Key Takeaways

- Binary options offer fixed-risk trading with predetermined outcomes—you either win a fixed amount or lose your investment.

- Top regulated binary brokers include Pocket Option, IQ Option, Quotex, Deriv, and Binomo—all offering user-friendly platforms for beginners.

- Always verify a broker’s regulation status through official financial authorities like CySEC, ASIC, or FSCA before depositing funds.

- Start with a demo account to practice risk-free before committing real money to binary trading.

- Never risk more than 1-2% of your trading capital on a single binary options trade.

Introduction to Binary Forex Trading

If you’ve ever wanted to trade the financial markets but felt overwhelmed by complex charts, endless indicators, and unpredictable price movements, binary forex trading might be the simplest entry point you’re looking for. Unlike traditional forex trading—where calculating profits, losses, and managing positions can get complicated—binary options boil down trading to its most fundamental question: will the price go up or down?

Honestly, picking your first binary options broker isn’t rocket science—but there are some critical things I wish someone had told me when I was starting out. Having traded binary options for years, I’ve learned that your success hinges more on understanding the rules of the game than on complex technical analysis.

What is Binary Forex Trading?

Binary forex trading combines the foreign exchange market with a simplified trading instrument called binary options. In its most basic form, a binary option is a type of financial contract where you predict whether a currency pair’s price will rise or fall within a specified time period. If your prediction is correct, you earn a fixed return—typically between 70-95% of your investment. If wrong, you lose the amount you invested.

Think of binary options like placing an “all or nothing” bet on a currency pair. You’re not buying or selling the actual currency—you’re simply predicting its direction. The “binary” in the name comes from the fact that there are only two possible outcomes: you either win a predetermined amount or lose your investment.

Everyday Analogy: Binary options are like betting on a coin toss, but instead of heads or tails, you’re choosing “price goes up” or “price goes down.” You know exactly what you’ll win before placing your bet, and the amount you can lose is limited to what you put in.

:max_bytes(150000):strip_icc()/OrderTicketMobileUpdated-e7ea25e426bf48308ee0dd1766143211.png)

Sample binary options trading interface showing call and put options [Investopedia](https://www.investopedia.com/articles/active-trading/061114/guide-trading-binary-options-us.asp)

Key Differences Between Binary Options and Forex

Before diving into binary options trading, it’s crucial to understand how it differs from traditional forex trading. These differences impact everything from your trading strategy to risk management.

| Feature | Binary Options | Traditional Forex |

|---|---|---|

| Risk Management | Fixed risk—you know exactly how much you can lose | Variable risk—losses can exceed your initial investment |

| Profit Potential | Fixed return (typically 70-95% of investment) | Unlimited profit potential based on market movement |

| Trade Duration | Fixed expiry times (from 30 seconds to months) | No expiry—positions can be held indefinitely |

| Complexity | Simple yes/no direction prediction | Complex calculations of pips, lots, and leverage |

| Fees | No explicit spreads or commissions | Spreads, commissions, overnight fees |

| Capital Requirements | Low entry point ($5-$10 minimum deposit on many platforms) | Higher capital needs for effective position sizing |

I once lost $500 on my first day trading forex because I didn’t understand leverage and margin calls. With binary options, that would have been impossible—my loss would have been limited to exactly what I invested in each trade. This fixed-risk nature is why many beginners find binary options more approachable.

Why Beginners Choose Binary Trading

New traders are often drawn to binary options for several compelling reasons:

- Simplicity – Binary options reduce trading to a straightforward yes/no proposition about market direction.

- Fixed Risk – You’ll never wake up to a margin call or discover losses larger than your initial investment.

- Low Entry Barriers – Many platforms allow you to start with as little as $10, making it accessible for those with limited capital.

- Quick Results – With expiry times as short as 30 seconds, you don’t need to wait days or weeks to see outcomes.

- No Complex Calculations – There’s no need to calculate position sizes, pip values, or leverage ratios.

However, these advantages come with important caveats. The simplified nature of binary options can create a gambling-like atmosphere that might encourage poor trading habits. The fast pace can lead to emotional decision-making rather than strategic trading.

Important Note: Binary options trading carries significant risks and isn’t suitable for everyone. Despite its simple appearance, it requires proper education, strategy development, and disciplined risk management. Some countries have restricted or banned binary options trading due to concerns about investor protection.

How Binary Forex Trading Works

Understanding Binary Options Contracts

Binary options contracts are straightforward financial instruments that enable traders to speculate on price movements without actually owning the underlying asset. Here’s how they function in the context of forex trading:

When trading a binary option, you’re essentially making a prediction about whether the price of a currency pair will rise above or fall below a certain price level (called the “strike price”) at a specified time in the future (the “expiration time”). If your prediction is correct, you receive a predetermined payout. If incorrect, you lose your investment.

For instance, let’s say you believe the EUR/USD will rise in the next hour. You might place a “call” (up) option with a $100 investment and a 80% payout rate. If at expiration the EUR/USD is higher than when you entered the trade, you’d receive $180 ($100 initial investment + $80 profit). If it’s lower, you’d lose your $100.

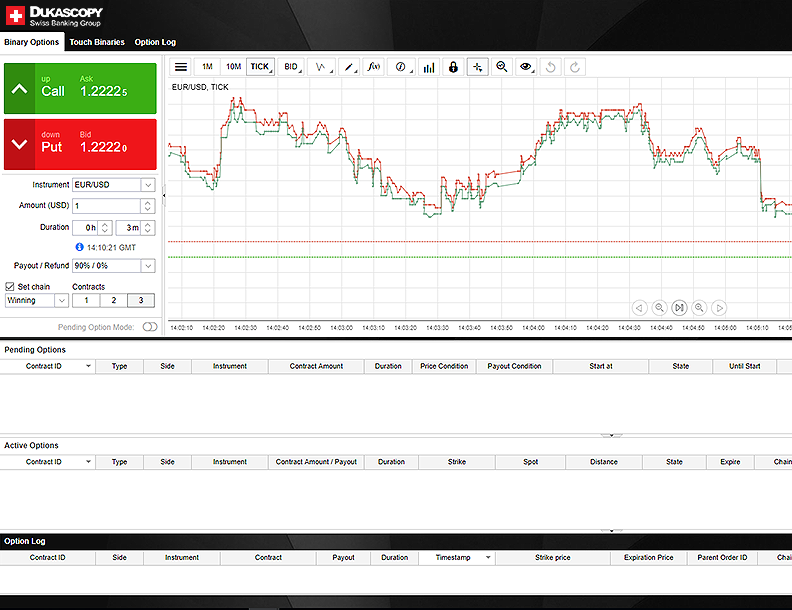

Binary options trading interface showing trade setup and potential payouts [Dukascopy](https://www.dukascopy.com/swiss/english/binary-options/trading-platforms/)

Common Terms Used in Binary Trading

Strike Price

The strike price is the price level against which the outcome of your binary option is measured. When you place a trade, the current market price becomes your reference point. For a “call” option to be successful, the price must be above this level at expiry. For a “put” option, it must be below this level.

For example, if EUR/USD is trading at 1.0550 when you place your binary option, this becomes your strike price. If you buy a call option and at expiration EUR/USD is at 1.0555, your option finishes “in the money.” If it’s at 1.0545, your option expires “out of the money.”

Expiration Time

The expiration time is when your binary option contract ends and the outcome is determined. Binary options offer a wide range of expiration times, from as short as 30 seconds to as long as several months. Short-term options (under 5 minutes) are often called “turbo options” and appeal to traders seeking quick results.

Your choice of expiration time significantly impacts your trading strategy. Shorter expiration times may be influenced more by market noise and less by fundamental factors, while longer expirations allow trends to develop but require more patience.

| Expiration Type | Time Frame | Best Used For |

|---|---|---|

| Turbo | 30 seconds to 5 minutes | Scalping strategies, news reaction |

| Short-term | 5 minutes to 1 hour | Intraday trend following |

| Medium-term | 1 hour to 1 day | Technical pattern completions |

| Long-term | 1 day to several months | Fundamental analysis, major trends |

How to Execute Binary Forex Trades

Executing a binary forex trade involves several straightforward steps:

- Select a Currency Pair – Choose from major pairs like EUR/USD, GBP/USD, or USD/JPY. Major pairs typically offer tighter spreads and more predictable movements.

- Choose Direction – Decide whether the price will rise (call/up) or fall (put/down) based on your analysis.

- Set Expiration Time – Select when your option will expire, ranging from seconds to months.

- Determine Investment Amount – Decide how much to risk on this single trade (ideally not more than 1-2% of your total account).

- Confirm Trade Details – Review the potential payout, your risk, and all parameters before placing the trade.

- Execute the Trade – Place the order and wait for expiration.

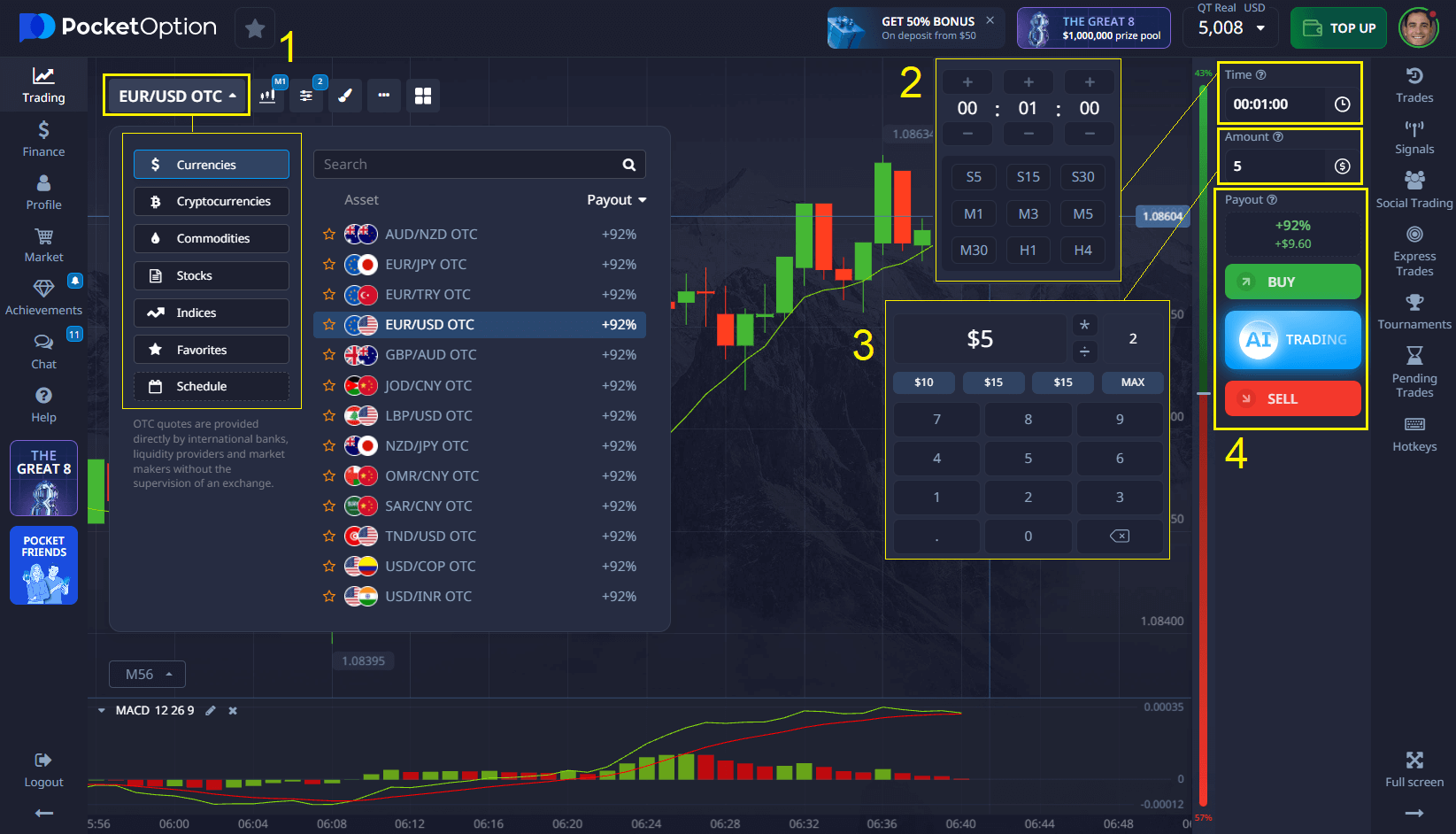

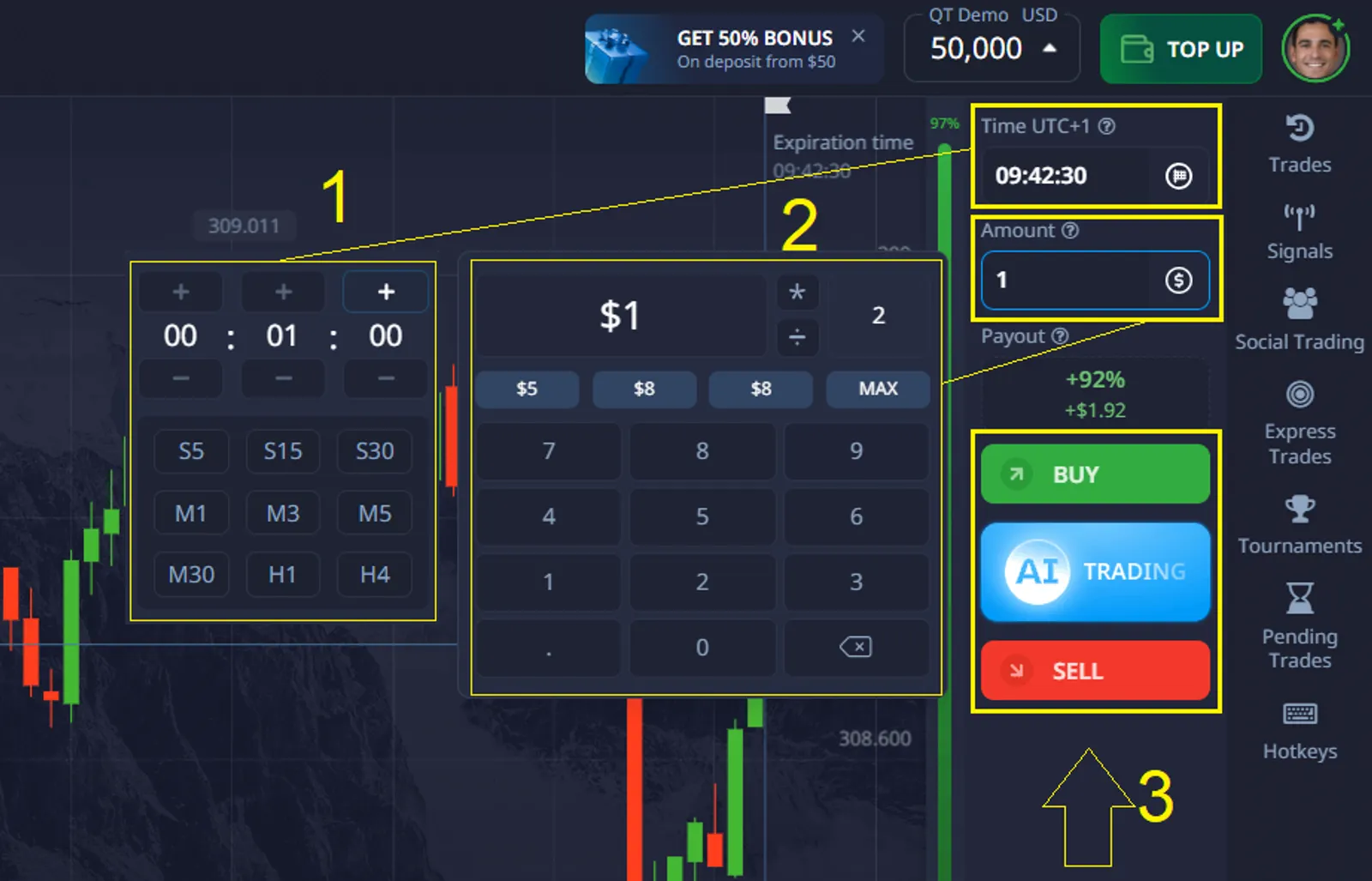

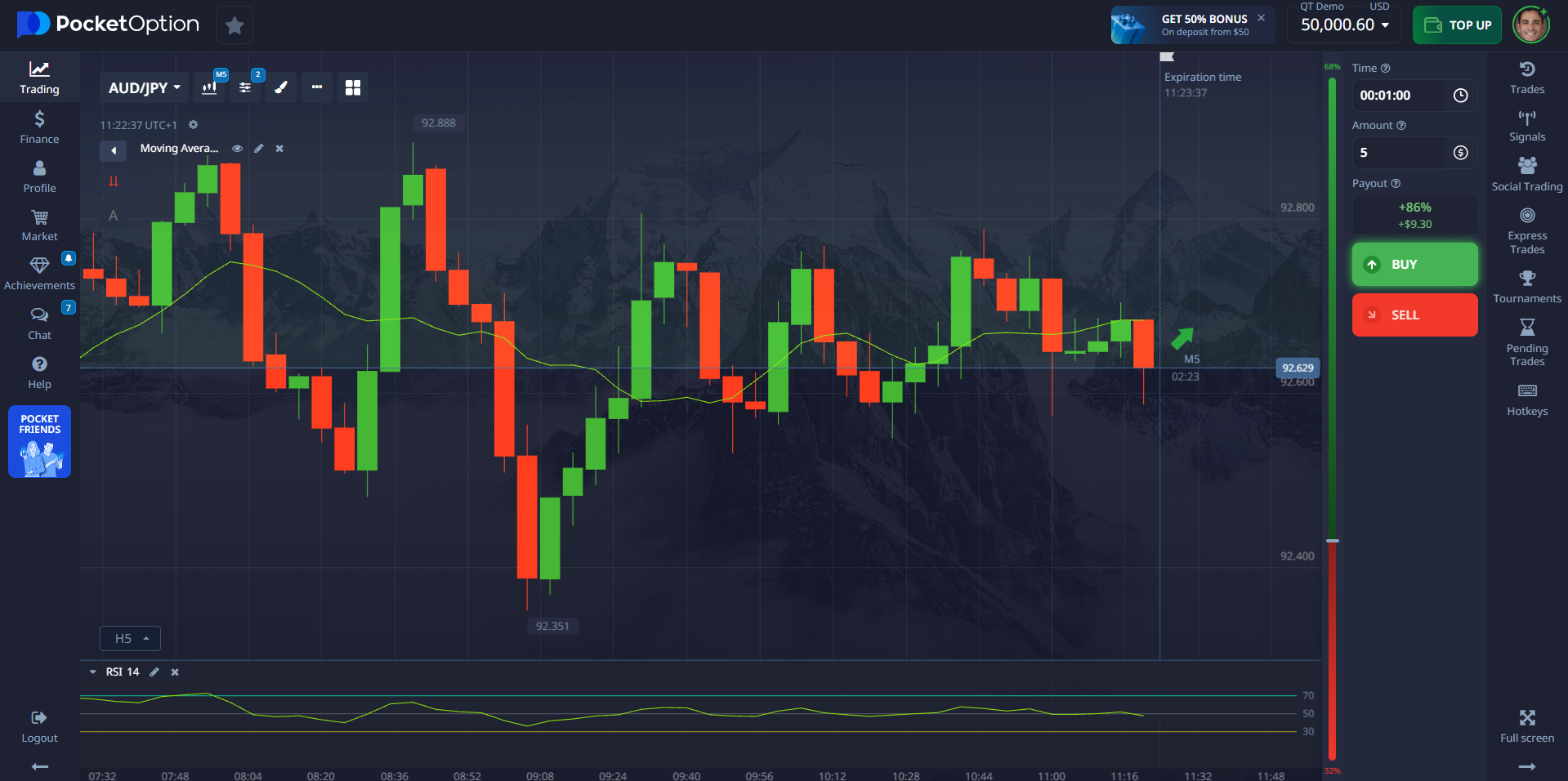

Most binary options platforms make this process user-friendly with simple interfaces. For example, on Pocket Option, you simply click the asset you want to trade, set your investment amount, select an expiration time, and click either “Up” or “Down” to place your trade.

Everyday Analogy: Trading binary options is like placing a bet on a horse race where you only need to guess if your horse will finish before or after a certain time—not whether it will win the entire race. The mechanics are simple, but picking the right horse consistently is where skill comes in.

Pocket Option’s trading interface showing a binary options trade setup [Pocket Option](https://pocketoption.com/blog/en/interesting/trading-platforms/is-pocket-option-a-binary-trading-platform/)

Benefits and Risks of Binary Forex Trading

Advantages of Binary Trading

Simplicity and Accessibility

One of binary options’ greatest appeals is its straightforward nature. Traditional forex trading can overwhelm beginners with concepts like leverage, margin, lot sizes, and complex order types. Binary options strip away these complexities—you simply decide if the price will go up or down, how much to invest, and when the trade will end.

This accessibility extends to capital requirements. While effective forex trading often requires several thousand dollars to properly manage risk, many binary options platforms allow you to start with as little as $5 or $10. This low barrier to entry makes it possible for almost anyone to begin trading financial markets.

Furthermore, binary platforms are designed with user experience in mind. The interfaces are typically intuitive, with clear visual elements and straightforward controls that don’t require extensive financial knowledge to navigate.

Fast Returns

Binary options offer the potential for quick returns, with some contracts expiring in as little as 30 seconds. This rapid feedback loop can be beneficial for learning and strategy testing, as you can quickly see the results of your trading decisions.

For traders who enjoy fast-paced action, binary options provide almost immediate gratification or correction. You don’t need to wait days, weeks, or months to see if your analysis was correct—you’ll know in minutes or even seconds.

The fixed and predetermined returns also simplify profit calculation. Before placing a trade, you know exactly how much you stand to gain if successful—typically 70% to 95% of your investment, depending on the broker and asset.

Risks of Binary Forex Trading

High Potential for Loss

Despite their apparent simplicity, binary options carry significant risks. The most obvious is the “all-or-nothing” nature of these instruments. Unlike traditional forex trading where you might exit a position with a partial loss, binary options typically result in either full profit or complete loss of your investment.

This binary outcome structure creates a mathematical disadvantage for traders. Most brokers offer payouts less than 100% (typically 70-95%) on winning trades, but take 100% on losing trades. For example, if a broker offers 80% payouts, you need to win more than 55.6% of your trades just to break even—a challenging win rate even for experienced traders.

The short expiration times can also work against traders, as short-term price movements are more susceptible to market noise and random fluctuations. This makes consistent prediction extremely difficult, especially for beginners who haven’t yet developed robust analytical skills.

Limited Regulatory Oversight

Perhaps the most serious risk in binary options trading is the regulatory environment. While legitimate, regulated brokers exist, the industry has attracted numerous unscrupulous operators due to its profitability and relatively lower barriers to entry compared to traditional brokerages.

In response to widespread fraud, many jurisdictions have either banned binary options outright or implemented strict regulations. The U.S., for instance, only allows binary options trading through CFTC-regulated exchanges like Nadex, while the UK’s FCA and Australia’s ASIC have banned the sale of binary options to retail consumers entirely.

Other common issues with less reputable platforms include:

- Manipulation of pricing to force losing trades

- Refusal to honor withdrawals or placing excessive restrictions

- Hidden fees or conditions that eat into profits

- False claims about expected returns or “guaranteed” systems

Warning: In March 2024, a U.S. District Court entered a judgment worth over $200 million in penalties against unregistered binary options platforms targeting U.S. citizens. The CFTC continues to aggressively pursue operators offering binary options illegally to American traders. Always verify a broker’s regulatory status before depositing funds. [Investopedia]

How to Start with Binary Forex Trading

Choosing a Reliable Binary Forex Broker

Key Factors to Consider (Licensing, Reputation, Payout)

Selecting the right broker is perhaps the most crucial decision you’ll make as a binary options trader. Here are the key factors to evaluate:

- Regulatory Status – Always prioritize brokers regulated by recognized financial authorities such as CySEC (Cyprus), ASIC (Australia), or FSCA (South Africa). Regulation provides a layer of protection for your funds and ensures the broker adheres to industry standards.

- Company History and Reputation – Research the broker’s operational history. How long have they been in business? What do other traders say about them? Look beyond the broker’s own website for independent reviews and forum discussions.

- Withdrawal Process – A reliable broker processes withdrawals promptly without excessive restrictions. Check the withdrawal methods available, associated fees, and average processing times.

- Payout Rates – Higher payout percentages (closer to 90-95%) improve your long-term profitability. Compare rates across several brokers, noting that payouts may vary by asset and expiration time.

- Minimum Deposit Requirements – Lower minimum deposits (ideally $5-$10) allow you to start with less risk while learning.

- Trading Platform Quality – The platform should be intuitive, stable, and offer necessary analytical tools. Most reputable brokers offer web-based platforms that don’t require downloads.

- Demo Account Availability – A free demo account with virtual funds allows you to practice without financial risk.

- Customer Support – Responsive, knowledgeable support via multiple channels (chat, email, phone) is essential, especially when dealing with financial matters.

Recommended Brokers for Beginners

Based on our comprehensive research of brokers mentioned in top search results, here are some of the most beginner-friendly binary options brokers in 2025:

| Broker | Regulation | Min. Deposit | Payout % | Demo Account | Key Feature |

|---|---|---|---|---|---|

| Pocket Option | IFMRRC | $10 | Up to 96% | Yes, unlimited | Social trading features |

| IQ Option | CySEC | $10 | Up to 95% | Yes, unlimited | Award-winning platform |

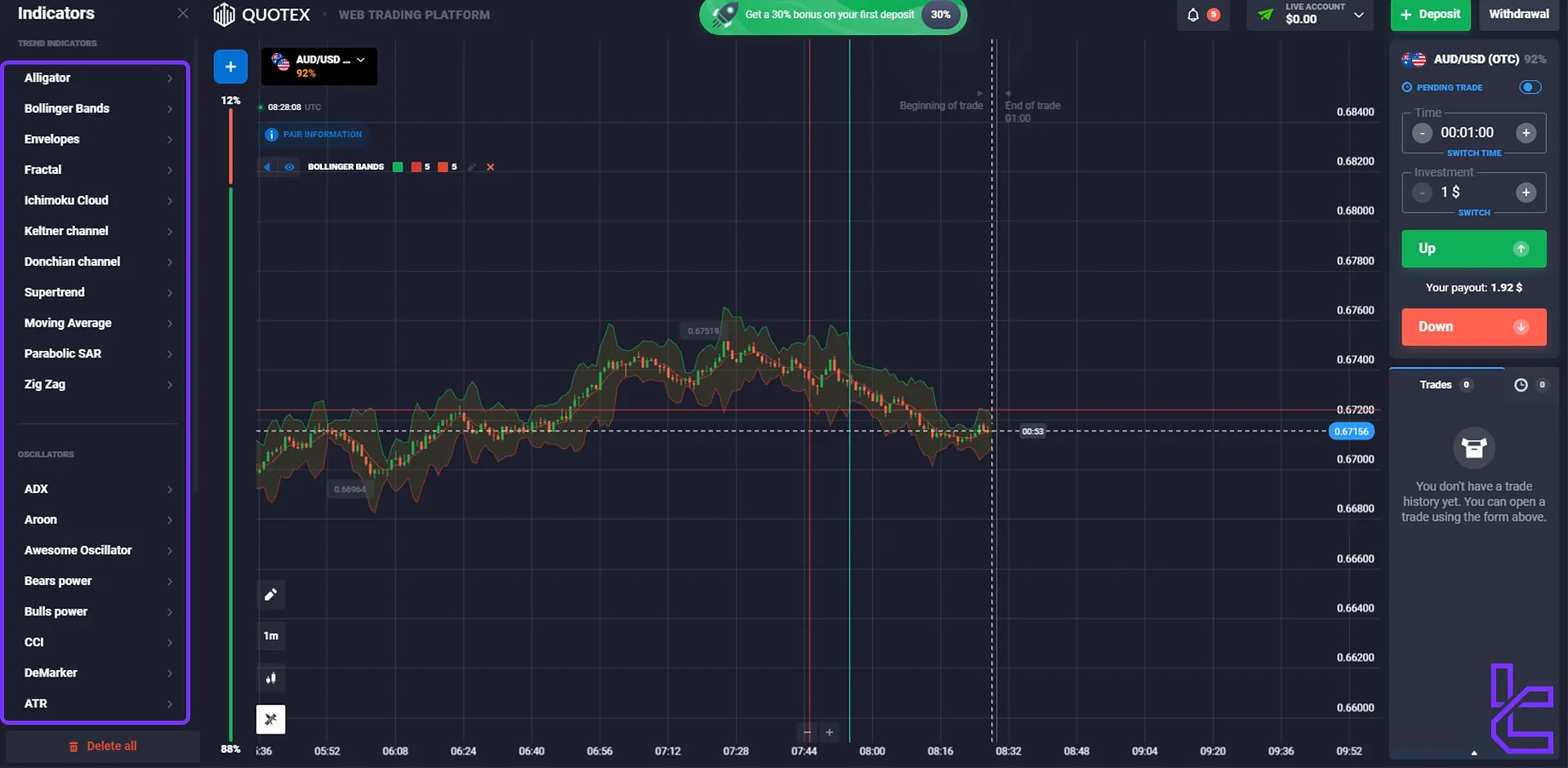

| Quotex | FMRRC | $10 | Up to 95% | Yes, unlimited | User-friendly interface |

| Deriv (former Binary.com) | MFSA, LFSA, VFSC | $5 | Up to 100% | Yes, unlimited | 20+ years experience |

| Binomo | FMRRC | $10 | Up to 90% | Yes, unlimited | Educational resources |

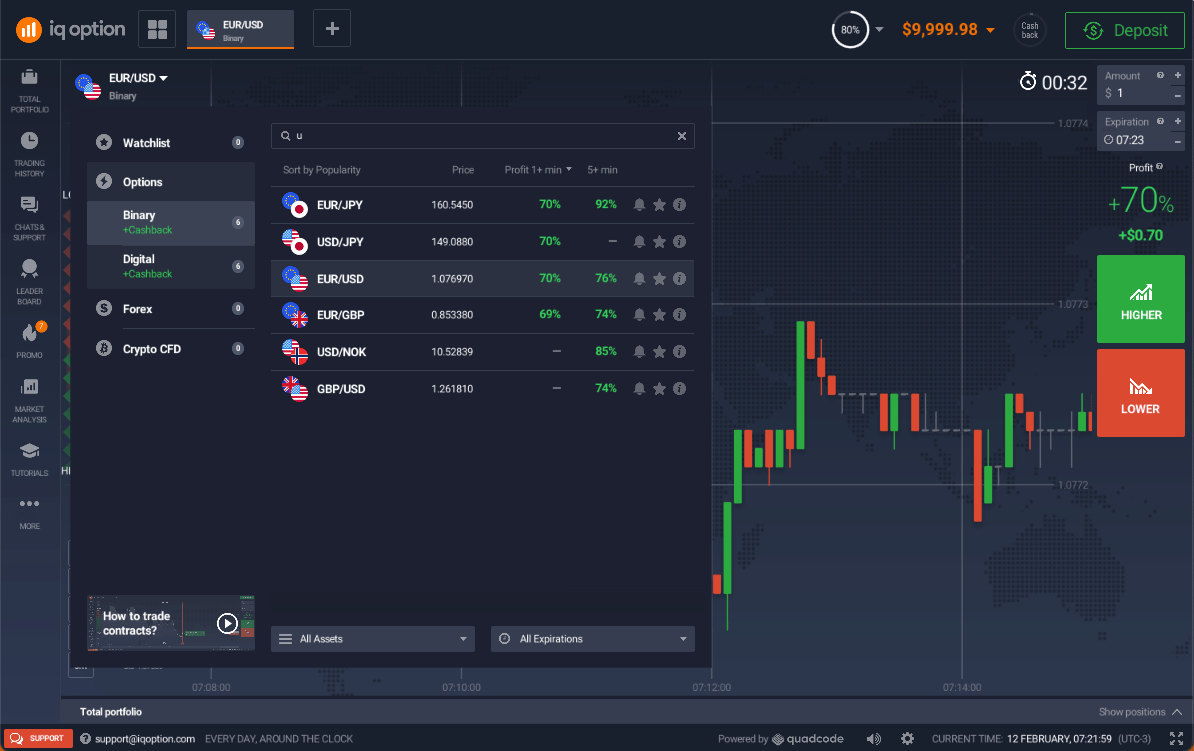

IQ Option’s trading platform interface [IQ Option](https://iqoption.com/lp/ultimate-trading/en/binary/)

Setting Up a Trading Account

Step-by-Step Guide to Account Registration

Setting up a binary options trading account is a straightforward process. Here’s a general guide that applies to most platforms:

- Choose a Broker – Select a regulated broker from the recommended list above based on your research.

- Visit the Official Website – Always access the broker’s site directly through their official web address to avoid scam sites.

- Find the Registration Button – Usually prominently displayed as “Register,” “Open Account,” or “Sign Up.”

- Complete the Registration Form – Provide basic information like your name, email, phone number, and create a password.

- Verify Your Email – Click the verification link sent to your email to confirm your account.

- Choose Account Type – Select between a demo account (practice with virtual funds) or real account (requires deposit).

- Complete Your Profile – Add any additional required information such as address and date of birth.

- Set Up Two-Factor Authentication – For additional security, enable 2FA if available.

- Familiarize Yourself with the Platform – Explore the interface, available assets, and tools before trading.

Verifying Your Account

Account verification is a mandatory process required by regulatory authorities to prevent fraud, money laundering, and comply with KYC (Know Your Customer) regulations. While you may be able to deposit and start trading with minimal verification, withdrawals typically require completing this process.

Standard verification documents include:

- Proof of Identity – A valid government-issued ID such as passport, driver’s license, or national ID card.

- Proof of Address – A recent utility bill, bank statement, or official letter (typically less than 3 months old) showing your name and address.

- Payment Verification – If you deposited via credit card, you may need to provide a photo of the card (with middle digits hidden for security).

Most brokers now offer streamlined verification processes where you can upload documents directly through their website or mobile app. Verification typically takes 1-3 business days but can be longer during busy periods.

Important Note: Many withdrawal problems in binary options trading stem from incomplete verification or mismatched information. To avoid delays, complete verification as soon as possible after registration and ensure all details match across your documents. If a broker refuses withdrawals after you’ve completed proper verification, this is a major red flag. [Expert Option Review]

Making Your First Trade

Demo Trading vs. Real Trading

Before risking real money, I strongly recommend spending at least 2-4 weeks trading on a demo account. Demo trading offers several crucial benefits:

- Learning the platform’s features without financial pressure

- Testing strategies and analyzing results without emotional interference

- Understanding how different market conditions affect binary options

- Building confidence and developing a consistent approach

- Establishing proper risk management habits

Many traders rush to real trading only to lose their deposits quickly due to lack of preparation. Remember that demo trading should mirror your intended real trading approach—use the same timeframes, assets, and risk parameters you plan to use with real funds.

However, demo trading does differ from real trading in important psychological ways. Without real money at stake, you won’t experience the emotional pressures that can significantly impact decision-making. Some traders find they perform well on demo accounts but struggle when real money is involved.

Pocket Option’s demo account interface for practice trading [Pocket Option](https://pocketoption.com/blog/en/interesting/trading-platforms/is-pocket-option-a-binary-trading-platform/)

Minimum Deposit Requirements

When you’re ready to transition to real trading, consider starting with the minimum deposit required by your chosen broker. Here’s a comparison of minimum deposit requirements for popular binary options brokers in 2025:

| Broker | Minimum Deposit | Minimum Trade Size | Deposit Methods |

|---|---|---|---|

| Pocket Option | $10 | $1 | Credit card, e-wallets, crypto, bank transfer |

| IQ Option | $10 | $1 | Credit card, e-wallets, crypto, bank transfer |

| Quotex | $10 | $1 | Credit card, e-wallets, crypto |

| Deriv | $5 | $1 | Credit card, e-wallets, crypto, bank transfer |

| Binomo | $10 | $1 | Credit card, e-wallets, local payment systems |

Starting with a smaller deposit helps manage risk while you gain experience. However, remember that smaller accounts require even more disciplined risk management—with a $10 deposit and $1 minimum trade size, a few consecutive losses can quickly deplete your account.

Everyday Analogy: Think of your first deposit as your tuition for learning to trade. Just like learning to drive, you’ll make mistakes at first. Starting with a smaller “vehicle” (account size) means any accidents will be less costly while you develop your skills.

Top Recommended Brokers for Binary Forex Trading

Pocket Option

Pocket Option has rapidly gained popularity among binary traders since its launch in 2017. Operated by Gembell Limited and registered in the Marshall Islands, the platform stands out for its user-friendly interface and social trading features.

Key Features:

- Low minimum deposit of just $10

- High payout rates up to 96% on successful trades

- Social trading functionality allowing you to copy successful traders

- Over 100 assets including currencies, stocks, commodities, and cryptocurrencies

- Educational materials and tournaments for traders

- Mobile app for trading on the go

Regulation: Pocket Option is registered with the International Financial Market Relations Regulation Center (IFMRRC), which isn’t a top-tier regulatory authority but does provide some oversight.

For beginners, Pocket Option offers an unlimited demo account with $10,000 in virtual funds to practice without risk. Their platform also features integrated social trading capabilities, allowing new traders to observe and copy more experienced users’ strategies.

Pocket Option’s demo trading environment [Pocket Option](https://pocketoption.com/blog/en/interesting/trading-platforms/binary-option-trading-demo/)

Open Your Pocket Option AccountIQ Option

Founded in 2013, IQ Option has established itself as one of the most reputable names in binary options trading. The company has won multiple awards for its innovative trading platform and serves millions of traders worldwide.

Key Features:

- Award-winning proprietary trading platform

- Extensive educational resources including webinars and video tutorials

- Advanced charting tools with multiple indicators

- Tournaments with prize pools for traders

- CySEC regulation (for European operations)

- 24/7 customer support in multiple languages

Regulation: IQ Option’s European operations are regulated by CySEC (Cyprus Securities and Exchange Commission), providing an additional layer of security for traders from supported regions.

What makes IQ Option particularly suitable for beginners is its comprehensive educational section. The broker offers detailed guides, tutorials, and webinars covering everything from basic concepts to advanced strategies. Their demo account provides $10,000 in virtual funds and includes all features of the real trading environment.

IQ Option’s comprehensive trading interface with advanced charts [Binary Options](https://www.binaryoptions.net/iq-option)

Open Your IQ Option AccountDeriv

Deriv is the rebranded version of Binary.com, one of the oldest and most established binary options brokers, operating since 1999. This long history gives Deriv significant credibility in an industry where many platforms come and go quickly.

Key Features:

- Multiple trading platforms including DTrader, DMT5, DBot (for automated trading)

- Wide range of trading instruments beyond binary options

- Competitive payouts up to 100% on some trade types

- Exceptionally low minimum deposit of $5

- Regulated by multiple authorities including MFSA and LFSA

- Advanced customization options for binary contracts

Regulation: Deriv operates under multiple regulatory licenses, including the Malta Financial Services Authority (MFSA), Labuan Financial Services Authority (LFSA), and Vanuatu Financial Services Commission (VFSC).

Deriv stands out for the variety of binary options types it offers, including standard high/low options, touch/no-touch, and range options. This variety allows beginners to explore different trading styles as they develop their skills.

Open Your Deriv AccountQuotex

Quotex is a relatively new platform that has quickly gained popularity due to its clean, intuitive interface and competitive trading conditions. Launched in 2019, the broker focuses exclusively on binary options trading.

Key Features:

- Modern, user-friendly trading platform

- Over 100 assets across multiple markets

- High payouts up to 95%

- Technical analysis tools including 30+ indicators

- Copy trading functionality

- Regular trading tournaments

Regulation: Quotex is regulated by the International Financial Market Relations Regulation Center (IFMRRC), which provides basic oversight but is not considered a top-tier regulator.

Beginners appreciate Quotex for its streamlined interface that doesn’t overwhelm with excessive features. The platform includes helpful visual aids like trend indicators and signals, making it easier for new traders to identify potential trading opportunities.

Quotex’s clean and modern trading interface [TradingFinder](https://tradingfinder.com/option/quotex/trading-platform/)

Open Your Quotex AccountBinomo

Operating since 2014, Binomo has established itself as a popular choice for binary options traders worldwide. The platform is known for its accessibility to traders with limited capital and its focus on educational resources.

Key Features:

- Low minimum deposit of $10

- Low minimum trade amount of $1

- Tiered account system with increasing benefits

- Regular trading tournaments with substantial prize pools

- Educational section with strategies and tutorials

- Over 60 assets available for trading

Regulation: Binomo is a member of the Financial Commission, an independent self-regulatory organization that provides dispute resolution services but doesn’t have governmental regulatory powers.

Binomo’s tiered account system (Standard, Gold, VIP) provides incentives for growth, with higher-level accounts offering increased payouts, faster withdrawals, and personal account managers. This structure can motivate beginners to develop their skills while providing a clear progression path.

Open Your Binomo AccountComprehensive guide to binary options trading basics and strategies

Binary Forex Trading Strategies

Essential Strategies for Beginners

Developing a consistent, methodical approach is crucial for success in binary options trading. While no strategy guarantees profits, these beginner-friendly approaches provide a solid foundation for new traders.

Trend Following Strategy

The trend-following strategy is one of the most straightforward and effective approaches for binary options beginners. As the famous trading adage states, “The trend is your friend.” This strategy involves identifying the current market direction and placing trades that align with that direction.

How to implement:

- Identify the Trend – Use a larger timeframe chart (1-hour or 4-hour) to determine the overall direction. Rising higher highs and higher lows indicate an uptrend; falling lower highs and lower lows indicate a downtrend.

- Confirm with Moving Averages – Apply two moving averages (for example, 20-period and 50-period). When the shorter MA crosses above the longer MA, it suggests an uptrend. When it crosses below, it suggests a downtrend.

- Wait for Pullbacks – In an uptrend, wait for price to pull back to a support level (like the moving average) before entering a “call” option. In a downtrend, wait for a rally to resistance before entering a “put” option.

- Select Appropriate Expiry – For this strategy, choose expiry times of at least 15-30 minutes to allow the trend sufficient time to reassert itself.

When I first tried trading EUR/USD using this strategy, I noticed that focusing only on strong trends with clear moving average alignments significantly improved my success rate. Avoid ranging markets where trends are unclear.

Breakout Strategy

Breakout trading involves identifying key support and resistance levels and placing trades when the price breaks through these levels with increased volume and momentum. This strategy capitalizes on the tendency for price to continue moving in the direction of the breakout.

How to implement:

- Identify Key Levels – Look for price areas that have repeatedly stopped advances or declines. These become your support and resistance levels.

- Look for Consolidation – The most powerful breakouts often occur after periods of tight consolidation (price moving sideways in a narrow range).

- Wait for the Break – When price decisively breaks through support or resistance (preferably with increased volume), place a “call” option for breaks above resistance or a “put” option for breaks below support.

- Confirm the Breakout – To avoid false breakouts, wait for a candle to close beyond the level before entering your trade.

- Choose Shorter Expiries – Breakout momentum is often strongest immediately after the break, so expiry times of 5-15 minutes typically work well with this strategy.

One effective variation is to focus on breakouts that occur around major news releases. Economic announcements often generate the volume needed to sustain a breakout’s momentum.

News-Based Trading Strategy

Binary options can be particularly effective for trading economic news releases, which often create sharp, directional price movements. This strategy involves placing trades based on market reactions to significant economic data or events.

How to implement:

- Follow an Economic Calendar – Use services like ForexFactory or Investing.com to track upcoming high-impact news events.

- Understand Expectations – Research market expectations for the upcoming release. The actual result’s deviation from these expectations often determines market reaction.

- Wait for the Release – Rather than predicting the outcome, wait for the data to be released and observe the initial market reaction.

- Trade the Reaction – If the news is significantly better than expected and the price moves up strongly, place a “call” option. If worse than expected with a strong downward move, place a “put” option.

- Use Short Expiries – News-based momentum typically diminishes quickly, so 2-5 minute expiries often work best.

This strategy requires quick execution but can be highly effective when major economic indicators like Non-Farm Payrolls, interest rate decisions, or GDP figures are released.

Range Trading Strategy

Markets often spend considerable time moving sideways in a defined range rather than trending. Range trading capitalizes on these periods by placing trades at the boundaries of the range, expecting price to reverse back toward the middle.

How to implement:

- Identify a Range – Look for markets where price has bounced between clear support and resistance levels at least 2-3 times.

- Confirm with Indicators – Oscillators like RSI or Stochastic work well with range-bound markets. When they show overbought conditions near resistance, consider “put” options. When they show oversold conditions near support, consider “call” options.

- Wait for Rejection – Enter trades after seeing evidence of price rejection at the boundaries (like reversal candlestick patterns).

- Set Appropriate Expiry – The expiry should allow sufficient time for price to move back toward the middle of the range—typically 15-30 minutes.

Range trading works best during quiet market periods, such as the Asian session or when no major news is expected. Avoid this strategy when significant announcements are pending.

60-Second Binary Options Strategy

This high-frequency approach focuses on very short-term price movements and is suitable for traders who enjoy fast-paced action. While exciting, it carries higher risk due to market noise in short timeframes.

How to implement:

- Focus on Liquid Assets – Major currency pairs like EUR/USD or GBP/USD have tighter spreads and more predictable short-term movements.

- Use Multiple Timeframes – Check the trend on a 5-minute chart to determine overall direction, then use a 1-minute chart for entry timing.

- Look for Momentum – Use indicators like MACD or RSI to identify short bursts of momentum.

- Confirm with Price Action – Wait for strong candlestick patterns like engulfing candles or pinbars that indicate potential reversals or continuation.

- Implement Strict Money Management – Due to the higher risk, limit these trades to 1% of your account or less.

I recommend practicing this strategy extensively on a demo account before using real funds. The psychological pressure of 60-second trading can lead to impulsive decisions if you’re not well-prepared.

Advanced Strategies for Experienced Traders

Hedging Strategy

Hedging involves opening positions in opposite directions to minimize potential losses. While this might seem counterintuitive, skilled traders can use hedging to secure profits or reduce risk in volatile conditions.

How to implement:

- Identify Uncertainty – Look for situations where price could move sharply in either direction, such as before major news events.

- Place Complementary Trades – Execute both “call” and “put” options with different expiry times. For example, a short-term “put” and a longer-term “call” if you expect initial downside followed by recovery.

- Calculate Required Win Rate – Due to the 70-95% typical payout, you’ll need at least one trade to win to avoid a net loss.

- Manage Exposure – Adjust position sizes so that potential losses are controlled even if both trades fail.

This strategy requires careful timing and calculation. It’s particularly useful during volatile market conditions or when you anticipate a potential reversal but are uncertain of its exact timing.

Using Technical Indicators (e.g., Moving Averages, RSI)

Advanced traders often combine multiple technical indicators to develop sophisticated trading systems with higher accuracy rates. These approaches go beyond single-indicator strategies by looking for confirmation across different analytical methods.

Moving Average Convergence Divergence (MACD) Strategy:

- Identify the overall trend using longer-term charts.

- Watch for the MACD line to cross above the signal line in an uptrend (for “call” options) or below the signal line in a downtrend (for “put” options).

- Confirm with histogram momentum—ideally, the histogram bars should be increasing in the direction of the trade.

- Enter trades with expiration times of 15-30 minutes to allow the signal sufficient time to develop.

RSI Divergence Strategy:

- Look for divergence between price action and the RSI indicator. For example, if price makes a higher high but RSI makes a lower high, this signals potential downward reversal (good for “put” options).

- Wait for confirmation—don’t trade the divergence alone. Look for candlestick patterns or support/resistance breaks that confirm the potential reversal.

- Use expiry times of at least 15-30 minutes, as divergence often takes time to play out.

Advanced indicator strategies require practice and refinement. Many successful traders keep detailed journals of their trades to identify which indicator combinations work best under specific market conditions.

Guide to using candlestick patterns in binary options trading

Common Mistakes Beginners Should Avoid

Overtrading and Emotional Trading

One of the most destructive habits in binary options trading is overtrading—placing too many trades out of impatience, boredom, or a desire to recover losses. This typically leads to poor trade selection and accelerated losses.

Signs you might be overtrading include:

- Trading without a clear setup that matches your strategy

- Entering multiple positions simultaneously across different assets

- Ignoring your predetermined trading hours or schedule

- Increasing position sizes after losses to “get back” to breakeven

- Feeling compelled to “always be in a trade”

Emotional trading—making decisions based on fear, greed, or frustration rather than analysis—often accompanies overtrading. After losing several trades in a row, traders may abandon their strategy in favor of impulsive decisions, typically worsening their situation.

How to avoid:

- Set a maximum number of daily trades (e.g., 3-5) and stick to it regardless of outcomes

- Take breaks after losing trades to reset your emotional state

- Use a trading journal to record your emotions alongside technical analysis

- Implement a checklist of conditions that must be met before placing a trade

- Consider using a demo account when you feel emotionally compromised

Remember that binary options will always be there tomorrow. Missing a trade is far better than forcing one that doesn’t align with your strategy.

Ignoring Market Trends and News

Binary options trading doesn’t occur in a vacuum. Failing to consider broader market context—such as prevailing trends, upcoming news events, or major economic developments—can sabotage otherwise sound trading decisions.

Common mistakes include:

- Placing trades against strong prevailing trends

- Trading immediately before major economic releases

- Ignoring correlation between related currency pairs

- Failing to check economic calendars before planning trades

- Not adjusting strategies during unusual market conditions (like holidays or crises)

For instance, attempting to trade a reversal when a currency pair is in a strong uptrend following a central bank’s hawkish comments could prove disastrous—regardless of what your technical indicators suggest.

How to avoid:

- Begin each trading session by reviewing an economic calendar

- Analyze multiple timeframes to understand both short and long-term trends

- Follow financial news sources for market-moving developments

- Be cautious about trading during major news announcements

- Consider the broader fundamental picture alongside technical analysis

Integrating fundamental analysis into your binary options trading doesn’t need to be complex. Even basic awareness of major economic events and trends can significantly improve your timing and trade selection.

Trading Without a Strategy

Perhaps the most fundamental mistake beginners make is trading without a clear, documented strategy. Random or intuition-based trading might occasionally produce wins, but long-term success requires a systematic approach.

Trading without a strategy leads to:

- Inconsistent results with no way to improve

- Difficulty identifying what works versus what doesn’t

- Emotional decision-making rather than rational analysis

- Inability to adapt to changing market conditions

- Frustration and account depletion

When I first started trading binary options, I would sometimes place trades simply because a currency pair “looked like it was going up” or because I had a “feeling.” This approach led to inconsistent results and, ultimately, losses.

How to develop a strategy:

- Identify a trading approach that suits your personality (trend following, range trading, etc.)

- Define specific entry conditions using concrete indicators or price patterns

- Establish rules for expiry time selection based on the strategy

- Document position sizing and risk management guidelines

- Test the strategy on a demo account for at least 50-100 trades

- Track results and refine the approach based on performance

A proper trading strategy doesn’t need to be complex, but it must be specific enough that two people following the same rules would take the same trades. This removes subjectivity and emotion from the process.

Trading Journal Tip: Create a structured trading journal that records not just trades but also market conditions, emotions, and adherence to your strategy. Include screenshots of entries and exits. Reviewing this journal weekly can reveal patterns and help identify both strengths and weaknesses in your approach.

Risk Management in Binary Forex Trading

Setting Risk Limits

Effective risk management is the cornerstone of long-term success in binary options trading. Without proper risk controls, even the best strategy will eventually lead to significant losses. The first step is establishing clear risk limits for your trading activities.

Per-Trade Risk Limit:

The most fundamental risk principle is limiting exposure on any single trade. Professional traders typically risk between 1% and 2% of their total trading capital per position. For binary options, this means:

- With a $500 account, each trade should be $5-$10 maximum

- With a $1,000 account, each trade should be $10-$20 maximum

- With a $5,000 account, each trade should be $50-$100 maximum

This approach ensures that no single trade can significantly damage your account, allowing you to withstand inevitable losing streaks.

Daily Risk Limit:

Beyond per-trade limits, establish a maximum daily loss threshold—typically 5% of your account. Once reached, stop trading for the day. This prevents the psychological trap of “revenge trading” after losses.

Weekly Risk Limit:

Similarly, set a weekly loss limit of perhaps 10% of your account. If reached, take a break for the remainder of the week to reassess your strategy and emotional state.

Importance of Money Management

Percentage Rule for Risk Management

The percentage-based approach to position sizing is crucial for account longevity. Unlike fixed-lot trading, percentage-based risk automatically adjusts your position size based on your current balance:

- When your account grows, your position size gradually increases, accelerating gains

- When your account shrinks, your position size naturally decreases, slowing losses

This creates a positive mathematical expectancy for your trading, assuming your strategy has an edge. Even with the same win rate, a trader using percentage-based position sizing will significantly outperform one using fixed trade sizes over time.

Example:

Starting with $1,000, risking 2% per trade:

- First trade: $20 risk (2% of $1,000)

- After growing to $1,200: $24 risk (2% of $1,200)

- After declining to $800: $16 risk (2% of $800)

This automatic adjustment protects your capital during drawdowns while allowing you to capitalize on winning streaks.

Setting a Budget and Sticking to It

Beyond trade-by-trade risk management, establish a clear overall budget for your binary options trading. This budget should represent money you can afford to lose without affecting your essential living expenses or financial goals.

Budget considerations:

- Separate your trading capital from personal finances

- Never trade with borrowed money or funds needed for bills

- Consider your initial deposit as “tuition” for learning to trade

- Have clear rules for withdrawals and adding funds

- Set realistic profit expectations based on your budget size

Many beginners make the mistake of continuously depositing more funds after losses without addressing the underlying issues in their trading approach. Instead, establish a “three strikes” rule—after three failed deposits, take a significant break to improve your skills on a demo account before committing more capital.

Diversifying Your Trades

While diversification works differently in binary options than in traditional investing, spreading your risk across different trade types, assets, and timeframes can enhance stability.

Asset diversification:

Trading multiple currency pairs can reduce risk, but be cautious about correlation. For instance, EUR/USD and GBP/USD often move similarly, so trading both simultaneously may effectively double your exposure rather than diversify it. Consider incorporating pairs with different base currencies or even different asset classes (commodities, indices) for true diversification.

Strategy diversification:

Rather than relying on a single trading approach, develop 2-3 complementary strategies that work under different market conditions:

- Trend-following strategies for directional markets

- Range-trading strategies for sideways markets

- Breakout strategies for volatile periods

Timeframe diversification:

Trading across different expiration times can smooth your results. Short-term trades might capture immediate movements, while longer-term options align with broader market trends.

However, avoid over-diversification, which can dilute your focus and expertise. It’s better to master a few strategies thoroughly than to apply many approaches superficially.

Everyday Analogy: Think of risk management in binary trading like driving a car. Your strategy determines your destination and route, but risk management controls your speed and safety measures. Even the best map won’t help if you’re driving recklessly fast or without seatbelts. Proper risk controls ensure you’ll reach your financial destination safely, even if you encounter some detours along the way.

Regulatory and Legal Considerations for Binary Forex Trading

Is Binary Forex Trading Legal?

The legal status of binary options trading varies significantly by country and continues to evolve as regulators respond to concerns about investor protection. Understanding the regulatory landscape is essential before you begin trading.

Current Legal Status by Region (2025):

| Region/Country | Legal Status | Notes |

|---|---|---|

| United States | Restricted | Only allowed through CFTC-regulated exchanges like Nadex; offshore brokers prohibited from soliciting US clients |

| European Union | Banned for retail | ESMA banned the sale of binary options to retail traders; professional traders may still access them |

| United Kingdom | Banned for retail | FCA permanently banned binary options for retail consumers in 2019 |

| Australia | Banned for retail | ASIC banned binary options in 2021, extension in place until 2031 |

| Canada | Restricted | Varies by province; generally prohibited unless offered by regulated exchanges |

| South Africa | Legal with regulation | Permitted through FSCA-regulated entities |

| Asia (varies by country) | Mixed | Japan allows through regulated exchanges; Singapore requires licensing; many countries have gray areas |

It’s important to note that even in jurisdictions where binary options are restricted, the focus is typically on protecting retail consumers rather than criminalizing trading itself. The restrictions generally target the offering or marketing of these products to retail traders rather than the act of trading.

Important Warning: Even if binary options trading is technically legal in your jurisdiction, using an unregulated offshore broker may violate local financial laws. Additionally, tax obligations on trading profits remain regardless of where the broker is located. Always consult with a legal professional familiar with financial regulations in your country.

Regulatory Bodies Overseeing Binary Trading

Several financial regulatory authorities oversee binary options trading globally. The presence of regulation provides a level of protection for traders through oversight, capital requirements for brokers, and complaint procedures.

Key Regulatory Bodies:

- Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) – United States

In the US, binary options must be traded on regulated exchanges and are considered securities. The CFTC and SEC actively pursue unregistered platforms targeting US customers. - Financial Conduct Authority (FCA) – United Kingdom

The FCA banned binary options for retail traders, citing concerns about their high-risk nature and potential for abuse. - Australian Securities and Investments Commission (ASIC) – Australia

ASIC implemented a ban on binary options for retail clients in 2021, extended until 2031, due to concerns about significant investor losses. - Cyprus Securities and Exchange Commission (CySEC) – Cyprus/EU

Many binary options brokers previously operated under CySEC regulation, but following ESMA’s EU-wide ban, CySEC now prohibits binary options for retail traders. - Financial Sector Conduct Authority (FSCA) – South Africa

The FSCA (formerly FSB) regulates binary options brokers operating in South Africa, requiring proper licensing and compliance.

Beyond these major regulators, various countries have their own financial authorities that may provide some oversight of binary options trading. However, the level of protection and enforcement varies significantly.

Best Practices to Ensure Safe and Legal Trading

To protect yourself while trading binary options, follow these essential best practices:

- Verify Broker Regulation

- Check the broker’s regulatory status on the regulator’s official website, not just the broker’s claims

- Verify license numbers and registration details

- Be wary of brokers registered in jurisdictions with minimal financial oversight

- Research Broker Reputation

- Look for independent reviews from established financial websites

- Check forums and social media for user experiences, particularly regarding withdrawals

- Test the broker’s customer service responsiveness before depositing significant funds

- Understand Terms and Conditions

- Read the fine print regarding bonuses, which often come with restrictive trading volume requirements

- Understand withdrawal procedures and any associated fees

- Know the broker’s policy on price disputes and trade cancellations

- Start Small and Test Withdrawals

- Begin with the minimum deposit to test the platform

- Make a small withdrawal early to verify the process works smoothly

- Increase your investment only after confirming reliability

- Maintain Proper Documentation

- Keep records of all deposits, trades, and communication with the broker

- Take screenshots of any unusual platform behavior or discrepancies

- Maintain proof of your identity verification submissions

- Use Secure Payment Methods

- Credit cards offer better protection against fraud than bank transfers

- Consider e-wallets for an additional layer of security

- Avoid sharing financial details over unsecured channels

Remember that even with regulated brokers, binary options trading carries significant financial risk. No regulatory protection can safeguard against trading losses resulting from poor strategy or risk management.

Popular Binary Forex Trading Platforms

Overview of Major Trading Platforms

The trading platform you choose significantly impacts your trading experience and potential success. Most binary options brokers offer proprietary platforms, each with distinct features, usability characteristics, and tools. Understanding these differences helps you select the platform that best matches your trading style.

Features to Look for in a Trading Platform

When evaluating binary options trading platforms, consider these essential features:

- Intuitive Interface – The platform should be easy to navigate, especially for beginners. Clear buttons for trade execution, easily accessible asset lists, and straightforward expiry time selection are crucial.

- Charting Capabilities – Look for platforms with comprehensive charting tools, including various timeframes, multiple chart types (candlestick, line, bar), and the ability to add technical indicators.

- Technical Indicators – The best platforms offer a range of built-in technical indicators like moving averages, RSI, MACD, and Bollinger Bands to assist with analysis.

- Mobile Compatibility – A robust mobile app or responsive mobile website ensures you can monitor and execute trades while away from your computer.

- Demo Account Access – Unlimited or extended demo account access allows you to practice strategies without financial risk.

- Educational Resources – Integrated tutorials, guides, and market analysis help develop your trading skills.

- Execution Speed – The platform should execute trades instantly without delays that could affect your entry price.

- Price Feeds – Reliable, accurate price feeds that align with major markets ensure fair trading conditions.

- Risk Management Tools – Features like early close options, which allow you to exit trades before expiration, can help manage risk.

- Trading History and Analytics – Comprehensive records of your trading history and performance analytics help you identify strengths and weaknesses.

Comparing Popular Binary Forex Platforms

Let’s compare the key features of the major binary options trading platforms available in 2025:

| Platform | Broker | Charting Tools | Mobile App | Unique Features | User Experience |

|---|---|---|---|---|---|

| Proprietary Platform | Pocket Option | Advanced (multiple indicators, timeframes) | iOS, Android | Social trading, tournaments, signals | Modern interface with customizable layouts |

| Proprietary Platform | IQ Option | Excellent (30+ indicators, drawing tools) | iOS, Android | Multi-chart view, video tutorials, tournaments | Award-winning design, intuitive for beginners |

| Proprietary Platform | Quotex | Good (20+ indicators, multiple timeframes) | iOS, Android | Copy trading, indicators, signal service | Clean interface, straightforward navigation |

| DTrader | Deriv | Advanced (comprehensive technical analysis) | iOS, Android | Multiple trade types, customizable contracts | Professional interface, steep learning curve |

| Proprietary Platform | Binomo | Good (multiple indicators, 4 timeframes) | iOS, Android | Tournaments, educational content | Clean interface suited for beginners |

Pocket Option’s comprehensive trading interface with technical analysis tools [Pocket Option](https://pocketoption.com/blog/en/interesting/trading-platforms/is-pocket-option-a-binary-trading-platform/)

Each platform has its strengths and potential drawbacks. For complete beginners, IQ Option and Quotex generally offer the most intuitive experience with gentle learning curves. For traders seeking advanced features and customization, Deriv’s platforms provide more sophisticated tools but require more time to master.

Binary Options Expiration Times and Payouts

Short-Term vs. Long-Term Expiries

Expiration times are a critical component of binary options trading strategy. The duration you select determines not only how long your capital is committed but also what type of market movements you’re attempting to capture.

Choosing the Right Expiry Time for Your Strategy

Short-Term Expiries (30 seconds to 5 minutes):

- Best suited for: Scalping strategies, news trading, quick market reactions

- Advantages: Quick results, higher volume of trading opportunities, immediate feedback on strategy

- Challenges: More susceptible to market noise, requires intense focus, can promote gambling-like behavior

- Strategy alignment: Works well with momentum indicators, candlestick patterns, and breakout strategies

Medium-Term Expiries (5 minutes to 1 hour):

- Best suited for: Intraday trend following, technical pattern completions

- Advantages: Filters out some market noise, allows trends to develop, less intensive monitoring

- Challenges: Requires more patience, fewer trading opportunities per day

- Strategy alignment: Works well with trend following indicators, support/resistance trading, and pullback strategies

Long-Term Expiries (1 hour to days/weeks):

- Best suited for: Major trend captures, fundamental analysis, swing trading

- Advantages: Less affected by market noise, aligns with broader market movements, requires less active monitoring

- Challenges: Ties up capital for longer periods, fewer trading opportunities

- Strategy alignment: Works well with fundamental analysis, long-term technical patterns, and major support/resistance levels

Many successful traders match their expiry times to the timeframe of their analysis. For example, if you’re using a 15-minute chart to identify a trading opportunity, an expiry of around 15-30 minutes often aligns well with that analysis.

A common mistake is using very short expiries regardless of the analytical timeframe. If you spot a trading opportunity on a 1-hour chart but use a 1-minute expiry, you’re essentially disconnecting your analysis from your execution.

How Payouts Work in Binary Forex

Understanding Fixed Returns and Losses

Unlike traditional forex trading, where profits and losses vary based on pip movement, binary options offer fixed and predetermined payouts. This simplifies profit calculation but creates a structural mathematical challenge for traders.

Payout Structure:

- Winning trades typically return between 70% and 95% of your investment amount (plus your original investment)

- Losing trades generally result in the loss of your entire investment (100%)

For example, if you invest $100 on a binary option with an 80% payout:

- If successful: You receive $180 ($100 initial investment + $80 profit)

- If unsuccessful: You lose your $100 investment

The Break-Even Win Rate:

Due to this asymmetric payout structure, you need to win more than 50% of your trades to be profitable. The exact break-even percentage depends on the payout rate:

| Payout Rate | Break-Even Win Rate |

|---|---|

| 70% | 58.8% |

| 75% | 57.1% |

| 80% | 55.6% |

| 85% | 54.1% |

| 90% | 52.6% |

| 95% | 51.3% |

The formula to calculate the break-even win rate is: 100 ÷ (100 + Payout Percentage)

Factors Affecting Payout Rates:

Binary options payout rates aren’t fixed across all trades. They vary based on several factors:

- Asset Volatility – More volatile assets typically offer lower payouts due to higher risk

- Expiration Time – Very short expiries (under 5 minutes) often offer lower payouts

- Market Conditions – During major news events, payouts may be reduced due to increased uncertainty

- Account Level – Some brokers offer higher payouts to VIP or higher-tier accounts

- Option Type – Different binary option varieties (high/low, touch/no-touch) have different payout structures

Everyday Analogy: Binary options payouts are like playing a coin flip game where you bet $10, but only win $8 if you’re right, while losing your full $10 if you’re wrong. To make money long-term, you need to be right significantly more than half the time to overcome this built-in disadvantage.

Tools and Resources for Binary Forex Traders

Charting Platforms and Indicators

While most binary options brokers provide basic charting capabilities, many serious traders supplement these with dedicated third-party charting platforms that offer more advanced analysis tools.

Popular Charting Platforms:

- TradingView – This web-based platform offers comprehensive charting with hundreds of indicators, drawing tools, and a social community of traders sharing ideas. The free version provides adequate functionality for most binary traders.

- MetaTrader 4/5 – Though primarily designed for forex trading, these platforms provide excellent technical analysis capabilities. Many traders use them alongside binary options platforms for deeper analysis.

- Investing.com Charts – This free service offers decent charting capabilities with major technical indicators and is accessible without downloads.

Essential Technical Indicators for Binary Options:

- Moving Averages – Simple and exponential moving averages help identify trends and potential support/resistance levels.

- Relative Strength Index (RSI) – This oscillator helps identify overbought and oversold conditions, making it valuable for range trading strategies.

- Moving Average Convergence Divergence (MACD) – Useful for identifying momentum shifts and potential trend changes.

- Bollinger Bands – These dynamic channels help gauge volatility and potential price reversal points.

- Stochastic Oscillator – Identifies potential reversals by comparing a security’s closing price to its price range over a specific period.

For beginners, I recommend mastering just 2-3 indicators rather than cluttering your charts with too many tools. A simple combination like a moving average, RSI, and volume indicator can provide substantial analytical insight without overwhelming you with conflicting signals.

Economic Calendars

Economic calendars are indispensable tools for binary options traders, as major economic announcements can create significant price movements that can be either exploited or avoided, depending on your strategy.

Key features of economic calendars:

- Upcoming economic data releases and events across all major economies

- Scheduled times for announcements (usually in your local timezone)

- Expected figures and previous results for comparison

- Impact ratings (low, medium, high) indicating potential market volatility

Recommended economic calendars:

- Forex Factory – Comprehensive and user-friendly with customizable views

- Investing.com – Detailed calendar with expected impact ratings

- DailyFX – Includes market commentary alongside calendar entries

For binary options trading, pay particular attention to high-impact events like interest rate decisions, employment reports, inflation data, and GDP releases. These events can create significant volatility and trading opportunities but also increase risk for open positions during the announcement.

Trading Calculators

Various calculators can help binary options traders make more informed decisions about position sizing, risk management, and profitability:

- Position Size Calculator – Determines appropriate trade size based on your account balance and risk tolerance

- Win Rate Calculator – Shows what win percentage you need to be profitable with various payout rates

- Risk/Reward Calculator – Helps visualize potential outcomes of trading strategies over time

- Compound Interest Calculator – Illustrates account growth potential with consistent returns

Many of these calculators can be found online for free, or you can create basic versions in spreadsheet software like Excel or Google Sheets.

Example Win Rate Calculator:

To determine if your strategy is potentially profitable, use this simple formula:

Required Win Rate = 100 ÷ (100 + Payout Percentage)

If your broker offers 75% payouts:

Required Win Rate = 100 ÷ (100 + 75) = 100 ÷ 175 = 57.14%

This means you need to win at least 57.14% of your trades just to break even.

Educational Resources

Continuous learning is essential for binary options traders at all levels. Here are valuable educational resources to enhance your trading knowledge:

Books:

- “Binary Options: Strategies for Directional and Volatility Trading” by Alex Nekritin

- “Trading Binary Options: Strategies and Tactics” by Abe Cofnas

- “Japanese Candlestick Charting Techniques” by Steve Nison (for technical analysis)

Online Courses:

- Udemy offers several binary options courses for beginners

- Many reputable brokers provide free educational courses on their platforms

- YouTube channels dedicated to binary options trading techniques

Forums and Communities:

- Reddit’s r/binaryoptions subreddit

- BabyPips.com forums (primarily forex but applicable concepts)

- TradingView’s social community for chart analysis

Broker Educational Resources:

Many top binary options brokers provide extensive educational materials:

- IQ Option offers comprehensive video tutorials and webinars

- Pocket Option provides strategy guides and market analysis

- Deriv features detailed explanations of option types and trading concepts

While self-education is valuable, be wary of expensive “guru” courses promising unrealistic results. Most trading knowledge can be acquired through free or low-cost resources from established sources.

Psychological Aspects of Binary Forex Trading

Managing Emotions in Trading

The psychological dimension of trading often determines success more than technical knowledge or analytical skills. Binary options trading, with its fast pace and all-or-nothing outcomes, can be particularly challenging emotionally.

Common Emotional Pitfalls:

- Fear – Causes missed opportunities, premature exits, and hesitation to implement strategies

- Greed – Leads to overtrading, ignoring risk management rules, and chasing losses

- Revenge Trading – Attempting to immediately recover losses with larger or riskier trades

- Euphoria – Overconfidence after winning streaks, leading to larger position sizes and reduced analysis

- Boredom – Taking trades outside your strategy just to feel engaged with the market

Practical Techniques for Emotional Management:

- Trading Journal – Document not just trades but also your emotional state before, during, and after each trade. This helps identify harmful patterns.

- Pre-Defined Trading Plan – Create detailed rules for entries, exits, and position sizing before market sessions, when emotions aren’t influencing decisions.

- Scheduled Breaks – Step away from trading after a series of losses or wins to regain emotional equilibrium.

- Physical Activity – Exercise before trading sessions to reduce stress hormones and improve decision-making.

- Meditation and Mindfulness – Regular practice helps develop awareness of emotional states that might affect trading decisions.

I’ve found that setting strict daily and weekly loss limits—and actually stopping when they’re reached—has been crucial for my emotional management. When I first started trading binary options, I would often double down after losses, hoping to recover quickly. This almost always led to further losses and emotional trading decisions.

Developing a Trading Mindset

Beyond managing emotions, developing a professional trading mindset is essential for long-term success in binary options trading. This mindset shift transforms trading from gambling into a business-like endeavor.

Elements of a Professional Trading Mindset:

- Probability Thinking – Understanding that individual trades don’t matter; it’s the long-term expectancy of your system that counts. Even the best strategies have losing trades.

- Process Over Outcome – Focus on executing your strategy correctly rather than on whether individual trades win or lose. A good decision can result in a losing trade, and a bad decision can sometimes be profitable.

- Continuous Improvement – Approach trading as a skill that develops over time through deliberate practice and review. Learn from both winning and losing trades.

- Risk Management Focus – Make capital preservation your primary concern, with profits as a secondary outcome. Professional traders are risk managers first, market analysts second.

- Emotional Detachment – View trading capital as a business expense rather than personal money. This reduces emotional attachment to outcomes.

Practical Steps to Develop This Mindset:

- Track Statistics – Monitor win rates, average wins/losses, and strategy performance across different market conditions. This shifts focus from individual trades to system performance.

- Set Realistic Expectations – Understand that consistent 10-15% monthly returns are excellent in trading. Unrealistic expectations create emotional pressure.

- Celebrate Process Adherence – Reward yourself for following your trading plan, regardless of outcome. This reinforces good habits.

- Study Market Structure – Develop a deep understanding of why markets move rather than just looking for entry signals. This builds confidence in your analysis.

- Simulate Worst-Case Scenarios – Mentally prepare for drawdowns and losing streaks so they don’t derail your emotional stability when they occur.

Everyday Analogy: Think of trading like being a baseball batter. Even the best hitters fail 70% of the time. They don’t get emotionally devastated by each strikeout or overjoyed by each hit. They focus on their technique, study the pitchers, and trust that good process leads to good results over time. Similarly, successful traders focus on their “batting average” over hundreds of trades rather than celebrating or mourning individual outcomes.

The psychological journey in trading is ongoing and personal. What works for managing one person’s emotions may not work for another. Experiment with different techniques and be honest about your psychological weaknesses—we all have them.

Conclusion

Key Takeaways from Binary Forex Trading for Beginners

Importance of Strategy and Risk Management

As we’ve explored throughout this guide, binary forex trading offers a simplified way to participate in financial markets, but this simplicity shouldn’t be mistaken for ease of profitability. Success in this arena requires a disciplined approach built on several foundational principles:

- Strategy Development – Random trading leads to random results. Develop a clear, rules-based strategy that defines your entry criteria, expiration time selection, and trade management. Test this strategy extensively on a demo account before risking real capital.

- Risk Management – The asymmetric risk-reward structure of binary options (where you typically risk 100% to gain 70-95%) makes proper position sizing essential. Never risk more than 1-2% of your account on a single trade, and implement daily and weekly loss limits.

- Broker Selection – Choose platforms that are properly regulated, offer competitive payouts, provide reliable trade execution, and have a proven track record of honoring withdrawals.

- Realistic Expectations – Understand that consistent profitability requires time, practice, and continuous learning. Binary options are not a path to quick riches, despite how they’re sometimes marketed.

I’ve found that traders who approach binary options with a business mindset—focusing on consistent execution and risk management rather than individual trade outcomes—are the ones who tend to succeed long-term.

Role of Education and Continuous Learning

The binary options landscape continues to evolve with changing regulations, platform innovations, and market conditions. Successful traders commit to ongoing education:

- Technical Analysis – Deepen your understanding of chart patterns, indicators, and price action to improve trade timing and accuracy.

- Fundamental Analysis – Learn how economic events and news impact currency pairs to either capitalize on or avoid volatility around announcements.

- Psychological Development – Study trading psychology to recognize and manage the emotional challenges that inevitably arise.

- Regulatory Awareness – Stay informed about changing regulations that might affect broker operations or trading opportunities in your region.

Consider allocating time weekly for educational activities—whether reading books, analyzing your trading journal, taking courses, or participating in trading communities. The markets reward those who continuously refine their approach.

Final Thoughts on Binary Forex Trading

Binary forex trading represents just one approach to financial market participation, with distinct advantages and challenges. As you begin your journey, remember:

- The simplified yes/no structure of binary options makes them accessible, but this simplicity comes with a mathematical disadvantage in the payout structure that must be overcome with solid strategy.

- Start small and focus on learning rather than earning in your early trading period. Consider your initial deposits as tuition for a practical education in trading.

- Demo trading is valuable, but paper profits don’t fully prepare you for the psychological reality of risking real money. Start with minimal amounts when transitioning to live trading.

- Be skeptical of “guaranteed” systems, signals services, or strategies promising unrealistic returns. If something sounds too good to be true in trading, it invariably is.

Binary forex trading can be a rewarding financial activity when approached with proper education, realistic expectations, and disciplined execution. By focusing on continuous improvement rather than overnight success, you can develop skills that serve you well not just in binary options but potentially across other trading vehicles as well.

Whether binary options become your primary trading focus or a stepping stone to other financial markets, the fundamental principles of strategy development, risk management, and psychological discipline remain universally applicable. Best of luck on your trading journey!

FAQs About Binary Forex Trading

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.