Key Takeaways

- Regulatory Compliance: Choose from Tier-1 jurisdictions like UK (FCA – £730,000 capital) or offshore options like Seychelles ($50,000 capital) for faster, cheaper licensing

- Technology Infrastructure: Budget $10,000-$120,000 annually for platforms like MetaTrader 4/5 or proprietary solutions with web/mobile support

- Capital Requirements: Minimum capital ranges from $0 (SVG) to $20+ million (US CFTC/NFA), with most offshore jurisdictions requiring $18,000-$100,000

- Licensing Timeline: Expect 3 weeks (SVG) to 12 months (UK/US) for license approval, with offshore jurisdictions typically taking 1-3 months

- Ongoing Compliance: Maintain segregated client funds, submit regular financial reports, and ensure AML/KYC procedures meet regulatory standards

Introduction

Understanding Forex Broker Requirements

Starting a forex brokerage in 2025 isn’t just about having capital—it’s about navigating a complex web of regulatory requirements, technology infrastructure, and operational obligations. Whether you’re eyeing the prestigious FCA regulation in the UK or considering cost-effective offshore licensing in Seychelles, understanding these requirements upfront can save you time, money, and potential regulatory headaches.

Think of forex broker requirements like building a house—you need a solid foundation (regulatory license), proper utilities (technology infrastructure), adequate funding (capital requirements), and ongoing maintenance (compliance obligations). Skip any of these, and your brokerage house might collapse before you welcome your first client.

Why Compliance Matters in the Forex Industry

The forex industry handles over $7.5 trillion in daily trading volume, making it the world’s largest financial market. With such massive money flows, regulators worldwide have tightened their grip on forex brokers to protect traders and maintain market integrity. As noted by Arincen’s regulatory analysis, “FOREX regulatory bodies are primarily responsible for establishing FOREX operational and execution standards in their country of operation.”

Think of it this way: Forex regulation is like a global farmers’ market—but for currencies. Just as market vendors need permits to sell produce, forex brokers need licenses to facilitate currency trading. The more prestigious the market location, the stricter the requirements.

What Is a Forex Broker?

Definition and Role of a Forex Broker

A forex broker serves as an intermediary between retail traders and the massive interbank foreign exchange market. They provide trading platforms, market access, and execution services that allow individual traders to buy and sell currencies without needing millions in capital or direct bank relationships.

Modern forex brokers like Pepperstone and IG Group offer more than just market access—they provide educational resources, analysis tools, and risk management features that help traders navigate the complex forex landscape.

Types of Forex Brokers

Understanding broker types is crucial because each model has different regulatory requirements and operational structures.

Market Makers (MM) / Dealing Desk Brokers

Market makers create internal markets for their clients, essentially becoming the counterparty to trades. When you buy EUR/USD, the market maker sells it to you from their own inventory. This model requires substantial capital reserves and sophisticated risk management systems.

Regulatory Impact: Market makers face stricter capital requirements because they assume market risk. For example, FCA-regulated market makers need £730,000 minimum capital compared to £125,000 for intermediary brokers.

Non-Dealing Desk Brokers

These brokers don’t take the opposite side of client trades. Instead, they route orders to external liquidity providers, acting as intermediaries rather than counterparties.

STP (Straight Through Processing) Brokers

STP brokers automatically route client orders to liquidity providers without manual intervention. This model reduces operational costs but requires robust technology infrastructure and multiple liquidity partnerships.

ECN (Electronic Communication Network) Brokers

ECN brokers provide direct market access through electronic networks connecting multiple market participants. They typically charge commissions rather than spreads, offering transparent pricing but requiring advanced technology platforms.

Hybrid Model Brokers

Many modern brokers like Exness and XTB combine multiple models, routing smaller trades internally while sending larger orders to external providers. This approach optimizes profitability while managing risk.

Open Your Exness AccountRegulatory Requirements and Licensing

Regulatory Bodies in Forex Markets

The forex industry operates under a complex web of national and international regulatory frameworks. Understanding these bodies and their requirements is essential for anyone looking to establish a legitimate forex brokerage.

Commodity Futures Trading Commission (CFTC)

The CFTC regulates forex brokers in the United States, imposing some of the world’s strictest requirements. CFTC-regulated brokers must maintain minimum operational capital of $20 million and register with the National Futures Association (NFA).

Financial Conduct Authority (FCA)

The UK’s FCA represents the gold standard of forex regulation. FCA licensing requirements include £730,000 minimum capital for market makers and £125,000 for intermediary brokers.

Cyprus Securities and Exchange Commission (CySEC)

CySEC offers European Union passporting rights, allowing brokers to operate across the EU from a single Cyprus license. CySEC requirements include €125,000 minimum capital for STP brokers and up to €730,000 for full investment firms.

Tier-1 Jurisdictions (A Category)

These jurisdictions offer the highest regulatory standards but impose the most stringent requirements.

United States and Switzerland

The US requires $20+ million in capital and extensive compliance frameworks. Switzerland’s FINMA maintains similar standards, focusing on institutional clients and high-net-worth individuals.

Tier-2 Jurisdictions (B Category)

These offer strong regulation with more reasonable entry requirements.

United Kingdom and Australia

The UK’s FCA and Australia’s ASIC maintain high standards while being more accessible to established firms. ASIC requires AUD $1 million minimum capital for forex brokers.

Tier-3 Jurisdictions (C Category)

These jurisdictions offer reasonable regulation with lower barriers to entry.

Cyprus, New Zealand, and Malta

Cyprus (CySEC) offers EU passporting with €125,000-€730,000 capital requirements. New Zealand’s FMA provides credible regulation with lower costs, while Malta’s MFSA offers similar EU benefits to Cyprus.

Offshore Jurisdictions (D Category)

These offer the lowest barriers to entry but may face credibility challenges.

Belize, Vanuatu, and Cayman Islands

Offshore jurisdictions typically require $50,000-$100,000 capital and offer fast licensing processes. However, as noted in B2Broker’s analysis, “it is essential to consider the trade-offs, such as potentially lower credibility and increased scrutiny from clients and partners.”

2025 Regulatory Update: Several jurisdictions have increased their capital requirements in 2024-2025. According to Atomiq Consulting, “Labuan hiked their capital up by 50% now it’s 1 million Malaysian ringgit, Seychelles now it’s $100,000, and there were some changes in Vanuatu related to the classes.”

Licensing Requirements

Obtaining a forex broker license involves multiple steps and extensive documentation.

Jurisdiction-Specific Licenses

Each jurisdiction has specific licensing categories. For example, Cyprus offers CIF (Cyprus Investment Firm) licenses with different capital requirements based on services offered.

| Jurisdiction | Regulator | Minimum Capital | License Cost | Timeframe |

|---|---|---|---|---|

| United Kingdom | FCA | £730,000 | £10,000-£30,000 | 6-12 months |

| Australia | ASIC | AUD $1,000,000 | $50,000-$100,000 | 6-12 months |

| Cyprus | CySEC | €125,000-€730,000 | €20,000+ | 6-12 months |

| Seychelles | FSA | $100,000 | $35,000-$45,000 | 2-3 months |

| Mauritius | FSC | $18,000 | $20,000-$25,000 | 3 months |

| Vanuatu | VFSC | $50,000 | $30,000-$40,000 | 2-3 months |

Compliance and Reporting

Regulatory compliance extends far beyond initial licensing.

Regulatory Updates

Regulators frequently update requirements. For example, CySEC’s 2024 supervisory priorities focus on professional conduct rules and client information management.

Compliance Reviews

Regular compliance reviews ensure ongoing adherence to regulatory standards. Brokers must maintain detailed records, submit periodic reports, and undergo periodic audits.

Open Your Pepperstone AccountCapital Requirements

Minimum Capital Standards by Jurisdiction

Capital requirements vary dramatically across jurisdictions, reflecting different regulatory philosophies and market conditions. Understanding these requirements is crucial for budgeting and jurisdiction selection.

U.S. Capital Requirements / US Market Entry Requirements

The United States imposes the world’s strictest capital requirements. US-regulated brokers must maintain $20 million in regulatory capital and register with both the CFTC and NFA. This massive capital requirement explains why only a handful of brokers operate in the US retail forex market.

UK Capital Thresholds / European Capital Requirements

The UK’s FCA requires different capital levels based on business model:

- Market Maker License: £730,000 minimum capital

- Intermediary License: £125,000 minimum capital

- Restricted License: £50,000 minimum capital

As noted in FCA licensing requirements, “The minimum capital requirement for a Dealer Licence, essentially a ‘market maker’, is EUR 730,000. An Intermediary Licence (i.e. Matched Principle) is EUR 125,000.”

Capital for Brokers in Australia and Europe

Australia’s ASIC requires AUD $1 million minimum capital, while European jurisdictions vary significantly. European forex regulations typically require €50,000-€730,000 depending on the country and license type.

Asian-Pacific Requirements

Asian regulators maintain varying standards:

- Singapore (MAS): SGD $1 million minimum

- Japan (JFSA): JPY 50 million minimum

- Hong Kong (SFC): HKD 5 million minimum

Offshore Jurisdiction Requirements

Offshore jurisdictions offer more accessible capital requirements:

- Seychelles: $100,000 (increased from $50,000 in 2024)

- Mauritius: $18,000

- Vanuatu: $50,000

- Belize: $50,000

- Saint Lucia: No specific capital requirement

Capital Increase Trend: Several offshore jurisdictions increased their capital requirements in 2024-2025. This trend reflects growing regulatory scrutiny and the need to maintain credibility in the global forex market.

Capital Requirements by Jurisdiction (2025)

Business and Operational Requirements

Business Plan Essentials

A comprehensive business plan is required for all forex broker license applications. This document must demonstrate your understanding of the market, regulatory environment, and operational capabilities.

Target Market and Revenue Projections

Your business plan must clearly define your target market and provide realistic revenue projections. B2Broker’s business plan guide emphasizes the importance of demonstrating market research and competitive analysis.

Marketing and Sales Strategy

Regulators want to see how you plan to acquire and retain clients while maintaining ethical marketing practices. This includes your approach to digital marketing, affiliate programs, and educational content.

Corporate Structure

The corporate structure must comply with local laws and regulatory requirements. Most jurisdictions require:

- Local incorporation with minimum shareholding requirements

- Board of directors with relevant experience

- Segregation of operational and holding companies

- Clear beneficial ownership structure

Office Locations

Physical presence requirements vary by jurisdiction. While some offshore locations accept virtual offices, Tier-1 regulators typically require:

- Local physical office with permanent staff

- Compliance officer based in the jurisdiction

- Local directors or authorized representatives

- Operational capabilities within the jurisdiction

Staffing Requirements

Forex brokers must maintain qualified staff to handle various operational aspects. Key positions include:

- Compliance Officer: Ensures regulatory adherence

- Risk Manager: Monitors market and credit risks

- Operations Manager: Oversees daily operations

- Customer Support: Handles client inquiries and issues

- IT Support: Maintains technical infrastructure

Business Continuity Plans

Regulators require detailed business continuity plans that address:

- System failures and disaster recovery

- Cybersecurity incidents

- Key personnel unavailability

- Market disruptions

- Regulatory changes

Technology Infrastructure

Trading Platforms

The trading platform is the heart of any forex brokerage. According to Quadcode, “Choosing the appropriate trading platform is pivotal in establishing a Forex broker. This platform is not just a tool; it’s the gateway through which your clients will interact with the dynamic FX market.”

MetaTrader 4 and MetaTrader 5

MetaTrader remains the most popular choice among forex brokers worldwide. However, recent cost increases have made it expensive for new brokers, with licensing fees reaching $10,000+ monthly.

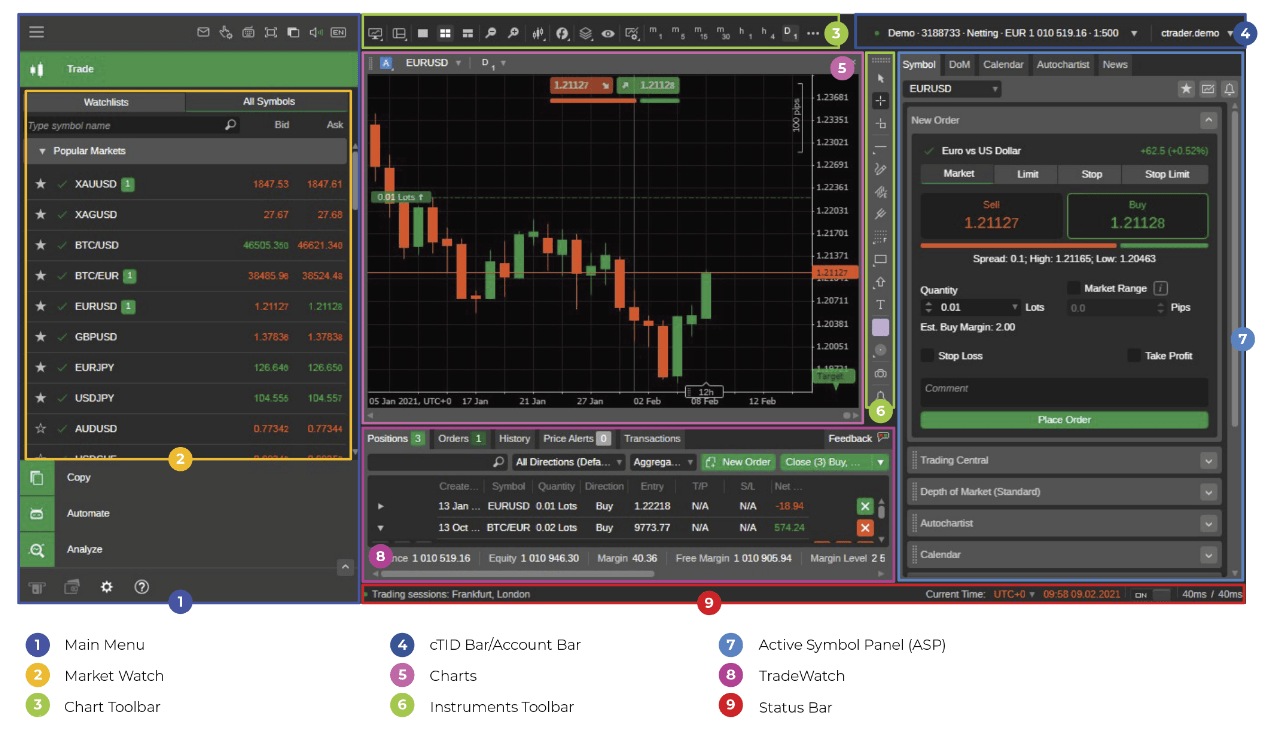

MetaTrader 5 trading interface showing the main dashboard, charts, and trading tools

Key MetaTrader features include:

- Advanced charting and technical analysis tools

- Automated trading capabilities (Expert Advisors)

- Mobile and web-based versions

- Multi-language support

- Extensive customization options

Proprietary Platforms

Many brokers develop proprietary platforms to reduce costs and differentiate their offerings. FXTM and XTB have successfully implemented proprietary solutions alongside MetaTrader.

cTrader web platform showing the modern, user-friendly interface preferred by many ECN brokers

Matching Engine Systems

The matching engine processes and executes trades in real-time. Key requirements include:

- Low-latency order processing (sub-millisecond)

- High-frequency trading capabilities

- Risk management integration

- Audit trail and compliance reporting

- Scalability to handle peak trading volumes

Liquidity Solutions

Access to deep liquidity is essential for competitive spreads and reliable execution.

Access to Interbank Markets

Tier-1 liquidity providers include major banks like Deutsche Bank, JPMorgan, and Barclays. However, accessing these providers requires substantial capital and regulatory compliance.

Bridging Technology

Liquidity bridges connect trading platforms to multiple liquidity sources, enabling:

- Aggregation of prices from multiple sources

- Automatic failover between providers

- Real-time spread optimization

- Risk management controls

Payment Processing Systems

Robust payment processing is crucial for client satisfaction and regulatory compliance.

Acceptable Payment Methods

Modern forex brokers must support multiple payment methods:

- Bank wire transfers

- Credit/debit cards

- E-wallets (Skrill, Neteller, PayPal)

- Cryptocurrencies (where legally permitted)

- Local payment methods per region

Transaction Limits

Payment systems must handle varying transaction sizes while maintaining AML compliance:

- Minimum deposits: $1-$100

- Maximum deposits: $10,000-$100,000+

- Daily withdrawal limits based on verification levels

- Monthly transaction monitoring

Processing Timeframes

Client expectations for processing times vary by method:

- Credit/debit cards: Instant deposits, 1-3 days withdrawals

- E-wallets: Instant deposits, same-day withdrawals

- Bank wires: 1-2 days deposits, 1-5 days withdrawals

- Cryptocurrencies: 10-60 minutes both ways

Security Features and Data Protection

Cybersecurity is paramount in forex operations, with brokers handling sensitive financial data and large monetary transactions.

Security Protocols

Essential security measures include:

- 256-bit SSL encryption for all communications

- Two-factor authentication (2FA)

- Regular security audits and penetration testing

- Secure API endpoints with rate limiting

- Real-time fraud detection systems

Data Protection Measures

Compliance with data protection regulations (GDPR, CCPA) requires:

- Data encryption at rest and in transit

- Regular data backups and recovery procedures

- Client data access controls and audit logs

- Right to data portability and deletion

- Data breach notification procedures

Cybersecurity Requirements

Regulatory cybersecurity requirements include:

- Firewall and intrusion detection systems

- Regular security updates and patch management

- Employee cybersecurity training programs

- Incident response procedures

- Cyber insurance coverage

System Redundancy

High availability requires:

- Multiple data centers with load balancing

- Real-time data replication

- Automated failover systems

- 99.9%+ uptime guarantees

- 24/7 technical monitoring

Disaster Recovery Plans

Comprehensive disaster recovery includes:

- Regular backup testing procedures

- Recovery time objectives (RTO) under 4 hours

- Recovery point objectives (RPO) under 1 hour

- Alternative trading venues during outages

- Clear communication protocols for clients

Technology Infrastructure Costs (Annual)

Risk Management Framework

Implementing Risk Management Systems

Risk management is not optional—it’s a regulatory requirement and business necessity. According to Quadcode, “establishing robust risk management protocols is akin to setting up a comprehensive insurance policy” for your brokerage.

Tools for Monitoring Market Volatility / Exposure Monitoring

Modern risk management systems must monitor multiple risk factors in real-time:

- Market exposure by currency pair and time frame

- Client position concentrations and correlations

- Liquidity provider credit risk

- Operational risk indicators

- Regulatory capital adequacy ratios

Risk Assessment Protocols

Systematic risk assessment includes:

- Daily value-at-risk (VaR) calculations

- Stress testing under extreme market conditions

- Counterparty risk evaluation

- Liquidity risk monitoring

- Operational risk assessments

Hedging Strategies and Margin Controls

Effective hedging requires:

- Real-time position netting across clients

- Automated hedging triggers

- Multiple hedging counterparties

- Dynamic margin requirements

- Stop-loss and take-profit automation

Client Fund Segregation

Regulatory requirements mandate strict segregation of client funds. Segregated accounts ensure that client money remains separate from broker operational funds, providing protection in case of broker insolvency.

Negative Balance Protection and Leverage Limits

European regulations, particularly ESMA rules, have transformed risk management requirements for retail clients.

Jurisdictional Requirements for Leverage

Leverage limits vary significantly by jurisdiction and client type:

- ESMA (EU): 30:1 for major pairs (retail clients)

- FCA (UK): Similar to ESMA post-Brexit

- ASIC (Australia): 30:1 for retail clients

- CFTC (US): 50:1 for major pairs

- Offshore jurisdictions: Often 500:1 or higher

Leverage Limits

ESMA’s product intervention measures establish specific leverage limits:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs

- 10:1 for commodities

- 5:1 for individual stocks

- 2:1 for cryptocurrencies

Margin Requirements

Margin requirements must be calculated dynamically based on:

- Volatility of the underlying instrument

- Client’s trading history and experience

- Account size and verification level

- Market conditions and liquidity

- Regulatory minimum requirements

Order Execution Policies

Transparent order execution policies must address:

- Price improvement procedures

- Slippage handling during volatile markets

- Requote policies and limitations

- Execution speed benchmarks

- Best execution reporting

Negative Balance Protection: ESMA regulations require “negative balance protection on a per account basis” to provide “an overall guaranteed limit on retail client losses.”

How to Start a Forex Broker in 2025: Expert Insights

This comprehensive video from Atomiq Consulting covers the essential costs, technology requirements, and licensing considerations for starting a forex brokerage in 2025. Key insights include MetaTrader licensing costs, regulatory capital requirements across jurisdictions, and the operational challenges facing new brokers.

Client Service and Acquisition

Marketing and Client Acquisition Strategies

Client acquisition in the forex industry requires sophisticated marketing approaches while maintaining regulatory compliance.

Online Marketing Tactics (SEO, Social Media)

Digital marketing forms the backbone of modern forex broker client acquisition:

- Search Engine Optimization: Target keywords like “forex broker,” “trading platform,” and specific instrument names

- Content Marketing: Educational articles, market analysis, and trading guides

- Social Media Marketing: LinkedIn for professional traders, YouTube for educational content

- Pay-Per-Click Advertising: Google Ads and social media advertising (subject to platform restrictions)

- Email Marketing: Automated nurture sequences and market updates

Offline Methods (Networking, Industry Events)

Traditional marketing remains important for institutional clients:

- Industry conferences and exhibitions

- Professional networking events

- Direct sales to institutional clients

- Partnership development with IBs

- Local market presence and events

Marketing and Promotional Guidelines

Forex marketing is heavily regulated, with specific requirements for promotional materials.

Advertising Restrictions

Common advertising restrictions include:

- Prohibition on guaranteed profits or “get rich quick” claims

- Mandatory risk warnings on all promotional materials

- Restrictions on targeting vulnerable populations

- Limitations on bonus and promotional offers

- Social media advertising restrictions by platform

Risk Disclaimers

All marketing materials must include prominent risk warnings. For example, typical disclaimers state: “Trading forex carries substantial risk and may not be suitable for all investors. 67-89% of retail investor accounts lose money when trading CFDs.”

Performance Claims

Performance claims must be:

- Factual and verifiable

- Representative of typical client outcomes

- Accompanied by appropriate risk warnings

- Compliant with local advertising standards

- Regularly updated to reflect current performance

Social Media Policies

Social media marketing requires specific policies covering:

- Content approval processes

- Influencer and affiliate disclosures

- Risk warning requirements

- Platform-specific compliance rules

- Crisis communication procedures

Client Retention and Support

Retaining clients is more cost-effective than acquiring new ones, making customer service crucial for long-term success.

Offering Excellent Customer Service

Modern forex brokers must provide multi-channel support:

- 24/5 live chat support during market hours

- Phone support in multiple languages

- Email support with guaranteed response times

- Video call support for complex issues

- Self-service knowledge bases and FAQs

Educational Resources for Traders / Client Education Programs

Educational content serves dual purposes: client retention and regulatory compliance. Leading brokers like IC Markets and FP Markets invest heavily in educational resources.

Training Materials

Comprehensive training programs should include:

- Beginner trading courses and webinars

- Advanced technical analysis training

- Risk management education

- Platform-specific tutorials

- Market analysis and economic calendar explanations

Support Requirements

Regulatory support requirements typically include:

- Qualified support staff with relevant certifications

- Multilingual support for international clients

- Escalation procedures for complex issues

- Complaint handling and resolution processes

- Regular support quality audits

Communication Channels

Modern communication channels include:

- Live chat with AI-powered initial responses

- WhatsApp Business for instant messaging

- Telegram channels for market updates

- Video conferencing for account managers

- Traditional email and phone support

Response Time Standards

Industry-standard response times:

- Live chat: Under 30 seconds

- Email: Within 2-4 hours

- Phone: Answer within 3 rings

- Complaints: Acknowledgment within 24 hours

- Complex issues: Resolution within 5 business days

Complaint Handling Procedures

Regulatory complaint handling requirements include:

- Clear complaint submission procedures

- Acknowledgment and tracking systems

- Internal escalation processes

- External ombudsman referral options

- Regular complaint analysis and improvement

Insurance and Protection

Client Fund Protection

Client fund protection is a cornerstone of forex regulation, ensuring that client money remains safe even if the broker faces financial difficulties.

Most reputable jurisdictions require client funds to be held in segregated accounts with Tier-1 banks. For example, Pepperstone holds client funds in segregated accounts with National Australia Bank, while IG Group uses multiple segregated accounts across different banks.

Professional Indemnity Insurance

Professional indemnity insurance protects brokers and their clients from losses resulting from professional negligence or errors. CXM reports coverage levels of up to $5,000,000 USD for FX and CFD brokerage activities.

Coverage typically includes:

- Professional negligence claims

- Errors and omissions in trading execution

- Technology failures and system errors

- Regulatory fines and penalties

- Legal defense costs

Compensation Schemes

Many jurisdictions operate investor compensation schemes that provide additional protection for retail clients.

Examples include:

- UK (FSCS): Up to £85,000 per client

- Cyprus (ICF): Up to €20,000 per client

- Australia (ASIC): Up to AUD $500,000 per client

- Germany (EdB): Up to €100,000 per client

Third-Party Liability Coverage

Third-party liability insurance protects against claims from external parties, including:

- Data breaches and cybersecurity incidents

- Regulatory violations and compliance failures

- Employment practices liability

- Directors and officers liability

- General commercial liability

Insurance Requirements: Titan FX recently announced “Professional Indemnity Insurance of up to US$500,000 per claim” as part of their enhanced client protection measures.

Educational and Staff Requirements

Staff Certifications

Regulatory bodies require key personnel to hold relevant certifications and demonstrate competency in their roles.

Common certification requirements include:

- UK (FCA): CF30 (Customer Function) and CF10 (Compliance Oversight)

- US (FINRA): Series 3 (National Commodities Futures) and Series 30 (Branch Managers)

- Australia (ASIC): RG146 compliance for financial advisors

- Cyprus (CySEC): CySEC certification for investment advisors

Compliance Training

Ongoing compliance training is mandatory for all staff handling client funds or providing investment advice.

Training programs must cover:

- Anti-money laundering procedures

- Know Your Customer requirements

- Market abuse and insider trading prevention

- Data protection and privacy regulations

- Cybersecurity awareness and procedures

Training Materials

Comprehensive training materials should include:

- Regulatory updates and changes

- Company policies and procedures

- Technical platform training

- Customer service excellence

- Risk management procedures

Trading Conditions

Spread and Commission Structures

Competitive trading conditions are essential for client acquisition and retention. The table below compares typical spreads and commissions offered by major regulated brokers.

| Broker | Regulator | EUR/USD Spread | Commission | Account Type |

|---|---|---|---|---|

| Pepperstone | FCA, ASIC | 0.0 pips | $7.00/lot | Razor |

| IC Markets | ASIC | 0.0 pips | $6.00/lot | Raw Spread |

| FP Markets | ASIC | 0.0 pips | $6.00/lot | Raw |

| XTB | FCA | 0.1 pips | $7.00/lot | Pro |

| IG Group | FCA | 0.6 pips | No commission | Standard |

| FXTM | FCA, CySEC | 0.1 pips | $10.00/lot | ECN |

| Exness | FCA, CySEC | 0.0 pips | $7.00/lot | Zero |

| ThinkMarkets | FCA, ASIC | 0.0 pips | $7.00/lot | ThinkZero |

Note: Spreads and commissions may vary based on market conditions, account size, and trading volume. Data compiled from broker websites and CompareForexBrokers.com as of 2025.

Open Your Exness AccountForex Trading Regulations 2025: European Perspective

This video from Regulated United Europe provides detailed insights into European forex regulations for 2025, covering licensing requirements, minimum share capital, and oversight by regulatory bodies like the FCA, BaFin, and AMF. Essential viewing for understanding European market entry requirements.

Ongoing Compliance

Regular Audits

Forex brokers must undergo regular internal and external audits to maintain their regulatory licenses. These audits examine financial records, compliance procedures, and operational systems.

Audit requirements typically include:

- Annual financial audits by certified public accountants

- Quarterly compliance reviews

- Monthly reconciliation of client funds

- Weekly capital adequacy reporting

- Daily transaction monitoring

License Renewals

Most forex licenses require annual renewals with associated fees and documentation updates. The renewal process typically involves:

- Updated financial statements

- Capital adequacy confirmations

- Compliance officer attestations

- Business plan updates

- Fee payments and regulatory assessments

Renewal timelines vary by jurisdiction:

- UK (FCA): Annual renewal with 3-month advance notice

- Cyprus (CySEC): Annual renewal with updated financials

- Seychelles (FSA): Annual renewal with reduced documentation

- Mauritius (FSC): Annual renewal with local audit requirements

Challenges in Becoming a Forex Broker

Regulatory Hurdles

The regulatory landscape for forex brokers has become increasingly complex, with new requirements emerging regularly. Recent industry analysis highlights several key challenges:

- Increasing Capital Requirements: Jurisdictions like Labuan have raised capital requirements by 50%, while Seychelles doubled theirs to $100,000

- Longer Licensing Timeframes: New applications can take 6-12 months in premier jurisdictions

- Enhanced Due Diligence: Regulators now conduct more thorough background checks on beneficial owners

- Ongoing Compliance Costs: Regular audits, reporting, and compliance monitoring add significant operational expenses

Capital and Financial Management

Beyond initial capital requirements, forex brokers face ongoing financial challenges:

- Working Capital: Sufficient funds for daily operations, marketing, and client withdrawals

- Technology Investment: Continuous updates to trading platforms and infrastructure

- Liquidity Management: Maintaining relationships with multiple liquidity providers

- Risk Management: Hedging market exposure and managing client credit risk

Technology Implementation

Technology challenges include:

- Platform Licensing Costs: MetaTrader licensing can cost $120,000+ annually

- Integration Complexity: Connecting multiple systems and service providers

- Scalability Requirements: Building systems that can handle growth

- Security Concerns: Protecting against cyber threats and data breaches

- Regulatory Technology: Implementing compliance monitoring and reporting systems

Reality Check: As noted in the Atomiq Consulting video, “2025 is extremely volatile as far as the markets go” and “it’s a very competitive business.” New brokers must be prepared for significant upfront investment and ongoing operational challenges.

Conclusion

Key Takeaways on Forex Broker Requirements

Starting a forex brokerage in 2025 requires careful planning, substantial capital, and ongoing commitment to regulatory compliance. The key requirements include:

- Regulatory Licensing: Choose between prestigious Tier-1 jurisdictions (£730,000+ capital) or accessible offshore options ($18,000-$100,000)

- Technology Infrastructure: Budget $10,000-$120,000 annually for platforms, with MetaTrader being the most expensive but popular option

- Operational Framework: Implement robust risk management, client fund segregation, and compliance monitoring systems

- Professional Team: Hire qualified staff with relevant certifications and ongoing training

- Insurance Coverage: Maintain professional indemnity and client protection insurance

The Importance of Compliance and Risk Management in Forex Brokerage

Compliance is not optional—it’s the foundation of a successful forex brokerage. Regulatory requirements exist to protect traders and maintain market integrity. Brokers who cut corners on compliance risk losing their licenses, facing regulatory penalties, and damaging their reputation.

Effective risk management protects both the broker and their clients. Features like negative balance protection and appropriate leverage limits help prevent excessive losses while maintaining attractive trading conditions.

Recap of Key Requirements for Becoming a Forex Broker

The journey to becoming a forex broker involves several critical steps:

- Jurisdiction Selection: Balance regulatory credibility with entry costs and timeframes

- Capital Preparation: Secure sufficient funds for licensing, operations, and working capital

- Technology Setup: Choose between MetaTrader licensing or proprietary platform development

- Regulatory Application: Prepare comprehensive documentation and undergo regulatory review

- Operational Launch: Implement compliance systems, hire qualified staff, and begin marketing

- Ongoing Compliance: Maintain regulatory standards through regular audits and reporting

Key Considerations

Before starting a forex brokerage, consider these critical factors:

- Market Saturation: The forex industry is highly competitive with established players

- Regulatory Trends: Requirements are becoming stricter, not more lenient

- Technology Costs: Platform licensing and development costs continue to rise

- Client Acquisition: Marketing restrictions make client acquisition challenging and expensive

- Operational Complexity: Running a forex brokerage requires expertise across multiple domains

Future Outlook / The Future of Forex Brokerage

The forex brokerage industry is evolving rapidly, with several trends shaping its future:

- Increased Regulation: Expect more stringent requirements and higher capital thresholds

- Technology Innovation: AI, blockchain, and advanced analytics will become standard

- Market Consolidation: Smaller brokers may struggle to compete with established players

- Cryptocurrency Integration: Crypto trading will become increasingly important

- Institutional Focus: Many brokers will shift toward institutional and professional clients

Final Recommendations

For aspiring forex brokers, consider these recommendations:

- Start Small: Consider offshore licensing first, then upgrade to Tier-1 jurisdictions

- Partner with Experts: Work with experienced regulatory consultants and technology providers

- Focus on Compliance: Invest in robust compliance systems from day one

- Plan for Growth: Build scalable systems that can handle increasing client volumes

- Differentiate Your Offering: Find unique value propositions in a crowded market

The forex brokerage industry offers significant opportunities for those willing to invest the time, money, and effort required. However, success requires careful planning, substantial resources, and unwavering commitment to regulatory compliance and client service.

For more information about specific brokers and their requirements, visit our comprehensive forex broker guides and broker reviews.

FAQs

- What Are the Licensing Requirements to Start a Forex Brokerage?

- Licensing requirements vary by jurisdiction but typically include minimum capital (ranging from $18,000 in Mauritius to $20+ million in the US), qualified management team, detailed business plan, AML/KYC procedures, and comprehensive documentation. The process takes 3 weeks to 12 months depending on the jurisdiction.

- How Much Capital Is Needed to Start a Forex Brokerage?

- Capital requirements range from $0 (Saint Vincent) to $20+ million (US CFTC). Popular jurisdictions include UK (£730,000), Cyprus (€125,000-€730,000), Seychelles ($100,000), and Mauritius ($18,000). Additional working capital is needed for operations, technology, and marketing.

- Do Forex Brokers Need to Be Registered With a Regulatory Body?

- Yes, legitimate forex brokers must be registered with regulatory bodies in their jurisdiction of operation. Operating without proper licensing is illegal and exposes both the broker and clients to significant risks. Regulatory registration provides client protection and ensures compliance with industry standards.

- What Are the Key Documents Required for a Forex Broker License?

- Key documents include: notarized passports of beneficial owners, educational diplomas and certifications, criminal background checks, articles of incorporation, comprehensive business plan, AML/KYC policies, proof of capital, corporate bank account details, and physical office address verification.

- How Long Does It Take to Obtain a Forex Broker License?

- Timeframes vary by jurisdiction: Saint Vincent (3 weeks), Seychelles (2-3 months), Mauritius (3 months), Cyprus (6-12 months), UK (6-12 months), and US (up to 12 months). Offshore jurisdictions are generally faster but may have lower credibility.

- Can I Start a Forex Brokerage Without a License?

- No, operating a forex brokerage without proper licensing is illegal in most jurisdictions and exposes you to criminal penalties, regulatory sanctions, and client lawsuits. Even in jurisdictions with minimal regulation, some form of business registration is typically required.

- What Are the Penalties for Non-Compliance With Forex Regulations?

- Penalties can include: license suspension or revocation, criminal prosecution, significant financial fines, prohibition from operating financial services, director disqualification, and civil lawsuits from clients. Regulatory penalties can reach millions of dollars.

- How Can a Forex Broker Ensure Client Fund Protection?

- Client fund protection requires: segregated accounts with tier-1 banks, regular reconciliation of client funds, professional indemnity insurance, participation in compensation schemes (where available), and strict separation of client and company funds. Some jurisdictions also require client money to be held in trust.

- What Are the AML and KYC Requirements for Forex Brokers?

- AML/KYC requirements include: customer due diligence procedures, identity verification, address verification, source of funds verification, ongoing monitoring of client transactions, suspicious activity reporting, record keeping (typically 5-7 years), and regular staff training on AML procedures.

- Which Trading Platforms Are Most Commonly Used by Forex Brokers?

- MetaTrader 4 and MetaTrader 5 are the most popular platforms, used by over 80% of forex brokers. Other platforms include cTrader, DXtrade, and proprietary platforms. Platform choice depends on licensing costs, features, and target market preferences.

- How Do Forex Brokers Manage Risk?

- Risk management includes: real-time position monitoring, automated hedging systems, margin requirements, stop-loss controls, liquidity provider diversification, client credit checks, and regular stress testing. Advanced brokers use sophisticated risk management software and maintain dedicated risk management teams.

- Is Negative Balance Protection a Requirement for Forex Brokers?

- Negative balance protection is mandatory for retail clients in ESMA-regulated jurisdictions (EU), FCA-regulated firms (UK), and ASIC-regulated brokers (Australia). It’s not required in offshore jurisdictions, but many brokers offer it voluntarily to attract clients.

- What Marketing Strategies Work Best for Forex Brokers?

- Effective marketing strategies include: educational content marketing, SEO optimization, social media presence, webinars and seminars, affiliate programs, partnership marketing, and targeted advertising. However, all marketing must comply with strict regulatory requirements and include appropriate risk warnings.

- How Do Forex Brokers Handle Client Support?

- Modern forex brokers provide: 24/5 support during market hours, multilingual support teams, multiple communication channels (chat, email, phone), escalation procedures for complex issues, educational resources, and complaint handling procedures. Response times typically range from 30 seconds (live chat) to 24 hours (email).

- How Often Do Forex Brokers Need to Submit Financial Reports?

- Reporting frequency depends on jurisdiction: daily position reports to some regulators, weekly capital adequacy reports, monthly client money reconciliations, quarterly compliance reports, and annual audited financial statements. High-tier jurisdictions require more frequent reporting.

- What Are the Differences Between A-Book and B-Book Brokers?

- A-Book brokers route client orders directly to liquidity providers, earning money from spreads or commissions. B-Book brokers act as counterparties to client trades, potentially profiting from client losses. Many brokers use hybrid models, routing some orders externally while internalizing others.

- Can Forex Brokers Offer Leverage?

- Yes, but leverage limits vary by jurisdiction and client type. ESMA limits retail clients to 30:1 for major pairs, while professional clients can access higher leverage. Offshore jurisdictions often allow 500:1 or higher leverage. Leverage must be appropriate for the client’s experience and risk tolerance.

- How Do Forex Brokers Maintain Compliance With Global Regulations?

- Compliance maintenance requires: dedicated compliance officers, regular regulatory training, automated compliance monitoring systems, legal counsel, regular audits, policy updates, and ongoing communication with regulators. Many brokers hire compliance consultants to ensure adherence to complex requirements.

- What Are the Capital Requirements for Forex Brokers in Different Jurisdictions?

- Capital requirements range widely: US ($20+ million), UK (£730,000), Australia (AUD $1 million), Cyprus (€125,000-€730,000), Seychelles ($100,000), Mauritius ($18,000), and Saint Vincent ($0). Higher capital requirements generally correlate with stronger regulatory oversight and client protection.

- What Are the Tax Obligations for Forex Brokers?

- Tax obligations include: corporate income tax on profits, VAT/GST on services (where applicable), withholding taxes on client payments, payroll taxes for employees, and potential transaction taxes. Tax rates vary significantly by jurisdiction, with some offshore locations offering preferential rates.

- How Important Is Technology for Forex Brokers?

- Technology is crucial for forex brokers, representing 30-40% of operational costs. Key requirements include: reliable trading platforms, fast execution systems, robust security measures, backup systems, mobile applications, and integration capabilities. Technology failures can result in significant losses and regulatory sanctions.

- What Security Measures Should a Forex Broker Have in Place?

- Essential security measures include: 256-bit SSL encryption, two-factor authentication, regular security audits, firewall protection, intrusion detection systems, secure data storage, employee security training, and cyber insurance. Regulatory requirements often mandate specific security standards.

- How Can a Forex Broker Attract Clients?

- Client attraction strategies include: competitive spreads and commissions, reliable execution, strong regulatory status, educational resources, excellent customer service, innovative features, effective marketing campaigns, and strong online presence. However, all marketing must comply with regulatory requirements.

- What Role Do Liquidity Providers Play in Forex Brokerage?

- Liquidity providers supply the prices and execution for client trades. They include: major banks, non-bank market makers, ECNs, and prime brokers. Brokers typically use multiple liquidity providers to ensure competitive pricing, reliable execution, and risk diversification.

- What Are the Main Costs Associated With Running a Forex Brokerage?

- Major costs include: licensing fees, regulatory capital, technology platforms, liquidity feeds, staff salaries, office rent, marketing expenses, insurance, legal fees, and ongoing compliance costs. Annual operating costs typically range from $500,000 to $5+ million depending on scale and jurisdiction.

- Can a Forex Broker Offer Cryptocurrency Trading as Well?

- Many jurisdictions allow forex brokers to offer cryptocurrency trading, but additional licensing or registration may be required. Crypto trading involves additional risks and regulatory considerations, including higher margin requirements and enhanced AML procedures.

- What Is a White-Label Forex Brokerage?

- A white-label forex brokerage allows entrepreneurs to operate under another company’s license and infrastructure while maintaining their own brand. This reduces startup costs and time-to-market but limits control over technology and regulatory relationships.

- How Do Regulatory Changes Impact Forex Brokers?

- Regulatory changes can significantly impact forex brokers through: increased capital requirements, new compliance obligations, operational restrictions, additional reporting requirements, and potential business model changes. Brokers must monitor regulatory developments and adapt their operations accordingly.

- Which jurisdictions are best for starting a forex brokerage?

- The best jurisdiction depends on your budget, target market, and long-term goals. Tier-1 jurisdictions (UK, Australia) offer credibility but require substantial capital. Offshore options (Seychelles, Mauritius) provide faster, cheaper entry but may face credibility challenges. Consider regulatory reputation, capital requirements, timeframes, and market access when choosing.

- What are the main compliance requirements for forex brokers?

- Main compliance requirements include: maintaining minimum capital levels, segregating client funds, implementing AML/KYC procedures, submitting regular reports to regulators, maintaining qualified staff, providing appropriate risk warnings, ensuring fair treatment of clients, and undergoing regular audits. Compliance requirements vary by jurisdiction but are becoming increasingly stringent globally.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.