Key Takeaways

- Only eToro is directly CNMV-licensed in Spain, while other EU brokers serve Spanish clients via MiFID II passporting

- €20,000 investor compensation protects client funds through CNMV-regulated brokers

- 1:30 leverage limit for major forex pairs, 1:20 for non-majors under EU regulations

- CFD advertising ban since July 2023 – CNMV prohibits marketing CFDs to retail investors

- Minimum capital requirements range from €75,000 to €750,000 for CNMV broker authorization

Understanding CNMV Regulation

What is the CNMV?

The Comisión Nacional del Mercado de Valores (CNMV), or National Securities Market Commission in English, serves as Spain’s primary financial regulator. Think of it as Spain’s version of the UK’s FCA or Germany’s BaFin—but with a distinctly Spanish approach to protecting investors.

Here’s a simple way to think about it: If forex trading were like driving, the CNMV would be the traffic authority making sure everyone follows the rules, has proper licenses, and stays safe on the road. They don’t want any reckless drivers endangering Spanish investors.

Overview of CNMV (Comisión Nacional del Mercado de Valores)

Established in 1988, the [CNMV](https://www.cnmv.es/) operates as an independent government agency under Spain’s Ministry of Economy and Finance. Its primary mission? Ensuring the transparency and proper functioning of Spanish securities markets while protecting investors from fraud and misconduct.

What makes the CNMV particularly interesting is its proactive stance on investor protection. Unlike some regulators who react to problems, the CNMV regularly issues public warnings about unauthorized entities—including fake versions of legitimate brokers like eToro clones.

Role and Responsibilities of CNMV in the Spanish Financial Markets

The CNMV’s responsibilities in the forex market include:

- Licensing and Authorization: Evaluating and granting licenses to forex brokers seeking to operate in Spain

- Ongoing Supervision: Monitoring licensed entities for compliance with regulatory requirements

- Investor Protection: Maintaining compensation schemes and ensuring client fund segregation

- Market Surveillance: Detecting and preventing market manipulation and fraudulent activities

- Enforcement Actions: Imposing penalties and sanctions for regulatory violations

- Public Warnings: Issuing alerts about unauthorized entities and potential scams

2024-2025 Priority: According to the [CNMV’s 2024 Activity Plan](https://www.cnmv.es/DocPortal/Publicaciones/PlanActividad/PDA2024_ENen.pdf), the regulator is intensifying its focus on CFD supervision, fraud prevention, and improving warning systems about unauthorized entities.

Establishment in 1988

The CNMV was created through Law 24/1988 as part of Spain’s broader financial market modernization efforts. This timing wasn’t coincidental—Spain was preparing for deeper integration with European markets and needed a robust regulatory framework.

Key Regulatory Changes

Since its inception, the CNMV has evolved significantly. Major milestones include the implementation of MiFID II in 2018, which harmonized regulations across the EU, and more recently, the July 2023 ban on CFD advertising to retail investors—a move that caught many brokers off guard.

Key Features of CNMV Regulation

Capital Requirements

CNMV-regulated forex brokers must maintain substantial capital reserves to ensure financial stability. The minimum capital requirements range from **€75,000 to €750,000**, depending on the broker’s classification:

| Broker Type | Minimum Capital | Additional Requirements |

|---|---|---|

| Market Maker | €750,000 | Additional liquidity ratios |

| Agency Broker | €150,000 | Professional indemnity insurance |

| Limited Scope | €75,000 | Restricted activities only |

Client Fund Protection

This is where CNMV regulation really shines for traders. Spanish-regulated brokers must:

- Segregate client funds in separate accounts, completely isolated from the broker’s operational funds

- Participate in the compensation scheme covering up to **€20,000** per client in case of broker insolvency

- Provide quarterly reporting on client fund balances to the CNMV

- Use only tier-1 banks for client fund custody

Think of it this way: Your money is like valuables in a safety deposit box. Even if the bank (broker) goes out of business, your safety deposit box (segregated account) remains yours, and there’s insurance (compensation scheme) to cover you if something goes wrong.

Risk Management Standards

CNMV-regulated brokers must implement comprehensive risk management frameworks including:

- Real-time position monitoring to prevent excessive leverage

- Automated margin call systems with clearly defined procedures

- Stress testing requirements for extreme market conditions

- Regular risk assessments submitted to the CNMV

Compliance Framework

Every CNMV-regulated broker must maintain robust compliance programs covering anti-money laundering (AML), client suitability assessments, and regular staff training on regulatory requirements.

MiFID II and European Alignment

European Regulatory Framework under MiFID II

Here’s where things get interesting for Spanish traders. While the CNMV regulates local brokers, Spain’s EU membership means traders can also access brokers regulated elsewhere in the EU through “passporting” rights.

Under [MiFID II regulations](https://www.esma.europa.eu/publications-and-data/interactive-single-rulebook/mifid-ii), any broker licensed by an EU regulator (like the UK’s FCA, Cyprus’s CySEC, or Germany’s BaFin) can legally serve Spanish clients without needing separate CNMV authorization.

Cross-Border Trading Rights and Passporting Benefits

This system creates more options for Spanish traders:

- Broader broker selection: Access to hundreds of EU-regulated brokers

- Competitive pricing: More competition often means better spreads and conditions

- Uniform protection standards: All EU brokers must meet similar investor protection requirements

- Dispute resolution: EU-wide arbitration systems for cross-border issues

How CNMV Aligns with EU Regulatory Standards

The CNMV has aligned its regulations closely with EU standards, implementing key MiFID II provisions including leverage limits, negative balance protection, and enhanced risk warnings. This means whether you trade with a Spanish broker or a UK broker, you’ll get similar protection levels.

Benefits of Trading with CNMV-Regulated Brokers

Investor Protection Measures

When you trade with a CNMV-regulated broker, you’re getting gold-standard protection. Here’s what that means in practice:

Fund Security

Your funds are held in segregated accounts at tier-1 banks, completely separate from the broker’s operational money.

Compensation Coverage

Up to €20,000 compensation if your broker becomes insolvent, backed by the Spanish guarantee fund.

Negative Balance Protection

You can never lose more than your account balance, even in extreme market conditions.

Clear Risk Warnings

Standardized risk disclosures help you understand exactly what you’re getting into.

Compensation Scheme Coverage

The Spanish investor compensation scheme (managed by FOGAIN) provides a safety net if your broker fails. Here’s how it works:

- Coverage limit: Up to €20,000 per client, per broker

- Claim timeframe: Must be filed within 3 months of the broker’s insolvency declaration

- Payout timeline: Compensation typically paid within 3-6 months

- What’s covered: Cash balances, unrealized profits, and pending transactions

Negative Balance Protection

This might be the most important protection for forex traders. Negative balance protection means you can never lose more money than you have in your trading account—even if the market moves dramatically against you.

Real-world example: During the Swiss franc shock in 2015, many traders saw their accounts go deeply negative due to extreme volatility. Under CNMV regulations, brokers would have to absorb those losses, not pass them on to clients.

Maximum Leverage Limits

CNMV enforces EU-wide leverage limits designed to protect retail traders:

| Asset Class | Maximum Leverage | Margin Requirement |

|---|---|---|

| Major Forex Pairs | 1:30 | 3.33% |

| Non-Major Forex, Gold | 1:20 | 5% |

| Major Indices | 1:20 | 5% |

| Commodities (ex. Gold) | 1:10 | 10% |

| Individual Stocks | 1:5 | 20% |

Top CNMV-Regulated Forex Brokers

Based on our comprehensive research of the Spanish forex market, here are the leading brokers serving Spanish traders under CNMV oversight or EU passporting arrangements:

eToro

Features and Benefits

Minimum Deposit: $100

Leverage: 1:30 (EU retail clients)

Platforms: eToro Web, CopyTrader, TradingCentral

Account Currencies: USD, EUR, GBP

Minimum Trade: $10

Instruments: Stocks, ETFs, Options, Crypto

Regulation: CNMV (Spain), CySEC, FCA

Special Feature: Social Trading

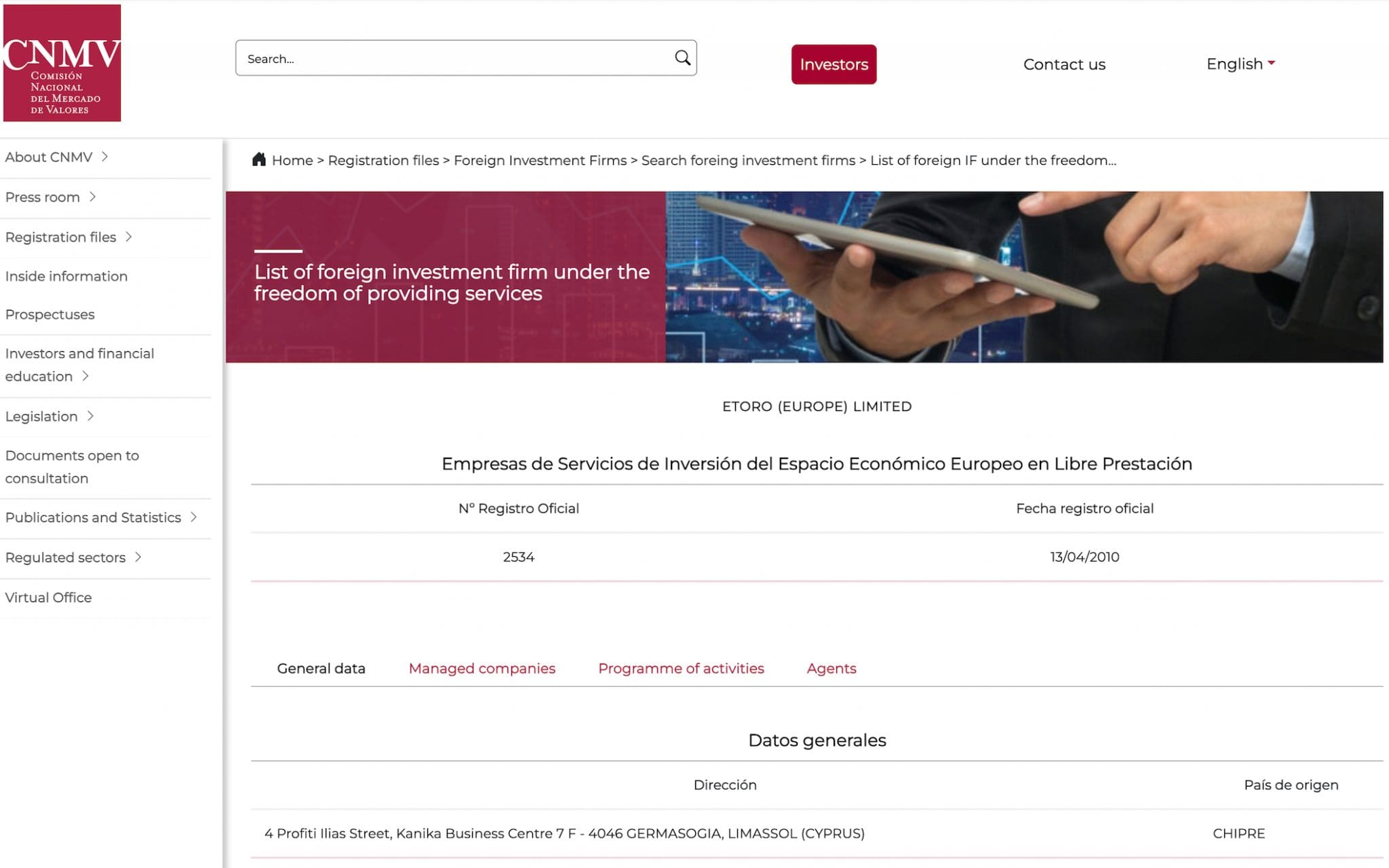

CNMV Licensing Details

eToro is the only broker with direct CNMV authorization in our research. According to the [DayTrading.com analysis](https://www.daytrading.com/brokers/regulated/cnmv), eToro holds a valid Spanish license, as confirmed by the official CNMV database.

Start Trading on eToro

Start Trading on eToro

XTB

Features and Benefits

Trading Platforms: xStation 5, xStation Mobile

Trustpilot Rating: 4.0/5 (1,949 reviews)

Forex Pairs: 70+ CFD forex pairs

Leverage: 1:30 for majors, 1:20 for others

EUR/USD Spread: 0.9 pips

USD/JPY Spread: 1.4 pips

Commission: $0 (Standard), $3.50/side (Pro)

Account Types: Standard, PRO, Islamic

CNMV Licensing Details

XTB operates a Spanish branch (XTB S.A., SUCURSAL EN ESPAÑA) under CNMV supervision, according to the [official CNMV register](https://www.cnmv.es/portal/consultas/esi/esisextranjerassuc?tipo=CSU&numero=40&vista=4&lang=en). The broker’s Polish parent company is regulated by KNF, with additional licenses from FCA, CySEC, and BaFin.

Open Your XTB AccountAvaTrade

Features and Benefits

Multi-regulation: 9 global licenses

Minimum Deposit: €100

Trading Platforms: MT4, MT5, AvaTradeGO

Educational Resources: Comprehensive training

Instruments: 1000+ trading instruments

Speciality: Beginner-friendly approach

Support: 24/5 multilingual support

Bonus Policy: Welcome bonuses available

CNMV Licensing Details

AvaTrade operates through its Spanish branch (AVA TRADE EU LIMITED, SUCURSAL EN ESPAÑA) registered with the CNMV. According to [Finance Magnates](https://www.financemagnates.com/forex/avatrades-expansion-focus-spain-takes-center-stage/), the company is expanding its Spanish operations and implementing new vanilla options following CNMV regulations.

Start Trading on AvaTradeFXTM (ForexTime)

Features and Benefits

Minimum Deposit: $1 USD

Spreads: Tight spreads from 1.3 pips

Platforms: MT4, MT5, FXTM mobile app

Account Types: Micro, Advantage, Advantage Plus

Commission: $0 on Micro & Advantage Plus

Instruments: Forex, metals, stocks, CFDs, indices, commodities, crypto

Education: Premium quality resources

Features: Personalized investment options

CNMV Licensing Details

FXTM operates under EU passporting arrangements and is listed in the [CNMV’s foreign investment firm register](https://www.cnmv.es/portal/consultas/esi/esisextranjeraslp?numero=3668&tipo=CLP&lang=en). The broker is regulated by CySEC in Cyprus and serves Spanish clients under MiFID II provisions.

Open Your FXTM AccountXM

Features and Benefits

Minimum Deposit: $5 USD

Base Currencies: 9 account currencies

Platforms: MT4, MT5

Demo Account: $100,000 virtual balance

Account Types: 4 types, no commission

Protection: Negative balance protection

Islamic Accounts: Swap-free conversion available

Instruments: Forex, commodities, stocks, crypto, metals

CNMV Licensing Details

XM Group serves Spanish clients through its Cyprus entity (XM Cyprus Limited), regulated by CySEC. The broker appears in CNMV’s list of authorized EU investment firms operating in Spain under passporting rights.

Start Trading on XMHFM (HotForex)

Features and Benefits

Instruments: 12,200+ tradable instruments

Forex Pairs: 50+ currency pairs

Spreads: From 0 pips

Platforms: MT4, MT5 (desktop & mobile)

Account Types: Micro, Premium, Zero Spread, HF Copy

Minimum Deposit: $5-300 range

Features: VPS hosting, 24/6 support

Special: Demo & swap-free accounts

CNMV Licensing Details

HFM operates as a multi-regulated broker with authorization from multiple EU regulators. According to the [YouTube analysis](https://www.youtube.com/watch?v=0BJhcZPe8MU), HFM ranks as a top CNMV-compliant broker, offering comprehensive trading conditions and strong regulatory oversight.

Open Your HFM AccountHYCM

Features and Benefits

Instruments: Forex, commodities, indices, cryptocurrencies, stocks, ETFs

Platforms: MT4, MT5, HYCM mobile app

Account Types: Fixed, Classic, Raw, Demo, Islamic

Regulation: FCA, CIMA, DFSA

Trading Style: ECN/STP execution

Education: Comprehensive trading resources

Support: Multilingual customer service

Technology: Advanced trading tools

CNMV Licensing Details

HYCM operates under stringent regulations from multiple authorities including the FCA, CIMA, and DFSA. The broker serves Spanish clients through EU passporting arrangements and maintains compliance with CNMV requirements for foreign investment firms.

Warning: The CNMV has issued alerts about unauthorized entities using similar names like “HYCM Capital Markets.” Always verify broker authorization through the [official CNMV register](https://www.cnmv.es/portal/consultas/busquedaporentidad?lang=en) before trading.

IC Markets

Features and Benefits

Speciality: ECN/STP broker with institutional-grade execution

Platforms: MT4, MT5, cTrader

Spreads: From 0.0 pips on Raw accounts

Account Management: PAMM Account support

Technology: Low-latency execution

Instruments: 232+ instruments

Regulation: ASIC, CySEC

Client Base: Retail and institutional

CNMV Licensing Details

IC Markets (EU) Ltd is registered in the [CNMV’s European Economic Area investment firm database](https://www.cnmv.es/portal/consultas/esi/esisextranjeraslp?tipo=CLP&numero=4666&lang=en) with registration number 4666, dated December 12, 2018. The broker operates under CySEC regulation and serves Spanish clients through EU passporting.

Open Your IC Markets AccountPepperstone

Features and Benefits

Execution Model: True ECN/STP

Platforms: MT4, MT5, cTrader, TradingView

Spreads: From 0.0 pips (Razor accounts)

Commission: From $3.50/lot roundturn

Technology: Ultra-fast execution speeds

Instruments: 1000+ CFDs

Regulation: ASIC, CySEC, FCA, SCB

Education: Comprehensive trading resources

CNMV Licensing Details

Pepperstone EU Limited is listed in the [CNMV foreign investment firm register](https://www.cnmv.es/portal/consultas/esi/esisextranjeraslp?numero=5001&tipo=CLP&lang=en) with registration number 5001. The company is regulated by CySEC and authorized to provide services in Spain under European passporting rules.

Caution: Be aware that scammers have created fake “Pepper Stone Ltd” entities. The legitimate broker is “Pepperstone,” not “Pepper Stone.” The CNMV has [warned against these impersonators](https://www.financemagnates.com/forex/spanish-regulator-flags-pepper-stone-primus-fx-7-other-websites/).

FxPro

Features and Benefits

Ranking: Rated best forex broker for 2025

Platforms: MT4, MT5, cTrader, FxPro Edge

Execution: No dealing desk (NDD)

Account Types: Multiple options for all levels

Regulation: Multi-regulated globally

Awards: Industry recognition for excellence

Technology: Advanced trading infrastructure

Support: Award-winning customer service

CNMV Licensing Details

FxPro is recognized by multiple industry sources as a top CNMV-compliant broker. According to [SA Shares analysis](https://sashares.co.za/cnmv-regulated-forex-brokers/), FxPro ranks as the best forex broker for 2025, offering comprehensive regulatory protection and superior trading conditions for Spanish clients.

Start Trading on FxProSwissquote

Features and Benefits

Specialty: Swiss banking standards and security

Pricing: Competitive spreads and transparent fees

Platforms: Advanced MT4, MT5, proprietary platforms

Currency Support: EUR base accounts

Regulation: FINMA (Swiss Financial Market Supervisory Authority)

Banking License: Full banking and securities trading license since 2001

Market Access: 30+ global exchanges

Standards: Highest Swiss banking protection

CNMV Licensing Details

Swissquote operates under Swiss banking regulations and serves EU clients, including Spain, through appropriate regulatory arrangements. The broker is frequently cited in CNMV-regulated broker lists and maintains compliance with European investment service requirements.

Start Trading on SwissquoteExpert Analysis: Top CNMV Regulated Forex Brokers

Watch this comprehensive analysis of the best CNMV-regulated forex brokers, featuring detailed reviews of regulatory compliance, trading conditions, and platform features:

This expert review covers FXTM, XM, HYCM, XTB, and HFM, explaining their regulatory status, trading conditions, and key features for Spanish traders.

How to Verify CNMV Authorization and Broker Licensing

Official Register Search Process on the CNMV Website

Before opening any trading account, you should always verify a broker’s authorization. Here’s the step-by-step process:

Step-by-Step Verification Process

- Visit the [CNMV official website](https://www.cnmv.es/portal/consultas/busquedaporentidad?lang=en)

- Navigate to “Search of authorised entities”

- Enter the broker’s name in the search box

- Click “Search” and review the results

- Check for registration number, address, and authorization date

- Verify the authorized activities match your trading needs

Documentation Requirements for Brokers

Legitimate CNMV-regulated brokers must maintain and display specific documentation:

- Authorization certificate from CNMV with registration number

- Terms and conditions in Spanish language

- Risk disclosure statements compliant with MiFID II

- Fee schedules with transparent pricing structure

- Complaints procedure including CNMV contact information

- Compensation scheme details explaining €20,000 coverage

Verification Steps and Checklist

Essential Verification Checklist

CNMV registration confirmed

Website shows regulation details

Spanish language support

Clear fee structure

Negative balance protection

Leverage limits compliant

Segregated accounts mentioned

Compensation scheme details

Red Flags and CNMV Warning System

Brokers Operating Without CNMV Registration

The CNMV actively monitors and warns against unauthorized entities operating in Spain. Recent warnings include companies falsely claiming to be regulated or using copycat names of legitimate brokers.

Common Red Flags

- Promises of guaranteed profits or “risk-free” trading

- Pressure tactics to deposit money quickly

- Unrealistic leverage offers exceeding EU limits (over 1:30)

- Poor website quality with spelling errors or missing legal information

- Unknown contact details or reluctance to provide company information

- Social media advertising with celebrity endorsements (banned under CNMV rules)

Unauthorized Broker Alerts and Recent CNMV Warnings

The CNMV regularly updates its warning lists. Recent alerts include:

- December 2024: Six unauthorized forex brokers warned by CNMV

- October 2024: Three additional brokers flagged for illegal operations

- July 2024: 14 unregistered forex and CFD entities identified

- Clone brokers: Fake versions of legitimate companies like eToro and Pepperstone

How to Identify Non-Compliant Brokers

Think of unauthorized brokers like street vendors selling “designer” watches: They might look legitimate at first glance, but closer inspection reveals poor quality, missing documentation, and no recourse if something goes wrong. Always check the official register—it’s your best protection.

To stay protected, always consult the [CNMV’s warning database](https://www.cnmv.es/portal/BusquedaAdvertencias.aspx) before trading with any new broker. The CNMV also provides a [list of other unauthorized entities](https://www.cnmv.es/docportal/aldia/Advertencias_CNMV_Otras_en.pdf) that may be conducting illegal financial activities.

Trading Conditions and Account Types

Maximum Leverage Ratios

Under CNMV and EU regulations, all retail forex traders in Spain are subject to standardized leverage limits. These restrictions were implemented to protect retail traders from excessive risk:

Minimum Deposit Requirements

CNMV-regulated and EU-compliant brokers offer varying minimum deposit requirements to accommodate different trader profiles:

| Broker | Minimum Deposit | Account Currency | Best For |

|---|---|---|---|

| FXTM | $1 | USD, EUR | Micro trading |

| XM | $5 | 9 currencies | Beginners |

| HFM | $5-300 | Multiple | Scalable accounts |

| eToro | $100 | USD, EUR, GBP | Social trading |

| AvaTrade | €100 | EUR, USD | Education focus |

Available Account Types

CNMV-compliant brokers typically offer several account types to meet different trading needs:

Standard Accounts

- • Fixed spreads or variable

- • No commission (spread-based)

- • Basic trading tools

- • Perfect for beginners

Premium/Pro Accounts

- • Lower spreads

- • Commission-based pricing

- • Advanced trading tools

- • Higher minimum deposits

Islamic Accounts

- • Swap-free trading

- • Sharia-compliant

- • No overnight interest

- • Available on request

Trading Platforms and Tools

Web-Based Platforms

Most CNMV-regulated brokers offer sophisticated web-based platforms accessible through any browser. These platforms typically include:

- Real-time charts with multiple timeframes and technical indicators

- One-click trading for quick order execution

- Risk management tools including stop-loss and take-profit orders

- Market news and analysis integrated into the platform

Desktop and Mobile Applications

The most popular trading platforms among Spanish forex traders include:

MetaTrader 4 (MT4)

The world’s most popular forex platform, offering:

- • Expert Advisors (automated trading)

- • Custom indicators and scripts

- • Advanced charting capabilities

- • Mobile sync across devices

MetaTrader 5 (MT5)

The newer generation platform featuring:

- • Multi-asset trading capabilities

- • Enhanced technical analysis tools

- • Economic calendar integration

- • Depth of market (DOM) display

cTrader

ECN-focused platform known for:

- • Level II pricing transparency

- • Advanced algorithmic trading

- • Intuitive user interface

- • Fast execution speeds

Proprietary Platforms

Custom-built solutions offering:

- • Unique trading tools

- • Integrated research and analysis

- • Social trading features

- • Simplified user experience

Analytical Tools and Charting Resources

CNMV-regulated brokers typically provide comprehensive analytical tools including technical indicators, fundamental analysis, economic calendars, and market sentiment data. Many also offer third-party integrations with services like TradingView, Autochartist, and Trading Central.

Fees and Commissions

Spread Structures

Understanding spreads is crucial for Spanish forex traders. Here’s a comparison of typical spreads offered by major CNMV-compliant brokers:

| Broker | EUR/USD | GBP/USD | USD/JPY | Spread Type |

|---|---|---|---|---|

| XTB | 0.9 pips | 1.4 pips | 1.4 pips | Variable |

| HFM | 0.0 pips* | 0.5 pips | 0.3 pips | Raw (Zero Spread) |

| FXTM | 1.3 pips | 1.8 pips | 1.6 pips | Fixed/Variable |

| IC Markets | 0.0 pips* | 0.1 pips* | 0.1 pips* | Raw ECN |

*Raw accounts with commission charges apply

Commission Models

CNMV-compliant brokers typically offer two main pricing models:

Spread-Only Model

No commission charges; costs built into spreads

- ✓ Simpler cost structure

- ✓ Better for small trades

- ✓ No additional fees

- ✗ Higher overall trading costs

Commission + Spread

Lower spreads plus small commission per trade

- ✓ Lower total costs for active traders

- ✓ More transparent pricing

- ✓ Better for larger trades

- ✗ More complex fee calculation

Deposit and Withdrawal Fees

Most CNMV-regulated brokers offer free deposits and withdrawals, but some charges may apply:

| Fee Type | Typical Cost | Notes |

|---|---|---|

| Bank Transfer (Deposit) | Free | Most brokers absorb costs |

| Credit/Debit Card | Free | Instant processing |

| E-wallets (Skrill, Neteller) | Free-2% | Varies by broker |

| Bank Transfer (Withdrawal) | €15-25 | International wire fees |

| Inactivity Fee | €5-50/month | After 3-12 months inactive |

Think of broker fees like airline pricing: Some carriers advertise low base prices but charge for everything extra (baggage, seats, meals). Others include everything in one higher price. In forex, spread-only brokers are like all-inclusive airlines, while commission-based brokers are like budget carriers—but often cheaper overall for frequent travelers (active traders).

Recent Regulatory Changes and Future Outlook

2024–2025 Updates from CNMV

The CNMV has implemented several significant regulatory changes that directly impact forex traders in Spain:

CFD Advertising Ban (July 2023 – Ongoing)

The most significant change is the complete prohibition of CFD advertising to retail investors. This ban includes:

- Social media advertising and influencer marketing

- Event sponsorships and brand advertising

- Celebrity endorsements and testimonials

- General public marketing campaigns

Important: Trading CFDs is still legal; only the advertising is banned. Traders can still open CFD accounts at their own initiative.

Enhanced Fraud Prevention Measures

According to the [CNMV’s 2024 Activity Plan](https://www.cnmv.es/DocPortal/Publicaciones/PlanActividad/PDA2024_ENen.pdf), the regulator has intensified its anti-fraud activities:

- Increased warning frequency: More regular alerts about unauthorized brokers

- International cooperation: Development of a shared database with IOSCO members

- Social media monitoring: Active surveillance of investment scams on social platforms

- Clone broker detection: Faster identification of fake versions of legitimate brokers

Impact on Traders and Brokers

These regulatory changes have created both challenges and benefits for the Spanish forex market:

Challenges

- Reduced marketing means less broker visibility

- Fewer promotional offers and bonuses

- Some international brokers reducing Spanish market focus

- Limited educational marketing materials

Benefits

- Reduced exposure to high-risk trading scams

- Better focus on genuine education vs. marketing

- Clearer distinction between legitimate and fake brokers

- Enhanced investor protection overall

Anticipated Future Developments

Based on current regulatory trends and CNMV priorities, several developments are likely in 2025-2026:

Expected Changes

- Cryptocurrency regulation: Clearer rules for crypto-forex hybrid products

- AI and algorithmic trading: New guidelines for automated trading systems

- Sustainability requirements: ESG considerations in forex product marketing

- Digital identity verification: Enhanced KYC procedures using digital technology

- Cross-border coordination: Stronger cooperation with other EU regulators

The overall trend suggests continued strengthening of investor protection measures while maintaining market competitiveness and innovation.

Comparison with Other EU Regulators

CySEC vs CNMV

Cyprus Securities and Exchange Commission (CySEC) is one of the most popular EU regulators for forex brokers. Here’s how it compares to CNMV:

| Aspect | CNMV (Spain) | CySEC (Cyprus) |

|---|---|---|

| Compensation Scheme | €20,000 | €20,000 |

| Maximum Leverage | 1:30 (retail) | 1:30 (retail) |

| Minimum Capital | €75,000-€750,000 | €730,000 (Class A) |

| CFD Advertising | Banned since 2023 | Allowed with restrictions |

| Market Focus | Spanish market | Global, EU passporting |

FCA vs CNMV

The UK’s Financial Conduct Authority (FCA), while no longer part of the EU, remains highly respected. Comparison with CNMV:

| Aspect | CNMV (Spain) | FCA (UK) |

|---|---|---|

| Compensation Scheme | €20,000 | £85,000 |

| Regulatory Approach | Rules-based, conservative | Principles-based, flexible |

| Market Access | EU passporting | Post-Brexit arrangements |

| Innovation | Conservative approach | Sandbox programs |

BaFin vs CNMV

Germany’s BaFin is known for strict supervision. Comparison shows both regulators prioritize investor protection, with BaFin having higher capital requirements (€730,000 minimum) and more stringent ongoing supervision, while CNMV focuses more on fraud prevention and public warnings.

Dispute Resolution and Complaints

Step-by-Step Process for Filing Complaints

If you have a dispute with a CNMV-regulated broker, follow this structured approach:

Complaint Resolution Steps

- Contact the broker directly: Most issues can be resolved through customer service

- Document everything: Keep records of all communications, trades, and account statements

- Use broker’s complaints procedure: All CNMV-regulated brokers must have formal complaint processes

- Wait for broker response: Brokers typically have 15-30 business days to respond

- Escalate if unsatisfied: If unresolved, proceed to external arbitration or regulatory complaint

Online Complaint Channels

CNMV provides multiple ways to file complaints:

- CNMV website: Online complaint form available 24/7

- Email: Direct email to CNMV’s complaints department

- Postal mail: Written complaints to CNMV headquarters

- Regional offices: In-person complaints at CNMV regional offices

CNMV Hotline Services

The CNMV operates a dedicated investor helpline:

CNMV Investor Helpline: 900 535 015 (toll-free within Spain)

Available Monday-Friday, 9:00-17:00 CET. Multilingual support available.

Resolution Timeframes through the Financial Ombudsman

Spain’s financial ombudsman service provides independent dispute resolution:

- Initial review: 30 days for ombudsman to assess complaint

- Investigation period: 60-90 days for full investigation

- Final decision: Binding decision issued within 120 days

- Appeal period: 30 days to appeal ombudsman decision

Escalation to CNMV for Further Investigation

If broker-level resolution fails, the CNMV can investigate potential regulatory violations:

CNMV Investigation Process: The regulator will examine whether the broker violated regulations, potentially leading to sanctions, fines, or license revocation. However, CNMV investigations focus on regulatory compliance rather than individual compensation claims.

Appeals Process

Final appeals can be made to Spanish administrative courts, though this is rarely necessary given the effectiveness of earlier resolution stages. Most disputes are resolved at the broker or ombudsman level.

Educational Resources and Support

CNMV Trading Guides and Publications

The CNMV provides extensive educational materials for Spanish investors:

- [Financial Education Plan](https://www.cnmv.es/portal/PlanEducacion-Financiera/PlanEducacionFinanciera.aspx?lang=en): Joint initiative with Bank of Spain covering forex basics

- Risk disclosure documents: Standardized explanations of forex trading risks

- Investment guides: Step-by-step guides for different financial products

- Warning publications: Regular updates on investment scams and unauthorized entities

- Market reports: Annual and quarterly analysis of Spanish financial markets

Broker-Offered Training Programs

CNMV-regulated brokers typically offer comprehensive educational programs:

Beginner Education

- • Forex fundamentals and terminology

- • Platform tutorials and walkthroughs

- • Risk management basics

- • Demo account training

- • Market analysis introduction

Advanced Training

- • Technical analysis masterclasses

- • Fundamental analysis workshops

- • Expert Advisor development

- • Multi-asset trading strategies

- • Portfolio management techniques

Risk Management Education and Webinars

Given the CNMV’s focus on investor protection, risk management education is particularly emphasized:

- Position sizing workshops: How to calculate appropriate trade sizes

- Stop-loss strategies: Effective use of risk management orders

- Correlation analysis: Understanding how different currency pairs move together

- Economic calendar training: Using news events for trading decisions

- Psychology seminars: Managing emotions and trading discipline

Think of forex education like learning to drive: You wouldn’t get behind the wheel without understanding traffic rules, road signs, and safety procedures. Similarly, successful forex trading requires understanding market mechanics, risk management, and regulatory requirements before risking real money.

Frequently Asked Questions

- What Does CNMV Stand For?

- CNMV stands for Comisión Nacional del Mercado de Valores, which translates to National Securities Market Commission in English. It is Spain’s primary financial regulator responsible for overseeing securities markets, investment firms, and investor protection.

- Is It Safe to Trade with a CNMV-Regulated Broker?

- Yes, trading with CNMV-regulated brokers is generally very safe. They must maintain minimum capital requirements (€75,000-€750,000), segregate client funds, provide negative balance protection, and participate in a compensation scheme covering up to €20,000 per client. The CNMV also enforces strict compliance and regularly monitors broker activities.

- How Can I Verify if a Broker Is CNMV-Regulated?

- Visit the [official CNMV website](https://www.cnmv.es/portal/consultas/busquedaporentidad?lang=en) and use the “Search of authorised entities” function. Enter the broker’s name to check their registration status, license number, and authorized activities. You can also check the list of foreign EU investment firms operating in Spain under passporting arrangements.

- What Protections Does CNMV Provide for Client Funds?

- CNMV requires regulated brokers to segregate client funds in separate accounts at tier-1 banks, completely isolated from the broker’s operational funds. Additionally, clients are covered by a compensation scheme up to €20,000 per person if the broker becomes insolvent. All accounts also have negative balance protection, meaning you cannot lose more than your account balance.

- What Are the Penalties for Brokers Without CNMV Regulation?

- Unauthorized brokers operating in Spain face severe penalties including fines up to €600,000, cease-and-desist orders, asset freezing, and potential criminal charges. The CNMV regularly issues public warnings about unauthorized entities and works with law enforcement to shut down illegal operations. Clients of unauthorized brokers have no regulatory protection or compensation rights.

- Are CNMV-Regulated Brokers Required to Offer Negative Balance Protection?

- Yes, under EU regulations implemented by the CNMV, all regulated brokers must provide negative balance protection to retail clients. This means your losses are limited to the funds in your trading account, even during extreme market volatility. This protection applies to all retail forex and CFD accounts.

- Can Non-EU Residents Trade with CNMV-Regulated Brokers?

- This depends on the specific broker and their licensing arrangements. Some CNMV-regulated brokers may accept international clients, while others focus exclusively on EU residents. Non-EU residents should verify their eligibility and may face different regulatory protections depending on their country of residence.

- Does CNMV Allow Cryptocurrency Trading?

- CNMV has a cautious approach to cryptocurrencies. While some regulated brokers may offer cryptocurrency CFDs, direct cryptocurrency trading is subject to specific regulations. The CNMV regularly warns about high-risk crypto investments and has implemented strict advertising restrictions similar to those applied to CFDs.

- How Does CNMV Protect Trader Funds?

- CNMV protects trader funds through multiple mechanisms: mandatory segregation of client funds in separate bank accounts, minimum capital requirements for brokers, regular financial audits and reporting, participation in the investor compensation scheme (€20,000 coverage), and strict penalties for non-compliance including license revocation.

- How Does CNMV Handle Broker Disputes and Complaints?

- CNMV has a structured complaint process: First, traders should contact the broker directly using their formal complaints procedure. If unresolved, complaints can be escalated to the CNMV via their website, phone hotline (900 535 015), or written correspondence. The CNMV investigates regulatory violations and can impose sanctions, though individual compensation claims are typically handled through Spain’s financial ombudsman service.

- What Trading Platforms Are Approved by CNMV?

- CNMV doesn’t specifically approve individual trading platforms, but regulated brokers must ensure their platforms meet technical and security standards. Popular platforms used by CNMV-regulated brokers include MetaTrader 4, MetaTrader 5, cTrader, and various proprietary platforms. All platforms must provide adequate risk warnings and comply with MiFID II requirements.

- What Is the Minimum Capital Requirement for CNMV Regulated Brokers?

- Minimum capital requirements range from €75,000 to €750,000 depending on the broker’s classification and services offered. Market makers typically need €750,000, agency brokers require €150,000, and limited scope brokers need €75,000. These amounts must be maintained continuously and are subject to regular regulatory review.

- What Leverage Limits Apply Under CNMV Regulation?

- CNMV enforces EU-wide leverage limits for retail clients: 1:30 for major forex pairs, 1:20 for non-major forex pairs and gold, 1:20 for major stock indices, 1:10 for commodities (except gold), and 1:5 for individual stocks. Professional clients may access higher leverage subject to suitability assessments.

- What Compensation Is Available if a Broker Fails?

- If a CNMV-regulated broker becomes insolvent, clients are protected by Spain’s investor compensation scheme managed by FOGAIN. The scheme covers up to €20,000 per client per broker, including cash balances, unrealized profits, and pending transactions. Claims must be filed within 3 months of insolvency declaration, with payouts typically made within 3-6 months.

- Are CNMV-Regulated Brokers Available Internationally?

- Many brokers with CNMV licenses also hold international licenses, allowing them to serve clients globally. However, Spanish residents specifically benefit from CNMV protection and EU passporting rights. International availability varies by broker and depends on their licensing arrangements in other jurisdictions.

- Why Is CNMV Regulation Crucial for Forex Traders in Spain?

- CNMV regulation provides essential protections including fund segregation, compensation coverage, leverage limits, negative balance protection, and regulatory oversight. It ensures brokers meet minimum capital requirements, follow transparent pricing practices, and maintain proper risk management systems. Without CNMV regulation, traders have no recourse if problems arise.

- Can I Trade Forex in Spain Without CNMV Registration?

- While Spanish residents can trade with EU-regulated brokers under MiFID II passporting arrangements, trading with completely unregulated brokers is highly risky and not recommended. Unregulated brokers offer no investor protection, compensation rights, or regulatory oversight. The CNMV regularly warns against such entities and advises using only properly regulated brokers.

- What Are the CNMV Requirements for Forex Brokers?

- CNMV requirements for forex brokers include: minimum capital from €75,000-€750,000, segregation of client funds, negative balance protection, leverage limit compliance (1:30 maximum for retail), regular financial reporting, risk management systems, AML compliance, proper authorization and licensing, and participation in the investor compensation scheme.

- How Can I Verify if a Broker Is CNMV-Regulated?

- Use the [CNMV’s official search engine](https://www.cnmv.es/portal/consultas/busquedaporentidad?lang=en) to verify broker authorization. Look for the broker’s registration number, authorized activities, and contact details. Be wary of brokers that cannot provide clear CNMV registration information or refuse to share their license details.

- How Do CNMV Brokers Differ from Non-EU Brokers?

- CNMV and EU brokers offer standardized investor protections including €20,000 compensation coverage, 1:30 leverage limits, negative balance protection, and segregated client funds. Non-EU brokers may offer higher leverage but typically provide less regulatory protection, limited compensation schemes, and may be subject to different dispute resolution procedures.

- What Are the Risks of Using Unregulated Brokers in Spain?

- Unregulated brokers pose significant risks including: no investor compensation or protection schemes, potential fund misappropriation, no regulatory oversight or complaint procedures, possible manipulation of prices and execution, risk of sudden closure without notice, no legal recourse through Spanish authorities, and potential involvement in money laundering or fraud schemes.

- Does CNMV Provide a Warning List for Fraudulent Brokers?

- Yes, the CNMV maintains active warning lists of unauthorized entities and potential scams. Check the [CNMV warnings database](https://www.cnmv.es/portal/BusquedaAdvertencias.aspx) regularly for updates. The CNMV also publishes alerts about clone brokers, fake investment schemes, and social media scams targeting Spanish investors.

Conclusion

Summary of Key Benefits of CNMV-Regulated Brokers

Trading with CNMV-regulated or EU-compliant brokers provides Spanish traders with comprehensive protection and peace of mind:

Financial Protection

- • €20,000 compensation coverage per broker

- • Segregated client funds in tier-1 banks

- • Negative balance protection on all accounts

- • Regular financial audits and reporting

Regulatory Standards

- • Standardized leverage limits (1:30 maximum)

- • Transparent fee structures and pricing

- • Professional dispute resolution procedures

- • Regular regulatory oversight and monitoring

Final Tips for Choosing a Trusted Forex Broker in Spain

Expert Recommendations

- Always verify regulation: Check the [CNMV register](https://www.cnmv.es/portal/consultas/busquedaporentidad?lang=en) before opening any account

- Start with demo accounts: Test platforms and conditions risk-free before depositing real money

- Compare total trading costs: Consider spreads, commissions, and overnight fees together

- Choose appropriate leverage: Don’t automatically use maximum leverage—start conservative

- Understand compensation limits: Don’t deposit more than €20,000 per broker initially

- Read all documentation: Understand terms, conditions, and fee structures completely

- Test customer support: Ensure you can reach support in Spanish when needed

Future Outlook for CNMV-Regulated Forex Trading

The Spanish forex market is evolving toward stronger investor protection while maintaining competitive trading conditions. Key trends to watch include:

- Enhanced digital services: More sophisticated online platforms and mobile trading apps

- Improved education: Better educational resources and risk awareness programs

- Technology integration: AI-powered risk management and automated compliance systems

- International cooperation: Stronger coordination with global regulators to combat fraud

- Sustainable trading: Growing focus on ESG considerations in financial services

Looking Ahead: The CNMV’s approach of prioritizing investor protection while maintaining market competitiveness positions Spain as a leader in forex regulation. Traders can expect continued improvements in safety, transparency, and service quality from regulated brokers.

Remember: In forex trading, regulatory protection isn’t just about following rules—it’s about preserving your capital and ensuring you have recourse when things go wrong. Choose wisely, trade safely, and always prioritize regulation over promotional offers.

Ready to Start Trading with a CNMV-Regulated Broker?

Choose from our recommended list of trusted, regulated brokers serving Spanish traders:

All recommended brokers are regulated and comply with CNMV/EU investor protection requirements. Trading involves risk of loss. Past performance is not indicative of future results.