“Honestly, picking the right licensing jurisdiction for your forex brokerage isn’t rocket science—but making the wrong choice could cost you millions and years of wasted effort.”

Key Takeaways

- Tier-1 regulators (FCA, ASIC, CySEC) require capital reserves from $125,000 to $20 million but offer the highest market credibility

- Offshore licenses (Seychelles, Vanuatu) can be obtained in 3-4 months with as little as $30,000 capital but come with reputation risks

- AML/KYC regulations are becoming stricter globally, with all jurisdictions requiring robust compliance systems by 2025

- Most brokers opt for MetaTrader 5 or cTrader platforms, each with distinct tech requirements and security features

- Pepperstone’s case shows how multi-jurisdictional licensing (FCA, ASIC, CySEC, BaFin, DFSA) can support global expansion

Understanding Forex Regulation

When launching a forex brokerage, the regulatory framework you choose defines everything: your capital requirements, operational costs, client base, and even the trading conditions you can offer. The decision between an onshore license in a heavily regulated market like the UK or an offshore option in Seychelles isn’t merely a business formality—it’s possibly your most critical strategic choice.

Importance of Forex Regulation

The forex market processes an average daily trading volume exceeding $7.5 trillion, making it the largest financial market globally. Without proper regulation, this immense liquidity and leverage could create significant systemic risks.

Regulation serves three primary purposes:

- Client Protection: Ensuring client funds are segregated from company assets and properly secured

- Market Integrity: Preventing market manipulation and illegal trading practices

- Financial Stability: Maintaining appropriate capital reserves to prevent broker insolvency

Forex Regulation Explained: What traders and brokers need to know

Key Global Regulatory Bodies

Regulatory bodies around the world are organized into tiers based on their strictness, reputation, and the protections they offer to traders:

| Tier | Regulatory Bodies | Reputation | Capital Requirements | Client Protections |

|---|---|---|---|---|

| Tier 1 | FCA (UK), ASIC (Australia), CFTC/NFA (US), BaFin (Germany), FINMA (Switzerland) | Highest market credibility | $125,000 – $20 million | Segregated accounts, investor compensation schemes, strict reporting |

| Tier 2 | CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), JFSA (Japan) | Good reputation, lighter than Tier 1 | $50,000 – $750,000 | Segregated accounts, some compensation protection |

| Tier 3 | FSA (Seychelles), VFSC (Vanuatu), FSC (Mauritius) | Business-friendly, lower oversight | $18,000 – $50,000 | Basic protections, fewer monitoring requirements |

U.S. (CFTC and NFA)

The United States maintains the most stringent regulatory environment in the world for forex brokers. The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) require an extraordinary $20 million in operational capital—a figure that rose dramatically from $5 million after the 2008 financial crisis. The application process typically takes 12-24 months and involves intensive background checks on all principals and key employees. American traders can only trade with NFA-registered brokers, severely limiting their options, and brokers face restrictions including the FIFO (First-In-First-Out) rule and no hedging allowed on the same currency pair.

UK (FCA)

The UK’s Financial Conduct Authority (FCA) operates with a tiered approach to licensing. Market makers need £730,000 (~$943,000) in capital, while STP (Straight-Through Processing) brokers require £125,000 (~$162,000). FCA regulation mandates segregation of client funds, comprehensive risk disclosures, and monthly financial statements. The regulatory structure in the UK remains in transition following Brexit, with some modifications expected in 2025-2026 as the UK establishes its post-EU regulatory framework.

According to the FCA website: “FCA-regulated brokers must adhere to strict ethical guidelines which include: segregation of client funds into separate bank accounts held with reputable banks; regular reporting and auditing obligations including the provision of monthly account statements and position records; maintaining an efficient management structure with qualified professionals.” [FCA](https://www.fca.org.uk/)

Australia (ASIC)

The Australian Securities and Investments Commission (ASIC) has steadily tightened its regulatory framework over the past five years. In 2024, it requires AUD 1 million (~$665,000) in operational capital, up from an initial AUD 50,000 several years ago. ASIC-regulated brokers must maintain a physical presence in Australia and submit to regular audits. The regulator has particularly focused on leverage restrictions in recent years, implementing a 30:1 maximum leverage on major currency pairs and even stricter limits on exotic pairs and other instruments.

Cyprus (CySEC)

The Cyprus Securities and Exchange Commission (CySEC) offers a popular pathway into the European markets through the EU passporting system. There are three license tiers: basic (€50,000 capital), standard (€125,000), and full (€730,000). Cyprus offers a relatively streamlined application process compared to other Tier 1-2 jurisdictions, typically taking 6-12 months, and its EU passporting rights allow CySEC-licensed brokers to operate throughout the European Economic Area without additional licenses.

Real-World Example: Pepperstone’s Multi-Jurisdictional Approach

Pepperstone, founded in 2010 in Australia, demonstrates the strategic use of multiple regulatory licenses. The company initially obtained ASIC regulation in Australia but has since expanded its regulatory portfolio to include:

- FCA (UK) license for serving British and certain international clients

- BaFin (Germany) license secured after Brexit to maintain EU market access

- CySEC (Cyprus) license as an additional European entry point

- DFSA (Dubai) license to strengthen their Middle Eastern presence

- SCB (Bahamas) license for certain international markets

According to Pepperstone’s website: “As well as being regulated by ASIC, SCB, CMA, CySEC, FCA, BaFin and DFSA, we segregate our client funds with tier 1 banks and offer many fee-free funding methods.” [Pepperstone](https://pepperstone.com/en/about-us/who-we-are/)

This multi-jurisdictional approach has allowed Pepperstone to expand globally while maintaining compliance with regional requirements—a strategy increasingly adopted by larger brokers seeking global reach.

Switzerland (FINMA)

The Swiss Financial Market Supervisory Authority (FINMA) offers one of Europe’s most prestigious licenses, but also one of the most expensive. Brokers need CHF 10 million (~$11.2 million) in capital—a figure that has kept many smaller operators away from this jurisdiction. The process typically takes 8-12 months and requires extensive documentation of risk management processes, capital adequacy, and corporate governance.

Germany (BaFin)

BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) requires forex brokers to maintain at least €750,000 in operating capital. BaFin-regulated brokers must maintain segregated client funds and bank accounts with major German financial institutions like Commerzbank and Deutsche Bank. The application process normally takes 9-12 months and requires comprehensive documentation of risk management systems.

Dubai (DFSA)

The Dubai Financial Services Authority (DFSA) has positioned itself as a bridge between Western regulatory standards and Middle Eastern markets. The capital requirements vary by license category, with most forex brokers needing between $500,000 and $2 million in capital. The application process typically takes 4-6 months and requires a physical presence in the Dubai International Financial Center.

Requirements for Obtaining a Forex Broker License

Researching Regulatory Jurisdictions

Before applying for a forex broker license, thorough research into potential jurisdictions is essential. Each jurisdiction offers different benefits, drawbacks, and specific requirements.

Comparison of Regulatory Bodies

Visual representation of various forex regulatory bodies and their trustworthiness (Source: Visual Capitalist)

When comparing jurisdictions, consider:

- Cost of Entry: Initial capital requirements, application fees, and ongoing regulatory costs

- Time to Market: Application processing times range from 1 month (Georgia) to 24 months (USA)

- Market Access: Which markets your license allows you to operate in (e.g., EU passporting)

- Reputation: How clients and banking partners perceive your regulatory oversight

- Operational Requirements: Physical office, local directors, staffing requirements

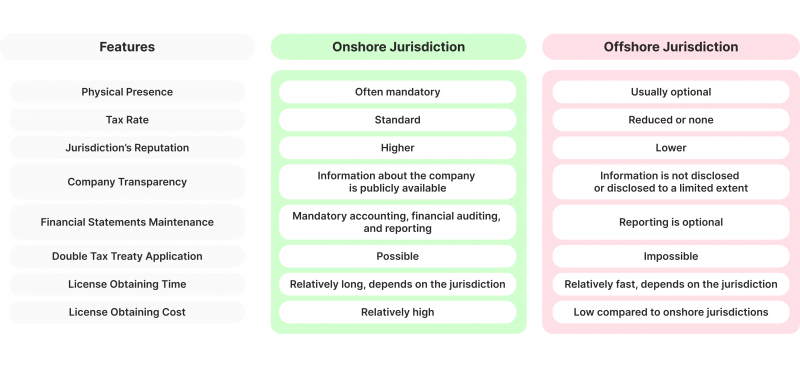

High-regulation vs. Low-regulation Jurisdictions

Onshore vs Offshore Jurisdiction Comparison

Comparison of onshore and offshore licensing characteristics (Source: B2Broker)

Establishing a Legal Entity

Establishing the proper legal entity is the first formal step in the license application process. Requirements vary by jurisdiction but generally include:

Legal structures and required documentation

- Company Registration: Typically a limited liability company (LLC) or public limited company (PLC)

- Articles of Incorporation: The company’s founding documents

- Shareholder Structure: Clear documentation of all shareholders with stakes above 10%

- Director Information: Most jurisdictions require between 2-4 directors with verified identities

- Corporate Bank Account: A functioning account with sufficient initial deposit

- Physical Office Space: Many jurisdictions require a physical presence with a verifiable address

- Criminal Background Checks: For all key personnel including directors, shareholders, and C-level executives

According to B2Broker, “Onshore jurisdictions refer to developed countries that adhere to international agreements with strict regulatory guidelines, requiring higher fees, longer processing times, strict capital and financial obligations, and a physical presence within the country.” [B2Broker](https://b2broker.com/news/onshore-vs-offshore-forex-broker-license/)

Capital Requirements by Jurisdiction

| Jurisdiction | Regulatory Body | Minimum Capital (USD) | Type of License | Processing Time |

|---|---|---|---|---|

| United States | CFTC/NFA | $20,000,000 | Retail Foreign Exchange Dealer | 12-24 months |

| United Kingdom | FCA | $125,000 – $943,000 | Tiered system (STP vs. Market Maker) | 6-12 months |

| Australia | ASIC | $665,000 (AUD 1M) | Australian Financial Services License | 6-12 months |

| Cyprus | CySEC | $54,000 – $790,000 | CIF License (tiered) | 6-12 months |

| Switzerland | FINMA | $11,200,000 (CHF 10M) | Banking License | 8-12 months |

| Germany | BaFin | $810,000 (€750,000) | Financial Services Institution License | 9-12 months |

| Mauritius | FSC | $30,000 (MUR 1M) | Investment Dealer License | 3 months |

| Seychelles | FSA | $50,000 | Securities Dealer License | 3-6 months |

| Vanuatu | VFSC | $50,000 | Dealers in Securities License | 2-3 months |

| Saint Vincent | FSA | No specified minimum | International Business Company | 3 weeks |

Based on this comparison, it’s clear why many startup brokers gravitate toward jurisdictions like Mauritius, Seychelles, and Vanuatu as their entry point into the forex industry. The capital requirements are significantly lower, and the time to market is much faster. However, this comes at the cost of market perception and potentially limited access to banking relationships and payment processors.

U.S.: $20 million minimum

The CFTC and NFA maintain the highest capital requirements in the industry at $20 million. This enormous threshold has effectively limited the U.S. market to a handful of large brokers like OANDA and Forex.com. The capital must be maintained at all times, with daily reporting requirements.

UK: £730,000 for Dealing Desk brokers

The UK implements a tiered system: Market Makers (dealing desk brokers) need £730,000 (~$943,000), while STP brokers require £125,000 (~$162,000). The FCA also mandates regular stress tests and maintains strict oversight of broker financial stability.

Australia: Specific ASIC requirements

ASIC requires AUD 1 million in operational capital, which must be maintained at all times. The regulator also requires detailed risk management frameworks and has specific requirements for client money handling.

According to Arincen, “All ASIC FOREX brokers should have a minimum of AUD1 million in operating capital, an amount that has been raised from an initial figure of AUD50,000.” [Arincen](https://en.arincen.com/blog/forex-regulations/asic-regulation)

Cyprus: €75,000 – €750,000 depending on services offered

CySEC offers a tiered system with three license types:

- Basic License: €50,000 capital requirement

- Standard License (STP): €125,000 capital requirement

- Full License (Market Maker): €730,000 capital requirement

How to Obtain a Forex Broker License: Detailed explanation of the process

The Application Process

Preparing Necessary Documentation

The documentation required for a forex broker license application is extensive and varies by jurisdiction. However, certain core documents are required almost universally:

Business Plan

A comprehensive business plan is required by all regulators and typically includes:

- Executive Summary: Overview of your brokerage concept

- Company Structure: Legal entity details, shareholder information, and corporate governance

- Market Analysis: Target audience, competitive landscape, and marketing strategy

- Operational Model: STP, ECN, Market Maker, or hybrid approach

- Technology Infrastructure: Trading platforms, liquidity providers, and technical setup

- Financial Projections: 3-5 year forecasts including capital utilization

- Risk Assessment: Identified risks and mitigation strategies

As noted by Gofaizen & Sherle, “When applying for a forex broker license, the documents typically include: Company’s articles of incorporation and founding materials, a detailed business plan, including market strategies, financial estimates, and risk management measures.” [Gofaizen & Sherle](https://gofaizen-sherle.com/forex-license)

Risk Management and Compliance Manuals

Regulators require detailed documentation of your risk management and compliance frameworks, including:

- Risk Management Policy: How you’ll handle market risk, credit risk, operational risk, and liquidity risk

- Compliance Manual: Internal procedures for regulatory compliance

- Corporate Governance Structure: Board composition, reporting lines, and responsibility allocation

- Business Continuity Plan: Disaster recovery and operational resilience measures

- Client Complaint Procedures: How customer issues will be addressed

AML and KYC Procedures

Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements have become increasingly stringent worldwide, with regulators requiring extensive documentation of procedures:

- Client Verification Process: How identities will be confirmed

- Risk-Based Assessment: How clients will be categorized by risk level

- Ongoing Monitoring Procedures: Systems for transaction monitoring

- Suspicious Activity Reporting: Procedures for detecting and reporting suspicious activity

- Sanctions Screening: How clients will be checked against global sanctions lists

- Record-Keeping Protocols: How records will be maintained and for how long

What Is AML KYC Compliance? Essential information for forex brokers

Financial Statements

Financial documentation typically includes:

- Proof of Capital: Bank statements showing required regulatory capital

- Audited Financial Statements: For established companies

- Source of Funds Documentation: Proving the legitimate source of investment capital

- Financial Projections: Detailed 3-5 year P&L forecasts

Submitting the License Application

Application fees and due diligence process

Application fees vary significantly by jurisdiction:

| Jurisdiction | Initial Application Fee | Annual Renewal Fee | Additional Costs |

|---|---|---|---|

| United Kingdom (FCA) | $10,000 – $30,000 | $5,000 – $25,000 | Compliance consultant fees, legal fees |

| Cyprus (CySEC) | $20,000 | $15,000 – $25,000 | CIF setup costs, compliance officer salary |

| Mauritius (FSC) | $750 | $2,500 | Local director fees, office rental |

| Seychelles (FSA) | $1,500 | $1,000 | Local representative fees |

| Vanuatu (VFSC) | $2,500 | $2,000 | Local agent fees |

The due diligence process typically includes:

- Background Checks: On all key personnel and shareholders

- Source of Funds Verification: Ensuring capital comes from legitimate sources

- Corporate Structure Review: Ensuring transparent ownership

- Business Model Assessment: Evaluating the viability of the proposed operation

Regulatory Reviews and Timeframes

According to our research, application review timeframes vary significantly:

- Fast-track jurisdictions (1-3 months): Saint Vincent and Grenadines (3 weeks), Comoro Islands (3-4 weeks), Georgia (1 month)

- Medium timeframe (3-6 months): Mauritius (3 months), Seychelles (2-3 months), Vanuatu (2-3 months)

- Longer timeframe (6-12 months): Cyprus (6-12 months), UK (6-12 months), Australia (6-12 months)

- Extended process (12+ months): United States (12-24 months), Switzerland (8-12 months)

According to Gofaizen & Sherle, “The United Kingdom generally takes between 6 and 12 months for licensing, while Cyprus also usually takes 6-12 months.” [Gofaizen & Sherle](https://gofaizen-sherle.com/forex-license)

Post-Licensing Obligations

Ongoing Reporting

After obtaining a license, brokers face continual reporting obligations, including:

- Financial Reporting: Monthly, quarterly, and annual financial statements

- Capital Adequacy Reports: Proving continuous compliance with capital requirements

- Client Money Reports: Demonstrating proper segregation and protection of client funds

- Significant Event Notifications: Reporting major operational changes, breaches, or incidents

- Annual Compliance Reports: Comprehensive review of compliance activities

According to Arincen, “FCA-regulated FOREX brokers are required to provide clients with monthly account statements and position records. They also need to supply the FCA with capital adequacy requirements calculated on a daily basis, audited financial statements produced annually or quarterly, and monthly financial statements prepared in accordance with best-practice accounting principles.” [Arincen](https://en.arincen.com/blog/forex-regulations/fca-regulation)

Audits and Compliance Monitoring

Regulatory audits are a fact of life for licensed forex brokers and can include:

- Regular Audits: Scheduled reviews of financial statements, processes, and compliance

- Surprise Inspections: Unannounced visits to ensure ongoing compliance

- Thematic Reviews: Industry-wide investigations into specific areas of concern

- Technology Audits: Reviews of IT infrastructure and cybersecurity measures

Case Study: FXTM Regulatory Compliance Framework

ForexTime (FXTM), a major global broker, exemplifies the comprehensive approach required for multi-jurisdictional regulatory compliance. The company maintains:

- Segregated Client Funds: FXTM keeps all client deposits segregated and insured up to $1 million

- Dedicated Compliance Team: Specialized staff monitor regulatory changes across all operating jurisdictions

- Automated Compliance Systems: Including AI-powered transaction monitoring and risk assessment

- Regular Staff Training: Ensuring all team members understand compliance obligations

According to their website: “Trade confidently with FXTM, where your funds are segregated and insured up to $1 million.” [FXTM](https://www.forextime.com/regulatory-compliance)

Popular Jurisdictions for Forex Broker Licensing

United States

Overview of CFTC and NFA requirements

The United States maintains the world’s most stringent forex regulatory environment. The Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) jointly oversee forex brokers, requiring:

- Massive Capital Requirements: $20 million minimum net capital

- Extensive Background Checks: For all principals, executives, and major shareholders

- Detailed Business Plans: Including comprehensive risk management frameworks

- Rigorous Compliance Procedures: Including trading surveillance systems

- Restricted Leverage: 50:1 on major currency pairs, 20:1 on minor pairs

- FIFO Rule Compliance: First-in, first-out position closing order

- Hedging Restrictions: No hedging allowed on the same currency pair

These requirements have effectively limited the U.S. retail forex market to only a handful of large brokers, with many international brokers choosing not to enter the American market due to the prohibitive regulatory requirements.

United Kingdom

FCA regulations and capital obligations

The UK’s Financial Conduct Authority (FCA) operates a principles-based regulatory approach with significant capital requirements but more flexibility than the U.S. system. Key aspects include:

- Tiered Capital Requirements: £730,000 for Market Makers, £125,000 for STP brokers

- Client Fund Segregation: Strict segregation of client funds from company assets

- Financial Services Compensation Scheme: Providing up to £85,000 protection per client

- Leverage Restrictions: 30:1 on major currency pairs, stricter limits on other instruments

- Negative Balance Protection: Clients cannot lose more than their deposit

Post-Brexit, the UK’s regulatory framework has begun to diverge from EU standards, with potential further changes expected in 2025-2026.

Australia

ASIC’s comprehensive requirements and mandatory physical presence

The Australian Securities and Investments Commission (ASIC) has strengthened its regulatory framework significantly since 2019, implementing:

- AUD 1 Million Capital Requirement: Approximately $665,000 USD

- Physical Presence Mandate: Requiring a real office with local staff

- Client Money Rules: Strict segregation and handling procedures

- Product Intervention Measures: Leverage caps and marketing restrictions

- Regular Compliance Reviews: Including on-site inspections

ASIC has particularly focused on consumer protection in recent years, implementing product intervention powers similar to those used by European regulators.

According to Arincen, “Brokers are required to be regulated by the ASIC to offer FOREX trading products and allied services to Australian citizens. In addition, the ASIC mandates that brokers must maintain a representative office in Australia, meaning they cannot operate solely from remote overseas locations.” [Arincen](https://en.arincen.com/blog/forex-regulations/asic-regulation)

Offshore Licensing Options

Seychelles, BVI, and Mauritius

Offshore jurisdictions remain popular options for startup brokers and those seeking more operational flexibility. These jurisdictions typically offer:

- Lower Capital Requirements: $18,000 to $50,000 versus millions in Tier 1 jurisdictions

- Faster Processing: 2-3 months versus 6-24 months for major regulators

- Reduced Operational Restrictions: Higher leverage and fewer product limitations

- Lower Compliance Costs: Simpler ongoing reporting requirements

- Tax Benefits: Often located in low or zero-tax jurisdictions

However, these benefits come with significant drawbacks:

- Reputational Considerations: Many experienced traders view offshore regulation skeptically

- Banking Challenges: Many tier-1 banks refuse to work with offshore-regulated entities

- Payment Processing Limitations: Some payment providers restrict offshore brokers

- Marketing Restrictions: Difficulty advertising in highly regulated markets

Best Broker For Forex Trading: Unregulated vs Regulated

Common Challenges in Forex Broker Licensing

High Capital Requirements

The substantial capital requirements for tier-1 jurisdictions present a significant barrier to entry for many prospective forex brokers. Most tier-1 regulators require between $125,000 and $20 million in initial capital—funds that must be locked up and cannot be used for operational expenses.

Strategies for addressing capital challenges include:

- Staged Regulatory Approach: Starting with an offshore license and upgrading as the business grows

- Strategic Partnerships: Seeking investment from established financial institutions

- White Label Solutions: Partnering with existing brokers before launching independently

How Does Regulatory Capital Work When Applying for a Forex License?

Stringent Compliance Procedures

The compliance burden for forex brokers has increased dramatically in recent years, with challenges including:

- AML/KYC Requirements: Increasingly sophisticated monitoring demands

- Cross-Border Compliance: Managing multiple regulatory frameworks simultaneously

- Technology Requirements: Implementing robust systems for monitoring and reporting

- Staff Training: Ensuring all personnel understand compliance obligations

According to Sumsub, “AML compliance for forex brokers typically includes robust KYC verification processes, transaction monitoring systems, suspicious activity reporting mechanisms, and record-keeping protocols that meet regulatory standards.” [Sumsub](https://sumsub.com/blog/forex/)

Regional Differences in Regulatory Expectations

Navigating the differences between regulatory regimes presents significant operational challenges. Major regional variations include:

- Leverage Limits: From 30:1 in Europe and Australia to 1000:1 in some offshore jurisdictions

- Product Restrictions: Different rules on offering CFDs, crypto derivatives, and other products

- Marketing Rules: Varying restrictions on promotional tactics and risk disclosures

- Client Categorization: Different definitions of retail versus professional clients

- Negative Balance Protection: Required in some jurisdictions but not others

For brokers operating globally, these differences require sophisticated compliance frameworks capable of applying different rules to clients based on their location.

Trading Platforms and Technology Requirements

Comparison of MetaTrader and cTrader Platforms

The choice of trading platform significantly impacts a broker’s technological requirements and the trading experience offered to clients. The two dominant platforms in the industry are MetaTrader (MT4/MT5) and cTrader.

| Feature | MetaTrader 5 | cTrader |

|---|---|---|

| Development | MetaQuotes Software | Spotware Systems |

| Market Share | Dominant (~80%) | Growing (~10%) |

| Programming Language | MQL5 | C# |

| Market Depth | Limited in standard version | Advanced depth of market |

| Trading Model | Supports all models | Primarily designed for ECN/STP |

| Broker Integration | More complex setup | Streamlined integration |

| User Interface | Traditional, more technical | Modern, user-friendly |

MetaTrader 5 trading platform interface

Forex broker regulation interface

MT5 vs. cTrader: Which Platform Is Right for Your Brokerage? (2024)

Technology Infrastructure Requirements

Regardless of the chosen platform, brokers must implement robust technology infrastructure including:

- Server Infrastructure: High-performance, low-latency servers near major financial centers

- Liquidity Connections: Stable feeds from multiple liquidity providers

- Backup Systems: Redundant systems to prevent downtime

- Security Measures: Advanced protection against cyber threats

- API Integrations: Connections to payment providers, CRM systems, and other services

- Monitoring Tools: Systems for overseeing platform performance

The infrastructure requirements vary based on the broker’s business model and expected trading volumes, but all regulated brokers must demonstrate robust technological capabilities to satisfy regulatory requirements.

FAQs

- What are the capital requirements for a forex broker?

- Capital requirements vary dramatically by jurisdiction. Tier-1 regulators like the CFTC (US) require $20 million, the FCA (UK) requires between £125,000-£730,000 depending on the business model, and ASIC (Australia) requires AUD 1 million. Offshore jurisdictions have much lower requirements, with Mauritius requiring approximately $30,000 and Seychelles requiring $50,000.

- How long does it take to get a forex broker license?

- Timeframes vary significantly by jurisdiction. Tier-1 licenses typically take 6-24 months (with the US being the longest at 12-24 months). Mid-tier jurisdictions like Cyprus take 6-12 months. Offshore jurisdictions are much faster, with Mauritius taking about 3 months, Seychelles 3-6 months, and Saint Vincent as little as 3 weeks.

- What is the difference between an offshore license and a tier-1 license?

- Tier-1 licenses (FCA, ASIC, CFTC) offer higher credibility and market confidence but come with stringent capital requirements (millions of dollars), lengthy application processes (6-24 months), and extensive ongoing compliance obligations. Offshore licenses (Seychelles, Vanuatu, SVG) offer lower capital requirements ($50,000 or less), faster processing (2-3 months), and fewer restrictions, but come with reputational challenges and potential banking and payment processing limitations.

- Can a forex broker operate without a license?

- Operating a forex brokerage without appropriate licensing is illegal in most countries with established financial regulations. Unlicensed brokers face severe penalties including financial sanctions, operational shutdown, and potential criminal charges for executives. Additionally, banking institutions and payment processors will not work with unlicensed entities, making it practically impossible to operate legitimately without proper authorization.

- What are KYC and AML, and why are they important?

- Know Your Customer (KYC) and Anti-Money Laundering (AML) are regulatory frameworks designed to prevent financial crimes. KYC requires brokers to verify client identities through document collection and verification. AML encompasses broader procedures to detect and prevent money laundering, including transaction monitoring, suspicious activity reporting, and risk assessment. These frameworks are critical for preventing financial crimes and are mandatory requirements for licensed brokers in all reputable jurisdictions.

- How can I verify if a forex broker is licensed?

- To verify a broker’s license: (1) Check the broker’s website for their regulatory information and license numbers; (2) Visit the relevant regulator’s website and use their search or verification tool (e.g., the FCA Register, ASIC Professional Register); (3) Confirm the license status, authorized activities, and any restrictions or warnings; (4) Verify the company name and registration address match the official records; (5) Check for any regulatory actions or sanctions against the broker on the regulator’s website.

- Are there penalties for operating without a forex broker license?

- Yes, penalties for operating without proper licensing are severe across most jurisdictions. These can include: financial penalties (often in the millions of dollars), criminal prosecution of company executives (potentially resulting in imprisonment), forced cessation of business activities, asset freezing, and placement on international warning lists. Additionally, the company and its executives may be permanently barred from the financial services industry in that jurisdiction.

- What is the cost of maintaining a forex broker license?

- Ongoing costs for maintaining a forex broker license include: annual renewal fees (ranging from $1,000 in offshore jurisdictions to $25,000+ in tier-1 jurisdictions), compliance costs (staff, systems, reporting), audit fees ($10,000-$50,000 annually depending on jurisdiction), regulatory capital lockup costs (opportunity cost of capital that cannot be used for operations), and professional services fees (legal, compliance consultancy). Total maintenance costs can range from $20,000 annually for offshore licenses to several hundred thousand dollars for tier-1 licenses.

- Can a forex broker operate in multiple jurisdictions?

- Yes, many established forex brokers operate in multiple jurisdictions using different subsidiaries with appropriate licenses for each region. Operating across jurisdictions requires: establishing separate legal entities in each jurisdiction, obtaining appropriate licenses for each entity, implementing jurisdiction-specific compliance frameworks, managing separate capital requirements, and potentially using different brand names or disclaimers for different regions. This approach allows for broader market access but increases operational complexity and compliance costs.

- Do regulatory requirements vary for different trading platforms?

- Regulatory requirements generally apply to the broker rather than the specific platform they use, but certain platform functionalities may face different regulatory treatments. For example, social trading features may face additional scrutiny under investment advice regulations, automated trading systems might require specific disclosures and risk controls, and certain platforms may need to demonstrate compliance with specific security standards or data protection requirements. However, the core regulatory framework applies regardless of platform choice.

- How does regulation affect the leverage a broker can offer?

- Regulation significantly impacts leverage limits. ESMA regulations in Europe restrict retail client leverage to 30:1 for major currency pairs and lower for other instruments. Similar restrictions apply in Australia under ASIC (30:1) and Japan under the JFSA (25:1). The UK’s FCA maintains limits comparable to ESMA’s. The US restricts leverage to 50:1 on major pairs and 20:1 on minor pairs. In contrast, offshore jurisdictions typically allow much higher leverage, sometimes up to 1000:1, which attracts traders seeking higher risk exposure but offers less regulatory protection.

- What post-licensing obligations do forex brokers have?

- Post-licensing obligations include: regular financial reporting (monthly, quarterly, and annual), maintaining minimum capital requirements at all times, submitting to regulatory audits and inspections, notifying regulators of significant business changes, ongoing staff training in compliance procedures, maintaining and updating AML/KYC systems, paying annual regulatory fees, and implementing proper client complaint handling procedures. The extent and frequency of these obligations vary by jurisdiction, with tier-1 regulators imposing more demanding requirements.

- How does licensing impact a broker’s credibility?

- Licensing significantly impacts a broker’s credibility in several ways: tier-1 licenses (FCA, ASIC, CFTC) signal strong regulatory oversight and greater client protection, which attracts more risk-averse and institutional clients; proper licensing enables partnerships with respected banks and payment providers; licenses that include investor compensation schemes provide additional client security; and regulated brokers typically appear in regulatory directories that clients can verify. The reputation effects are substantial—brokers with strong regulatory credentials can charge higher spreads and typically experience greater client retention.

- What are the main regulatory bodies overseeing forex brokers?

- The main regulatory bodies include: Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the US, Cyprus Securities and Exchange Commission (CySEC), Financial Services Agency (JFSA) in Japan, Swiss Financial Market Supervisory Authority (FINMA), Federal Financial Supervisory Authority (BaFin) in Germany, and the Dubai Financial Services Authority (DFSA). Tier-2 and offshore regulators include the Financial Services Commission (FSC) in Mauritius, Financial Services Authority (FSA) in Seychelles, and Vanuatu Financial Services Commission (VFSC).

- What documents are required for a forex broker license application?

- Required documents typically include: business registration paperwork, detailed business plan with 3-5 year projections, proof of regulatory capital, AML and KYC policies and procedures, risk management framework, professional background information for all directors and key personnel, criminal background checks, proof of physical office space, technical infrastructure documentation, organizational chart showing reporting lines, compliance manual, client agreements and risk disclosures, and audited financial statements (for existing businesses). The specific requirements and level of detail vary by jurisdiction, with tier-1 regulators requiring more extensive documentation.

- Why are some brokers based in offshore locations?

- Brokers choose offshore locations for multiple reasons: lower capital requirements ($30,000-$50,000 versus millions in tier-1 jurisdictions), faster licensing processes (2-3 months versus 6-24 months), reduced operational restrictions (higher leverage offerings, fewer product limitations), lower compliance costs with simpler reporting requirements, tax advantages in low or zero-tax jurisdictions, and as an entry strategy for new brokers who plan to upgrade to tier-1 licenses as they grow. However, these benefits are counterbalanced by reputational challenges, banking relationship difficulties, and limited access to certain markets.

- What happens if a broker loses their license?

- When a broker loses their license, several consequences follow: they must immediately cease offering regulated services in that jurisdiction, notify all clients of the license revocation, implement an orderly wind-down process or client transfer to another regulated entity, potentially face fines and other penalties, and experience severe reputational damage that may affect operations in other jurisdictions. Depending on the reason for license revocation, company directors and senior managers may face personal liability or bans from working in financial services. Recovery from license revocation is extremely difficult, and many brokers do not survive the process.

Conclusion

The forex broker licensing landscape represents a complex interplay between regulatory rigor, capital requirements, compliance obligations, and market access. As we’ve seen throughout this guide, there is no one-size-fits-all approach to choosing a regulatory jurisdiction or navigating the licensing process.

For startup brokerages, the decision often comes down to balancing immediate operational constraints against long-term strategic goals. While offshore jurisdictions offer lower barriers to entry, they come with reputational considerations that can impact client acquisition and banking relationships. Conversely, tier-1 regulators provide strong market credibility but require significant capital investment and operational infrastructure.

Looking ahead to the remainder of 2025 and beyond, several trends are likely to shape the regulatory landscape:

- Increasing Harmonization: Regulatory standards are gradually converging across jurisdictions, with offshore regulators implementing more robust requirements

- Enhanced Technology Requirements: Regulators are placing greater emphasis on cybersecurity and technological resilience

- Stronger AML/KYC Frameworks: As financial crime grows more sophisticated, compliance requirements will continue to intensify

- ESG Considerations: Environmental, social, and governance factors are beginning to influence regulatory approaches

For brokers seeking to navigate this complex environment, a staged approach often makes the most sense: starting with a more accessible license and upgrading as the business grows and capital reserves increase. Regardless of the chosen path, maintaining robust compliance frameworks and staying ahead of regulatory changes remains essential for long-term success in the forex industry.

The most successful brokers will be those who view regulatory compliance not merely as a box-checking exercise but as a foundational element of their business strategy—one that builds trust with clients, facilitates banking relationships, and creates sustainable competitive advantage in an increasingly crowded marketplace.

Final Regulatory Insight

“In the forex industry, your regulatory framework isn’t just about compliance—it’s a fundamental business decision that shapes everything from your operational costs and market access to your client perception and banking relationships. Choose carefully, because changing course once established is both expensive and disruptive.”