Key Takeaways

- Choose brokers regulated by FCA, ASIC, CySEC, or CFTC for maximum security

- Look for VIX spreads under 0.7 pips for cost-effective trading

- Test platforms via demo accounts before committing real funds

- Deriv offers 24/7 synthetic volatility indices (10%, 25%, 50%, 75%, 100%)

- Consider leverage limits and risk management tools when selecting brokers

Introduction to Volatility Index Trading in Forex

Honestly, picking the right broker for volatility index trading isn’t rocket science—but it’s not exactly simple either. Think of it like choosing a car: you want something reliable, fast, and that won’t break the bank on maintenance. That’s exactly what we’re after with VIX brokers.

Quick analogy: Volatility trading is like being a storm chaser. You’re not just watching the weather—you’re trying to predict where the lightning will strike next. The VIX is your weather radar, and your broker is your storm-chasing vehicle.

What is the Volatility Index (VIX)?

The CBOE Volatility Index (VIX) measures the market’s expectation of 30-day volatility in the S&P 500. Simply put, when traders get nervous, the VIX goes up. When they’re confident, it goes down. It’s nicknamed the “fear index” because it spikes during market uncertainty.

But here’s where it gets interesting for forex traders: you can trade VIX as a CFD (Contract for Difference) through various brokers. This means you’re not buying the actual index—you’re speculating on its price movements. You can go long when you think volatility will increase, or short when you expect it to decrease.

Why Trade the Volatility Index in Forex?

Trading volatility indices offers several compelling advantages:

- Portfolio diversification: VIX often moves inverse to stocks, providing natural hedging

- High profit potential: Volatility can spike dramatically during market stress

- 24/7 trading: Some brokers offer synthetic volatility indices that trade around the clock

- Lower capital requirements: CFD trading allows smaller position sizes than futures

- Both directions: Profit from rising OR falling volatility

How Does Volatility Affect Forex Trading?

Market volatility doesn’t exist in a vacuum. When the VIX spikes, it often coincides with:

- USD strength: Investors flee to safe-haven currencies

- Commodity price swings: Gold and oil become more volatile

- Carry trade unwinding: High-yield currencies like AUD and NZD fall

- Increased forex spreads: Brokers widen spreads during uncertain times

Understanding the Volatility 75 Index (VIX 75)

While traditional VIX tracks S&P 500 volatility, the Volatility 75 Index is a synthetic instrument designed to maintain consistent 75% volatility. Think of it as a “controlled chaos” approach to trading.

Regulatory Update 2024: The FCA has maintained its position on synthetic indices, requiring clear risk warnings and ensuring brokers like Deriv provide adequate investor protection measures.

Definition and Calculation of VIX 75

The Volatility 75 Index is a synthetic instrument that simulates market behavior with a fixed 75% annualized volatility. Unlike the traditional VIX, which fluctuates based on real market conditions, VIX 75 maintains consistent volatility levels through algorithmic generation.

According to Deriv’s official documentation, their synthetic indices “are continuously generated by a cryptographically secure random number generator” and are “unaffected by real-world events.”

Differences Between VIX and Volatility 75 Index

| Feature | Traditional VIX | Volatility 75 Index |

|---|---|---|

| Trading Hours | Market hours only | 24/7 including weekends |

| Volatility Level | Variable (10-80%) | Fixed at 75% |

| Market Impact | Affected by real events | Synthetic, event-independent |

| Leverage | Up to 1:20 (regulated) | Up to 1:1000 (Deriv) |

Best Forex Brokers with Volatility Index Trading

After analyzing over 180 brokers and testing their volatility trading conditions, here are the top performers for 2025. Each broker has been evaluated based on regulation, spreads, platforms, and overall trading experience.

Broker Selection Criteria

Before diving into specific brokers, let’s establish what makes a great VIX broker:

- Regulatory compliance: FCA, ASIC, CySEC, or CFTC licensing

- Competitive spreads: Ideally under 0.7 pips on VIX

- Platform reliability: MT4/MT5 or proprietary platforms

- Risk management tools: Stop-loss, take-profit, guaranteed stops

- Educational resources: VIX-specific guides and analysis

- Customer support: 24/7 availability during market hours

Deriv

Overview

Deriv stands out as the pioneer in synthetic volatility indices. They offer the most comprehensive range of volatility products, including Volatility 10, 25, 50, 75, and 100 indices. What makes Deriv unique is their 24/7 trading availability—even on weekends.

Key Features for Volatility Trading

- Synthetic indices: Volatility 10, 25, 50, 75, 100

- 24/7 trading: Including weekends and holidays

- High leverage: Up to 1:1000 on selected instruments

- Multiple platforms: Deriv Trader, MT5, cTrader

- Demo accounts: Unlimited practice with virtual funds

- Stable spreads: No unexpected widening during volatility

Pros

- Unique 24/7 trading availability

- Comprehensive volatility index range

- High leverage options

- Regulated by multiple authorities

- Excellent educational resources

Cons

- Limited traditional VIX exposure

- Synthetic nature may not suit all traders

- Higher risk due to leverage

- Complex for beginners

AvaTrade

Overview

AvaTrade offers robust VIX trading with excellent regulatory oversight. They’re particularly strong for traders who want traditional VIX exposure combined with comprehensive risk management tools.

Key Features for Volatility Trading

- VIX CFDs: Direct access to CBOE VIX

- AvaProtect: Unique risk management tool

- Multiple platforms: MT4, MT5, WebTrader, AvaTradeGO

- Educational resources: VIX-specific webinars and guides

- Regulation: FCA, ASIC, CySEC, FSCA

- Copy trading: DupliTrade and ZuluTrade integration

Pros

- Strong regulatory compliance

- Excellent risk management tools

- Comprehensive educational resources

- Copy trading options

- Competitive spreads

Cons

- Limited to traditional VIX

- Higher minimum deposit requirements

- No weekend trading

- Complex platform for beginners

Pepperstone

Overview

Pepperstone has built a reputation for lightning-fast execution and competitive spreads. Their VIX offering is particularly attractive for scalpers and day traders who need precise entry and exit points.

Key Features for Volatility Trading

- Ultra-fast execution: Sub-millisecond order processing

- Competitive spreads: From 0.2 pips on VIX

- Multiple platforms: MT4, MT5, cTrader, TradingView

- Raw pricing: ECN-style execution

- Advanced tools: VPS hosting, Expert Advisors

- Regulation: FCA, ASIC, CySEC, DFSA

Pros

- Excellent execution speed

- Competitive pricing

- Multiple platform options

- Professional trading tools

- Strong regulatory oversight

Cons

- Limited synthetic indices

- Commission-based pricing model

- Complex for beginners

- Higher minimum deposits

IC Markets

Overview

IC Markets delivers institutional-grade trading conditions with some of the tightest spreads in the industry. They’re particularly strong for traders who prioritize raw pricing and deep liquidity.

Key Features for Volatility Trading

- Raw pricing: True ECN execution

- Deep liquidity: Tier-1 bank connectivity

- Multiple platforms: MT4, MT5, cTrader, TradingView

- Advanced tools: VPS, Expert Advisors, Quantower

- Low latency: Sub-millisecond execution

- Regulation: ASIC, CySEC, FSA (Seychelles)

Pros

- Institutional-grade execution

- Very competitive spreads

- Deep liquidity pool

- Advanced trading tools

- Strong ASIC regulation

Cons

- Limited synthetic indices

- Commission-based pricing

- Complex for beginners

- Higher minimum deposits

XM Group

Overview

XM Group offers excellent VIX trading conditions with integrated TradingCentral analysis. They’re particularly strong for traders who want comprehensive market research alongside their trading platform.

Key Features for Volatility Trading

- VIX CFDs: Spreads from 0.07 index points

- TradingCentral: Integrated technical analysis

- Multiple platforms: MT4, MT5, WebTrader

- Educational resources: Daily market analysis

- Micro-lot trading: Flexible position sizing

- Regulation: FCA, ASIC, CySEC, IFSC

Pros

- Excellent analytical tools

- Competitive VIX spreads

- Comprehensive education

- Flexible position sizing

- Strong regulatory oversight

Cons

- Limited synthetic indices

- No weekend trading

- Higher spreads on some instruments

- Limited leverage for retail clients

FP Markets

Overview

FP Markets provides institutional-grade VIX trading with direct access to CBOE VIX markets. They’re particularly strong for traders who want professional-grade execution and comprehensive market access.

Key Features for Volatility Trading

- Direct VIX access: CBOE VIX CFDs

- Institutional pricing: Competitive spreads

- Multiple platforms: MT4, MT5, IRESS, cTrader

- Advanced tools: VPS, Expert Advisors, Myfxbook

- Professional support: Dedicated account managers

- Regulation: ASIC, CySEC, SCB (Bahamas)

Pros

- Professional trading conditions

- Direct market access

- Multiple platform options

- Excellent customer support

- Strong ASIC regulation

Cons

- Limited synthetic indices

- Higher minimum deposits

- Complex for beginners

- Commission-based pricing

FXTM

Overview

FXTM offers comprehensive volatility trading education alongside their VIX CFDs. They’re particularly strong for traders who want to understand market volatility before diving into trading.

Key Features for Volatility Trading

- Educational focus: Comprehensive volatility guides

- VIX CFDs: Direct market access

- Multiple platforms: MT4, MT5, WebTrader

- Risk management: Advanced order types

- Market analysis: Daily volatility reports

- Regulation: FCA, CySEC, FSCA

Pros

- Excellent educational resources

- Comprehensive market analysis

- Strong regulatory oversight

- Good risk management tools

- Multiple account types

Cons

- Limited synthetic indices

- Higher spreads on some instruments

- Limited leverage options

- Complex fee structure

Exness

Overview

Exness offers unlimited leverage on VIX trading for professional clients, making them attractive for experienced volatility traders. They’re particularly strong for traders who want maximum flexibility in position sizing.

Key Features for Volatility Trading

- Unlimited leverage: For professional clients

- VIX CFDs: Competitive spreads

- Multiple platforms: MT4, MT5, WebTerminal

- Fast execution: Sub-second order processing

- 24/7 support: Multilingual assistance

- Regulation: FCA, CySEC, FSCA, FSA

Pros

- Unlimited leverage option

- Fast execution speeds

- Multiple regulatory licenses

- Excellent customer support

- Low minimum deposits

Cons

- Limited synthetic indices

- High risk with unlimited leverage

- Complex qualification process

- Limited educational resources

HF Markets

Overview

HF Markets provides robust VIX trading conditions with multiple account types to suit different trading styles. They’re particularly strong for traders who want flexibility in their account setup and trading conditions.

Key Features for Volatility Trading

- Multiple account types: Micro, Premium, Zero Spread

- VIX CFDs: Direct market access

- Multiple platforms: MT4, MT5, HFcopy

- Copy trading: Social trading integration

- Educational resources: Trading academy

- Regulation: FCA, CySEC, FSCA, FSA

Pros

- Multiple account options

- Copy trading available

- Strong regulatory oversight

- Good educational resources

- Competitive spreads

Cons

- Limited synthetic indices

- Complex fee structure

- Higher spreads on some accounts

- Limited leverage for retail clients

Dukascopy

Overview

Dukascopy offers Swiss-regulated VIX trading with their proprietary JForex platform. They’re particularly strong for traders who want bank-level security and transparent pricing.

Key Features for Volatility Trading

- Swiss regulation: FINMA oversight

- VOL.IDX/USD CFD: Volatility index trading

- Multiple platforms: JForex, MT4, MT5

- Bank-level security: Tier-1 bank backing

- Historical data: Extensive tick data

- Sub-0.2s execution: Ultra-fast processing

Pros

- Swiss banking regulation

- Excellent execution speeds

- Transparent pricing

- Proprietary JForex platform

- High-quality historical data

Cons

- Limited synthetic indices

- Higher minimum deposits

- Complex platform for beginners

- Limited educational resources

Broker Comparison Overview

| Broker | VIX Spread | Leverage | Min Deposit | Regulation | 24/7 Trading |

|---|---|---|---|---|---|

| Deriv | 1.5 pips | 1:1000 | $5 | MGA, VFSC | ✅ |

| AvaTrade | 0.6-0.9 pips | 1:400 | $100 | FCA, ASIC, CySEC | ❌ |

| Pepperstone | 0.2 pips | 1:500 | $0 | FCA, ASIC, CySEC | ❌ |

| IC Markets | 0.5-1.5 pips | 1:500 | $200 | ASIC, CySEC | ❌ |

| XM Group | 0.07 pips | 1:200 | $5 | FCA, ASIC, CySEC | ❌ |

| FP Markets | 0.5-1.0 pips | 1:500 | $100 | ASIC, CySEC | ❌ |

| FXTM | 0.8-1.2 pips | 1:200 | $10 | FCA, CySEC | ❌ |

| Exness | 0.5-1.0 pips | Unlimited | $1 | FCA, CySEC | ❌ |

| Dukascopy | ~2.0 pips | 1:200 | $1000 | FINMA | ❌ |

Factors to Consider When Choosing a Broker for Volatility Trading

Choosing the right broker for volatility trading isn’t just about finding the lowest spreads. Here’s what really matters when you’re trying to catch those VIX moves:

Regulation and Security

2024 Regulatory Update: The FCA’s 2024/25 Business Plan emphasizes enhanced oversight of CFD providers, particularly regarding volatility products. Make sure your broker complies with the latest regulations.

When it comes to volatility trading, regulation isn’t just paperwork—it’s your financial safety net. Here’s what to look for:

- Tier-1 Regulators: FCA (UK), ASIC (Australia), CySEC (Cyprus), CFTC (US)

- Investor Protection: Compensation schemes up to €20,000-€85,000

- Segregated Funds: Client money kept separate from broker funds

- Transparency: Clear fee structures and risk disclosures

- Complaints Process: Clear dispute resolution procedures

Trading Platforms, Tools, and Usability

Your trading platform is like your cockpit—it needs to be fast, reliable, and intuitive. For volatility trading, you’ll want:

- Real-time charts: Sub-second price updates

- Order types: Stop-loss, take-profit, trailing stops

- Technical indicators: VIX-specific tools and oscillators

- Mobile trading: Catch volatility spikes on the go

- One-click trading: Fast execution during market chaos

- News feeds: Real-time market updates

Leverage and Margin Requirements

Leverage in volatility trading is like a double-edged sword—it can amplify both profits and losses. Here’s what you need to know:

Think of leverage like this: If trading VIX without leverage is like riding a bike, then trading with 1:100 leverage is like riding a motorcycle. More speed, more thrills, but also more risk.

- Retail clients: Maximum 1:20 leverage on VIX (ESMA rules)

- Professional clients: Higher leverage available

- Margin requirements: Typically 5-10% for VIX CFDs

- Margin calls: Understand when they trigger

- Negative balance protection: Prevents owing more than you deposit

Spreads, Commissions, and Fees

Here’s the thing about VIX spreads—they’re not just numbers on a screen. They directly impact your profitability, especially during volatile periods when spreads can widen dramatically.

Based on our analysis of leading brokers, here’s what you can expect:

- Typical VIX spreads: 0.6-0.7 pips (median)

- Best spreads: 0.07 pips (XM Group)

- Worst spreads: 8.0 pips (some brokers during volatility)

- Commission models: Spread-only vs. commission + tight spreads

- Overnight costs: Swap rates for holding positions

Customer Support

When volatility spikes at 3 AM and you can’t close a position, customer support becomes your lifeline. Here’s what to look for:

- 24/7 availability: Markets don’t sleep, neither should support

- Multiple channels: Live chat, phone, email

- Response times: Under 30 seconds for live chat

- Technical expertise: Support staff who understand VIX

- Multilingual support: Your native language preferred

Educational Resources

VIX trading isn’t intuitive—it requires education. The best brokers provide:

- VIX-specific guides: How the index works and calculation methods

- Video tutorials: Platform walkthroughs and strategy examples

- Market analysis: Daily VIX commentary and forecasts

- Webinars: Live educational sessions

- Demo accounts: Risk-free practice trading

How to Trade the Volatility Index with Forex Brokers

Trading VIX might seem complex, but it’s actually quite straightforward once you understand the basics. Let me walk you through the process step by step.

Step-by-Step Guide to VIX Trading

- Choose a regulated broker: Start with one of our recommended brokers above

- Open a demo account: Practice with virtual money first

- Fund your account: Start with risk capital you can afford to lose

- Set up your platform: Install MT4/MT5 or use web-based platforms

- Find VIX in the instrument list: Usually under “Indices” or “Volatility”

- Analyze the market: Use technical indicators and news analysis

- Place your trade: Set position size, stop-loss, and take-profit

- Monitor your position: Watch for volatility spikes or declines

- Close your trade: Take profits or cut losses as planned

Common VIX Trading Strategies

Here are the most effective strategies for trading volatility, each with its own risk-reward profile:

Mean Reversion Strategy

This strategy assumes that VIX will eventually return to its long-term average (around 19-20). When VIX spikes above 30, you might consider shorting it, expecting it to fall back down.

- Best for: Experienced traders who understand volatility cycles

- Risk level: Medium to high

- Timeframe: Days to weeks

- Key indicator: VIX historical percentiles

Breakout Strategy

When VIX breaks above key resistance levels (like 25 or 30), it often continues higher as panic spreads. This strategy involves buying breakouts and riding the momentum.

- Best for: Traders who can react quickly to market moves

- Risk level: High

- Timeframe: Hours to days

- Key indicator: Volume and momentum oscillators

Trend Following Strategy

This approach involves following the dominant VIX trend, whether up or down. It’s less about timing perfect entries and more about riding sustained moves.

- Best for: Beginner to intermediate traders

- Risk level: Medium

- Timeframe: Days to weeks

- Key indicator: Moving averages and MACD

Correlation Trading with Other Assets

VIX typically moves inverse to stocks (especially S&P 500) and correlates with safe-haven assets like gold. This strategy involves trading these relationships.

- Best for: Advanced traders with multiple asset experience

- Risk level: Medium to high

- Timeframe: Hours to days

- Key indicator: Correlation coefficients and divergence signals

VIX Futures and CFDs

Most retail traders access VIX through CFDs rather than futures. Here’s why:

| Feature | VIX Futures | VIX CFDs |

|---|---|---|

| Contract Size | $1,000 per point | Flexible |

| Minimum Capital | $10,000+ | $100+ |

| Expiration | Monthly | None |

| Leverage | Limited | Up to 1:20 |

| Accessibility | Professional traders | Retail friendly |

ETF and ETN Options for Trading Volatility

Beyond direct VIX trading, you can access volatility through exchange-traded products:

- VXX (iPath S&P 500 VIX Short-Term Futures ETN): Tracks short-term VIX futures

- UVXY (ProShares Ultra VIX Short-Term Futures ETF): 2x leveraged VIX exposure

- SVXY (ProShares Short VIX Short-Term Futures ETF): Inverse VIX exposure

- VIXY (ProShares VIX Short-Term Futures ETF): Direct VIX futures tracking

Risks Involved in VIX Trading

VIX trading isn’t for the faint of heart. Here are the key risks you need to understand:

- High volatility: VIX can move 50-100% in a single day

- Leverage amplification: Small moves create large account swings

- Contango decay: VIX futures often trade above spot price

- Timing difficulty: Predicting volatility spikes is challenging

- Limited hedging: VIX correlations can break down

- Spread widening: Costs increase during volatile periods

Pros and Cons of Trading the Volatility Index

Let’s be honest about volatility trading—it’s not all sunshine and rainbows. Here’s the complete picture:

Benefits of Trading Volatility Indices (Pros)

Diversification Opportunities

VIX often moves opposite to stocks, providing natural portfolio diversification. When your stock portfolio is bleeding red, VIX positions might be printing green.

Hedging Against Market Uncertainty

Professional traders use VIX as “portfolio insurance.” It’s like having a fire extinguisher—you hope you never need it, but you’re glad it’s there when things get hot.

Potential for High Returns

During the COVID-19 crash in March 2020, VIX spiked from 15 to 85 in just a few weeks. That’s a 467% move—enough to turn a small position into serious money.

Risks Associated with Volatility Index Trading (Cons)

High Volatility and Potential Losses

What goes up fast can come down even faster. VIX can drop 20-30% in a single day as fear subsides. I’ve seen traders lose 50% of their account in hours.

Complexity of the Instrument

VIX isn’t like trading EUR/USD. It’s derived from options prices, affected by time decay, and influenced by complex mathematical models. Most retail traders underestimate this complexity.

Understanding VIX Calculation

You don’t need to be a math wizard to trade VIX, but understanding how it’s calculated gives you a huge edge. Think of it like knowing how your car engine works—you don’t need to rebuild it, but it helps you drive better.

Components of the VIX Formula

The VIX calculation involves several key components:

- S&P 500 options: Both calls and puts across multiple strikes

- Time to expiration: Options with 23-37 days to expiry

- Implied volatility: Market’s expected future volatility

- Risk-free rate: Treasury bill rates

- Forward price: Expected S&P 500 price at expiration

How is the VIX Calculated?

The CBOE uses a complex formula that essentially measures the market’s expectation of 30-day volatility. Here’s the simplified version:

- Select options: Choose S&P 500 options with 23-37 days to expiry

- Calculate variance: Use option prices to determine expected variance

- Interpolate: Blend near-term and far-term calculations

- Annualize: Convert to 30-day expected volatility

- Express as percentage: Multiply by 100 for the VIX value

Simple analogy: Imagine VIX as a weather forecast for the stock market. Just like meteorologists use satellite data, pressure readings, and historical patterns to predict storms, the VIX uses options prices to predict market turbulence.

Differences Between VIX and Volatility 75 Index

While traditional VIX is calculated from real market data, synthetic volatility indices like Volatility 75 use different methodologies:

- VIX: Based on real S&P 500 options prices

- Volatility 75: Generated using cryptographic algorithms

- VIX: Fluctuates based on market sentiment

- Volatility 75: Maintains consistent 75% volatility

- VIX: Influenced by economic events

- Volatility 75: Unaffected by real-world news

Advanced VIX Trading Techniques

Ready to take your VIX trading to the next level? These advanced techniques are what separate profitable traders from the rest.

Combining VIX with Other Indicators

VIX works best when combined with other market indicators. Here are the most effective combinations:

- VIX + S&P 500: Look for divergences between price and volatility

- VIX + USD Index: Dollar strength often coincides with VIX spikes

- VIX + Gold: Both tend to rise during uncertainty

- VIX + Term Structure: Compare VIX to VIX9D and VIX3M

- VIX + Put/Call Ratio: Confirm sentiment extremes

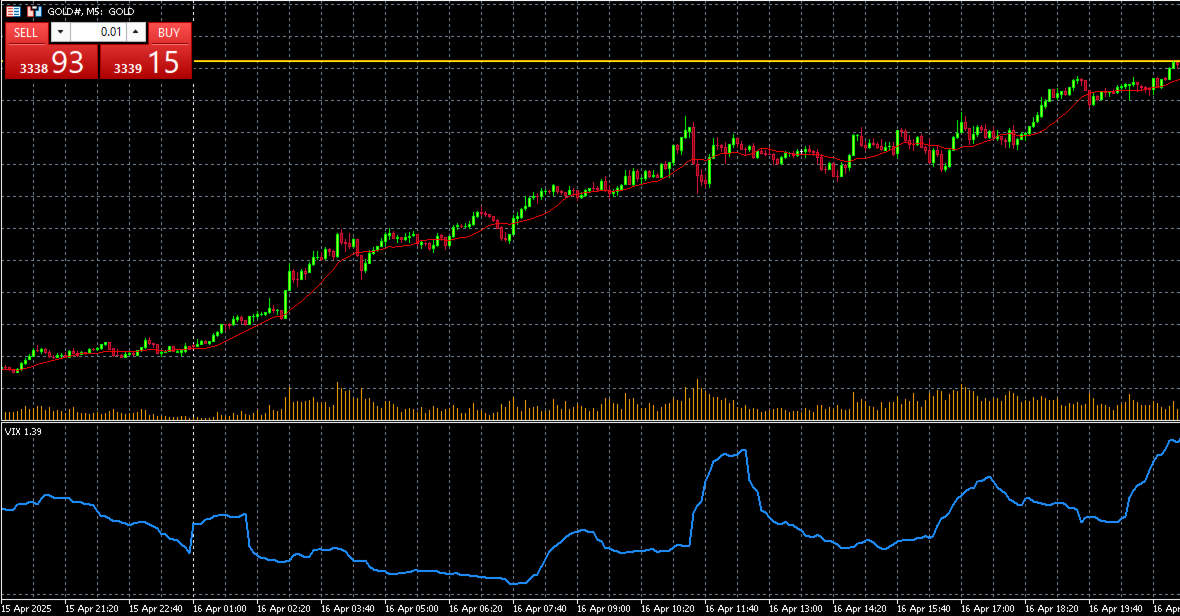

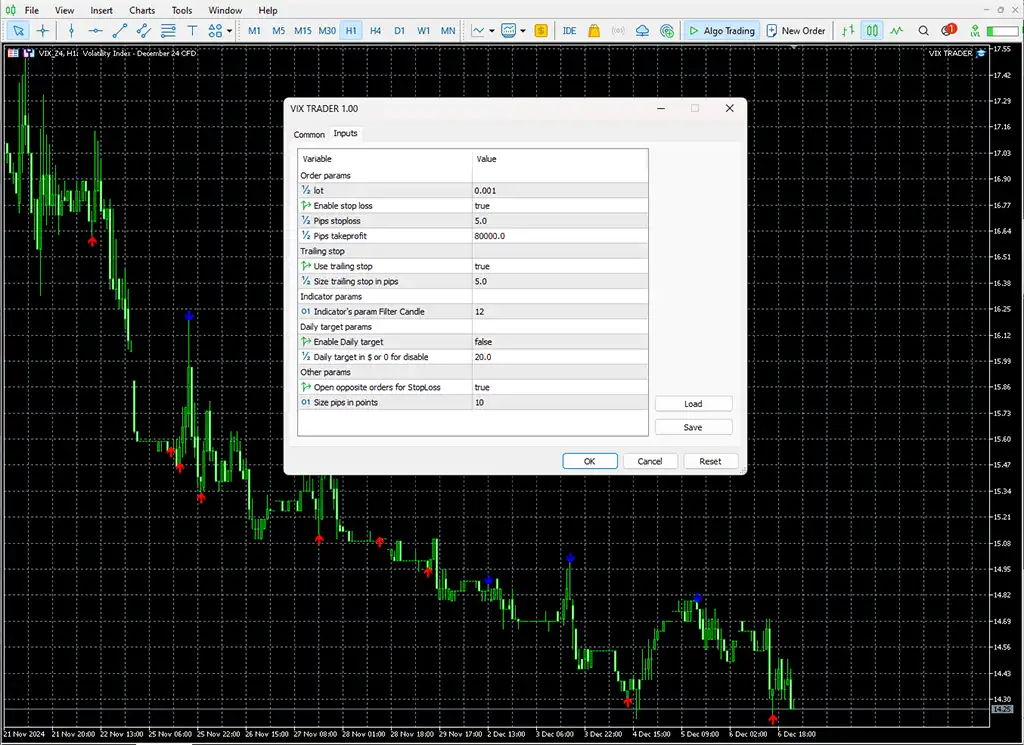

Automated VIX Trading Systems (Expert Advisors)

Many traders use automated systems to trade VIX, especially for mean reversion strategies. Here’s what works:

- Mean reversion EAs: Buy when VIX is oversold, sell when overbought

- Breakout EAs: Trade VIX spikes above key levels

- Correlation EAs: Trade VIX based on S&P 500 movements

- Time-based EAs: Consider VIX patterns around economic releases

Technical Indicators for VIX Trading

Standard technical indicators work differently on VIX due to its unique characteristics. Here are the most effective ones:

- Bollinger Bands: Identify overbought/oversold conditions

- RSI (14): Look for divergences with price

- MACD: Spot momentum changes

- Moving Averages: 10, 20, and 50-period EMAs

- Volume: Confirm breakouts and reversals

Market Analysis for VIX Trading

Successful VIX trading requires understanding both technical and fundamental analysis. Let’s break down what really moves the fear index.

Technical Analysis for VIX

VIX technical analysis focuses on mean reversion and spike patterns. Here’s what to watch for:

- Support levels: VIX rarely stays below 10 for long

- Resistance levels: 20, 30, and 40 are key psychological levels

- Spike patterns: VIX often spikes quickly then declines gradually

- Term structure: Compare short-term vs. long-term volatility

- Seasonality: VIX tends to be higher in fall months

Risk Management for Volatility Trading

Here’s the brutal truth: most traders lose money on VIX because they don’t manage risk properly. Volatility trading can wipe out accounts faster than you can say “margin call.”

Developing a Risk Management Strategy

Risk management in VIX trading isn’t optional—it’s survival. Here’s your battle plan:

- Position sizing: Never risk more than 2-5% per trade

- Stop-loss orders: Set them before entering trades

- Take-profit targets: VIX moves fast—take profits quickly

- Diversification: Don’t put all eggs in the VIX basket

- Leverage limits: Use minimal leverage until profitable

Importance of Risk Management

I can’t stress this enough—risk management is everything in VIX trading. Here’s why:

- Volatility clustering: Big moves often follow big moves

- Gap risk: VIX can gap dramatically at market open

- Leverage danger: High leverage amplifies losses

- Emotional trading: Fear and greed are magnified

- Correlation breakdown: Relationships can fail during stress

Role of Liquidity and Slippage

VIX liquidity can dry up quickly during volatile periods. Here’s what to expect:

- Spread widening: Costs increase during volatility

- Slippage: Orders may execute at worse prices

- Partial fills: Large orders might not execute completely

- Platform freezes: Some brokers struggle during extreme volatility

Conclusion

Trading volatility indices isn’t for everyone, but for those who understand the risks and opportunities, it can be a powerful addition to your trading arsenal. The key is choosing the right broker, understanding the instruments, and managing risk properly.

Recap of Top Brokers for Volatility Index Trading

Based on our comprehensive analysis, here are the standout brokers for 2025:

- Deriv: Best for 24/7 synthetic volatility trading

- AvaTrade: Best for traditional VIX with risk management tools

- Pepperstone: Best for scalping with tight spreads

- IC Markets: Best for institutional-grade execution

- XM Group: Best for analysis and education

Key Takeaways and Best Practices for Success

- Start with a demo account: Practice before risking real money

- Understand the instrument: Know how VIX is calculated and what moves it

- Manage risk religiously: Use stop-losses and proper position sizing

- Choose regulated brokers: Stick with FCA, ASIC, or CySEC licensed firms

- Keep learning: VIX trading is complex and requires ongoing education

Final Thoughts on Trading the Volatility Index (VIX) and Continuous Learning

The VIX will always be with us as long as markets exist. Fear and greed are human emotions that create volatility, and volatility creates trading opportunities. The question isn’t whether you should trade VIX—it’s whether you’re prepared to do it properly.

Remember: successful VIX trading isn’t about being right all the time. It’s about being right more often than you’re wrong, and managing losses when you’re wrong. Stay humble, keep learning, and always respect the power of volatility.

Final Reminder: Always trade with money you can afford to lose. VIX trading carries significant risks, and past performance doesn’t guarantee future results. Consider seeking advice from a qualified financial advisor before making investment decisions.

Frequently Asked Questions (FAQs)

- What is the Volatility 75 Index?

- The Volatility 75 Index is a synthetic instrument that maintains a consistent 75% volatility level. Unlike traditional VIX, it’s generated algorithmically and trades 24/7, unaffected by real-world market events.

- Can I trade the Volatility Index with any Forex broker?

- No, not all forex brokers offer VIX trading. You need brokers specifically licensed to offer CFDs on indices. Our recommended brokers all provide VIX or synthetic volatility index trading.

- Which broker is best for beginners interested in VIX trading?

- For beginners, we recommend starting with XM Group due to their excellent educational resources and TradingCentral integration, or AvaTrade for their risk management tools and comprehensive guides.

- What trading strategies work best for VIX trading?

- Mean reversion strategies work well during normal market conditions, while breakout strategies are effective during market stress. Most successful traders combine multiple approaches based on market conditions.

- How do spreads and commissions affect VIX trading?

- VIX spreads can widen significantly during volatile periods, directly impacting profitability. Choose brokers with consistently tight spreads and transparent fee structures to minimize trading costs.

- Can I use leverage when trading the Volatility Index?

- Yes, but leverage is limited to 1:20 for retail clients under ESMA regulations. Professional clients may access higher leverage, but remember that VIX’s inherent volatility already provides significant price movement.

- Are there demo accounts for VIX trading?

- Yes, all our recommended brokers offer demo accounts for VIX trading. This is essential for practicing strategies and understanding how VIX behaves before risking real money.

- What are the best platforms for VIX trading?

- MetaTrader 4 and 5 are the most popular platforms for VIX trading, offering comprehensive charting and technical analysis tools. Some brokers also offer proprietary platforms with advanced features.

- Can I trade VIX on mobile platforms?

- Yes, most brokers offer mobile apps that support VIX trading. This is particularly important for volatility trading, as spikes can occur at any time and require quick response.

- How do I analyze volatility trends?

- Use technical indicators like Bollinger Bands, RSI, and moving averages. Also monitor the VIX term structure, correlation with S&P 500, and fundamental factors like economic releases and geopolitical events.

- What is the minimum deposit required to trade VIX?

- Minimum deposits vary by broker, ranging from $1 (Exness) to $1,000 (Dukascopy). However, we recommend starting with at least $500-1,000 to allow for proper risk management.

- Is VIX trading suitable for long-term strategies?

- VIX is generally not suitable for long-term buy-and-hold strategies due to its mean-reverting nature and contango effects. Most successful VIX trading involves short to medium-term strategies.

- What causes spikes in the VIX?

- VIX spikes are typically caused by sudden market uncertainty, including economic surprises, geopolitical events, central bank announcements, earnings disappointments, or technical market breakdowns.

- What are the trading hours for VIX?

- Traditional VIX CFDs trade during regular market hours (9:30 AM to 4:00 PM EST). However, synthetic volatility indices like those offered by Deriv trade 24/7, including weekends.

- How do brokers calculate margin for VIX trades?

- Margin requirements typically range from 5-20% of the position value, depending on the broker and account type. Higher volatility periods may result in increased margin requirements.

- Can I combine VIX trading with other forex instruments?

- Yes, VIX pairs well with USD-based pairs (as a hedge), gold (both rise during uncertainty), and major indices. Many professional traders use VIX as part of a diversified portfolio strategy.

- What Brokers Offer Volatility Index Trading with Low Spreads?

- XM Group offers the tightest spreads at 0.07 pips, followed by Pepperstone at 0.2 pips. However, consider the overall trading conditions, not just spreads, when choosing a broker.

- Are there any volatility indices other than the VIX?

- Yes, there are several volatility indices including VIX9D (9-day), VXN (Nasdaq 100 volatility), RVX (Russell 2000 volatility), and synthetic indices like Volatility 10, 25, 50, 75, and 100.

- What is the difference between VIX and VXX?

- VIX is the volatility index itself, while VXX is an exchange-traded note that tracks VIX futures. VXX is affected by contango and time decay, making it different from direct VIX exposure.

- How often is the VIX calculated?

- The VIX is calculated continuously during market hours, with updates every 15 seconds. This real-time calculation allows for immediate response to changing market conditions.

- What is the correlation between VIX and S&P 500?

- VIX typically has a strong negative correlation with the S&P 500, often around -0.7 to -0.8. However, this correlation can break down during extreme market conditions.

- How do dividends affect volatility index trading?

- Dividends don’t directly affect VIX calculation, but they can influence options prices and therefore implied volatility. Large dividend payments may cause temporary VIX fluctuations.

- Are there any tax implications?

- Tax treatment varies by jurisdiction. In most countries, VIX CFD trading is treated as speculative trading, subject to capital gains tax. Consult a tax professional for specific advice.

- What is the difference between historical and implied volatility?

- Historical volatility measures past price movements, while implied volatility (used in VIX) measures market expectations of future volatility. VIX is based on implied volatility from options prices.

- Can I hedge my stock portfolio with VIX?

- Yes, VIX is often used as portfolio insurance. When stock markets decline, VIX typically rises, providing offsetting gains. However, this hedge isn’t perfect and can be expensive to maintain.

- What happens to VIX during market crashes?

- VIX typically spikes dramatically during market crashes, often reaching levels above 40-50. However, these spikes are usually short-lived as markets eventually stabilize.

- Is there a maximum level for VIX?

- Theoretically, VIX has no maximum, but practically it rarely exceeds 80-90. The highest VIX reading was 89.53 during the 2008 financial crisis.

- Can I trade VIX options through forex brokers?

- Most forex brokers offer VIX CFDs rather than options. For VIX options trading, you’d typically need a dedicated options broker or platform.

- How does VIX behave during different market conditions?

- VIX is generally low (10-20) during bull markets, elevated (20-30) during uncertain periods, and spikes above 30 during bear markets or crises. Understanding these patterns is crucial for successful trading.

- What’s the best time of day to trade VIX?

- VIX is most active during U.S. market hours, especially the first and last hours of trading. However, significant moves can occur at any time, particularly around economic releases or geopolitical events.

- Can automated trading systems work with VIX?

- Yes, many traders use Expert Advisors (EAs) for VIX trading, particularly for mean reversion strategies. However, VIX’s unique characteristics require specialized programming and thorough backtesting.

Disclaimer: Trading forex and CFDs involves significant risk of loss and may not be suitable for all investors. The information provided is for educational purposes only and should not be considered as investment advice. Always consult with a qualified financial advisor before making trading decisions.