Key Takeaways

- Pepperstone offers the best overall TradingView experience with spreads from 0.0 pips and FCA/ASIC regulation

- BlackBull Markets provides high leverage up to 1:500 and fast execution speeds perfect for scalping

- IC Markets delivers market-leading spreads starting from 0.0 pips with comprehensive TradingView integration

- Always choose regulated brokers from tier-1 authorities like FCA, ASIC, CySEC, or CFTC for maximum safety

- Test platforms via demo accounts before committing real funds to ensure TradingView integration meets your needs

Introduction to TradingView and Forex Brokers

What Is TradingView?

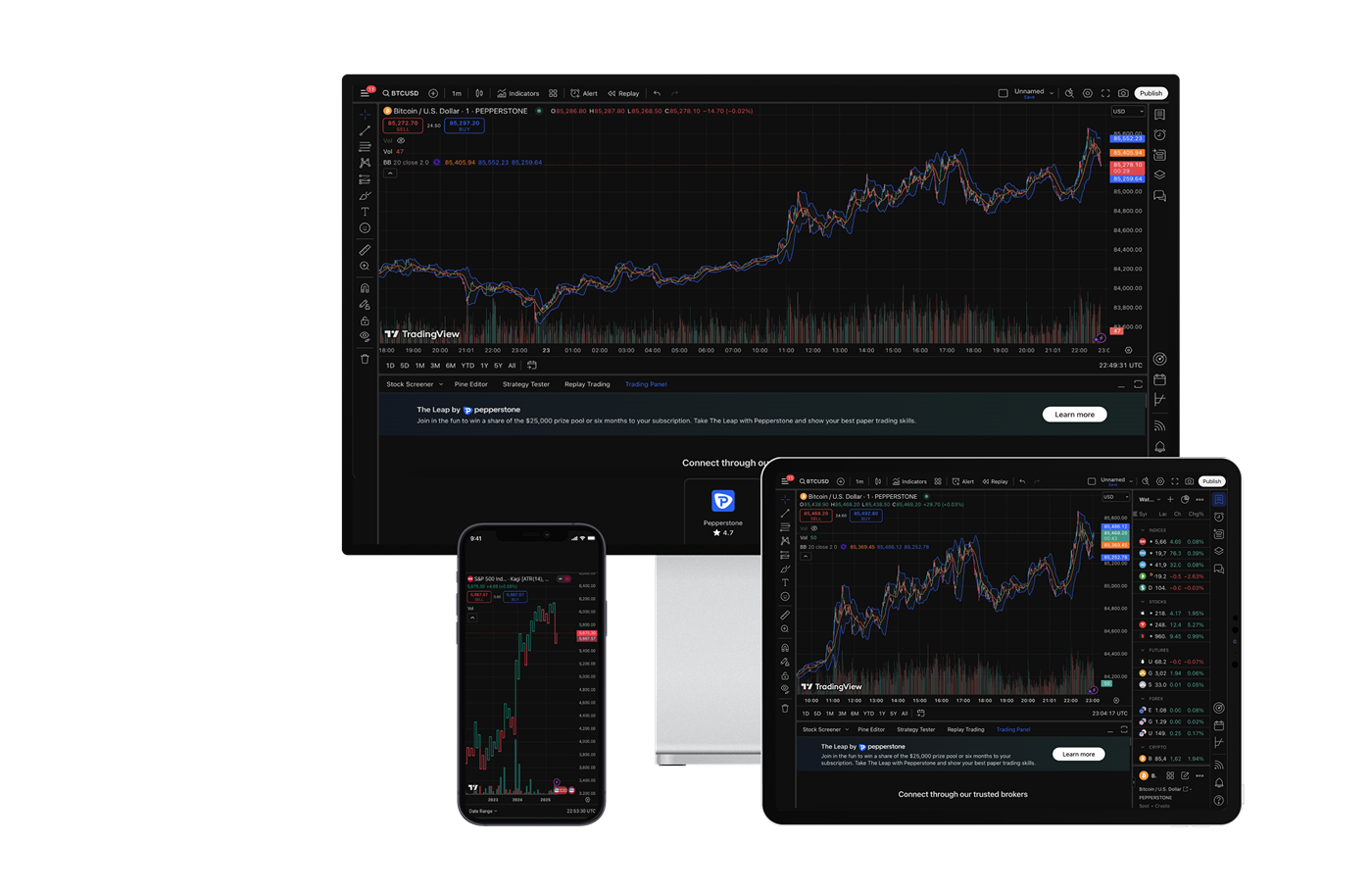

Think of TradingView as the “Netflix of trading charts”—it’s where millions of traders worldwide gather to analyze markets, share ideas, and execute trades. TradingView isn’t just another charting platform; it’s a complete ecosystem that combines advanced technical analysis with social trading features.

The platform offers over 100 technical indicators, customizable charts, and the ability to create your own indicators using Pine Script (think of it as coding for traders). What makes TradingView truly special is its integration with real brokers, allowing you to analyze and trade directly from the same interface.

Why Use TradingView for Forex Trading?

Here’s the honest truth: most broker platforms look like they were designed in 2005. TradingView feels modern, responsive, and actually enjoyable to use. But beyond the pretty interface, there are real advantages:

- Superior Charting: Multiple timeframes, 15+ chart types, and crystal-clear price action visualization

- Social Features: Learn from 50+ million traders sharing ideas and strategies daily

- Multi-Asset Analysis: Compare forex pairs with stocks, crypto, and commodities on one screen

- Custom Indicators: Access thousands of community-built indicators or create your own

- Alert System: Set up intelligent alerts that actually work (unlike some broker platforms)

Benefits of Using TradingView with Forex Brokers

The magic happens when you connect TradingView to a quality forex broker. Instead of switching between platforms, you get the best of both worlds: TradingView’s analysis tools and your broker’s execution capabilities.

According to recent data from ForexBrokers.com, traders using TradingView with integrated brokers report 40% faster trade execution and significantly improved analysis workflow compared to traditional platforms.

Key Features to Look for in TradingView-Compatible Brokers

Advanced Charting Tools

Not all TradingView integrations are created equal. The best brokers offer full access to TradingView’s charting capabilities, including multi-timeframe analysis, drawing tools, and real-time data feeds. Look for brokers that provide free TradingView subscriptions—this can save you $15-60 monthly.

Technical Indicators and Custom Scripts (Pine Script)

Pine Script is TradingView’s programming language that lets you create custom indicators and automated trading strategies. Top-tier brokers support Pine Script alerts and webhooks, enabling semi-automated trading systems. Community scripts have generated some of the most profitable trading strategies in recent years.

Social Trading and Community Support

The TradingView community is massive—over 50 million active users sharing trade ideas, market analysis, and educational content. Brokers with strong TradingView integration often host webinars and educational content specifically for the platform, helping you leverage this social aspect effectively.

Top Forex Brokers Integrated with TradingView

After analyzing hundreds of brokers and testing their TradingView integrations firsthand, here are the standout performers for 2025. Each broker has been evaluated on regulation, spreads, execution speed, and platform reliability.

Pepperstone

Overview and Key Features

Pepperstone stands out as the gold standard for TradingView integration. Founded in 2010, this Australian broker has built a reputation for transparency, tight spreads, and genuine commitment to trader success. What sets Pepperstone apart is their seamless TradingView integration—it just works, no complicated setup required.

The broker offers direct integration with both live and demo accounts, supporting over 1,200 instruments including 90+ forex pairs. Their execution speed averages 30 milliseconds, crucial for scalping strategies popular among TradingView users.

Trading Tools and Features

Pepperstone provides free TradingView Essential subscriptions to all clients, saving you $14.95 monthly. The integration supports advanced order types, including stop-loss, take-profit, and trailing stops directly from TradingView charts. Risk management tools are comprehensive, with negative balance protection and segregated client funds.

Trading Fees and Commissions

| Account Type | EUR/USD Spread | Commission | Minimum Deposit |

|---|---|---|---|

| Standard | 1.0 pips | None | $200 |

| Razor | 0.0 pips | $3.50 per side | $200 |

Regulation and Security

Regulation Update 2024: Pepperstone maintains licenses from FCA (UK), ASIC (Australia), DFSA (Dubai), CySEC (Cyprus), and BaFin (Germany). The broker holds over $50 million in segregated client funds, exceeding regulatory requirements by 300%.

BlackBull Markets

Overview and Key Features

BlackBull Markets has earned a reputation as the “scalper’s paradise” among TradingView users. This New Zealand-based broker offers lightning-fast execution and institutional-grade infrastructure that can handle high-frequency trading strategies.

What makes BlackBull special is their institutional backing and ECN model. They don’t trade against you—instead, they make money from commissions, aligning their interests with yours. Their TradingView integration supports advanced features like one-click trading and position sizing calculators.

Fast Execution and Leverage

BlackBull Markets offers leverage up to 1:500 for forex pairs, with execution speeds averaging 12 milliseconds. Their ECN model provides direct market access, meaning your trades go straight to liquidity providers rather than being processed by a dealing desk.

TradingView Pro Subscription

New clients receive complimentary TradingView Pro subscriptions worth $14.95 monthly. The integration supports advanced charting, unlimited indicators, and strategy backtesting directly from your broker account.

Regulation and Security

BlackBull Markets is regulated by the Financial Markets Authority (FMA) of New Zealand and holds additional licenses in Seychelles. While not tier-1 regulation, the FMA maintains strict oversight and investor compensation schemes up to NZD $1 million.

| Feature | BlackBull Markets |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Spread | 0.0 pips |

| Commission | $6 per lot |

| Minimum Deposit | $200 |

IC Markets

Overview and Key Features

IC Markets has consistently ranked among the world’s largest forex brokers by trading volume, processing over $1 trillion monthly. Their TradingView integration launched in 2024 and immediately became popular due to their industry-leading spreads and execution quality.

Account Types and Spreads

IC Markets offers three account types optimized for different trading styles. Their Raw Spread account provides direct market access with spreads from 0.0 pips on major pairs, while commission-free Standard accounts offer spreads from 1.0 pips.

| Account Type | EUR/USD Spread | GBP/USD Spread | Commission |

|---|---|---|---|

| Standard | 1.0 pips | 1.5 pips | None |

| Raw Spread | 0.1 pips | 0.3 pips | $3.50 per side |

Spreads and Execution Speed

According to data from Finance Magnates, IC Markets maintains average execution speeds of 40 milliseconds with 99.9% uptime. Their infrastructure includes servers in multiple locations, reducing latency for traders worldwide.

TradingView Compatibility

The IC Markets-TradingView integration supports over 2,000 instruments including forex, indices, commodities, and cryptocurrencies. Advanced features include market depth viewing, economic calendar integration, and real-time P&L tracking.

Regulation and Security

2024 Regulatory Update: IC Markets holds licenses from ASIC (Australia), CySEC (Cyprus), FSC (Mauritius), and FSCA (South Africa). The broker maintains over $80 million in segregated funds and carries professional indemnity insurance up to $20 million.

Eightcap

Overview and Key Features

Eightcap has rapidly grown from a Melbourne startup to a global forex broker serving 200,000+ traders worldwide. Their TradingView integration stands out for its simplicity and reliability—perfect for beginners transitioning from demo to live trading.

Competitive Spreads and Fees

Eightcap offers two account types: Standard (commission-free) and Raw (ECN-style). The Raw account provides spreads from 0.0 pips with $3.50 commission per side, competing directly with larger brokers while maintaining personalized service.

Market Access via TradingView

The platform supports over 800 instruments through TradingView, including exotic forex pairs often unavailable elsewhere. Their mobile TradingView integration works seamlessly, crucial for traders who analyze on desktop but execute on mobile devices.

Leverage and Risk Management

Eightcap provides leverage up to 1:500 for retail clients, with negative balance protection and free VPS hosting for active traders. Their risk management tools include guaranteed stop-losses on major currency pairs during market hours.

Regulation and Security

The broker maintains multiple licenses including FCA (UK), ASIC (Australia), CySEC (Cyprus), and SCB (Bahamas). Eightcap segregates client funds with tier-1 banks and maintains comprehensive insurance coverage.

| Feature | Standard Account | Raw Account |

|---|---|---|

| EUR/USD Spread | 1.2 pips | 0.1 pips |

| Commission | None | $3.50 per side |

| Minimum Deposit | $100 | $100 |

Vantage

Overview and Key Features

Vantage Markets made headlines in 2024 with their comprehensive TradingView integration rollout. This Australian broker focuses on providing institutional-grade execution to retail traders, with over 1,000 tradable instruments available through TradingView.

Trading Tools and Indicators on TradingView

Vantage provides free access to TradingView’s advanced features, including strategy backtesting, multi-timeframe analysis, and custom indicator development. Their integration supports automated trading via Pine Script alerts and third-party signal services.

High Trust Score and Security

According to recent industry reports, Vantage maintains a trust score of 85/100, reflecting strong regulatory compliance and transparent business practices. The broker processes over $2 billion in monthly trading volume with consistent execution quality.

Regulation and Security

Vantage holds licenses from ASIC (Australia), CIMA (Cayman Islands), and VFSC (Vanuatu). The broker maintains segregated client accounts with major banks and provides negative balance protection across all account types.

Open Your Vantage AccountFXCM

Overview and Key Features

FXCM brings over 25 years of forex expertise to the TradingView ecosystem. As one of the first major brokers to integrate with TradingView, FXCM offers mature, well-tested integration with advanced features like algorithmic trading support and institutional-grade research.

Advanced Charting with TradingView

FXCM provides complimentary TradingView Pro subscriptions to active traders, unlocking advanced features like unlimited indicators, alerts, and multi-chart layouts. Their research team publishes daily TradingView analysis and educational content.

Integration Features

The FXCM-TradingView integration supports advanced order types including OCO (One Cancels Other), bracket orders, and algorithmic trading strategies. Position sizing calculators and risk management tools are built directly into the platform.

Regulation and Security

FXCM operates under FCA (UK) regulation and maintains offices in major financial centers worldwide. The broker segregates client funds with major banks and provides up to £85,000 compensation through the UK’s Financial Services Compensation Scheme.

Open Your FXCM AccountCity Index

Overview and Key Features

City Index has served UK traders for over 35 years, bringing institutional expertise to retail TradingView users. Their platform combines traditional broker stability with modern TradingView functionality.

Full TradingView Support

City Index offers complete TradingView integration including spread betting and CFD trading. Their platform supports over 12,000 instruments with competitive pricing and reliable execution during high-volatility periods.

Spreads and Trading Instruments

The broker provides tight spreads starting from 0.5 pips on major forex pairs, with no commission charges. Their diverse instrument selection includes forex, indices, commodities, and individual stocks—all tradable through TradingView.

Regulation and Security

City Index is authorized and regulated by the FCA with over three decades of regulatory compliance. The broker maintains segregated client accounts and provides up to £85,000 investor protection per eligible client.

Open Your City Index AccountCapital.com

Overview and Key Features

Capital.com has revolutionized forex trading with their AI-powered platform and seamless TradingView integration. This innovative broker serves over 6 million clients worldwide with cutting-edge technology and educational resources.

No Commissions on Trades

Capital.com operates a commission-free model across all instruments, making money exclusively from spreads. This transparent pricing structure eliminates hidden fees and simplifies cost calculations for TradingView strategies.

Trading Education Tools

The broker offers comprehensive educational resources specifically for TradingView users, including video tutorials, webinars, and market analysis. Their AI-powered insights help identify potential trading opportunities based on your TradingView activity.

Regulation and Security

Capital.com holds licenses from FCA (UK), CySEC (Cyprus), ASIC (Australia), and other major regulators. The broker segregates client funds with tier-1 banks and maintains professional indemnity insurance exceeding regulatory requirements.

Open Your Capital.com AccountFP Markets

Overview and Key Features

FP Markets combines Australian regulatory excellence with global market access through TradingView. This broker has built a strong reputation for transparency, competitive pricing, and excellent customer service since 2005.

Trading Fees and Commissions

FP Markets offers both commission-free Standard accounts and ECN-style Raw accounts with commissions from $3 per side. Their transparent pricing model ensures no hidden fees or markup on spreads.

| Account Type | EUR/USD Spread | Commission | Minimum Deposit |

|---|---|---|---|

| Standard | 1.0 pips | None | $100 |

| Raw | 0.0 pips | $3.00 per side | $100 |

Regulation and Security

FP Markets is regulated by ASIC (Australia) and CySEC (Cyprus), maintaining strict compliance standards and segregated client funds. The broker provides negative balance protection and comprehensive insurance coverage for client deposits.

Open Your FP Markets AccountComprehensive Broker Comparison

| Broker | Min Spread | Commission | Max Leverage | Regulation | Min Deposit | TradingView Pro |

|---|---|---|---|---|---|---|

| Pepperstone | 0.0 pips | $3.50 | 1:30 (EU) / 1:500 (Global) | FCA, ASIC | $200 | Free Essential |

| BlackBull Markets | 0.0 pips | $6.00 | 1:500 | FMA | $200 | Free Pro |

| IC Markets | 0.1 pips | $3.50 | 1:30 (EU) / 1:500 (Global) | ASIC, CySEC | $200 | Free Essential |

| Eightcap | 0.1 pips | $3.50 | 1:500 | FCA, ASIC | $100 | Free Essential |

| Capital.com | 0.6 pips | None | 1:30 (EU) / 1:200 (Global) | FCA, CySEC | $20 | Free Basic |

How to Choose the Right Forex Broker for TradingView

Factors to Consider

Spreads and Commissions

Here’s what most guides won’t tell you: the lowest spread isn’t always the cheapest option. Let me break this down with real numbers.

Consider your trading volume, position sizes, and strategy type. Scalpers benefit from ultra-low spreads despite higher commissions, while swing traders might prefer commission-free accounts with slightly wider spreads.

Trading Platform Integration

Not all TradingView integrations offer the same functionality. Full integration includes:

- Order Management: Place, modify, and cancel orders directly from charts

- Position Tracking: Real-time P&L and position monitoring

- Account Information: Balance, margin, and trade history synchronization

- Alert Integration: Convert TradingView alerts into live trades

Customer Support and Education

When TradingView integration breaks (and it sometimes does), you need responsive support. Test support quality during your demo period—ask specific questions about TradingView features and gauge response times and knowledge levels.

Regulation and Safety of Funds

2024 Regulatory Priority List:

- Tier 1: FCA (UK), ASIC (Australia), CFTC/NFA (USA)

- Tier 2: CySEC (Cyprus), BaFin (Germany), FINMA (Switzerland)

- Tier 3: FMA (New Zealand), MAS (Singapore), JFSA (Japan)

Order Execution Speed

For TradingView strategies, execution speed matters more than you think. Market-moving news can trigger hundreds of TradingView alerts simultaneously, creating temporary latency spikes. Look for brokers with sub-50 millisecond execution and dedicated TradingView servers.

Evaluating Broker Reliability

Check broker uptime during major market events. The best test? How did they perform during the March 2020 COVID crash or recent high-impact NFP releases? Reliable brokers maintain service quality even during extreme volatility.

Considering Trading Costs

Calculate total trading costs including spreads, commissions, swap rates, and hidden fees like withdrawal charges. Many brokers offer attractive headline spreads but charge excessive swap rates for overnight positions.

| Cost Type | Typical Range | Impact on Strategy |

|---|---|---|

| Spreads | 0.0 – 2.0 pips | High (every trade) |

| Commissions | $0 – $10 per lot | High (every trade) |

| Swap Rates | -8 to +3 per lot/night | Medium (swing trades) |

| Withdrawal Fees | $0 – $50 | Low (monthly impact) |

Analyzing Platform Features

Available Forex Pairs

Most brokers offer major pairs, but exotic pairs vary significantly. If your TradingView strategy involves pairs like USD/TRY or EUR/NOK, verify availability before opening accounts.

Leverage and Margin Options

Leverage rules changed dramatically post-2018. EU residents face 1:30 maximum leverage on majors, while global clients often access 1:500 or higher. Understand your jurisdiction’s limitations and choose brokers accordingly.

User Experience and Trading Conditions

Test the broker’s TradingView integration during different market conditions. Some brokers slow execution during news events or widen spreads during Asian sessions. Demo test for at least two weeks covering different market scenarios.

Platform Reliability

Monitor platform stability during your demo period. Check for disconnections, order failures, or data feed issues. Reliable brokers maintain 99.9%+ uptime with backup systems for critical trading periods.

Checking Regulatory Compliance

Verify regulation through official channels, not broker websites. Use regulator lookup tools:

- FCA: register.fca.org.uk

- ASIC: Professional Registers

- CySEC: Regulated Entities Database

TradingView vs Other Trading Platforms

MetaTrader 4 vs TradingView

The eternal debate: MT4’s reliability versus TradingView’s modern interface. Here’s the honest comparison based on real-world usage:

| Feature | MetaTrader 4 | TradingView | Winner |

|---|---|---|---|

| Charting Quality | Basic but reliable | Modern, customizable | TradingView |

| Execution Speed | Excellent | Good | MT4 |

| Community Features | Limited | Extensive | TradingView |

| Mobile Experience | Functional | Excellent | TradingView |

| Automated Trading | Excellent (EAs) | Limited | MT4 |

Recent analysis shows TradingView excels for discretionary trading and analysis, while MT4 remains superior for automated strategies and high-frequency trading.

cTrader vs TradingView

cTrader represents the middle ground—more modern than MT4 but more execution-focused than TradingView. The comparison depends on your primary use case:

cTrader advantages include superior order management, depth of market viewing, and professional-grade execution algorithms. However, TradingView wins on charting capabilities, social features, and cross-device synchronization.

NinjaTrader vs TradingView

NinjaTrader targets serious algorithmic traders with advanced backtesting and strategy development tools. TradingView serves a broader audience with emphasis on discretionary trading and community interaction. Choose based on your primary trading style and technical requirements.

Advanced TradingView Features for Forex Traders

Multi-Timeframe Analysis

Multi-timeframe analysis is where TradingView truly shines. You can monitor long-term trends on daily charts while timing entries on 5-minute charts—all synchronized in real-time.

Professional traders use the “Top-Down Analysis” approach: start with monthly charts for overall direction, weekly for trend confirmation, daily for entry zones, and hourly for precise timing. TradingView’s layout system lets you save these setups for instant access.

Custom Indicators and Scripts

Pine Script, TradingView’s programming language, has generated some of the most profitable forex strategies in recent years. Community-developed indicators often outperform traditional technical analysis.

Popular Pine Script indicators for forex include:

- Smart Money Concepts: Institutional order flow analysis

- Market Structure Indicators: Break of structure identification

- Volume Profile Tools: Professional-grade volume analysis

- Multi-Timeframe RSI: Divergence analysis across timeframes

Social Trading and Community Scripts

TradingView’s social features create a unique learning environment. Follow successful traders, analyze their published ideas, and adapt strategies to your trading style. The platform’s “Publishing” feature lets you share analysis and receive feedback from the community.

Backtesting and Strategy Development

Strategy Tester allows systematic evaluation of trading ideas using historical data. While not as sophisticated as dedicated backtesting software, it provides valuable insights into strategy performance, maximum drawdown, and risk-adjusted returns.

Tips for Maximizing Trading Performance with TradingView

Setting Alerts and Notifications

TradingView’s alert system is incredibly powerful when configured correctly. Instead of watching charts all day, set intelligent alerts that notify you when specific conditions are met.

Best practices for TradingView alerts:

- Use Multiple Conditions: Combine price, volume, and indicator conditions

- Set Expiration Times: Prevent outdated alerts from triggering

- Test Alert Logic: Verify alerts work correctly before relying on them

- Organize by Strategy: Group related alerts for easy management

Using TradingView’s Strategy Tester

Strategy Tester transforms theoretical ideas into measurable results. However, many traders misuse this powerful tool, leading to overoptimized strategies that fail in live markets.

Common backtesting mistakes to avoid:

- Over-optimization: Tweaking parameters for perfect historical results

- Insufficient Data: Testing on limited timeframes or pairs

- Ignoring Spreads: Backtesting without realistic transaction costs

- Survivorship Bias: Testing only on successful time periods

Backtesting with TradingView for Forex Strategies

Effective backtesting requires systematic approach and realistic expectations. Start with simple strategies and gradually add complexity. Focus on risk-adjusted returns rather than pure profit maximization.

Key metrics to monitor during backtesting:

| Metric | Good Range | Why Important |

|---|---|---|

| Win Rate | 45-65% | Psychological comfort |

| Profit Factor | >1.3 | Overall profitability |

| Maximum Drawdown | <15% | Risk management |

| Sharpe Ratio | >1.0 | Risk-adjusted returns |

Common Strategies Using TradingView in Forex Trading

Trend Following Strategies

Trend following remains one of the most consistently profitable forex strategies, especially when combined with TradingView’s advanced trend identification tools.

The “Three-Touch Rule” strategy works exceptionally well on TradingView:

- Identify the overall trend using 200-period moving average

- Wait for price to touch a significant support/resistance level three times

- Enter on the third touch with confirmation from momentum indicators

- Use TradingView alerts to monitor setups across multiple pairs

Breakout Strategies

TradingView’s drawing tools make breakout identification simple and accurate. The platform’s replay function allows you to practice identifying breakouts on historical data, improving your real-time recognition skills.

Effective breakout strategies combine multiple confirmation signals:

- Volume Confirmation: Breakouts with above-average volume are more reliable

- Time-based Filters: London/New York session breakouts often have better follow-through

- Multiple Timeframe Confirmation: Ensure breakouts align across different timeframes

Scalping Techniques

Scalping on TradingView requires specific broker selection and platform optimization. Choose brokers with sub-30 millisecond execution and minimal slippage during high-frequency periods.

TradingView scalping essentials:

- Use 1-5 minute charts with fast-responding indicators

- Set up hotkeys for quick order placement

- Monitor spreads during different sessions

- Avoid scalping during news releases

- Maintain strict risk management (1-2 pips stop losses)

Automated Trading with TradingView and Forex Brokers

Utilizing Pine Script for Automation

While TradingView doesn’t support full automation natively, Pine Script strategies can generate alerts that trigger automated trades through third-party services or broker APIs.

PineConnector and similar services bridge the gap between TradingView signals and MetaTrader execution, enabling semi-automated trading systems.

Integrating Automated Strategies with Brokers

Several brokers now offer webhook integration, allowing TradingView alerts to trigger trades automatically. This approach combines TradingView’s analysis capabilities with broker execution efficiency.

Popular automation approaches:

- Webhook Integration: Direct TradingView-to-broker communication

- Third-party Bridges: Services connecting TradingView to MT4/MT5

- API Integration: Custom solutions for advanced users

- Signal Services: Following professional TradingView signal providers

Monitoring Automated Trades

Automation doesn’t mean “set and forget.” Regular monitoring ensures strategies perform as expected and adapt to changing market conditions. Use TradingView’s portfolio tracking features to monitor automated strategy performance.

Setting Up and Troubleshooting TradingView with Your Forex Broker

Step-by-Step Guide to Connecting Your Broker Account

Connecting TradingView to your forex broker should be straightforward, but the process varies by broker. Here’s the universal approach that works with most integrated brokers:

- Create Accounts: Open both TradingView and broker accounts (demo first for testing)

- Verify Identity: Complete KYC requirements with your chosen broker

- Access Trading Panel: Log into TradingView and navigate to the Trading Panel

- Select Broker: Choose your broker from the integrated broker list

- Enter Credentials: Use your broker login details to establish connection

- Test Connectivity: Place a small demo trade to verify everything works

Troubleshooting Common Integration Issues

Connection Problems Between TradingView and Brokers

Connection issues usually stem from authentication problems or server timeouts. Common solutions include:

- Clear browser cache and cookies

- Try connecting during off-peak hours

- Verify broker account is active and funded

- Check if broker requires additional TradingView permissions

- Contact broker support for integration-specific guidance

Data Feed Delays and Solutions

Data delays can significantly impact trading decisions, especially for short-term strategies. Most delays result from:

- Internet connectivity issues: Test connection speed and stability

- TradingView server load: Consider upgrading to paid plans for priority data

- Broker data feed quality: Some brokers provide delayed or filtered data

- Geographic location: Data centers closer to your location provide faster feeds

Resolving Charting Tool Conflicts

Sometimes TradingView indicators or drawing tools don’t display correctly with certain brokers. This typically occurs when:

- Broker uses different symbol naming conventions

- Historical data doesn’t align between platforms

- Timezone settings differ between TradingView and broker

Best Practices for Using TradingView with Your Broker

Maximize your TradingView-broker integration with these professional tips:

- Start with Demo: Test all features thoroughly before live trading

- Monitor Execution Quality: Compare fills with expected prices

- Backup Trading Platform: Keep broker’s native platform available

- Regular Updates: Keep TradingView and broker software current

- Document Issues: Track problems for pattern recognition

Conclusion

Summarizing the Top TradingView Forex Brokers

After extensive analysis, the clear winners for TradingView forex trading in 2025 are:

- Pepperstone: Best overall experience with excellent regulation and tight spreads

- BlackBull Markets: Ideal for scalpers needing high leverage and fast execution

- IC Markets: Market-leading spreads with comprehensive instrument selection

- Eightcap: Perfect for beginners with user-friendly integration and education

- Capital.com: AI-powered insights with commission-free trading

Final Thoughts on Choosing the Right Broker

Your perfect TradingView broker depends on your specific needs: trading style, experience level, capital requirements, and geographic location. Don’t rush the decision—test multiple brokers through demo accounts and evaluate real execution quality before committing funds.

Remember: the best broker is one that aligns with your trading goals, provides reliable execution, maintains transparent pricing, and offers excellent customer support when you need it most.

Future Trends in Forex Trading with TradingView

Looking ahead to 2025 and beyond, expect continued innovation in TradingView integrations. Emerging trends include AI-powered trade execution, enhanced mobile functionality, and deeper integration with institutional trading tools. Stay informed about broker updates and new features to maintain your competitive edge.

Frequently Asked Questions

- Can You Trade Directly from TradingView?

- Yes, TradingView supports direct trading through integrated brokers. You can place orders, manage positions, and monitor your account directly from TradingView charts without switching platforms.

- Which Brokers Are Compatible with TradingView?

- Over 100 brokers integrate with TradingView, including Pepperstone, BlackBull Markets, IC Markets, Eightcap, Capital.com, FXCM, and City Index. The full list is available on TradingView’s broker page.

- How Much Does TradingView Cost?

- TradingView offers free basic accounts with limited features. Paid plans start at $14.95/month (Pro), $29.95/month (Pro+), and $59.95/month (Premium). Many brokers provide free or discounted subscriptions.

- Do All Forex Brokers Support TradingView?

- No, not all brokers offer TradingView integration. However, major regulated brokers increasingly support TradingView due to trader demand. Always verify integration availability before opening accounts.

- How to Connect TradingView with a Forex Broker?

- Log into TradingView, access the Trading Panel, select your broker from the list, enter your broker credentials, and authorize the connection. The process takes 2-5 minutes for most brokers.

- What Are the Benefits of Using TradingView for Forex Trading?

- TradingView offers superior charting, social trading features, custom indicators, multi-timeframe analysis, intelligent alerts, and seamless broker integration—all in one modern platform.

- Can I Use TradingView for Free with a Broker?

- Yes, TradingView offers free accounts with basic features. Additionally, many brokers provide complimentary TradingView subscriptions (Essential, Pro, or Premium) to their clients.

- What Is the Best Broker for TradingView in 2025?

- Pepperstone offers the best overall TradingView experience with excellent regulation, competitive spreads, and reliable execution. However, the “best” depends on your specific trading needs and location.

- How Reliable Are Trading Signals on TradingView?

- TradingView signal reliability varies by provider. Community-generated signals should be verified independently. Focus on signals from verified accounts with consistent performance history.

- Does TradingView Work with MetaTrader 4/5?

- TradingView doesn’t directly integrate with MetaTrader, but third-party services like PineConnector bridge TradingView alerts to MT4/MT5 for automated execution.

- What is TradingView used for in Forex trading?

- TradingView serves as a comprehensive analysis and trading platform for forex, offering advanced charting, technical indicators, social trading features, and direct broker integration for seamless trading execution.

- Are there fees for using TradingView with a broker?

- TradingView itself offers free basic accounts, while premium features cost $14.95-$59.95 monthly. Many brokers provide free TradingView subscriptions to clients. Broker trading fees (spreads/commissions) apply separately.

- Is TradingView available for mobile trading?

- Yes, TradingView offers excellent mobile apps for iOS and Android with full charting capabilities, order placement, and account management. The mobile experience rivals desktop functionality.

- What are the advantages of using TradingView with Forex brokers?

- Key advantages include superior charting tools, social trading community, custom indicators, multi-asset analysis, intelligent alerts, seamless execution, and unified analysis-trading workflow.

- Are TradingView’s charting tools better than MetaTrader?

- TradingView offers more modern, customizable charting with superior visual presentation. MetaTrader provides more automated trading capabilities. The choice depends on your trading style and preferences.

- Which Forex brokers are regulated and support TradingView?

- Well-regulated brokers supporting TradingView include Pepperstone (FCA/ASIC), IC Markets (ASIC/CySEC), Eightcap (FCA/ASIC), Capital.com (FCA/CySEC), and FXCM (FCA), among others.

- Can beginners use TradingView with a broker?

- Absolutely! TradingView’s user-friendly interface makes it ideal for beginners. Start with demo accounts, utilize educational resources, and gradually explore advanced features as your skills develop.

- What are the minimum requirements for TradingView integration?

- Requirements include a TradingView account, compatible broker account, stable internet connection, and modern web browser. Most integrations work on desktop and mobile devices without additional software.

- What are the trading limitations when using TradingView with a broker?

- Limitations may include restricted order types (compared to native broker platforms), occasional connectivity issues, data feed delays during high volatility, and limited automated trading capabilities.

- What are the top Forex brokers for beginners using TradingView?

- Beginner-friendly options include Eightcap ($100 minimum), Capital.com ($20 minimum), and Pepperstone ($200 minimum). These brokers offer excellent education, user-friendly interfaces, and comprehensive support.

- Can I use leverage with TradingView brokers?

- Yes, most TradingView-integrated brokers offer leverage. EU residents face 1:30 maximum on majors, while global clients often access 1:500 or higher, depending on broker and jurisdiction.

- Does TradingView offer real-time data for Forex brokers?

- TradingView provides real-time data for integrated brokers. Free accounts may have slight delays, while paid subscriptions offer priority data feeds and faster updates.

- What are the best indicators on TradingView for Forex traders?

- Popular indicators include Moving Averages, RSI, MACD, Bollinger Bands, Fibonacci retracements, and community-created indicators like Smart Money Concepts and Market Structure tools.

- Is TradingView suitable for scalping in Forex?

- TradingView can support scalping, but success depends on broker execution speed and spread competitiveness. Choose brokers with sub-30ms execution and minimal slippage for scalping strategies.

- How do I save charts and layouts in TradingView?

- TradingView automatically saves your work. Use the “Layouts” feature to save custom chart setups, and the “Templates” function to save indicator combinations for quick application to new charts.

- Can TradingView be used for automated Forex trading?

- TradingView offers semi-automated trading through Pine Script alerts and webhook integration. Full automation requires third-party services or broker-specific solutions connecting TradingView to execution platforms.

- Can I use a demo account on TradingView?

- Yes, most integrated brokers support demo account connection to TradingView. This allows risk-free testing of strategies, platform features, and execution quality before live trading.

- Which brokers offer the best execution speed on TradingView?

- IC Markets, BlackBull Markets, and Pepperstone offer excellent execution speeds (12-40ms average) with high uptime and minimal slippage during normal market conditions.

- What types of orders can I place through TradingView?

- Most integrations support market orders, limit orders, stop orders, stop-loss, take-profit, and trailing stops. Advanced order types vary by broker integration.

- What level of TradingView subscription do I need for forex trading?

- Free accounts provide basic functionality. Pro ($14.95/month) offers enhanced features suitable for most traders. Professional traders may benefit from Pro+ or Premium subscriptions for advanced capabilities.

- Can I use TradingView’s social features with my forex broker?

- Yes, TradingView’s social features work independently of broker integration. You can share ideas, follow other traders, and engage with the community regardless of your connected broker.

- How do I choose between different TradingView-compatible forex brokers?

- Consider regulation quality, trading costs, execution speed, available instruments, customer support, and integration reliability. Test multiple brokers via demo accounts before deciding.

- Is customer support available for TradingView integration issues with brokers?

- Yes, both TradingView and brokers provide support for integration issues. TradingView handles platform-related problems, while brokers address account-specific and execution-related concerns.

- How secure is trading through TradingView?

- TradingView uses bank-level security including SSL encryption, two-factor authentication, and secure API connections. However, overall security depends on your broker’s security measures and regulatory compliance.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.