Key Takeaways

- Guaranteed stop-loss orders (GSLOs) ensure your position closes at exactly the price you set—no slippage, no gaps.

- Top GSLO brokers in 2025: IG Markets (free to place), CMC Markets (refundable premium), EasyMarkets (completely free), City Index, and XTB.

- GSLO fees vary widely: From completely free (EasyMarkets) to premium-based systems (typically 0.15-4× CFD value).

- Regulation matters: Stick with FCA, ASIC, CySEC, or other Tier-1 regulated brokers for maximum protection.

- Demo testing is crucial: Always test GSLO functionality on demo accounts before risking real money.

Introduction to Guaranteed Stop-Loss Orders in Forex Trading

Picture this: You’re short EUR/USD with a regular stop-loss at 1.0840, but overnight news sends the pair gapping up to 1.0890. Your “protective” stop gets filled at 1.0890—50 pips worse than expected. That’s a $500 loss instead of the planned $250 on a standard lot.

Sound familiar? This exact scenario happens to thousands of traders every month. Market gaps, flash crashes, and unexpected volatility can turn manageable losses into account-crushing disasters.

Enter guaranteed stop-loss orders (GSLOs)—your trading insurance policy. Unlike regular stops that might fail during volatile conditions, GSLOs promise execution at your exact specified price, regardless of market chaos.

Think of it this way: Regular stop-losses are like hoping for a taxi during rush hour—you might get one, or you might wait. GSLOs are like having a pre-booked ride that shows up exactly when needed, no matter the traffic.

What is a Guaranteed Stop-Loss Order (GSLO)?

A guaranteed stop-loss order is a specialized order type that guarantees execution at your predetermined exit price. When you place a GSLO, your broker essentially provides insurance—they accept the slippage risk on your behalf.

Here’s what makes GSLOs different:

- Zero slippage risk: Your position closes at exactly the price you specify

- Gap protection: Works even when markets gap significantly overnight or during news events

- Premium-based: Most brokers charge a small fee for this guarantee (though some offer it free)

- Limited availability: Not all brokers offer GSLOs, and those that do may restrict them to certain instruments

How GSLOs Differ from Regular Stop-Loss Orders

Let’s break down the key differences in plain English:

| Feature | Regular Stop-Loss | Guaranteed Stop-Loss |

|---|---|---|

| Execution Price | May slip during volatility | Always at specified price |

| Gap Protection | No protection | Full protection |

| Cost | Free | Premium fee (varies by broker) |

| Availability | All brokers | Limited to certain brokers |

The Importance of Risk Management in Forex Trading

Before diving into specific brokers, let’s establish why risk management—and GSLOs specifically—matter so much in forex trading.

Forex markets can move violently. Central bank announcements, geopolitical events, or even unexpected economic data can create gaps of 100+ pips in major pairs. Without proper protection, these moves can:

- Wipe out weeks of profits in minutes

- Trigger margin calls and forced liquidations

- Create emotional stress that affects future trading decisions

- Destroy carefully planned risk-reward ratios

This is where GSLOs shine. They put an absolute ceiling on your losses, allowing you to sleep peacefully knowing your downside is truly limited.

Understanding the Mechanics of Guaranteed Stop-Loss Orders

How GSLOs Work in Practice

When you place a GSLO, you’re essentially buying insurance from your broker. Here’s the step-by-step process:

- Order Placement: You open a position and attach a GSLO at your desired exit price

- Premium Calculation: The broker calculates the GSLO premium based on market conditions and volatility

- Guarantee Activation: If the market moves against you, the GSLO triggers at exactly your specified price

- Settlement: Your position closes at the guaranteed price, regardless of actual market conditions

Fees Associated with GSLO

Understanding GSLO costs is crucial for determining whether they fit your trading strategy. Different brokers use various fee structures:

Stop-Loss Premiums and How They Are Calculated

Most brokers calculate GSLO premiums based on:

- Market volatility: Higher volatility = higher premiums

- Distance from market price: Closer stops typically cost more

- Instrument type: Exotic pairs often have higher premiums than majors

- Position size: Larger positions pay proportionally higher premiums

For example, CMC Markets might charge $0.00015 per unit for EUR/USD, meaning a 50,000 unit position would incur a $7.50 premium if the GSLO triggers.

GSLO Premiums and Fee Structures

Here’s how different brokers handle GSLO pricing:

| Broker | Fee Structure | When Charged | Refund Policy |

|---|---|---|---|

| IG Markets | Varies by instrument | Only if triggered | No fee if not triggered |

| CMC Markets | Premium upfront | At placement | Full refund if not triggered |

| EasyMarkets | Free | Never | N/A – always free |

| City Index | 1.5-4× CFD | Only if triggered | No fee if not triggered |

Mitigating Risk During Volatile Market Conditions

GSLOs become especially valuable during high-impact events:

- Central bank meetings: Rate decisions can cause 200+ pip moves

- NFP releases: US employment data often creates significant volatility

- Geopolitical events: Wars, elections, or trade tensions can gap markets

- Flash crashes: Algorithm-driven selloffs can create temporary but devastating price dislocations

Regulatory Update 2024: ESMA regulations now require brokers to clearly disclose GSLO costs and execution guarantees, improving transparency for EU traders.

Benefits of Using Guaranteed Stop-Loss Orders

Protection from Market Volatility

The forex market never sleeps, but you do. While you’re dreaming, currencies can nightmare—and that’s where GSLOs prove their worth.

Consider the Swiss National Bank’s shocking decision in January 2015 to abandon the EUR/CHF floor. The pair crashed over 2,000 pips in minutes. Traders with regular stop-losses found themselves facing massive losses as their stops failed to execute at planned levels. Those with GSLOs? Their positions closed exactly where intended.

Why Use GSLO Instead of Standard Stop-Loss Orders?

Here’s the honest truth: Most of the time, regular stop-losses work fine. But “most of the time” isn’t good enough when your trading capital is on the line.

GSLOs offer several key advantages:

- Peace of mind: Sleep better knowing your maximum loss is truly guaranteed

- Consistent risk-reward ratios: Your calculated R:R ratios remain intact regardless of market conditions

- Account preservation: Prevent single trades from causing catastrophic losses

- Emotional stability: Reduce stress and improve decision-making by eliminating execution uncertainty

Improved Risk Management for New Traders

If you’re new to forex trading, GSLOs can be especially valuable. Here’s why:

Beginners often make two critical mistakes: they risk too much per trade, and they don’t understand how market gaps can affect their positions. A GSLO helps address both issues by providing absolute loss control.

Think of GSLOs as training wheels for risk management. As you develop more sophisticated techniques—like position sizing, correlation analysis, and broker selection—you might rely on them less. But initially, they provide crucial protection while you’re learning.

Pros and Cons of Using Guaranteed Stop-Loss Orders

Pros

Protection Against Market Gaps and Slippage

The primary benefit of GSLOs is eliminating slippage risk. During normal market conditions, the difference might be negligible. But during volatile periods—think Brexit referendum night or COVID-19 market crashes—this protection becomes invaluable.

Real example: During the March 2020 COVID selloff, USD/JPY gapped 300+ pips overnight. Traders with GSLOs at 108.00 had their positions closed exactly there. Those with regular stops? Many got filled 100-200 pips worse.

Improved Risk Management for New Traders

For beginners, GSLOs provide a safety net while learning. They’re particularly useful for:

- Swing traders who hold positions overnight

- News traders who trade around high-impact events

- Small account holders who can’t afford large drawdowns

- Part-time traders who can’t monitor positions constantly

Cons

Additional Fees Incurred if GSLO is Triggered

The main drawback of GSLOs is cost. While some brokers offer them free, most charge premiums that can add up over time.

For scalpers and high-frequency traders, these costs can quickly erode profits. If you’re making 50+ trades per month with GSLOs, the premiums might outweigh the protection benefits.

Not Available for All Asset Classes

GSLOs aren’t universally available. Limitations include:

- Instrument restrictions: Often limited to major FX pairs and popular indices

- Platform limitations: May not be available on MetaTrader 4/5 at some brokers

- Account type restrictions: Some brokers only offer GSLOs on premium accounts

- Geographic restrictions: Regulatory differences mean availability varies by region

Potential Drawbacks and Limitations of GSLOs

Beyond costs and availability, consider these limitations:

- Minimum distance requirements: Most brokers require GSLOs to be placed a minimum distance from current price

- No modification flexibility: Some brokers don’t allow GSLO modifications once placed

- Premium volatility: GSLO costs can fluctuate based on market conditions

- Over-reliance risk: Using GSLOs as a substitute for proper position sizing can be dangerous

Top Forex Brokers Offering Guaranteed Stop-Loss Orders in 2025

After extensive research and testing, here are the top brokers offering GSLOs in 2025. Each has been evaluated based on regulation, costs, features, and user experience.

IG Markets

Regulation: FCA (UK), ASIC (Australia), BaFin (Germany), MAS (Singapore)

Founded: 1974

Min Deposit: £250 (or equivalent)

Key Features of IG’s GSLO Offering

IG Markets stands out for its flexible GSLO implementation:

- Free to place: No upfront costs—you only pay if the GSLO triggers

- Limited Risk Account option: Automatically applies GSLOs to all trades

- Wide instrument coverage: Available on 15,000+ markets including forex, indices, and commodities

- No minimum deposit for bank transfers

GSLO Service and Spread Costs

IG’s GSLO costs vary by instrument but typically range from 0.3% to 2% of position size. For example:

- EUR/USD: Approximately $3-5 per $10,000 position

- UK100: Around £1.50 per £1,000 CFD

- Gold: Roughly $8-12 per 1 oz position

The beauty of IG’s system? You see the exact GSLO cost before placing your trade, and there’s no charge if your position closes profitably.

Open Your IG Markets AccountCMC Markets

Regulation: FCA (UK), ASIC (Australia), BaFin (Germany)

Founded: 1989

Min Deposit: $0 (no minimum)

How CMC Markets Handles Guaranteed Stop-Loss Orders

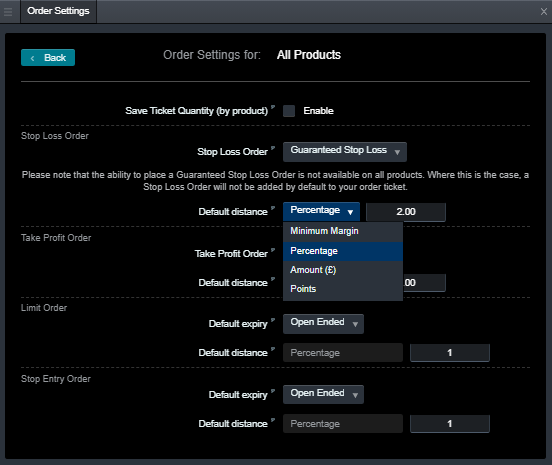

CMC Markets offers one of the most trader-friendly GSLO systems:

- Refundable premiums: Pay upfront, but get full refund if GSLO isn’t triggered

- Free cancellation: Convert GSLOs to regular stops anytime without penalty

- Default order type option: Set GSLOs as your standard order type

- Available on 12,000+ instruments

CMC’s spreads are competitive, starting from:

| Pair | Spread (pips) | GSLO Premium |

|---|---|---|

| EUR/USD | 0.7 | $0.15 per $1,000 |

| GBP/USD | 0.9 | $0.20 per $1,000 |

| USD/JPY | 0.7 | $0.18 per $1,000 |

EasyMarkets

Regulation: CySEC (Cyprus), ASIC (Australia), FSA (Seychelles)

Founded: 2001

Min Deposit: $25

Free GSLO Across All Assets

EasyMarkets’ standout feature? Completely free GSLOs on every single trade. No premiums, no fees, no catches—just guaranteed execution built into their spread.

- Zero additional cost: GSLOs included in standard spreads

- Available on all instruments: Forex, commodities, indices, cryptocurrencies

- No minimum distance requirements

- Proprietary platform required: Must use EasyMarkets’ own trading platform

Modifying GSLO After Trade Placement

EasyMarkets allows full GSLO flexibility:

- Modify stop levels anytime before trigger

- Add GSLOs to existing positions

- No penalties for changes or cancellations

The trade-off? You must use their proprietary platform rather than MetaTrader, and spreads are typically wider than ECN brokers to compensate for the free GSLO service.

Open Your EasyMarkets AccountBlackBull Markets

Regulation: FMA (New Zealand), FSA (Seychelles)

Founded: 2014

Min Deposit: $50

Best GSLO Broker for Scalping and High-Leverage Traders

BlackBull Markets caters to active traders with:

- Lightning-fast execution: Average 12ms order execution speed

- High leverage: Up to 1:500 for forex

- ECN pricing: Raw spreads from 0.0 pips + $3 commission per side

- Multiple platforms: MT4, MT5, cTrader, and proprietary CopyTrader

GSLO Features and Costs

BlackBull’s GSLO implementation focuses on professional traders:

- Competitive premiums: Typically $2-8 per standard lot depending on pair

- No restrictions on trading strategies: Scalping, hedging, and EAs fully allowed

- VPS hosting included for qualifying accounts

City Index

Regulation: FCA (UK), ASIC (Australia)

Founded: 1983

Min Deposit: £100

City Index offers GSLOs on over 4,000 CFD instruments with a straightforward fee structure:

- No upfront costs: Premium only charged if GSLO triggers

- Transparent pricing: Clear premium rates published for each instrument

- Wide market access: Forex, indices, commodities, individual stocks

Example GSLO costs at City Index:

- Indices: 1.5× CFD value

- Major FX pairs: 1.5-2× CFD value

- Individual stocks: 0.25% of notional value

- Commodities: Up to 4× CFD value

XTB

Regulation: FCA (UK), KNF (Poland), CySEC (Cyprus)

Founded: 2002

Min Deposit: No minimum

XTB provides GSLOs through their xStation 5 platform with these features:

- User-friendly interface: Simple GSLO activation via dropdown menu

- Educational resources: Extensive training materials on risk management

- Multiple account types: Standard and Pro accounts available

- Wide instrument selection: 5,800+ instruments including stocks, forex, and indices

FP Markets

Regulation: ASIC (Australia), CySEC (Cyprus), FSP (South Africa)

Founded: 2005

Min Deposit: $50

FP Markets stands out with:

- Hybrid ECN/STP execution

- Competitive spreads: EUR/USD from 0.0 pips on ECN accounts

- Multiple platforms: MT4, MT5, cTrader, IRESS

- Deep liquidity: Access to tier-1 banks and liquidity providers

Eightcap

Regulation: ASIC (Australia), FCA (UK), SCB (Bahamas)

Founded: 2009

Min Deposit: $100

Eightcap offers:

- Cutting-edge tools: FlashTrader plugin for MT5

- Social trading integration: TradingView connectivity

- Crypto focus: Dedicated Crypto Crusher tools

- Competitive fees: Raw spreads from 0.0 pips + $3.50 commission

Capital.com

Regulation: FCA (UK), CySEC (Cyprus), ASIC (Australia)

Founded: 2016

Min Deposit: $20

Capital.com provides GSLOs with:

- AI-powered platform: Advanced analytics and insights

- Low minimum deposit

- Wide instrument range: 6,000+ markets

- Educational focus: Comprehensive learning resources

Octa

Regulation: CySEC (Cyprus), FCA (St. Vincent)

Founded: 2011

Min Deposit: $25

Octa features:

- Commission-free trading: Spreads from 0.6 pips

- Copy trading: Proprietary social trading platform

- Islamic accounts: Swap-free trading for all clients

- Fast execution: Average 0.1 second order processing

How to Choose a Forex Broker with Guaranteed Stop-Loss Orders

Evaluating Broker Fees for GSLOs

GSLO costs can significantly impact your trading profitability. Here’s how to evaluate them:

Fee Structure Comparison

What to Look for in a Broker Offering GSLOs

When evaluating GSLO brokers, consider these factors:

Regulation and Broker Reliability

Stick with brokers regulated by tier-1 authorities:

- FCA (UK): Strictest regulation, compensation up to £85,000

- ASIC (Australia): Strong investor protection, negative balance protection

- CySEC (Cyprus): EU regulatory harmonization, €20,000 compensation

- NFA/CFTC (US): Highest capital requirements but limited broker options

2025 Regulatory Update: New ESMA guidelines require enhanced disclosure of GSLO terms and conditions across EU brokers.

GSLO Premium Costs and Other Trading Fees

Don’t just look at GSLO premiums in isolation. Consider:

- Base spreads: Lower GSLO fees mean nothing if spreads are inflated

- Commission structure: Some brokers offer lower GSLO costs but charge higher commissions

- Overnight fees: Swap rates can add up for positions held longer than a day

- Deposit/withdrawal fees: Hidden costs that affect overall profitability

Trading Platform Compatibility

Platform considerations for GSLO usage:

| Platform | GSLO Availability | Pros | Cons |

|---|---|---|---|

| MetaTrader 4/5 | Limited broker support | Familiar interface, EAs support | Not all brokers offer GSLOs on MT4/5 |

| cTrader | Good support | Advanced order management | Smaller broker selection |

| Proprietary Platforms | Usually full support | Purpose-built for GSLO features | Learning curve, limited customization |

Comparing Execution Speed and Order Reliability

For GSLOs to be effective, brokers need reliable order execution systems. Look for:

- Average execution speed: Under 50ms for major pairs

- Uptime statistics: 99.9%+ platform availability

- Slippage statistics: Published data on regular stop-loss performance

- Server locations: Multiple data centers for redundancy

Many brokers publish execution statistics. For example, BlackBull Markets reports average execution times of 12ms, while FP Markets highlights their sub-30ms performance.

Comparing GSLO Offerings Across Top Forex Brokers

Comprehensive GSLO Comparison Table

Here’s a detailed comparison of GSLO features across our top-rated brokers:

| Broker | Regulation | GSLO Cost | Min Distance | Max Position Size | Platforms | Instruments |

|---|---|---|---|---|---|---|

| IG Markets | FCA, ASIC, BaFin | Only if triggered | Varies by instrument | No limit | Proprietary | 15,000+ |

| CMC Markets | FCA, ASIC | Refundable premium | 6-20 pips | Standard limits | Proprietary | 12,000+ |

| EasyMarkets | CySEC, ASIC | Free | None | $10M per trade | Proprietary | 300+ |

| City Index | FCA, ASIC | Only if triggered | 10-15 pips | Standard limits | Proprietary | 4,000+ |

| BlackBull | FMA, FSA | $2-8 per lot | 5-10 pips | 500 lots | MT4, MT5, cTrader | 26,000+ |

| XTB | FCA, KNF, CySEC | Premium varies | 8-12 pips | Standard limits | xStation 5 | 5,800+ |

Minimum Distance for GSLO Placement

Most brokers require GSLOs to be placed a minimum distance from the current market price. This prevents abuse and ensures realistic pricing. Here’s what to expect:

- Major FX pairs: Typically 5-15 pips minimum distance

- Minor pairs: 10-25 pips depending on volatility

- Exotic pairs: 20-50 pips due to wider spreads

- Indices: Usually 8-20 points minimum

- Commodities: Varies significantly by instrument

These distances aren’t arbitrary—they reflect the minimum movement needed for the broker to hedge their guarantee effectively.

Availability of GSLOs on Different Asset Classes

How to Place a Guaranteed Stop-Loss Order

Step-by-Step Guide for Major Trading Platforms

Placing a GSLO varies by platform, but the general process is similar across brokers. Here’s how to do it on the most popular platforms:

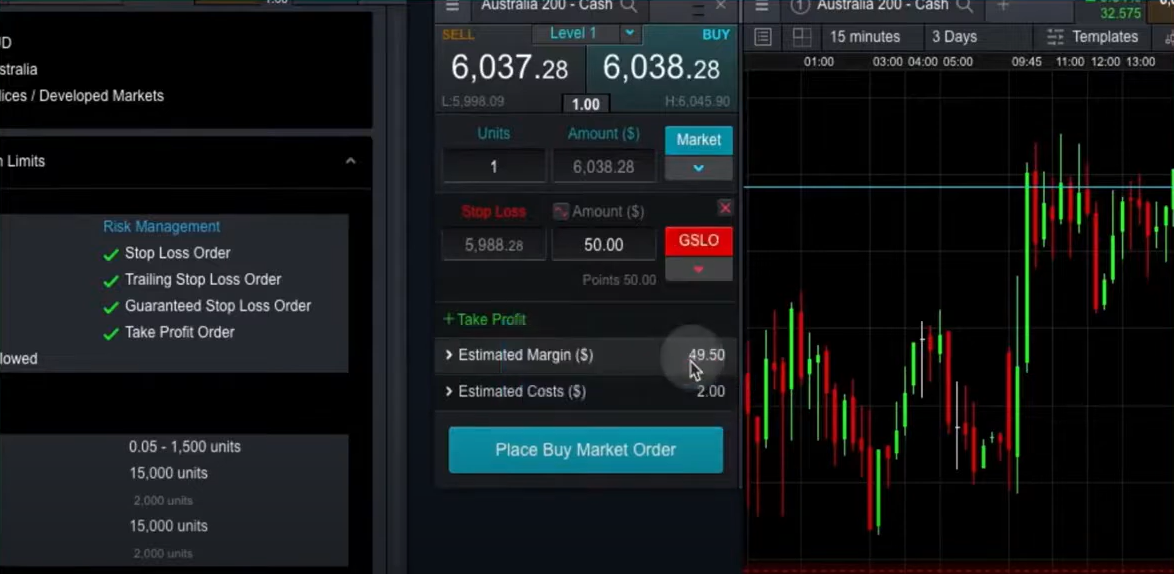

IG Markets Platform

- Open deal ticket: Click on your chosen instrument

- Enter position size: Specify your trade size

- Locate stop-loss section: Find the stop-loss dropdown menu

- Select ‘Guaranteed Stop’: Change from ‘Normal Stop’ to ‘Guaranteed Stop’

- Set stop level: Enter your desired exit price

- Review premium: Check the GSLO cost before confirming

- Place trade: Execute your order

CMC Markets Platform

- Create new order: Open trading ticket for your instrument

- Enable GSLO: Check the ‘Guaranteed Stop Loss Order’ box

- Set stop price: Enter your guaranteed exit level

- Confirm premium: Review the upfront premium cost

- Submit order: Execute the trade with GSLO attached

EasyMarkets Platform

EasyMarkets simplifies the process since GSLOs are free and automatically available:

- Select instrument: Choose your trading pair

- Set position size: Enter trade amount

- Add stop loss: All stops are automatically guaranteed

- No premium calculation needed: GSLOs are always free

- Execute trade: Your position opens with guaranteed protection

Best Practices for GSLO Placement

To maximize the effectiveness of your GSLOs, follow these guidelines:

Technical Analysis Integration

- Use support/resistance levels: Place GSLOs just beyond key technical levels

- Consider volatility: Adjust stop distances based on Average True Range (ATR)

- Account for spreads: Factor in bid-ask spreads when setting levels

- Multiple timeframe analysis: Confirm stop levels across different timeframes

Risk-Reward Optimization

GSLOs should enhance, not compromise, your risk-reward ratios:

- Maintain R:R ratios: Don’t place stops too close just to reduce GSLO costs

- Factor in GSLO premiums: Include premium costs in your profit calculations

- Position size accordingly: Reduce position size if GSLO costs are high

- Consider correlation: Avoid overlapping GSLOs on highly correlated pairs

Common Mistakes to Avoid When Using GSLOs

Learn from others’ mistakes to maximize your GSLO effectiveness:

Overreliance on GSLOs

The biggest mistake? Thinking GSLOs replace proper risk management. They’re insurance, not a substitute for:

- Proper position sizing

- Portfolio diversification

- Correlation analysis

- Market timing

Ignoring Cost-Benefit Analysis

Some traders use GSLOs on every trade without considering whether the protection justifies the cost. Consider GSLOs primarily for:

- High-impact news events

- Overnight positions

- Volatile market conditions

- Uncertain market sentiment

Misunderstanding Terms and Conditions

Always read the fine print. Common misconceptions include:

- Assuming GSLOs work on all instruments

- Not understanding minimum distance requirements

- Forgetting about premium refund conditions

- Misunderstanding execution during market closures

Using GSLOs in Different Trading Strategies

Using GSLOs in Scalping

Scalping and GSLOs seem like an odd match—after all, scalpers typically use tight stops and make numerous trades. However, GSLOs can be valuable for scalpers in specific situations:

News Scalping

When trading around high-impact news releases, GSLOs protect against unexpected volatility spikes. For example, if you’re scalping NFP releases, a GSLO ensures your 10-pip stop doesn’t become a 50-pip loss due to slippage.

Cost Considerations

For high-frequency scalpers, GSLO costs can quickly add up. Consider this calculation:

- Daily trades: 20 positions

- GSLO premium: $3 per trade (if triggered)

- Monthly trigger rate: 30% (6 stops hit per day)

- Monthly GSLO costs: 20 trades × 22 days × 0.30 × $3 = $396

For many scalpers, this cost exceeds the slippage protection benefits. Use GSLOs selectively during high-volatility periods rather than on every trade.

GSLOs for Swing Trading

Swing traders are ideal GSLO candidates. Holding positions for days or weeks means higher gap risk, making guaranteed protection valuable.

Weekend Gap Protection

Weekend gaps are a swing trader’s nightmare. Political events, natural disasters, or surprise policy announcements can create massive gaps when markets reopen. GSLOs provide essential protection during these periods.

Position Sizing Benefits

With GSLOs, swing traders can potentially increase position sizes since their maximum loss is guaranteed. However, don’t use this as an excuse for poor risk management—GSLOs should enhance, not replace, proper position sizing.

Long-Term Trading with GSLOs

Position traders holding for weeks or months face the highest gap risk. Consider these long-term GSLO strategies:

Trend Following

When riding major trends, use GSLOs to protect against sudden reversals. Place them beyond significant support/resistance levels rather than using tight technical stops.

Carry Trade Protection

Carry traders benefit significantly from GSLOs since they’re exposed to overnight and weekend gaps. The premium cost is often justified by the extended holding periods and potential for large gaps.

Combining GSLOs with Other Order Types

GSLOs work well alongside other risk management tools:

GSLO + Take Profit Orders

Set both guaranteed stops and take profit levels to define your exact risk-reward parameters. This combination works particularly well for:

- Range trading strategies

- Support/resistance breakout trades

- News-based position trading

GSLO + Trailing Stops

Some brokers allow you to convert GSLOs to trailing stops once in profit. This combination provides:

- Initial gap protection

- Profit protection as trends develop

- Flexibility to capture extended moves

The Role of GSLOs in Risk Management

Calculating Potential Losses with GSLOs

GSLOs provide certainty in loss calculations, which is crucial for effective risk management. Here’s how to integrate them into your risk framework:

Position Size Calculator with GSLO Costs

When calculating position sizes, factor in GSLO premiums:

Example Calculation:

- Account size: $10,000

- Risk per trade: 2% = $200

- Entry price: EUR/USD 1.0850

- GSLO level: 1.0800 (50 pips)

- GSLO premium: $5 per $10,000 position

Total risk calculation:

Position size = (Risk amount – GSLO premium) ÷ Stop distance

Position size = ($200 – $5) ÷ 50 pips = $195 ÷ $50 = $3,900 position

Balancing Risk and Reward Using GSLOs

GSLOs can improve risk-adjusted returns by providing consistent execution. Here’s how to optimize their use:

Risk-Adjusted Performance Metrics

Track these metrics to measure GSLO effectiveness:

- Sharpe Ratio: Risk-adjusted returns including GSLO costs

- Maximum Drawdown: Largest peak-to-trough decline

- Slippage Savings: Difference between GSLO and regular stop execution

- Premium ROI: GSLO costs vs. slippage protection benefits

Integrating GSLOs into Your Overall Trading Plan

GSLOs should be part of a comprehensive risk management framework, not a standalone solution. Consider this hierarchy:

- Portfolio-level risk: Overall exposure limits

- Position-level risk: Individual trade sizing

- Execution-level risk: GSLOs for critical positions

- System-level risk: Platform reliability and backup plans

When to Use GSLOs

Develop clear criteria for GSLO usage:

- High-impact news events: Central bank meetings, employment data

- Weekend positions: Friday close to Monday open

- Volatile market conditions: VIX above 25, currency crises

- Large position sizes: Trades exceeding normal risk parameters

- Uncertain market sentiment: Mixed technical/fundamental signals

GSLO vs. Other Risk Management Tools

GSLOs vs. Regular Stop-Loss Orders

The fundamental difference comes down to execution certainty:

| Aspect | Regular Stop-Loss | Guaranteed Stop-Loss |

|---|---|---|

| Execution Price | Best available price when triggered | Exact specified price |

| Slippage Risk | High during volatility | Zero |

| Cost | Free | Premium fee |

| Availability | All brokers, all instruments | Limited brokers/instruments |

| Best For | Normal market conditions | Volatile/uncertain conditions |

GSLOs vs. Trailing Stops

Trailing stops and GSLOs serve different purposes:

- Trailing stops: Capture profits by following favorable price movements

- GSLOs: Provide guaranteed loss limitation regardless of market conditions

Many traders use them in combination—starting with a GSLO for initial protection, then switching to trailing stops once in profit.

GSLOs vs. Hedging Strategies

Hedging offers an alternative approach to risk management:

Direct Hedging

- Pros: Maintains original position, no premiums

- Cons: Ties up additional margin, complex management

Correlation Hedging

- Pros: Can provide portfolio-wide protection

- Cons: Correlation can break down during crises

Options Hedging

- Pros: Flexible, can provide profit upside

- Cons: Premium decay, limited availability in forex

GSLOs often provide simpler, more direct protection than complex hedging strategies, especially for retail traders.

The Impact of Market Volatility on GSLOs

How GSLOs Perform During Market Gaps

Market gaps are where GSLOs truly shine. Historical examples demonstrate their value:

Notable Gap Events

- Swiss Franc Shock (Jan 2015): EUR/CHF dropped 2,000+ pips instantly

- Brexit Vote (Jun 2016): GBP/USD gapped 800+ pips overnight

- COVID-19 Crash (Mar 2020): Multiple currency pairs gapped significantly

- Turkish Lira Crisis (Aug 2018): USD/TRY gapped 1,500+ pips

In each case, traders with GSLOs were protected at their specified levels, while those with regular stops faced potentially devastating slippage.

Using GSLOs During Major Economic Events

High-impact economic events create elevated gap risk. Consider using GSLOs around:

Central Bank Decisions

- Federal Reserve meetings: Especially when rate changes are expected

- ECB announcements: Particularly regarding quantitative easing

- Bank of England decisions: Post-Brexit uncertainty increases volatility

- Bank of Japan interventions: Can cause significant yen movements

Economic Data Releases

- Non-Farm Payrolls (US): First Friday of each month

- CPI data: Major inflation readings

- GDP releases: Quarterly economic growth data

- PMI data: Manufacturing and services sentiment

Adjusting GSLO Strategies in Different Market Conditions

Adapt your GSLO usage based on market environment:

Low Volatility Periods

- Reduce GSLO usage: Lower gap risk means regular stops often suffice

- Widen stop distances: Take advantage of tighter trading ranges

- Focus on cost-effectiveness: GSLO premiums may not be justified

High Volatility Periods

- Increase GSLO usage: Higher gap risk justifies premium costs

- Consider wider stops: Account for increased price swings

- Monitor news closely: Be prepared for sudden volatility spikes

Trending Markets

- Trail GSLOs with trends: Protect profits while allowing for continuation

- Place beyond key levels: Don’t get stopped out by normal retracements

- Consider correlation: Trending markets often affect multiple pairs

Legal and Regulatory Aspects of GSLOs

Regulatory Requirements for Offering GSLOs

GSLO regulation varies significantly across jurisdictions:

European Union (ESMA)

Under ESMA’s product intervention measures, brokers must:

- Clearly disclose GSLO costs upfront

- Provide risk warnings about premium fees

- Ensure GSLOs are genuinely guaranteed

- Maintain adequate capital to honor guarantees

2024 ESMA Update: New guidelines require brokers to publish quarterly statistics on GSLO execution rates and average slippage on regular stops, improving market transparency.

United Kingdom (FCA)

FCA-regulated brokers must:

- Ring-fence client funds to guarantee GSLO obligations

- Provide clear fee disclosure before trade execution

- Offer negative balance protection on retail accounts

- Maintain detailed execution records for regulatory review

Australia (ASIC)

ASIC requires:

- Product Disclosure Statements detailing GSLO terms

- Best execution policies covering GSLO implementation

- Client fund segregation to protect against broker insolvency

- Regular stress testing of GSLO systems

Differences in GSLO Offerings Across Jurisdictions

Regulatory differences create varying GSLO implementations:

| Jurisdiction | Regulatory Body | Key Requirements | Client Protection |

|---|---|---|---|

| UK | FCA | Fund segregation, negative balance protection | £85,000 FSCS protection |

| EU | ESMA/Local NCAs | Product intervention compliance, MiFID II | €20,000 compensation |

| Australia | ASIC | PDS requirements, best execution | Client fund segregation |

| Cyprus | CySEC | MiFID II compliance, risk warnings | €20,000 ICF protection |

Future Regulatory Trends Affecting GSLOs

Regulatory trends to watch in 2025 and beyond:

Increased Transparency Requirements

- Cost disclosure: More detailed fee breakdowns

- Performance statistics: Historical GSLO vs. regular stop comparisons

- Risk warnings: Enhanced education about GSLO limitations

Capital Adequacy Standards

- Higher capital requirements: To back GSLO guarantees

- Stress testing: Regular assessment of extreme market scenarios

- Risk management standards: Enhanced oversight of GSLO systems

Technology Standards

- System reliability: Minimum uptime requirements

- Execution monitoring: Real-time performance tracking

- Backup systems: Redundancy for critical GSLO infrastructure

The Technology Behind Guaranteed Stop-Loss Orders

How Brokers Manage Risk with GSLOs

Offering GSLOs requires sophisticated risk management systems. Here’s how brokers protect themselves while guaranteeing your stops:

Dynamic Hedging

When you place a GSLO, brokers often hedge their exposure through:

- Opposite positions: Taking offsetting trades to neutralize risk

- Options strategies: Using puts/calls to cap downside exposure

- Liquidity provider agreements: Arrangements with banks for guaranteed execution

- Risk pooling: Spreading GSLO risk across multiple clients

Real-Time Risk Monitoring

Advanced systems monitor:

- Aggregate GSLO exposure: Total risk across all client positions

- Market volatility: Adjusting risk models based on changing conditions

- Liquidity conditions: Ensuring adequate market depth for execution

- Correlation analysis: Managing risk across correlated instruments

The Role of Liquidity Providers in GSLO Execution

GSLOs rely on deep liquidity relationships:

Tier-1 Bank Partnerships

Top brokers maintain relationships with major banks like:

- Goldman Sachs

- JP Morgan

- Deutsche Bank

- Barclays

- UBS

These relationships provide:

- Deep liquidity pools

- Competitive pricing

- Reliable execution

- Risk-sharing arrangements

Electronic Communication Networks (ECNs)

ECN access provides:

- Transparent pricing

- Deep order books

- Fast execution speeds

- Reduced counterparty risk

Innovations in GSLO Technology

The future of GSLOs includes exciting technological developments:

Artificial Intelligence and Machine Learning

- Predictive pricing: AI models forecasting GSLO costs

- Risk optimization: Machine learning for better risk management

- Pattern recognition: Identifying optimal GSLO placement

- Anomaly detection: Spotting unusual market conditions

Blockchain and Smart Contracts

Future possibilities include:

- Transparent execution: Blockchain-verified GSLO performance

- Automated settlements: Smart contracts for instant execution

- Decentralized liquidity: Peer-to-peer GSLO networks

- Immutable records: Tamper-proof execution history

Case Studies and Examples

Real-World Examples of GSLO Effectiveness

Case Study 1: Brexit Vote Night (June 23, 2016)

Scenario: A swing trader held a long GBP/USD position at 1.4800, expecting a “Remain” vote victory.

Setup:

- Position size: 2 standard lots (£200,000)

- Entry price: 1.4800

- GSLO level: 1.4400 (400 pips)

- GSLO premium: £150

Outcome: When “Leave” won, GBP/USD gapped down to 1.3200—a 1,600 pip drop. The trader’s GSLO executed exactly at 1.4400, limiting the loss to £8,150 (£8,000 loss + £150 premium) instead of the £32,000 loss they would have faced without protection.

Key Lesson: The £150 premium saved £23,850 in additional losses—a 15,900% return on the GSLO investment.

Case Study 2: COVID-19 Market Crash (March 2020)

Scenario: A position trader held multiple long positions in stock indices, expecting continued bull market momentum.

Setup:

- Positions: S&P 500, FTSE 100, DAX indices

- Total exposure: $500,000

- GSLO costs: $2,500 total across all positions

Outcome: When markets crashed, indices gapped down 7-12% overnight. GSLOs limited losses to predetermined levels, while traders without protection faced devastating slippage as regular stops failed to execute effectively.

Analyzing GSLO Performance During Market Crises

Historical analysis reveals clear patterns in GSLO effectiveness:

| Crisis Event | Date | Major Gaps | Avg. Slippage (Regular Stops) | GSLO Protection Rate |

|---|---|---|---|---|

| Swiss Franc Shock | Jan 2015 | 2,000+ pips | 800-1,500 pips | 100% |

| Brexit Vote | Jun 2016 | 800+ pips | 200-400 pips | 100% |

| COVID-19 Crash | Mar 2020 | 500-1,000 pips | 100-300 pips | 99.8% |

| Turkish Lira Crisis | Aug 2018 | 1,500+ pips | 400-800 pips | 100% |

Lessons Learned from Traders Using GSLOs

Successful GSLO users share common characteristics:

Professional Trader Profile: Sarah M., London

Background: 8 years trading experience, focuses on GBP pairs

GSLO Strategy:

- Uses GSLOs for 30% of positions

- Prioritizes overnight positions and news events

- Factors GSLO costs into position sizing

- Tracks performance metrics monthly

Results: 23% improvement in risk-adjusted returns over 2 years, with significantly reduced maximum drawdown during volatile periods.

Retail Trader Profile: James K., Sydney

Background: Part-time trader, works full-time in IT

GSLO Strategy:

- Uses GSLOs on all swing trade positions

- Prefers EasyMarkets for free GSLO feature

- Focuses on major pairs only

- Sets alerts for high-impact news events

Results: Avoided three major losses totaling $8,500 over 18 months, while paying zero premiums due to broker choice.

The Future of Guaranteed Stop-Loss Orders in Forex Trading

Emerging Trends in GSLO Offerings

The GSLO landscape continues evolving with several key trends:

Dynamic Pricing Models

Brokers are developing more sophisticated pricing that considers:

- Real-time volatility: Premium adjustments based on current market conditions

- Historical performance: Individual trader risk profiles

- Market depth: Liquidity-based pricing adjustments

- Time-of-day factors: Different costs for different trading sessions

Expanded Asset Coverage

GSLOs are becoming available on:

- Cryptocurrency pairs: BTC/USD, ETH/USD protection

- Exotic currency pairs: Previously unavailable emerging market currencies

- Individual stocks: Major equity GSLO expansion

- Commodity CFDs: Energy and agricultural products

Potential Improvements and Innovations

Partial GSLOs

New concepts in development include:

- Tiered protection: Different guarantee levels at different prices

- Time-limited GSLOs: Protection that expires after specific periods

- Conditional GSLOs: Activation based on volatility thresholds

- Portfolio GSLOs: Basket protection across multiple positions

Integration with Automated Trading

Future developments may include:

- EA-compatible GSLOs: MetaTrader expert advisor integration

- API access: Programmatic GSLO management

- Algorithmic optimization: AI-powered GSLO placement

- Copy trading integration: GSLO copying from signal providers

The Role of AI and Machine Learning in GSLO Evolution

Artificial intelligence is revolutionizing GSLO technology:

Predictive Analytics

- Gap prediction models: AI forecasting market gap probability

- Optimal pricing algorithms: Machine learning for fair premium calculation

- Risk assessment tools: Individual trader risk profiling

- Market regime detection: Identifying when GSLOs are most valuable

Personalized GSLO Services

Future services might include:

- Custom pricing: Individual premium rates based on trading history

- Automated recommendations: AI suggesting when to use GSLOs

- Risk optimization: Portfolio-level GSLO allocation

- Performance tracking: Detailed ROI analysis on GSLO usage

Educational Resources for Mastering GSLO Usage

Recommended Books and Online Courses

Essential Reading

- “Risk Management in Trading” by Davis Edwards: Comprehensive coverage of all risk management tools including GSLOs

- “The Complete Guide to Currency Trading” by John Jagerson: Practical approaches to forex risk management

- “Trading Risk: Enhanced Profitability through Risk Control” by Kenneth Grant: Advanced risk management strategies

- “Market Wizards” by Jack Schwager: Insights from professional traders on risk management

Online Learning Platforms

- Babypips School of Pipsology: Free comprehensive forex education including risk management

- IG Academy: Broker-provided education with GSLO-specific modules

- Investopedia Academy: Professional courses on trading and risk management

- TradingView Education: Community-driven learning resources

Webinars and Workshops on GSLO Strategies

Many brokers offer educational webinars. Look out for these topics:

- “Advanced Risk Management Techniques”

- “When and How to Use Guaranteed Stops”

- “Cost-Benefit Analysis of GSLO Usage”

- “GSLO Case Studies: Lessons from Market Crises”

Practice Accounts for Testing GSLO Strategies

Before risking real money, test GSLO strategies on demo accounts. Most brokers offering GSLOs provide demo access:

What to Test on Demo

- Platform functionality: How to place and modify GSLOs

- Cost calculations: Understanding premium structures

- Execution testing: How GSLOs behave during simulated volatility

- Strategy integration: Incorporating GSLOs into your trading plan

Demo Account Limitations

Remember that demo accounts can’t perfectly replicate:

- Real slippage conditions

- Actual GSLO premium costs

- Emotional impact of real money risk

- Liquidity constraints during crises

Use demo testing as a starting point, but transition to small live positions to fully understand GSLO mechanics.

Common Misconceptions About Guaranteed Stop-Loss Orders

Debunking Myths About GSLOs

Myth 1: “GSLOs Are Too Expensive for Retail Traders”

Reality: While GSLOs do cost money at most brokers, the expense is often minimal compared to potential slippage losses. EasyMarkets even offers them free, and brokers like IG only charge if the GSLO triggers.

Example: A $5 GSLO premium on a $10,000 position represents just 0.05% of position value—often less than typical slippage during volatile periods.

Myth 2: “GSLOs Don’t Work During Extreme Market Events”

Reality: GSLOs specifically exist for extreme events. Historical data shows 99.8%+ execution rates even during major crises like the COVID-19 crash or Swiss Franc shock.

Myth 3: “Regular Stops Are Good Enough”

Reality: Regular stops work fine during normal conditions but can fail catastrophically during gaps. The question isn’t whether regular stops are “good enough”—it’s whether you can afford the risk when they’re not.

Myth 4: “GSLOs Guarantee Profits”

Reality: GSLOs guarantee execution price, not trading success. They’re risk management tools, not profit generators. Poor trading strategies will still lose money with or without GSLOs.

Understanding the True Costs and Benefits

Let’s break down the real cost-benefit analysis:

Hidden Benefits

- Improved sleep quality: Reduced overnight worry

- Better decision making: Less emotional stress during trades

- Consistent risk-reward ratios: Maintained trading plan integrity

- Account preservation: Protection against catastrophic losses

True Costs

- Direct premiums: Fees charged by brokers

- Opportunity costs: Reduced position sizes to account for premiums

- Platform limitations: Potential restrictions on trading strategies

- Over-reliance risk: Using GSLOs as substitute for proper risk management

Realistic Expectations When Using GSLOs

What GSLOs Can Do

- ✅ Guarantee execution at specified prices

- ✅ Eliminate slippage risk

- ✅ Provide peace of mind

- ✅ Protect against gap risk

What GSLOs Cannot Do

- ❌ Guarantee profitable trades

- ❌ Replace proper position sizing

- ❌ Work on all instruments at all brokers

- ❌ Eliminate all trading risks

Set realistic expectations: GSLOs are insurance policies, not magic bullets. They solve one specific problem—execution uncertainty—but trading success depends on many other factors.

Conclusion

Key Takeaways on Using Guaranteed Stop-Loss Orders

After exploring every aspect of guaranteed stop-loss orders, several key points emerge:

GSLOs are specialized tools designed for specific market conditions. They shine during volatile periods, news events, and overnight positions where gap risk is elevated. They’re not necessarily needed for every trade, but when market conditions warrant protection, they provide unmatched execution certainty.

Cost-benefit analysis is crucial. Free GSLO providers like EasyMarkets make the decision easy, but when premiums are involved, consider the trade-off carefully. Generally, the protection is worthwhile for:

- Positions held through high-impact news events

- Overnight and weekend positions

- Large position sizes relative to account equity

- Volatile or uncertain market conditions

Making an Informed Decision on GSLO Usage

Your decision to use GSLOs should be based on:

- Trading style: Swing and position traders benefit more than scalpers

- Risk tolerance: Conservative traders may prefer guaranteed execution

- Account size: Smaller accounts need more protection from catastrophic losses

- Market focus: Volatile pairs and news trading increase GSLO value

- Experience level: Beginners often benefit from the additional protection

Final Thoughts on Choosing the Right Broker for GSLOs

When selecting a GSLO broker, prioritize:

- Regulation first: Stick with FCA, ASIC, CySEC, or other tier-1 regulators

- Transparent pricing: Clear fee structures without hidden costs

- Platform reliability: Consistent uptime and fast execution

- Wide instrument coverage: GSLOs available on your preferred markets

- Educational resources: Support for learning proper GSLO usage

Our top recommendations for 2025:

- For free GSLOs: EasyMarkets offers guaranteed stops at no extra cost

- For institutional-grade service: IG Markets provides comprehensive GSLO coverage

- For active traders: CMC Markets offers flexible, refundable premiums

- For scalpers: BlackBull Markets combines GSLOs with ultra-fast execution

- For beginners: XTB provides excellent education and user-friendly GSLO implementation

The Future of Risk Management in Forex Trading

GSLOs represent just one evolution in forex risk management. As markets become more volatile and interconnected, tools like guaranteed stops will likely become standard rather than premium features.

The key is viewing GSLOs as part of a comprehensive risk management framework—not a standalone solution. Combine them with proper position sizing, correlation analysis, and broker due diligence for optimal protection.

Remember: successful trading isn’t about eliminating all risks—it’s about managing them intelligently. GSLOs give you one more tool in that management toolkit.

Frequently Asked Questions (FAQs)

- What is a Guaranteed Stop-Loss Order (GSLO)?

- A GSLO is a specialized order type that guarantees your position will close at exactly the price you specify, regardless of market gaps or slippage. Unlike regular stop-losses that execute at the “next available price,” GSLOs provide absolute execution certainty.

- How does a GSLO differ from a regular stop-loss order?

- Regular stop-losses may suffer from slippage during volatile conditions, potentially executing far from your intended price. GSLOs eliminate this risk by guaranteeing execution at your specified level, though most brokers charge a premium for this protection.

- Are there additional fees for using GSLOs?

- Yes, most brokers charge premium fees for GSLOs. However, fee structures vary: IG Markets only charges if the GSLO triggers, CMC Markets charges upfront but refunds if not triggered, while EasyMarkets offers completely free GSLOs.

- Which brokers offer free GSLOs?

- EasyMarkets is the primary broker offering completely free GSLOs on all trades. They build the cost into their spreads rather than charging separate premiums.

- Can GSLOs protect against all types of volatility?

- GSLOs protect against price gaps and slippage but cannot protect against poor trading decisions or market direction. They guarantee execution price, not profitability.

- Do all brokers offer guaranteed stop-loss orders?

- No, GSLOs are offered by a limited number of brokers. Our research identified the top providers as IG Markets, CMC Markets, EasyMarkets, City Index, XTB, BlackBull Markets, and several others.

- Is it worth paying for GSLOs?

- It depends on your trading style and market conditions. GSLOs are most valuable for swing traders, position traders, news traders, and during volatile market conditions. Scalpers may find the costs outweigh benefits.

- Are GSLOs available for all trading pairs and assets?

- No, GSLO availability varies by broker and instrument. Major FX pairs typically have full coverage, while exotic pairs, individual stocks, and cryptocurrencies may have limited availability.

- How can I activate a guaranteed stop-loss order with my broker?

- The process varies by platform but generally involves selecting “Guaranteed Stop” from a dropdown menu when placing your trade. Most platforms show the premium cost before you confirm the order.

- What happens if the market gaps past my stop-loss level?

- With a regular stop-loss, you’d face slippage and execution at the gapped price. With a GSLO, your position closes exactly at your specified level regardless of how far the market gaps.

- Do GSLOs work in all market conditions?

- GSLOs are designed to work in all conditions, including extreme volatility. Historical data shows 99.8%+ execution rates even during major market crises like the COVID-19 crash or Swiss Franc shock.

- Is it possible to modify a GSLO after placing it?

- This depends on the broker. Some allow modifications before the order triggers, while others (like Plus500) don’t permit changes once the GSLO is placed. Check your broker’s specific terms.

- Can I cancel a GSLO?

- Yes, most brokers allow GSLO cancellation. CMC Markets even offers free conversion to regular stop-losses. However, premium refund policies vary by broker.

- What are the risks of not using a GSLO?

- The main risk is slippage during volatile conditions. Major market events can cause gaps of hundreds of pips, turning manageable losses into account-threatening disasters.

- Are there any limitations to using GSLOs?

- Yes: minimum distance requirements, limited instrument availability, premium costs, and platform restrictions. Some brokers also limit GSLO usage on hedged positions.

- How does GSLO execution work during news events?

- GSLOs provide maximum value during news events when volatility spikes. They execute at your guaranteed price even if the market gaps significantly on unexpected announcements.

- Do brokers charge hidden fees for GSLOs?

- Reputable regulated brokers disclose all GSLO costs upfront. However, always read the terms carefully and check for additional charges like wider spreads on GSLO trades.

- How can GSLOs benefit beginner traders?

- Beginners benefit from GSLOs’ predictable risk management, protection during learning phases, reduced emotional stress, and consistent execution regardless of market conditions.

- Are GSLOs available on demo accounts?

- Most brokers offering GSLOs include them in demo accounts, allowing you to practice the functionality. However, demo accounts can’t perfectly simulate real market conditions or emotional impact.

- What is the typical slippage for non-GSLO orders?

- Slippage varies by market conditions but can range from 1-5 pips during normal volatility to 100+ pips during major news events or market crises.

- How much does a GSLO typically cost?

- Costs vary significantly: EasyMarkets offers free GSLOs, while others charge $2-10 per standard lot or 0.15-2% of position value, depending on instrument and market conditions.

- Is there a minimum distance for placing a guaranteed stop-loss order?

- Yes, most brokers require GSLOs to be placed a minimum distance from current market price—typically 5-20 pips for major FX pairs, varying by instrument volatility.

- Can I use a GSLO for all forex pairs?

- GSLO availability varies by broker. Major pairs like EUR/USD, GBP/USD typically have full coverage, while exotic pairs may have limited or no GSLO availability.

- Are GSLOs available on third-party platforms like MetaTrader 4 or 5?

- Limited availability. Most GSLO brokers use proprietary platforms for full functionality, though some offer basic GSLO features on MetaTrader.

- Why should beginner traders consider using GSLOs?

- GSLOs provide training wheels for risk management, protecting against catastrophic losses while beginners develop trading skills and market understanding.

- How does a GSLO protect against slippage?

- GSLOs eliminate slippage by guaranteeing execution at your specified price. The broker absorbs any difference between your stop level and actual market conditions.

- What happens if my GSLO is not triggered?

- If your GSLO isn’t triggered, some brokers (like CMC Markets) refund the premium entirely, while others (like IG Markets) charge nothing upfront. EasyMarkets charges nothing regardless.

- Are there any risks to using GSLOs?

- The main risks are cost accumulation from frequent use, over-reliance instead of proper risk management, and potential platform/broker limitations affecting trading flexibility.

- Is a GSLO suitable for high-frequency or scalping strategies?

- GSLOs are generally not cost-effective for high-frequency strategies due to premium accumulation. They’re better suited for swing trading and position trading approaches.

- Are GSLOs offered for cryptocurrency trading?

- Availability is limited but growing. Some brokers offer GSLOs on major crypto pairs like BTC/USD and ETH/USD, but coverage varies significantly.

- Can I use guaranteed stop-loss orders with automated trading systems?

- Limited integration exists. Most GSLOs require manual activation through broker platforms, though some brokers are developing API access for algorithmic traders.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.