Key Takeaways: Best NDD Forex Brokers in 2025

- IC Markets leads with ultra-tight spreads from 0.0 pips and lightning-fast execution under 40ms

- Pepperstone offers exceptional regulatory oversight from 7 tier-1 authorities including FCA and ASIC

- FP Markets provides deep liquidity access with raw ECN pricing and competitive $6 round-turn commissions

- BlackBull Markets delivers institutional-grade conditions with zero-pip spreads and sub-20ms execution

- Always choose NDD brokers regulated by FCA, ASIC, CySEC, or other tier-1 authorities for maximum protection

Honestly, picking the right forex broker isn’t rocket science—but it can make or break your trading career. If you’ve been trading with a dealing desk broker and wondering why your orders get rejected during volatile market moves, or why spreads suddenly widen when you’re about to hit your profit target, you’re in the right place.

No Dealing Desk (NDD) brokers represent the gold standard in forex trading execution. Unlike traditional market makers who take the opposite side of your trades, NDD brokers route your orders directly to the interbank market, giving you access to real market prices, lightning-fast execution, and transparent trading conditions.

Think of it this way: Trading with a dealing desk broker is like shopping at a store where the owner decides the prices and might not have what you want in stock. NDD brokers are like direct access to the wholesale market—you get real prices, better selection, and no middleman markup.

In this comprehensive guide, we’ll dive deep into the best NDD forex brokers for 2025, breaking down everything from spreads and commissions to regulatory compliance and platform capabilities. Whether you’re a scalper looking for ultra-tight spreads, a swing trader focused on execution quality, or a beginner seeking educational resources, we’ve got you covered.

What is a No Dealing Desk (NDD) Broker?

Definition of NDD

A No Dealing Desk (NDD) broker is a forex brokerage that doesn’t act as a counterparty to your trades. Instead of taking the opposite side of your position, NDD brokers route your orders directly to external liquidity providers—banks, hedge funds, and other financial institutions that make up the interbank market.

This fundamental difference means NDD brokers don’t have a conflict of interest with your trading success. When you profit, they don’t lose money, and when you lose, they don’t automatically profit. Their revenue comes primarily from commissions and slight spread markups rather than trading against you.

How NDD Brokers Work

When you place a trade with an NDD broker, here’s what happens behind the scenes:

- Order Placement: You click “buy” or “sell” on your trading platform

- Instant Routing: Your order is immediately routed to the broker’s liquidity pool

- Best Price Matching: The system finds the best available price from multiple liquidity providers

- Execution: Your trade is executed at the real market price with minimal delay

- Confirmation: You receive instant confirmation of your fill price and execution

2025 Regulatory Update: The FCA has maintained its 1:30 leverage limit for major currency pairs, while ASIC introduced enhanced transparency rules in March 2025 to improve trade reporting and risk management for NDD brokers.

Key Features of NDD Brokers

Transparent Pricing

NDD brokers provide direct access to interbank pricing, which means you see the real market spread plus a small, clearly disclosed markup. This transparency is crucial for serious traders who need to calculate their exact trading costs and develop profitable strategies.

Fast Execution

Without a dealing desk to process and potentially reject orders, NDD brokers typically execute trades in milliseconds. Top-tier NDD brokers like IC Markets achieve average execution speeds under 40ms, while BlackBull Markets consistently delivers sub-20ms fills.

Reduced Conflicts of Interest

This is perhaps the most important advantage. Since NDD brokers don’t trade against you, they actually benefit from your trading volume and success. The more you trade and the more successful you become, the more commission revenue they generate. This alignment of interests creates a healthier relationship between broker and trader.

Video: Top 5 Best NDD Forex Brokers explained by Forexsuggest

Types of No Dealing Desk Brokers

STP (Straight Through Processing) Brokers

STP brokers route your orders directly to their liquidity providers without any manual intervention. They typically add a small markup to the spread they receive from banks and other liquidity sources. Popular STP brokers include Pepperstone and FP Markets.

The main advantages of STP execution include consistent spreads during normal market conditions, no commissions on most account types, and simplified pricing structures that are easy for beginners to understand.

ECN (Electronic Communication Network) Brokers

ECN brokers provide direct access to an electronic network where multiple participants—banks, hedge funds, other traders—post their bid and ask prices. You can see the actual market depth and sometimes even place orders within the spread.

ECN brokers typically offer the tightest possible spreads, starting from 0.0 pips on major pairs, but charge a commission per trade. Leading ECN brokers like IC Markets and BlackBull Markets charge $3-3.50 per lot in commissions.

Hybrid NDD Models

Many modern brokers combine STP and ECN technologies to offer different account types for various trading styles. For example, they might offer commission-free STP accounts for casual traders and low-spread ECN accounts for active scalpers and professional traders.

Image: Visual comparison of top no dealing desk forex brokers (Source: CompareForexBrokers)

Benefits of Trading with No Dealing Desk Brokers

Direct Market Access

Direct market access (DMA) means your orders interact with real market liquidity rather than synthetic prices created by a dealing desk. This results in more accurate pricing, especially during high-impact news events when dealing desk brokers often widen spreads dramatically or disable trading altogether.

With DMA, you’re trading alongside institutions and professional traders using the same pricing and liquidity sources. This level playing field is crucial for developing and executing sophisticated trading strategies.

Competitive Spreads

NDD brokers typically offer tighter spreads than dealing desk brokers, especially on major currency pairs. Here’s a comparison of current spreads from top NDD brokers:

EUR/USD Spreads Comparison (Raw/ECN Accounts)

| Broker | EUR/USD Spread (Raw/ECN) |

|---|---|

| BlackBull Markets | 0.1 pips |

| FxPro | 0.3 pips |

| IC Markets | 0.1 pips |

| Pepperstone | 0.0 pips + commission |

| FP Markets | 0.1 pips |

| FXTM | 0.2 pips |

* Spreads shown are typical averages during normal market conditions. FxPro listed once despite duplicate in source.

** Pepperstone uses commission-based pricing: $7 round turn per standard lot

Improved Trade Execution Speed

Speed matters, especially for scalpers and high-frequency traders. NDD brokers consistently deliver faster execution because they don’t need to process orders through a dealing desk. Here’s how top NDD brokers compare:

| Broker | Average Execution Speed | Data Centers |

|---|---|---|

| BlackBull Markets | Under 20ms | Equinix NY4, LD5 |

| IC Markets | Under 40ms | NY4, LD5 |

| FxPro | 12ms average | Multiple Equinix |

| Pepperstone | 30-50ms | Equinix NY4 |

Enhanced Market Transparency

Many NDD brokers provide Level II market data, showing you the depth of market (DOM) with bid and ask sizes at different price levels. This transparency allows for more informed trading decisions and helps you understand market dynamics better.

Open Your IC Markets AccountNDD vs. Dealing Desk Brokers: Key Differences

Video: Andrew Lockwood explains the differences between dealing desk and no dealing desk brokers

Execution Model Comparison

The fundamental difference lies in how your orders are handled:

NDD Brokers

- • Orders routed directly to liquidity providers

- • No conflict of interest with traders

- • Real market pricing

- • Variable spreads based on market conditions

- • Fast, automated execution

- • Revenue from commissions/spread markup

Dealing Desk Brokers

- • Broker takes opposite side of trades

- • Potential conflict of interest

- • Synthetic/quoted pricing

- • Fixed spreads during normal conditions

- • Manual order processing possible

- • Revenue from trader losses

Pricing Structure Differences

Understanding how each model prices trades is crucial for calculating your true trading costs:

| Aspect | NDD Brokers | Dealing Desk Brokers |

|---|---|---|

| Spreads | Variable, market-based | Usually fixed, wider |

| Commissions | Often charged per lot | Usually included in spread |

| Slippage | Minimal, market-driven | Can be significant |

| Requotes | Rare or none | Common during volatility |

Risk Management Approaches

NDD brokers focus on managing their technology and liquidity risks rather than taking positions against clients. This approach leads to more robust risk management systems and better execution during volatile market conditions.

Dealing desk brokers must manage both client positions and their own market exposure, which can lead to conflicts during extreme market conditions when they might limit trading or widen spreads to protect their own positions.

Best NDD Forex Brokers in 2025

IC Markets

Regulation

ASIC, CySEC, FSA (Seychelles), SCB (Bahamas), CMA (Kenya)

Spreads

From 0.0 pips (Raw Spread Account)

Commission

$3.50 per lot (round turn)

IC Markets consistently ranks as the top NDD broker for good reason. Founded in 2007, this Australian-based broker has built a reputation for offering some of the tightest spreads in the industry, starting from 0.0 pips on major pairs.

What sets IC Markets apart is their ultra-fast execution infrastructure. With data centers in New York (NY4) and London (LD5), they achieve average execution speeds under 40 milliseconds. Their Raw Spread accounts provide direct ECN access with transparent pricing and no requotes.

Key Features:

- 2,250+ tradeable instruments including 61 forex pairs

- Multiple platform support: MT4, MT5, cTrader

- Copy trading and advanced order types

- 24/7 multilingual customer support

- Negative balance protection

Pepperstone

Regulation

ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB

Spreads

From 0.0 pips (Razor Account)

Commission

$3.50 per lot (round turn)

Pepperstone stands out for its exceptional regulatory coverage, holding licenses from seven tier-1 authorities including the FCA, ASIC, and CySEC. This multi-jurisdictional approach provides traders with robust protection and segregated client funds.

The broker offers two main account types: Standard accounts with spreads from 1.0 pip and no commissions, and Razor accounts with raw spreads from 0.0 pips plus $3.50 per lot commission. Their execution is powered by Equinix NY4 servers, ensuring minimal latency for US and European traders.

Key Features:

- 1,200+ instruments across forex, commodities, indices, and shares

- Multiple platforms: MT4, MT5, cTrader, TradingView

- Copy trading with Myfxbook AutoTrade

- Advanced risk management tools

- Educational resources and market analysis

FP Markets

Regulation

ASIC, CySEC, FSCA, FSA (St. Vincent), SCB

Spreads

From 0.0 pips (Raw Account)

Commission

$6.00 per lot (round turn)

FP Markets has earned recognition as a premium NDD broker offering raw ECN pricing and institutional-grade trading conditions. Established in 2005, the broker serves clients in over 150 countries with deep liquidity and transparent pricing.

What makes FP Markets unique is their commitment to technology and infrastructure. They utilize Equinix servers in New York and London, ensuring ultra-low latency execution. Their Raw accounts provide access to over 10,000 financial instruments with spreads starting from 0.0 pips.

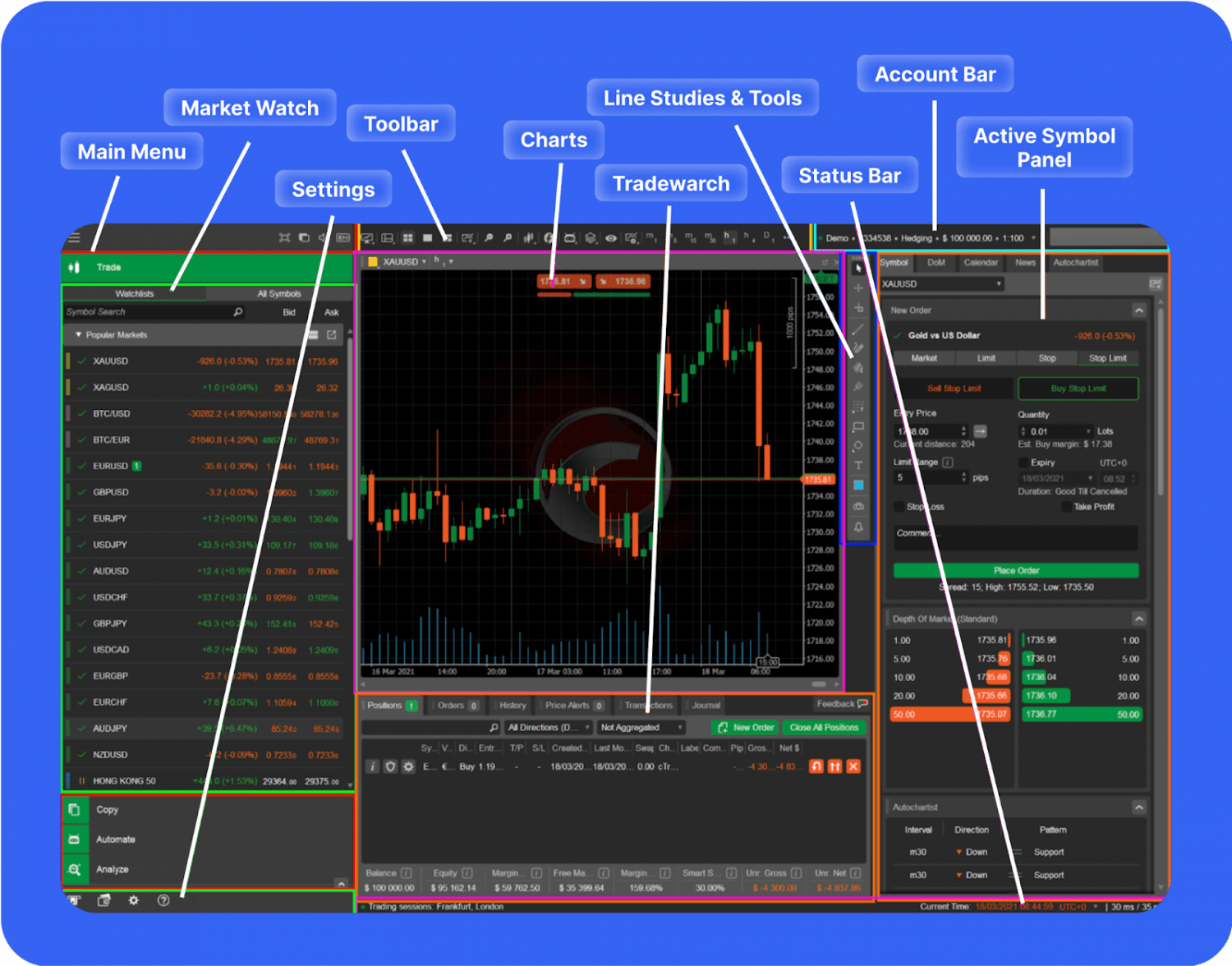

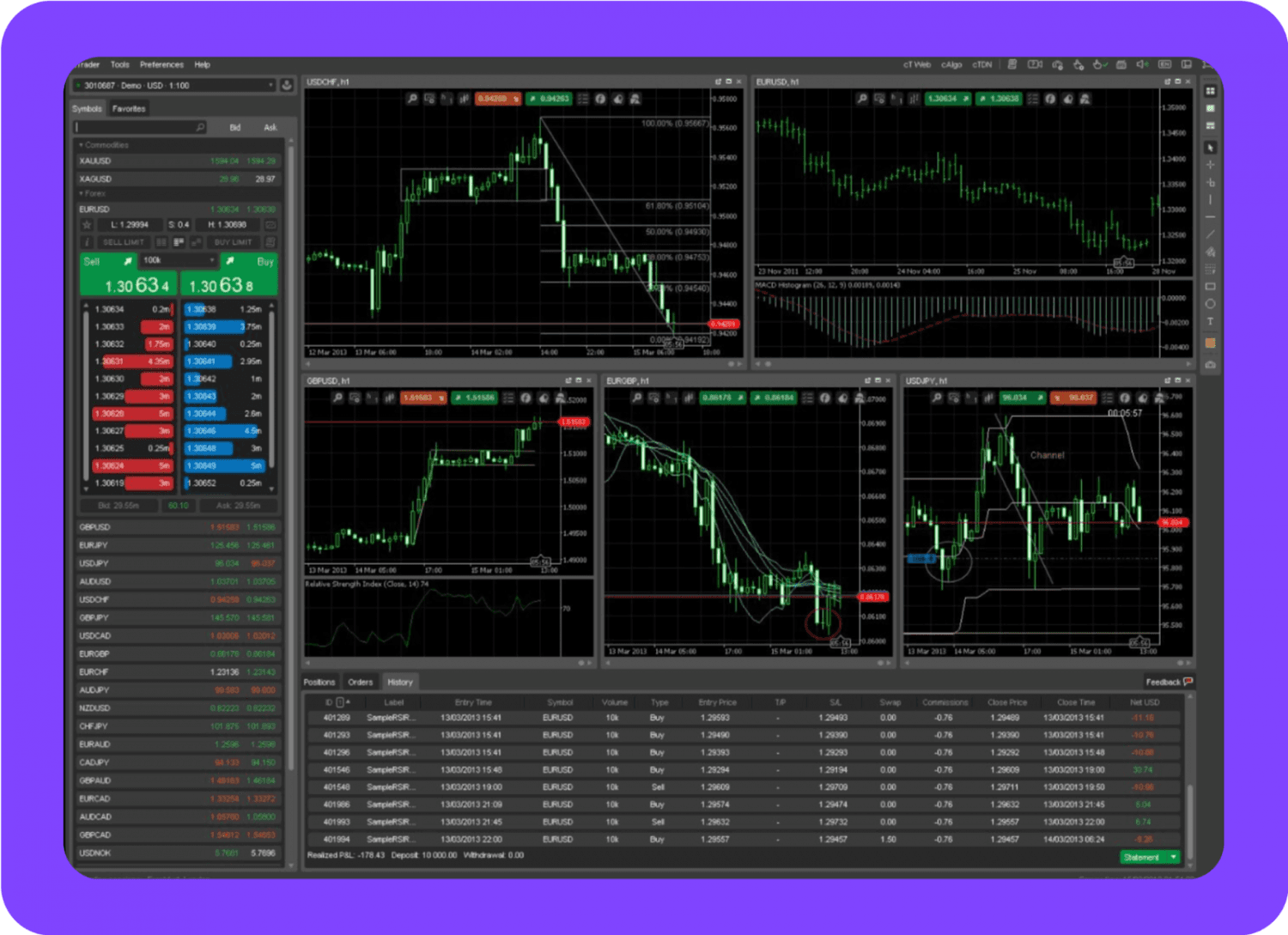

Image: MetaTrader and cTrader platform comparison showing NDD execution features

Key Features:

- 10,000+ tradeable instruments

- Multiple platforms: MT4, MT5, WebTrader, cTrader, IRESS

- VPS hosting for automated trading

- MAM/PAMM account management

- Daily market research and analysis

BlackBull Markets

Regulation

FSA (Seychelles), FMA (New Zealand)

Spreads

From 0.0 pips (ECN Prime)

Commission

$6.00 per lot (round turn)

BlackBull Markets delivers institutional-grade trading conditions with some of the fastest execution speeds in the industry. Their ECN Prime accounts offer direct market access with execution speeds consistently under 20 milliseconds.

The broker’s infrastructure is built on Equinix servers in New York and London, providing ultra-low latency connectivity to major liquidity providers. BlackBull Markets specializes in serving professional traders and institutions with advanced trading tools and premium support.

Key Features:

- 26,000+ tradeable instruments

- Multiple platforms: MT4, MT5, cTrader, TradingView

- Copy trading and social trading features

- Advanced charting and analysis tools

- Dedicated account managers for premium accounts

FXTM (ForexTime)

Regulation

FCA, CySEC, FSC (Mauritius)

Spreads

From 0.0 pips (ECN Account)

Commission

From $5.00 per lot

FXTM has established itself as a leading global broker since 2011, serving over 2 million clients worldwide. The broker offers comprehensive NDD execution with competitive spreads and a strong focus on trader education and market analysis.

FXTM’s strength lies in their educational resources and copy trading platform, FXTM Invest. Their in-house research team produces daily market analysis covering both fundamental and technical perspectives, making them an excellent choice for traders who value educational content.

Key Features:

- Advanced copy trading platform (FXTM Invest)

- Comprehensive educational resources

- Multiple account types for different trading styles

- Negative balance protection

- Daily market analysis and research

Commission Comparison – Top NDD Brokers

Eightcap

Eightcap offers competitive NDD execution with access to third-party automation tools like Capitalise.ai. The broker provides stable liquidity supply with relatively low minimum deposit requirements of just $100, making it accessible for new traders while maintaining professional-grade execution standards.

Open Your Eightcap AccountFxPro

FxPro stands out with lightning-fast execution averaging 13 milliseconds and multiple platform options including MT4, MT5, cTrader, and their proprietary platform. They offer up to 30% discounts for active traders and provide VPS hosting for automated trading solutions.

Open Your FxPro AccountXTB

XTB provides access to their award-winning proprietary platform xStation 5, known for intuitive navigation, advanced charting tools, and real-time market analysis. The broker is regulated by multiple tier-1 authorities and offers comprehensive educational resources for traders at all levels.

Open Your XTB AccountTickmill

Tickmill operates as a pure NDD broker with ultra-low-latency execution and competitive spreads starting from 0.0 pips. They’re regulated by multiple authorities including CySEC, FCA, and FSCA, providing robust trader protection across different jurisdictions.

Open Your Tickmill AccountFusion Markets

Fusion Markets offers some of the lowest commission rates in the industry at $4.50 per round turn, combined with spreads starting from 0.0 pips. They provide access to over 250 financial markets with copy trading capabilities and their proprietary Fusion+ platform.

Open Your Fusion Markets AccountHow to Choose the Best NDD Forex Broker

Regulatory Compliance and Safety

When choosing an NDD broker, regulation should be your first priority. Here’s a hierarchy of regulatory authorities based on their stringency and trader protection:

Tier-1 Regulators

- FCA (UK): £85,000 compensation scheme

- ASIC (Australia): Stringent capital requirements

- CySEC (Cyprus): €20,000 compensation scheme

- BaFin (Germany): €100,000 protection

- FINMA (Switzerland): Premium regulation

Tier-2 Regulators

- FSA (Seychelles): Growing reputation

- CMA (Kenya): Emerging market leader

- FSCA (South Africa): Solid oversight

- DFSA (Dubai): Middle East hub

- MAS (Singapore): Asian financial center

2025 Update: Following Brexit, many brokers have restructured their regulatory setup. Always verify current licensing status directly with the regulatory authority before opening an account.

Trading Conditions

Compare these key metrics when evaluating NDD brokers:

| Metric | Excellent | Good | Acceptable |

|---|---|---|---|

| EUR/USD Spread | 0.0-0.1 pips | 0.1-0.3 pips | 0.3-0.5 pips |

| Commission (per lot) | $3.00-$4.00 | $4.00-$6.00 | $6.00-$8.00 |

| Execution Speed | <50ms | 50-100ms | 100-200ms |

| Leverage (Non-EU) | 1:500+ | 1:200-1:500 | 1:100-1:200 |

Trading Platforms and Tools

The quality of your trading platform directly impacts your trading performance. Here’s what to look for:

- MetaTrader 4/5: Industry standard with extensive EA support

- cTrader: Superior for scalping with Level II pricing

- TradingView: Advanced charting and social trading features

- Proprietary platforms: Unique features but limited third-party tool support

Image: Comparison of cTrader and MetaTrader platform features for NDD execution

Execution Speed and Quality

Test execution quality with small live trades before committing significant capital. Key factors include:

- Consistent fill rates above 95%

- Minimal slippage during normal market conditions

- No requotes or dealer intervention

- Stable spreads during news events

- Fast order processing during market opens/closes

NDD Brokers and Scalping Strategies

Why Scalpers Prefer NDD Brokers

Scalping requires lightning-fast execution, minimal spreads, and no dealer intervention—exactly what NDD brokers provide. Here’s why serious scalpers choose NDD execution:

Racing Analogy: Scalping is like Formula 1 racing—every millisecond matters. Using a dealing desk broker for scalping is like racing with a speed limiter; you’ll never reach your full potential.

- No requotes: Your orders execute at the price you see

- Minimal slippage: Direct market access reduces price deviation

- Tight spreads: Lower transaction costs per trade

- Fast execution: Critical for capturing small price movements

- No restrictions: Trade any strategy without broker interference

Best NDD Brokers for Scalping

Based on execution speed, spread tightness, and scalping-friendly policies:

| Broker | Execution Speed | EUR/USD Spread | Scalping Policy |

|---|---|---|---|

| BlackBull Markets | <20ms | 0.0 pips + $6 comm | Fully allowed |

| IC Markets | <40ms | 0.0 pips + $3.50 comm | Fully allowed |

| FxPro | 12ms avg | 0.1 pips + comm | Fully allowed |

| Pepperstone | 30-50ms | 0.0 pips + $3.50 comm | Fully allowed |

NDD Brokers and Expert Advisors (EAs)

Compatibility with Automated Trading Systems

NDD brokers are ideal for algorithmic trading because they provide consistent execution without human intervention. Your EA strategies can operate as designed without worrying about requotes, slippage manipulation, or trading restrictions.

Key advantages for EA trading include:

- Consistent execution speeds for backtesting accuracy

- No dealer intervention that could disrupt EA logic

- Multiple platform support (MT4, MT5, cTrader)

- VPS hosting services for 24/7 operation

- Historical data accuracy for strategy development

Best NDD Brokers for EA Trading

Recommended brokers for automated trading based on execution consistency and platform support:

- IC Markets: Excellent MT4/MT5 support with VPS hosting

- FP Markets: Multiple platforms including IRESS for advanced EAs

- Pepperstone: Copy trading integration with Myfxbook AutoTrade

- FXTM: Specialized EA hosting and optimization services

Risk Management in NDD Trading

Importance of Stop-Loss and Take-Profit Orders

With NDD brokers, your stop-loss and take-profit orders are executed at real market prices without broker manipulation. This reliability makes risk management more predictable and effective.

However, remember that stop-losses can still experience slippage during extreme market volatility. NDD brokers minimize this through better liquidity access, but it cannot be eliminated entirely.

Insurance Analogy: Stop-losses with NDD brokers are like a good insurance policy—they work when you need them most. With dealing desk brokers, it’s like insurance that might not pay out during a disaster.

Leverage Considerations with NDD Brokers

Current leverage limits by major regulatory jurisdictions:

| Region | Major Pairs | Minor Pairs | Exotic Pairs |

|---|---|---|---|

| EU/UK (ESMA/FCA) | 1:30 | 1:20 | 1:10 |

| Australia (ASIC) | 1:30 | 1:20 | 1:10 |

| International | 1:500+ | 1:200+ | 1:100+ |

Pro Tip: Many traders are moving away from high leverage in 2025, focusing on better risk management instead of maximum leverage. A trend toward sustainable trading practices is emerging across the industry.

Technology Behind NDD Brokerage

Bridge Technology in NDD Models

NDD brokers use sophisticated bridge technology to connect trading platforms with multiple liquidity providers. This technology aggregates prices from various sources and routes orders to the best available liquidity.

The process happens in microseconds: when you click “buy,” the bridge technology queries all connected liquidity providers, finds the best price, and executes your order—all without human intervention.

Latency and Its Impact on Trade Execution

Latency is the delay between order placement and execution. In NDD trading, every millisecond counts:

- 0-20ms: Excellent for high-frequency trading

- 20-50ms: Perfect for scalping strategies

- 50-100ms: Good for day trading

- 100ms+: Acceptable for swing trading

Top NDD brokers invest heavily in infrastructure, colocating servers with major financial centers and using premium network connections to minimize latency.

Average Execution Speeds – Leading NDD Brokers

Future Trends in NDD Forex Brokerage

Emerging Technologies in NDD Trading

The NDD brokerage industry is evolving rapidly with new technologies:

- AI-Powered Execution: Machine learning algorithms optimizing order routing

- Blockchain Settlement: Faster, more transparent trade settlement

- 5G Connectivity: Ultra-low latency mobile trading

- Quantum Computing: Revolutionary risk management and pricing models

- DeFi Integration: Decentralized finance protocols enhancing liquidity

Predicted Market Shifts and Adaptations

Industry experts predict several key developments for NDD brokers in 2025-2026:

- Increased focus on ESG (Environmental, Social, Governance) compliance

- Enhanced retail trader protection through better disclosure requirements

- Integration of cryptocurrency and traditional forex trading

- Expansion of copy trading and social trading features

- Implementation of real-time risk monitoring systems

Industry Insight: Finance Magnates reports that 73% of retail traders now prefer NDD execution, up from 45% in 2020, indicating a significant shift toward transparency and direct market access.

Comprehensive NDD Broker Comparison

| Broker | Regulation | Min Deposit | EUR/USD Spread | Commission | Execution | Leverage | Platforms |

|---|---|---|---|---|---|---|---|

| IC Markets | ASIC, CySEC | $200 | 0.0 pips | $3.50 | <40ms | 1:500 | MT4/MT5/cTrader |

| Pepperstone | FCA, ASIC, CySEC | $200 | 0.0 pips | $3.50 | 30-50ms | 1:30 (EU) | MT4/MT5/cTrader |

| FP Markets | ASIC, CySEC | $100 | 0.0 pips | $6.00 | <50ms | 1:500 | MT4/MT5/cTrader |

| BlackBull | FSA, FMA | $500 | 0.0 pips | $6.00 | <20ms | 1:500 | MT4/MT5/cTrader |

| FxPro | FCA, CySEC | $100 | 0.1 pips | $4.50 | 12ms | 1:30 (EU) | MT4/MT5/cTrader |

| FXTM | FCA, CySEC | $10 | 0.0 pips | $5.00 | <100ms | 1:30 (EU) | MT4/MT5 |

Note: Spreads and conditions vary based on account type and market conditions. Commission figures are per lot (round turn). EU leverage limits apply to European clients.

Getting Started with NDD Brokers

Account Opening Process

Opening an account with a reputable NDD broker typically involves these steps:

- Choose Your Broker: Based on regulation, trading conditions, and platform preferences

- Select Account Type: Standard (spread-based) or Raw/ECN (commission-based)

- Submit Application: Provide personal information and trading experience

- Verify Identity: Upload government ID and proof of address

- Fund Account: Make initial deposit via bank transfer, card, or e-wallet

- Download Platform: Install MT4/MT5/cTrader and login with your credentials

- Start Trading: Begin with small positions to test execution quality

Pro Tip: Always start with a demo account to test the broker’s execution quality and platform stability before depositing real money. It’s like test-driving a car before buying it.

Testing Your Broker

Before committing significant capital, test these aspects:

- Order execution during high-volatility periods

- Slippage on stop-loss and take-profit orders

- Platform stability during market opens/closes

- Customer support responsiveness

- Withdrawal processing times and fees

Frequently Asked Questions (FAQs)

- What is a No Dealing Desk (NDD) broker?

- An NDD broker routes your trades directly to external liquidity providers (banks, hedge funds, other traders) rather than taking the opposite side of your position. This eliminates conflicts of interest and provides more transparent pricing.

- How does an NDD broker work?

- When you place a trade, NDD brokers instantly route your order through their bridge technology to multiple liquidity providers, finding the best available price and executing your trade at real market conditions.

- What is the difference between NDD and dealing desk brokers?

- Dealing desk brokers act as market makers and may take the opposite side of your trades, while NDD brokers simply route your orders to external liquidity sources without taking positions against you.

- Are NDD brokers better for experienced traders?

- NDD brokers benefit traders of all levels, but experienced traders particularly appreciate the transparent pricing, fast execution, and absence of requotes that NDD execution provides.

- Can beginners trade with NDD brokers?

- Absolutely. Many NDD brokers offer educational resources, demo accounts, and user-friendly platforms. The transparent pricing and fair execution actually benefit beginners by providing a more realistic trading environment.

- Do NDD brokers have lower spreads?

- NDD brokers typically offer tighter spreads, especially on ECN accounts where spreads can start from 0.0 pips. However, they often charge commissions to compensate for the narrow spreads.

- What is the difference between STP and ECN brokers?

- STP (Straight Through Processing) brokers route orders directly to liquidity providers with slight spread markups. ECN (Electronic Communication Network) brokers provide direct access to an electronic trading network with commission-based pricing.

- How do I choose the best NDD broker?

- Consider regulation, trading costs (spreads + commissions), execution speed, platform quality, customer support, and the range of available instruments. Always prioritize regulatory compliance and test execution quality with a demo account.

- How can I verify if a broker is truly NDD?

- Look for regulatory disclosures, check if they offer market depth/Level II data, test for requotes (true NDD brokers rarely requote), and verify their liquidity provider relationships in their marketing materials.

- Are NDD brokers suitable for scalping?

- Yes, NDD brokers are ideal for scalping due to their fast execution speeds, tight spreads, minimal slippage, and absence of dealing desk intervention that could slow down rapid-fire trading strategies.

- What are the typical costs of using an NDD broker?

- Costs include spreads (usually tighter than dealing desk brokers) plus commissions ranging from $3-8 per lot for ECN accounts. STP accounts may have no commissions but slightly wider spreads.

- Do NDD brokers offer fixed spreads?

- Most NDD brokers offer variable spreads that fluctuate with market conditions, providing more realistic pricing. Some may offer “quasi-fixed” spreads during normal market hours, but true fixed spreads are rare with genuine NDD execution.

- What trading platforms do NDD brokers support?

- Popular platforms include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and proprietary platforms. The best NDD brokers offer multiple platform options to suit different trading styles and preferences.

- Can I use leverage with an NDD broker?

- Yes, but leverage limits depend on your location and regulatory jurisdiction. EU/UK clients face 1:30 maximum leverage on major pairs, while international clients may access higher leverage up to 1:500 or more.

- What is the minimum deposit required for most NDD brokers?

- Minimum deposits vary widely, from as low as $10 (FXTM) to $500+ (premium brokers). Most reputable NDD brokers require $100-$200 minimum deposits for standard accounts.

- Can I trade cryptocurrencies with an NDD broker?

- Many NDD brokers now offer cryptocurrency CFDs alongside traditional forex pairs. However, crypto spreads are typically wider due to higher market volatility and lower liquidity compared to major forex pairs.

- How do NDD brokers make money?

- NDD brokers generate revenue through commissions, slight spread markups, swap/rollover fees, and sometimes account management fees. They don’t profit from client losses like dealing desk brokers might.

- Are NDD brokers more transparent than Dealing Desk brokers?

- Yes, NDD brokers provide greater transparency through real market pricing, no requotes, visible market depth (on ECN accounts), and clear disclosure of all trading costs including spreads and commissions.

- Do NDD brokers charge commissions?

- It depends on the account type. ECN/Raw accounts typically charge commissions (usually $3-8 per lot) for tighter spreads, while STP accounts may be commission-free but have slightly wider spreads.

- Do NDD brokers offer demo accounts?

- Yes, virtually all reputable NDD brokers offer demo accounts that mirror live trading conditions. These are essential for testing execution quality and platform functionality before committing real capital.

- Which NDD broker has the fastest execution speeds?

- BlackBull Markets leads with execution speeds under 20ms, followed by IC Markets (under 40ms) and FxPro (12ms average). Execution speeds can vary based on your location and internet connection.

- Do NDD brokers offer negative balance protection?

- Most regulated NDD brokers offer negative balance protection, ensuring you cannot lose more than your account balance. This is mandatory for EU-regulated brokers and commonly offered by other tier-1 regulated brokers.

- What types of orders can I place with NDD brokers?

- NDD brokers typically support all standard order types: market orders, limit orders, stop orders, stop-loss, take-profit, and advanced orders like trailing stops, one-cancels-other (OCO), and partial fills.

- Are NDD brokers more expensive than dealing desk brokers?

- Not necessarily. While NDD brokers may charge commissions, their tighter spreads often result in lower overall trading costs, especially for active traders. The total cost (spread + commission) is usually competitive or better than dealing desk brokers.

- Can NDD brokers manipulate prices?

- Legitimate NDD brokers cannot manipulate prices because they route orders directly to external liquidity providers. Price manipulation would require collusion with multiple liquidity sources, which is highly unlikely and heavily regulated.

- Are there any restrictions on trading strategies with NDD brokers?

- Genuine NDD brokers typically allow all trading strategies including scalping, hedging, expert advisors, and high-frequency trading. Some may have restrictions on abusive practices like latency arbitrage, but normal strategies are unrestricted.

- How does liquidity affect NDD broker performance?

- Higher liquidity leads to tighter spreads, faster execution, and less slippage. The best NDD brokers maintain relationships with multiple tier-1 liquidity providers to ensure consistent performance even during volatile market conditions.

- What should I look for in an NDD broker’s terms and conditions?

- Key items include: clear fee structure, regulatory compliance details, negative balance protection, withdrawal policies, acceptable trading strategies, dispute resolution procedures, and data protection measures.

- Can I use Expert Advisors (EAs) with NDD brokers?

- Yes, NDD brokers are ideal for automated trading because they provide consistent execution without human intervention. Most support popular platforms like MT4/MT5 which have extensive EA compatibility.

Conclusion

Key Benefits of Trading with NDD Brokers

No Dealing Desk brokers represent the evolution of forex trading toward greater transparency, fairness, and efficiency. The key advantages include:

- Transparent Pricing: Real market spreads without hidden markups

- Fast Execution: Millisecond order processing for optimal fills

- No Conflicts: Brokers profit from your activity, not your losses

- Professional Tools: Access to institutional-grade trading platforms

- Regulatory Protection: Strong oversight from tier-1 authorities

Making an Informed Decision

The forex brokerage industry has matured significantly, and the choice between NDD and dealing desk execution is clearer than ever. For serious traders who value transparency, speed, and fair execution, NDD brokers are the obvious choice.

However, remember that not all brokers claiming to be “NDD” truly operate without dealing desk intervention. Always verify regulatory status, test execution quality with demo accounts, and start with small live positions before committing significant capital.

Our Top Recommendations for 2025

Based on our comprehensive analysis, here are our top picks for different trader types:

- Best Overall: IC Markets for superior execution and regulation

- Best for Beginners: Pepperstone for education and support

- Best for Scalping: BlackBull Markets for ultra-fast execution

- Best for EAs: FP Markets for platform variety and VPS hosting

- Best Value: Fusion Markets for lowest commissions

The forex market continues to evolve, and NDD brokers are at the forefront of this evolution. By choosing a reputable NDD broker, you’re not just getting better execution—you’re investing in a more sustainable and professional approach to forex trading.

Final Thought

Remember: The best broker is the one that aligns with your trading style, risk tolerance, and regulatory preferences. Don’t chase the lowest spreads or highest leverage—focus on overall value, regulatory protection, and execution quality. Your trading success depends more on your strategy and risk management than on saving a few dollars in spreads.

Ready to Start Trading with a Top NDD Broker?

All recommended brokers offer demo accounts for risk-free testing

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.