Key Takeaways

- IC Markets leads as the #1 MetaTrader 5 broker with spreads from 0.0 pips and superior third-party tools

- Pepperstone offers exceptional execution speed and Smart Trader Tools for advanced users

- FP Markets provides the best low-cost option with competitive Raw ECN spreads

- Always verify regulation – prioritize brokers with FCA, ASIC, CySEC, or equivalent top-tier oversight

- Test before you trade – every broker mentioned offers demo accounts for platform evaluation

Introduction to MetaTrader 5 (MT5)

Let’s be honest—choosing a MetaTrader 5 broker isn’t rocket science, but it’s not exactly a walk in the park either. With dozens of brokers claiming to offer the “best” MT5 experience, how do you separate the wheat from the chaff?

After testing over 80 brokers and analyzing thousands of data points, I’ve put together this comprehensive guide to help you find the perfect MT5 broker. Whether you’re a scalper chasing every pip or a swing trader looking for reliable execution, this guide has you covered.

What Is MetaTrader 5 (MT5)?

MetaTrader 5 is the next-generation trading platform from MetaQuotes Software, designed to be a comprehensive multi-asset trading solution. Unlike its predecessor MT4, which was primarily forex-focused, MT5 opens doors to stocks, commodities, indices, cryptocurrencies, and futures—all from one platform.

Think of it this way: If MT4 is like a specialized sports car built for racing, MT5 is like a luxury SUV that can handle city streets, highways, and off-road adventures with equal ease.

Key Features of MT5

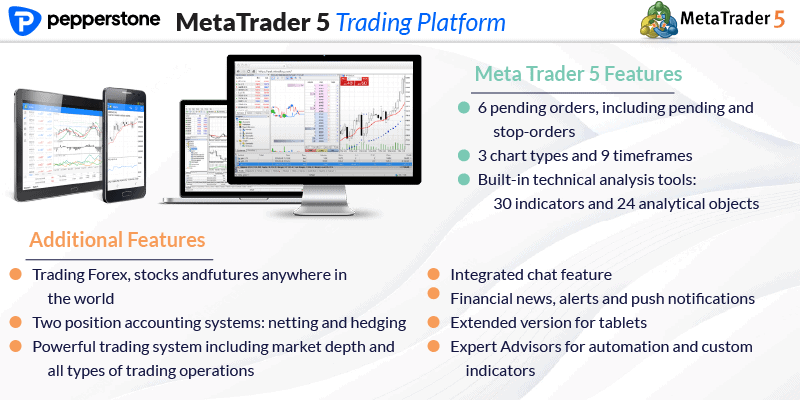

Here’s what makes MT5 stand out from the crowd:

- 21 timeframes vs. MT4’s 9 (more flexibility for analysis)

- 6 order types vs. MT4’s 4 (including Buy Stop Limit and Sell Stop Limit)

- 38 built-in indicators vs. MT4’s 30

- Depth of Market (DOM) feature for better price transparency

- Economic calendar integrated directly into the platform

- Multi-threaded strategy tester for faster backtesting

- MQL5 programming language for more sophisticated automation

MT4 vs. MT5: Key Differences

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 | 21 |

| Order Types | 4 | 6 |

| Built-in Indicators | 30 | 38 |

| Programming Language | MQL4 | MQL5 |

| Depth of Market | No | Yes |

| Multi-Asset Trading | Limited | Comprehensive |

| Strategy Tester | Single-threaded | Multi-threaded |

Advanced Features of MT5

What really sets MT5 apart is its institutional-grade features. The platform supports netting and hedging positions, gives you access to Level II pricing, and includes a built-in MQL5 Market where you can buy or rent trading robots and indicators.

The strategy tester alone is worth the upgrade—it’s like having a Formula 1 pit crew analyze your trading strategies while MT4 users are stuck with a basic mechanic.

MT5 Compatibility with Forex Trading

Despite being designed as a multi-asset platform, MT5 excels at forex trading. It handles micro-lots, mini-lots, and standard lots with precision, supports all major currency pairs, and offers advanced order management features that serious forex traders demand.

Why Choose MetaTrader 5?

Here’s the bottom line: MT5 is built for traders who want more than just basic charting and order entry. It’s for those who understand that successful trading requires proper tools, reliable execution, and the flexibility to adapt to changing markets.

Whether you’re analyzing correlations between currency pairs and stock indices or testing complex algorithmic strategies, MT5 gives you the horsepower to get the job done right.

Top MetaTrader 5 Forex Brokers

After extensive testing and analysis, here are the brokers that truly deliver on their MT5 promises. Each has been evaluated on execution speed, spreads, regulatory compliance, and overall user experience.

IC Markets – Best Overall for MetaTrader 5

Winner of ForexBrokers.com 2025 Annual Award for #1 MetaTrader broker

Features and Benefits

IC Markets has earned its reputation as the gold standard for MT5 trading. With over 2,250 tradable instruments and integration with premium third-party tools like Autochartist and Trading Central, it’s built for serious traders who demand institutional-grade execution.

Pros

- Spreads from 0.0 pips on major pairs

- Advanced Trading Tools package

- Multiple regulatory licenses

- Excellent execution speeds

- Professional-grade platform add-ons

Cons

- Higher minimum deposit ($200)

- Can be overwhelming for beginners

- Limited educational resources

Spreads and Fees

IC Markets offers two account types with distinct pricing models:

- Raw Spread accounts: EUR/USD from 0.0 pips + $3.5 commission per lot per side

- Standard accounts: EUR/USD from 0.8 pips with no commission

Regulation: IC Markets is regulated by ASIC (Australia), CySEC (Cyprus), FSA (Seychelles), SCB (Bahamas), and CMA (Kenya). This multi-jurisdictional approach ensures robust client protection.

Trading Platforms and Execution

Beyond MT5, IC Markets provides access to cTrader, TradingView, and their proprietary platform. The execution is lightning-fast with average speeds under 40ms, making it ideal for scalpers and algorithmic traders.

Start Trading with IC Markets

Start Trading with IC Markets

Pepperstone – Best for Fast Order Execution

8-year streak as Best in Class for MetaTrader

Features and Benefits

Pepperstone has built a reputation around speed and reliability. Their Smart Trader Tools and Figaro integration make MT5 even more powerful, while their Razor accounts offer institutional-grade spreads.

Pros

- Ultra-fast execution (under 30ms)

- Smart Trader Tools included

- No minimum deposit

- Premium third-party integrations

- Excellent mobile app

Cons

- Commission-based pricing on best accounts

- Limited crypto CFD offerings

- No US clients accepted

Spreads and Fees

- Razor accounts: EUR/USD from 0.0 pips + $3.5 commission per lot per side

- Standard accounts: EUR/USD from 1.0 pips with no commission

Regulation: Pepperstone is regulated by ASIC (Australia), FCA (UK), CySEC (Cyprus), BaFin (Germany), DFSA (Dubai), CMA (Kenya), and SCB (Bahamas).

Trading Platforms and Execution

Pepperstone’s MT5 integration includes access to TradingView charts, cTrader, and their proprietary mobile app. The execution technology is built for speed, with most orders filled in under 30 milliseconds.

Open Your Pepperstone Account

Open Your Pepperstone Account

FP Markets – Best Low-Cost Option

4-time Best in Class MetaTrader offering

Features and Benefits

FP Markets strikes the perfect balance between cost and features. Their Raw ECN account offers institutional-grade spreads at a fraction of the cost, while their comprehensive platform suite includes MT5, MT4, and cTrader.

Pros

- Ultra-competitive spreads from 0.0 pips

- Low $50 minimum deposit

- Excellent customer service

- Comprehensive platform suite

- Strong regulatory backing

Cons

- Limited third-party tools

- Basic research offerings

- Fewer advanced features

Spreads and Fees

- Raw ECN accounts: EUR/USD from 0.0 pips + $3 commission per lot per side

- Standard accounts: EUR/USD from 1.2 pips with no commission

Regulation: FP Markets is regulated by ASIC (Australia), CySEC (Cyprus), FSA (Seychelles), FSCA (South Africa), and SCB (Bahamas).

Trading Platforms and Execution

FP Markets provides a robust MT5 experience with access to over 70 currency pairs, commodities, indices, and cryptocurrencies. The platform supports advanced order types and includes integrated risk management tools.

Start Trading with FP Markets

Start Trading with FP Markets

AvaTrade – Best for Beginner Traders

Comprehensive educational resources and user-friendly interface

Features and Benefits

AvaTrade excels at making MT5 accessible to new traders without sacrificing advanced features. Their comprehensive educational program and intuitive interface make it easy to get started, while their multi-asset offerings keep you growing.

Pros

- Excellent educational resources

- User-friendly interface

- Strong regulatory backing

- Copy trading available

- Multiple account types

Cons

- Higher spreads than competitors

- Limited third-party tools

- Withdrawal fees apply

Spreads and Fees

- Standard accounts: EUR/USD from 1.5 pips (spread-only pricing)

- Professional accounts: Lower spreads available for qualified traders

Regulation: AvaTrade is regulated by CySEC (Cyprus), ASIC (Australia), FCA (UK), FSCA (South Africa), and multiple other jurisdictions.

Trading Platforms and Execution

AvaTrade’s MT5 platform includes access to over 1,000 instruments across multiple asset classes. The platform supports both algorithmic and copy trading, making it ideal for traders who want to learn from others.

Start Learning with AvaTradeXM Group – Best for Mobile Trading

Serves over 10 million customers globally

Features and Benefits

XM Group has built a massive following by focusing on reliability and accessibility. Their MT5 mobile app is among the best in the industry, and their educational resources are comprehensive and regularly updated.

Pros

- Excellent mobile platform

- Over 1,000 instruments

- Strong educational program

- Multiple account types

- Global regulatory coverage

Cons

- Higher spreads on standard accounts

- Limited advanced tools

- Withdrawal restrictions in some regions

Spreads and Fees

- Standard accounts: EUR/USD from 1.0 pips (spread-only)

- XM Zero accounts: EUR/USD from 0.0 pips + commission

Regulation: XM Group is regulated by CySEC (Cyprus), ASIC (Australia), FSC (Belize), DFSA (Dubai), and multiple other authorities.

Exness – Best for Professional Traders

Unlimited leverage and institutional-grade execution

Features and Benefits

Exness caters to professional traders who need maximum flexibility and powerful execution. Their unlimited leverage offering and institutional-grade infrastructure make them a favorite among experienced traders.

Pros

- Unlimited leverage available

- Tight spreads and fast execution

- Professional-grade tools

- Excellent customer support

- Multiple account types

Cons

- High minimum for professional accounts

- Limited educational resources

- Not suitable for beginners

Spreads and Fees

- Professional accounts: EUR/USD from 0.0 pips + low commission

- Standard accounts: EUR/USD from 1.0 pips

Regulation: Exness is regulated by CySEC (Cyprus), FCA (UK), FSA (Seychelles), and other major authorities.

Eightcap

Regulation: ASIC, CySEC, FCA, SCB

Key Features: 800+ markets, advanced charting, economic calendar

Spreads: From 0.0 pips on ECN accounts

Trade with EightcapBlackBull Markets

Regulation: FMA (New Zealand)

Key Features: 26,000+ instruments, ECN execution

Spreads: From 0.0 pips on Prime accounts

Trade with BlackBullFusion Markets

Regulation: ASIC, VFSC

Key Features: Ultra-low costs, multiple platforms

Spreads: From 0.0 pips + $2.25 commission

Trade with FusionFxPro

Regulation: FCA, CySEC, FSCA

Key Features: Excellent customer service, educational resources

Spreads: From 0.0 pips on Raw accounts

Trade with FxProMT5 Broker Comparison Chart

Spreads and Commissions Comparison

| Broker | EUR/USD Spread | Commission | GBP/USD Spread | USD/JPY Spread | Account Type |

|---|---|---|---|---|---|

| IC Markets | 0.0 pips | $3.50/lot | 0.23 pips | 0.14 pips | Raw Spread |

| Pepperstone | 0.0 pips | $3.50/lot | 0.1 pips | 0.1 pips | Razor |

| FP Markets | 0.0 pips | $3.00/lot | 0.2 pips | 0.1 pips | Raw ECN |

| AvaTrade | 1.5 pips | No commission | 1.8 pips | 1.5 pips | Standard |

| XM Group | 1.0 pips | No commission | 1.2 pips | 1.0 pips | Standard |

| Exness | 0.0 pips | $3.50/lot | 0.1 pips | 0.1 pips | Professional |

Key Features to Look for in a MetaTrader 5 Forex Broker

Not all MT5 brokers are created equal. Here’s what separates the wheat from the chaff:

Regulation and Security

This isn’t negotiable. Your broker should be regulated by at least one top-tier authority. Here’s the hierarchy:

Top-Tier Regulators

- FCA (UK): Gold standard for European regulation

- ASIC (Australia): Strict oversight with strong client protections

- CySEC (Cyprus): EU-compliant with passporting rights

- NFA/CFTC (US): Stringent but limited to US residents

- BaFin (Germany): Conservative approach with excellent stability

Low Spreads and Commissions

Trading costs can make or break your profitability. Here’s what to look for:

Standard vs. Raw Spreads on MT5

Most brokers offer two pricing models:

- Standard accounts: Wider spreads, no commission. Good for casual traders.

- Raw/ECN accounts: Tight spreads + commission. Better for active traders.

Think of it like this: Standard accounts are like buying a car with financing included—convenient but more expensive. Raw accounts are like paying cash—more upfront work but better long-term value.

Trading Tools and Plugins

Premium brokers offer third-party integrations that can significantly enhance your trading:

Third-Party Tools Integration

Autochartist

Automated pattern recognition and trade opportunity alerts

Trading Central

Professional market analysis and trade ideas

Smart Trader Tools

Advanced risk management and position sizing

TradingView

Advanced charting and social trading features

Platform Compatibility

Your broker should offer MT5 across all devices:

MT5 Across Devices

- Desktop: Windows, Mac, Linux compatibility

- Web: Browser-based trading without downloads

- Mobile: iOS and Android apps with full functionality

Execution Speeds and Slippage

In forex, milliseconds matter. Look for brokers offering:

- Execution speeds under 50ms

- Minimal slippage during news events

- STP or ECN execution models

Available Markets and Instruments

MT5’s strength lies in its multi-asset capabilities. Your broker should offer:

- Forex: Major, minor, and exotic currency pairs

- Indices: Global stock market indices

- Commodities: Gold, oil, agricultural products

- Stocks: Individual company shares

- Cryptocurrencies: Bitcoin, Ethereum, and altcoins

How to Choose the Best MetaTrader 5 Broker

Choosing the right broker isn’t about finding the “perfect” one—it’s about finding the one that matches your trading style and goals. Here’s my step-by-step framework:

Step 1: Verify Regulation and Licensing

Start with the basics. Check your broker’s regulatory status using these resources:

- FCA Register for UK brokers

- ASIC Register for Australian brokers

- CySEC Database for Cyprus brokers

Step 2: Assess Trading Fees and Commissions

Calculate your expected monthly trading volume and compare total costs across brokers. Don’t just look at spreads—factor in commissions, overnight fees, and withdrawal charges.

Step 3: Test Platform Features and Tools

Open demo accounts with your top 3 choices. Test order execution, platform stability, and available tools. This is crucial—you’ll be spending hours on this platform.

Step 4: Evaluate Execution Speed and Technology

For active traders, execution speed is paramount. Look for brokers offering:

- Low-latency connections

- Co-location services

- VPS hosting options

Advantages of Using MT5 for Forex Trading

Advanced Charting and Analysis Tools

MT5’s charting capabilities are simply superior. With 21 timeframes and 38 built-in indicators, you can analyze markets from multiple perspectives. The ability to display unlimited charts simultaneously means you can monitor correlations and spot opportunities across different currency pairs.

Multi-Asset Trading Capabilities

Unlike MT4’s forex-centric approach, MT5 lets you trade currencies, stocks, indices, and commodities from a single platform. This is particularly valuable for correlation trading and portfolio diversification.

Improved Backtesting Functionality

The multi-threaded strategy tester in MT5 is a game-changer. It can run multiple optimization passes simultaneously, dramatically reducing the time needed to validate trading strategies.

Enhanced Automated Trading Features

MQL5 is more powerful than MQL4, allowing for sophisticated Expert Advisors and custom indicators. The language supports object-oriented programming, making it easier to develop complex trading systems.

How to Get Started with a MetaTrader 5 Broker

Opening a Trading Account

The account opening process has been streamlined across most brokers. Here’s what you’ll typically need:

- Personal Information: Full name, address, phone number

- Financial Information: Employment status, income, trading experience

- Documentation: Government-issued ID, proof of address

- Account Type Selection: Standard vs. ECN/Raw accounts

Setting Up the MetaTrader 5 Platform

Once your account is approved, you’ll receive login credentials and server information. Here’s how to get started:

Downloading and Installing MT5

Most brokers provide customized MT5 installations with their servers pre-configured. Always download from your broker’s website to ensure you get the correct version.

Downloading the Desktop Version

- Visit your broker’s MT5 download page

- Download the appropriate version for your operating system

- Run the installer and follow the prompts

- Log in using your broker-provided credentials

Using the MT5 WebTrader

For those who prefer browser-based trading, MT5 WebTrader offers full functionality without the need for downloads. Simply log in through your broker’s website.

Installing MT5 on Mobile Devices

Download the official MetaTrader 5 app from your device’s app store, then add your broker’s server and login credentials.

Opening a Demo Account

I always recommend starting with a demo account, even if you’re an experienced trader. This allows you to:

- Test the broker’s execution speed and platform stability

- Familiarize yourself with MT5’s features

- Develop and test trading strategies

- Evaluate customer support quality

Making Your First Trade

Start small and focus on execution quality rather than profits. Here’s a simple checklist for your first trade:

Placing Your First Trade on MT5

- Select your currency pair from the Market Watch

- Right-click and select “New Order” or use F9

- Choose order type (Market, Pending, etc.)

- Set your lot size (start with 0.01 lots)

- Configure stop loss and take profit levels

- Review and execute the trade

Managing Risk with MT5

MT5 includes sophisticated risk management tools. Use them:

- Position Sizing: Never risk more than 1-2% per trade

- Stop Losses: Set these before entering any position

- Take Profits: Define your exit strategy in advance

- Trailing Stops: Use these to protect profits on winning trades

MT5 Trading Strategies

Technical Analysis on MT5

MT5’s advanced charting makes it perfect for technical analysis. The platform’s strength lies in its ability to display multiple timeframes simultaneously and apply sophisticated indicators.

Popular technical strategies that work well on MT5:

- Support and Resistance Trading: Use MT5’s drawing tools to identify key levels

- Moving Average Crossovers: Leverage the platform’s 38 built-in indicators

- Fibonacci Retracements: MT5’s Fibonacci tools are comprehensive and accurate

- Candlestick Patterns: Enhanced pattern recognition with better timeframe analysis

Fundamental Analysis Tools

MT5 includes an integrated economic calendar and news feed, making it easier to align your trades with fundamental events. Key features include:

- Real-time economic calendar

- News feed integration

- Market sentiment indicators

- Correlation analysis tools

Algorithmic Trading with MT5

MT5’s MQL5 language enables sophisticated algorithmic trading strategies. The platform supports:

- Expert Advisors (EAs): Fully automated trading systems

- Custom Indicators: Develop your own technical analysis tools

- Scripts: Automate routine trading tasks

- Signal Services: Follow and copy other traders’ strategies

Social and Copy Trading Options

Many MT5 brokers offer social trading features, allowing you to:

- Follow successful traders

- Copy their trades automatically

- Analyze their performance metrics

- Adjust risk parameters to match your comfort level

MT5 Mobile Trading

MT5 Mobile App Features

The MT5 mobile app isn’t just a scaled-down version of the desktop platform—it’s a full-featured trading environment optimized for mobile devices. Key features include:

- Full charting capabilities with 21 timeframes

- 38 technical indicators available on mobile

- One-click trading for fast execution

- Push notifications for price alerts and trade updates

- Complete order management including pending orders

Comparing MT5 Mobile Experience Across Brokers

While the core MT5 mobile app is the same, brokers differentiate themselves through:

- Custom plugins and tools

- Execution speed and server quality

- Additional features like news feeds

- Customer support integration

Tips for Effective Mobile Trading

- Use price alerts instead of constantly watching charts

- Keep position sizes smaller than desktop trading

- Pre-set stop losses and take profits

- Avoid complex strategies that require extensive analysis

Bonuses and Promotions Offered by MT5 Brokers

Welcome Bonuses

Many brokers offer welcome bonuses to new MT5 traders. Common types include:

- Deposit bonuses: 50-100% of your initial deposit

- No-deposit bonuses: Free trading credit to test the platform

- Cashback programs: Rebates on trading volume

Important: Always read the terms and conditions. Bonus funds often come with trading volume requirements that may not align with your trading style.

Deposit Bonuses

Deposit bonuses can boost your trading capital, but they usually come with strings attached:

- Minimum trading volume requirements

- Time limits for bonus usage

- Restrictions on withdrawal of bonus funds

Loyalty Programs

Long-term traders often benefit from loyalty programs that offer:

- Reduced spreads based on trading volume

- Cashback on commissions

- Priority customer support

- Exclusive market analysis and signals

Common MT5 Issues and Troubleshooting

Connection Problems

Connection issues are the most common MT5 problems. Solutions include:

- Check server status: Ensure your broker’s servers are operational

- Verify internet connection: Test with other applications

- Firewall settings: Ensure MT5 isn’t blocked by security software

- Try different servers: Many brokers offer multiple server locations

Chart Loading Issues

If charts aren’t loading properly:

- Reset chart data by pressing F5

- Clear the platform cache

- Check your internet bandwidth

- Contact your broker’s technical support

Expert Advisor (EA) Errors

EA problems often stem from:

- Incorrect parameter settings

- Insufficient account balance

- Market closure outside trading hours

- Broker restrictions on automated trading

Platform Crashes and Freezes

To minimize platform stability issues:

- Keep MT5 updated to the latest version

- Close unnecessary charts and tools

- Restart the platform regularly

- Consider using a VPS for 24/7 stability

Risks and Considerations When Choosing an MT5 Broker

Market Volatility

MT5’s advanced features can tempt traders to take on excessive risk. Remember that:

- Higher leverage amplifies both profits and losses

- Multiple asset classes mean increased market exposure

- Advanced tools don’t guarantee trading success

- Emotional discipline remains crucial regardless of platform sophistication

Broker Reliability

Not all brokers offering MT5 are created equal. Red flags include:

- Lack of proper regulation

- Frequent platform outages

- Withdrawal difficulties

- Poor customer support

- Unrealistic promotional offers

Due Diligence Checklist: Before depositing funds, verify your broker’s regulatory status, read online reviews, test their customer support, and start with a small deposit to evaluate their withdrawal process.

Future of MT5 and Forex Trading

Upcoming MT5 Features and Updates

MetaQuotes continues to enhance MT5 with regular updates. Recent developments include:

- Improved mobile reporting with visual trading summaries

- New indicators including Market Profile and ZigZag

- Enhanced data windows for better market analysis

- Optimized history display for large datasets

Emerging Trends in Forex Trading Platforms

The future of forex trading platforms will likely include:

- AI-powered analysis tools for better trade signals

- Blockchain integration for transparent execution

- Enhanced social trading features

- Improved mobile functionality rivaling desktop platforms

How Brokers Are Adapting to Changing Trader Needs

Progressive brokers are investing in:

- Faster execution infrastructure

- Educational resources and trading tools

- Mobile-first platform development

- Cryptocurrency and digital asset integration

Conclusion

Summary of the Best MT5 Brokers

After extensive analysis, here are my top recommendations based on different trading needs:

- Best Overall: IC Markets – Superior execution and third-party tools

- Best for Speed: Pepperstone – Lightning-fast execution with Smart Trader Tools

- Best Value: FP Markets – Competitive spreads with excellent service

- Best for Beginners: AvaTrade – Comprehensive education and support

- Best for Professionals: Exness – Unlimited leverage and institutional features

Choosing the Right MT5 Broker for Your Needs

Your ideal broker depends on your trading style, experience level, and specific requirements. Consider these factors:

- Trading frequency: Active traders benefit from ECN accounts with tight spreads

- Experience level: Beginners should prioritize education and support

- Capital requirements: Some brokers require higher minimum deposits

- Geographic location: Ensure your chosen broker accepts clients from your country

Final Tips for Choosing the Right Broker

Before making your final decision:

- Test multiple brokers with demo accounts

- Verify regulatory status through official channels

- Read the fine print on fees and withdrawal policies

- Start small and scale up as you gain confidence

- Keep learning and adapting to market changes

Remember, the best broker is the one that aligns with your trading goals and provides reliable, cost-effective access to the markets. Don’t get caught up in flashy promotions or unrealistic promises—focus on the fundamentals of regulation, execution quality, and customer service.

For more detailed broker reviews and comparisons, visit our complete guide to choosing a reliable forex broker.

Frequently Asked Questions (FAQs)

- What is the difference between MetaTrader 4 (MT4) and MetaTrader 5 (MT5)?

- MT5 offers 21 timeframes vs MT4’s 9, includes 6 order types vs 4, has 38 built-in indicators vs 30, supports multi-asset trading, and features an improved strategy tester. MT5 is designed for more advanced trading and portfolio management.

- Can I use MetaTrader 5 on my mobile device?

- Yes, MT5 is available for iOS and Android devices. The mobile app includes full charting capabilities, all 38 indicators, push notifications, and complete order management functionality.

- Which brokers offer the lowest spreads on MT5?

- IC Markets, Pepperstone, and FP Markets offer some of the lowest spreads on MT5, with EUR/USD spreads starting from 0.0 pips on their ECN/Raw accounts (plus commission).

- Can I trade cryptocurrencies using MetaTrader 5?

- Yes, many MT5 brokers offer cryptocurrency CFDs including Bitcoin, Ethereum, and other major altcoins. However, availability varies by broker and jurisdiction.

- How do I choose between different MT5 account types?

- Standard accounts offer wider spreads with no commission, suitable for casual traders. ECN/Raw accounts provide tighter spreads plus commission, better for active traders. Consider your trading frequency and volume when choosing.

- Is MetaTrader 5 better for beginners or advanced traders?

- MT5 caters to both, but its advanced features make it particularly suitable for experienced traders. Beginners can start with basic functionality and gradually explore advanced features like algorithmic trading and multi-asset capabilities.

- What are the best features of MetaTrader 5 for algo trading?

- MT5 offers MQL5 programming language, improved strategy tester, unlimited charts, Depth of Market, and access to the MQL5 Market for purchasing Expert Advisors and indicators.

- Can I integrate third-party plugins with MT5?

- Yes, many brokers offer third-party integrations like Autochartist, Trading Central, and Smart Trader Tools. Availability depends on your broker.

- Are there any MT5 brokers with zero commissions?

- Yes, brokers like AvaTrade and XM offer commission-free trading on their standard accounts, but these typically have wider spreads compared to commission-based ECN accounts.

- How secure is MetaTrader 5 for online trading?

- MT5 uses advanced encryption and security protocols. However, broker security depends on their regulatory compliance and infrastructure. Always choose regulated brokers with segregated client accounts.

- Are MetaTrader 5 brokers regulated?

- The best MT5 brokers are regulated by top-tier authorities like FCA, ASIC, CySEC, and others. Always verify regulatory status before opening an account.

- Can I use automated trading on MT5?

- Yes, MT5 supports Expert Advisors (EAs) for automated trading. The platform includes a built-in strategy tester and access to the MQL5 Market for purchasing or renting trading robots.

- How do I choose the best MT5 broker?

- Consider regulation, trading costs, execution speed, available instruments, platform features, and customer support. Test multiple brokers with demo accounts before making a decision.

- What are the benefits of using MetaTrader 5?

- MT5 offers advanced charting, multi-asset trading, improved backtesting, more order types, better mobile functionality, and enhanced automation capabilities compared to MT4.

- How do I customize charts in MetaTrader 5?

- Right-click on any chart to access customization options including color schemes, grid settings, timeframes, and indicators. You can save custom templates for reuse.

- Does MetaTrader 5 work on Mac?

- Yes, MT5 is available for Mac either as a native application or through MT5 WebTrader, which runs in any web browser.

- Are there any fees for using MetaTrader 5?

- The MT5 platform itself is free. You pay trading costs (spreads/commissions) to your broker, not to MetaQuotes for using the platform.

- How do I access MetaTrader 5 on mobile?

- Download the official MT5 app from your device’s app store, then add your broker’s server details and login credentials to access your account.

- How do I backtest strategies on MetaTrader 5?

- Use the built-in Strategy Tester (Ctrl+R) to test Expert Advisors on historical data. MT5’s multi-threaded tester is significantly faster than MT4’s version.

- What is the minimum deposit to start with an MT5 broker?

- Minimum deposits vary by broker, ranging from $0 (Pepperstone) to $200 (IC Markets). Most brokers require $50-$100 to get started.

- Can I trade stocks with MetaTrader 5?

- Yes, MT5 supports stock CFDs and in some cases, actual stocks. Availability depends on your broker and jurisdiction.

- What leverage is available on MetaTrader 5 brokers?

- Leverage varies by broker and regulation. EU clients are limited to 1:30, while other jurisdictions may offer up to 1:500 or higher. Some brokers like Exness offer unlimited leverage.

- How do I use MetaTrader 5 signals?

- Access the Signals tab in MT5 to browse and subscribe to trading signals from other traders. You can copy their trades automatically based on your risk preferences.

- How do I withdraw profits from MetaTrader 5 brokers?

- Withdrawals are processed through your broker’s client portal, not directly through MT5. Methods typically include bank transfers, credit cards, and e-wallets.

- What is the minimum deposit for MT5 trading?

- Minimum deposits range from $0 to $200 depending on the broker. Most established brokers require $50-$100 to open a live account.

- How does MT5 compare to other trading platforms?

- MT5 offers more advanced features than MT4, better multi-asset support than most proprietary platforms, and superior automation capabilities compared to web-based platforms.

- What are the system requirements for running MT5?

- MT5 requires Windows 7 or later, 512MB RAM minimum (2GB recommended), and a stable internet connection. Mac and Linux versions are also available.

- Can I use multiple MT5 accounts with different brokers?

- Yes, you can install multiple MT5 instances or use the same installation with different broker servers and login credentials.

- Are there any limitations to MT5 demo accounts?

- Demo accounts typically have time limits (30-90 days) and may not perfectly replicate live market conditions. Some advanced features may be restricted.

- What types of orders can I place on MT5?

- MT5 supports 6 order types: Market, Buy Limit, Sell Limit, Buy Stop, Sell Stop, Buy Stop Limit, and Sell Stop Limit orders.

- Is MT5 better than MT4 for scalping?

- Yes, MT5 offers faster execution, more precise timing, better order management, and improved platform stability, making it superior for scalping strategies.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.