Key Takeaways

- True forex trading without a broker is practically impossible for retail traders—brokers provide essential market access and infrastructure

- Trading without leverage is possible and reduces risk, but requires significantly larger capital (e.g., $10,000 for a 1% return of $100)

- Alternative methods include P2P platforms, bank currency exchanges, and trust management, but each has limitations and higher costs

- Regulated brokers like Pepperstone, IC Markets, and XTB offer no-leverage accounts with spreads from 0.0 pips

- FCA, ASIC, and CySEC have implemented leverage caps (1:30 for major pairs) to protect retail traders since 2018-2024

Introduction to Forex Trading

What is Forex Trading?

Forex trading, short for foreign exchange trading, is the global marketplace where currencies are bought and sold against each other. Think of it like a massive international farmers’ market—but instead of trading apples for oranges, you’re trading dollars for euros, pounds for yen, and so on.

The forex market is absolutely enormous. We’re talking about over $6 trillion traded daily according to the Bank for International Settlements, making it the largest financial market in the world. That’s more than all stock markets combined!

Simple Analogy: Imagine you’re at an airport currency exchange. You hand over $100 and get €85 back. Later, when the euro strengthens, you exchange those €85 for $110. You just made $10 profit—that’s forex trading in its simplest form.

Role of Forex Brokers

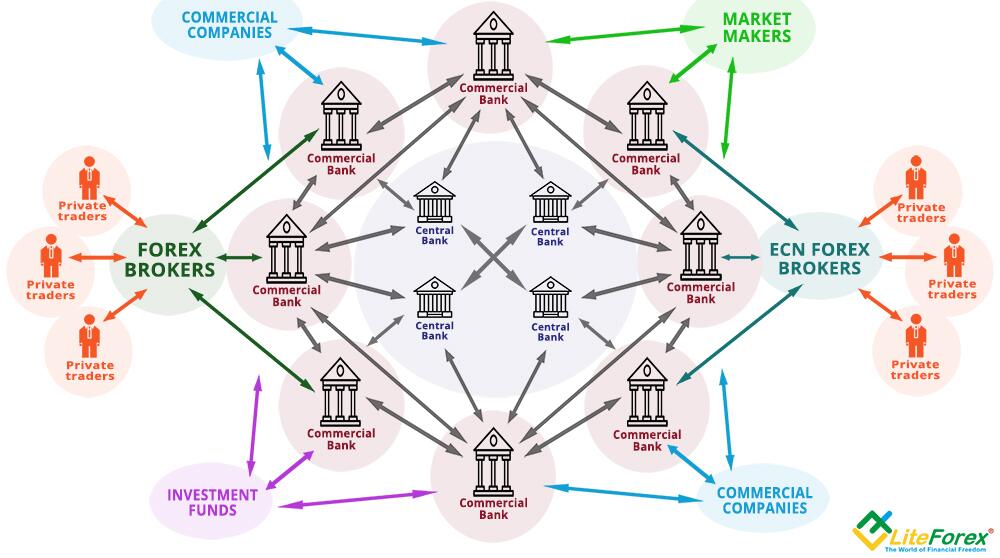

Here’s where things get interesting. You might wonder: “Can’t I just trade currencies directly?” Well, not really. Forex brokers act as intermediaries between you and the massive interbank market where the real action happens.

Think of brokers as your gateway to the forex world. They provide the trading platforms, market access, and infrastructure that make forex trading possible for regular folks like us. Without them, you’d need millions of dollars and direct relationships with major banks—not exactly feasible for most traders.

According to LiteFinance, attempting to trade forex without a broker is “essentially impossible except via limited alternatives” that come with substantial practical and financial constraints.

Role of Leverage in Forex Trading

Leverage is like borrowing money from your broker to make bigger trades. If you have $1,000 and use 1:100 leverage, you can control $100,000 worth of currency. Sounds tempting, right?

But here’s the catch—leverage is a double-edged sword. While it can amplify your profits, it can also magnify your losses. That’s why regulatory bodies like the FCA, ASIC, and CySEC have implemented strict leverage limits for retail traders.

2024 Regulatory Update: European brokers are limited to 1:30 leverage on major currency pairs, while ASIC has reduced maximum leverage to 1:30 for retail clients as of 2021, with ongoing reviews for further restrictions.

Understanding Forex Brokers

What is a Forex Broker?

A forex broker is essentially your middleman in the currency markets. They provide the technology, liquidity, and market access that make trading possible. But not all brokers are created equal—understanding the different types can help you make better decisions.

Types of Forex Brokers

Market Makers

Market makers create their own market by taking the opposite side of your trade. When you buy EUR/USD, they sell it to you from their own inventory. This might sound concerning, but reputable market makers like IG Group are heavily regulated and provide stable pricing.

ECN Brokers

Electronic Communication Network (ECN) brokers connect you directly to the interbank market. They don’t take the opposite side of your trades but instead charge commissions. Pepperstone and IC Markets are excellent examples of ECN brokers.

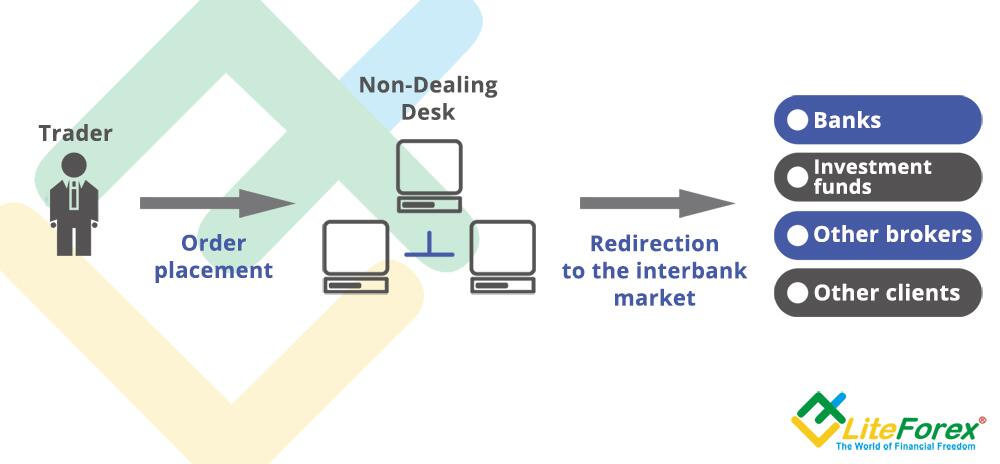

STP Brokers

Straight Through Processing (STP) brokers automatically pass your orders to liquidity providers without dealer intervention. They combine some benefits of both market makers and ECN brokers.

The Concept of Leverage in Forex

What is Leverage in Forex?

Leverage in forex is borrowed capital that allows you to control larger positions than your account balance would normally permit. It’s expressed as a ratio—1:50 means you can control $50 for every $1 in your account.

How Leverage Works in Forex Trading

Let’s break this down with a real example. Say you have $2,000 in your account and want to trade EUR/USD with 1:50 leverage:

- Without leverage: You can trade $2,000 worth of EUR/USD

- With 1:50 leverage: You can trade $100,000 worth of EUR/USD

- A 1% move in your favor nets you $1,000 instead of $20

The YouTube tutorial below provides excellent visual examples of how leverage works in practice:

Advantages of Leverage in Forex Trading

Leverage offers several benefits when used responsibly:

- Capital Efficiency: You can open larger positions with less capital

- Enhanced Profit Potential: Small price movements can generate significant returns

- Portfolio Diversification: Use remaining capital for other investments

- Accessibility: Enter markets that would otherwise require substantial capital

The Risks of Trading with Leverage

Amplified Losses

The same mechanism that amplifies profits also amplifies losses. A 2% adverse move with 1:50 leverage can wipe out your entire account. This isn’t theoretical—it happens to traders every day.

Margin Calls and Account Liquidation

When your account equity falls below the required margin level, brokers issue margin calls. If you can’t deposit more funds, they’ll close your positions at a loss to protect both parties.

Increased Volatility and Emotional Trading

High leverage creates psychological pressure. Watching significant swings in your account balance can lead to poor decision-making, overtrading, and abandoning your trading plan.

| Regulator | Maximum Leverage (Major Pairs) | Maximum Leverage (Minor Pairs) | Effective Date |

|---|---|---|---|

| FCA (UK) | 1:30 | 1:20 | August 2018 |

| ESMA (EU) | 1:30 | 1:20 | August 2018 |

| ASIC (Australia) | 1:30 | 1:20 | March 2021 |

| CySEC (Cyprus) | 1:30 | 1:20 | August 2018 |

| CFTC/NFA (USA) | 1:50 | 1:20 | October 2010 |

Trading Forex Without a Broker

Is it Possible to Trade Forex Without a Broker?

The short answer? Not really—at least not in the traditional sense that most people understand “forex trading.” Let me explain why, and then we’ll explore the limited alternatives that do exist.

When most people think of forex trading, they imagine analyzing charts, placing trades on currency pairs like EUR/USD, and potentially making profits from price movements. This type of trading requires access to the interbank forex market, sophisticated trading platforms, and real-time pricing data. For retail traders, this access is only possible through licensed forex brokers.

Direct Access to the Interbank Market

The forex market isn’t a centralized exchange like the New York Stock Exchange. Instead, it’s a network of banks, financial institutions, and large corporations trading currencies directly with each other. This is called the interbank market.

Challenges of Accessing the Forex Market Without a Broker

To access the interbank market directly, you’d need:

- Massive Capital Requirements: Minimum trading amounts typically start at $1 million

- Credit Lines: Established relationships with major banks

- Sophisticated Technology: High-speed trading systems and data feeds

- Regulatory Compliance: Meeting institutional-level regulatory requirements

According to VT Markets, “for ordinary individuals, gaining this access without intermediaries or brokers is extremely difficult.”

Costs and Risks of Brokerless Trading

Even if you could access the interbank market directly, the costs would be prohibitive:

- Technology Costs: Professional trading systems cost hundreds of thousands of dollars

- Data Feeds: Real-time market data subscriptions are expensive

- Compliance Costs: Legal and regulatory compliance expenses

- Operational Risk: No protection if counterparties default

Peer-to-Peer (P2P) Currency Exchange Platforms

P2P platforms represent one of the more viable alternatives to traditional brokers. These platforms connect individuals who want to exchange currencies directly with each other.

Pros and Cons of P2P Platforms for Forex Trading

Advantages

- Lower costs – no broker fees or commissions

- Direct peer-to-peer transactions

- Potentially better exchange rates

- Greater transparency in pricing

Disadvantages

- Counterparty risk – the other party may default

- Lack of regulatory oversight

- Limited liquidity for large trades

- No access to leveraged positions

Using Financial Institutions for Forex Trading

Banks and currency exchange services offer another alternative, though it’s quite different from what most people consider “forex trading.”

Here’s how it works: You buy one currency at a bank or currency exchange office and sell it later when the rate has improved. For example, you might exchange $10,000 for €8,500 when EUR/USD is at 1.1765. If the euro strengthens to 1.2000, you could exchange back and receive $10,200.

Challenges of Trading Without a Broker

Limited Market Access

Without a broker, you’re limited to basic currency exchange services. You can’t:

- Trade exotic currency pairs

- Access real-time market data

- Use advanced order types

- Implement automated trading strategies

Higher Capital Requirements

Bank currency exchanges typically have minimum amounts and charge significant fees. The DefcoFX analysis shows that meaningful profits require substantial capital—a $10,000 position might only yield 1% returns without leverage.

Lack of Trading Tools and Platforms

Professional forex trading requires sophisticated tools:

- Advanced charting software

- Technical analysis indicators

- Economic calendars

- Risk management tools

- Automated trading capabilities

These tools are exclusively available through licensed forex brokers and their trading platforms.

Trading Forex Without Leverage

Can You Trade Forex Without Leverage?

Is It Possible?

Absolutely! Trading forex without leverage is not only possible but increasingly popular among risk-conscious traders. Many brokers offer “1:1 leverage” or “no leverage” accounts specifically for this purpose.

When you trade without leverage, you’re using only your own capital. If you have $5,000 in your account, you can only open positions worth up to $5,000. It’s that simple.

Benefits of Trading Without Leverage

Lower Risk Management

The biggest advantage of no-leverage trading is dramatically reduced risk. You simply cannot lose more than you invest. There are no margin calls, no forced liquidations, and no overnight gaps that can wipe out your account.

As Seacrest Markets notes, “The biggest pro to trading Forex without leverage is the decreased mental pressure and stress of increased capital exposure and the prospect of a margin call.”

Full Control Over Position Size

Without leverage, you maintain complete control over your risk exposure. Every dollar in profit or loss directly corresponds to your actual investment, making it easier to understand and manage your portfolio.

Reduced Risk Exposure

No-leverage trading eliminates the risk of catastrophic losses that can occur with high leverage. You’ll never face scenarios where small market movements result in substantial account losses.

Disadvantages of Trading Without Leverage

Smaller Profit Margins

The most obvious drawback is limited profit potential. Currency pairs typically move in small increments—often less than 1% per day. Without leverage, these small movements translate to correspondingly small profits.

Consider this example from DefcoFX: “A trader with $5,000 buying EUR/USD at 1.1000 and selling at 1.1100 (100-pip gain) realizes only a $45.45 profit (0.91% return).”

Requires Larger Capital

To generate meaningful income without leverage, you need substantially more capital. Professional traders often recommend starting with at least $50,000-$100,000 for no-leverage forex trading to generate worthwhile returns.

| Account Size | 1% Monthly Return | 2% Monthly Return | Annual Income (1%) |

|---|---|---|---|

| $5,000 | $50 | $100 | $600 |

| $25,000 | $250 | $500 | $3,000 |

| $100,000 | $1,000 | $2,000 | $12,000 |

| $500,000 | $5,000 | $10,000 | $60,000 |

Who Should Consider Trading Without Leverage?

No-leverage trading isn’t for everyone, but it can be ideal for:

- Conservative Investors: Those prioritizing capital preservation over high returns

- Beginners: New traders learning the markets without excessive risk

- Institutional Investors: Large funds with substantial capital bases

- Retirees: Individuals seeking steady, low-risk income streams

- High-Net-Worth Individuals: Wealthy investors diversifying their portfolios

Case Study: Successful Traders Who Trade Without Leverage

Institutional Traders vs. Retail Traders

Many institutional traders and hedge funds operate with minimal leverage. Warren Buffett’s Berkshire Hathaway, for instance, typically uses very little leverage despite having access to virtually unlimited credit.

The key difference is capital size. While retail traders might struggle to generate meaningful returns on $10,000 without leverage, institutional investors working with $100 million+ can generate substantial absolute returns even with modest percentage gains.

Trading Forex Without a Broker or Leverage

Advantages of Avoiding Leverage and Brokers

Greater Trading Discipline

When you can’t rely on leverage to amplify small wins, you’re forced to develop better trading strategies and more disciplined risk management. This often leads to more sustainable long-term success.

Control Over Trades

Without broker intermediation, you have direct control over your currency exchanges. There’s no risk of broker manipulation, slippage, or conflicts of interest that can occur with some brokers.

Disadvantages of Trading Without a Broker or Leverage

Lack of Access to Advanced Trading Tools

Professional forex trading relies heavily on sophisticated tools and platforms. Without a broker, you lose access to:

- Real-time market data and news feeds

- Advanced charting and technical analysis tools

- Automated trading systems and expert advisors

- Risk management calculators

- Economic calendars and market analysis

Limited Market Information

Brokers provide valuable market insights, research, and analysis that independent traders often lack. This information gap can significantly impact trading decisions and profitability.

Higher Transaction Costs

Bank currency exchanges and P2P platforms often charge higher fees and offer worse exchange rates than professional forex brokers. VT Markets research shows that “banks often charge higher fees and offer less competitive rates” compared to regulated brokers.

Alternatives to Traditional Forex Brokers and Leverage

Direct Market Access (DMA)

Direct Market Access allows you to place orders directly into the market order book without dealer intervention. While not technically “broker-free,” DMA provides greater transparency and potentially better execution.

Several brokers offer DMA services:

- IC Markets: Offers true DMA with cTrader platform

- Pepperstone: Provides DMA through cTrader and MT4/MT5

- FP Markets: DMA available on multiple platforms

Cryptocurrency Exchanges for Forex Trading

Some cryptocurrency exchanges offer forex-like trading through crypto pairs that mirror traditional currency movements. This provides an alternative route to currency speculation.

Pros and Cons of Using Crypto Exchanges

Advantages

- 24/7 trading availability

- Lower regulatory restrictions

- Innovative trading features

- Access to tokenized forex pairs

Disadvantages

- Higher volatility and risk

- Limited regulatory protection

- Complex tax implications

- Technology risks and hacks

Social Trading and Copy Trading

Social trading platforms allow you to follow and copy successful traders automatically. While still requiring a broker, this reduces the need for personal analysis and decision-making.

Leading social trading platforms include:

- eToro: Pioneer in social trading

- ZuluTrade: Comprehensive copy trading network

- cTrader Copy: Available through multiple brokers

- FXTM Invest: Strategy manager program

Forex ETFs and Futures

Exchange-traded funds (ETFs) and futures contracts provide exposure to currency movements without traditional forex trading.

| ETF Symbol | Currency Focus | Expense Ratio | Average Volume |

|---|---|---|---|

| UUP | US Dollar | 0.40% | High |

| FXE | Euro | 0.40% | High |

| FXY | Japanese Yen | 0.40% | Medium |

| FXB | British Pound | 0.40% | Medium |

Key Factors to Consider When Trading Without a Broker or Leverage

Risk Management Strategies

Even without leverage, proper risk management remains crucial. Here are essential strategies for no-leverage, broker-free trading:

- Position Sizing: Never risk more than 2-3% of capital on any single trade

- Diversification: Spread risk across multiple currency pairs or assets

- Stop Losses: Set predetermined exit points for losing trades

- Capital Preservation: Prioritize protecting your capital over chasing profits

Importance of Market Analysis

Without broker-provided research and analysis, you’ll need to develop your own market analysis capabilities. This includes:

- Technical Analysis: Chart patterns, indicators, and price action

- Fundamental Analysis: Economic data, central bank policies, and geopolitical events

- Sentiment Analysis: Market positioning and trader sentiment indicators

Trading Tools and Resources Needed

Charting Software

Professional charting tools are essential for market analysis:

- TradingView: Web-based charts with advanced features

- Bloomberg Terminal: Professional-grade platform (expensive)

- MetaTrader: Free platform with extensive indicator library

Data Feeds

Access to real-time market data is crucial for making informed decisions. Consider subscribing to:

- Reuters data feeds

- Bloomberg market data

- Free alternatives like Yahoo Finance or Google Finance

Economic Calendars and News Sources

Stay informed about market-moving events through:

- Forex Factory: Comprehensive economic calendar

- Investing.com: Real-time news and analysis

- DailyFX: Professional forex market analysis

Technical Analysis Tools

Essential technical analysis tools include:

- Moving averages and trend indicators

- Oscillators (RSI, MACD, Stochastic)

- Support and resistance levels

- Fibonacci retracements

Risk Management Calculators

Use online calculators to determine:

- Position sizes based on risk tolerance

- Profit and loss projections

- Currency conversion rates

- Correlation between currency pairs

Trading Costs to Be Aware Of

Trading without traditional brokers doesn’t eliminate costs—it often increases them:

| Cost Type | Traditional Broker | Bank Exchange | P2P Platform |

|---|---|---|---|

| Spreads | 0.1-2.0 pips | 200-800 pips | 50-200 pips |

| Commissions | $0-7 per lot | 2-5% of transaction | 1-3% of transaction |

| Platform Fees | Usually free | N/A | $10-50/month |

| Data Fees | Usually free | N/A | $20-100/month |

Trading Platforms for Brokerless and No-Leverage Forex

Overview of Platforms Supporting No-Leverage and Brokerless Trading

While truly brokerless trading is limited, several platforms cater to no-leverage traders or provide alternatives to traditional broker services:

Choosing the Right Trading Platform

When selecting a platform for no-leverage or alternative forex trading, consider:

- Regulatory Status: Ensure proper licensing and oversight

- Account Types: Availability of 1:1 leverage accounts

- Trading Tools: Quality of charting and analysis features

- Costs: Transparent fee structure

- Customer Support: Responsive and knowledgeable service

Case Study: Top Platforms for Brokerless and No-Leverage Trading

| Broker | Min Deposit | EUR/USD Spread | Commission | Regulation | Platforms |

|---|---|---|---|---|---|

| Pepperstone | $200 | 0.0 pips | $3.50/lot | FCA, ASIC, CySEC | MT4, MT5, cTrader |

| IC Markets | $200 | 0.0 pips | $3.50/lot | ASIC, CySEC | MT4, MT5, cTrader |

| XTB | $1 | 0.1 pips | $0 | FCA, CySEC | xStation 5 |

| IG Group | $300 | 0.6 pips | $0 | FCA, ASIC | IG Platform |

| FXTM | $10 | 1.3 pips | $0 | FCA, CySEC | MT4, MT5 |

Best Practices for Successful Forex Trading Without a Broker or Leverage

Managing Risk Effectively

Risk management becomes even more critical when trading without traditional safety nets. Here’s a comprehensive risk management framework:

- Capital Allocation: Never risk more than you can afford to lose completely

- Position Limits: Limit individual trades to 1-2% of total capital

- Correlation Analysis: Avoid concentrated exposure to correlated currency pairs

- Regular Review: Conduct weekly portfolio reviews and adjustments

Maintaining Consistent Profitability

Consistency is key when working with limited leverage and alternative trading methods:

- Realistic Expectations: Target 5-15% annual returns rather than get-rich-quick schemes

- Journal Everything: Document all trades, decisions, and market observations

- Continuous Learning: Stay updated on market developments and trading techniques

- Patience: Wait for high-probability setups rather than forcing trades

Adopting a Long-Term Strategy

No-leverage trading naturally lends itself to longer-term approaches:

- Swing Trading: Hold positions for days to weeks

- Position Trading: Hold positions for months to years

- Carry Trading: Profit from interest rate differentials

- Trend Following: Ride major currency trends

Common Pitfalls to Avoid

Overtrading and Emotional Decision-Making

Without the excitement of leverage, some traders compensate by overtrading. This is counterproductive and erodes returns through increased transaction costs.

Neglecting Risk Management

The reduced risk of no-leverage trading can lead to complacency. Always maintain proper risk management protocols regardless of leverage levels.

Failing to Adapt to Market Changes

Markets evolve constantly. Strategies that worked in trending markets may fail in range-bound conditions. Stay flexible and adapt your approach as needed.

Regulatory and Legal Considerations

Understanding Forex Regulations

Even when trading without traditional brokers, you’re still subject to financial regulations. Key regulatory bodies include:

- FCA (UK): Financial Conduct Authority oversees UK financial services

- ASIC (Australia): Australian Securities and Investments Commission

- CySEC (Cyprus): Cyprus Securities and Exchange Commission

- CFTC/NFA (USA): Commodity Futures Trading Commission and National Futures Association

2024 Regulatory Update: The FCA announced new rules under the Public Offers and Admissions to Trading Regulations 2024, effective December 2024. These rules enhance investor protection and market transparency across all financial products, including forex instruments.

Ensuring Compliance in Brokerless Trading

When engaging in alternative forex trading methods, ensure compliance with:

- Anti-Money Laundering (AML) Laws: Maintain proper transaction records

- Tax Reporting Requirements: Report all trading gains and losses

- Know Your Customer (KYC) Rules: Verify identities of trading counterparties

- Market Manipulation Laws: Avoid any practices that could be construed as market manipulation

Legal Risks and Protections

Trading without regulated brokers exposes you to additional legal risks:

- Counterparty Default: No regulatory compensation schemes

- Fraud Protection: Limited recourse for fraudulent activities

- Dispute Resolution: No access to financial ombudsman services

- Asset Protection: Funds may not be segregated or protected

Risks of Unregulated Forex Trading

Unregulated forex trading carries significant risks that traders should understand:

| Aspect | Regulated Broker | Unregulated Platform |

|---|---|---|

| Fund Protection | Segregated accounts, compensation schemes | No protection, funds at risk |

| Dispute Resolution | Ombudsman services available | Limited legal recourse |

| Operational Standards | Strict compliance requirements | No oversight or standards |

| Transparency | Regular reporting and audits | Minimal disclosure requirements |

Tax Implications

Reporting Requirements

Forex trading profits and losses must be reported to tax authorities regardless of how you trade. Key considerations include:

- Trading vs. Investment: Classification affects tax treatment

- Record Keeping: Maintain detailed transaction records

- International Reporting: Additional requirements for foreign currency transactions

- Professional Advice: Consult tax professionals familiar with forex trading

Tax Benefits and Liabilities

Different trading methods may have varying tax implications:

- Capital Gains: Most forex profits taxed as capital gains

- Business Income: Professional traders may be taxed as business income

- Loss Deductions: Trading losses may offset other income

- Section 988 Elections: US traders can elect different tax treatment

Steps to Start Trading Forex Without a Broker or Leverage

Researching the Forex Market

Before jumping into alternative forex trading, invest time in comprehensive market research:

- Understand Currency Fundamentals: Study major currencies and their economic drivers

- Learn Technical Analysis: Master chart reading and indicator usage

- Study Market Hours: Understand optimal trading times for different pairs

- Research Historical Data: Analyze past market behavior and cycles

Developing a Trading Strategy and Plan

A solid trading plan is essential for success without traditional broker support:

- Define Objectives: Set realistic profit and risk targets

- Choose Trading Style: Select approach that matches your capital and time availability

- Risk Management Rules: Establish clear position sizing and stop-loss rules

- Review Process: Schedule regular strategy evaluation and updates

Setting Up Your Trading Account

Even for alternative trading methods, you’ll need proper account setup:

- Capital Requirements: Ensure adequate funding for your chosen strategy

- Bank Relationships: Establish accounts for currency exchange if needed

- Technology Setup: Install necessary software and data feeds

- Backup Plans: Prepare contingency procedures for technical failures

Selecting the Right Platform

Choose platforms and tools that support your trading approach:

- No-Leverage Brokers: If using brokers, select those offering 1:1 leverage

- P2P Platforms: Research reputation and security of peer-to-peer services

- Data Providers: Ensure reliable access to market information

- Analysis Tools: Select charting and analysis software

Managing Risk Without Broker Support

Without broker risk management tools, you’ll need to implement your own systems:

- Position Tracking: Maintain detailed records of all positions

- Risk Monitoring: Regular assessment of total risk exposure

- Emergency Procedures: Plans for rapid position closure if needed

- Capital Management: Systematic approach to capital allocation and preservation

Conclusion

Is Trading Forex Without a Broker or Leverage Right for You?

The answer depends on your trading goals, risk tolerance, and available capital. Here’s how to decide:

Consider no-leverage trading if you:

- Have substantial capital ($50,000+)

- Prefer steady, low-risk returns

- Want to avoid margin calls and forced liquidations

- Are learning forex trading fundamentals

Avoid broker-free trading if you:

- Have limited capital for meaningful returns

- Require professional trading tools and platforms

- Need regulatory protection for your funds

- Want access to exotic currency pairs and advanced order types

Summary of Benefits and Drawbacks

Key Benefits

- Elimination of leverage risk and margin calls

- Full control over trading capital

- Reduced emotional pressure and stress

- Lower counterparty risk (in some cases)

- Forced development of disciplined trading habits

Key Drawbacks

- Limited profit potential without significant capital

- Higher transaction costs and wider spreads

- Lack of professional trading tools and platforms

- Reduced regulatory protection

- Limited access to market data and analysis

Key Takeaways for Risk Management and Success

If you decide to pursue forex trading without traditional brokers or leverage, remember these critical points:

- Start Small: Begin with modest amounts to test your approach

- Educate Yourself: Invest heavily in forex education and market analysis

- Maintain Discipline: Stick to your trading plan regardless of market conditions

- Monitor Costs: Track all transaction costs and fees carefully

- Stay Informed: Keep up with regulatory changes and market developments

Final Thoughts on Trading Forex Without a Broker or Leverage

While it’s technically possible to trade forex without traditional brokers or leverage, the practical challenges are significant. For most retail traders, working with a well-regulated, low-leverage broker remains the most practical approach.

If you’re determined to minimize broker dependency and leverage usage, consider starting with a regulated broker offering 1:1 leverage accounts. This gives you the benefits of no leverage while maintaining access to professional tools, regulatory protection, and competitive pricing.

Remember, successful forex trading isn’t about finding shortcuts or avoiding brokers—it’s about developing solid trading skills, managing risk effectively, and maintaining realistic expectations about returns.

Open Your FXTM AccountFAQs

- Can I trade Forex without a broker?

- Technically no, not in the traditional sense. You can exchange currencies through banks or P2P platforms, but accessing the professional forex market requires broker services for market access, platforms, and tools.

- Is it legal to trade Forex without a broker?

- Yes, currency exchange is legal, but you must comply with anti-money laundering laws, tax reporting requirements, and other financial regulations in your jurisdiction.

- What are the risks of trading without leverage?

- The main risks are opportunity cost (limited profit potential), inflation risk (returns may not beat inflation), and the need for substantial capital to generate meaningful income.

- Why do institutional traders often avoid leverage?

- Institutional traders typically have large capital bases and prioritize capital preservation over aggressive returns. They can generate substantial absolute profits with modest percentage gains.

- Is it profitable to trade Forex without leverage?

- It can be profitable but requires substantial capital. A $100,000 account earning 10% annually generates $10,000 profit, while a $5,000 account at the same rate only makes $500.

- How much capital do I need to trade without leverage?

- Most experts recommend at least $50,000-$100,000 to generate meaningful income from no-leverage forex trading. Smaller amounts are suitable for learning but may not provide substantial returns.

- Can I use P2P platforms to trade Forex?

- Yes, P2P platforms allow direct currency exchange between individuals, but they carry counterparty risk, lack regulatory oversight, and typically offer worse rates than professional brokers.

- What tools are available for trading without a broker?

- You’ll need independent charting software (like TradingView), market data feeds, economic calendars, and risk management calculators. These tools typically cost more than broker-provided alternatives.

- How can I manage risk when trading without leverage?

- Use position sizing (limit individual trades to 1-2% of capital), diversification across multiple pairs, stop-loss orders, and regular portfolio reviews to manage risk effectively.

- What is the best strategy for trading without a broker?

- Long-term strategies like swing trading and position trading work best for no-broker trading. Focus on major currency pairs, use both technical and fundamental analysis, and maintain strict risk management.

- Are there any alternatives to brokers for retail traders?

- Limited alternatives include currency ETFs, futures contracts, bank currency services, and P2P platforms, but each has significant limitations compared to regulated forex brokers.

- Can beginners trade without leverage?

- Yes, and it’s often recommended for learning. No-leverage trading forces beginners to develop proper risk management and realistic return expectations without the pressure of margin calls.

- What’s the difference between brokered and non-brokered Forex trading?

- Brokered trading provides professional platforms, tight spreads, regulatory protection, and advanced tools. Non-brokered trading typically involves higher costs, limited tools, and reduced regulatory protection.

- Can I make money without using leverage in forex?

- Yes, but returns will be limited to actual currency price movements (typically 1-3% annually for stable pairs). You need substantial capital to generate meaningful absolute profits.

- Is trading without a broker or leverage more difficult?

- Yes, it’s significantly more challenging due to higher costs, limited tools, wider spreads, and the need for independent market analysis and risk management systems.

- Are there brokers that offer no-leverage accounts?

- Yes, many regulated brokers offer 1:1 leverage accounts including Pepperstone, IC Markets, XTB, IG Group, and FXTM. These accounts provide professional trading tools without leverage risk.

- What are the costs associated with trading without a broker?

- Costs include wider spreads (200-800 pips vs. 0.1-2.0 pips with brokers), higher transaction fees (2-5% vs. $0-7 per lot), and separate charges for data feeds and analysis tools.

- How does trading without leverage affect position size?

- Without leverage, your position size is limited to your actual account balance. A $10,000 account can only open $10,000 worth of positions, compared to potentially $500,000 with 1:50 leverage.

- How do I access the Forex market without a broker?

- Options include bank currency exchange services, P2P currency platforms, cryptocurrency exchanges with forex pairs, and currency ETFs, though each has significant limitations compared to broker access.

- What trading platforms support no-leverage forex trading?

- Most major platforms (MetaTrader 4/5, cTrader, proprietary broker platforms) support no-leverage trading through 1:1 leverage settings. Independent platforms include TradingView for analysis.

- How much money do I need to start trading Forex without a broker?

- While you can start with any amount, practical no-broker trading typically requires $10,000-$50,000 minimum to cover higher transaction costs and generate meaningful returns.

- Is it safer to trade Forex without leverage?

- Yes, no-leverage trading eliminates margin calls and limits losses to your invested capital. However, you still face market risk, and broker-free methods may lack regulatory protections.

- How do I conduct technical analysis without broker tools?

- Use independent charting platforms like TradingView, subscribe to market data feeds, and invest in professional analysis software. These typically cost $50-200 monthly but provide comprehensive analysis tools.

- Can I automate my Forex trading without a broker?

- Automation is very limited without broker platforms. You’d need custom programming solutions and API access to exchanges or banks, which is technically complex and expensive for retail traders.

- Which regulated brokers are best for no-leverage trading?

- Top choices include Pepperstone (FCA/ASIC regulated, 0.0 pip spreads), IC Markets (ASIC/CySEC, cTrader platform), and XTB (FCA/CySEC, commission-free trading) for their combination of regulation, tools, and competitive pricing.

- What are the tax implications of trading without a broker?

- Tax treatment remains the same—you must report all forex gains and losses regardless of trading method. However, different approaches (P2P, banks, ETFs) may have varying classification rules for tax purposes.

- How do central bank policies affect no-leverage trading?

- Central bank decisions have significant impact on currency values. Without leverage, you need larger moves to generate meaningful profits, making fundamental analysis of monetary policy even more important for success.

- What’s the minimum effective account size for profitable no-leverage trading?

- While you can start with less, most professional traders recommend $25,000-$50,000 minimum for no-leverage forex trading to generate sufficient income after accounting for higher transaction costs and limited profit margins.

- Are there any forex trading communities for no-leverage traders?

- Yes, online communities like Reddit’s r/Forex, Forex Factory forums, and specialized groups on social media platforms discuss conservative trading approaches, though dedicated no-leverage communities are less common than general forex forums.

- How do I stay updated on market news without broker research?

- Subscribe to financial news services like Reuters, Bloomberg, or free alternatives like Forex Factory, DailyFX, and Investing.com. Consider paid research from independent analysts for deeper market insights.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.