital requirements for FSC BVI forex brokers typically range from $100,000 to $250,000 depending on the license category and business scope. The FSC may require additional capital based on risk assessment and business volume.

- Can BVI Brokers Accept International Clients?

- Yes, FSC BVI brokers can generally accept international clients from most countries, subject to their own compliance policies and any restrictions from client jurisdictions. Some countries may prohibit their residents from using offshore brokers.

- How Often Are BVI Brokers Audited?

- FSC BVI brokers must submit annual audited financial statements and undergo regular supervisory reviews. The frequency of on-site inspections varies based on risk assessment, but brokers face ongoing monitoring and must report significant changes or issues immediately.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.