Key Takeaways

- Market Maker (B-Book) brokers can lose money when clients make profitable trades, as they take the opposite side of client positions

- ECN/STP (A-Book) brokers generally don’t lose money from client wins, as they pass trades to liquidity providers and earn from spreads and commissions

- Most regulated brokers, including Pepperstone, FP Markets, and XTB, use hybrid A-Book/B-Book models to manage risk based on client profiles

- Brokers face significant losses during “black swan” events like the 2015 Swiss Franc crisis when extreme market volatility overwhelms risk management systems

- Regulations by authorities like FCA, ASIC, and CySEC have imposed leverage caps (1:30 for major pairs) and negative balance protection to reduce risks for both traders and brokers

Understanding Forex Broker Business Models

One of the most common questions in forex trading is whether brokers lose money when traders win. The answer isn’t straightforward—it depends entirely on the broker’s business model. Let’s break down the main types of forex brokers and examine how each model affects the broker-trader relationship, particularly regarding who profits when trades are successful.

Think of forex brokers as businesses with different operating models—just like how restaurants can be fast-food chains, fine dining establishments, or food delivery services. Each model has its own way of making money, and some have more conflicts of interest than others.

Market Maker (B-Book) Brokers

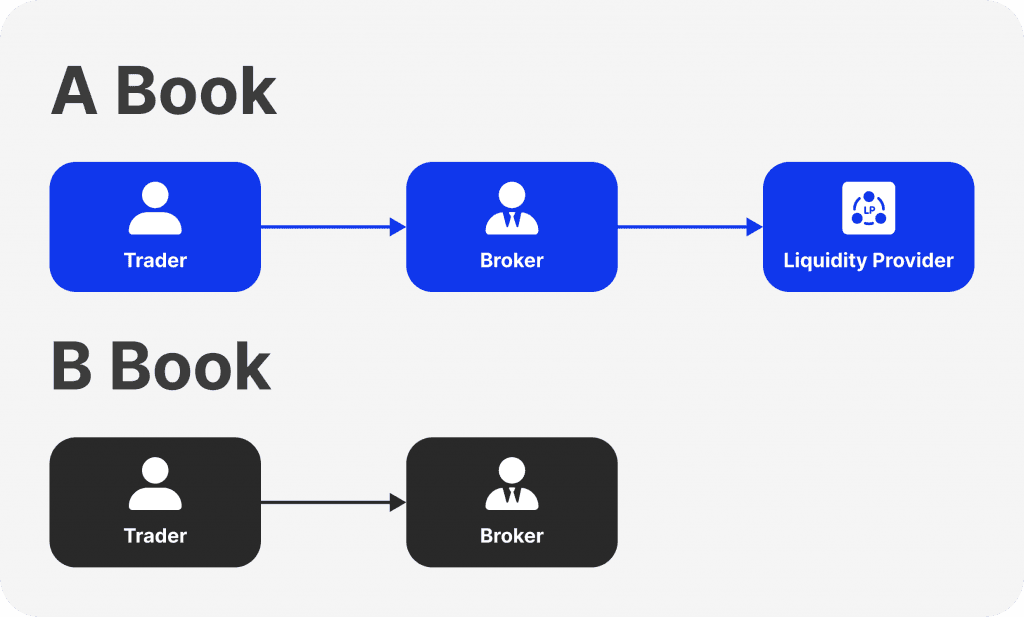

Market maker brokers, also known as B-Book brokers or dealing desk brokers, take the opposite side of their clients’ trades. This creates a fundamental conflict of interest: when you win, they lose; when you lose, they win.

Diagram showing the difference between A-Book and B-Book broker models [B2CORE](https://b2core.com/news/a-book-vs-b-book-broker-business-models/)

How Market Makers Operate

Market makers essentially “make the market” for their clients by providing both bid and ask prices. They operate with a dealing desk that determines the prices shown to traders, which may not necessarily reflect the true interbank rates. This approach gives them greater control over the trading environment, including spreads, execution speed, and even trade outcomes.

In a B-Book model, client orders never reach the actual forex market. Instead, they remain “on the books” of the broker, who acts as the counterparty to every trade. This internalization of client orders allows the broker to potentially profit from client losses, creating what many consider a problematic incentive structure.

Taking the Opposite Side of Trades

When a B-Book broker takes the opposite side of your trade, they’re essentially betting against you. If you buy EUR/USD expecting it to rise, the broker is effectively selling EUR/USD, hoping it will fall. This direct opposition of interests raises ethical questions about whether such brokers might manipulate trading conditions to increase the likelihood of client losses.

According to a 2024 study by Trading Critique, approximately 70% of retail forex brokers operate at least partially on the B-Book model, especially with smaller client accounts, making this conflict of interest widespread in the industry [Trading Critique](https://tradingcritique.com/forex/top-10-regulated-forex-brokers-in-the-world/).

Potential Losses for Market Makers

Yes, market maker brokers can absolutely lose money—specifically when their clients make profitable trades. If a significant number of clients take profitable positions simultaneously, especially during major market moves, B-Book brokers can suffer substantial losses.

For example, during the January 2015 Swiss Franc crisis, when the Swiss National Bank unexpectedly removed the EUR/CHF peg, many B-Book brokers faced catastrophic losses. Some, like Alpari UK, were forced into insolvency because they couldn’t cover the profits owed to clients who held long CHF positions [Investopedia](https://www.investopedia.com/articles/forex/041515/how-forex-brokers-make-money.asp).

Profit Potential from Client Losses

The flip side is that B-Book brokers directly profit from client losses. Given that industry statistics consistently show that approximately 70-80% of retail forex traders lose money, this business model can be extremely profitable for brokers. The B-Book model thrives on the statistical reality that the majority of retail traders will ultimately lose their deposits.

Some brokers even classify clients based on their profitability, with winning traders often being moved to an A-Book model (discussed next), while losing traders are kept on the B-Book to maximize broker profits.

STP (Straight Through Processing) Brokers

STP brokers take a fundamentally different approach by passing client orders directly to liquidity providers in the interbank market. These brokers act as intermediaries rather than counterparties to their clients’ trades.

Diagram illustrating how STP brokers process client orders [Forex Central](https://www.forex-central.net/STP-brokers.php)

How STP Brokers Manage Risk

STP brokers manage risk by immediately transferring it to liquidity providers. When a client places an order, the broker routes it directly to banks or other liquidity providers who execute the trade. The broker doesn’t take a position against the client but instead earns revenue primarily through spreads and possibly commissions.

This model eliminates the direct conflict of interest present in the B-Book model. The broker doesn’t care whether clients win or lose—they make money regardless through transaction fees. As Quadcode explains, “STP brokers operate on a model that directly routes traders’ orders to the interbank market where big banks trade. By doing so, they eliminate the need for a dealing desk and ensure no interference in order execution, allowing for a seamless trading experience” [Quadcode](https://quadcode.com/blog/what-are-ecn-and-stp-forex-brokers).

Can STP Brokers Lose Money?

STP brokers face significantly less risk of losing money from client trading activities compared to market makers. Since they don’t take the opposite side of trades, they’re generally insulated from direct losses when clients make profitable trades.

However, STP brokers can still face losses in several scenarios:

- If they offer guaranteed stop-losses and the market gaps significantly

- During extreme market volatility when liquidity dries up

- If clients default on margin calls and the broker can’t recover the funds

- Due to operational failures, technological glitches, or “fat finger” errors

Mitigating Losses

STP brokers mitigate potential losses through several mechanisms:

- Maintaining relationships with multiple liquidity providers to ensure best execution even during volatile market conditions

- Implementing robust risk management systems to monitor exposure and client positions

- Requiring adequate margin and enforcing strict margin call procedures

- Employing sophisticated technology to minimize operational risks and execution errors

ECN (Electronic Communications Network) Brokers

ECN brokers represent the most transparent model in forex trading. They provide a direct connection between traders and the interbank market through an Electronic Communications Network.

How ECN Brokers Generate Revenue

ECN brokers generate revenue primarily through commissions rather than spreads. They display the raw spreads from liquidity providers and charge a fixed or percentage-based commission on each trade. This model aligns the broker’s interests with their clients’, as the broker’s revenue increases with trading volume, regardless of whether clients win or lose.

According to FxScouts, “ECN brokers act as transparent conduits in the Forex market, creating a seamless connection between buyers and sellers and providing real-time pricing reflective of the market’s immediate state” [FxScouts](https://fxscouts.com/broker-comparison/avatrade-vs-fpmarkets).

Advantages of ECN Brokers

ECN brokers offer several advantages over other models:

- Greater transparency with direct access to the interbank market

- Tighter spreads reflecting real market conditions (though with added commissions)

- No conflict of interest since the broker doesn’t trade against clients

- Deeper liquidity by aggregating quotes from multiple providers

- Faster execution with minimal or no requotes

How ECN Brokers Avoid Losses / Profit Without Client Losses

ECN brokers maintain profitability regardless of client outcomes. Their revenue model is based on transaction volume rather than client losses. The more trades clients make, the more commission revenue the broker generates, creating a healthier alignment of interests between broker and trader.

As explained by Quadcode, “They are well-suited for traders who value transparency and often deal with high volumes of trade… Electronic Communication Network, or ECN, brokers provide an environment where market players may trade against one another, therefore avoiding the need for a middleman” [Quadcode](https://quadcode.com/blog/what-are-ecn-and-stp-forex-brokers).

Hybrid Broker Models

In reality, many brokers don’t strictly adhere to a single model but instead operate hybrid systems combining elements of both A-Book (ECN/STP) and B-Book (market maker) approaches.

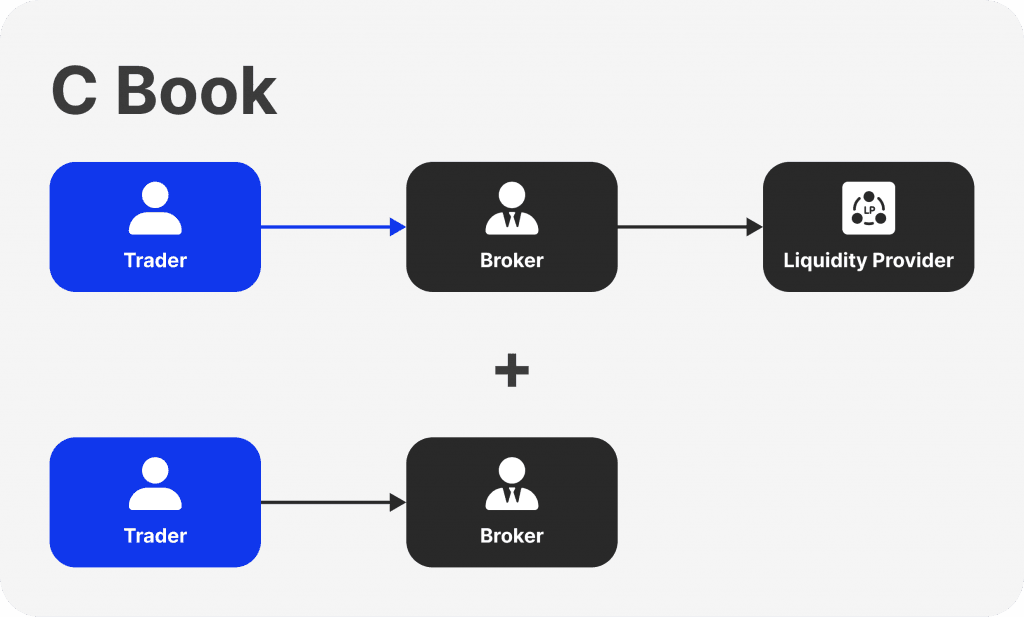

Visualization of the hybrid C-Book broker model [B2CORE](https://b2core.com/news/a-book-vs-b-book-broker-business-models/)

Client Classification

Hybrid brokers often classify clients based on their trading behavior, profitability, and risk profile:

- A-Book clients: Consistently profitable traders or those with large accounts are typically routed to liquidity providers (A-Book), as the broker doesn’t want to take the risk of losing money against these traders

- B-Book clients: Newer traders, those with smaller accounts, or traders with a history of losses are often kept on the B-Book, where the broker acts as the counterparty

B2Core describes this approach: “The hybrid broker model—called the C-Book—efficiently controls risk by combining aspects of both techniques. Under this strategy, brokers divide up client deals according to risk profiles. High-risk trades are handled internally (B-Book), while low-risk trades are routed to liquidity providers (A-Book)” [B2CORE](https://b2core.com/news/a-book-vs-b-book-broker-business-models/).

Hybrid Approaches

Modern forex brokers often implement sophisticated hybrid approaches:

- Dynamic routing: Orders may be dynamically routed to either A-Book or B-Book based on real-time risk assessment

- Partial hedging: Brokers may internalize a portion of client orders while hedging the rest with liquidity providers

- Volume-based routing: Smaller trades might be kept on the B-Book while larger trades are sent to liquidity providers

The A-Book vs B-Book Debate

The debate over which model is better continues in the forex community. While A-Book models offer greater transparency and alignment of interests, B-Book models can sometimes provide better execution, lower costs (no commissions), and more stable trading conditions, especially during volatile markets.

According to a YouTube explanation by financial expert Kimmel Trading, “There’s nothing inherently wrong with B-Book brokers if they’re regulated and transparent about their model. The problem arises when brokers aren’t honest about their practices or manipulate trading conditions to increase client losses” [YouTube](https://www.youtube.com/watch?v=zdHh3JHqWxI).

Ultimately, both models can be operated ethically or unethically—regulation and transparency are more important factors than the business model itself.

How Forex Brokers Generate Revenue

Understanding how forex brokers make money helps explain when and why they might lose money. Let’s explore the various revenue streams that keep brokers profitable even when some clients are winning.

Spread and Commission Income

The primary sources of income for most forex brokers are spreads and commissions—the transaction costs charged on each trade.

Understanding Spread and Pips

The spread is the difference between the bid price (what you can sell a currency for) and the ask price (what you can buy it for). Measured in pips (percentage in point), it represents the broker’s built-in fee for facilitating the trade.

For example, if the EUR/USD bid price is 1.1000 and the ask price is 1.1002, the spread is 2 pips. Every time a trader opens and closes a position, they pay this difference, which goes to the broker as revenue.

As Dukascopy Bank explains, “In forex trading, the spread is basically the transaction cost – it’s how brokers make their money. Think of it like the middleman’s fee” [Dukascopy](https://www.dukascopy.com/swiss/english/marketwatch/articles/forex-spread/?c=1743604275).

Variable vs. Fixed Spreads

Brokers offer two main types of spreads:

- Fixed spreads remain constant regardless of market conditions, providing predictability for traders but typically being wider on average

- Variable spreads fluctuate based on market liquidity and volatility, usually tightening during high-liquidity periods and widening during market-moving events

Most market maker brokers offer fixed spreads, while ECN/STP brokers typically provide variable spreads that reflect actual market conditions.

Commission-Based Brokers

ECN and some STP brokers charge explicit commissions instead of or in addition to spreads. These commissions are typically calculated per lot traded (standard lot = 100,000 units of currency) and range from $2-10 per lot per side.

For example, according to recent data, Pepperstone charges $3.50 per lot per side ($7.00 round-turn) on their Razor account, while HFM charges $3.00 per lot [CompareForexBrokers](https://www.compareforexbrokers.com/reviews/pepperstone-vs-hf-markets/).

| Broker | Account Type | Average EUR/USD Spread | Commission (per standard lot) | Effective Cost |

|---|---|---|---|---|

| Pepperstone | Standard | 1.0-1.2 pips | $0 | 1.0-1.2 pips |

| Pepperstone | Razor (ECN) | 0.0-0.2 pips | $7.00 round-turn | ~0.8-1.0 pips |

| HFM | Premium | 1.4 pips | $0 | 1.4 pips |

| HFM | Zero Spread | 0.1-0.3 pips | $6.00 round-turn | ~0.7-0.9 pips |

| Exness | Standard | 1.0 pips | $0 | 1.0 pips |

| Exness | Zero | 0.1 pips | $7.00 round-turn | ~0.8 pips |

How Do Forex Brokers Make Money on Low Spreads?

Some brokers advertise ultra-low or even “zero” spreads, leading traders to wonder how they remain profitable. The answer typically involves:

- Commission-based revenue that replaces spread income

- High-volume business models where small margins on many trades add up

- Supplementary revenue streams like swap fees and ancillary services

- B-Book operations where the broker profits from client losses despite low spreads

Other Sources of Income for Brokers

Beyond spreads and commissions, forex brokers generate revenue through several additional channels.

Leverage and Margin Trading

Leverage allows traders to control larger positions with a small amount of capital. While leverage itself isn’t a direct revenue source, it amplifies trading volumes, leading to increased spread and commission income for brokers.

However, leverage cuts both ways. While it can enhance broker profitability through increased trading volumes, it also increases risk exposure when clients use high leverage and market volatility spikes. This explains why regulators like the FCA and ASIC have imposed leverage caps in recent years.

According to DayTrading.com, “The FCA introduced specific rules in 2019 to protect traders, especially those dealing with complex products like CFDs: Leverage Limits: Caps on leverage reduce the risk of significant losses, protecting both clients and brokers” [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

Swap Fees and Interest Rates (Overnight Financing)

Swap fees, also called overnight or rollover fees, are charged when positions are held open overnight. These fees reflect the interest rate differential between the two currencies in the pair.

Brokers typically add a markup to these rates, creating another revenue stream. For positions held for extended periods, especially in pairs with large interest rate differentials, swap fees can become a significant cost for traders and a substantial income source for brokers.

Payment Processing Fees

Some brokers charge fees for deposits and withdrawals, particularly for certain payment methods. While these fees are often justified as covering third-party costs, they can also represent a small but steady income stream.

Educational and Trading Tools

While many brokers offer free educational resources and tools to attract clients, some charge for premium features, advanced analytics, or specialized trading tools. These value-added services create additional revenue while enhancing the trading experience.

Additional Services and Tools for Traders

Modern forex brokers increasingly offer supplementary services that generate income:

- Signal services and trade recommendations

- Copy trading and social trading platforms

- VPS (Virtual Private Server) hosting for automated trading

- Premium analysis and research

- Managed account services with performance fees

B-Book Trading Profits

For brokers operating fully or partially on the B-Book model, client losses represent a direct profit. Given the high percentage of retail traders who lose money (often cited as 70-80%), this can be extremely lucrative for market maker brokers.

As explained in a Reddit analysis of 10,000 failed forex trades: “After 4 years of trading and way too many blown accounts early on, I became obsessed with understanding why most forex traders fail” [Reddit](https://www.reddit.com/r/Forexstrategy/comments/1m3h0hx/i_tracked_10000_failed_forex_trades_to_find_why/). This statistical reality of retail trader failure benefits B-Book brokers significantly.

Additional Revenue Streams

Some brokers have developed innovative additional revenue sources:

- Currency conversion fees when depositing/withdrawing in different currencies

- Inactivity fees for dormant accounts

- Data subscriptions for premium market information

- Cross-selling of other financial products and services

- White-label solutions for smaller brokers

When Do Forex Brokers Lose Money?

Despite their multiple revenue streams and sophisticated business models, forex brokers aren’t immune to losses. There are several scenarios where brokers can face significant financial pressure.

Scenarios Where Forex Brokers Can Face Losses

Understanding when brokers lose money helps traders comprehend the inherent risks in the forex ecosystem and why brokers implement certain policies.

Market Risk Exposure / Market Volatility and Black Swan Events

The most dramatic broker losses typically occur during extreme market events that cause unprecedented volatility. The 2015 Swiss Franc de-pegging from the Euro stands as the most notorious example.

On January 15, 2015, the Swiss National Bank suddenly abandoned its currency peg to the euro, causing the Swiss Franc to appreciate by nearly 30% within minutes. This black swan event led to catastrophic losses for many brokers, including:

- Alpari UK: Forced into insolvency

- FXCM: Required a $300 million bailout

- IG Group: Reported losses of approximately £30 million

- Excel Markets: Ceased operations due to insolvency

As Investopedia explains: “Traders caught on the wrong side of either of these trades lost their money, and some were not able to make good on the margin requirements. In the case of the Swiss franc debacle, this even resulted in some brokers suffering catastrophic losses and going into bankruptcy” [Investopedia](https://www.investopedia.com/articles/forex/041515/how-forex-brokers-make-money.asp).

More recently, the COVID-19 market crash in March 2020 and the Russia-Ukraine conflict in 2022 created extreme volatility that challenged broker risk management systems.

Overexposure to Client Wins

B-Book brokers face direct losses when their clients make profitable trades. While statistically most retail traders lose money, a broker can still face significant losses if:

- A large proportion of clients take the same profitable position (especially during major economic announcements)

- Several high-net-worth clients make substantial winning trades

- The broker fails to adequately hedge their exposure to client positions

This risk is why many brokers employ hybrid models, moving consistently profitable traders to the A-Book while keeping losing traders on the B-Book.

Counterparty Risk

A-Book brokers face counterparty risk from their liquidity providers. If a liquidity provider fails or defaults on obligations, the broker may still be responsible for honoring client positions.

During the 2008 financial crisis, several brokers faced losses due to the failure or near-failure of major banks that served as their liquidity providers. This highlighted the importance of working with multiple, well-capitalized liquidity providers to distribute risk.

Operational Losses and Bankruptcy

Brokers can also face losses from operational issues:

- Technology failures leading to incorrect pricing or execution

- “Fat finger” errors where trades are executed at wrong prices or sizes

- Cybersecurity breaches resulting in theft or operational disruption

- Regulatory fines for compliance failures

- Legal settlements from client lawsuits

Recent examples include the June 2024 cyberattack on several mid-sized forex brokers that resulted in temporary platform outages and, in at least one case, unauthorized access to client funds, requiring the broker to cover the losses [FinanceMagnates](https://www.financemagnates.com/forex/analysis/forex-and-cfd-brokers-pay-30000-for-enhanced-client-fund-insurance/).

The Role of Capitalization and Risk Management

A broker’s ability to withstand losses depends heavily on its capitalization and risk management practices.

Capital Requirements

Regulatory authorities impose minimum capital requirements on forex brokers to ensure they can meet their obligations to clients. These requirements vary by jurisdiction:

- FCA (UK): €730,000 – €3.8 million depending on the scope of services

- ASIC (Australia): AUD 1 million plus adequate buffer

- CySEC (Cyprus): €730,000 for full-service brokers

- NFA/CFTC (US): $20 million in adjusted net capital

However, meeting minimum capital requirements doesn’t guarantee a broker can withstand extreme market events. The brokers that survived the Swiss Franc crisis typically maintained capital well above regulatory minimums and had robust risk management systems in place.

Importance of Segregated Accounts

Client fund segregation is critical for protecting both clients and brokers. By keeping client funds in separate accounts from operational capital, brokers ensure that:

- Client money is protected in case of broker insolvency

- The broker cannot use client funds for its own operations

- Client funds are easier to return in case of regulatory issues

As TopForex.Trade explains: “The regulator operates an Investor Compensation Fund (ICF), which provides coverage to clients of CySEC-regulated brokers in case the broker fails to fulfill its financial obligations” [TopForex.Trade](https://topforex.trade/academy/cysec-regulated-fx-brokers/).

Risk Management Strategies Used by Brokers

Sophisticated brokers employ multiple risk management techniques to prevent catastrophic losses:

- Hedging client exposure with liquidity providers

- Position limits to prevent overexposure to any single currency pair

- Diversification across currency pairs and client types

- Stress testing for extreme market scenarios

- Dynamic margin requirements that increase during volatile periods

- Circuit breakers that pause trading during extreme volatility

The most resilient brokers maintain a balance between profitability and risk management, ensuring they can weather market storms while still offering competitive trading conditions.

How Forex Brokers Manage Risk

Risk management is the cornerstone of sustainable forex brokerage operations. Let’s explore the sophisticated strategies brokers employ to mitigate potential losses while maintaining service quality.

Role of Liquidity Providers

Liquidity providers form the backbone of the forex market, offering the necessary counterparties for trades. These typically include:

- Tier 1 banks like JPMorgan, Citibank, Deutsche Bank

- Non-bank financial institutions like XTX Markets, Jump Trading

- Specialized liquidity providers like Finalto, B2Prime, and Liquidity.net

According to B2PRIME, “The ten companies listed here are among the strongest options in 2025, each offering institutional-grade infrastructure, asset coverage, and technology” [B2PRIME](https://b2prime.com/news/top-10-forex-liquidity-providers-in-2024).

Spreads and Liquidity Providers

The quality and number of liquidity providers directly impact the spreads brokers can offer. Brokers with access to multiple tier-1 liquidity sources can typically offer tighter spreads and better execution.

For example, Pepperstone’s partnership with over 22 liquidity providers enables them to offer raw spreads from 0.0 pips on their ECN accounts [Pepperstone](https://pepperstone.com/en/ways-to-trade/pricing/).

Automated Trading Systems

Modern brokers rely heavily on sophisticated automated systems for risk management:

- Automated hedging algorithms that dynamically balance exposure

- Real-time monitoring systems tracking market conditions and client positions

- Anomaly detection to identify potential trading abuses or technical issues

- Automated margin calls and liquidations to prevent negative balances

These systems operate 24/7, constantly adjusting to changing market conditions and client activity patterns.

Managing Market Risk

Brokers employ various techniques to manage market risk, particularly during volatile conditions.

Position Netting

Position netting involves offsetting opposing client positions before hedging with liquidity providers. For example, if one client buys 1 lot of EUR/USD and another sells 1 lot, these positions can be internally matched, reducing the broker’s external hedging needs.

This approach is particularly common in hybrid model brokers, allowing them to minimize transaction costs while still managing overall exposure.

Hedging Strategies

Brokers use various hedging strategies to protect against adverse market movements:

- Complete hedging: Mirroring all client positions with liquidity providers (typical for pure A-Book brokers)

- Partial hedging: Hedging only a percentage of client exposure based on risk assessment

- Threshold hedging: Only hedging positions above a certain size threshold

- Portfolio hedging: Managing net exposure across all currency pairs rather than hedging individual positions

Liquidity Provider Relationships

Maintaining strong relationships with multiple liquidity providers is crucial for effective risk management. Brokers typically connect to several providers through:

- FIX API connections for direct market access

- Prime brokerage arrangements with major banks

- Liquidity aggregators that combine feeds from multiple sources

As Finalto notes, “One-size-fits all liquidity is so 2024. Brokers need partners who can tailor technology and services to their business strategies and help them” adapt to changing market conditions [Finalto](https://www.finalto.com/blogs/what-brokers-need-from-their-liquidity-providers-in-2025/).

Broker Risk Assessment Techniques

Sophisticated brokers employ advanced risk assessment techniques to manage exposure more effectively.

Client Profiling

Many brokers categorize clients based on their trading behavior, profitability, and risk profile:

- High-risk clients: Traders using high leverage, volatile strategies, or trading during news events

- Low-risk clients: Conservative traders with consistent patterns and moderate leverage

- Algorithmic traders: Clients using automated systems that may require special monitoring

- News traders: Clients who specifically trade around economic releases

This profiling allows brokers to apply appropriate risk management approaches to different client segments.

Position Size Limits

To prevent overexposure, brokers often implement maximum position sizes for different currency pairs and account types. These limits may be:

- Fixed per client (e.g., maximum 50 lots per position)

- Proportional to account equity (e.g., no more than 5% of equity per position)

- Pair-specific (lower limits for exotic or volatile pairs)

- Dynamic based on market conditions (reduced during high volatility)

Exposure Management

Brokers closely monitor their total exposure across different currency pairs and client segments. When exposure becomes imbalanced, they may:

- Increase hedging ratios for overexposed pairs

- Temporarily widen spreads to discourage additional positions

- Adjust margin requirements for specific currency pairs

- Limit new positions until exposure rebalances

Capital Requirements and Regulation

Regulatory oversight plays a crucial role in ensuring brokers maintain adequate capital and risk management systems.

Role of Financial Regulators in Reducing Broker Losses

Financial regulators have implemented several measures to reduce the risk of broker failures:

- Minimum capital requirements: Ensuring brokers have adequate financial resources

- Leverage restrictions: Limiting the maximum leverage available to retail clients

- Stress testing requirements: Ensuring brokers can withstand market shocks

- Mandatory risk disclosure: Making clients aware of the risks of forex trading

- Reporting obligations: Regular financial and operational reports to regulators

According to DayTrading.com, “The FCA placed strict limits on leverage for retail traders, capping it at levels between 1:30 and 1:2 depending on the asset. By reducing leverage, the FCA helps CFD traders avoid rapid losses that can wipe out accounts” [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

How Brokers Ensure Stability During Market Volatility

To maintain stability during volatile market conditions, brokers implement various precautionary measures:

- Increased margin requirements during anticipated volatility (elections, central bank decisions)

- Circuit breakers that temporarily pause trading during extreme price movements

- Dynamic spread widening to reflect increased risk and reduced liquidity

- Position size limitations during high-impact news events

- Enhanced monitoring of client positions and market conditions

These measures help protect both the broker and its clients from the negative impacts of extreme market movements.

Impact of Market Volatility

Market volatility presents both opportunities and risks for forex brokers.

Risk During High Volatility

High volatility periods significantly increase risks for brokers:

- Price gaps can lead to slippage and execution issues

- Liquidity may dry up, making it difficult to hedge positions

- Client stop-losses may not execute at intended levels

- Margin calls may not be processed quickly enough

- System capacity may be overwhelmed by high transaction volumes

B2Broker notes that “These range from direct market entry (DMA), advanced execution technologies, risk management instruments, customization, analytics and integration services” are essential during high volatility periods [PPmedia](https://ppmedia.rs/finest-liquidity-suppliers-for-forex-brokers-2024/).

Managing Black Swan Events

Black swan events—rare, unpredictable occurrences with extreme impact—pose the greatest threat to broker stability. Examples include:

- The 2015 Swiss Franc de-pegging

- The 2016 Brexit vote

- The 2020 COVID-19 market crash

- The 2022 Russia-Ukraine conflict

- Flash crashes in various currency pairs

To prepare for such events, forward-thinking brokers:

- Maintain capital buffers well above regulatory requirements

- Conduct extreme scenario stress tests regularly

- Implement robust business continuity plans

- Obtain specialized insurance coverage for extreme market events

- Diversify across markets and client types to avoid concentration risk

As Finance Magnates reports, “Now, firms can secure these safeguards, starting from $30,000 annually (depending on the number of clients). In fact, around 40 companies within the industry have already adopted supplementary insurance to protect against extreme market events” [FinanceMagnates](https://www.financemagnates.com/forex/analysis/forex-and-cfd-brokers-pay-30000-for-enhanced-client-fund-insurance/).

Controversial Practices: Do Brokers Want You to Lose?

The forex industry has been plagued by accusations of unethical practices designed to increase client losses. Let’s examine these controversies and separate fact from fiction.

Video explaining the ethics and regulation around A-Book vs B-Book broker models

Stop Loss Hunting and Price Manipulation

“Stop loss hunting” refers to the practice of artificially moving prices to trigger client stop losses before returning to previous levels. This controversial practice has been widely discussed in trading communities.

Investopedia describes it as follows: “Stop hunting is a legitimate form of trading. It’s nothing more than the art of flushing the losing players out of the market” [Investopedia](https://www.investopedia.com/articles/forex/06/stophunting.asp). However, when done by brokers specifically to trigger client stops, many consider it unethical.

Why Some Brokers Use These Tactics

B-Book brokers have a financial incentive to encourage client losses. Some may engage in questionable practices to increase their profits:

- Widening spreads during high-impact news events beyond what market conditions justify

- Delaying execution on profitable trades while executing losing trades instantly

- Creating artificial price spikes to trigger stop losses

- Requoting profitable trades while accepting losing trades without requotes

As discussed on Forex Factory, “If you lose, they pocket your money; if you win, you pocket their money. This is why broker will do all they can to give you the worse conditions such that you lose” [ForexFactory](https://www.forexfactory.com/thread/155138-how-do-retail-forex-brokers-lose-money-when).

Can Brokers Manipulate Prices Against Traders? / Can Brokers Manipulate Prices in Their Favor?

The ability of brokers to manipulate prices depends largely on their business model and regulatory oversight:

- Market makers (B-Book): Have greater ability to manipulate prices as they create their own quotes rather than passing orders to the market

- ECN/STP brokers (A-Book): Have limited ability to manipulate prices as they provide direct market access

- Regulated brokers: Face significant penalties for price manipulation, reducing the likelihood of such practices

- Unregulated brokers: Have few external constraints on their behavior

A 2024 study published in the Journal of Physics Conference Series attempted to detect stop hunt patterns using indicators and expert advisors, noting that “This research tries to combine trading systems, indicators and expert advisors that aim to help traders detect fake market price movements to minimize losses” [IOP Science](https://iopscience.iop.org/article/10.1088/1742-6596/1502/1/012054).

Is Stop Loss Hunting Legal?

The legality of stop loss hunting exists in a gray area:

- When performed by market participants seeking liquidity, it’s considered a legitimate trading strategy

- When done by brokers manipulating their own price feed to trigger client stops, it may violate regulatory rules against market manipulation

- Proving broker manipulation is extremely difficult, making enforcement challenging

Regulators like the FCA, ASIC, and CySEC have rules against price manipulation, but evidence must be clear and substantial for enforcement action.

Requoting and Slippage: How They Affect Traders

Requoting occurs when a broker offers a different price than the one requested by the trader, requiring confirmation before execution. Slippage refers to the difference between the expected execution price and the actual execution price.

While both can occur legitimately due to market volatility and liquidity conditions, some unethical practices include:

- Asymmetric slippage: Allowing negative slippage (worse prices) but preventing positive slippage (better prices)

- Selective requoting: Frequently requoting profitable trades while executing unprofitable ones without delay

- Last look practices: Taking an additional “look” at the market before deciding whether to execute a client’s trade

The Role of Unregulated Brokers in Client Losses

Unregulated brokers pose the highest risk for traders, as they operate without oversight from recognized financial authorities.

Signs of Scam Brokers

Traders should be wary of brokers exhibiting these warning signs:

- Lack of regulation by recognized authorities (FCA, ASIC, CySEC, etc.)

- Unrealistic promises of guaranteed returns or risk-free trading

- Excessive bonuses with restrictive withdrawal conditions

- Pressure tactics to deposit more money

- Difficulties withdrawing funds or excessive delays

- Lack of company information or unclear corporate structure

- Poor or non-existent customer support

- Unusual trading conditions that differ significantly from industry norms

How Brokers Manipulate Trade Conditions

Unscrupulous brokers may employ various techniques to manipulate trading conditions:

- Price shading: Slightly adjusting prices against clients’ positions

- Spread widening: Temporarily increasing spreads when clients place orders

- Execution delays: Deliberately slowing execution on potentially profitable trades

- Server “technical issues” during major market moves

- Hidden fees buried in terms and conditions

- Leverage bait-and-switch: Advertising high leverage but imposing restrictions when profitable

What Are the Risks of Trading with Unregulated Brokers?

The risks of using unregulated brokers include:

- Outright fraud: The broker may simply disappear with client funds

- No recourse: Without regulatory oversight, traders have limited options if issues arise

- No compensation schemes: Regulated jurisdictions offer protection funds (e.g., FSCS in the UK)

- Unfair trading practices: Greater likelihood of price manipulation and other abuses

- No operational standards: May lack proper risk management or segregation of client funds

As Quora discussions reveal: “Do Forex brokers lose money? Yes they lose money, brokers that have ECN have risks. Remember the CHF event where Swiss unpegged the Franc. But this risk is much lower than the risk you take when dealing with an unregulated broker who might simply disappear with your money” [Quora](https://www.quora.com/What-are-the-potential-risks-of-using-an-unregulated-forex-broker-Is-it-safe-to-use-them-or-is-there-a-possibility-of-them-stealing-your-money).

What Traders Can Do to Avoid Broker Manipulation

While not all brokers engage in manipulative practices, traders should take precautions to protect themselves. Here are key strategies to minimize your exposure to potential broker manipulation.

Choose Regulated Brokers

The single most important step in protecting yourself is selecting a broker regulated by a reputable financial authority. Tier-1 regulators include:

- Financial Conduct Authority (FCA) in the United Kingdom

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus/EU

- National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) in the United States

- Financial Services Agency (JFSA) in Japan

These regulators impose strict operational standards and offer various protections for traders. For example, according to DayTrading.com, “Regulatory protections under the FCA include: Compensation: up to £85,000 per client via the Financial Services Compensation Scheme if a broker fails” [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

Look for Brokers with Transparent Pricing Models

Transparency in pricing is a strong indicator of a broker’s integrity. Look for brokers that:

- Clearly disclose all spreads, commissions, and fees upfront

- Explain their execution model (A-Book, B-Book, or hybrid)

- Provide detailed order execution policies

- Offer access to price history and execution statistics

- Publish average spreads and execution times

Many reputable brokers now publish execution quality metrics. For example, Pepperstone states that their fill rates are “99.62%, based on all trades data between 01/07/2024 and 30/09/2024” [Pepperstone](https://pepperstone.com/en-gb/markets-and-symbols/index-cfds/).

Avoiding Unethical Brokers

Beyond regulation and transparency, there are several additional steps traders can take to avoid unethical brokers:

- Research broker reviews from multiple sources

- Test with a small deposit before committing significant funds

- Verify withdrawal processes work smoothly

- Check complaint history with regulators and forums

- Be wary of unsolicited contact or high-pressure sales tactics

Common Red Flags of Scam Brokers

Be vigilant for these warning signs that may indicate a problematic broker:

- Unrealistic promises of guaranteed profits or minimal risk

- Obscure company information or registration in loosely regulated jurisdictions

- Excessive bonuses with restrictive withdrawal terms

- Limited payment options or preference for irreversible payment methods

- Poor or inconsistent execution with frequent requotes

- Pushy account managers encouraging larger deposits or risky trades

- Unexplained fees or charges

- Significant differences between demo and live account performance

As noted in Reddit discussions tracking failed forex trades, many losses stem not just from trading strategies but from broker selection: “I tracked 10,000 failed forex trades to find why 87% of traders lose money” [Reddit](https://www.reddit.com/r/Forexstrategy/comments/1m3h0hx/i_tracked_10000_failed_forex_trades_to_find_why/).

How to Choose a Reliable Forex Broker

Selecting the right forex broker is one of the most critical decisions for your trading success. Here’s a comprehensive framework to help you make an informed choice.

Key Factors to Consider

When evaluating potential brokers, assess these crucial elements:

Regulatory Oversight and Licensing

Verify that the broker is properly regulated by at least one reputable authority. Strong regulation provides:

- Client fund protection through segregated accounts

- Capital adequacy requirements ensuring broker financial stability

- Compensation schemes in case of broker insolvency

- Conduct rules governing how brokers must treat clients

- Complaint mechanisms for resolving disputes

As Money Hub explains: “Every broker that wants to solicit retail forex and CFD trading services to Australian residents is required to hold a valid AFSL license from ASIC” [MoneyHub](https://www.moneyhub.co.nz/forex-regulation.html).

Transparent Fee Structures

Evaluate the broker’s complete fee structure, including:

- Spreads (fixed vs. variable)

- Commissions per trade

- Overnight (swap) fees

- Deposit and withdrawal fees

- Inactivity charges

- Currency conversion costs

Compare total trading costs rather than just headline rates. Sometimes a higher-commission account with tighter spreads may be more economical for active traders than a “commission-free” account with wider spreads.

| Broker | Account Type | EUR/USD Spread | Commission | Minimum Deposit | Leverage (Retail) |

|---|---|---|---|---|---|

| Pepperstone | Razor (ECN) | 0.0-0.2 pips | $3.50 per side | $200 | 30:1 (FCA/ASIC) |

| HFM | Zero | 0.1-0.3 pips | $3.00 per side | $100 | 30:1 (CySEC) |

| XTB | Pro | 0.1-0.3 pips | $3.50 per side | $100 | 30:1 (FCA) |

| Exness | Zero | 0.1 pips | $3.50 per side | $50 | 30:1 (CySEC/FCA) |

| FP Markets | Raw ECN | 0.0-0.2 pips | $3.00 per side | $100 | 30:1 (ASIC) |

Client Support and Reputation

Assess the quality and availability of customer support:

- 24/5 or 24/7 availability

- Multiple contact channels (chat, email, phone, etc.)

- Multilingual support if needed

- Response time to queries

- Knowledge level of support staff

Research the broker’s reputation through:

- Independent review sites

- Trading forums

- Social media feedback

- Industry awards and recognition

What Are the Signs of a Reputable Forex Broker?

Reputable brokers typically demonstrate:

- Longevity in the industry (5+ years)

- Multiple regulatory licenses across different jurisdictions

- Clear company information and corporate structure

- Transparent policies for execution, slippage, and requotes

- Reasonable marketing without exaggerated claims

- Robust educational resources and trading tools

- Fast and reliable withdrawals

- Audited financial statements

How Do I Know if a Broker Is Trustworthy?

To verify a broker’s trustworthiness:

- Check regulatory status directly on regulator websites

- Verify company registration and years in operation

- Test customer service with pre-account questions

- Start with a small deposit to test withdrawal processes

- Compare execution quality between demo and live accounts

- Research any regulatory actions or fines against the broker

- Look for transparency about execution model and conflict management

Top 10 Most Trusted Forex Brokers

Based on 2024-2025 data and multiple regulatory credentials, here are ten of the most trusted forex brokers mentioned across top SERPs:

Pepperstone

Pepperstone’s MetaTrader 5 trading platform [Pepperstone](https://pepperstone.com/en/platforms/trading-platforms/mt5/)

Regulation: FCA (UK), ASIC (Australia), DFSA (Dubai), BaFin (Germany), CMA (Kenya)

Founded: 2010

Minimum Deposit: $200

Trading Features: Razor-thin spreads from 0.0 pips with commission, over 60 currency pairs, multiple account types

Platforms: MetaTrader 4, MetaTrader 5, cTrader

Known For: Fast execution speed (average 30ms), excellent customer service, and transparent pricing

Open Your Pepperstone AccountIG Markets

Regulation: FCA (UK), ASIC (Australia), FSCA (South Africa), MAS (Singapore), BaFin (Germany)

Founded: 1974

Minimum Deposit: $250

Trading Features: 17,000+ markets, comprehensive research tools, proprietary platform

Platforms: MT4, ProRealTime, IG Platform

Known For: Longest-established broker, extensive market access, strong educational resources

Open Your IG AccountHFM

HFM’s mobile trading application [HFM](https://www.hfm.com/sc/hf/)

Regulation: CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FCA (UK)

Founded: 2010

Minimum Deposit: $5

Trading Features: 1000+ instruments, 0.0 pip spreads on Zero account, multiple account types

Platforms: MT4, MT5, HFM App

Known For: Low minimum deposit, competitive spreads, high leverage options in certain jurisdictions

Open Your HFM AccountXTB

Regulation: FCA (UK), KNF (Poland), CySEC (Cyprus), CNMV (Spain), BaFin (Germany)

Founded: 2002

Minimum Deposit: $0 / €0

Trading Features: 5,400+ instruments, commission-free stocks and ETFs up to €100,000 monthly volume

Platforms: xStation 5, MT4

Known For: Zero-fee stock trading, user-friendly platform, excellent customer service

Open Your XTB AccountXM

Regulation: CySEC (Cyprus), ASIC (Australia), DFSA (Dubai), IFSC (Belize)

Founded: 2009

Minimum Deposit: $5

Trading Features: 1000+ instruments, micro account options, multilingual support

Platforms: MT4, MT5

Known For: Low minimum deposit, extensive educational resources, 24/7 support

Open Your XM AccountFP Markets

Regulation: ASIC (Australia), CySEC (Cyprus), FSCA (South Africa)

Founded: 2005

Minimum Deposit: $100

Trading Features: 10,000+ instruments, Raw ECN pricing, IRESS platform for stock trading

Platforms: MT4, MT5, IRESS

Known For: Fast execution, strong regulatory framework, competitive ECN pricing

Open Your FP Markets AccountExness

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSC (Mauritius)

Founded: 2008

Minimum Deposit: $1

Trading Features: Unlimited leverage in certain jurisdictions, automated withdrawals, virtual private server

Platforms: MT4, MT5

Known For: Rapid withdrawals, high trading volume, transparent reporting

Open Your Exness AccountBD Swiss

Regulation: FCA (UK), CySEC (Cyprus), FSC (Mauritius)

Founded: 2012

Minimum Deposit: $100

Trading Features: 1500+ assets, personal trading coaching, webinars and seminars

Platforms: MT4, MT5, BDSwiss Webtrader

Known For: Educational resources, multiple trading platforms, trading signals

Open Your BDSwiss AccountAvaTrade

Regulation: Central Bank of Ireland, ASIC (Australia), FSCA (South Africa), FSA (Japan), FRSA (UAE)

Founded: 2006

Minimum Deposit: $100

Trading Features: AvaProtect risk management tool, copy trading, trading central signals

Platforms: MT4, MT5, AvaTradeGO, AvaOptions

Known For: Risk management tools, regulated in multiple jurisdictions, social trading

Open Your AvaTrade AccountBlackBull

Regulation: FMA (New Zealand), FSA (Seychelles)

Founded: 2014

Minimum Deposit: $100

Trading Features: Institutional grade liquidity, ECN/STP model, multiple base currencies

Platforms: MT4, MT5, WebTrader

Known For: Competitive ECN spreads, quality customer service, transparency

Open Your BlackBull AccountRegulatory Environment in Forex Trading

The regulatory landscape for forex brokers has evolved significantly in recent years, with authorities implementing stricter rules to protect retail traders and ensure broker stability.

Key Regulatory Bodies Worldwide

Several major regulatory authorities oversee forex brokers globally:

- Financial Conduct Authority (FCA) – United Kingdom

- Australian Securities and Investments Commission (ASIC) – Australia

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus/European Union

- National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) – United States

- Financial Services Agency (JFSA) – Japan

- Monetary Authority of Singapore (MAS) – Singapore

- Dubai Financial Services Authority (DFSA) – UAE

- Financial Sector Conduct Authority (FSCA) – South Africa

2024-2025 Key Regulatory Updates

Recent regulatory changes affecting forex brokers include:

- ASIC (Australia): New derivative transaction reporting requirements effective October 2025, affecting cross-border transactions and offshore platforms [AInvest](https://www.ainvest.com/news/asic-rules-forex-trading-australia-enhanced-transparency-liability-2507/)

- FCA (UK): Permanent restrictions on CFD products with leverage caps between 30:1 and 2:1 depending on asset class [FCA](https://www.fca.org.uk/news/press-releases/fca-confirms-permanent-restrictions-sale-cfds-and-cfd-options-retail-consumers)

- Cyprus Securities and Exchange Commission (CySEC): Enhanced compliance and licensing measures for forex brokers operating in Cyprus [EternityLaw](https://www.eternitylaw.com/news/regulatory-updates-for-forex-brokers-in-cyprus-navigating-cysec-s-mandates/)

Importance of Regulatory Compliance for Brokers

Regulatory compliance is not just a legal requirement but a business necessity for brokers seeking long-term success:

- Enhanced credibility and trust with clients

- Access to banking relationships and payment processors

- Protection against reputational damage

- Reduced risk of legal challenges from clients

- Clear operational framework for business practices

According to Legal AES, “A CySEC license in Cyprus not only enhances your firm’s credibility but also opens doors to the European markets under the MiFID II regulatory framework” [LegalAES](https://legalaes.com/forex-license-in-cyprus/).

Legal and Compliance Considerations

Brokers must navigate a complex web of legal and compliance considerations:

Regulatory Requirements

Key regulatory requirements for forex brokers typically include:

- Minimum capital requirements (varying by jurisdiction)

- Client fund segregation in separate accounts

- Regular financial reporting and audits

- Leverage restrictions (typically 30:1 for major pairs for retail clients)

- Negative balance protection for retail clients

- Risk disclosures and transparent marketing

- AML/KYC procedures for client onboarding

DayTrading.com explains that “The FCA introduced specific rules in 2019 to protect traders, especially those dealing with complex products like CFDs: Leverage Limits: Caps on leverage reduce the risk of significant losses, protecting both clients and brokers” [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

Reporting Obligations

Regulated brokers must fulfill various reporting obligations:

- Transaction reporting to regulatory authorities

- Financial statements and capital adequacy reports

- Client complaint statistics

- Risk management procedures and stress test results

- AML/CTF compliance reports

Client Protection Measures

Regulations mandate various client protection measures:

- Compensation schemes (e.g., FSCS in the UK provides up to £85,000 protection)

- Mandatory risk warnings about the percentage of retail clients who lose money

- Appropriateness assessments for complex products

- Fair marketing rules prohibiting misleading claims

- Best execution policies requiring optimal order execution

According to DayTrading.com, these protections include “Negative balance protection so that you cannot lose more pounds than you initially invested” and “Transparency about the fees you will incur and the significant risks of online trading” [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

Trading Platforms Offered by Forex Brokers

Trading platforms are the primary interface between traders and the market. The choice of platform can significantly impact trading efficiency, execution quality, and overall experience.

Popular Trading Platforms (e.g., MetaTrader 4/5)

Several platforms dominate the forex trading landscape:

MetaTrader 4 (MT4)

Released in 2005, MT4 remains the most widely used forex trading platform globally. Its key features include:

- User-friendly interface with customizable charts

- Expert Advisors (EAs) for automated trading

- MQL4 programming language for custom indicators and scripts

- 9 timeframes from 1-minute to monthly charts

- 30 built-in indicators and unlimited custom indicators

- Mobile versions for iOS and Android

According to a comparison by TradingPedia, “MT4 is an application installed on a computer while cTrader is a web platform. cTrader offers 26 timeframes while MT4 offers 9 timeframes” [TradingPedia](https://www.tradingpedia.com/forex-brokers/stp-forex-brokers-explained/).

MetaTrader 5 (MT5)

Released in 2010, MT5 is the successor to MT4, offering expanded capabilities:

- Multi-asset trading (forex, stocks, futures, options)

- 21 timeframes from 1-minute to monthly

- Economic calendar integrated into the platform

- Advanced MQL5 language with object-oriented programming

- Market depth and DOM (Depth of Market) trading

- Strategy tester with multi-currency testing

Overview of MetaTrader 5 trading platform [Blueberry Markets](https://blueberrymarkets.com/academy/metatrader-5-the-complete-guide/)

cTrader

Developed by Spotware Systems, cTrader is known for its focus on transparency and direct market access:

- Clean, modern interface designed for both beginners and professionals

- Full market depth visibility showing the order book

- cBots for automated trading using C# programming

- Advanced order types including OCO (One-Cancels-Other)

- Level 2 pricing showing multiple liquidity providers

- Detailed trading analytics and performance reports

According to ForexBrokers.com, “For instance, in July 2024, Pepperstone listed average spreads of 0.10 pip for the EUR/USD on its Razor account, which brings its effective spread to 0.80 pips when including the commission” [ForexBrokers.com](https://www.forexbrokers.com/guides/best-ctrader-brokers).

Proprietary Platforms

Many larger brokers offer their own proprietary platforms with unique features:

- IG’s web platform with advanced charting and risk management tools

- XTB’s xStation 5 with integrated educational resources

- AvaTrade’s AvaTradeGO optimized for mobile trading

- OANDA’s fxTrade with proprietary market analysis

Features to Look for in a Trading Platform

When evaluating trading platforms, consider these key features:

- Execution speed and reliability – especially important for scalpers and high-frequency traders

- Charting capabilities – range of timeframes, indicators, and drawing tools

- Order types – variety of order types (market, limit, stop, OCO, etc.)

- Automation potential – support for algorithmic trading and custom strategies

- User interface – intuitive layout and customization options

- Mobile functionality – full-featured mobile apps for on-the-go trading

- Stability – low downtime and resource usage

- Security features – two-factor authentication, encryption

- Analysis tools – built-in technical and fundamental analysis resources

- Integration capabilities – compatibility with third-party tools and services

Technology and Infrastructure Costs

For brokers, providing robust trading platforms involves significant technological investment:

Trading Platform Expenses

Brokers incur various costs related to trading platforms:

- Licensing fees for third-party platforms (MetaTrader, cTrader)

- Development costs for proprietary platforms

- Customization and branding expenses

- Updates and maintenance to keep platforms current

- Technical support staff for platform-related issues

Server and Connectivity Costs

The backbone of reliable trading involves substantial infrastructure expenses:

- Server hardware in multiple locations for redundancy

- Co-location services near exchange data centers

- Low-latency network connections between servers

- DDoS protection and cybersecurity measures

- Backup systems and disaster recovery infrastructure

Development and Maintenance

Ongoing technology expenses for brokers include:

- In-house development teams for platform improvements

- Regular security audits and vulnerability testing

- Integration with payment processors and banking systems

- Compliance with evolving regulatory requirements

- Data storage and management for trade history and client information

These technology costs represent a significant operational expense for brokers, highlighting why they need consistent revenue streams to maintain high-quality services.

Account Types and Features

Forex brokers typically offer various account types catering to different trader profiles, experience levels, and trading styles.

Standard vs. ECN Accounts

The two primary account models differ significantly in execution method and cost structure:

Standard Accounts

Standard accounts (sometimes called “classic” or “mini” accounts) typically feature:

- Fixed or variable spreads that include the broker’s markup

- No commission on trades (revenue built into the spread)

- Market maker execution (often B-Book model)

- Lower minimum deposits (often $100-200 or less)

- Simpler fee structure with all costs included in the spread

These accounts are generally suitable for beginners and lower-volume traders who prefer simplicity and predictable costs.

ECN Accounts

ECN accounts (sometimes called “raw spread” or “pro” accounts) typically offer:

- Raw interbank spreads with minimal or no markup

- Commission charged per trade (usually $3-10 per standard lot round-turn)

- Direct market access via the Electronic Communication Network

- Higher minimum deposits (often $500-1000)

- Faster execution with minimal or no requotes

These accounts are ideal for experienced traders, high-volume traders, and those using scalping or algorithmic strategies that benefit from minimal spread and fast execution.

Comparison Table

| Feature | Standard Account | ECN Account |

|---|---|---|

| Typical Spread (EUR/USD) | 1.0-2.0 pips | 0.0-0.3 pips |

| Commission | None | $3-10 per lot round-turn |

| Execution Model | Market Maker / B-Book | STP / A-Book |

| Minimum Deposit | Lower ($50-200) | Higher ($500-1000) |

| Execution Speed | Good | Excellent |

| Ideal For | Beginners, occasional traders | Experienced traders, high volume |

Demo Accounts and Their Benefits

Demo accounts are practice trading environments that simulate real market conditions without financial risk:

- Risk-free practice with virtual funds

- Identical platform experience to live trading

- Opportunity to test strategies without financial consequences

- Familiarization with platform features and functionality

- Testing automated trading systems before deployment with real funds

Most brokers offer demo accounts with features like:

- Virtual balance (typically $10,000-100,000)

- Time-limited access (30 days to indefinite)

- Access to all trading instruments offered on live accounts

- Real market data with minimal delay

While demo accounts provide valuable practice, they have limitations:

- No psychological pressure of real money at stake

- Sometimes idealized execution compared to live accounts

- Potential differences in slippage and requotes compared to live trading

Islamic Accounts (Swap-Free)

Islamic accounts (also called swap-free accounts) are designed to comply with Sharia law, which prohibits the payment or receipt of interest (riba).

Are Swap-Free Accounts Truly Free?

While Islamic accounts eliminate traditional swap/rollover fees, they typically compensate through alternative fee structures:

- Higher spreads to offset the lost swap revenue

- Administrative fees for positions held beyond certain periods (often 1-5 days)

- Fixed handling fees replacing the interest-based swap

- Time limits on how long positions can be held without fees

Traders considering Islamic accounts should carefully review the complete fee structure to understand the true costs compared to standard accounts.

Features of Islamic Accounts

Islamic accounts typically offer:

- No overnight swap fees or interest charges

- Compliance with Sharia principles

- Access to all trading instruments (though some brokers restrict certain pairs)

- Same platform features as standard accounts

- Alternative fee structures to replace interest-based charges

Most major brokers now offer Islamic account options to accommodate traders from Muslim countries and others who prefer swap-free trading.

Client Relationship Management

Effective client relationship management is crucial for broker success and profitability. Let’s examine how brokers manage their client relationships and the associated costs.

Customer Support Costs

Providing quality customer support represents a significant expense for forex brokers:

- 24/5 or 24/7 support staff across multiple time zones

- Multilingual support teams to serve global clients

- Support infrastructure including ticketing systems, live chat, and call centers

- Training and development for support personnel

- Quality assurance and monitoring of support interactions

Premium brokers often invest heavily in customer support as a differentiator. For example, XTB is consistently rated highly for customer service, with dedicated account managers and rapid response times [TradingBible](https://thetradingbible.com/compare/pepperstone-vs-xtb).

Marketing Expenses

Broker marketing costs have increased substantially in recent years due to rising competition:

- Digital advertising across search engines and social media

- Content marketing including educational resources and market analysis

- Affiliate and IB (Introducing Broker) programs with revenue sharing

- Sponsorships of sports teams and events

- Traditional advertising in financial media

- Promotional offers such as deposit bonuses and trading competitions

HFM, for instance, has invested in affiliate programs that offer partners “30% (Thirty per cent) of the spread and/or commission” for referred clients [HFM](https://www.hfm.com/load_terms?file=HFSV/2024-01_HFSV_Affiliate_Agreement_2024-01.pdf).

Retention Strategies

Client retention is typically more cost-effective than acquisition. Brokers employ various strategies to maintain client engagement and loyalty:

- Loyalty programs with increasing benefits for long-term clients

- Educational resources including webinars, videos, and articles

- Regular market analysis and trading signals

- Personalized communication from account managers

- Trading tools and add-ons to enhance the trading experience

- Rewards for trading volume such as rebates or reduced fees

- Community building through forums and social trading features

According to CompareFXBrokers, “Pepperstone charges $3.50 per lot in USD, while HF Markets has a slightly lower rate of $3.00 per lot. Both brokers offer competitive spreads and are well-regulated” [CompareForexBrokers](https://www.compareforexbrokers.com/reviews/pepperstone-vs-hf-markets/), showing how brokers adjust their fee structures to remain competitive and retain clients.

The Impact of Client Lifetime Value

Brokers calculate client lifetime value (CLV) to determine appropriate acquisition and retention spending:

- Average client lifespan (typically 6-24 months for retail traders)

- Average trading volume and resulting revenue

- Cross-selling potential for additional services

- Referral value through word-of-mouth marketing

- Acquisition cost to initially attract the client

Brokers generally aim to ensure their customer acquisition cost (CAC) is less than one-third of the expected lifetime value, allowing for profitable client relationships even with significant support and retention expenses.

The Reality of Retail Trader Performance

Understanding retail trader performance provides crucial context for broker profitability and potential losses.

The 90/90/90 Rule

A widely cited statistic in the forex industry is the “90/90/90 rule,” which suggests that:

- 90% of retail traders lose money

- 90% of those traders lose 90% of their capital

- 90% do so within 90 days

While this exact formulation lacks rigorous academic support, regulatory disclosures confirm that a significant majority of retail traders do lose money:

- FCA (UK): 69-76% of retail CFD accounts lose money

- ASIC (Australia): 63-80% of retail traders lose money

- CySEC (Cyprus): 68-81% of retail investors lose money

As BestBrokers.com reports, “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs” [BestBrokers](https://www.bestbrokers.com/forex-brokers/best-forex-trading-apps/).

Why Most Retail Traders Lose

Several factors contribute to the high failure rate among retail forex traders:

- Inadequate education and preparation before trading live funds

- Poor risk management including position sizing and leverage use

- Emotional decision-making driven by fear and greed

- Lack of structured trading plan or inconsistent strategy application

- Unrealistic profit expectations leading to excessive risk-taking

- Insufficient capital to weather normal market fluctuations

- Overtrading and excessive transaction costs

- Failure to adapt to changing market conditions

A comprehensive Reddit analysis tracking 10,000 failed forex trades found that “After 4 years of trading and way too many blown accounts early on, I became obsessed with understanding why most forex traders fail” [Reddit](https://www.reddit.com/r/Forexstrategy/comments/1m3h0hx/i_tracked_10000_failed_forex_trades_to_find_why/).

Impact on Broker Profitability

The high failure rate among retail traders directly impacts broker profitability, particularly for those using the B-Book model:

- Direct profit from client losses for B-Book operations

- Shorter customer lifecycles as traders deplete their accounts

- Higher client acquisition costs to replace lost traders

- Marketing challenges due to high industry failure rates

- Regulatory scrutiny concerning investor protection

This statistical reality explains why many brokers are reluctant to fully transition to an A-Book model, despite the reduced risk it offers. The potential profits from B-Book operations can be substantial when most clients are statistically likely to lose.

How Do Brokers Benefit from Long-Term Traders?

Despite the profitability of the B-Book model with losing traders, many brokers recognize the value of nurturing long-term, successful traders:

- Consistent transaction revenue through spreads and commissions

- Lower acquisition costs relative to lifetime value

- Positive testimonials and referrals from satisfied clients

- Enhanced reputation in the trading community

- Larger average account sizes as successful traders grow their capital

- Reduced regulatory risk compared to models dependent on client losses

Forward-thinking brokers often implement programs specifically designed to support trader development and success, recognizing that sustainable profitability comes from aligning interests with their clients rather than opposing them.

As YouTube channel ForexSignals explains in their analysis of broker models, “Former city trader reveals TRUTH behind Forex brokers. Some brokers genuinely want their clients to succeed because it creates long-term sustainable relationships” [YouTube](https://www.youtube.com/watch?v=aknkNktE–w).

Future of Forex Brokerage

The forex brokerage industry continues to evolve rapidly. Understanding emerging trends can help traders anticipate changes in broker operations and potential impacts on the broker-client relationship.

Technological Innovations

Several technological advancements are reshaping the forex brokerage landscape:

- AI and machine learning for risk management, client profiling, and personalized experiences

- Blockchain technology for transparent transaction recording and settlement

- Big data analytics for more sophisticated market analysis and pattern recognition

- Enhanced mobile trading with advanced features previously limited to desktop platforms

- Social and copy trading platforms connecting traders in collaborative networks

- Cloud-based infrastructure enabling more reliable service with reduced downtime

As Finalto observes, “One-size-fits all liquidity is so 2024. Brokers need partners who can tailor technology and services to their business strategies” [Finalto](https://www.finalto.com/blogs/what-brokers-need-from-their-liquidity-providers-in-2025/).

Regulatory Changes

The regulatory environment continues to evolve, with several trends emerging:

- Global regulatory convergence with increasing standardization across jurisdictions

- Enhanced disclosure requirements forcing greater transparency from brokers

- Stricter leverage restrictions to protect retail traders from excessive risk

- Focus on algorithmic trading oversight and flash crash prevention

- Expansion of transaction reporting requirements for better market surveillance

- Increased scrutiny of payment for order flow and execution quality

Recent regulatory developments include “Australia’s 2025 ASIC Rules: New Derivative-Transaction Reports and Their Impact on Forex Tax Filing,” which will expand reporting requirements to include nexus derivatives in October 2025, affecting offshore platforms and cross-border transactions [FinanceFeeds](https://financefeeds.com/australias-2025-asic-rules-new-derivative-transaction-reports-and-their-impact-on-forex-tax-filing/).

Market Evolution

The forex market itself is undergoing significant changes that affect broker operations:

- Increasing retail participation in previously institutional markets

- Growth of multi-asset trading beyond traditional forex pairs

- Rising competition from fintech disruptors with innovative business models

- Consolidation among brokers through mergers and acquisitions

- Expansion into emerging markets with growing middle classes

- Integration with traditional finance through partnerships and products

A notable example is “Crypto.com Exchange Acquires CySEC-regulated Broker, Plans to Offer CFDs in Q3 2025. The crypto platform purchased Cyprus-based Allnew Investments to obtain a Cyprus Investment Firm license” [Finance Magnates](https://www.financemagnates.com/terms/c/cysec/), demonstrating the increasing convergence between traditional forex and cryptocurrency markets.

Implications for the “Do Brokers Lose Money?” Question

These evolving trends have several implications for our central question:

- Increasing transparency requirements may force more brokers toward A-Book models

- Advanced risk management technologies could reduce broker exposure to losses

- Regulatory convergence may standardize capital requirements and risk controls

- Multi-asset offerings could diversify revenue streams, reducing reliance on forex trading profits

- Competition may compress margins, putting pressure on less capitalized brokers

The future forex brokerage landscape will likely feature a mix of traditional models and innovative approaches. Brokers who balance profitability with client success, regulatory compliance, and technological advancement will be best positioned to thrive.

FAQs

- Do Forex Brokers Lose Money If You Win?

- It depends on the broker’s business model. Market Maker (B-Book) brokers can lose money when clients win because they take the opposite side of trades. However, ECN/STP (A-Book) brokers don’t lose when clients win as they simply route orders to liquidity providers and earn from spreads and commissions regardless of trade outcomes. Many brokers use hybrid models, where some trades go to the A-Book and others to the B-Book based on client profitability and risk assessment.

- How Do Forex Brokers Make Money If They Don’t Charge Commissions?

- No-commission brokers primarily earn revenue through the bid-ask spread—the difference between buying and selling prices. They typically offer wider spreads than commission-based accounts to compensate. They may also generate income through overnight financing charges (swaps), deposit/withdrawal fees, currency conversion fees, and inactivity charges. For B-Book brokers, direct profit from client losses can be a significant revenue source, as statistically around 70-80% of retail traders lose money [Dukascopy](https://www.dukascopy.com/swiss/english/marketwatch/articles/forex-spread/?c=1743604275).

- Can a Broker Go Bankrupt? / What happens if a forex broker goes bankrupt? / What Happens to My Money?

- Yes, brokers can go bankrupt, as seen during the 2015 Swiss Franc crisis when several brokers failed. If a regulated broker becomes insolvent, your funds are typically protected up to certain limits by compensation schemes—for example, the FSCS in the UK covers up to £85,000 per client. Client funds held in segregated accounts are generally protected from creditors’ claims. However, if you’re using an unregulated broker, you may lose all your funds with little recourse. This is why choosing regulated brokers with strong capitalization is crucial [DayTrading.com](https://www.daytrading.com/brokers/regulated/fca).

- How Do Market Makers Work in Forex? / What is a Market Maker and Do They Trade Against Clients?