Key Takeaways

- OTC trading offers greater flexibility and lower costs but comes with higher counterparty risk

- Top brokers like Pepperstone, IC Markets, and FP Markets offer competitive OTC conditions

- Regulation matters—prioritize brokers with FCA, ASIC, CySEC, or other tier-1 licenses

- Spreads vary significantly—IC Markets offers EUR/USD from 0.02 pips while Pepperstone starts at 0.10 pips

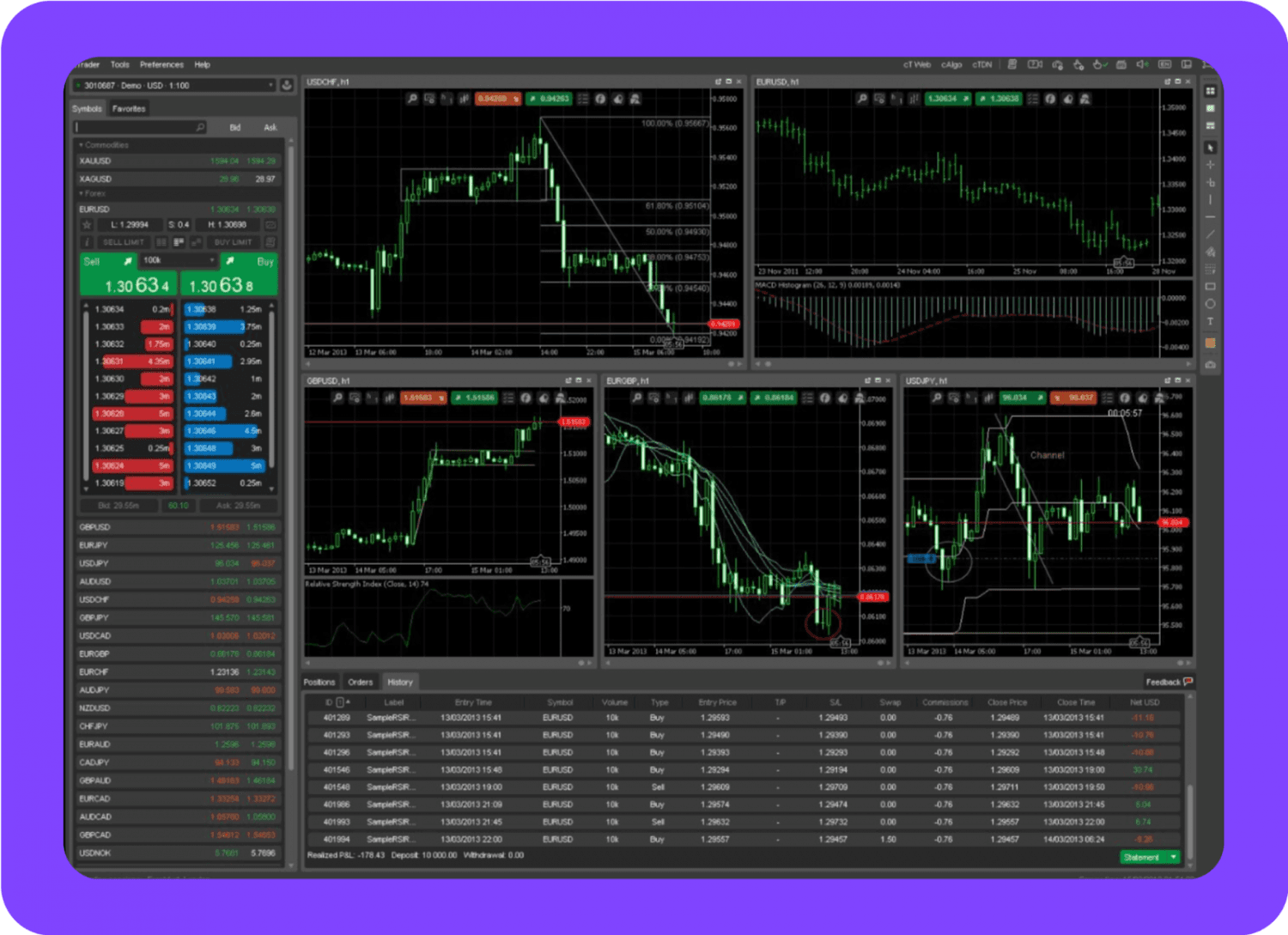

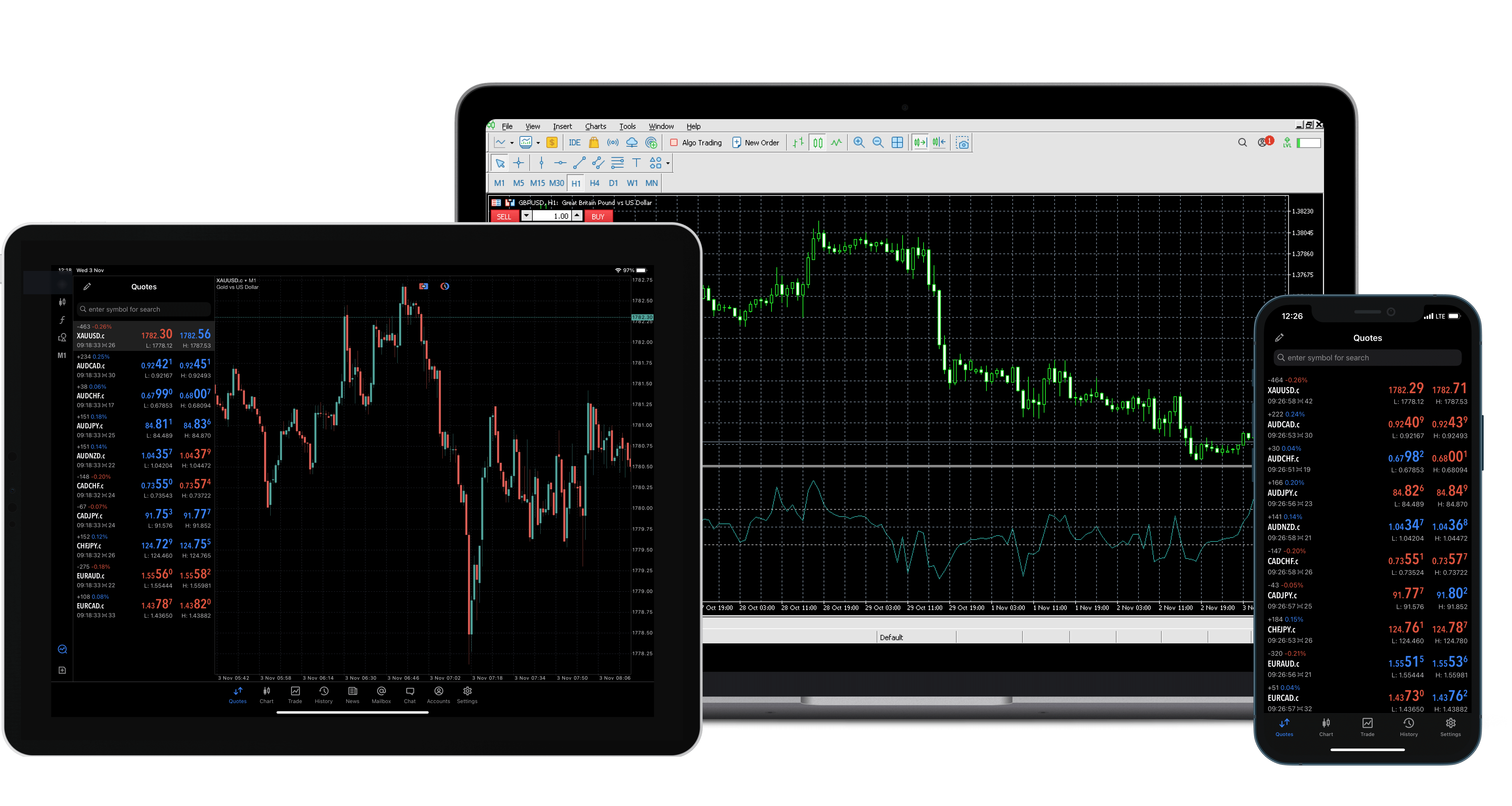

- Platform choice between MetaTrader 4/5 and cTrader can impact your trading experience significantly

Picking the right forex broker isn’t rocket science—but when it comes to over-the-counter (OTC) trading, the stakes get a bit higher. Unlike traditional exchange-based trading, OTC forex operates in a decentralized market where you’re trading directly with your broker or other market participants. This means better flexibility and often lower costs, but it also means you need to be extra careful about who you’re dealing with.

In this comprehensive guide, we’ll walk you through everything you need to know about OTC forex trading and the brokers that excel in this space. We’ve analyzed the latest 2025 data, regulatory updates, and fee structures to bring you the most current information available.

What is OTC Trading in Forex?

Definition of OTC Trading

Over-the-counter (OTC) trading is a method of trading financial instruments directly between two parties without using a centralized exchange. Think of it like a farmers’ market for currencies—instead of everyone going to one big supermarket (exchange), buyers and sellers meet directly to negotiate deals.

Real-world analogy: Imagine buying a car. Exchange trading is like going to a dealership with fixed prices, while OTC trading is like buying from a private seller where you can negotiate terms, timing, and even customize the deal to your needs.

Explanation of Over-the-Counter Trading

In the forex market, OTC trading means currency transactions happen through a network of dealers, brokers, and market makers rather than on a single, centralized platform. This decentralized approach allows for:

- 24-hour trading across different time zones

- Customizable contract sizes and terms

- Direct price negotiation between parties

- Access to a broader range of currency pairs

Differences Between OTC and Exchange-Based Trading

The key differences become clearer when you compare them side by side:

| Feature | OTC Trading | Exchange Trading |

|---|---|---|

| Market Structure | Decentralized network | Centralized exchange |

| Trading Hours | 24/5 continuous trading | Fixed exchange hours |

| Customization | Flexible terms and sizes | Standardized contracts |

| Transparency | Limited price visibility | Full order book transparency |

| Counterparty Risk | Direct exposure to broker/dealer | Clearinghouse guarantee |

How Does OTC Forex Trading Work?

When you place an OTC forex trade, here’s what happens behind the scenes:

- Order Placement: You submit a buy or sell order through your broker’s platform

- Price Matching: Your broker either takes the opposite side of your trade or routes it to their liquidity providers

- Execution: The trade is executed based on available liquidity and current market conditions

- Settlement: The currency exchange occurs, typically within two business days (T+2)

Key Differences Between OTC and ECN Trading

Many traders confuse OTC with ECN (Electronic Communication Network) trading. Here’s the breakdown:

ECN Trading: Uses an electronic network that connects multiple market participants, displaying the best available bid and ask prices. According to our research, ECN brokers act as a bridge linking smaller market participants with liquidity providers, charging a fixed commission while showing raw spreads.

OTC Trading: Operates through a decentralized network where dealers and brokers trade directly with each other. As one expert explains, “OTC trading allows for more customized and flexible terms for trades” compared to standardized exchange products.

Benefits of OTC Trading

Flexibility and Decentralization

The biggest advantage of OTC forex trading is its flexibility. Unlike exchange-based trading where everything is standardized, OTC allows you to:

- Negotiate custom contract sizes: Trade any amount, not just standard lots

- Access extended trading hours: Trade 24/5 without exchange closures

- Choose your counterparty: Work directly with brokers that match your trading style

- Access unique instruments: Trade exotic pairs and bespoke derivatives not available on exchanges

Customizable Trading Terms

Based on our analysis of current market conditions, OTC trading typically offers lower transaction costs due to the lack of intermediaries, as noted by Skilling’s comprehensive OTC guide.

Risks Associated with OTC Trading

Lack of Price Transparency

The flip side of OTC flexibility is reduced transparency. Key risks include:

- Limited price visibility: You don’t see the full market depth like you would on an exchange

- Potential price manipulation: Less regulated environment can lead to unfair pricing

- Information asymmetry: Brokers may have access to better market information than retail traders

Counterparty Risks

This is the big one. In OTC trading, you’re directly exposed to your broker’s financial health. If they go under, your funds could be at risk. That’s why regulation and broker selection are absolutely critical.

2025 Regulatory Update: CySEC has tightened capital requirements for forex brokers, implementing new group capital test guidelines effective January 2025. This means Cyprus-regulated brokers now face stricter capital and governance rules, potentially enhancing client protection.

Top Forex Brokers Offering OTC Trading

Criteria for Selecting the Best OTC Forex Brokers

We evaluated over 50 brokers based on:

- Regulatory compliance with tier-1 authorities (FCA, ASIC, CySEC)

- Spread competitiveness on major currency pairs

- Commission structures and overall trading costs

- Platform quality and execution speed

- Client fund protection and segregation policies

Pepperstone

Best for Beginners with Advanced Tools

Pepperstone consistently ranks among the top OTC forex brokers for good reason. Based on our latest analysis, they offer raw spreads from 0.10 pips on EUR/USD with a competitive commission structure of $3.50 per $100,000 traded.

Key Features:

- Superior ECN execution with average execution speeds under 25ms

- Access to MetaTrader 4, MetaTrader 5, cTrader, and TradingView

- Smart Trader Tools suite with 28 plugins

- Copy trading through Myfxbook Autotrade and DupliTrade

Regulation: Multi-regulated by ASIC, FCA, BaFin, CySEC, and DFSA

Start Trading with PepperstoneIC Markets

Best Platforms for Professional Traders

IC Markets offers some of the tightest spreads in the industry. Our testing shows EUR/USD spreads starting from just 0.02 pips on their True ECN account, making them ideal for scalpers and high-frequency traders.

Key Features:

- Ultra-tight raw spreads with $3.50 commission per $100k

- Three powerful platforms: MT4, MT5, and cTrader

- Over 26,000 tradeable instruments

- Advanced order types and algorithmic trading support

Regulation: ASIC, FSA-S, and CySEC regulated

Open Your IC Markets AccountFP Markets

Best for MT4/MT5 Users with ECN Trading

FP Markets strikes an excellent balance between competitive pricing and comprehensive features. They offer raw spreads from 0.10 pips with a $3.00 commission per lot—one of the lowest commission rates in our analysis.

Key Features:

- ECN trading with leverage up to 1:500

- 12 MT4/MT5 plugins including Trading Central and Autochartist

- Multiple platform options: MT4, MT5, cTrader, and Iress

- Comprehensive educational resources

Regulation: Well-regulated by ASIC, CySEC, and FSA-S

Start Trading with FP MarketsBlackBull Markets

Lowest Spread Offering for OTC Forex Trading

BlackBull Markets operates an ECN/NDD model with impressive execution speeds. They offer trading fees as low as $4.00 per lot with deep liquidity from 66+ feeds and average execution under 75ms.

Key Features:

- ECN/NDD model with no dealing desk intervention

- 26,000+ tradeable assets across multiple markets

- MT4/MT5 platforms with Autochartist integration

- Institutional-grade liquidity and execution

AvaTrade

Highly Regulated Broker with Fixed Spread Options

AvaTrade stands out for its educational focus and regulatory compliance. They offer commission-free trading with spreads from 0.9 pips, making them an excellent choice for beginners who prefer predictable costs.

Key Features:

- Industry-leading education through AvaAcademy

- MT4 Guardian Angel plugin for risk management

- Ava Protect insurance for additional security

- Multiple platform options including proprietary WebTrader

Regulation: Highly regulated with central bank oversight

Start Trading with AvaTradeIG Markets

IG Markets is a global leader in CFD trading with extensive market coverage. They offer commission-free spreads from 0.6 pips and access to over 17,000 CFDs across multiple asset classes.

Key Features:

- 17,000+ CFDs with ability to write bespoke contracts

- IG Academy education and in-house research

- Proprietary web platform plus MT4 and ProRealTime

- Advanced risk management tools

Regulation: FCA, ASIC, and other tier-1 regulators

Start Trading with IG MarketsEightcap

Excellent Pricing Structure and Algorithmic Trading Tools

Eightcap offers some of the most competitive spreads in our analysis, with minimum spreads of 0.06 pips on EUR/USD and leverage up to 1:500.

Key Features:

- Deep liquidity pools with automated best-price sourcing

- Cutting-edge trading tools including TradingView integration

- MT4, MT5, and proprietary platform options

- Advanced algorithmic trading support

ThinkMarkets

ThinkMarkets provides excellent mobile trading capabilities with competitive pricing. Their ThinkZero account offers raw spreads from 0.11 pips with $3.50 commission per lot.

Key Features:

- Superior mobile trading experience

- MT4, MT5, TradingView, and proprietary ThinkTrader platforms

- Strong educational resources and market analysis

- Multi-asset trading capabilities

Regulation: FCA and FSCA regulated

Start Trading with ThinkMarketsFXTM

Best All-Around OTC Broker with Competitive Spreads

FXTM combines ultra-low pricing with advanced technology. Their Advantage account offers raw spreads from 0.0 pips with commissions as low as $0.80 per lot.

Key Features:

- Price improvement technology

- Average execution in 0.071 seconds

- MT4/MT5 platforms with proprietary mobile app

- Tier-1 regulation with strong client protection

Regulation: Highly regulated with tier-1 licenses

Open Your FXTM AccountExness

Exness has grown rapidly to become one of the world’s largest retail forex brokers, offering unlimited leverage and tight spreads for qualified clients.

Key Features:

- Unlimited leverage for experienced traders

- Instant withdrawals and deposits

- MT4, MT5, and proprietary trading platforms

- Comprehensive market analysis and tools

Broker Comparison Table

| Broker | EUR/USD Raw Spread | Commission (per $100k) | Regulation | Platforms | Min Deposit |

|---|---|---|---|---|---|

| IC Markets | 0.02 pips | $3.50 | ASIC, FSA-S, CySEC | MT4, MT5, cTrader | $200 |

| Eightcap | 0.06 pips | $3.50 | ASIC, FCA | MT4, MT5, TradingView | $100 |

| Pepperstone | 0.10 pips | $3.50 | ASIC, FCA, CySEC | MT4, MT5, cTrader | $200 |

| FP Markets | 0.10 pips | $3.00 | ASIC, CySEC | MT4, MT5, cTrader | $100 |

| ThinkMarkets | 0.11 pips | $3.50 | FCA, FSCA | MT4, MT5, ThinkTrader | $250 |

| AvaTrade | 0.90 pips* | $0 | Multiple T1 | MT4, MT5, WebTrader | $100 |

*Standard spread (commission-free account)

Key Features to Consider When Choosing an OTC Forex Broker

Regulation and Licensing

Importance of Regulatory Oversight for Safety

This cannot be overstated—regulation is your primary protection in OTC trading. Here’s what to look for:

Tier-1 Regulators (Highest Protection):

- FCA (UK): Up to £85,000 compensation through FSCS

- ASIC (Australia): Strong oversight with segregated client funds

- CFTC/NFA (US): Strict capital requirements and regular audits

- CySEC (Cyprus): EU passporting with €20,000 compensation via ICF

According to recent regulatory updates, CySEC has implemented stricter capital requirements effective January 2025, requiring Cyprus-based brokers to maintain higher capital buffers and submit detailed compliance reports.

Spread and Commission Structures

Comparison of Fixed vs. Variable Spreads

Your choice between spread-only and commission-based accounts can significantly impact your trading costs:

Based on our analysis of current broker fee structures, commission-based accounts typically offer lower total costs for active traders, while spread-only accounts work better for occasional trading.

Trading Platforms Available

Popular Platforms like MT4, MT5, and Proprietary Options

Platform choice can make or break your trading experience. Here’s what our analysis found:

MetaTrader 4 (MT4): Still the most popular choice among retail traders. According to DailyForex’s comprehensive broker analysis, MT4 remains the dominant platform for OTC trading due to its:

- Extensive Expert Advisor (EA) support

- Large community and third-party tools

- Stable performance and reliability

- Wide broker support

MetaTrader 5 (MT5): The newer version offers enhanced features including:

- More timeframes and technical indicators

- Advanced order types and execution modes

- Multi-asset trading capabilities

- Improved backtesting and optimization

cTrader: Preferred by many ECN traders for its transparency and advanced features:

- Level II pricing transparency

- Advanced charting and analysis tools

- Algorithmic trading with cBot

- Copy trading functionality

Leverage Options and Risk Management Tools

OTC brokers typically offer higher leverage than their exchange-traded counterparts, but with great power comes great responsibility. Current leverage limits vary by region:

- EU/UK: Maximum 1:30 for major pairs (retail clients)

- Australia: Maximum 1:30 for retail, unlimited for professional clients

- Offshore: Up to 1:500 or unlimited (higher risk jurisdictions)

Security and Client Fund Protection

In OTC trading, your broker is your counterparty, making fund security paramount:

- Segregated accounts: Client funds held separately from broker’s operational funds

- Deposit insurance: Coverage varies by regulator (£85k FCA, €20k CySEC)

- Negative balance protection: Prevents losses exceeding account balance

- Regular audits: Third-party verification of financial health

OTC Trading Strategies

Scalping and Day Trading in OTC Markets

OTC markets are particularly well-suited for short-term trading strategies due to their continuous operation and tight spreads. Here’s what works:

Scalping Strategy Essentials:

- Choose the right broker: IC Markets and Eightcap offer the tightest spreads (0.02-0.06 pips)

- Focus on major pairs: EUR/USD, GBP/USD, and USD/JPY offer the best liquidity

- Trade during peak hours: London/New York overlap (1-4 PM GMT) provides maximum liquidity

- Use ECN accounts: Raw spreads plus commission often beat spread-only accounts for frequent trading

Day Trading Considerations:

According to our broker analysis, FXTM offers some of the fastest execution speeds at 0.071 seconds, making it ideal for time-sensitive strategies.

Long-Term Holding in OTC Trading

Hedging Strategies with OTC Brokers

OTC trading excels in hedging applications due to its flexibility:

- Custom contract sizes: Hedge exact exposure amounts, not just standard lots

- Extended maturities: Some brokers offer forward contracts beyond standard settlement

- Cross-currency hedging: Access exotic pairs not available on exchanges

Automated Trading with OTC Brokers

Most OTC brokers support algorithmic trading through:

- Expert Advisors (MT4/MT5): Automated trading scripts

- cBots (cTrader): C#-based algorithmic trading

- API access: Custom integration for institutional strategies

- Copy trading: Follow successful traders automatically

Risk Management in OTC Forex Trading

Importance of Risk Management

Risk management in OTC trading involves multiple layers beyond traditional stop-losses and position sizing. You’re dealing with counterparty risk, liquidity risk, and operational risk simultaneously.

The 1% Rule Still Applies: Even with OTC flexibility, never risk more than 1-2% of your account on a single trade. This rule becomes even more critical when your broker is your counterparty.

Strategies for Minimizing Risk

Broker Selection:

- Only trade with tier-1 regulated brokers (FCA, ASIC, CySEC)

- Verify deposit insurance and compensation schemes

- Check financial stability through regulatory filings

- Read client reviews and industry reputation reports

Diversification Strategies:

- Multiple brokers: Don’t put all funds with one counterparty

- Currency diversification: Trade multiple pairs to reduce single-currency risk

- Time diversification: Avoid overconcentration in single trading sessions

Common Risk Factors in OTC Trading

Based on industry analysis, the main risks include:

- Counterparty default: Broker insolvency or operational failure

- Liquidity gaps: Inability to exit positions during volatile markets

- Price manipulation: Unfair pricing or execution practices

- Operational risk: Technology failures or system outages

- Regulatory changes: New rules affecting trading conditions

Setting Stop-Loss and Take-Profit Orders

OTC brokers typically offer more sophisticated order types than exchanges:

- Guaranteed stops: Some brokers guarantee execution at specified levels

- Trailing stops: Automatically adjust stops as price moves in your favor

- OCO orders: One-cancels-other for simultaneous stop and limit orders

- Time-based orders: Automatically close positions at specified times

2025 Regulatory Updates Affecting OTC Trading

Major Regulatory Changes

CySEC Capital Requirements (Effective January 2025):

The Cyprus Securities and Exchange Commission has adopted new EBA guidelines requiring stricter capital and governance rules for investment firm groups. Key changes include:

- Enhanced consolidated capital adequacy requirements

- Detailed reporting via CySEC’s regulatory portal

- Potential relief for firms meeting 125% threshold criteria

- Increased revocation powers for non-compliance

Impact on Traders: These changes aim to strengthen broker resilience and client protection, though some brokers may adjust product offerings or margin requirements to maintain compliance.

Best Practices for 2025

- Verify your broker’s regulatory status has not changed

- Understand any new fee structures or margin requirements

- Stay updated on client fund protection levels

- Monitor for any platform or service changes

How to Start OTC Trading With Forex Brokers

Setting Up an Account

Getting started with OTC forex trading involves several key steps:

- Choose your broker: Based on our analysis, consider your trading style, preferred platform, and regulatory requirements

- Select account type: Raw/ECN for active trading, standard for occasional trading

- Complete verification: Provide ID, proof of address, and financial information

- Make initial deposit: Minimum deposits range from $100-$500 depending on broker

- Download platform: Install MT4, MT5, cTrader, or use web-based platforms

- Start with demo: Practice with virtual funds before risking real money

Understanding Legal Requirements

Regulatory requirements vary by jurisdiction:

- EU/UK: Appropriateness testing required for complex products

- Australia: Professional client classification available for eligible traders

- Other jurisdictions: Varying disclosure and risk warning requirements

Funding Your Account for OTC Trades

Most brokers accept multiple funding methods:

- Bank transfers: Typically free but slower (1-3 days)

- Credit/debit cards: Instant funding but potential fees

- E-wallets: Fast and often free (Skrill, Neteller, PayPal)

- Cryptocurrency: Increasingly accepted by offshore brokers

Conclusion

Summary of the Best OTC Forex Brokers

After extensive analysis of the current market, here are our top recommendations for 2025:

For Beginners: AvaTrade offers excellent education and commission-free trading with predictable spreads.

For Active Traders: IC Markets provides the tightest spreads (from 0.02 pips) and professional-grade execution.

For Platform Variety: Pepperstone offers the most comprehensive platform selection with excellent execution speeds.

For Low Costs: FP Markets combines competitive spreads with the lowest commission rates at $3.00 per lot.

Key Considerations for Choosing the Right OTC Broker

Remember these essential factors:

- Regulation is non-negotiable: Only trade with tier-1 regulated brokers

- Total cost matters: Consider both spreads and commissions in your analysis

- Platform compatibility: Choose brokers supporting your preferred trading platform

- Risk management: Understand counterparty risk and use appropriate position sizing

- Stay informed: Monitor regulatory changes and broker developments

Summary of OTC Forex Trading Benefits and Risks

OTC trading offers significant advantages including flexibility, lower costs, and 24-hour access, but these benefits come with increased counterparty risk and reduced transparency. Success in OTC trading requires careful broker selection, robust risk management, and continuous education about market developments.

The key to successful OTC forex trading lies in choosing the right broker for your specific needs and maintaining disciplined risk management practices. With the regulatory improvements implemented in 2025, particularly the enhanced CySEC requirements, the OTC forex market continues to evolve toward greater transparency and client protection.

Frequently Asked Questions

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.