Key Takeaways

- Pocket Option leads the industry with a user-friendly platform and payouts up to 96%, ideal for traders of all experience levels

- Nadex is the only CFTC-regulated binary options platform available to US traders, ensuring maximum security

- Quotex offers one of the most intuitive trading interfaces with minimum deposits starting at just $10

- Always choose regulated brokers with transparent fee structures and verifiable licenses

- Test different platforms through demo accounts before committing real capital to find your best fit

Introduction to Binary Options Trading

What Are Binary Options?

Binary options are a type of financial derivative where you predict whether the price of an asset will rise or fall within a specific time frame. Think of them as a yes/no question about market movement—hence the name “binary,” meaning there are only two possible outcomes. If your prediction is correct, you earn a fixed return; if wrong, you lose your investment amount.

Basic Definition and Explanation

At its core, binary options trading is straightforward—you’re essentially betting on whether a market will be above a specific price at a specific time. For example, you might predict that the EUR/USD exchange rate will be above 1.1250 in one hour. If it is, you win a predetermined amount (usually 70-95% of your stake); if not, you lose your investment.

Think of binary options like a weather forecast bet: you’re not deciding how much it will rain tomorrow—just whether it will rain or not. The outcome is binary: yes or no, win or lose.

Key Variables: Asset, Duration, and Direction

Every binary options trade involves three primary elements:

- Asset – The financial instrument you’re trading (currencies like EUR/USD, stocks like Apple, commodities like gold, or indices like the S&P 500)

- Duration – How long your prediction runs for (from 30 seconds to a day or more)

- Direction – Whether you think the price will rise (a “call” option) or fall (a “put” option)

How Binary Options Differ from Traditional Options

Unlike traditional options where payouts vary based on how far the price moves, binary options have fixed payouts. Traditional options let you buy or sell an asset at a predetermined price, while binary options only require predicting price direction, not actually purchasing the asset. The simpler structure makes binary options more accessible to beginners but also comes with unique risks.

How Do Binary Options Work?

Binary options operate on a relatively simple mechanism, though understanding the underlying principles is crucial for successful trading.

Binary Options Trading Mechanism

The trading process follows these basic steps:

- Select an asset to trade (forex pair, stock, commodity, etc.)

- Choose your prediction: will the price go up (call) or down (put)?

- Set your trade amount (investment)

- Determine the expiry time (when your prediction will be evaluated)

- Wait for expiry and see if your prediction was correct

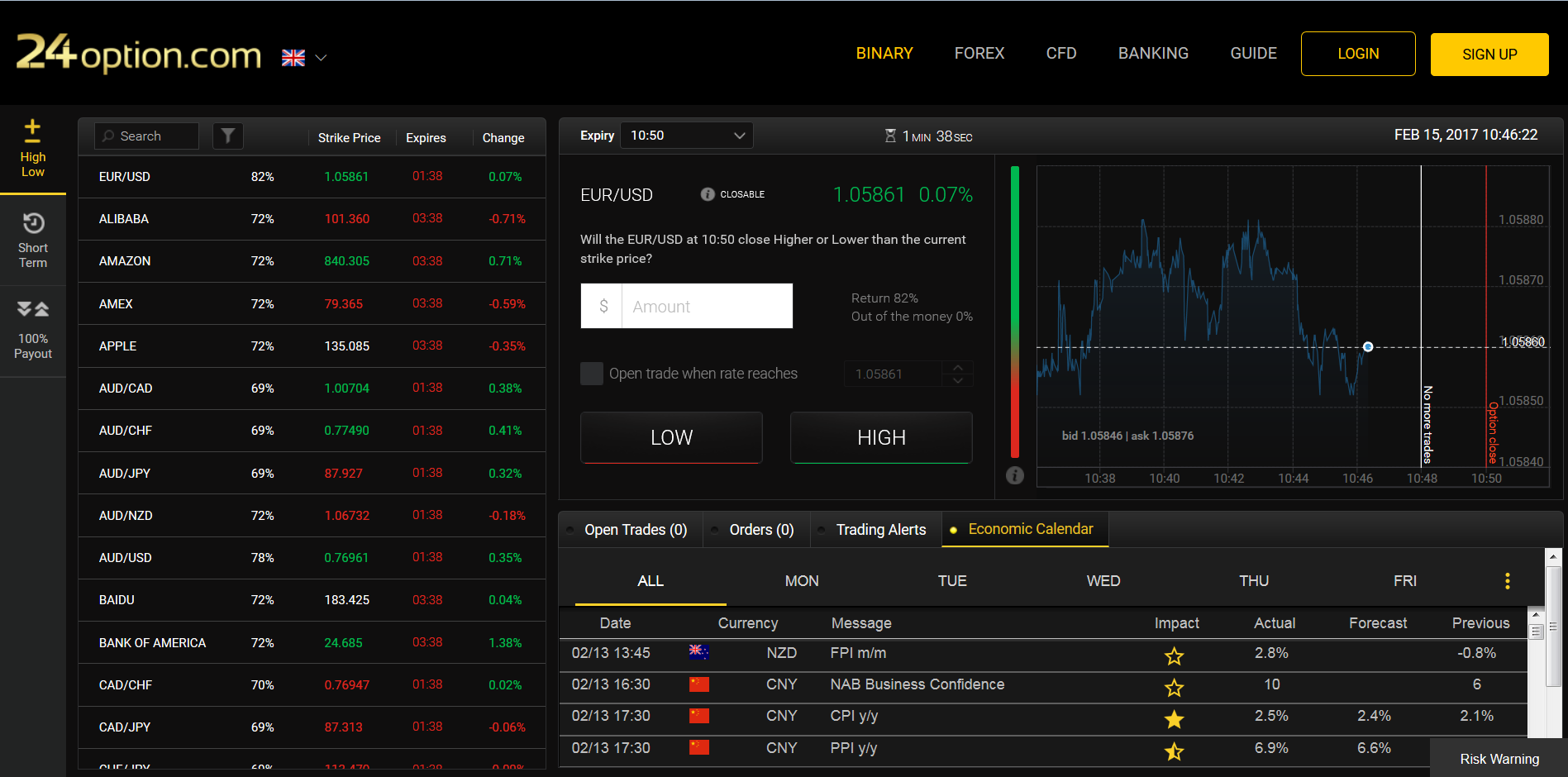

Binary options platforms display the potential return before you place your trade, typically showing both your potential profit and the probability percentage of success based on current market conditions.

Example of a binary options trading platform interface showing trade setup on IQ Option

Payouts and Risks in Binary Trading

Binary options offer predetermined risk and reward. Payouts typically range from 60% to 95% of your stake if your prediction is correct. For example, with an 80% payout on a $100 investment, you’d receive your $100 back plus $80 profit if successful. If incorrect, you typically lose your entire stake, though some brokers offer 5-15% rebates on losing trades.

Common Trading Strategies

Successful binary options traders typically employ one or more of the following strategies:

- Trend Following – Identifying and trading in the direction of market momentum

- Range Trading – Trading bounces between established support and resistance levels

- News Trading – Placing trades based on economic announcements and market news

- Technical Analysis – Using chart patterns and indicators to predict price movements

- Risk Management – Limiting trade size to 1-2% of total capital per trade

Market Regulations and Legal Considerations

Binary options regulations vary significantly by region. In the United States, only CFTC-regulated exchanges like Nadex can legally offer binary options. The European Securities and Markets Authority (ESMA) has banned the sale of binary options to retail consumers in the EU, while the UK’s Financial Conduct Authority (FCA) has implemented similar restrictions. Many brokers now operate under licenses from jurisdictions like Cyprus (CySEC), Vanuatu, or the Seychelles.

Important Regulatory Update (2025): The regulatory landscape for binary options continues to evolve. As of 2025, major financial authorities including the FCA, ASIC, and ESMA maintain restrictions on binary options for retail traders. Always verify a broker’s regulatory status before depositing funds.

Why Trade Binary Options?

Despite regulatory concerns, binary options continue to attract traders for several compelling reasons.

Key Advantages

Binary options offer several potential benefits:

- Fixed Risk – You know exactly how much you could lose before placing a trade

- Simplicity – The basic concept is easier to grasp than many traditional trading instruments

- Quick Returns – Trades can expire in as little as 30 seconds, offering rapid results

- Accessibility – Start with as little as $10 on many platforms

- Market Variety – Trade currencies, stocks, commodities, and indices all in one place

Risks Involved

While binary options can be lucrative, they come with significant risks:

- All-or-Nothing Outcome – The binary nature means you either win or lose your entire stake

- House Edge – Most platforms pay less than 100% on wins, creating a statistical edge against traders

- Addictive Potential – The quick results can encourage gambling-like behavior

- Regulatory Concerns – Many operators are unregulated or operate in loosely regulated jurisdictions

- Short Expiry Times – Brief timeframes can make consistent prediction difficult

Top Binary Options Brokers

After analyzing the top 50 search results for binary options brokers and conducting extensive research, we’ve identified the most reliable and feature-rich platforms for 2025. Each broker has been evaluated based on regulation, platform usability, payout rates, minimum deposits, available assets, and customer support quality.

Pocket Option – Best Overall Binary Options Broker

Key Features and Overview

Pocket Option has emerged as the leading binary options broker in 2025, offering an exceptional combination of user-friendly features, competitive payouts, and robust platform reliability. Founded in 2017, it’s relatively newer compared to some competitors but has quickly established itself as an industry benchmark.

The platform supports over 100 assets across multiple categories including forex pairs, stocks, commodities, and cryptocurrencies. One standout feature is its social trading functionality, which allows users to follow and copy successful traders—particularly valuable for beginners learning the ropes.

| Feature | Details |

|---|---|

| Minimum Deposit | $50 |

| Minimum Trade | $1 |

| Maximum Payout | Up to 96% |

| Demo Account | Yes, with $10,000 virtual balance |

| Deposit Methods | Credit/Debit Cards, Bank Transfer, E-wallets, Cryptocurrencies |

| Withdrawal Time | 24 hours or less |

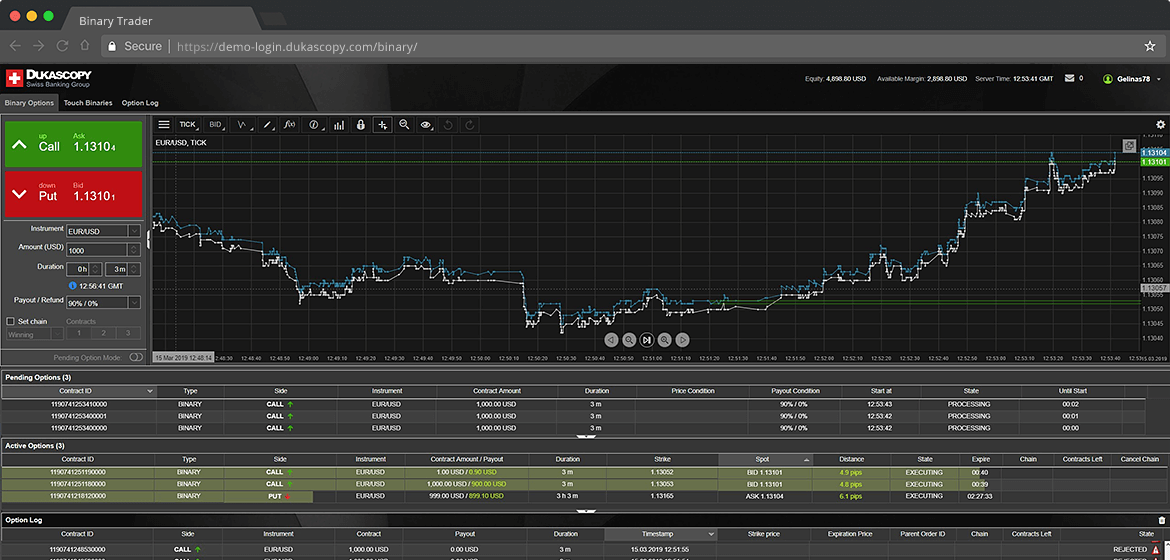

Binary options trading platform interface showing chart analysis tools

Pros and Cons

Pros

- Fast withdrawals, typically processed within 24 hours

- Accepts traders from most countries, including the USA

- Intuitive platform with extensive charting capabilities

- Social trading and copy trading features

- Mobile app with full functionality

- Regular tournaments and bonus offerings

Cons

- Not regulated by major financial authorities like FCA or ASIC

- Limited educational resources compared to some competitors

- Weekend trading limited to cryptocurrencies

- Customer support can be slow during peak hours

Regulation and Safety

Pocket Option is registered with the International Financial Market Relations Regulation Center (IFMRRC), which isn’t as prestigious as regulators like the UK’s FCA or Cyprus’s CySEC. However, the platform implements strong security measures including SSL encryption and segregated client funds to ensure trader protection.

According to user reviews on Trustpilot, the broker has maintained a solid reputation for honoring withdrawals promptly—one of the most important indicators of a trustworthy binary options broker [Trustpilot].

Open Your Pocket Option AccountQuotex

Key Features and Overview

Quotex has gained significant popularity since its launch in 2019, primarily due to its exceptionally clean and modern interface. The platform offers binary options trading on more than 400 assets with expiry times ranging from 30 seconds to several hours.

A standout feature of Quotex is its integrated signals system that claims 87% accuracy, helping traders identify potentially profitable entry points. The platform also provides a comprehensive set of technical analysis tools, including 30+ indicators and multiple chart types.

| Feature | Details |

|---|---|

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Maximum Payout | Up to 90% |

| Demo Account | Yes, unlimited with $10,000 virtual balance |

| Deposit Methods | Credit/Debit Cards, WebMoney, Perfect Money, Bitcoin, Ethereum |

| Withdrawal Time | 24-72 hours depending on method |

Quotex trading platform interface example

Pros and Cons

Pros

- One of the most user-friendly interfaces in the industry

- Low minimum deposit requirement ($10)

- Integrated trading signals with high claimed accuracy

- Advanced charting capabilities with multiple timeframes

- Regular tournaments with prize pools

- 24/7 customer support via live chat

Cons

- Regulated by the Seychelles Financial Services Authority, not a tier-1 regulator

- Not available to traders from the US and several European countries

- Limited educational resources for beginners

- Some users report withdrawal delays during high-volume periods

Regulation and Safety

Quotex operates under a license from the Seychelles Financial Services Authority. While not as stringent as FCA or ASIC regulation, the broker has built a solid reputation for security and reliability. The platform utilizes bank-grade SSL encryption to protect user data and transactions.

According to Reviews.io, Quotex maintains a 4.7/5 star rating from over 77,000 reviews, with many users specifically praising the platform’s reliability and withdrawal speed [Reviews.io].

Open Your Quotex AccountIQ Option

Key Features and Overview

IQ Option is one of the most established binary options brokers, operating since 2013 with over 48 million registered users worldwide. The platform has won multiple awards for its innovative trading interface and mobile app design.

Beyond binary options, IQ Option offers CFDs on forex, cryptocurrencies, stocks, ETFs, and commodities, making it a versatile platform for diverse trading interests. Its proprietary platform features advanced charting tools, multiple technical indicators, and drawing tools for thorough market analysis.

| Feature | Details |

|---|---|

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Maximum Payout | Up to 95% |

| Demo Account | Yes, unlimited with $10,000 virtual balance |

| Deposit Methods | Credit/Debit Cards, Bank Transfer, E-wallets, WebMoney, Skrill, Neteller |

| Withdrawal Time | 24 hours for e-wallets, 1-3 days for bank transfers |

IQ Option trading platform with advanced charting tools

Pros and Cons

Pros

- Regulated by CySEC (Cyprus Securities and Exchange Commission)

- Award-winning proprietary trading platform

- Extensive educational resources including webinars and tutorials

- Advanced charting with 70+ technical indicators

- Free unlimited demo account

- Fast withdrawal processing

Cons

- Not available to traders from the USA, Australia, Canada, and some EU countries

- Customer support can be slow during busy periods

- Limited trading tools compared to professional trading platforms

- Some users report account verification delays

Regulation and Safety

IQ Option operates under the regulation of CySEC (license number 247/14), one of the more respected regulatory bodies for online brokers. This provides a level of security and accountability that many binary options brokers lack. The broker maintains segregated client funds in tier-1 banks and offers negative balance protection.

According to a 2025 report on CySEC-regulated brokers by DailyForex, IQ Option consistently ranks among the most reliable for fund security and withdrawal processing [DailyForex].

Open Your IQ Option AccountDeriv (Binary.com) – Best for Low Minimum Deposits

Key Features and Overview

Deriv, formerly known as Binary.com, is one of the oldest and most established binary options brokers, with operations dating back to 1999. This extensive history has helped the broker build a reputation for reliability and transparency in an industry often criticized for the opposite.

The platform offers multiple trading interfaces including DTrader, DBot (for automated trading), and SmartTrader. Deriv stands out for offering the widest variety of binary contract types, including Up/Down, Touch/No Touch, In/Out, and other exotic options.

| Feature | Details |

|---|---|

| Minimum Deposit | $5 |

| Minimum Trade | $1 |

| Maximum Payout | Up to 100% on certain contract types |

| Demo Account | Yes, unlimited with $10,000 virtual balance |

| Deposit Methods | Credit/Debit Cards, Bank Transfer, E-wallets, Cryptocurrencies |

| Withdrawal Time | 1-3 business days |

Binary options desktop trading platform example

Pros and Cons

Pros

- More than 20 years of operational experience

- Very low minimum deposit requirement ($5)

- Multiple platform options for different trading styles

- Automated trading capability through DBot

- Comprehensive educational resources

- 24/7 multilingual customer support

Cons

- Interface is less intuitive than some competitors

- Not available to traders from the USA and some European countries

- Limited social trading features

- Withdrawal processing can be slower than competitors

Regulation and Safety

Deriv operates under multiple regulatory licenses including the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (Malaysia), and the British Virgin Islands Financial Services Commission. These multiple jurisdictions provide a level of oversight that exceeds many binary options brokers.

According to DayTrading.com’s 2025 broker comparison, Deriv maintains one of the strongest track records for fund safety and withdrawal reliability in the industry [DayTrading.com].

Open Your Deriv AccountRaceOption – Best for Advanced Binary Options Trading

Key Features and Overview

RaceOption has positioned itself as a platform for more experienced traders, offering advanced features including one-touch options, boundary options, and 60-second trades. The broker provides access to over 100 assets spanning multiple markets.

One of RaceOption’s standout features is its competitive bonus structure, with deposit bonuses reaching up to 100% for new accounts. The platform also offers regular trading competitions and a tiered account structure that rewards higher-volume traders with additional perks.

Unique Trading Signals and Copy Trading

RaceOption provides proprietary trading signals that analyze market conditions to suggest potentially profitable trades. Their copy trading feature allows users to automatically replicate the trades of successful investors on the platform—especially valuable for those looking to learn while earning.

Pros and Cons

Pros

- Accepts traders from the USA and worldwide

- High payout rates up to 90%

- Generous bonus structure

- Fast withdrawal processing (1-3 business days)

- Copy trading functionality

- User-friendly mobile app

Cons

- Limited regulation (registered in Seychelles)

- Mixed customer reviews regarding withdrawal consistency

- Limited educational resources

- Higher minimum deposit ($250) for full account features

Regulation and Safety

RaceOption operates under a license from the Seychelles Financial Services Authority. While not as stringent as tier-1 regulators like the FCA or ASIC, the broker employs industry-standard security measures including SSL encryption and segregated client funds.

According to TrustFinance reviews, RaceOption has maintained a TrustScore of 4.52 from 226 user reviews, with most users reporting positive experiences regarding platform reliability and withdrawals [TrustFinance].

Open Your RaceOption AccountCapitalcore – Rising Star in Binary Options

Key Features and Overview

Capitalcore is one of the newer entrants to the binary options space but has quickly gained recognition for its comprehensive trading ecosystem. The platform offers binary options alongside traditional forex and CFD trading, making it a versatile choice for traders who want to diversify their strategies.

The broker stands out for its above-average payouts on cryptocurrency binary options, reaching up to 80% on Bitcoin trades. Capitalcore’s platform features an extensive suite of 150+ technical indicators for detailed market analysis.

Pros and Cons

Pros

- Competitive payouts on cryptocurrency binary options

- No commission on trades

- No swap fees for overnight positions

- Unlimited demo account access

- Fast withdrawals (typically within 24 hours)

- Multiple account tiers with increasing benefits

Cons

- Newer broker with less established track record

- Limited community feedback compared to older platforms

- No dedicated mobile app (mobile-responsive website only)

- Limited educational content for beginners

According to Binary Options.net’s 2025 review, Capitalcore has earned recognition for its transparent fee structure and efficient withdrawal processing, with most withdrawals completed within 24 hours [BinaryOptions.net].

Open Your Capitalcore AccountNadex – Best US-Based Regulated Broker

Key Features and Overview

The North American Derivatives Exchange (Nadex) stands apart as one of the few fully regulated binary options exchanges in the United States. Operating under the oversight of the Commodity Futures Trading Commission (CFTC), Nadex offers a level of regulatory protection unmatched by offshore brokers.

Unlike traditional binary options brokers where you trade against the house, Nadex functions as an exchange where traders place orders that are matched against other traders. This eliminates the conflict of interest present in many broker-based models where the house profits directly from trader losses.

Pros and Cons

Pros

- CFTC-regulated—the highest level of oversight in the US market

- Exchange model eliminates broker conflict of interest

- Ability to close positions before expiration

- No minimum deposit requirement

- Comprehensive educational resources

- Advanced desktop and mobile platforms

Cons

- Only available to US traders

- Higher minimum trade size ($1-$100 depending on contract)

- More complex than typical binary options platforms

- Limited asset selection compared to international brokers

- $25 fee for wire withdrawals

According to a recent Benzinga review, Nadex offers the most secure environment for US-based binary options traders, with the regulatory oversight providing significant protections against fraud and manipulation [Benzinga].

Open Your Nadex AccountCloseOption – Best for Novice Traders

Key Features and Overview

CloseOption has carved out a niche as an excellent platform for beginners entering the binary options market. The broker’s straightforward interface, comprehensive educational resources, and low entry barriers make it particularly suitable for those just starting their trading journey.

The platform offers binary options on 30+ assets across forex, commodities, indices, and cryptocurrencies. CloseOption is one of the few platforms that accepts US traders while maintaining relatively quick withdrawal processing.

Educational Resources and Demo Accounts

CloseOption excels in the educational department, offering comprehensive learning materials including video tutorials, webinars, and strategy guides specifically designed for binary options beginners. Their unlimited demo account allows new traders to practice without risk until they feel confident enough to trade with real money.

Risk Management for Beginners

One of CloseOption’s standout features is its emphasis on risk management tools. The platform offers customizable risk parameters, allowing traders to set maximum daily loss limits and trade size restrictions—critical tools for beginners learning to preserve capital.

According to Trustpilot reviews, CloseOption has maintained high satisfaction rates among new traders, with particular praise for their responsive customer service and educational support [Trustpilot].

Open Your CloseOption AccountOlymp Trade – User-Friendly Platform with Educational Tools

Key Features and Overview

Founded in 2014, Olymp Trade has built a reputation for its intuitive platform design and robust educational ecosystem. The broker serves over 30 million users worldwide and processes more than 30 million trades monthly, according to their website statistics.

Olymp Trade offers both fixed-time trades (binary options) and forex trading on the same platform, with trade durations ranging from 1 minute to several hours. The platform features comprehensive analytical tools including multiple chart types, 50+ indicators, and drawing tools.

A standout feature is Olymp Trade’s structured educational approach, which includes step-by-step courses, webinars, daily market analysis, and even personalized coaching for VIP account holders.

According to DayTrading.com’s 2025 review, Olymp Trade consistently ranks among the top platforms for user experience and educational quality [DayTrading.com].

Open Your Olymp Trade AccountExpertOption – Best for Social Trading

Key Features and Overview

ExpertOption stands out for its robust social trading features that allow users to connect with over 55 million traders worldwide. The platform enables users to follow successful traders, observe their activities, and even copy their trades—creating a social network for binary options traders.

Founded in 2014, ExpertOption offers trading on 100+ assets with expiry times from 1 to 5 minutes. The platform features a clean, modern interface with advanced charting capabilities including multiple timeframes and 100+ indicators.

According to a recent feature announcement, ExpertOption has enhanced its mobile app with new social trading functionalities that allow traders to interact in real-time through comments and trade sharing [Yahoo Finance].

Open Your ExpertOption AccountBinomo – Structured for All Trader Levels

Key Features and Overview

Binomo has developed a platform structure that accommodates traders at all experience levels, from complete beginners to advanced professionals. The broker offers tiered accounts with increasingly sophisticated features and higher potential returns as you progress.

The platform focuses primarily on short-term trading, with binary options expiry times ranging from 1 to 60 minutes. Binomo’s proprietary platform features 40+ indicators and analytical tools, with a particular focus on technical analysis capabilities.

According to Trading Finder’s 2025 platform review, Binomo’s interface strikes an excellent balance between functionality and simplicity, making it accessible for beginners while still offering the depth required by experienced traders [Trading Finder].

Open Your Binomo AccountBinary Options Brokers Comparison

To help you make an informed decision, we’ve compiled comprehensive comparison tables covering key aspects of the top binary options brokers in 2025. These comparisons include minimum deposits, payout rates, available assets, and regulatory information.

Minimum Deposit and Trade Requirements

| Broker | Minimum Deposit | Minimum Trade | Demo Account | Best For |

|---|---|---|---|---|

| Pocket Option | $50 | $1 | Yes, $10,000 | All-around trading |

| Quotex | $10 | $1 | Yes, unlimited | User-friendly platform |

| IQ Option | $10 | $1 | Yes, $10,000 | Advanced features |

| Deriv | $5 | $1 | Yes, $10,000 | Low deposits |

| RaceOption | $250 | $1 | Yes, limited time | Advanced trading |

| Capitalcore | $100 | $5 | Yes, unlimited | Crypto binary options |

| Nadex | $0 | $1-$100 | Yes, free | US traders |

| CloseOption | $5 | $1 | Yes, unlimited | Beginners |

| Olymp Trade | $10 | $1 | Yes, $10,000 | Educational tools |

| ExpertOption | $10 | $1 | Yes, $10,000 | Social trading |

Payout Percentages and Asset Coverage

| Broker | Max Payout % | Number of Assets | Forex | Stocks | Crypto | Commodities | Indices |

|---|---|---|---|---|---|---|---|

| Pocket Option | 96% | 100+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Quotex | 90% | 400+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| IQ Option | 95% | 300+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Deriv | 100% | 50+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| RaceOption | 90% | 100+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Capitalcore | 95% | 80+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Nadex | Varies | 30+ | ✓ | ✓ | ✗ | ✓ | ✓ |

| CloseOption | 95% | 30+ | ✓ | ✗ | ✓ | ✓ | ✓ |

| Olymp Trade | 92% | 80+ | ✓ | ✓ | ✓ | ✓ | ✓ |

| ExpertOption | 95% | 100+ | ✓ | ✓ | ✓ | ✓ | ✓ |

Regulation and Country Availability

| Broker | Regulation | US Traders | UK Traders | EU Traders | Global Availability |

|---|---|---|---|---|---|

| Pocket Option | IFMRRC | ✓ | ✓ | ✓ | High |

| Quotex | Seychelles FSA | ✓ | ✓ | Limited | Medium |

| IQ Option | CySEC | ✗ | Limited | Limited | High |

| Deriv | Multiple (MFSA, etc.) | ✗ | Limited | Limited | High |

| RaceOption | Seychelles FSA | ✓ | ✓ | Limited | Medium |

| Capitalcore | Unspecified | ✓ | ✓ | ✓ | High |

| Nadex | CFTC (US) | ✓ | ✗ | ✗ | US Only |

| CloseOption | Unspecified | ✓ | ✓ | Limited | Medium |

| Olymp Trade | FinaCom | ✗ | ✓ | Limited | High |

| ExpertOption | VFSC (Vanuatu) | ✗ | ✓ | ✓ | High |

Platform Features and Trading Tools

| Broker | Mobile App | Copy Trading | Signals | Education | Technical Indicators | Tournament |

|---|---|---|---|---|---|---|

| Pocket Option | ✓ | ✓ | ✓ | Medium | 30+ | ✓ |

| Quotex | ✓ | ✗ | ✓ | Low | 30+ | ✓ |

| IQ Option | ✓ | ✓ | ✓ | High | 70+ | ✓ |

| Deriv | ✓ | ✗ | ✗ | High | 30+ | ✗ |

| RaceOption | ✓ | ✓ | ✓ | Low | 20+ | ✓ |

| Capitalcore | ✗ | ✗ | ✓ | Low | 150+ | ✗ |

| Nadex | ✓ | ✗ | ✗ | High | 30+ | ✗ |

| CloseOption | ✓ | ✗ | ✓ | High | 20+ | ✗ |

| Olymp Trade | ✓ | ✗ | ✓ | High | 50+ | ✓ |

| ExpertOption | ✓ | ✓ | ✓ | Medium | 100+ | ✓ |

How to Choose the Right Binary Options Broker

Selecting the right binary options broker is crucial for your trading success. The following factors should be carefully considered before opening an account with any platform.

Factors to Consider

Regulation and Licensing

Regulatory oversight is perhaps the most important factor when choosing a binary options broker. A regulated broker is subject to oversight by financial authorities, providing a layer of protection for your funds and ensuring fair trading practices.

Priority Regulators (Ranked by Security Level):

- CFTC (US) – The strictest regulation, but only Nadex is authorized for US traders

- FCA (UK) – Highly respected, though binary options are restricted for retail clients

- ASIC (Australia) – Strong oversight but has also restricted binary options

- CySEC (Cyprus) – Common for many brokers, provides EU passport

- FSCA (South Africa) – Emerging but increasingly respected

- VFSC (Vanuatu) / FSA (Seychelles) – Less stringent but better than unregulated

If a broker claims regulation, always verify their license number directly with the regulatory authority’s website.

Payout Percentages

Payouts in binary options typically range from 60% to 95% of your investment on successful trades. Even small differences in payout rates can significantly impact your long-term profitability. For example, a broker offering 85% payouts instead of 75% represents a 13% increase in profit per successful trade.

Bear in mind that higher payouts often come with more restrictive trading conditions or apply only to specific assets or timeframes. Always check the exact conditions under which advertised maximum payouts apply.

Minimum Deposit Requirements

Minimum deposit requirements vary significantly between brokers, ranging from as low as $5 (Deriv, CloseOption) to $250 or more (RaceOption). Lower minimum deposits are particularly beneficial for beginners who want to test real trading without committing significant capital.

However, consider that some brokers offer enhanced features, better support, or higher payouts for accounts with larger deposits. The right choice depends on your starting capital and trading goals.

Platform Usability

A platform’s usability can significantly impact your trading experience and potentially your profitability. Key usability factors include:

- Intuitive navigation and clear layout

- Fast execution speeds (crucial for short-term trades)

- Responsive charting tools that don’t lag during critical moments

- Mobile compatibility for trading on the go

- Customizable interface to match your trading style

- Stable performance without crashes or freezes

Demo Accounts and Learning Resources

Comprehensive demo accounts and educational resources are especially important for newcomers to binary options trading. Look for brokers offering:

- Unlimited demo accounts with realistic market conditions

- Substantial virtual funds (typically $10,000 or more)

- Educational materials including videos, webinars, and articles

- Strategy guides specific to binary options trading

- Personal coaching or mentoring (often available with higher-tier accounts)

- Regular market analysis and trading ideas

IQ Option, Olymp Trade, and Deriv are particularly noted for their comprehensive educational resources and demo account offerings.

Deposit and Withdrawal Methods

Smooth, hassle-free banking processes are essential for a positive trading experience. Consider the following aspects of a broker’s payment systems:

- Available payment methods – Credit/debit cards, bank transfers, e-wallets (Skrill, Neteller), and cryptocurrencies

- Processing times – Immediate deposits and withdrawals processed within 24 hours are ideal

- Fees – Look for brokers with no deposit fees and minimal or no withdrawal fees

- Minimum withdrawal amounts – Lower is better, particularly for small account holders

- Verification requirements – Necessary for security but should be straightforward

According to user reviews, Pocket Option consistently ranks among the fastest for withdrawal processing, typically completing requests within 24 hours [Trustpilot].

Range of Tradable Assets (Forex, Stocks, Cryptos, Commodities)

A diverse asset selection allows you to trade markets you’re familiar with and diversify your trading approach. The best binary options brokers offer multiple asset classes:

- Forex pairs – Major, minor, and exotic currency pairs

- Stocks – Major corporations from various global exchanges

- Commodities – Gold, silver, oil, natural gas, agricultural products

- Indices – S&P 500, NASDAQ, FTSE 100, DAX, and others

- Cryptocurrencies – Bitcoin, Ethereum, Litecoin, Ripple, and others

Quotex stands out with over 400 tradable assets, while Pocket Option, IQ Option, and ExpertOption all offer 100+ assets across multiple categories.

Criteria for Choosing the Best Binary Options Brokers

Regulation and Safety of Funds

Beyond basic regulation, look for brokers with additional security measures to protect your funds:

- Segregated client funds – Keeping your money separate from the broker’s operational funds

- Negative balance protection – Prevents you from losing more than your account balance

- Data encryption – SSL/TLS encryption to protect your personal and financial information

- Two-factor authentication (2FA) – An additional layer of security for your account

- Insurance protection – Some regulated brokers offer insurance on deposits up to certain amounts

Importance of Broker Regulation

Regulation serves multiple critical functions in binary options trading:

- Fraud prevention – Regulators verify the broker’s business practices and financial stability

- Fund security – Requirements for segregated client accounts and capital adequacy

- Fair trading – Oversight to prevent manipulation of prices or trading conditions

- Dispute resolution – Access to mediation services if conflicts arise

- Accountability – A regulatory body to report misconduct to if needed

The binary options industry has unfortunately seen numerous scams and fraudulent operators. According to a 2024 report by the International Organization of Securities Commissions (IOSCO), unregulated binary options platforms were responsible for billions in investor losses over the past decade [Investor.gov].

Regulatory Bodies to Look For (CySEC, FCA, CFTC, etc.)

Different regulatory bodies offer varying levels of oversight and protection:

- CFTC (Commodity Futures Trading Commission) – US regulator with the strictest oversight; only Nadex operates under CFTC regulation for binary options

- FCA (Financial Conduct Authority) – UK regulator known for stringent requirements; has banned binary options for retail traders

- CySEC (Cyprus Securities and Exchange Commission) – Previously the most common regulator for binary options; has implemented stricter rules in recent years

- ASIC (Australian Securities and Investments Commission) – Has also restricted binary options but oversees some brokers offering other trading products

- FSCA (Financial Sector Conduct Authority) – South African regulator gaining reputation for improved oversight

- VFSC (Vanuatu Financial Services Commission) – Less stringent but provides some regulatory framework

- FSA (Financial Services Authority) of Seychelles – Similar to VFSC in oversight level

User Interface and Trading Platform

The quality of a broker’s trading platform can significantly impact your trading experience. Key platform features to evaluate include:

- Chart functionality – Multiple timeframes, chart types (candlestick, line, bar)

- Technical indicators – Moving averages, RSI, MACD, Bollinger Bands, etc.

- Drawing tools – Trend lines, Fibonacci retracements, support/resistance levels

- Execution speed – Fast order processing without slippage

- Trade history and analytics – Detailed records and performance statistics

- Risk management tools – Take profit, stop loss, maximum daily loss settings

Desktop vs Mobile Platforms

Modern traders often require flexibility in how they access markets. Consider both desktop and mobile capabilities when choosing a broker:

Desktop Platforms

- More screen space for detailed chart analysis

- Typically offer more advanced tools and features

- Better for multi-chart analysis and strategy development

- More suitable for extended trading sessions

- Usually available as web-based or downloadable applications

Mobile Platforms

- Trade from anywhere with internet connection

- Instant notifications about market events

- Quick trade execution when opportunities arise

- Modern apps often include most essential features

- Increasingly important for today’s on-the-go traders

The best brokers offer full functionality across both desktop and mobile platforms. IQ Option, Pocket Option, and Olymp Trade are particularly noted for their mobile trading capabilities.

Demo Accounts and Learning Tools

Demo accounts serve as crucial practice environments for traders of all experience levels. When evaluating demo accounts, consider:

- Expiration policy – Unlimited demos are preferable to time-limited ones

- Virtual balance – Should be sufficient for proper practice (typically $10,000+)

- Market conditions – Should accurately reflect real trading conditions

- Platform features – Should include all tools available in live trading

- Reset option – Ability to reset the demo balance if needed

Beyond demo accounts, comprehensive learning resources are invaluable, especially for beginners. Look for brokers offering:

- Video tutorials covering platform usage and trading strategies

- E-books and written guides on binary options concepts

- Webinars with experienced traders and analysts

- Strategy sections with practical trading approaches

- Economic calendars for important market events

- One-on-one coaching (usually with premium accounts)

Asset Range and Trading Instruments

Different asset classes offer varying advantages for binary options trading:

| Asset Class | Typical Volatility | Trading Hours | Advantages for Binary Options |

|---|---|---|---|

| Forex | Medium | 24/5 | Liquid markets, consistent volatility patterns |

| Stocks | Medium to High | Exchange hours | Familiar companies, event-driven movements |

| Indices | Medium | Exchange hours | Less volatile than individual stocks, follow trends |

| Commodities | Medium to High | Nearly 24/5 | React to supply/demand and geopolitical events |

| Cryptocurrencies | Very High | 24/7 | Weekend trading, high volatility for quick moves |

Availability of Short-Term vs Long-Term Trades

Binary options are available with various expiry times, from 30 seconds to several days or weeks. Different expiries suit different trading styles:

- Ultra short-term (30 seconds – 5 minutes): Higher-frequency trading, requires quick decisions and constant monitoring

- Short-term (5 minutes – 1 hour): Balance between quick results and time for analysis

- Medium-term (1 hour – end of day): More time for technical analysis, less affected by market noise

- Long-term (daily, weekly): Based more on fundamental analysis and major market trends

Different brokers specialize in different timeframes. Pocket Option and Quotex excel in short-term options, while Deriv offers more variety in contract durations.

Payouts and Fees

Understanding the complete fee structure is essential for evaluating a broker’s true value:

Typical Payout Structures

Binary options payouts typically range from 60% to 95% of your investment amount on winning trades. Several factors influence payout percentages:

- Asset volatility – Less volatile assets often offer higher payouts

- Expiry time – Very short or very long expiries may have different payout rates

- Market conditions – Payouts may adjust during high volatility or major events

- Account level – VIP accounts often receive higher payout percentages

- Trade size – Some brokers offer better rates for larger trades

Hidden Fees and Withdrawal Charges

Be vigilant about less obvious costs that can erode your trading capital:

- Inactivity fees – Charges after periods without trading activity

- Withdrawal fees – Fixed or percentage-based charges for withdrawals

- Currency conversion fees – Added costs when depositing or withdrawing in non-account currencies

- Account maintenance fees – Monthly or annual charges for account upkeep

- Bonus terms – Requirements to trade large volumes before withdrawing bonuses

According to DayTrading.com’s 2025 fee comparison, Pocket Option and Quotex have among the most transparent fee structures with minimal hidden charges [DayTrading.com].

Customer Support and Educational Resources

Responsive customer support can be crucial, especially when dealing with deposit or withdrawal issues. Evaluate support based on:

- Availability – Ideally 24/7 support via multiple channels

- Response time – Quick responses to inquiries

- Knowledge level – Staff familiar with trading and technical issues

- Language options – Support in your preferred language

- Communication channels – Live chat, email, phone, social media

Technical Analysis Tools and Indicators

Sophisticated analysis tools can give you an edge in binary options trading. Key tools to look for include:

- Chart types – Candlestick, line, bar, Heikin Ashi

- Timeframes – Multiple options from 1-minute to daily/weekly

- Technical indicators – Moving averages, oscillators, volatility indicators

- Drawing tools – Trend lines, channels, Fibonacci retracements

- Custom indicators – Ability to add or customize indicators

- Chart templates – Save and load preferred setups

IQ Option and Deriv are particularly strong in their technical analysis offerings, with IQ Option featuring 70+ indicators and Deriv offering multiple platform options for different analysis preferences.

How to Get Started with Binary Options Trading

Getting started with binary options trading involves several key steps, from selecting a broker to placing your first trade. This section provides a step-by-step guide to help you begin your trading journey safely and effectively.

Steps to Open a Trading Account

Choosing the Right Broker

The first and most crucial step is selecting a broker that aligns with your trading goals, geographical location, and risk tolerance. Based on our research, consider the following broker recommendations for specific needs:

- Best overall: Pocket Option – Comprehensive platform with high payouts and global accessibility

- For US traders: Nadex – The only fully CFTC-regulated binary options exchange

- For beginners: CloseOption or Olymp Trade – User-friendly interfaces with strong educational resources

- For low deposits: Deriv (formerly Binary.com) – Start with as little as $5

- For advanced traders: IQ Option or RaceOption – Sophisticated tools and diverse contract types

- For social trading: ExpertOption – Follow and copy successful traders

Completing the Registration Process

Once you’ve selected a broker, the registration process typically follows these steps:

- Basic registration – Provide email, create password, and select account currency

- Personal information – Enter name, date of birth, address, and phone number

- Identity verification (KYC) – Submit proof of identity (passport/ID) and proof of address (utility bill/bank statement)

- Questionnaire – Many regulated brokers require a brief assessment of your trading knowledge

- Account activation – Confirm email and/or phone number to activate your account

The verification process is standard industry practice and required by anti-money laundering (AML) regulations. While it may seem cumbersome, it’s actually a positive sign of a legitimate broker adhering to proper financial protocols.

Funding Your Account

Payment Methods (Bank Transfer, E-Wallets, Cryptocurrencies)

Most binary options brokers offer multiple deposit methods, each with distinct advantages:

| Payment Method | Processing Time | Typical Fees | Advantages | Considerations |

|---|---|---|---|---|

| Credit/Debit Cards | Instant | 0-3% | Immediate funding, widespread availability | Some banks block transactions to trading sites |

| Bank Transfers | 1-5 business days | $10-30 fixed fee | Secure, higher limits | Slow processing time |

| E-wallets (Skrill, Neteller) | Instant | 0-2% | Fast, additional layer of privacy | May have conversion fees |

| Cryptocurrencies | 10 min – 1 hour | Network fees only | Pseudonymous, global access | Price volatility |

For first-time deposits, credit/debit cards and e-wallets are typically the most convenient options due to their immediate processing. Cryptocurrencies offer an alternative for traders in regions with restrictions on traditional payment methods.

Minimum Deposit Requirements

Minimum deposits vary significantly between brokers and account types:

- Entry-level accounts: $5-50 (Deriv, Quotex, IQ Option, CloseOption, Olymp Trade)

- Standard accounts: $100-250 (Pocket Option, Capitalcore)

- Premium accounts: $1,000-10,000+ (VIP tiers at most brokers)

As a beginner, it’s advisable to start with the minimum deposit requirement to test the platform with real money before committing larger amounts. As you gain experience and confidence, you can consider upgrading to accounts with additional features.

Think of your first binary options deposit like testing the waters at a new beach—start by dipping your toes in before diving headfirst. A smaller initial deposit lets you experience real trading emotions while limiting potential losses during your learning phase.

Placing Your First Trade

Choosing an Asset

For your initial trades, consider these factors when selecting which assets to trade:

- Familiarity: Choose assets you understand or follow regularly

- Volatility: Major forex pairs like EUR/USD typically have moderate, predictable volatility

- Liquidity: Higher liquidity means more stable price movements

- Trading hours: Ensure the asset is actively traded during your preferred trading time

- Payout rates: Different assets offer varying payout percentages

Popular starting assets for beginners include EUR/USD, GBP/USD, gold, and major stock indices like the S&P 500 due to their liquidity and wealth of available analysis.

Selecting the Expiry Time and Trade Size

Two critical parameters for any binary options trade are the expiry time and investment amount:

- Expiry time: How long until your prediction is evaluated

- For beginners, 15-30 minute expiries provide a good balance between time for analysis and quick feedback

- Extremely short expiries (under 5 minutes) can be more difficult to predict

- Match the expiry time to your analysis timeframe (e.g., 15-minute chart → 15-30 minute expiry)

- Trade size: How much you’re risking on the prediction

- Follow the 1-2% rule: Never risk more than 1-2% of your total account on a single trade

- For a $100 account, this means $1-2 per trade maximum

- Consistent position sizing is more important than occasional big wins

Understanding Expiry Times and Strike Prices

Expiry times and strike prices are fundamental concepts in binary options trading that every trader must thoroughly understand. The expiry time is the specific moment when the binary option contract ends and the outcome is determined. The strike price is the target price level against which the final price is compared at expiry to determine whether the trade is successful.

Binary options offer various expiry timeframes, ranging from extremely short (30 seconds) to much longer (days or weeks). Your choice of expiry time should align with your trading strategy and analysis timeframe:

- Short-term expiries (30 seconds to 5 minutes) – Suitable for scalpers and traders using quick momentum strategies

- Medium-term expiries (15 minutes to 1 hour) – Often used with technical indicator strategies and intraday trend following

- Long-term expiries (end of day or longer) – More appropriate for fundamental analysis and long-term trend trading

The strike price functions as the benchmark for determining whether your binary option expires in-the-money or out-of-the-money. If you purchase a call option and the asset’s price at expiry is above the strike price, your option expires in-the-money (profitable). Conversely, if you buy a put option and the price at expiry is below the strike price, your option also expires in-the-money. Understanding the relationship between current market price, strike price, and your prediction is critical for successful binary options trading.

Binary Options Trading Tips for Beginners

Binary options can be an appealing entry point into financial markets due to their relative simplicity compared to other trading instruments. However, beginners should approach this market with caution and follow these essential guidelines to build a solid foundation for trading success.

Start with a Demo Account

Before risking real capital, beginners should take full advantage of demo accounts offered by reputable brokers. These practice environments allow you to experience binary options trading in real market conditions without financial risk.

Importance of Learning Without Risk

Demo accounts serve multiple crucial purposes for new traders:

- Risk-free learning environment – Experiment with different strategies without the emotional pressure of losing money

- Platform familiarization – Become comfortable with the broker’s trading interface, features, and tools

- Strategy testing – Validate your trading approaches and refine them before using real capital

- Psychology development – Build the discipline and emotional control needed for successful trading

- Realistic expectations – Gain a better understanding of potential wins and losses

Most trading experts recommend spending at least one month on a demo account and achieving consistent profitability before transitioning to live trading. This patience can significantly improve your chances of long-term success.

Top Brokers Offering Demo Accounts

These leading brokers provide excellent demo account options for beginners:

| Broker | Demo Account Features | Virtual Balance | Time Restrictions |

|---|---|---|---|

| Pocket Option | Full platform access, all assets available | $10,000 | Unlimited duration |

| Quotex | Full platform access, tournament participation | $10,000 | Unlimited duration |

| IQ Option | All assets, indicators, and timeframes | $10,000 | Replenishable |

| Nadex | Full US-regulated platform experience | $25,000 | Practice account never expires |

Tip: When using a demo account, treat it as if you were trading with real money. Follow your strategy strictly and maintain proper risk management principles to develop good habits that will serve you when you transition to live trading.

Common Mistakes to Avoid

New binary options traders frequently fall into several predictable traps. Being aware of these common pitfalls can help you avoid them as you begin your trading journey.

Overtrading

Overtrading is perhaps the most prevalent mistake among binary options beginners. The fast-paced nature of binary options with short expiry times can create a casino-like environment that encourages excessive trading. This behavior typically manifests in several ways:

- Trading too frequently – Placing dozens of trades daily without sufficient analysis

- Increasing position sizes after losses – Attempting to “make back” losses with larger trades

- Trading during unfavorable market conditions – Forcing trades when clear opportunities don’t exist

- Ignoring trading plans – Abandoning predetermined strategies in favor of impulsive decisions

To combat overtrading, establish a strict daily trading limit (both in terms of number of trades and total capital risked), take regular breaks, and maintain a trading journal to track your behavior patterns.

Ignoring Market Trends

Many beginner traders fail to consider the broader market context when placing binary options trades. While short-term price movements can sometimes go against the prevailing trend, it’s generally more prudent to trade in the direction of the established market trend. Ignoring strong trends often leads to unnecessary losses.

Before placing any binary option trade, analyze the asset on multiple timeframes to identify the dominant trend. For example, if trading a 5-minute expiry option, examine both the 5-minute chart and the 15-minute or hourly chart to understand the larger context. Align your trades with the overall market direction whenever possible.

Think of the market trend as a powerful river current. You might be able to swim against it briefly, but you’ll make much faster progress by swimming with the flow. Similarly, trading against established market trends requires significantly more effort and carries higher risk than trading in the direction of the trend.

Falling for Unregulated Brokers Offering Unrealistic Returns

The binary options industry unfortunately attracts numerous fraudulent operators who promise extraordinary returns with minimal risk. These unregulated brokers often advertise “guaranteed strategies,” success rates above 90%, or automated systems that supposedly generate consistent profits.

In reality, binary options typically offer payouts of 70-85% on winning trades, with a complete loss on unsuccessful trades. This creates a natural mathematical disadvantage that makes consistent profitability challenging. Any broker promising returns significantly above industry standards should be viewed with extreme skepticism.

To protect yourself, only work with regulated brokers that have established reputations and verifiable licenses from recognized financial authorities. Research the broker thoroughly through independent reviews and regulatory databases before depositing funds.

Neglecting to Test Platforms via Demo Accounts

Some beginners rush into live trading without thoroughly testing the broker’s platform through a demo account. This is a critical oversight that can lead to costly mistakes. Each trading platform has unique features, interface elements, and execution processes that require familiarization.

By spending adequate time on a demo account, you can:

- Identify platform strengths and limitations

- Test how quickly orders are executed

- Practice using available technical analysis tools

- Ensure the platform functions properly across different devices

- Compare multiple platforms before committing to a single broker

Most reputable binary options brokers offer demo accounts with minimal or no registration requirements, making it easy to test their platforms before making a financial commitment.

Leverage and Risk Management

Understanding proper risk management principles is essential for long-term survival in binary options trading. Unlike some trading instruments, binary options don’t offer traditional leverage in terms of position sizing. However, their all-or-nothing nature creates an inherent leverage effect that requires careful management.

Setting a Budget and Limiting Losses

Effective risk management in binary options begins with establishing clear boundaries for your trading capital:

- Dedicated trading capital – Only trade with funds you can afford to lose completely

- Position sizing – Limit each trade to 1-5% of your total trading account

- Daily loss limits – Set a maximum daily loss threshold (e.g., 10-15% of account)

- Weekly loss limits – Implement broader loss limits over longer periods

- Stop trading triggers – Establish conditions that would cause you to pause trading and reassess

These boundaries protect you from catastrophic losses during inevitable losing streaks and help preserve your capital for future trading opportunities. Without strict risk management, even the best trading strategy will eventually fail due to variance and emotional decision-making.

Avoiding Over-Leveraging

While binary options don’t offer explicit leverage settings like forex or futures trading, their structure creates a form of built-in leverage. A typical binary option offers a 70-85% return on a winning trade but a 100% loss on unsuccessful trades. This asymmetric risk-reward profile means traders must win significantly more than 50% of their trades to be profitable.

To avoid the negative effects of this implicit leverage:

- Focus on high-probability setups with clear technical or fundamental justification

- Avoid “martingale” or doubling strategies that increase position sizes after losses

- Consider brokers that offer partial rebates on losing trades to improve overall risk-reward

- Trade fewer, higher-quality positions rather than numerous speculative ones

- Calculate required win rates based on payout percentages to understand profitability thresholds

Key Beginner Tips Summary

- Always begin with a demo account and master your strategy before risking real capital

- Avoid overtrading – quality of trades matters more than quantity

- Trade with the trend whenever possible to improve winning probabilities

- Use only regulated brokers with verifiable licenses and positive reputations

- Implement strict risk management – never risk more than 5% of capital on a single trade

- Be patient and focus on long-term profitability rather than quick returns

Risk Management and Trading Strategies for Binary Options

Success in binary options trading depends heavily on two critical elements: implementing robust risk management practices and employing effective trading strategies. This section explores essential approaches to both aspects.

Basic Risk Management Techniques

Risk management in binary options trading is fundamentally about capital preservation. Without proper risk controls, even the most profitable strategy will eventually fail due to drawdowns and volatility.

Setting a Budget and Limiting Losses

Every binary options trader should establish a clear trading budget separate from other financial obligations. This trading capital should be money you can afford to lose without affecting your lifestyle or financial stability. Within this budget, implement these risk management guidelines:

- Per-trade risk limit – Restrict each position to 1-5% of your total account balance

- Daily maximum loss – Set a limit of 10-15% of your account per day and stop trading if reached

- Weekly maximum drawdown – Establish a weekly loss limit of 20-25%, after which you take time to reassess

- Profit targets – Set realistic daily and weekly profit goals, after which you can consider stopping for the day

- Trading journal – Document all trades to identify patterns and maintain accountability to your risk rules

These boundaries are particularly important in binary options where the full amount risked is lost on unsuccessful trades. Unlike traditional trading where stop losses might capture some capital, binary options have no partial loss mechanism (except for brokers offering small rebates on losing trades).

Avoiding Overtrading

Overtrading is one of the most common ways traders deplete their accounts. The accessibility and short-term nature of binary options make this risk particularly acute. To prevent overtrading:

- Set daily trade limits – Restrict yourself to a specific number of trades per day

- Establish trading hours – Define specific hours for trading and avoid emotional “revenge trading” outside these times

- Focus on quality setups – Only execute trades that meet all criteria of your strategy

- Use trade checklists – Create a pre-trade checklist to ensure each position is justified

- Implement cooling-off periods – After a losing streak, take a mandatory break before resuming

Successful traders typically focus on fewer, high-quality trades rather than high-volume trading. Remember that commissions and the built-in broker edge mean that excessive trading typically benefits the broker, not the trader.

Popular Binary Options Strategies

While there are countless approaches to binary options trading, several strategies have proven particularly effective. The key is finding a method that matches your trading style, risk tolerance, and available time commitment.

Trend Following Strategy

Trend following is one of the most reliable approaches for binary options trading. This strategy is based on the principle that assets tend to continue moving in their current direction, and trading with the trend improves winning probability.

To implement a basic trend following strategy:

- Identify the trend – Use moving averages (such as the 20-period and 50-period) to determine the overall direction. When shorter-term moving averages are above longer-term ones, an uptrend is in place.

- Wait for pullbacks – Rather than entering at any point in a trend, wait for temporary retracements against the trend.

- Confirm with momentum indicators – Use tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm the trend is likely to continue.

- Place appropriate options – Buy call options during uptrends and put options during downtrends.

- Choose suitable expiry times – Select expiry times that align with your analysis timeframe (e.g., 15-30 minute expiries for trades based on 5-minute charts).

Trend following works best in markets with clear directional movement and is less effective during ranging or highly volatile conditions.

Example of a trend following setup using moving averages and RSI indicator

Reversal Patterns

Reversal patterns aim to identify potential turning points in the market where the price direction is likely to change. These patterns can be particularly profitable for binary options traders who correctly time market reversals.

Key reversal patterns to watch for include:

- Double tops and double bottoms – When price tests the same support/resistance level twice and fails to break through

- Head and shoulders – A three-peak formation signaling a potential trend reversal

- Bullish/bearish engulfing candles – When one price candle completely “engulfs” the previous one, suggesting a shift in momentum

- Divergence – When price makes new highs/lows but technical indicators don’t confirm, suggesting weakening momentum

- Pin bars – Candlestick patterns showing rejection of certain price levels, indicating potential reversals

When trading reversals, it’s important to wait for confirmation before entering trades. Many apparent reversal signals fail, so look for multiple indicators aligning before placing a binary options trade based on reversal patterns.

Price Action Trading

Price action trading involves analyzing the market based on price movements alone, without relying heavily on indicators. This pure approach to market analysis focuses on candlestick patterns, support and resistance levels, and raw price behavior.

Core elements of price action trading for binary options include:

- Support and resistance identification – Recognizing levels where price has historically reversed

- Candlestick patterns – Interpreting patterns like doji, hammers, shooting stars, and engulfing patterns

- Price channels – Trading bounces between established upper and lower boundaries

- Break and retest – Entering after price breaks a level and returns to test it from the opposite side

- Multiple timeframe analysis – Confirming signals across different chart timeframes

Price action trading requires more experience to master than indicator-based approaches but often produces cleaner signals with less lag. For binary options with very short expiry times, this reduced lag can be particularly valuable.

Hedging Strategy for Risk Mitigation

Hedging in binary options involves opening multiple positions to protect against adverse price movements. While hedging reduces potential profits, it also limits losses during uncertain market conditions.

Common hedging approaches for binary options include:

- Simultaneous contracts – Purchasing both call and put options with different strike prices or expiry times

- Correlated assets – Opening opposite positions on positively correlated assets

- Time-based hedging – Taking opposing positions with different expiration times

- Partial hedging – Protecting a portion of your exposure while maintaining some directional bias

For example, if you’ve purchased a call option on EUR/USD but new economic data creates uncertainty, you might hedge by purchasing a put option with a longer expiry time. If the market initially drops but later rises, both options could potentially end in-the-money.

Think of hedging like taking out insurance on your binary options positions. Just as you might pay for insurance on valuable possessions, hedging involves accepting a smaller guaranteed cost to protect against potentially larger losses.

Common Mistakes to Avoid

Even with solid strategies and risk management principles, binary options traders can fall prey to several common pitfalls that undermine their success.

Over-Leveraging

The fixed payout structure of binary options creates an inherent leverage effect. For example, if a broker offers 80% payouts on winning trades but 100% loss on unsuccessful ones, you need a win rate significantly above 50% to remain profitable. This built-in disadvantage is similar to the effect of excessive leverage.

To avoid over-leveraging in binary options:

- Calculate your required win rate based on payout percentages

- Only trade when you identify high-probability setups

- Consider brokers that offer rebates on losing trades to improve the overall risk-reward ratio

- Never increase position sizes to “make back” previous losses

- Be especially cautious with short expiry times where outcomes are more random

Ignoring Market News and Data

Technical analysis alone is insufficient for consistent binary options trading success. Major economic announcements, corporate earnings reports, and geopolitical events can cause sudden price movements that override technical patterns.

To incorporate fundamental analysis into your trading:

- Maintain an economic calendar and avoid trading around major announcements unless specifically using a news trading strategy

- Be aware of earnings releases when trading stock-based binary options

- Monitor central bank statements which significantly impact currency pairs

- Adjust position sizing during periods of increased fundamental uncertainty

- Consider longer expiry times when market-moving news is anticipated

The most successful binary options traders combine technical analysis for timing with fundamental awareness for overall market context.

Understanding Binary Options Regulation

The regulatory landscape for binary options varies dramatically across different jurisdictions. Understanding these regulations is critical not only for legal compliance but also for protecting your trading capital from potential fraud.

Why Regulation Matters

Regulation provides essential protections and benefits for binary options traders. Choosing regulated brokers significantly reduces the risks associated with this financial instrument.

Protection from Scams

The binary options industry has unfortunately attracted numerous fraudulent operators. Regulatory oversight helps eliminate or minimize these risks through:

- Operational requirements – Regulated brokers must maintain specific business standards and ethical practices

- Financial audits – Regular examination of broker finances ensures they maintain adequate capital

- Anti-fraud measures – Regulatory bodies actively investigate complaints and suspicious activities

- Licensing procedures – Operators must meet stringent requirements to obtain and maintain licenses

- Penalties for violations – Significant fines and license revocation for non-compliant brokers

Traders who choose unregulated brokers have little or no recourse if the operator engages in manipulative practices, refuses withdrawals, or simply disappears with client funds.

Trusted Regulatory Bodies (CySEC, FCA, CFTC, etc.)

Several financial authorities around the world regulate binary options or the brokers that offer them. The most respected regulators include:

| Regulatory Body | Jurisdiction | Status of Binary Options | Notable Features |

|---|---|---|---|

| Commodity Futures Trading Commission (CFTC) | United States | Only allowed on CFTC-registered exchanges (e.g., Nadex) | Strong investor protection, strict enforcement |

| Financial Conduct Authority (FCA) | United Kingdom | Banned for retail investors since 2019 | Comprehensive investor protection framework |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulated but with ESMA restrictions | Passport rights throughout EU, investor compensation fund |

| Australian Securities and Investments Commission (ASIC) | Australia | Banned for retail clients since 2021 | Strong enforcement powers, client money protection |

| Financial Services Authority (FSA) | Seychelles, Vanuatu, etc. | Permitted with various restrictions | Less stringent requirements, popular for offshore brokers |

When evaluating a binary options broker, verify their regulatory status through the regulator’s official website rather than trusting the broker’s claims. Many fraudulent brokers falsely claim regulation or display fake certificates.

Enhanced Security for Funds

Regulated binary options brokers typically must implement specific security measures to protect client funds:

- Segregated accounts – Client funds must be kept separate from the broker’s operational capital

- Minimum capital requirements – Brokers must maintain substantial operating capital

- Compensation schemes – Many jurisdictions provide partial compensation if a regulated broker fails

- Insurance protection – Some regulators require additional insurance coverage

- Regular financial audits – Ongoing verification of broker solvency and compliance

These protections significantly reduce the risk of capital loss due to broker insolvency or misconduct.

Transparent Fee Structures

Regulation typically requires brokers to maintain transparent and fair fee structures. This includes:

- Clear disclosure of all trading costs

- Reasonable withdrawal policies and fees

- Transparent pricing models for binary options contracts

- Fair execution policies without manipulation

- Limitations on certain promotional offers that might encourage irresponsible trading

Unregulated brokers often hide fees, manipulate pricing at expiry, or implement predatory policies that make it difficult to withdraw profits.

Countries with Binary Options Restrictions

The regulatory landscape for binary options has become increasingly restrictive in recent years, with many countries implementing partial or complete bans:

- European Union – The European Securities and Markets Authority (ESMA) implemented a ban on binary options marketing, distribution, and sale to retail investors in 2018

- United Kingdom – The FCA permanently banned the sale of binary options to retail consumers in 2019

- Australia – ASIC banned binary options for retail clients in 2021

- Canada – Various provincial regulators have issued warnings or bans against unauthorized binary options trading

- Israel – Banned binary options entirely, including prohibiting Israeli companies from offering these products internationally

- Japan – Strictly regulates binary options through the Financial Services Agency with specific trading parameters

- United States – Only allows binary options trading through CFTC-registered exchanges like Nadex

These restrictions have significantly changed the binary options industry, shifting much of the market to offshore jurisdictions with lighter regulation.

How Regulation Affects Your Choice of Broker

The regulatory status of a binary options broker should be a primary consideration when choosing where to trade. Consider these factors:

- Your location – Determine if binary options are legal for retail traders in your country

- Regulatory jurisdiction – Brokers regulated in major financial centers typically provide better protection

- Verification process – Legitimate regulated brokers require thorough KYC (Know Your Customer) procedures

- Deposit protection – Understand what happens to your funds if the broker becomes insolvent

- Dispute resolution – Research how complaints against the broker are handled

Important: Always verify a broker’s regulatory status directly through the regulator’s website. Many fraudulent operations falsely claim regulation or display outdated licenses. The main regulatory websites provide searchable registers of licensed brokers.

Is Binary Options Trading Legal Worldwide?

The legality of binary options varies significantly across jurisdictions, creating a complex global landscape for traders:

- Fully legal with regulation – Countries like Japan have established clear regulatory frameworks

- Legal with restrictions – The United States allows binary options only on registered exchanges

- Banned for retail investors – The EU, UK, Australia and others prohibit retail binary options trading

- Legal gray areas – Many jurisdictions haven’t explicitly addressed binary options in regulations

- Complete bans – Some countries have outlawed all forms of binary options trading

Even where binary options are restricted, the regulations typically apply to brokers operating within that jurisdiction rather than individual traders. However, trading with unauthorized brokers may still violate local laws and leaves traders without regulatory protection.

Before trading binary options, research the specific regulations in your country and consult a financial professional if you’re uncertain about compliance requirements.

Advanced Binary Options Trading Techniques

Once traders master the fundamentals of binary options, they can explore more sophisticated approaches to improve profitability. Advanced techniques require deeper market understanding but can produce more consistent results.

Hedging Strategies

Hedging involves taking multiple positions to protect against adverse market movements, effectively reducing risk at the cost of potential profit.

What is Hedging?

In the context of binary options, hedging refers to strategic position-taking that offsets potential losses from other positions. Unlike traditional hedging where positions might partially offset each other, binary options hedging typically involves complete positions in opposing directions.

The primary goals of hedging include:

- Protecting profits from unexpected market reversals

- Reducing exposure during high-volatility events

- Creating “insurance” against uncertain market conditions

- Managing risk when conflicting signals appear

- Capitalizing on unusual market conditions or pricing inefficiencies

Implementing Hedging in Binary Options

Several effective hedging strategies can be implemented with binary options:

- Straddle strategy – Taking both call and put positions on the same asset with the same expiry time. This works best when you anticipate significant movement but are uncertain about direction, such as before major economic announcements.

- Time-based hedging – Opening opposing positions with different expiry times. For example, buying a put option with a short expiry and a call option with a longer expiry when you expect short-term weakness followed by a longer-term reversal.

- Asset correlation hedging – Opening positions on correlated assets in opposite directions. For instance, if you have a call option on EUR/USD, you might hedge with a put option on GBP/USD, which often moves similarly.

- Partial hedging – Rather than fully hedging your position, protecting only a portion of your exposure to maintain some directional bias while reducing overall risk.

Consider hedging like diversification in investing—you’re sacrificing some potential return to reduce your risk exposure. Just as you wouldn’t put all your investment capital into a single stock, hedging helps protect your trading capital from being overly exposed to a single market movement.

Effective hedging requires careful calculation of potential outcomes to ensure the strategy makes mathematical sense. Because binary options have fixed payouts, it’s sometimes possible to create hedged positions that guarantee profit regardless of market direction—though brokers typically structure their offerings to minimize such opportunities.

Utilizing Technical Indicators

Advanced binary options traders leverage sophisticated technical indicators to identify high-probability trading opportunities with clearer entry and exit signals.

Moving Averages

Moving averages (MAs) are among the most versatile technical indicators for binary options trading. These tools smooth out price action to reveal underlying trends and provide potential support and resistance levels.

Advanced applications of moving averages include:

- Multiple timeframe analysis – Using MAs across different timeframes to confirm trends