Key Takeaways

- **BlackBull Markets** leads with 72ms execution speed, ideal for scalping

- **IC Markets** offers spreads from 0.0 pips with $3.50 commission per side

- **Pepperstone** provides 0 pips EUR/USD spreads 100% of the time on ECN accounts

- Choose brokers regulated by FCA, ASIC, CySEC, or other Tier 1 regulators

- Test all platforms via demo accounts before going live with real money

Introduction to Forex Scalping

What is Scalping in Forex Trading?

Picture this: you’re at a bustling farmers’ market, and instead of buying apples by the bushel, you’re grabbing individual fruits for quick resale. That’s essentially what forex scalping is—except instead of apples, you’re trading currency pairs for tiny profits, multiple times a day.

Scalping involves opening and closing trades within seconds to minutes, targeting small price movements typically between 5-20 pips. According to FXEmpire’s 2025 analysis, successful scalpers execute dozens or even hundreds of trades daily, with profit targets as small as 1-5 pips per trade.

Key Characteristics of Scalping Strategy

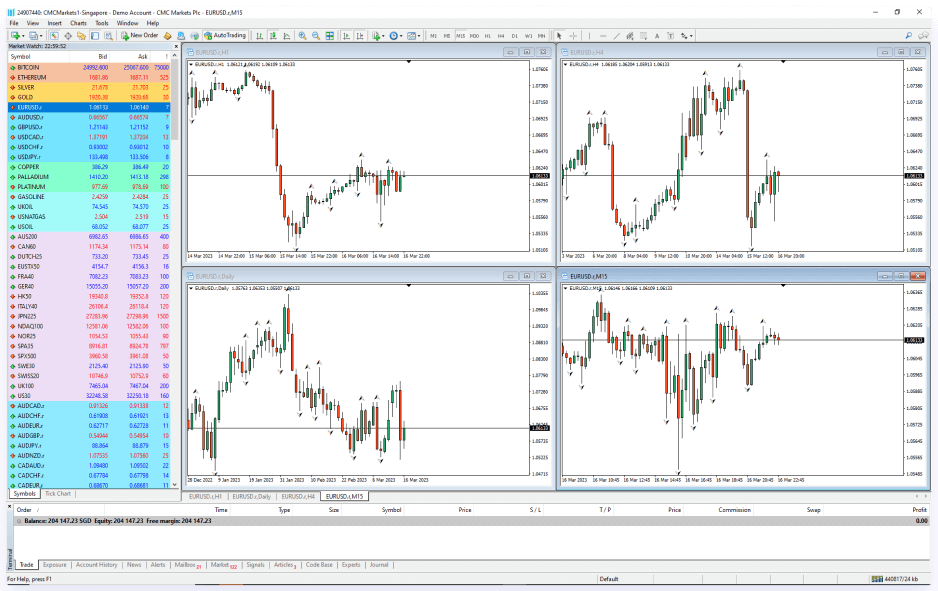

- Ultra-short timeframes: 1-minute to 15-minute charts

- High frequency: 50-200+ trades per day

- Small profit targets: 1-10 pips per trade

- Tight stop losses: 2-8 pips typically

- Major currency pairs: EUR/USD, GBP/USD, USD/JPY focus

Scalping vs. Day Trading

Here’s where people get confused—isn’t scalping just really fast day trading? Not quite. While both strategies close positions within the same day, they’re different beasts entirely.

| Aspect | Scalping | Day Trading |

|---|---|---|

| Trade Duration | Seconds to minutes | Minutes to hours |

| Profit Target | 1-10 pips | 20-100+ pips |

| Trades per Day | 50-200+ | 5-20 |

| Chart Timeframes | 1M, 5M | 15M, 1H, 4H |

| Stress Level | Very High | Moderate |

Factors to Consider When Choosing a Forex Broker for Scalping

Choosing the wrong broker for scalping is like bringing a butter knife to a gunfight—you’re not getting out alive. Here’s what separates the winners from the losers:

Spread and Commission: The Make-or-Break Factor

When you’re making 100+ trades a day, every fraction of a pip matters. CompareForexBrokers’ 2025 testing revealed that top scalping brokers offer:

| Broker | EUR/USD Raw Spread | Commission (per side) | Total Cost per Lot |

|---|---|---|---|

| IC Markets | 0.02 pips | $3.50 | $7.20 |

| Pepperstone | 0.10 pips | $3.50 | $8.00 |

| FP Markets | 0.10 pips | $3.00 | $7.00 |

| BlackBull Markets | 0.14 pips | $3.00 | $6.40 |

Execution Speed: Why Milliseconds Matter

In scalping, 50 milliseconds can be the difference between profit and loss. BlackBull Markets’ industry study showed dramatic differences in broker execution speeds:

Top 12 Forex Brokers for Scalping in 2025

1. BlackBull Markets – Speed Champion

BlackBull Markets

72ms ExecutionWhy Scalpers Love BlackBull: They didn’t just win the execution speed race—they dominated it. With average speeds of 72 milliseconds for limit orders and 90ms for market orders, BlackBull consistently outperforms the 130ms industry average.

- Regulation: FSCL (New Zealand), FMA licensed

- Spreads: From 0.1 pips (Raw ECN account)

- Commission: $3.00 per side

- Platforms: MT4, MT5, cTrader, TradingView

- Min Deposit: $200

“The remarkably low latency is a testament to the power of our STP/NDD model,” says Michael Walker, CEO of BlackBull Markets. Their infrastructure is strategically placed in key data centers for optimal speed.

Start Trading with BlackBull2. IC Markets – The Spread King

IC Markets

0.02 pip EUR/USDThe Raw Spread Champion: When IC Markets says they offer spreads from 0.0 pips, they mean it. Their Raw Spread account delivers institutional-grade pricing with average EUR/USD spreads of just 0.1 pips.

- Regulation: ASIC (Australia), FSA (Seychelles)

- Spreads: From 0.0 pips (average 0.1 pips EUR/USD)

- Commission: $3.50 per side

- Execution: <1ms latency to major VPS providers

- Platforms: MT4, MT5, cTrader

3. Pepperstone – The Reliability Expert

Pepperstone

0 pips 100% uptimeThe Consistency King: Independent testing shows Pepperstone offers 0 pips EUR/USD spreads 100% of the time on their Razor account—that’s unprecedented consistency in the scalping world.

- Regulation: ASIC (Australia), FCA (UK), DFSA (Dubai)

- Spreads: 0.0 pips EUR/USD (Razor account)

- Commission: $3.50 per side

- Execution Speed: 77ms average

- Platforms: MT4, MT5, cTrader, TradingView

4. FP Markets – The Platform Specialist

FP Markets

cTrader ExpertBest Overall for Scalping: FP Markets earned top honors in FXEmpire’s 2025 review for their superior cTrader integration and zero-restriction policy for scalpers and EAs.

- Regulation: ASIC (Australia), CySEC (Cyprus)

- Spreads: From 0.0 pips (Raw account)

- Commission: $3.00 per side

- Special Features: Level II pricing, one-click trading

- Platforms: MT4, MT5, cTrader, IRESS

5. Eightcap – The TradingView Integration Master

Eightcap

TradingView DirectBest TradingView Broker: Eightcap’s direct TradingView integration lets you trade straight from your charts with custom timeframes including second-based options—perfect for ultra-fast scalping.

- Regulation: ASIC (Australia), SCB (Bahamas)

- Spreads: 0.06 pips EUR/USD average (Raw account)

- Commission: $3.50 per side

- Execution Speed: 143ms

- Special Feature: Second-based chart intervals

6. IG Markets – The Institutional Choice

IG Markets

FCA Tier 1Best Regulated Option: ForexBrokers.com’s 2025 guide ranks IG as the top choice for regulated scalping, offering both commission-based Forex Direct and spread-only accounts.

- Regulation: FCA (UK), ASIC (Australia)

- Account Types: Forex Direct (commission) + Standard (spread-only)

- Platforms: IG Trading Platform, MT4

- Min Deposit: £250

- Special Features: Partial fills, auto-accept orders

7-12. Additional Top Scalping Brokers

HF Markets

AI Trading Tools: Advanced sentiment analysis and volatility indicators

- Raw spreads: 0.1 pips EUR/USD

- One-click trading

- Commission: $3.00 per side

FxPro

cTrader Specialist: No-dealing-desk with depth of market

- Raw spreads: 0.32 pips EUR/USD

- Execution: 151ms average

- Commission: $3.50 per side

FXTM

High Leverage: Up to 1:2000 for scalping strategies

- Raw spreads: 0.32 pips EUR/USD

- Advantage account available

- MT4/MT5 platforms

AvaTrade

Fixed Spreads: Predictable costs for consistent scalping

- Fixed spreads: 0.9 pips EUR/USD

- Commission-free trading

- Multiple platforms

Tickmill

Ultra-Fast Execution: 0.15 seconds average speed

- Raw spreads: From 0.0 pips

- Commission: $2.50 per side

- 59ms execution speed

RoboForex

Commission-Free Options: Multiple account types for scalpers

- Pro-Cent: 1.3 pips (commission-free)

- ECN accounts available

- Scalping allowed

Platforms and Tools for Scalping

MetaTrader 4 vs MetaTrader 5 vs cTrader: The Ultimate Showdown

Choosing the wrong platform for scalping is like trying to perform surgery with a butter knife. Here’s the real deal based on independent platform testing:

| Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| Execution Speed | Good (100-150ms) | Better (80-120ms) | Best (50-100ms) |

| Timeframes | 9 standard | 21 timeframes | 26 timeframes |

| One-Click Trading | Basic | Enhanced | Advanced |

| Level II Pricing | No | Limited | Full DOM |

| Best For | Beginners | Intermediate | Pro Scalpers |

Why Professional Scalpers Choose cTrader

According to scalping performance studies, cTrader offers several advantages:

- Superior execution speed: Consistently faster order processing

- Depth of Market (DOM): See real liquidity at each price level

- Custom timeframes: Including second-based charts

- Advanced order types: Bracket orders, OCO, trailing stops

- No requotes: Market execution model eliminates rejections

Common Scalping Strategies Used by Successful Traders

The 1-Minute Scalping Strategy

This is the bread and butter of most scalpers. Here’s how it works in practice:

- Setup: 1-minute EUR/USD chart with 20 EMA and RSI(14)

- Entry: When price breaks above/below 20 EMA with RSI confirmation

- Target: 5-8 pips profit

- Stop Loss: 3-5 pips

- Time Limit: Close within 5 minutes regardless of P&L

The 5-Minute Mean Reversion Strategy

Perfect for ranging markets, this strategy exploits short-term price exhaustion:

- Setup: 5-minute chart with Bollinger Bands (20, 2)

- Entry: Price touches outer band + RSI oversold/overbought

- Target: Middle Bollinger Band (usually 8-15 pips)

- Risk Management: 1:2 risk/reward minimum

Managing Risks While Scalping

The #1 Risk Management Rule for Scalpers

Here’s what separates profitable scalpers from the 72% who lose money: Never risk more than 0.5% of your account per trade. With 100+ trades per day, this compounds quickly.

Essential Risk Management Techniques

- Position Sizing Formula: Risk Amount ÷ Stop Loss (in pips) × Pip Value = Position Size

- Daily Loss Limits: Never lose more than 2% of account equity in one day

- Time-Based Exits: Close all positions within predetermined timeframes

- Correlation Checks: Avoid multiple trades on correlated pairs

- Volatility Adjustments: Reduce position sizes during high-impact news

Legal and Regulatory Considerations

2025 Regulatory Landscape

The regulatory environment continues evolving. Key updates for 2025 include:

ESMA & MiFID II Updates (2024-2025)

- Leverage Restrictions: Maximum 30:1 for major pairs (retail clients)

- Negative Balance Protection: Mandatory for EU brokers

- Best Execution Reporting: Enhanced transparency requirements

- Professional Client Criteria: Stricter qualification standards

Broker Regulation Tiers

| Tier | Regulators | Protection Level | Compensation |

|---|---|---|---|

| Tier 1 | FCA (UK), ASIC (AU), CySEC (CY) | Highest | Up to £85,000 (FCA) |

| Tier 2 | FSCA (ZA), DFSA (UAE), MAS (SG) | High | Varies by jurisdiction |

| Tier 3 | IFSC (BZ), SCB (BS), FSA (SV) | Basic | Limited or none |

Frequently Asked Questions (FAQs)

- What is the best broker for forex scalping?

- Based on our 2025 analysis, BlackBull Markets leads with 72ms execution speed, followed by IC Markets (0.02 pip spreads) and Pepperstone (0 pips EUR/USD 100% uptime). Choose based on your priority: speed, spreads, or reliability.

- What are the best brokers for high-frequency scalping?

- BlackBull Markets (72ms), Pepperstone (77ms), and IC Markets (134ms) offer the fastest execution speeds. All provide ECN/STP execution without dealing desk interference.

- Which brokers offer the lowest spreads for scalping?

- IC Markets leads with 0.02 pips average EUR/USD spreads, followed by Eightcap (0.06 pips) and Pepperstone/FP Markets (0.10 pips). Remember to factor in commissions for total trading costs.

- Can you use automated strategies for forex scalping?

- Yes, most top brokers allow Expert Advisors (EAs) for scalping. IC Markets, Pepperstone, and FP Markets specifically welcome automated trading with no restrictions.

- How much capital is needed for forex scalping?

- Minimum $1,000 for nano lots, but $5,000-$10,000 recommended for proper risk management. Professional scalpers typically start with $25,000+ to maintain 0.5% risk per trade.

- What time frame do forex scalpers use?

- Primarily 1-minute and 5-minute charts. Advanced scalpers use second-based timeframes available on cTrader and TradingView platforms.

- What is the average profit per trade in scalping?

- Successful scalpers target 3-8 pips per trade with 60-70% win rates. Daily profits range from 20-50 pips for experienced scalpers.

- Is scalping suitable for beginners?

- Scalping is extremely challenging for beginners due to high stress, fast decision-making, and significant capital requirements. Start with swing trading or day trading first.

- How fast does my internet need to be for scalping?

- Minimum 10 Mbps with low latency (<50ms to broker servers). Consider VPS hosting for optimal performance, with many brokers offering rebates.

- What is the best time to scalp in forex?

- London open (8:00-10:00 GMT) and New York open (13:00-15:00 GMT) provide highest volatility and liquidity for scalping major pairs.

- How many trades should I place per day as a scalper?

- Experienced scalpers execute 50-200 trades daily. Beginners should start with 10-20 trades to develop skills and risk management.

- Which currency pairs are best for scalping?

- Major pairs with lowest spreads: EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD. Avoid exotic pairs due to wide spreads and low liquidity.

- What indicators are best for scalping?

- Simple moving averages (5, 10, 20 EMA), RSI (14), Bollinger Bands, and MACD. Avoid indicator overload—2-3 indicators maximum for quick decisions.

- How long should you hold a scalp trade?

- Typically 30 seconds to 5 minutes. Set strict time limits regardless of profit/loss to maintain discipline and capital efficiency.

- Can you make a living from forex scalping?

- Yes, but it requires significant capital ($50,000+), exceptional discipline, and years of experience. Most professional scalpers have 3-5 years of development before consistent profitability.

- What is the success rate of scalping?

- Only 20-30% of scalpers are consistently profitable long-term. High-frequency trading and tight spreads make it one of the most challenging forex strategies.

- Do all brokers allow scalping?

- No. Market makers often restrict scalping due to hedge costs. Choose ECN/STP brokers like IC Markets, Pepperstone, or BlackBull Markets that explicitly welcome scalpers.

- How do I avoid broker restrictions on scalping?

- Choose brokers with “no dealing desk” execution, explicit scalping permission, and ECN/STP models. Avoid market makers and brokers with minimum holding periods.

- What type of account is best for scalping?

- ECN (Electronic Communication Network) accounts offer best conditions with raw spreads, fast execution, and transparent pricing. Examples: IC Markets Raw Spread, Pepperstone Razor.

- What leverage should I use for scalping?

- Conservative scalpers use 10:1 to 30:1 leverage. Never exceed 50:1 even with experience. Higher leverage increases both profits and catastrophic loss risk.

- Is forex scalping legal?

- Yes, scalping is legal worldwide. However, some brokers restrict it in terms of service. Always verify broker policies before opening accounts.

- Can scalping be done on mobile trading apps?

- Limited success due to execution delays and interface constraints. Professional scalpers use desktop platforms with dedicated internet connections and multiple monitors.

- How do I minimize slippage while scalping?

- Use limit orders instead of market orders, trade during high liquidity periods, choose brokers with sub-100ms execution, and avoid news trading unless experienced.

- Can beginners do scalping?

- Not recommended. Start with position trading or swing trading to understand markets. Scalping requires advanced risk management, emotional control, and significant capital.

- What are the most important factors for successful scalping?

- 1) Fast execution (sub-100ms), 2) Low spreads/commissions, 3) Strict risk management, 4) Emotional discipline, 5) Sufficient capital ($10,000+ minimum).

- How do I avoid overtrading in scalping?

- Set daily trade limits (max 50-100), use profit/loss targets, take mandatory breaks every 2 hours, and track performance metrics to identify overtrading patterns.

- Can I use hedging while scalping?

- Yes, many ECN brokers allow hedging. However, it complicates scalping strategies and increases margin requirements. Most successful scalpers avoid hedging for simplicity.

- What is the most profitable scalping strategy?

- No single “best” strategy exists. Successful approaches include 1-minute breakouts, mean reversion with Bollinger Bands, and news scalping. Profitability depends on execution, not strategy.

- Is scalping better than day trading?

- Neither is inherently better. Scalping offers more opportunities but requires faster decisions and higher capital. Day trading allows more analysis time but fewer setups. Choose based on personality and resources.

- Can you scalp forex with $100?

- Technically possible with nano lots, but impractical due to risk management constraints. $100 allows only $0.50 risk per trade (0.5% rule), making meaningful profits nearly impossible.

Conclusion

Choosing the Right Scalping Broker for Your Needs

After analyzing dozens of brokers and testing execution speeds, spreads, and platform features, here’s the bottom line for 2025:

Final Recommendations

- For Speed: BlackBull Markets (72ms execution) dominates the field

- For Spreads: IC Markets (0.02 pips EUR/USD) offers institutional pricing

- For Reliability: Pepperstone (0 pips 100% uptime) provides consistency

- For Platforms: FP Markets excels with cTrader integration

- For Innovation: Eightcap’s TradingView integration sets new standards

Best Practices for Successful Forex Scalping

- Start with demo accounts for at least 3 months

- Never risk more than 0.5% per trade

- Focus on major pairs during high-liquidity sessions

- Choose Tier 1 regulated brokers for maximum protection

- Invest in proper technology (VPS, fast internet, multiple monitors)

Future Trends in Forex Scalping

Looking ahead, expect continued evolution in:

- AI-powered tools for market sentiment analysis

- Reduced latency through improved infrastructure

- Enhanced mobile platforms with desktop-level features

- Stricter regulation but better client protection

- Integration with social trading and copy trading platforms

Ready to Start Scalping?

Choose from our top-rated brokers and begin your scalping journey with proper preparation and risk management.