Discover the ultimate guide to copy trading forex brokers in 2025. From eToro’s CopyTrader to advanced MetaTrader signals, we’ve tested and ranked the top platforms to help you make informed decisions and maximize your trading potential.

Key Takeaways

- eToro leads with the most user-friendly CopyTrader interface and largest social trading community with over 30 million users worldwide

- Regulatory compliance is crucial—prioritize brokers regulated by FCA, ASIC, CySEC, or NFA with proper licensing and investor protection schemes

- Platform diversity matters: Pepperstone offers MetaTrader signals while IC Markets provides cTrader Copy integration

- Fee structures vary significantly—eToro charges spreads only, while some platforms add performance fees ranging from 15-30% of profits

- Demo accounts are essential for testing copy trading strategies before risking real capital, available on all top-rated platforms

Introduction to Copy Trading in Forex

What is Copy Trading?

Copy trading is a revolutionary investment strategy that allows you to automatically replicate the trades of experienced and successful forex traders. Think of it as having a professional trader manage your account—but instead of handing over complete control, you’re essentially “mirroring” their trading decisions in real-time.

Here’s a simple analogy: Imagine you’re at a farmers’ market and there’s a local expert who always knows which vendors have the freshest produce. Instead of wandering around blindly, you simply follow their lead and buy from the same stalls. Copy trading works similarly—you identify successful traders and automatically copy their “purchases” (trades) in the forex market.

The beauty of copy trading lies in its simplicity and accessibility. You don’t need years of market analysis experience or deep technical knowledge about currency pairs, economic indicators, or chart patterns. Instead, you leverage the expertise of seasoned professionals who’ve already put in the hard work of learning the markets.

How Copy Trading Works in Forex Markets

The mechanics behind copy trading are surprisingly straightforward, though the technology that makes it possible is quite sophisticated. Here’s how the process unfolds:

Signal Generation: When a professional trader (often called a “signal provider” or “strategy manager”) executes a trade on their account, the copy trading platform automatically detects this action. Whether they’re buying EUR/USD, shorting GBP/JPY, or placing a pending order on gold, the system captures every detail.

Trade Replication: Within milliseconds, the platform calculates the proportional trade size for your account based on your available balance and risk settings. If the signal provider risks 2% of their account on a trade, the system will automatically size your trade to risk the same percentage (or whatever percentage you’ve pre-configured).

Automatic Execution: Your broker receives the trade instruction and executes it on your behalf. This happens without any manual intervention—you could be sleeping, working, or on vacation, and the trades still get copied to your account.

The entire process typically takes less than a second from the moment the original trade is placed to when it appears in your account. This speed is crucial in forex markets where prices can move rapidly, and a few seconds’ delay could mean the difference between profit and loss.

Benefits of Copy Trading for Beginners and Experienced Traders

For Beginners: Copy trading serves as an excellent entry point into forex markets. Instead of spending months or years learning technical analysis, fundamental analysis, and risk management, beginners can start generating potential returns immediately by following proven traders. It’s like having a mentor whose every move you can observe and learn from.

The educational aspect shouldn’t be underestimated. By watching how successful traders react to different market conditions—when they enter trades, how they manage risk, and when they exit positions—beginners naturally absorb trading wisdom that would otherwise take years to develop.

For Experienced Traders: Even seasoned traders find copy trading valuable for diversification and time management. You might specialize in EUR/USD day trading but want exposure to exotic currency pairs or different trading styles. By copying a specialist in these areas, you can diversify your strategies without having to become an expert in every niche.

Copy trading also allows experienced traders to explore new markets or time zones. If you’re based in New York but want to capitalize on Asian session volatility, you can copy a successful trader based in Singapore who specializes in that market session.

Advantages and Disadvantages of Copy Trading

Advantages and Disadvantages of Copy Trading

Pros of Copy Trading

- Immediate Market Access: Start trading professionally managed strategies from day one, without years of learning curves

- Time Efficiency: No need to spend hours analyzing charts, reading economic reports, or monitoring market news

- Learning Opportunities: Observe and learn from experienced traders’ decision-making processes in real-time

- Diversification: Copy multiple traders with different strategies, time frames, and currency pair specializations

- Emotional Discipline: Automated execution removes emotional decision-making that often leads to trading mistakes

- 24/7 Market Coverage: Professional traders can monitor markets around the clock, ensuring you don’t miss opportunities

Cons of Copy Trading

- Lack of Control: You’re dependent on another trader’s decisions, which may not always align with your risk tolerance or market outlook

- Performance Risk: Even successful traders can experience losing streaks or changes in performance over time

- Platform Dependency: Technical issues, delays, or platform failures can impact trade execution

- Limited Learning: While you can observe trades, you may not understand the reasoning behind each decision

- Fees and Costs: Many platforms charge performance fees or higher spreads, which can eat into profits

- Overconfidence Risk: Early success might lead to overconfidence and inadequate due diligence when selecting traders to copy

Important Consideration: According to recent studies by financial regulators, approximately 60-80% of retail forex traders lose money. While copy trading can improve your odds by following successful traders, it doesn’t eliminate the inherent risks of forex trading. Always ensure you understand these risks and only invest money you can afford to lose.

Best Copy Trading Forex Brokers

eToro – Best Overall for Social Trading and Copy Trading

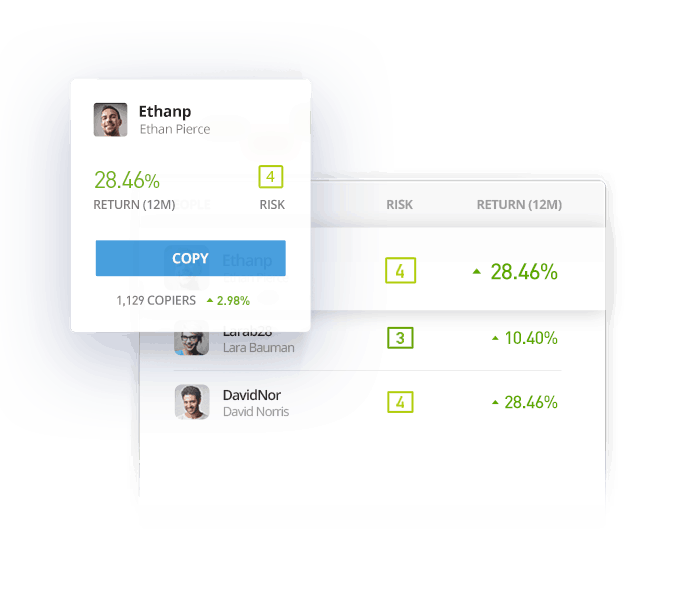

eToro has revolutionized the concept of social trading and stands as the undisputed leader in the copy trading space. With over 30 million registered users worldwide and operations since 2007, eToro has built the most comprehensive social trading ecosystem in the industry.

Key Features

eToro’s platform combines traditional trading with social networking elements, creating an environment where traders can interact, share strategies, and learn from each other. The platform offers access to over 2,300 tradeable instruments, including 47 currency pairs, cryptocurrencies, stocks, commodities, and ETFs.

The standout feature is the comprehensive trader profiles that display detailed statistics, including win rates, average profit per trade, risk scores, and complete trading history. This transparency allows copiers to make informed decisions about which traders to follow.

Copy Trading Tools

eToro’s CopyTrader system is remarkably sophisticated yet user-friendly. The platform uses advanced algorithms to automatically proportionally size trades based on your account balance and the signal provider’s position sizing. You can set maximum trade amounts, stop-loss limits for the entire copy relationship, and even pause copying during high-volatility periods.

Features of eToro’s CopyTrader

- Smart Portfolios: Pre-built portfolios of top traders organized by themes like “Crypto,” “Tech Stocks,” or “Conservative Traders”

- Risk Management: Built-in stop-loss functionality, maximum daily loss limits, and position size controls

- Performance Analytics: Real-time performance tracking with detailed profit/loss statements and risk metrics

- Social Features: Follow, comment, and interact with traders before deciding to copy them

- Mobile Integration: Full copy trading functionality available on iOS and Android apps

Fees and Commissions

eToro operates on a spread-only model for forex trading, with no additional commissions for copy trading. Spreads are competitive but not the tightest in the industry—EUR/USD typically ranges from 1-3 pips depending on market conditions and account type.

| Aspect | Details |

|---|---|

| Minimum Deposit | $200 (varies by country) |

| Copy Trading Fee | No additional fees |

| EUR/USD Spread | 1-3 pips |

| Withdrawal Fee | $5 per withdrawal |

| Inactivity Fee | $10/month after 12 months |

How to Start Copy Trading with eToro

- Account Creation: Register for a free eToro account and complete identity verification

- Fund Your Account: Deposit a minimum of $200 using various payment methods

- Explore Traders: Use the CopyTrader feature to browse and analyze potential traders to follow

- Select Traders: Choose traders based on performance history, risk level, and trading strategy

- Set Parameters: Configure your copy amount, stop-loss settings, and risk management rules

- Monitor Performance: Track your copied trades and adjust settings as needed

Pros and Cons

Pros:

- Largest copy trading community with extensive trader selection

- User-friendly interface suitable for beginners

- Comprehensive risk management tools

- No additional copy trading fees

- Strong regulatory compliance (FCA, CySEC, ASIC)

Cons:

- Spreads are wider than specialized forex brokers

- Limited advanced charting and analysis tools

- Withdrawal fees can add up over time

- Platform can be overwhelming for beginners due to social features

AvaTrade – Best for DupliTrade and AvaSocial

AvaTrade has established itself as a premier destination for copy trading by offering multiple integrated platforms rather than relying on a single solution. Founded in 2006 and regulated by multiple tier-one authorities, AvaTrade provides access to both proprietary and third-party copy trading solutions.

ZuluTrade Integration

AvaTrade’s partnership with ZuluTrade provides access to one of the world’s largest networks of signal providers. ZuluTrade’s platform features over 100,000 signal providers trading various strategies across multiple time frames and risk levels.

The ZuluTrade integration offers advanced analytics and risk management tools, including ZuluGuard™ protection that automatically pauses copying when a signal provider’s behavior deviates from their historical patterns. This feature has helped protect copiers from significant losses during periods of erratic trading behavior.

DupliTrade Functionality

DupliTrade represents AvaTrade’s premium copy trading solution, focusing on institutional-grade signal providers and advanced risk management. The platform emphasizes quality over quantity, featuring carefully vetted traders with proven track records.

Key DupliTrade features include real-time trade copying with minimal latency, customizable risk parameters, and detailed performance analytics. The platform also offers reverse trading capabilities, allowing users to automatically take opposite positions to selected signal providers—useful for hedging strategies or when you believe a trader’s strategy has become outdated.

Features of AvaTrade’s Copy Trading Platforms

- Multi-Platform Access: Choose between ZuluTrade, DupliTrade, and AvaSocial based on your needs

- Risk Management Suite: Advanced stop-loss options, maximum drawdown limits, and automated position sizing

- Performance Analytics: Comprehensive statistics including Sharpe ratios, maximum drawdown periods, and monthly returns

- Educational Resources: Extensive library of copy trading tutorials and market analysis

- Demo Accounts: Practice copy trading with virtual funds before committing real capital

Minimum Deposit and Account Types

AvaTrade offers flexible account options to accommodate different trader profiles and capital levels. The standard account requires a minimum deposit of $100, making it accessible to beginners, while premium accounts with enhanced features require higher minimums.

| Account Type | Minimum Deposit | Copy Trading Platforms | Special Features |

|---|---|---|---|

| Standard | $100 | ZuluTrade, AvaSocial | Basic copy trading features |

| Premium | $2,000 | All platforms | Dedicated support, advanced analytics |

| VIP | $10,000 | All platforms + custom solutions | Personal account manager, custom strategies |

AvaTrade vs. Competitors for Copy Trading

AvaTrade’s strength lies in its platform diversity and regulatory compliance. While eToro dominates in user-friendly social trading, AvaTrade excels in providing professional-grade tools and multiple platform options. The ability to switch between different copy trading ecosystems within the same brokerage account is unique in the industry.

Compared to single-platform brokers, AvaTrade’s approach allows traders to diversify their copy trading strategies across different signal provider networks, potentially reducing correlation risk and improving overall performance consistency.

Pros and Cons

Pros:

- Multiple copy trading platforms under one broker

- Strong regulatory oversight (FCA, ASIC, CBI, FSA)

- Professional-grade risk management tools

- Competitive spreads and low commissions

- Comprehensive educational resources

Cons:

- Platform complexity may overwhelm beginners

- Higher minimum deposits for premium features

- Limited social trading features compared to eToro

- Some copy trading platforms charge additional fees

Pepperstone – Best for MetaTrader Signals

Pepperstone has carved out a unique position in the copy trading space by focusing on MetaTrader integration and institutional-grade execution. Founded in 2010 in Australia, Pepperstone has grown to become one of the world’s largest forex brokers, with a particular strength in providing low-latency trade execution that’s crucial for successful copy trading.

Overview of Copy Trading on Pepperstone

Pepperstone’s copy trading ecosystem centers around three main platforms: MetaTrader Signals, CopyTrading by Pepperstone, and Signal Start. This multi-platform approach allows traders to choose the solution that best fits their experience level and trading preferences.

The MetaTrader Signals integration is particularly noteworthy because it taps into the world’s largest network of trading signals, with over 100,000 signal providers across all asset classes. This massive selection means traders can find specialists for virtually any trading style, from scalping to long-term position trading.

Key Features and Platform Support

Pepperstone’s copy trading solutions are built around the MetaTrader 4 and MetaTrader 5 platforms, which are widely regarded as the industry standard for professional forex trading. This foundation provides superior charting capabilities, expert advisor (EA) support, and advanced order management features.

The CopyTrading by Pepperstone platform offers a more streamlined experience with web-based access and mobile apps. Signal providers are carefully vetted and ranked based on performance metrics, risk scores, and consistency measures. The platform provides detailed analytics including profit factors, Sharpe ratios, and maximum drawdown statistics.

- Institutional Execution: Sub-second trade copying with minimal slippage thanks to tier-1 liquidity providers

- Advanced Analytics: Professional-grade performance metrics and risk analysis tools

- Platform Flexibility: Choose between MT4/MT5 signals or web-based copy trading solutions

- Global Signal Network: Access to signal providers from around the world trading different sessions

- Risk Management: Sophisticated position sizing algorithms and drawdown protection

Trading Costs on Pepperstone

Pepperstone operates two main account types: Razor accounts with raw spreads plus commission, and Standard accounts with wider spreads but no commission. For copy trading, both account types are viable, though the choice depends on your trading frequency and copied strategies.

| Account Type | EUR/USD Spread | Commission | Minimum Deposit |

|---|---|---|---|

| Standard | 1.0 pips | None | $200 |

| Razor | 0.0 pips | $3.50 per lot | $200 |

For active copy trading strategies that generate multiple trades per day, the Razor account often provides better overall costs despite the commission structure. The raw spreads can be significantly lower than standard accounts, especially during active trading hours.

Pros and Cons

Pros:

- Exceptional trade execution speed and quality

- Access to the largest network of MetaTrader signals

- Professional-grade platforms and tools

- Competitive spreads and transparent pricing

- Strong regulatory compliance (FCA, ASIC, CySEC, DFSA)

Cons:

- Less user-friendly for complete beginners

- Limited social trading features

- Requires familiarity with MetaTrader platforms

- Signal quality varies significantly across providers

FXTM – Best for Copying Expert Traders

FXTM (ForexTime) has built a reputation for excellence in copy trading through its proprietary FXTM Invest platform. Established in 2011, FXTM has focused on creating a curated environment where only proven, experienced traders can become signal providers, ensuring higher-quality trading strategies for followers.

Key Features

FXTM Invest stands out for its rigorous trader selection process and comprehensive risk management framework. Unlike platforms that allow any trader to become a signal provider, FXTM requires potential strategy managers to meet strict criteria including minimum track record requirements, consistent profitability, and risk management standards.

The platform offers transparent performance metrics and detailed trader profiles that include complete trading history, risk scores, and even personality assessments to help copiers understand the trader’s approach to markets. This psychological profiling is unique in the industry and helps copiers select traders whose risk tolerance aligns with their own.

FXTM’s copy trading system automatically adjusts position sizes based on account equity and risk settings, ensuring that copied trades maintain appropriate risk levels regardless of account size differences between the signal provider and follower.

Pros and Cons

Pros:

- Rigorous trader vetting process ensures quality signal providers

- Comprehensive risk management tools and safeguards

- Transparent performance reporting and analytics

- User-friendly platform suitable for beginners

- Strong regulatory oversight (FCA, CySEC, FSCA)

- Educational resources and market analysis

Cons:

- Limited number of signal providers compared to larger platforms

- Higher minimum investment requirements for some strategies

- Platform availability restricted in some jurisdictions

- Less social interaction features compared to eToro

XM – Best for Signal Providers and Community

XM Group has created one of the most attractive ecosystems for both signal providers and followers through their comprehensive copy trading program. Founded in 2009, XM has grown to serve over 5 million clients worldwide, with copy trading being a significant driver of their success.

MetaTrader Suite for Copy Trading

XM’s copy trading solution is built entirely around the MetaTrader ecosystem, leveraging both MT4 and MT5 platforms. This integration provides seamless access to thousands of signal providers while maintaining the advanced charting and analysis capabilities that professional traders require.

The platform supports multiple signal subscriptions simultaneously, allowing traders to diversify across different signal providers and strategies. XM’s execution infrastructure ensures minimal latency between signal generation and trade execution, which is crucial for strategies that rely on precise timing.

XM’s Copy Trading Features and Strategies

- Diverse Strategy Selection: Access to scalping, swing trading, news trading, and algorithmic strategies

- Real-Time Execution: Trades copied within milliseconds with minimal slippage

- Flexible Position Sizing: Customizable risk management with position size limits and stop-loss controls

- Performance Tracking: Detailed analytics and reporting for all copied strategies

- Mobile Access: Full copy trading functionality on iOS and Android platforms

Incentives for Signal Providers

XM offers one of the most generous compensation structures for signal providers in the industry, with profit sharing rates up to 50%. This attractive rate helps attract high-quality traders to the platform, ultimately benefiting followers with better strategy selection.

Signal providers also receive detailed analytics about their followers, including subscriber growth rates, total capital following their signals, and performance feedback. This transparency helps providers optimize their strategies and communication with followers.

Trading Conditions on XM for Copy Trading

| Feature | Details |

|---|---|

| Minimum Deposit | $5 |

| Maximum Leverage | 1:1000 |

| EUR/USD Spread | 1.6 pips (Standard) |

| Signal Provider Commission | Up to 50% |

| Copy Trading Fee | None (spreads only) |

Pros and Cons

Pros:

- Very low minimum deposit requirement ($5)

- High leverage options for experienced traders

- Generous signal provider compensation attracts quality traders

- Strong MetaTrader integration with advanced features

- Multiple regulatory licenses (FCA, ASIC, CySEC)

Cons:

- Spreads are wider than some specialized forex brokers

- Platform complexity may challenge beginners

- Limited social trading features

- High leverage can amplify losses

IC Markets – Best for ECN Trading and Copy Trading

IC Markets has established itself as the go-to broker for traders seeking institutional-grade execution combined with comprehensive copy trading solutions. As one of the world’s largest forex brokers by volume, IC Markets offers unparalleled liquidity and execution speed that’s crucial for effective copy trading.

Features and Fees

IC Markets operates on a true ECN (Electronic Communication Network) model, providing direct market access with no dealing desk intervention. This structure ensures that copied trades are executed at the best available market prices with minimal slippage, regardless of trade size or market conditions.

The broker offers two main account types: Raw Spread accounts with commission-based pricing and Standard accounts with wider spreads but no commissions. For copy trading, the Raw Spread account typically provides better overall costs, especially for active strategies.

Copy Trading Features and Platforms

IC Markets integrates multiple copy trading solutions including cTrader Copy, ZuluTrade, and their proprietary IC Social platform. This diversity allows traders to choose the platform that best matches their experience level and trading preferences.

- cTrader Copy: Advanced algorithmic copy trading with sophisticated risk management

- ZuluTrade Integration: Access to thousands of signal providers with comprehensive analytics

- IC Social: Mobile-first social trading platform with community features

- MetaTrader Signals: Support for MT4 and MT5 signal services

Trading Fees and Minimum Deposits

| Account Type | Minimum Deposit | EUR/USD Spread | Commission |

|---|---|---|---|

| Standard | $200 | 1.0 pips | None |

| Raw Spread | $200 | 0.0 pips | $3.00 per lot |

| cTrader | $200 | 0.0 pips | $3.00 per lot |

Pros and Cons

Pros:

- True ECN execution with institutional-grade liquidity

- Multiple copy trading platforms and solutions

- Extremely competitive spreads and low commissions

- Advanced cTrader platform with sophisticated tools

- Strong regulatory compliance (ASIC, CySEC, FSA)

Cons:

- Platform complexity may overwhelm beginners

- Limited educational resources for copy trading

- Requires technical knowledge for optimal use

- Customer support primarily during business hours

Additional Top Copy Trading Brokers

NAGA – Innovative Social Trading Platform

NAGA has created a unique ecosystem that combines traditional copy trading with social networking features, creating a more engaging and educational experience for users. The platform’s Autocopy feature allows for sophisticated strategy copying with advanced risk management tools.

Key Features: Social trading feed, trader profiles with detailed statistics, mobile-first design, cryptocurrency integration, and educational content.

Minimum Deposit: €250

Regulation: CySEC

Open Your NAGA AccountHFM – Comprehensive Copy Trading Tools

HFM (formerly HotForex) offers a well-rounded copy trading platform with emphasis on transparency and risk management. The platform features detailed trader analytics and flexible copying parameters that appeal to both beginners and experienced traders.

Key Features: HF Copy platform, detailed performance metrics, risk scoring system, and educational resources.

Minimum Deposit: $50

Regulation: FCA, CySEC, FSCA

Open Your HFM AccountVantage – Multi-Platform Copy Trading

Vantage Markets provides access to multiple copy trading platforms including ZuluTrade, DupliTrade, and Myfxbook AutoTrade, giving traders unprecedented choice in copy trading solutions.

Key Features: Multiple platform access, competitive spreads, professional execution, and comprehensive trader analytics.

Minimum Deposit: $50

Regulation: ASIC, VFSC

Open Your Vantage AccountRoboForex – Low-Cost Copy Trading

RoboForex’s CopyFX platform focuses on providing low-cost copy trading solutions with no additional fees beyond standard spreads. The platform offers a wide selection of signal providers and sophisticated risk management tools.

Key Features: CopyFX platform, no additional copying fees, diverse strategy selection, and advanced analytics.

Minimum Deposit: $10

Regulation: CySEC, FSCA

Open Your RoboForex AccountComprehensive Broker Comparison Table

To help you make an informed decision, here’s a detailed comparison of the top copy trading forex brokers based on key factors that matter most to traders:

| Broker | Regulation | Min Deposit | Copy Trading Platform | EUR/USD Spread | Copy Fee | Best For |

|---|---|---|---|---|---|---|

| eToro | FCA, CySEC, ASIC | $200 | CopyTrader | 1-3 pips | None | Beginners, Social Trading |

| AvaTrade | FCA, ASIC, CBI | $100 | ZuluTrade, DupliTrade | 1.5 pips | Platform dependent | Platform Diversity |

| Pepperstone | FCA, ASIC, CySEC | $200 | MT4/MT5 Signals | 1.0 pips | Signal dependent | MetaTrader Users |

| FXTM | FCA, CySEC, FSCA | $200 | FXTM Invest | 1.3 pips | Performance based | Expert Traders |

| XM | FCA, ASIC, CySEC | $5 | MT4/MT5 Signals | 1.6 pips | None | Low Capital, High Leverage |

| IC Markets | ASIC, CySEC, FSA | $200 | cTrader Copy, ZuluTrade | 0.1 pips* | Commission based | ECN Trading |

| NAGA | CySEC | €250 | Autocopy | 1.2 pips | None | Social Features |

| HFM | FCA, CySEC, FSCA | $50 | HF Copy | 1.8 pips | Performance based | Comprehensive Tools |

| Vantage | ASIC, VFSC | $50 | ZuluTrade, Myfxbook | 1.4 pips | Platform dependent | Platform Variety |

| RoboForex | CySEC, FSCA | $10 | CopyFX | 1.7 pips | None | Low Fees |

*Raw spread account with commission

Factors to Consider When Choosing a Copy Trading Forex Broker

Regulation and Security

Regulatory compliance should be your top priority when selecting a copy trading broker. The forex industry has seen its share of unregulated operators and fraudulent schemes, making regulatory oversight crucial for protecting your capital.

Tier-1 Regulators to Look For:

- FCA (UK): Financial Conduct Authority – Known for strict oversight and comprehensive investor protection

- ASIC (Australia): Australian Securities and Investments Commission – Strong regulatory framework with compensation schemes

- CySEC (Cyprus): Cyprus Securities and Exchange Commission – EU-wide regulatory recognition with investor protection

- NFA/CFTC (USA): National Futures Association/Commodity Futures Trading Commission – Strict oversight for US clients

- BaFin (Germany): Federal Financial Supervisory Authority – Conservative approach with strong consumer protection

Recent regulatory developments in 2024 have strengthened oversight of copy trading platforms. The FCA has issued new guidance requiring clearer disclosure of risks and performance statistics, while ASIC has implemented stricter licensing requirements for platforms offering copy trading services.

Always verify that your chosen broker is properly licensed by checking the regulator’s official website. Legitimate brokers will prominently display their license numbers and regulatory information.

Platform Usability and Features

The user experience can make or break your copy trading success, especially if you’re new to the concept. A well-designed platform should provide clear navigation, comprehensive trader profiles, and intuitive risk management tools.

Essential Platform Features:

- Trader Search and Filtering: Advanced filters for performance, risk level, trading style, and asset classes

- Detailed Statistics: Historical performance, drawdown periods, win rates, and risk scores

- Risk Management Tools: Stop-loss settings, position size controls, and maximum exposure limits

- Real-Time Monitoring: Live portfolio tracking with profit/loss updates and performance metrics

- Mobile Compatibility: Full functionality on smartphones and tablets for on-the-go management

Range of Tradable Assets

While forex is often the primary focus, having access to other asset classes can provide valuable diversification opportunities. Look for brokers that offer copy trading across multiple markets including commodities, indices, cryptocurrencies, and individual stocks.

This diversity allows you to follow specialists in different markets—perhaps copying a gold trader during periods of economic uncertainty while also following a tech stock specialist for growth opportunities.

Fees and Commissions

Copy trading fees can vary dramatically between brokers and platforms. Understanding the complete fee structure is crucial for calculating your true returns and comparing brokers effectively.

Common Fee Structures:

- Spread-Only: No additional copy trading fees, costs included in bid-ask spreads

- Performance Fees: Percentage of profits (typically 15-30%) paid to signal providers

- Subscription Fees: Monthly fees for accessing premium signal providers

- Commission-Based: Fixed fee per trade or per lot traded

Fee Impact Example: If you’re copying a trader who generates 20% annual returns, but the platform charges a 25% performance fee, your net return drops to 15%. Always factor in all fees when evaluating potential returns.

Minimum Deposit Requirements

Minimum deposit requirements vary widely among brokers, from as low as $5 at XM to $250 or more at premium platforms. However, the legal minimum doesn’t necessarily represent a practical minimum for successful copy trading.

Consider that many successful signal providers require minimum copy amounts of $200-$500 to ensure proper position sizing. Starting with too little capital may limit your ability to copy the best traders or maintain appropriate risk management.

Customer Support and Resources

Copy trading can involve complex technical issues and time-sensitive decisions, making responsive customer support essential. Look for brokers offering 24/5 support (covering all forex trading hours) with multiple contact methods including live chat, phone, and email.

Educational resources are equally important, especially for beginners. The best brokers provide comprehensive guides on copy trading strategies, risk management, and platform tutorials.

Copy Trading Specific Features

Beyond basic copying functionality, advanced features can significantly enhance your copy trading experience:

- Proportional Copying: Automatic scaling of trades based on account size differences

- Reverse Copying: Ability to automatically take opposite positions to a selected trader

- Partial Copying: Copy only specific trade types or currency pairs from a signal provider

- Time-Based Copying: Copy trades only during specific hours or market sessions

- Multi-Account Management: Copy different traders across multiple sub-accounts

How Copy Trading Works

Overview of Copy Trading Mechanisms

Understanding the technical mechanics behind copy trading helps you make better decisions about platforms, signal providers, and risk management. At its core, copy trading relies on sophisticated software that monitors signal providers’ accounts and automatically replicates their trades on followers’ accounts.

The process begins when a signal provider executes a trade on their account. Within milliseconds, the copy trading platform’s servers detect this action and generate corresponding trade instructions for all followers. These instructions must account for different account sizes, risk preferences, and any custom filters that followers have set.

Copy Trading vs. Mirror Trading

While often used interchangeably, copy trading and mirror trading have distinct differences that affect how you should approach each:

Copy Trading: Replicates individual trader decisions with some customization possible. You follow specific traders and can adjust risk parameters, position sizes, and even pause copying certain trades. The relationship is more personal and flexible.

Mirror Trading: Follows pre-defined strategies or algorithms rather than individual traders. These strategies are typically backtested and optimized but may be less adaptable to changing market conditions. Mirror trading often involves less human discretion and more systematic approach.

Most modern platforms blur these lines by offering both individual trader copying and algorithmic strategy following, giving you the best of both worlds.

How Traders Select Strategies and Signal Providers

Successful copy trading starts with careful signal provider selection. This process should combine quantitative analysis with qualitative assessment to build a well-rounded view of potential providers.

Quantitative Factors:

- Historical Performance: Look for consistent returns over multiple market cycles, not just recent hot streaks

- Maximum Drawdown: Understand the worst-case scenario losses you might experience

- Sharpe Ratio: Measures risk-adjusted returns, helping you identify efficient traders

- Win Rate vs. Average Win/Loss: Some traders win frequently with small gains, others win big but less often

- Trading Frequency: Ensure the trading style matches your risk tolerance and monitoring capabilities

Qualitative Factors:

- Trading Philosophy: Understand the trader’s approach to markets and risk management

- Market Commentary: Traders who explain their decisions provide valuable learning opportunities

- Transparency: Look for traders who openly discuss both wins and losses

- Consistency: Prefer traders with steady approaches over those who frequently change strategies

Risk Management in Copy Trading

Effective risk management in copy trading requires multiple layers of protection, from individual trade limits to overall portfolio exposure controls.

Position-Level Risk Management:

- Maximum Position Size: Limit how much capital can be allocated to any single trade

- Stop-Loss Overrides: Set tighter stop-losses than the signal provider if your risk tolerance is lower

- Take-Profit Modifications: Consider taking profits earlier than the signal provider to lock in gains

Account-Level Risk Management:

- Maximum Drawdown Limits: Automatically pause copying if losses exceed a predetermined threshold

- Daily/Weekly Loss Limits: Protect against rapid account depletion during volatile periods

- Correlation Management: Avoid copying multiple traders who follow similar strategies

- Capital Allocation: Never risk more than 10-20% of your total trading capital on copy trading

Regulatory Environment for Copy Trading

Key Regulations by Region

The regulatory landscape for copy trading has evolved significantly in recent years, with major financial authorities implementing specific rules to protect retail investors while fostering innovation in financial technology.

European Union (MiFID II & MiCA)

The Markets in Financial Instruments Directive II (MiFID II) provides the primary regulatory framework for copy trading in the EU. Under MiFID II, copy trading platforms must provide clear risk warnings, detailed cost disclosures, and appropriateness assessments for retail clients.

The new Markets in Crypto Assets Regulation (MiCA), implemented in 2024, specifically addresses copy trading in cryptocurrency markets, requiring platforms to obtain additional licenses for crypto copy trading services.

United Kingdom (FCA Regulation): Following Brexit, the FCA has maintained strict oversight of copy trading platforms, requiring clear disclosure of past performance disclaimers and mandatory risk warnings. In 2024, the FCA issued new guidance requiring platforms to display worst-case scenario calculations prominently.

Australia (ASIC Oversight): ASIC requires copy trading platforms to hold Australian Financial Services Licenses (AFSL) and comply with strict disclosure requirements. Recent updates in 2024 mandated clearer fee structures and improved investor education materials.

United States (CFTC/NFA Framework): The US market remains highly restricted for retail copy trading, with most platforms unavailable to US residents. However, qualified institutional investors can access copy trading through registered investment advisors and commodity trading advisors.

Regulatory Bodies Overseeing Copy Trading

Multiple regulatory bodies have jurisdiction over different aspects of copy trading, creating a complex but comprehensive oversight structure:

- Securities Regulators: Oversee copy trading involving stocks, ETFs, and other securities

- Banking Regulators: Monitor deposit-taking institutions offering copy trading services

- Derivatives Regulators: Supervise copy trading in forex, CFDs, and other derivative instruments

- Consumer Protection Agencies: Ensure fair treatment and transparent marketing practices

Compliance Requirements for Brokers and Traders

Regulatory compliance creates both obligations and protections for copy trading participants:

Broker Obligations:

- Maintain segregated client accounts with tier-1 banks

- Provide clear risk warnings and performance disclaimers

- Implement know-your-customer (KYC) and anti-money laundering (AML) procedures

- Offer investor compensation scheme participation where required

- Maintain minimum capital requirements based on business size and risk profile

Signal Provider Requirements:

- Identity verification and background checks

- Trading experience and competency assessments

- Ongoing performance monitoring and risk management

- Disclosure of any conflicts of interest or material changes in strategy

How Regulations Affect Copy Trading

Regulatory oversight has generally positive effects on the copy trading industry, though it does create some limitations and compliance costs:

Positive Effects: Enhanced investor protection, improved platform transparency, standardized risk disclosure, and reduced fraudulent operators.

Challenges: Increased compliance costs passed to users, reduced platform availability in some jurisdictions, and more complex onboarding processes.

The regulatory trend is clearly toward greater oversight and investor protection, which benefits serious participants while weeding out questionable operators.

Copy Trading Risks and How to Mitigate Them

Market Risks

Copy trading doesn’t eliminate the fundamental risks of forex trading—it merely transfers the decision-making responsibility to another party. Understanding and managing these risks is crucial for long-term success.

Leverage Risk: Many signal providers use high leverage to amplify returns, but this also amplifies potential losses. A 2% market move against a highly leveraged position can wipe out significant account equity. Always understand the leverage levels used by traders you’re copying and adjust your risk accordingly.

Market Volatility: Forex markets can experience sudden, dramatic moves due to economic events, geopolitical tensions, or central bank interventions. Even the best traders can be caught off-guard by these events, leading to significant losses.

Correlation Risk: Copying multiple traders who follow similar strategies or trade the same currency pairs can create hidden correlation risks. When market conditions turn against their shared approach, all your copied positions may suffer simultaneously.

Platform Risks

Technical and operational risks inherent in copy trading platforms can affect your trading results independent of market performance.

Execution Delays: Even minor delays between signal generation and trade execution can impact performance, especially for scalping strategies that rely on precise timing. Network issues, server problems, or high market volatility can all contribute to execution delays.

System Failures: Platform outages during critical market moments can prevent trades from being copied or exit signals from being executed. This risk is particularly concerning during major economic announcements or market stress periods.

Data Integrity: Incorrect or delayed data feeds can lead to trades being copied at wrong prices or missed entirely. This risk emphasizes the importance of choosing platforms with robust technical infrastructure.

Trader Selection Risks

Perhaps the most significant risk in copy trading is selecting the wrong signal providers. Even successful traders can experience performance deterioration over time.

Strategy Drift: Traders may gradually change their approach without explicitly announcing it, leading to different risk profiles than initially expected. A conservative trader might become more aggressive, or a scalper might shift to swing trading.

Psychological Pressure: Having followers can change a trader’s behavior. Some may become more conservative to protect their reputation, while others might take excessive risks to impress followers with spectacular returns.

Account Size Effects: As signal providers’ accounts grow, they may face liquidity constraints or position size limitations that didn’t exist when they built their track record with smaller accounts.

How to Manage Copy Trading Risks

Diversification Strategy:

- Copy multiple traders (typically 3-8) with different trading styles and time frames

- Ensure geographic and market session diversification

- Mix conservative and aggressive traders to balance risk and return

- Regularly review correlation between copied traders and adjust allocations

Position Sizing Rules:

- Never allocate more than 15-20% of your capital to any single signal provider

- Use smaller position sizes when starting with new signal providers

- Increase allocations gradually based on proven performance consistency

- Set maximum daily and weekly loss limits across all copied positions

Monitoring and Review Process:

- Review copied trader performance at least weekly

- Set up alerts for significant drawdowns or changes in trading behavior

- Maintain detailed records of all copied trades for analysis

- Be prepared to stop copying traders who show deteriorating performance

Risk Management Analogy: Think of copy trading like hiring a money manager. You wouldn’t give all your investment capital to one manager, nor would you ignore their performance once hired. The same principles apply to copy trading—diversify, monitor, and be ready to make changes when necessary.

Steps to Start Copy Trading

Creating a Copy Trading Account

Setting up your copy trading account properly from the start can save you time and help avoid costly mistakes later. The account opening process has become increasingly streamlined, but there are important considerations at each step.

Step 1: Choose Your Broker

Based on our comprehensive analysis, we recommend starting with one of the top-tier brokers like eToro for beginners or IC Markets for more experienced traders seeking professional execution. Consider factors like regulation, minimum deposits, available platforms, and fee structures when making your decision.

Step 2: Complete the Registration Process

Modern brokers have simplified registration while maintaining regulatory compliance. You’ll typically need:

- Government-issued ID (passport or driver’s license)

- Proof of address (utility bill or bank statement, typically within 3 months)

- Basic financial information and trading experience questionnaire

- Risk tolerance assessment and suitability evaluation

Step 3: Verify Your Identity

Identity verification usually takes 1-3 business days, though some brokers offer instant verification during business hours. This process is mandatory under anti-money laundering regulations and helps protect your account security.

Step 4: Fund Your Account

Consider starting with a modest amount while you learn the platform and evaluate signal providers. Most successful copy traders recommend starting with 3-6 months of anticipated profits from your regular income, ensuring you can withstand initial learning curve losses without financial stress.

Selecting the Right Trader to Copy

Signal provider selection is arguably the most critical aspect of copy trading success. This process requires both analytical rigor and intuitive judgment about trader psychology and market conditions.

Initial Screening Criteria:

- Track Record Length: Look for at least 12 months of consistent trading history, preferably including different market conditions

- Performance Consistency: Prefer steady performers over those with extreme wins followed by large losses

- Risk Management: Evaluate maximum drawdown periods and recovery times

- Trading Style Alignment: Ensure the trader’s approach matches your risk tolerance and time availability

Advanced Analysis Techniques:

- Monthly Return Distribution: Look for traders with more winning months than losing months

- Market Condition Performance: Analyze how traders perform during trending vs. ranging markets

- News Event Management: Observe how traders handle high-impact economic releases

- Position Management: Study how traders add to winning positions and cut losing ones

Red Flags to Avoid:

- Traders with gaps in their trading history or deleted/hidden trades

- Extremely high returns (>100% annually) with correspondingly high risk

- Traders who don’t use stop-losses or proper risk management

- Signal providers with very few followers (may indicate performance issues)

- Traders who frequently change their strategy or trading style

Setting Risk Management Parameters

Proper risk management setup is your primary defense against significant losses and should be configured before copying any trades.

Account-Level Settings:

- Maximum Daily Loss: Set a daily loss limit of 2-5% of account equity

- Maximum Weekly Loss: Implement weekly limits of 5-10% to prevent rapid account depletion

- Maximum Monthly Drawdown: Consider pausing copy trading if monthly losses exceed 15-20%

- Stop-Loss Override: Use tighter stop-losses than signal providers if you’re more risk-averse

Position-Level Controls:

- Maximum Position Size: Limit individual trades to 2-5% of account equity

- Trade Size Scaling: Set conservative multipliers when starting with new signal providers

- Currency Pair Limits: Restrict exposure to exotic pairs if you prefer major currencies

- Time-Based Filters: Copy trades only during specific market hours if desired

Performance Monitoring Setup:

- Configure alerts for significant drawdowns or unusual trading activity

- Set up regular performance review schedules (weekly or bi-weekly)

- Establish clear criteria for when to stop copying a trader

- Create a systematic process for evaluating new signal providers

Important Reminder: Most regulatory authorities require brokers to display the following warning: “Past performance is not indicative of future results. Copy trading involves significant risk of loss and may not be suitable for all investors. You should carefully consider whether copy trading is appropriate for your financial situation and risk tolerance.”

Advanced Copy Trading Techniques

Partial Copying and Trade Customization

Advanced copy trading goes beyond simple trade replication to include sophisticated customization options that allow you to tailor signal provider strategies to your specific needs and risk tolerance.

Selective Copying Strategies:

- Currency Pair Filtering: Copy only trades on major pairs (EUR/USD, GBP/USD, USD/JPY) while avoiding exotic currencies

- Time-Based Copying: Restrict copying to specific market sessions, such as only London or New York hours

- Trade Size Filtering: Copy only trades above or below certain position sizes to match risk preferences

- Direction Filtering: Copy only buy orders or sell orders if you have a directional market bias

Risk Adjustment Techniques:

- Position Size Scaling: Use smaller or larger position sizes than the signal provider based on your risk tolerance

- Stop-Loss Tightening: Set tighter stop-losses to limit downside risk

- Take-Profit Modification: Take profits earlier or later than the signal provider based on your strategy

- Correlation Limits: Prevent copying highly correlated positions from multiple traders

Reverse Copy Trading

Reverse copy trading, also known as “fade trading,” involves taking positions opposite to a selected signal provider. This strategy can be effective when you identify consistently losing traders or when market conditions favor contrarian approaches.

When to Consider Reverse Copying:

- Signal providers showing consistent losses over extended periods

- Traders who consistently buy at market tops or sell at market bottoms

- Overconfident traders who don’t use proper risk management

- Market environments that favor contrarian strategies

Reverse Copying Risk Management:

Reverse copying requires even more careful risk management than regular copy trading because you’re betting against established market participants. Set tighter position limits and be prepared to exit quickly if the original trader’s strategy begins working.

Copy Trading with Algorithmic Strategies

The integration of algorithmic trading with copy trading platforms has created new opportunities for sophisticated strategy implementation.

Algorithm-Based Signal Providers:

- Trend Following Systems: Algorithms that identify and follow market trends across multiple timeframes

- Mean Reversion Strategies: Systems that capitalize on price deviations from historical averages

- Arbitrage Algorithms: Strategies that exploit price differences across markets or time frames

- News Trading Bots: Algorithms that react to economic announcements and news events

Benefits of Algorithmic Copy Trading:

- Eliminates emotional decision-making from both signal generation and copying

- Provides consistent strategy execution regardless of market conditions

- Offers backtested performance data for more reliable evaluation

- Enables 24/7 market monitoring and trade execution

Advanced Strategy Analogy: Think of advanced copy trading techniques like customizing a car. You might love a particular model (signal provider) but want different tires (risk levels), a different transmission (timing), or modified engine settings (position sizes). These customizations help the vehicle perform better for your specific needs while maintaining its core capabilities.

Educational Resources for Copy Traders

Broker-Provided Learning Materials

The best copy trading brokers have recognized that educated clients are more successful and loyal, leading to comprehensive educational programs specifically designed for copy trading.

eToro’s Educational Ecosystem: eToro provides one of the most comprehensive educational programs in the industry, including the eToro Academy with courses specifically focused on copy trading. Their content covers everything from basic platform navigation to advanced portfolio management techniques.

FXTM’s Professional Development: FXTM offers detailed webinars and tutorials focused on evaluating signal providers and managing copy trading portfolios. Their educational content emphasizes risk management and long-term strategy development.

IC Markets’ Technical Resources: IC Markets provides in-depth platform tutorials for their various copy trading solutions, including cTrader Copy and ZuluTrade integration guides. Their focus is on technical implementation and advanced features.

Third-Party Courses and Webinars

Independent educational providers offer valuable perspectives on copy trading strategies and market analysis:

- Online Trading Academies: Many established trading education companies now offer copy trading specific courses

- YouTube Educational Channels: Free content from experienced copy traders sharing strategies and platform reviews

- Trading Forums and Communities: Peer-to-peer learning through discussions and shared experiences

- Professional Certification Programs: Some organizations offer formal certification in social and copy trading

Community Forums and Discussion Groups

Active participation in copy trading communities can accelerate your learning curve and help you avoid common pitfalls:

Platform-Specific Communities: Most major copy trading platforms maintain active user forums where traders share experiences, discuss signal providers, and exchange strategies.

Social Media Groups: Facebook groups, Reddit communities, and Discord servers dedicated to copy trading provide real-time discussions and peer support.

Professional Networks: LinkedIn groups focused on algorithmic and social trading offer more serious, career-oriented discussions.

The Future of Copy Trading in Forex

Emerging Technologies in Copy Trading

The copy trading industry continues to evolve rapidly, driven by advances in artificial intelligence, blockchain technology, and regulatory frameworks. These developments promise to make copy trading more accessible, transparent, and effective for retail investors.

Artificial Intelligence Integration: AI-powered systems are beginning to enhance copy trading in several ways. Smart matching algorithms can now identify signal providers whose trading styles complement your risk profile and investment goals more accurately than traditional filtering methods.

Machine learning models analyze vast amounts of trading data to predict which signal providers are likely to outperform in different market conditions. These systems can identify subtle patterns in trader behavior that human analysis might miss, such as how a trader’s performance correlates with specific economic indicators or market volatility levels.

Blockchain and Transparency: Blockchain technology is being explored to create immutable records of trading performance, eliminating the possibility of manipulated track records or selective reporting. Smart contracts could automate performance fee calculations and distributions, reducing costs and increasing transparency.

Advanced Risk Management: New platforms are implementing sophisticated risk management algorithms that can dynamically adjust position sizes based on real-time volatility measurements, correlation analysis between copied traders, and market stress indicators.

Predicted Trends for 2025 and Beyond

Institutional Adoption: We expect to see increased institutional interest in copy trading technologies, both as service providers and consumers. Hedge funds and asset managers are beginning to explore copy trading as a distribution channel for their strategies, while institutional investors see copy trading as a way to access retail trading alpha.

Regulatory Standardization: The regulatory landscape will likely see increased harmonization across jurisdictions, making it easier for platforms to operate globally while maintaining consistent investor protections.

Micro-Investing Integration: Copy trading is expected to integrate more closely with micro-investing platforms, allowing users to copy trades with spare change or small regular contributions, making professional trading strategies accessible to even smaller investors.

ESG and Sustainable Trading: Environmental, Social, and Governance (ESG) considerations are beginning to influence copy trading, with platforms developing filters for sustainable trading strategies and signal providers who consider ESG factors in their decision-making.

Industry Growth Projection: According to recent industry reports, the global copy trading market is expected to grow at a compound annual growth rate (CAGR) of 15-20% through 2027, driven by increasing retail participation in financial markets and technological advances in trading platforms.

Conclusion

Why Copy Trading is a Growing Trend

Copy trading represents a democratization of professional trading strategies, breaking down barriers that have traditionally separated retail investors from institutional-grade portfolio management. The combination of technological advancement, regulatory clarity, and growing financial literacy has created an environment where copy trading can thrive.

The appeal is clear: rather than spending years learning complex market analysis or risking capital on inexperienced trading decisions, investors can immediately access the expertise of proven professionals. This isn’t just about convenience—it’s about leveling the playing field in financial markets that have long favored institutional participants.

Key Takeaways for Copy Trading Beginners

- Start Small and Learn: Begin with modest capital and focus on understanding the platforms and signal provider evaluation before scaling up

- Diversification is Crucial: Never put all your capital with one signal provider—spread risk across multiple traders with different strategies

- Regulation Matters: Only use platforms regulated by tier-1 authorities like FCA, ASIC, or CySEC

- Risk Management is Your Responsibility: Even when copying successful traders, you must implement your own risk controls and position sizing

- Continuous Monitoring Required: Copy trading isn’t “set it and forget it”—regular performance review and adjustments are essential

Key Takeaways for Choosing the Best Copy Trading Broker

- Platform Quality Over Marketing: Focus on execution speed, platform stability, and risk management tools rather than flashy marketing promises

- Transparent Fee Structure: Understand all costs including spreads, performance fees, and platform charges before committing

- Signal Provider Quality: Platforms with rigorous trader vetting processes typically offer better long-term results

- Educational Support: Brokers that invest in trader education tend to have more successful clients

- Technical Infrastructure: Reliable trade execution and minimal downtime are non-negotiable for successful copy trading

Summarizing the Best Copy Trading Forex Brokers

Based on our comprehensive analysis, here are our top recommendations for different trader profiles:

Best Overall: eToro – Unmatched social trading features, user-friendly interface, and largest community of signal providers make it ideal for beginners and intermediate traders.

Best for Professionals: IC Markets – Superior execution, multiple platform options, and institutional-grade infrastructure suit advanced traders and those requiring the best possible trading conditions.

Best Platform Variety: AvaTrade – Multiple copy trading platforms under one broker provide flexibility and diversification options.

Best for MetaTrader Users: Pepperstone – Exceptional MetaTrader integration and professional execution make it ideal for traders familiar with these platforms.

Final Thoughts on Choosing the Right Platform

The “best” copy trading broker depends on your individual needs, experience level, and trading goals. Beginners should prioritize user-friendly platforms with strong educational resources and comprehensive risk management tools. Experienced traders might prefer platforms offering advanced customization options and superior execution quality.

Remember that copy trading success depends more on your signal provider selection and risk management discipline than on the specific platform you choose. Any of our top-rated brokers can facilitate successful copy trading when used properly.

The Future of Copy Trading in Forex Markets

Copy trading is evolving from a niche service to a mainstream investment approach. As artificial intelligence, blockchain technology, and regulatory frameworks continue to mature, we can expect copy trading to become even more sophisticated and accessible.

The integration of ESG considerations, micro-investing capabilities, and institutional participation will likely expand the market significantly over the next decade. For individual investors, this means more choice, better technology, and potentially improved returns from professional strategy access.

Final Thoughts on the Benefits of Copy Trading for Different Types of Traders

For Beginners: Copy trading provides an invaluable learning opportunity while potentially generating returns from day one. The key is viewing it as both an investment strategy and an educational tool.

For Intermediate Traders: Copy trading offers diversification opportunities and exposure to strategies or markets you haven’t mastered independently. It can complement your existing trading while teaching new approaches.

For Advanced Traders: Copy trading enables you to scale your capital across multiple proven strategies, potentially accessing approaches that would be too time-intensive to implement personally. It can also provide passive income streams while you focus on other trading activities.

Regardless of your experience level, copy trading represents an evolution in how individual investors can access professional trading strategies. When implemented with proper due diligence, risk management, and realistic expectations, it can be a valuable addition to your investment toolkit.

Frequently Asked Questions (FAQs)

- What is the minimum deposit for copy trading?

- Minimum deposits vary significantly among brokers. XM offers the lowest at $5, while most established platforms like eToro require $200. However, practical minimums for effective copy trading are typically $500-$1,000 to ensure proper diversification and risk management.

- Can you make money with copy trading?

- Yes, many traders profit from copy trading, but success isn’t guaranteed. Studies suggest that approximately 20-30% of retail forex traders are profitable, and copy trading can improve these odds by accessing proven strategies. However, all trading involves risk of loss.

- Which platform is best for copy trading?

- eToro is generally considered the best overall platform due to its user-friendly interface and large community. IC Markets is preferred by professional traders for execution quality, while AvaTrade offers the most platform variety. Your choice should depend on your experience level and specific needs.

- What are the fees associated with copy trading?

- Fees vary by platform and include spreads (typically 1-3 pips for EUR/USD), performance fees (15-30% of profits on some platforms), and subscription fees for premium signal providers. Some brokers like eToro charge no additional copy trading fees beyond spreads.

- How does copy trading differ from social trading?

- Copy trading automatically replicates trades from signal providers, while social trading includes broader community interaction, discussions, and manual decision-making based on shared information. Copy trading is more automated, while social trading involves more active participation.

- Is copy trading legal in my country?

- Copy trading is legal in most countries when conducted through regulated brokers. However, availability varies—it’s restricted in the US for retail investors but widely available in Europe, Australia, and most other jurisdictions. Check with local financial authorities for specific regulations.

- How do I select the best trader to copy?

- Focus on consistent performance over 12+ months, reasonable risk levels (maximum drawdown under 30%), transparent communication, and trading styles that match your risk tolerance. Avoid traders with extremely high returns or erratic performance patterns.

- What risks are involved in copy trading?

- Main risks include market risk (losses from adverse price movements), platform risk (technical failures), and signal provider risk (trader performance deterioration). Leverage amplifies these risks. Proper diversification and risk management are essential.

- Can I control trades after copying them?

- Most platforms allow some control, including setting stop-losses, taking profits early, or pausing copying. However, the level of control varies by platform. Some offer advanced customization while others provide only basic override functions.

- How can I find profitable traders to copy?

- Use platform filtering tools to screen for consistent performers, analyze historical statistics, read trader profiles and communications, and start with small amounts to test performance. Look for transparency and reasonable risk levels rather than just high returns.

- Is copy trading good for beginners?

- Copy trading can be beneficial for beginners as it provides exposure to professional strategies while learning about markets. However, beginners should start small, focus on education, and understand that copy trading still involves significant risks.

- Can I copy multiple traders at once?

- Yes, most platforms support copying multiple traders simultaneously. This is recommended for diversification—typically 3-8 traders with different strategies and risk levels. Ensure you monitor correlation between copied traders to avoid overexposure to similar strategies.

- What happens if the trader I copy stops trading?

- If a signal provider stops trading, your copied positions typically remain open until you manually close them or the provider resumes trading. Most platforms notify you when providers become inactive, allowing you to decide whether to find new traders to copy.

- Do I need any trading experience to start copy trading?

- While previous trading experience is helpful, it’s not required for copy trading. However, you should understand basic forex concepts, risk management principles, and platform functionality. Most brokers provide educational resources for beginners.

- How are profits shared in copy trading?

- Profit sharing varies by platform. Some brokers charge performance fees (typically 15-30% of profits) paid to signal providers, while others operate on spread-only models. Always understand the complete fee structure before starting to copy.

- Are there any hidden fees in copy trading?

- Reputable regulated brokers disclose all fees, but always read terms carefully. Watch for inactivity fees, withdrawal charges, currency conversion costs, and weekend holding charges. The best brokers provide transparent fee schedules without hidden costs.

- What is the difference between signal providers and copy traders?

- Signal providers (also called strategy managers or master traders) are the experienced traders whose trades you copy. Copy traders (or followers) are investors who replicate these trades. Signal providers often earn performance fees, while copy traders pay these fees.

- How long should I follow a trader before copying them?

- Observe potential signal providers for at least 2-4 weeks before copying with real money. This allows you to understand their trading style, risk management approach, and consistency. Some traders use demo accounts for extended evaluation periods.

- Can I stop copy trading at any time?

- Yes, you can typically stop copying a trader immediately, though existing open positions may remain active depending on platform settings. Most platforms allow you to close all copied positions or let them run to completion based on your preference.

- What are the best copy trading brokers for mobile trading?

- eToro, NAGA, and IC Markets offer the most comprehensive mobile copy trading experiences. eToro’s mobile app is particularly user-friendly for beginners, while IC Markets provides professional-grade mobile functionality for advanced traders.

- What is the minimum investment for copy trading?

- While some brokers allow copy trading with $5-$50, practical minimums are higher. Most successful copy traders recommend starting with at least $500-$1,000 to allow proper diversification across multiple signal providers and effective risk management.

- How do copy trading fees work?

- Copy trading fees typically include spreads (built into trade prices), performance fees (percentage of profits), and sometimes subscription fees for premium signals. Some platforms charge no additional fees beyond spreads, while others may charge 15-30% of profits.

- Can you lose money with copy trading?

- Yes, copy trading involves significant risk of loss. Even successful traders can experience losing periods, and past performance doesn’t guarantee future results. Proper risk management, diversification, and starting with affordable amounts are essential to managing these risks.

- Which platform offers the best copy trading experience for beginners?

- eToro is widely considered the best platform for beginners due to its intuitive interface, comprehensive educational resources, large community, and user-friendly risk management tools. The platform’s social features also help beginners learn from experienced traders.

- How does tax work with copy trading profits?

- Copy trading profits are typically taxed as capital gains in most jurisdictions, but tax treatment varies by country and individual circumstances. Some countries treat forex trading as gambling or business income. Consult with a qualified tax professional for advice specific to your situation.

- Are there any platforms that specialize in cryptocurrency copy trading?

- eToro, NAGA, and several specialized crypto platforms offer cryptocurrency copy trading. However, crypto copy trading involves additional volatility risks compared to forex. Ensure the platform is properly regulated and understand the unique risks of cryptocurrency markets.

- What is social trading, and how is it related to copy trading?

- Social trading is a broader concept that includes community interaction, discussion forums, and shared market insights. Copy trading is a subset of social trading focused specifically on automatically replicating trades. Many platforms combine both approaches.

- Do all brokers offer copy trading features?

- No, not all forex brokers offer copy trading. It requires specialized technology and regulatory approvals. Many traditional brokers focus solely on direct trading, while others partner with third-party copy trading platforms to offer these services.

- Is copy trading good for long-term investing?

- Copy trading can be suitable for long-term investing when used with appropriate signal providers who focus on longer-term strategies. However, most copy trading platforms are designed for shorter-term trading. Consider your investment timeline when selecting signal providers.

- Can I use multiple copy trading platforms simultaneously?

- Yes, you can use multiple platforms to diversify your copy trading approach, access different signal providers, and compare platform features. However, this requires more time for monitoring and management, and you’ll need to meet minimum deposit requirements for each platform.

- Which is better: copy trading or trading on my own?

- Both approaches have merits. Copy trading provides immediate access to professional strategies but offers less control and involves fees. Independent trading offers full control and potentially higher returns but requires significant time investment and market knowledge. Many traders use both approaches.

- How do I get started with copy trading?

- Start by choosing a reputable regulated broker, opening an account with modest capital, spending time evaluating signal providers, and beginning with small position sizes. Focus on learning platform features and risk management before scaling up your investment.

- Which are the top brokers for social trading?

- The top social trading brokers are eToro (largest community and best social features), AvaTrade (multiple platform options), IC Markets (professional execution), NAGA (innovative social features), and FXTM (curated trader selection). Each excels in different aspects of social trading.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.