Key Takeaways

- AMF regulation ensures trader protection through strict oversight and fund segregation requirements

- Always verify broker authorization via the official REGAFI database before opening accounts

- Top AMF brokers include XM, Exness, AvaTrade, and Pepperstone with competitive spreads starting from 0.1 pips

- MiFID II compliance provides additional investor protections including negative balance protection

- Use the AMF blacklist to avoid unauthorized brokers and potential scams

Understanding AMF Regulation

Picture this: you’re sitting at your computer, ready to start forex trading, and you’re faced with dozens of broker options. How do you know which ones are actually safe? That’s where the Autorité des Marchés Financiers (AMF) comes in—think of them as your financial bodyguard in the wild west of forex trading.

What is the Autorité des Marchés Financiers (AMF)?

The AMF is France’s financial markets watchdog, established in 2003 through the Financial Security Act. Unlike your typical government bureaucracy, the AMF operates as an independent public authority with serious teeth. They’re the folks who make sure forex brokers play by the rules—and trust me, you want them on your side.

2024 Update: The AMF has strengthened its regulatory framework with enhanced reporting requirements and stricter enforcement measures. As of January 1, 2024, all AMF-regulated brokers must comply with updated electronic reporting standards and enhanced client protection measures.

Role and Responsibilities of the AMF

The AMF doesn’t just sit around reading paperwork (though they do plenty of that). Here’s what they actually do to protect your hard-earned money:

- Licensing and Authorization: They decide who gets to play in the French financial sandbox

- Ongoing Supervision: Regular check-ups to ensure brokers aren’t cutting corners

- Investigation Powers: They can dig deep when something smells fishy

- Enforcement Actions: From fines to complete shutdowns—they mean business

- Investor Education: Helping traders like you make informed decisions

The Role of AMF in the Forex Market

In the forex world specifically, the AMF ensures that brokers operating in France follow MiFID II regulations. This isn’t just bureaucratic red tape—it’s your shield against dodgy practices. Every AMF-regulated broker must maintain segregated client accounts, provide clear risk warnings, and offer negative balance protection.

Think of it this way: If forex trading is like driving, the AMF is like having traffic lights, speed limits, and police patrols. Sure, you could drive without them, but would you really want to?

AMF’s Relationship with Other EU Regulators

The AMF doesn’t work in isolation. They collaborate closely with other European regulators like the FCA, CySEC, and BaFin. This means if a broker messes up in one country, word travels fast across the EU regulatory network.

Key Benefits of Trading with AMF Regulated Brokers

Security and Transparency

Security of Funds

When you deposit money with an AMF-regulated broker, your funds don’t just disappear into some mysterious account. These brokers must keep your money in segregated accounts—completely separate from their operating funds. It’s like having your money in a safety deposit box that only you can access.

Segregated Accounts

Here’s the deal: if an AMF-regulated broker goes belly-up tomorrow (unlikely, but let’s be realistic), your trading funds are protected. They’re held in separate accounts at reputable banks, often covered by compensation schemes up to €100,000 per client.

Transparent Trading Conditions

AMF regulations require brokers to be crystal clear about their fees, spreads, and trading conditions. No hidden surprises, no fine print tricks—what you see is what you get.

Investor Protection

Negative Balance Protection

This is huge, especially for new traders. Negative balance protection means you can never lose more than what’s in your trading account. Even if the market moves against you faster than a French TGV train, you won’t end up owing the broker money.

Dispute Resolution

Got a problem with your broker? AMF-regulated brokers must provide clear complaint procedures and participate in alternative dispute resolution schemes. It’s like having a referee in your corner.

How to Verify AMF Authorization

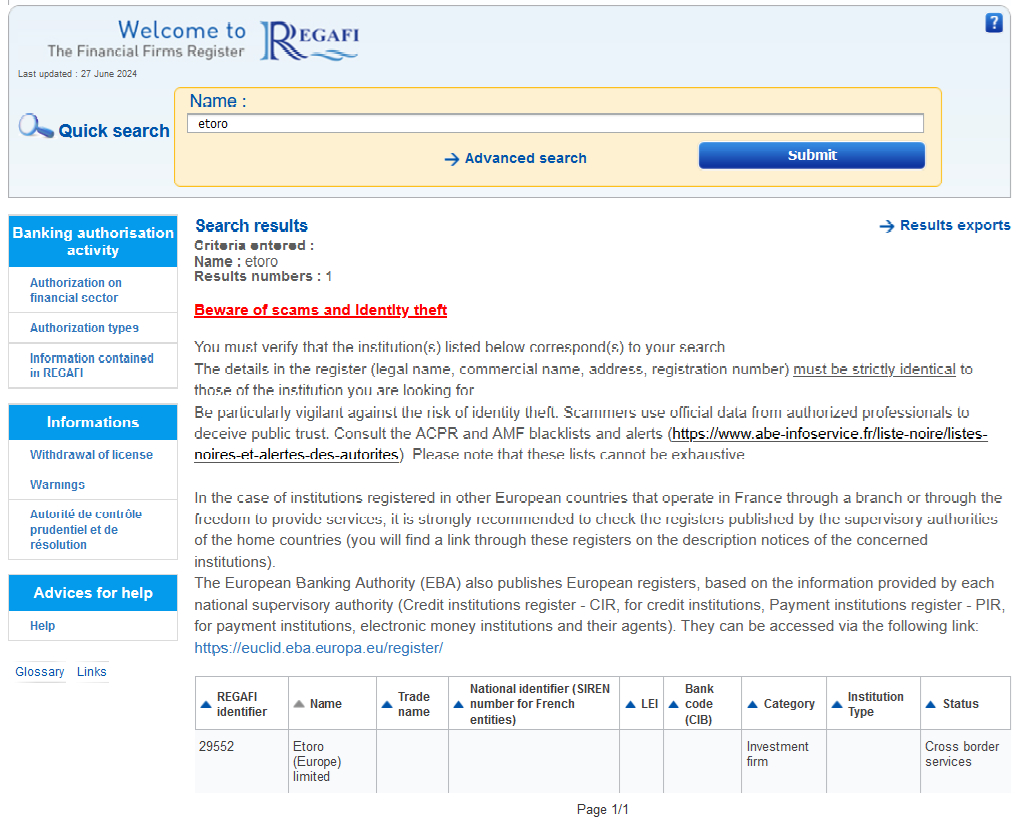

Checking AMF’s Official Registry (REGAFI Database)

Here’s your step-by-step detective guide to checking if a broker is legit:

- Visit the REGAFI database

- Enter the broker’s name in the search field

- Check the results—if they appear, click for detailed information

- Verify the license number and authorized activities

- Cross-reference with the broker’s website claims

Pro Tip: Don’t just take a broker’s word for it. The REGAFI database is updated regularly and is the only official source for verification. If a broker claims AMF regulation but doesn’t appear in REGAFI, run!

Red Flags for Unregulated Brokers Claiming AMF Regulation

Watch out for these warning signs:

- ❌ Claims regulation but not found in REGAFI

- ❌ Offers unrealistic leverage (above EU limits)

- ❌ Promises guaranteed profits

- ❌ Pressures you to deposit immediately

- ❌ No physical address in France or EU

- ❌ Poor website quality or broken English

Top AMF Regulated Forex Brokers for 2025

After extensive research and analysis of the top-ranking brokers in France, here are the cream of the crop—each one verified through the REGAFI database and offering excellent trading conditions for French traders.

XM Broker

XM has been a household name in forex since 2009, and for good reason. With ACPR/AMF license #73640, they’re as legitimate as they come. What sets XM apart is their commitment to education—perfect if you’re just starting your trading journey.

Trading Platforms

XM offers both MetaTrader 4 and MetaTrader 5, plus their web-based platform. Whether you’re a chart-loving technical analyst or prefer simple point-and-click trading, they’ve got you covered.

Account Types

Choose from Micro, Standard, XM Ultra Low, and Shares accounts. The Micro account is perfect for beginners with its $5 minimum deposit, while the Ultra Low account offers spreads from just 0.6 pips.

| Account Type | Min Deposit | EUR/USD Spread | Leverage |

|---|---|---|---|

| Micro | $5 | 1.0 pips | 1:888 |

| Standard | $5 | 1.0 pips | 1:888 |

| Ultra Low | $50 | 0.6 pips | 1:500 |

Exness

Exness (ACPR/AMF license #74630) is the broker of choice for traders who want unlimited leverage and ultra-tight spreads. Founded in 2008, they’ve built a reputation for lightning-fast execution and transparent pricing.

Platform Compatibility

Exness supports MT4, MT5, and their proprietary web terminal. Their mobile apps are particularly impressive, offering full functionality on the go.

Leverage and Spreads

Here’s where Exness shines—they offer unlimited leverage for experienced traders and spreads starting from 0.3 pips on EUR/USD.

| Account Type | Min Deposit | EUR/USD Spread | Commission |

|---|---|---|---|

| Standard | $1 | 1.0 pips | None |

| Raw Spread | $200 | 0.0 pips | $3.50/lot |

| Zero | $500 | 0.0 pips | $3.50/lot |

AvaTrade

AvaTrade is like the Swiss Army knife of forex brokers—they do everything well. With regulation across multiple jurisdictions including AMF authorization, they offer over 250 trading instruments and some of the best educational resources in the business.

Regulatory Overview

Beyond AMF regulation, AvaTrade holds licenses from the Central Bank of Ireland, ASIC, FSCA, and others. This multi-regulatory approach provides extra security for traders.

Available Accounts

AvaTrade offers Retail, Professional, and Islamic accounts. Their AvaProtect feature is unique—it’s like insurance for your trades, protecting against losses for a small fee.

Open Your AvaTrade AccountPepperstone

Pepperstone is the darling of professional traders and scalpers. Their claim to fame? Some of the tightest spreads in the industry and execution speeds measured in milliseconds. They’re authorized by AMF through their EU passport.

Regulatory Authorities

Pepperstone holds primary regulation from FCA and ASIC, with MiFID II passporting allowing them to serve French clients under AMF oversight.

Platform and Technology

They offer cTrader, MT4, MT5, and ZuluTrade. Their Razor account on cTrader offers spreads from 0.0 pips with a small commission—perfect for serious traders.

| Account Type | Min Deposit | EUR/USD Spread | Commission |

|---|---|---|---|

| Standard | $200 | 1.0 pips | None |

| Razor | $200 | 0.0 pips | $3.50/lot |

IG Markets

IG Markets is the granddaddy of retail forex trading—they’ve been around for over 45 years and know a thing or two about financial markets. With direct AMF authorization and a trust score that’s off the charts, they’re perfect for conservative traders.

Highest Trust Score Rating

IG consistently ranks as one of the most trusted brokers globally, with excellent financial stability and transparent operations.

Advanced Trading Tools

Their proprietary platform offers advanced charting, automated trading, and risk management tools that rival professional trading software.

Open Your IG AccountTrading 212

Trading 212 has revolutionized commission-free trading in Europe. Their clean interface and zero-commission stock trading make them perfect for traders who want to diversify beyond forex.

Commission-Free Trading

Trading 212 offers commission-free stock and ETF trading, with competitive forex spreads starting from 0.2 pips on major pairs.

Open Your Trading 212 AccountMarkets.com

Markets.com combines user-friendly trading with professional-grade tools. They’re particularly strong in educational content and market analysis, making them ideal for intermediate traders looking to improve their skills.

Open Your Markets.com AccountIC Markets

IC Markets is the speed demon of forex brokers. With server locations in major financial centers and institutional-grade technology, they offer some of the fastest execution speeds in the industry.

Execution Speed

IC Markets averages execution speeds of under 40 milliseconds, crucial for scalpers and high-frequency traders.

Open Your IC Markets AccountSaxo Bank

Saxo Bank is the premium choice for serious traders and institutions. With over 40,000 tradable instruments and world-class research, they’re perfect for traders who want everything under one roof.

Institutional Features

Saxo offers direct market access, advanced order types, and institutional-grade pricing for professional traders.

Open Your Saxo Bank AccountFXTM

FXTM (ACPR/AMF license #74495) has built a strong reputation for customer service and education. They offer a good balance of competitive spreads and comprehensive support.

| Account Type | Min Deposit | EUR/USD Spread | Leverage |

|---|---|---|---|

| Micro | $10 | 1.3 pips | 1:1000 |

| Standard | $100 | 1.3 pips | 1:1000 |

| ECN | $500 | 0.1 pips | 1:1000 |

Choosing the Best AMF Regulated Broker

Picking the right broker is like choosing a business partner—you want someone reliable, trustworthy, and aligned with your goals. Here’s your decision-making framework:

Key Features to Look for in an AMF Regulated Broker

Trading Platforms

Your trading platform is your cockpit—it needs to be intuitive, stable, and feature-rich. The most popular choices among AMF-regulated brokers are:

- MetaTrader 4 (MT4): The classic choice, perfect for forex trading

- MetaTrader 5 (MT5): More advanced, supports stocks and futures

- cTrader: Modern, intuitive, great for algorithmic trading

- Proprietary platforms: Custom-built solutions often with unique features

Account Types

Look for brokers offering multiple account types to match your experience level and trading style:

- Demo accounts: Risk-free practice (essential for beginners)

- Micro accounts: Small position sizes for learning

- Standard accounts: The middle ground for most traders

- ECN/Raw accounts: Direct market access for professionals

- Islamic accounts: Swap-free for Muslim traders

Commission and Fees

Understanding costs is crucial. Here’s what to look for:

| Fee Type | What to Expect | Industry Standard |

|---|---|---|

| EUR/USD Spread | Fixed or Variable | 0.5-2.0 pips |

| Commission | Per lot traded | $0-7 per lot |

| Overnight fees | Swap charges | Varies by currency |

| Deposit/Withdrawal | Processing fees | Usually free |

Customer Support

When you’re trading your hard-earned money, responsive support isn’t a luxury—it’s a necessity. Look for:

- 24/5 availability during market hours

- Multiple contact methods (phone, email, live chat)

- French language support

- Quick response times

- Knowledgeable staff

AMF Trading Restrictions and Guidelines

Leverage Limitations

Thanks to ESMA regulations, AMF-regulated brokers must comply with strict leverage limits:

- Major currency pairs: 30:1 maximum

- Minor currency pairs: 20:1 maximum

- Gold: 20:1 maximum

- CFDs on stocks: 5:1 maximum

- Cryptocurrency CFDs: 2:1 maximum

Think of leverage limits like speed limits: They’re there to protect you from yourself. Sure, unlimited leverage sounds exciting, but it’s also the fastest way to blow up your account.

Marketing Restrictions

AMF-regulated brokers must follow strict marketing guidelines:

- Clear risk warnings must be prominent

- No promises of guaranteed profits

- Honest representation of potential losses

- Transparent pricing information

Compliance Requirements for Forex Brokers

AMF-regulated brokers must:

- Maintain minimum capital requirements

- Submit regular financial reports

- Segregate client funds

- Provide negative balance protection

- Offer complaint procedures

- Conduct suitability assessments

AMF Blacklists and Fraud Prevention

What is the AMF Blacklist?

The AMF blacklist is your early warning system against scam brokers. Updated regularly, it lists unauthorized companies and websites that illegally offer financial services in France.

2024 Statistics: The AMF shut down 181 fraudulent investment sites in 2024, with victims losing an average of €29,500 each. Don’t become a statistic—always check the blacklist before trading.

How to Avoid Blacklisted Brokers

Your protection checklist:

- Check the REGAFI database first

- Cross-reference with the AMF blacklist

- Verify physical address and contact information

- Look for proper risk warnings

- Be skeptical of unrealistic promises

Steps to Report Fraudulent Brokers

If you encounter a suspicious broker:

- Contact the AMF directly

- Provide all relevant documentation

- Report to local authorities if money was lost

- Share your experience on trader forums

Trading Costs and Fees

Understanding costs is like knowing the rules of the game—essential for success. Here’s what you’ll encounter with AMF-regulated brokers:

Spreads

The spread is the difference between the buy and sell price. It’s how most brokers make money. Typical spreads for AMF-regulated brokers:

| Currency Pair | Typical Spread | Best Available |

|---|---|---|

| EUR/USD | 0.5-1.5 pips | 0.0-0.3 pips |

| GBP/USD | 1.0-2.0 pips | 0.5-1.0 pips |

| USD/JPY | 0.5-1.5 pips | 0.1-0.5 pips |

Commissions

Some brokers charge commissions instead of (or in addition to) spreads. This is common with ECN accounts where you get direct market pricing.

Overnight Fees

Hold a position overnight? You’ll pay or receive a swap fee based on interest rate differentials between currencies. AMF brokers must clearly display these rates.

Deposit and Withdrawal Methods

Bank Transfers

The most secure method, though sometimes slower. All AMF-regulated brokers accept SEPA transfers for European clients.

Credit/Debit Cards

Fast and convenient, though some banks may block gambling-related transactions. Visa and Mastercard are universally accepted.

E-wallets

PayPal, Skrill, and Neteller offer quick deposits and withdrawals. Perfect for frequent traders who need fast access to funds.

Educational Resources

The best AMF-regulated brokers don’t just take your money—they help you become a better trader. Look for comprehensive educational packages including:

Trading Courses

From basic forex concepts to advanced strategies, quality brokers offer structured learning paths.

Webinars

Live and recorded sessions with professional traders and market analysts.

Market Analysis

Daily, weekly, and monthly market commentary to keep you informed about market conditions.

Advantages and Disadvantages of Trading with AMF Regulated Brokers

Advantages of Trading with AMF Regulated Brokers

Security of Funds

Your money is safer than a bank vault. Segregated accounts and compensation schemes provide multiple layers of protection.

Investor Protection

Negative balance protection, clear complaint procedures, and regulatory oversight create a safety net for traders.

Dispute Resolution

Got a problem? AMF-regulated brokers must provide clear paths to resolution, including ombudsman services.

Disadvantages of AMF Regulated Forex Brokers

Stringent Regulations and Limits on Leverage

ESMA’s leverage limits might frustrate experienced traders used to higher leverage. Maximum 30:1 on major pairs can feel restrictive.

Limited Availability of High-Leverage Accounts

Professional traders can access higher leverage, but qualification requirements are strict and regularly reviewed.

How to Work Around Restrictions?

Some options include:

- Qualifying for professional trader status

- Using multiple positions instead of higher leverage

- Focusing on lower-risk trading strategies

- Considering offshore entities (with increased risk)

Conclusion

Recap of the Importance of AMF Regulation

After diving deep into the world of AMF-regulated forex brokers, one thing should be crystal clear: regulation isn’t just bureaucratic red tape—it’s your financial safety net. The AMF’s oversight ensures that French traders have access to transparent, fair, and secure trading environments.

We’ve explored how the Autorité des Marchés Financiers works tirelessly to protect traders through strict licensing requirements, ongoing supervision, and swift enforcement actions against bad actors. The REGAFI database serves as your verification tool, while the AMF blacklist acts as your early warning system against fraudulent brokers.

Key Considerations

Remember these crucial points as you embark on or continue your forex trading journey:

- Always verify regulation through the official REGAFI database—don’t take anyone’s word for it

- Understand the costs—spreads, commissions, and overnight fees can significantly impact your profitability

- Choose based on your needs—beginners need education and support, while professionals prioritize execution speed and tight spreads

- Stay informed about regulatory changes and broker updates

- Practice first—use demo accounts to test strategies and platforms before risking real money

Final Recommendations for Safe Forex Trading

Based on our comprehensive analysis, here are my top recommendations for French traders in 2025:

- For beginners: Start with XM or AvaTrade for their excellent educational resources

- For cost-conscious traders: Consider Pepperstone or Exness for their competitive spreads

- For professional traders: IG Markets or Saxo Bank offer institutional-grade tools and execution

- For algorithmic traders: IC Markets or Pepperstone provide the speed and technology you need

Whatever your choice, remember that successful forex trading isn’t just about finding the right broker—it’s about developing the right skills, mindset, and risk management practices. The AMF-regulated brokers we’ve discussed provide the secure foundation you need, but the rest is up to you.

Start with a demo account, educate yourself continuously, and never risk more than you can afford to lose. The forex market will be here tomorrow, next month, and next year—there’s no rush to risk everything today.

Final thought: Choosing an AMF-regulated broker is like choosing a co-pilot for your trading journey. You want someone experienced, trustworthy, and committed to getting you to your destination safely. The brokers we’ve discussed all fit that bill—now it’s time to take off.

Frequently Asked Questions (FAQs)

- What does it mean for a broker to be AMF regulated?

- When a broker is AMF regulated, it means they’ve been authorized by France’s financial markets authority to offer trading services. This includes strict compliance with MiFID II regulations, fund segregation requirements, and ongoing supervision to ensure trader protection.

- How can I check if a broker is AMF regulated?

- Use the official REGAFI database. Simply enter the broker’s name in the search field and verify their authorization status, license number, and authorized activities.

- Are AMF-regulated brokers safer than others?

- Yes, AMF-regulated brokers offer significantly higher safety standards through segregated accounts, compensation schemes up to €100,000, negative balance protection, and strict operational requirements enforced by French regulatory authority.

- What is the AMF blacklist, and how does it protect traders?

- The AMF blacklist is a regularly updated list of unauthorized companies and fraudulent websites. It protects traders by identifying scam operators before they can cause financial harm. Always check this list before opening accounts.

- Can non-French residents use AMF-regulated brokers?

- Yes, AMF-regulated brokers can serve clients throughout the European Union under MiFID II passporting rights. Non-EU residents may also be accepted depending on the broker’s specific licensing arrangements.

- What is the difference between AMF and other European regulators like FCA or CySEC?

- While all follow MiFID II standards, each has slight variations in enforcement and requirements. AMF focuses on French market oversight, FCA on UK standards, and CySEC on Cyprus. All provide similar levels of trader protection within the EU framework.

- Do AMF-regulated brokers offer better trading conditions?

- Not necessarily better pricing, but definitely more transparent and reliable conditions. AMF regulation ensures clear disclosure of all costs, fair execution, and consistent platform performance without hidden fees or manipulation.

- How does AMF handle disputes between brokers and traders?

- AMF requires regulated brokers to maintain internal complaint procedures and participate in alternative dispute resolution schemes. If internal resolution fails, traders can escalate to ombudsman services or the AMF directly.

- Are AMF-regulated brokers subject to MiFID II regulations?

- Yes, all AMF-regulated brokers must comply with MiFID II requirements including suitability assessments, best execution policies, negative balance protection, and leverage limits for retail clients.

- Can AMF-regulated brokers offer leverage for retail traders?

- Yes, but with ESMA-imposed limits: 30:1 for major currency pairs, 20:1 for minor pairs and gold, 5:1 for stock CFDs, and 2:1 for cryptocurrency CFDs. Professional traders can access higher leverage.

- What is the minimum deposit required for AMF regulated brokers?

- Minimum deposits vary by broker and account type, ranging from $1 (Exness) to $200 (Pepperstone). Most offer micro accounts with deposits under $100 to accommodate new traders.

- How does AMF protect trader funds?

- Through mandatory fund segregation in separate bank accounts, compensation schemes covering up to €100,000 per client, regular broker audits, and strict capital adequacy requirements to ensure operational stability.

- What leverage limits apply to AMF regulated brokers?

- ESMA leverage limits apply: 30:1 for major forex pairs, 20:1 for minor pairs and commodities, 10:1 for non-major stock indices, 5:1 for individual stocks, and 2:1 for cryptocurrencies.

- What are the tax implications of trading with AMF-regulated brokers?

- French residents must declare forex trading profits as capital gains or professional income depending on trading frequency. Consult a tax advisor for specific guidance as regulations vary by individual circumstances.

- Do AMF-regulated brokers accept cryptocurrencies?

- Many AMF-regulated brokers offer cryptocurrency CFDs with 2:1 maximum leverage. However, they typically don’t accept crypto as deposit methods, preferring traditional payment systems for compliance reasons.

- How long does it take for a broker to get AMF approval?

- The AMF authorization process typically takes 6-12 months, involving detailed financial documentation, business plan review, background checks on key personnel, and systems audits to ensure compliance readiness.

- What action does AMF take against unregulated brokers?

- AMF can issue public warnings, add companies to blacklists, coordinate with ISPs to block websites, work with law enforcement for criminal prosecution, and impose fines or other sanctions within their jurisdiction.

- How do I file a complaint against an AMF regulated broker?

- First, use the broker’s internal complaint procedure. If unsatisfied, contact the AMF directly through their website or write to them at 17 Place de la Bourse, 75082 Paris Cedex 02, providing all relevant documentation.

- Are trading robots allowed by AMF-regulated brokers?

- Yes, most AMF-regulated brokers support automated trading through Expert Advisors (EAs) on MetaTrader platforms or API connections. However, traders remain responsible for their automated systems’ actions and results.

- Can AMF-regulated brokers provide binary options?

- No, AMF has banned binary options marketing and sale to retail clients since 2018. This permanent prohibition applies to all brokers operating in France, protecting consumers from high-risk products.

- How does AMF cooperate with other European regulators?

- Through ESMA (European Securities and Markets Authority), AMF shares information, coordinates enforcement actions, develops common standards, and ensures consistent regulatory approaches across EU member states.

- Are there any restrictions on trading exotic currency pairs with AMF brokers?

- No specific restrictions on exotic pairs, but ESMA leverage limits of 20:1 apply to minor currency pairs. Brokers must provide appropriate risk warnings due to higher volatility and wider spreads.

- What happens if an AMF-regulated broker goes bankrupt?

- Client funds in segregated accounts are protected and returned to traders. The French compensation scheme covers up to €100,000 per client for any shortfall, ensuring trader funds remain safe even in broker insolvency.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.