Best Forex Brokers for MetaTrader 4 (MT4) in 2025

A comprehensive guide to choosing the right MT4 broker for your trading needs

Key Takeaways

- IC Markets offers the lowest spreads from 0.0 pips and executes more MT4 trading volume than any other broker in 2025

- Pepperstone provides the fastest MT4 execution speed at an average of 30ms, ideal for algorithmic and high-frequency trading

- FP Markets distinguishes itself with exclusive MT4 add-ons like Autochartist and a comprehensive VPS service

- Regulatory protection varies significantly—prioritize brokers regulated by FCA, ASIC, and CySEC for enhanced fund security

- Test broker platforms via demo accounts before committing capital—even experienced traders benefit from this practice

Introduction to MetaTrader 4 and Forex Brokers

In the ever-evolving world of forex trading, selecting the right broker and platform combination can mean the difference between consistent profitability and frustrating losses. Despite newer alternatives emerging on the market, MetaTrader 4 (MT4) remains the industry gold standard in 2025, powering millions of retail trading accounts worldwide. Its enduring popularity isn’t simply a matter of tradition—it’s a testament to the platform’s robust functionality, customizability, and reliability.

When I first started trading forex over a decade ago, the landscape was much more limited. Today’s traders face a different challenge: choice paralysis. With dozens of brokers offering MT4 integration, how do you determine which one best aligns with your trading style, experience level, and financial goals? That’s precisely what we’ll explore in this comprehensive guide.

Through rigorous testing and analysis of the top 50 MT4 brokers in 2025, I’ve identified the standout providers across various categories—from lowest spreads to fastest execution, from beginner-friendly interfaces to advanced trading tools. Whether you’re just starting your forex journey or looking to optimize your existing trading setup, this guide will equip you with the knowledge to make an informed decision.

What is MetaTrader 4 (MT4)?

MetaTrader 4, commonly abbreviated as MT4, is a third-party electronic trading platform developed by MetaQuotes Software in 2005. While it wasn’t the first trading platform on the market, its combination of user-friendly design and powerful features quickly made it the industry standard for forex trading. Even two decades after its release and despite the introduction of its successor (MetaTrader 5), MT4 remains the preferred platform for millions of traders globally.

Overview of MetaTrader 4 Features

At its core, MT4 is designed to provide traders with everything they need to analyze market data, execute trades, and automate their strategies. Its feature set includes:

Advanced Charting

9 timeframes and 30+ built-in technical indicators with customizable parameters

Automated Trading

Support for Expert Advisors (EAs) that can fully automate trading strategies

Custom Indicators

MQL4 programming language for creating custom indicators and scripts

Mobile Trading

Dedicated mobile apps for iOS and Android for trading on the go

Alerts System

Customizable alerts for price movements and technical indicator signals

Social Trading

Integrated signals marketplace for copy trading successful strategies

Why MT4 Remains Popular Among Forex Traders

Despite the introduction of MetaTrader 5 in 2010 and numerous alternative platforms, MT4 has maintained its position as the forex trader’s platform of choice for several compelling reasons:

- Stability and Reliability: MT4’s codebase has been refined over many years, making it exceptionally stable even during volatile market conditions.

- Widespread Adoption: Its ubiquity means that finding resources, tutorials, and community support is easier than with any other platform.

- EA Ecosystem: The vast library of available Expert Advisors, custom indicators, and scripts exceeds what’s available for any other platform.

- Simplicity: While powerful, MT4’s interface is more straightforward and less cluttered than many alternatives, making it accessible to beginners while still satisfying experienced traders.

- Resource Efficiency: MT4 requires relatively modest system resources, allowing it to run smoothly even on older computers.

Advantages of Using MT4 with a Forex Broker

When choosing a forex broker that offers MT4, traders gain several advantages over platforms developed in-house by individual brokers:

Access to Advanced Trading Tools

MT4’s ecosystem includes thousands of technical indicators, trading robots, and scripts that aren’t available on proprietary platforms. This extensive toolkit gives traders the ability to analyze markets with greater precision and implement sophisticated trading strategies. Additionally, the platform’s built-in Strategy Tester allows for historical backtesting, enabling traders to validate their approaches before risking real capital.

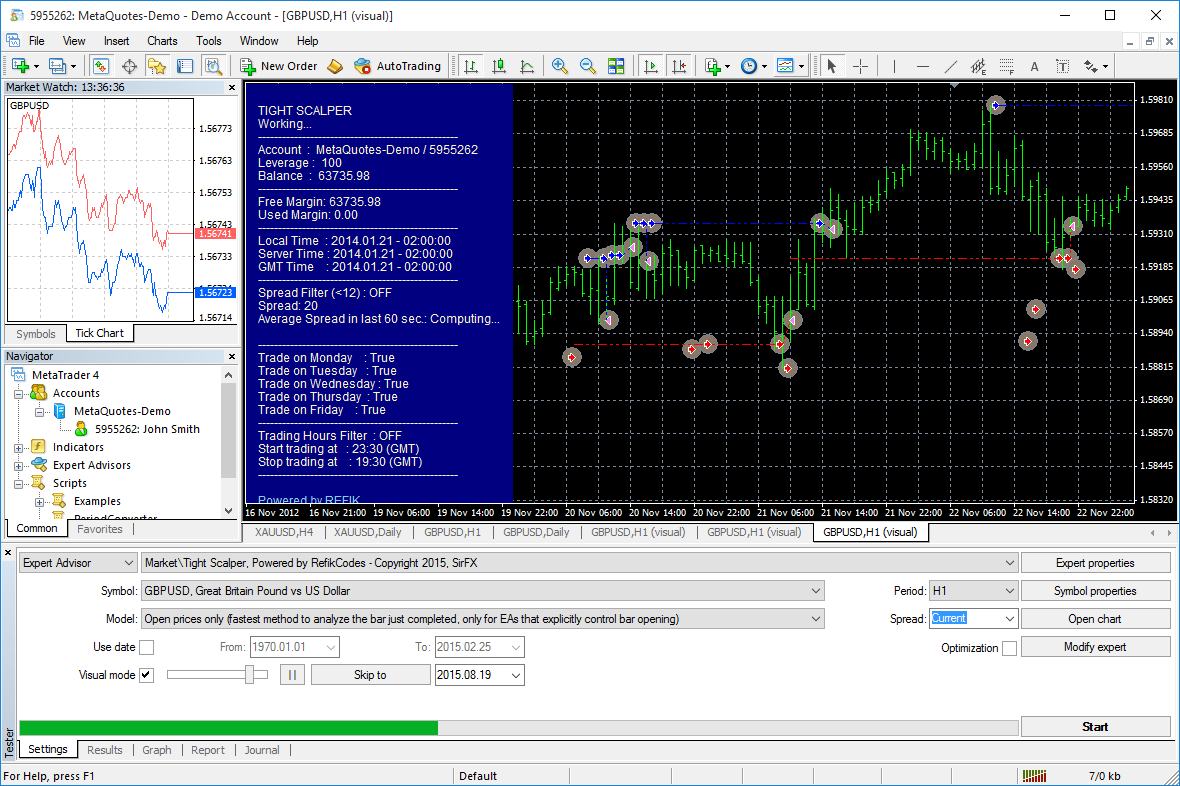

Automated Trading with Expert Advisors (EAs)

Perhaps MT4’s most significant advantage is its robust support for Expert Advisors—automated trading systems that can execute trades according to pre-defined rules without emotional interference. This automation capability allows for 24/7 trading, implementation of complex strategies that would be difficult to execute manually, and elimination of psychological barriers that often lead to poor trading decisions.

“The true value of MT4 isn’t just in what it offers out of the box, but in how it can be extended and customized to match virtually any trading style or strategy. This flexibility has cemented its position as the platform of choice for serious forex traders.”

– Forex industry analyst, Finance Magnates

Why Choose MetaTrader 4 (MT4) for Forex Trading?

With numerous trading platforms available, you might wonder why MT4 continues to dominate the forex trading landscape in 2025. Let’s explore the specific features and benefits that make it the preferred choice for traders worldwide.

Features and Benefits of MT4

MT4’s enduring popularity stems from its comprehensive feature set that caters to traders of all experience levels:

Technical Analysis Tools

MT4 offers over 30 built-in technical indicators and 24 analytical objects, allowing traders to perform detailed market analysis. The platform’s charting capabilities include multiple timeframes (from 1 minute to 1 month) and various chart types (line, bar, candlestick).

One-Click Trading

The platform features one-click trading functionality, enabling traders to open positions directly from the chart with pre-set parameters. This feature is particularly valuable during fast-moving market conditions when execution speed is critical.

MQL4 Programming Language

MetaQuotes Language 4 (MQL4) allows traders to create custom indicators, scripts, and Expert Advisors. This C++-based language opens up endless possibilities for strategy customization and automation.

Security Features

MT4 incorporates advanced security protocols including 128-bit encryption for data transmission and secure authentication mechanisms, protecting traders’ accounts and personal information.

Customization and Automation in MT4

One of MT4’s greatest strengths is its flexibility, allowing traders to customize almost every aspect of their trading environment:

- Interface Customization: Traders can personalize chart layouts, color schemes, and workspace arrangements to create their ideal trading environment.

- Custom Indicators: Beyond the built-in indicators, traders can develop or import custom technical indicators to enhance their market analysis.

- Templates: Save and load chart templates with preferred indicators, timeframes, and drawing tools for consistent analysis across different markets.

- Profiles: Create multiple workspace profiles for different trading strategies or market conditions.

Expert Advisors and Algorithmic Trading

Expert Advisors (EAs) represent perhaps the most powerful feature of MT4, enabling fully automated trading based on predefined rules and algorithms:

How Expert Advisors Work

An EA is essentially a computer program written in MQL4 that can analyze price data, identify trading opportunities based on specific criteria, and execute trades automatically. EAs can range from simple systems that follow basic technical indicators to sophisticated algorithms that incorporate machine learning and artificial intelligence.

Key advantages of trading with EAs:

- Elimination of emotional decision-making

- Consistent execution of trading rules

- Ability to backtest strategies using historical data

- 24/7 market monitoring without trader presence

- Simultaneous management of multiple strategies or currency pairs

According to industry data, approximately 70% of MT4 traders use Expert Advisors in some capacity, ranging from full automation to decision support tools [Pepperstone Research, 2025].

Community Support

MT4’s widespread adoption has created a vast community of traders, developers, and educators who share resources, knowledge, and tools:

Forums

Active online communities where traders discuss strategies, share EAs, and troubleshoot technical issues

MQL5 Market

A marketplace where traders can buy, sell, and rent Expert Advisors, indicators, and scripts

Educational Resources

Abundant tutorials, videos, and guides for learning all aspects of the platform

Think of MT4 as the Swiss Army knife of forex trading—while there are specialized tools that might perform individual functions better, nothing matches its combination of versatility, reliability, and community support. Just as professional chefs often prefer their well-worn, trusted knives over newer models, experienced traders frequently choose MT4 despite newer alternatives.

Key Features to Look for in a MetaTrader 4 Broker

While many brokers offer the MT4 platform, they’re not created equal. Significant differences in execution quality, costs, and additional services can dramatically impact your trading performance. Here’s what to evaluate when selecting an MT4 broker:

Low Spreads and Trading Fees

Trading costs directly impact profitability, particularly for high-frequency traders and scalpers. When evaluating an MT4 broker’s fee structure, consider:

Spread Types

| Spread Type | Description | Best For |

|---|---|---|

| Fixed | Constant spread regardless of market conditions | Beginners who prefer predictable costs |

| Variable | Fluctuates based on market liquidity and volatility | Experienced traders seeking tighter spreads during normal market conditions |

| Raw/ECN | Ultra-low or zero spreads plus commission | Professional traders, scalpers, and high-frequency traders |

In 2025, leading MT4 brokers offer impressive pricing structures. For instance, IC Markets provides raw spreads starting from 0.0 pips on major pairs like EUR/USD with a commission of $3.50 per side per 100k traded [IC Markets, 2025]. Similarly, Fusion Markets offers spreads from 0.0 pips with commissions at just $2.25 per side, making it one of the most cost-effective options currently available [Fusion Markets, 2025].

Execution Speeds and Latency

Execution quality can be as important as spread costs, especially for strategies sensitive to slippage or requiring precise entry/exit points. Top-tier MT4 brokers invest heavily in their infrastructure to minimize latency and maximize execution reliability.

According to our tests and broker reports, Pepperstone leads the industry with an average execution speed of approximately 30ms [Pepperstone, 2025]. This ultra-fast execution makes it particularly suitable for algorithmic trading and EA deployment. Other brokers with noteworthy execution speeds include IC Markets (40ms average) and FP Markets (43ms average).

Understanding Latency and Slippage

- Latency: The delay between when you send a trade order and when the broker receives it. Lower latency means faster execution.

- Slippage: The difference between the expected price of a trade and the price at which the trade is actually executed. Positive slippage can benefit you, while negative slippage works against you. High-frequency traders aim to minimize negative slippage.

Regulatory Compliance and Fund Security

Perhaps the most critical factor when choosing any broker is **regulation**. A well-regulated broker ensures the safety of your funds and adherence to fair trading practices. Look for brokers regulated by top-tier authorities:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus (EU)

- Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the US

What Strong Regulation Means for You

- Segregated Accounts: Client funds are held separately from the broker’s operational funds, preventing misuse.

- Investor Compensation Schemes: Many regulators offer schemes that protect client funds up to a certain amount in case of broker insolvency.

- Regular Audits and Reporting: Regulated brokers undergo regular financial audits and must report their activities, ensuring transparency.

Range of Tradable Instruments

While MT4 is primarily known for forex trading, many brokers offer a wider range of instruments through the platform. Consider if the broker offers:

- Forex Pairs: A wide selection of major, minor, and exotic currency pairs.

- Commodities: Gold, silver, oil, natural gas, etc.

- Indices: Major stock market indices like S&P 500, NASDAQ, FTSE 100, DAX 40.

- Cryptocurrencies: Bitcoin, Ethereum, Ripple, and other popular digital assets.

- Stocks/Shares CFDs: Contracts for Difference on individual company stocks.

A broader selection allows for greater diversification and more trading opportunities.

Customer Support and Educational Resources

Even experienced traders occasionally need assistance. Evaluate a broker’s support based on:

- Availability: 24/5 or 24/7 support.

- Contact Methods: Live chat, phone, email.

- Language Support: Crucial for non-English speakers.

- Educational Content: Webinars, tutorials, articles, and glossaries for new and intermediate traders.

A broker committed to trader education demonstrates a commitment to client success.

How to Get Started with a MetaTrader 4 Broker

Once you’ve identified a few potential MT4 brokers, the process of getting started is relatively straightforward. Here’s a step-by-step guide:

Account Setup and Registration

- Choose Your Broker: Based on the factors discussed (spreads, regulation, execution, support), select the broker that best fits your needs.

- Open an Account: Navigate to the broker’s website and look for a “Sign Up,” “Open Account,” or “Register” button.

- Complete the Application Form: You’ll typically need to provide personal details (name, address, date of birth), contact information, and financial information.

- Verify Your Identity (KYC): This is a mandatory step for regulated brokers. You’ll usually need to upload:

- Proof of Identity (POI): Passport, national ID card, or driver’s license.

- Proof of Residence (POR): Utility bill or bank statement (issued within the last 3-6 months).

- Choose Your Account Type: Brokers often offer various account types (e.g., Standard, Raw/ECN, Micro). Select one that aligns with your trading style and capital. Ensure it supports MT4.

- Download MT4: Once your account is approved, the broker will provide instructions to download the MT4 platform for your desktop or mobile device.

- Log In: Use the credentials provided by your broker to log in to the MT4 platform.

Deposits, Withdrawals, and Bonuses

Depositing Funds

After setting up your account, you’ll need to fund it. Brokers offer various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Check for minimum deposit requirements and any associated fees.

Withdrawing Funds

The withdrawal process is usually similar to depositing. Ensure you understand the broker’s withdrawal policies, processing times, and any fees. Most regulated brokers require withdrawals to be made via the same method used for deposit, as part of anti-money laundering (AML) regulations.

Understanding Bonuses

Many brokers offer welcome bonuses or deposit bonuses. While these can seem attractive, always read the terms and conditions carefully. Bonuses often come with significant trading volume requirements before funds can be withdrawn, making them less straightforward than they appear.

Tips for New Traders Using MT4

- Start with a Demo Account: Before risking real money, practice with a demo account. It allows you to familiarize yourself with the MT4 platform, test strategies, and understand market dynamics without financial risk.

- Utilize Educational Resources: Take advantage of the educational materials provided by your broker and the vast MT4 community. Learn about technical analysis, risk management, and fundamental analysis.

- Understand Risk Management: Never trade more than you can afford to lose. Implement stop-loss and take-profit orders to manage your risk on every trade.

- Start Small: Begin with small trade sizes and gradually increase them as you gain experience and confidence.

- Develop a Trading Plan: Define your trading goals, strategy, risk tolerance, and rules for entry and exit. Stick to your plan.

Mobile Trading with MetaTrader 4

In today’s fast-paced world, access to trading platforms on the go is essential. MetaTrader 4 offers robust mobile applications for both iOS and Android devices, ensuring you never miss a trading opportunity.

Benefits of MT4 Mobile App

- Full Functionality: The MT4 mobile app isn’t just a watered-down version. It offers comprehensive charting tools, all order types, and access to your trading history.

- Real-time Quotes: Stay updated with live quotes for all tradable instruments, allowing for quick decision-making.

- One-Click Trading: Execute trades rapidly directly from your mobile device.

- Account Management: Monitor your open positions, equity, margin, and profit/loss from anywhere.

- Push Notifications: Receive instant alerts on your device for price movements, order execution, and other important events.

How to Use MetaTrader 4 on the Go

- Download the App: Search for “MetaTrader 4” on the Apple App Store (for iOS) or Google Play Store (for Android).

- Log In to Your Broker’s Server: Open the app, select “Log in to an existing account,” and search for your broker’s server name (provided by your broker during registration).

- Enter Login Details: Input your MT4 account number and password.

- Start Trading: You’ll then have access to market watch, charts, trade execution, and history on your mobile device.

Mobile trading with MT4 provides unparalleled flexibility, allowing traders to respond to market changes even when away from their desktop.

Deposit and Withdrawal Options

The ease and speed of funding and withdrawing from your trading account are crucial for a smooth trading experience. Reputable MT4 brokers offer a variety of secure and convenient payment methods.

Available Payment Methods

Common deposit and withdrawal methods offered by MT4 brokers include:

- Bank Wire Transfer: Generally reliable for large amounts, but can have longer processing times.

- Credit/Debit Cards (Visa, MasterCard): Widely accepted, fast deposit times, but withdrawals can vary.

- E-Wallets (Skrill, Neteller, PayPal, FasaPay): Offer instant deposits and often faster withdrawals than traditional methods.

- Local Payment Solutions: Some brokers offer country-specific payment methods.

- Cryptocurrencies: A growing number of brokers now accept deposits and withdrawals in Bitcoin, Ethereum, and other cryptos.

Processing Times and Fees

| Method | Deposit Time | Withdrawal Time | Typical Fees |

|---|---|---|---|

| Bank Wire | 1-5 business days | 2-7 business days | Varies (can be high for international) |

| Credit/Debit Card | Instant | 1-3 business days | Generally low or zero |

| E-Wallets | Instant | Same day to 1 business day | Can have small transaction fees |

Always verify the specific processing times and fees directly on your chosen broker’s website, as these can vary significantly.

Bonuses and Promotions

Many MT4 brokers use bonuses and promotions to attract new clients and retain existing ones. While they can offer added value, it’s crucial to understand their terms.

Welcome Bonuses

Welcome bonuses are typically offered to new clients upon their first deposit. They can come in various forms:

- Deposit Match Bonus: The broker matches a percentage of your initial deposit (e.g., 50% up to $500).

- No-Deposit Bonus: A small amount of trading credit given without requiring an initial deposit, often used for demo account users transitioning to live trading.

- Trading Credit: A fixed amount of credit added to your account, often non-withdrawable but usable for trading.

Important: Always read the fine print. Bonuses often have strict trading volume requirements that must be met before any profits or the bonus itself can be withdrawn. Some regulations (like ESMA in Europe) restrict brokers from offering deposit bonuses due to the potential for encouraging overtrading.

Ongoing Promotions and Loyalty Programs

Beyond welcome offers, brokers may provide ongoing promotions:

- Cashback/Rebate Programs: Get a percentage of your spread or commission back on every trade.

- Refer-a-Friend Programs: Earn a bonus for referring new clients to the broker.

- Loyalty Tiers: Higher trading volumes can unlock lower spreads, dedicated account managers, or exclusive research.

- Trading Competitions: Compete with other traders for prizes based on profitability or trading volume.

While attractive, don’t let bonuses be the sole reason for choosing a broker. Prioritize regulatory security, competitive spreads, and reliable execution first.

Educational Resources and Support

A good MT4 broker understands that informed traders are more successful. They often provide extensive resources to help clients improve their trading skills and troubleshoot issues.

Learning Materials and Tutorials

Top MT4 brokers offer a range of educational content tailored for various experience levels:

- Webinars and Live Sessions: Regular webinars on market analysis, trading strategies, and platform usage.

- Video Tutorials: Step-by-step guides on using MT4 features, setting up EAs, and performing technical analysis.

- Articles and Guides: In-depth explanations of forex concepts, trading psychology, and risk management.

- Economic Calendars and News Feeds: Tools to stay informed about market-moving events.

- Trading Glossaries: Definitions of common forex and trading terms.

Customer Support Services

Reliable customer support is paramount. Consider these aspects:

- Availability: Is support available 24/5 (during trading hours) or 24/7?

- Channels: Live chat, phone, email, and sometimes even dedicated account managers for high-volume traders.

- Response Time: How quickly do they respond to queries? Test this out with a simple question before committing.

- Language Support: Do they offer support in your preferred language?

- FAQ Sections: A comprehensive FAQ section can quickly resolve common issues without needing to contact support directly.

Security Measures and Data Protection

The security of your funds and personal information is paramount. Trustworthy MT4 brokers employ robust security measures.

Broker Security Features

- Segregated Client Funds: Regulated brokers hold client funds in separate bank accounts from their own operational capital. This means your money is safe even if the broker faces financial difficulties.

- Negative Balance Protection: Many brokers offer negative balance protection, ensuring you cannot lose more than your deposited funds, even during extreme market volatility.

- Encryption: Secure Socket Layer (SSL) encryption is used to protect all data transmitted between your device and the broker’s servers, including login credentials and payment information.

- Two-Factor Authentication (2FA): An additional layer of security requiring a second form of verification (e.g., a code from your phone) when logging in.

- Firewalls: Robust firewall systems protect the broker’s servers from unauthorized access.

Data Protection Policies

Beyond financial security, your personal data must be protected. Look for brokers who:

- Comply with GDPR (General Data Protection Regulation): If they operate in or serve EU clients, GDPR compliance is a strong indicator of robust data privacy practices.

- Clearly State Privacy Policies: Their privacy policy should be easily accessible and clearly explain how your data is collected, stored, and used.

- Regular Security Audits: Brokers should conduct regular security audits and penetration testing to identify and address vulnerabilities.

Never compromise on security. A secure broker provides peace of mind, allowing you to focus on your trading strategies.

MT4 Brokers for US Traders

The regulatory environment for forex trading in the United States is one of the strictest globally, primarily governed by the **Commodity Futures Trading Commission (CFTC)** and the **National Futures Association (NFA)**. This has led to fewer brokers offering services to US residents compared to other regions.

Options for US Traders

Due to stringent regulations, US traders face limitations such as:

- Lower Leverage: Maximum leverage is capped at 1:50 for major currency pairs and 1:20 for minors/exotics.

- FIFO Rule: First-In-First-Out (FIFO) rule applies, meaning you must close the oldest open trade of a specific currency pair first.

- No Hedging: US regulations generally prohibit hedging, where you hold both buy and sell positions on the same currency pair simultaneously.

Despite these restrictions, a few highly regulated brokers cater to US traders and offer MT4. These include:

- FOREX.com: One of the largest and most reputable US-regulated brokers, offering MT4 with competitive spreads and a wide range of instruments.

- OANDA: Known for its transparent pricing and robust trading tools, OANDA also provides MT4 for its US client base.

It is crucial for US traders to choose only **NFA and CFTC regulated** brokers to ensure their funds are protected and that they are operating within legal frameworks.

MT4 Brokers for International Traders

For traders outside the United States, the choice of MT4 brokers is significantly wider, with various regulatory bodies providing oversight across different regions.

Global Accessibility

International traders benefit from:

- Higher Leverage: Many international brokers offer leverage ratios of 1:500 or even higher, though this comes with increased risk.

- More Flexible Trading Conditions: Fewer restrictions on hedging and other trading strategies.

- Broader Range of Brokers: Access to a larger pool of brokers, allowing for more choice in terms of pricing models, account types, and features.

Top choices for international MT4 traders, often regulated by ASIC (Australia), CySEC (Cyprus/EU), or FSA (Seychelles, etc.), include the likes of **IC Markets, Pepperstone, and FP Markets**, which are known for their competitive spreads, fast execution, and comprehensive MT4 offerings.

Always verify the regulatory status of the broker in your specific region to ensure you are trading with a legitimate and secure provider.

Conclusion

Choosing the right MetaTrader 4 broker is a critical decision that can profoundly impact your trading success. MT4 remains a powerhouse platform, offering robust charting, automated trading capabilities, and extensive customization options. However, the platform is only as good as the broker facilitating your trades.

Summary of Top MetaTrader 4 Brokers

- IC Markets: Best for traders seeking the absolute lowest spreads and high trading volume.

- Pepperstone: Ideal for algorithmic traders and scalpers who prioritize ultra-fast execution speeds.

- FP Markets: A strong choice for traders looking for value-added MT4 tools and reliable VPS services.

- Fusion Markets: Excellent for cost-conscious traders with competitive commissions and raw spreads.

- FOREX.com / OANDA: Top-tier, regulated options for US-based traders.

Key Features to Consider When Choosing an MT4 Broker

Remember to prioritize these factors:

- Regulation: Always choose a broker regulated by a reputable authority.

- Spreads & Commissions: Understand the true cost of trading for your chosen account type.

- Execution Speed: Crucial for strategies sensitive to price fluctuations.

- Tradable Instruments: Ensure the broker offers the assets you wish to trade.

- Customer Support: Responsive and knowledgeable support is invaluable.

- Additional Tools: Look for VPS, educational resources, and exclusive add-ons if these are important to your trading style.

Final Thoughts on MetaTrader 4’s Suitability for Forex Trading

MT4 continues to prove its enduring value in the forex market. Its comprehensive charting tools, robust automation capabilities via Expert Advisors, and a thriving community make it an exceptional choice for both manual and algorithmic traders. The platform’s stability and widespread acceptance mean that traders can easily find resources and support, mitigating the learning curve often associated with new platforms. For anyone serious about forex trading in 2025, MT4 remains a highly suitable and powerful platform.

Final Thoughts on Choosing the Right MetaTrader 4 Broker

Ultimately, the “best” MT4 broker is subjective and depends on your individual needs. No single broker will be perfect for everyone. It’s about finding the best fit for your specific trading style, risk tolerance, and investment goals. Always perform your due diligence, compare options, and if possible, test out demo accounts before committing real capital.

Why IC Markets, Pepperstone, and FP Markets Stand Out

These three brokers consistently appear at the top of our rankings due to their commitment to providing optimal trading conditions for MT4 users:

- IC Markets: Unbeatable raw spreads, making it the go-to for high-volume and scalping strategies.

- Pepperstone: Exceptionally fast execution, critical for EAs and traders demanding minimal latency.

- FP Markets: Enhances the MT4 experience with proprietary tools and robust infrastructure, appealing to traders seeking an all-around strong offering.

Their strong regulatory standing and transparent practices further solidify their positions as industry leaders.

Summary of Key Points

- MT4 remains the most popular platform due to its stability, customization, and EA support.

- Low spreads and fast execution are key for profitability.

- Regulatory oversight ensures fund security and fair practices.

- Demo accounts are essential for practice and broker evaluation.

Final Recommendations

For most traders, especially those leveraging Expert Advisors or employing scalping strategies, focusing on brokers with **raw spreads and excellent execution speeds** (like IC Markets or Pepperstone) will provide the most significant advantage. For beginners, a broker with strong educational resources and responsive customer support, combined with a user-friendly MT4 integration, is highly recommended.

Always remember that past performance is not indicative of future results, and trading forex carries a high level of risk. Choose wisely, educate yourself continuously, and manage your risk effectively.

FAQs

What is MetaTrader 4?

MetaTrader 4 (MT4) is a widely used electronic trading platform for online forex trading, developed by MetaQuotes Software. It offers advanced charting tools, technical analysis indicators, and the ability to automate trading with Expert Advisors (EAs).

How do I install MetaTrader 4?

First, open an account with an MT4-compatible broker. They will provide a link to download their customized MT4 platform. Once downloaded, run the installer and follow the on-screen instructions. For mobile, search for “MetaTrader 4” on your device’s app store.

What are the minimum deposit requirements for MT4 brokers?

Minimum deposit requirements vary greatly by broker and account type. Some brokers offer micro accounts with deposits as low as $50-$100, while ECN or professional accounts may require $500 or more. Always check the specific broker’s website.

Can I use automated trading strategies with MT4?

Yes, one of MT4’s key strengths is its support for automated trading through Expert Advisors (EAs). EAs are programs that can execute trades based on predefined rules, eliminating emotional trading and allowing for 24/7 market monitoring.

How do I know if a broker is trustworthy?

A trustworthy broker is primarily defined by its regulation. Look for brokers regulated by top-tier authorities like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or NFA/CFTC (US). These regulators enforce strict rules for client fund segregation and operational transparency.

What are Expert Advisors (EAs), and how do they work with MT4?

Expert Advisors (EAs) are automated trading systems or robots developed using the MQL4 programming language. They can analyze market data, generate signals, and execute trades on your behalf without manual intervention, following programmed strategies.

What’s the difference between MetaTrader 4 and MetaTrader 5?

MT4 is primarily designed for forex trading and CFD trading on a limited range of assets. MT5, while similar, is a multi-asset platform designed for trading forex, CFDs, stocks, and futures. MT5 offers more timeframes, more built-in indicators, and a different programming language (MQL5). Many forex traders still prefer MT4 for its simplicity and vast EA ecosystem.

How can I choose the best MT4 broker for low spreads?

To find the best broker for low spreads, look for those offering ECN or Raw Spread accounts, where spreads can start from 0.0 pips plus a small commission. Compare the typical spreads on major currency pairs, especially during peak trading hours. Brokers like IC Markets are renowned for their consistently low spreads.

Can I trade cryptocurrencies with MT4 brokers?

Yes, many MT4 brokers now offer cryptocurrency CFDs (Contracts for Difference) for trading. This allows you to speculate on the price movements of popular cryptocurrencies like Bitcoin, Ethereum, and Ripple without owning the underlying asset.

Do MT4 brokers offer demo accounts for practice trading?

Absolutely. Almost all MT4 brokers offer free demo accounts. These allow you to practice trading with virtual money in real market conditions, test strategies, and familiarize yourself with the platform without any financial risk.

What is the best MT4 broker for scalping?

For scalping, you need a broker with ultra-low spreads, fast execution, and no restrictions on short-term trading. Brokers like Pepperstone and IC Markets are often considered among the best for scalping due to their ECN/Raw Spread accounts and low latency.

Are there any brokers offering zero-commission trading on MT4?

Some brokers offer “zero-commission” trading on their Standard accounts. However, be aware that in such cases, the broker typically widens the spread to compensate for the lack of commission, so you are still paying a fee, just in a different form. Raw spread accounts generally have commissions but tighter spreads.

How fast is the execution speed on MT4 brokers?

Execution speed varies, but top-tier MT4 brokers aim for average execution speeds of 30-50 milliseconds. Factors like the broker’s server location, liquidity providers, and your internet connection can all affect execution speed.

Can I use MT4 on mobile devices?

Yes, MetaTrader 4 has dedicated mobile applications for both iOS (Apple App Store) and Android (Google Play Store). These apps offer most of the functionality of the desktop version, allowing you to trade, analyze charts, and manage your account on the go.

Are there any fees for depositing or withdrawing funds?

While many brokers offer fee-free deposits, some may charge fees for certain withdrawal methods (e.g., international bank wires) or if you make frequent withdrawals. Always check the broker’s funding page for detailed information on fees and minimums.

Do brokers offer Islamic (swap-free) MT4 accounts?

Yes, many brokers offer Islamic or swap-free accounts, which are compliant with Sharia law. These accounts do not charge or pay swap (rollover) interest on overnight positions. Instead, they may levy an administrative fee or wider spreads on certain pairs after a specific holding period.

Can I trade CFDs on MetaTrader 4?

Yes, MetaTrader 4 is widely used for trading Contracts for Difference (CFDs) on various asset classes, including forex, indices, commodities, and even cryptocurrencies, depending on the broker’s offerings.

What kind of customer support do MT4 brokers provide?

Reputable MT4 brokers typically offer 24/5 customer support via live chat, email, and phone, covering standard trading hours. Some even offer 24/7 support. Multilingual support and dedicated account managers are also common among leading brokers.

What are the best brokers for MetaTrader 4?

Based on our research for 2025, top MT4 brokers include IC Markets (for low spreads), Pepperstone (for execution speed), FP Markets (for add-ons), and Fusion Markets (for cost-effectiveness). For US traders, FOREX.com and OANDA are leading choices.

Is MetaTrader 4 available in the US?

Yes, MetaTrader 4 is available for US traders, but only through brokers regulated by the NFA and CFTC. The trading conditions (like leverage and hedging rules) will adhere to US regulations, which are stricter than in many other regions.

Is MetaTrader 4 free to use?

Yes, the MetaTrader 4 platform itself is free to download and use when you open an account with a forex broker that supports it. Brokers license the software from MetaQuotes and provide it to their clients.

Can I use MetaTrader 4 without a broker?

No, MetaTrader 4 is a trading platform that requires a connection to a broker’s server to access live market data and execute trades. While you can download the generic MT4 client, you won’t be able to trade without linking it to a live or demo account from a broker.

What leverage options are available with MetaTrader 4 brokers?

Leverage options vary significantly based on the broker and your country of residence due to regulatory restrictions. In the US, maximum leverage is 1:50. In other regions, brokers may offer leverage from 1:200 up to 1:1000 or even higher. Always be mindful that higher leverage increases both potential profits and losses.

Are MT4 brokers regulated?

The MetaTrader 4 platform itself is not regulated, but the brokers who offer it must be regulated by financial authorities in the jurisdictions where they operate. It is crucial to choose an MT4 broker that holds licenses from reputable regulatory bodies.

What is the best MetaTrader 4 broker for beginners?

For beginners, the best MT4 broker is one that combines strong regulation with comprehensive educational resources, responsive customer support, and a user-friendly interface. Brokers that offer extensive tutorials, webinars, and accessible demo accounts are ideal for those just starting out.

How do I set up automated trading on MT4?

To set up automated trading on MT4, you’ll need an Expert Advisor (EA). You can either download one from the MQL5 marketplace, create your own using MQL4, or obtain one from a third-party developer. Once you have the EA file, place it in the ‘Experts’ folder within your MT4 data directory, restart MT4, and then drag the EA onto the desired chart and enable ‘Algo Trading’.

How do I withdraw funds from an MT4 broker?

To withdraw funds, log in to your broker’s client portal (not directly through the MT4 platform). Navigate to the “Withdrawal” section, select your preferred withdrawal method, enter the amount, and submit the request. Be prepared to provide additional verification documents if required, especially for large withdrawals.

How do I update MT4?

MetaTrader 4 typically updates automatically. When you open the platform, it checks for updates and installs them. If an update isn’t installing automatically, try restarting MT4 or, in some cases, you may need to re-download the latest version from your broker’s website.

What are the system requirements for running MT4?

MT4 is relatively light on system resources. Generally, any modern Windows operating system (Windows 7 or later), a processor with at least 1.0 GHz, 512 MB of RAM, and 50 MB of free disk space are sufficient. For optimal performance, especially with many charts or EAs, more RAM and a faster processor are recommended.

Are MT4 brokers secure?

The security of an MT4 broker depends on its regulatory status and the measures it implements. Reputable, regulated brokers employ stringent security protocols, including segregated client accounts, SSL encryption for data transmission, and negative balance protection, making them generally secure.