Key Takeaways

- Fusion Markets offers the lowest commission at $2.25 per side ($4.50 round turn), while Tickmill leads for GBP/EUR base currencies at £2.00/€2.00 per side.

- Raw spread accounts typically provide better value for high-volume traders despite commission fees, as spreads can be as low as 0.0 pips.

- Regulatory protection varies significantly—ASIC, FCA, and CySEC limit retail leverage to 1:30, while offshore regulators allow up to 1:500 or higher.

- Commission costs are only one component of trading expenses—consider spreads, overnight fees, funding charges, and account base currency.

- Testing broker platforms via demo accounts is essential before committing real capital, especially for assessing execution quality and platform stability.

Introduction to Low-Commission Forex Brokers

In the competitive world of forex trading, commission costs can make the difference between profitable and unprofitable strategies—especially for active traders. While many brokers advertise “commission-free” trading, experienced traders understand that costs are always present, whether embedded in the spread or charged as separate commission fees.

Let me be honest upfront—picking a broker isn’t rocket science, but understanding the true cost of trading with different brokers can be confusing. Having traded with dozens of brokers over the years, I’ve learned that headline commission rates tell only part of the story. The real question is: what’s the total cost per trade, and how does it affect your specific trading style?

Think of forex commission structures like airline pricing. The budget carrier might advertise a $50 ticket (low spread/no commission), but by the time you add baggage fees, seat selection, and other “extras,” the full-service airline charging $75 upfront (commission) might actually be cheaper. In forex, the “extras” are the widened spread, overnight financing costs, and other hidden fees.

This guide examines the latest data from 2025, analyzing the true costs of trading with various brokers. We’ll explore raw vs. standard accounts, regulatory considerations, and platform options to help you identify the broker that offers the best value for your trading approach.

Whether you’re a high-frequency scalper where every fraction of a pip matters, or a position trader more concerned with platform reliability and regulation, this guide will help you navigate the often misleading world of forex broker fees.

What Are Forex Commissions?

Before diving into specific brokers, it’s essential to understand what forex commissions actually are and how they differ from other trading costs.

Forex commissions are explicit fees charged by brokers for executing trades on your behalf. These are typically quoted as a fixed amount per standard lot (100,000 units of base currency) traded. For example, a commission of $3.50 per side means you’ll pay $3.50 when opening a position and another $3.50 when closing it—totaling $7.00 for a complete round-turn transaction.

Commission Structures in Forex

Commission structures typically fall into three categories:

- Fixed per-lot commission: A set dollar amount charged per standard lot (e.g., $3 per side, $6 round turn)

- Percentage-based commission: A small percentage of the trade value (less common in retail forex)

- Volume-based tiered commission: Rates that decrease as your monthly trading volume increases

While the industry standard for ECN/raw spread accounts hovers around $3.50 per side ($7 round turn), our research shows that rates can vary significantly between brokers, from as low as $2.25 to over $5.00 per side.

Why Low Commissions Matter for Forex Traders

Commission costs might seem small in isolation, but their impact can be substantial depending on your trading approach.

Impact on Different Trading Styles

For high-frequency traders, such as scalpers and day traders, even small differences in commission rates can dramatically affect profitability. Consider the following example:

Scalping Example

A scalper making 20 round-turn trades per day (400 per month) trading 1 standard lot each time would pay:

- With Fusion Markets ($4.50 round turn): $1,800 monthly in commissions

- With an average broker ($7.00 round turn): $2,800 monthly in commissions

The difference of $1,000 per month ($12,000 annually) could be the difference between a profitable and unprofitable strategy.

For swing and position traders who trade less frequently, the impact of commission differences is less pronounced. However, these traders should still consider the total cost, including spreads and overnight financing fees, which can accumulate significantly for positions held for days or weeks.

In 2025’s increasingly competitive market environment with narrowing profit margins, cost efficiency has become even more crucial. According to recent industry data, retail forex traders who carefully optimize their trading costs can improve their overall profitability by 15-20% compared to those who don’t [CompareForexBrokers](https://www.compareforexbrokers.com/awards/).

Spread vs. Commission-Based Pricing

Understanding the difference between spread-only and commission-based pricing models is fundamental to evaluating the true cost of trading.

How Spread and Commission Models Work

Forex brokers typically offer two main pricing structures:

Standard (Spread-Only) Accounts

- No separate commission fees

- Wider spreads (typically from 1.0 pips on major pairs)

- Broker profit built into the spread markup

- Simpler fee structure for beginners

- Often feature fixed spreads that don’t widen during volatility

Raw Spread (Commission) Accounts

- Explicit commission charges

- Tighter raw spreads (from 0.0 pips on major pairs)

- More transparent cost structure

- Generally lower total trading costs

- Variable spreads that reflect actual market liquidity

The key difference is where the broker’s profit comes from. In spread-only accounts, brokers mark up the raw interbank spread; in commission accounts, they pass on raw market spreads but charge a separate commission.

Which Offers Better Value?

According to our 2025 analysis, raw spread accounts with commissions typically offer better overall value for most active traders, especially when trading major pairs with high liquidity. However, the optimal choice depends on your trading style:

| Trading Style | Recommended Account Type | Reasoning |

|---|---|---|

| Scalping | Raw Spread (Commission) | Tightest possible spreads critical for small profit targets |

| Day Trading | Raw Spread (Commission) | Lower overall costs for multiple daily trades |

| Swing Trading | Either, depends on frequency | Less sensitive to spread differences; consider overnight fees |

| Position Trading | Standard (Spread Only) | Spread differences less impactful; simplicity may be preferred |

| Beginners | Standard (Spread Only) | Simpler to understand total costs; no commission calculations |

Think of the difference between raw spread and standard accounts like wholesale vs. retail shopping. With standard accounts, you’re buying at retail price—convenient but more expensive. Raw spread accounts are like buying wholesale with a membership fee (commission); it costs more upfront but typically saves money if you trade regularly.

One common misconception is that standard “commission-free” accounts have no trading costs. In reality, the cost is simply built into the spread. To accurately compare total costs, we need to calculate the effective cost per round-trip trade.

How to Evaluate Total Trading Costs

To properly compare brokers, we need to look beyond headline commission rates and calculate the true cost per trade, which includes both spreads and commissions.

The Total Cost Formula

For a standard lot (100,000 units) of currency, the formula to calculate total trading cost is:

Total Cost = (Spread in pips × Value per pip) + Round-turn commission

For EUR/USD, where 1 pip typically equals $10 per standard lot:

Total Cost = (Spread in pips × $10) + Commission

Comparing Real-World Examples

Let’s compare the actual trading costs of three popular brokers for a 1 standard lot trade on EUR/USD:

| Broker | Account Type | Average Spread | Commission (Round Turn) | Total Cost |

|---|---|---|---|---|

| Fusion Markets | Zero (Raw) | 0.1 pips ($1.00) | $4.50 | $5.50 |

| Fusion Markets | Classic (Standard) | 0.9 pips ($9.00) | $0.00 | $9.00 |

| IC Markets | Raw Spread | 0.1 pips ($1.00) | $7.00 | $8.00 |

| IC Markets | Standard | 1.0 pips ($10.00) | $0.00 | $10.00 |

| Pepperstone | Razor | 0.1 pips ($1.00) | $7.00 | $8.00 |

| Pepperstone | Standard | 1.1 pips ($11.00) | $0.00 | $11.00 |

As this comparison shows, the raw spread (commission-based) accounts typically offer lower total costs despite the added commission. However, this advantage becomes more pronounced with increased trading volume and when trading major pairs with naturally tight spreads.

Additional Costs to Consider

Beyond spreads and commissions, a complete cost analysis should include:

- Swap/Overnight Fees: Charges for positions held beyond the trading day

- Currency Conversion Fees: Costs for trading in currencies different from your account base

- Deposit/Withdrawal Fees: Charges for moving money in and out of your trading account

- Inactivity Fees: Penalties for accounts that remain dormant

- Platform Fees: Some brokers charge for premium tools or VPS services

In 2025, we’re seeing more brokers eliminating ancillary fees like deposit, withdrawal, and inactivity charges to remain competitive. However, it’s still crucial to check the fine print before opening an account.

Top Forex Brokers with the Lowest Commissions

Based on our comprehensive analysis of the forex broker landscape in 2025, we’ve identified the following brokers offering the most competitive commission structures while maintaining high-quality service and regulation.

Fusion Markets – Overall Lowest Commission Broker

Fusion Markets has established itself as the industry leader for low-cost trading, offering the lowest commission rate of any major forex broker at just $2.25 per side ($4.50 round turn).

Key Features and Benefits

- Commission: $2.25 per side ($4.50 round turn)

- Spreads: Raw spreads from 0.0 pips

- Platforms: MT4, MT5, cTrader, TradingView

- Minimum Deposit: $0

- Regulation: ASIC (Australia), VFSC (Vanuatu)

- No deposit or withdrawal fees

Pros & Cons

- Lowest commission rates globally

- Competitive raw spreads

- Multiple platform options

- No hidden fees

- Relatively newer broker (founded 2017)

- Limited educational resources

According to our testing, Fusion Markets delivers on its promise of low costs while maintaining competitive execution speeds. The broker ranks third in execution speed globally, making it particularly suitable for algorithmic traders and scalpers [CompareForexBrokers](https://www.compareforexbrokers.com/awards/low-commissions/).

The broker offers both Classic (spread-only) and ZERO (raw spread + commission) accounts, with the latter providing exceptional value for high-volume traders. In our tests, the total round-turn cost for trading 1 standard lot of EUR/USD averaged just $5.50—significantly lower than industry standards.

Open Your Fusion Markets AccountTickmill – Lowest Commissions for GBP/EUR Base Currencies

While Fusion Markets leads for USD and AUD base currencies, Tickmill offers the lowest commissions for traders using GBP or EUR as their base currency.

Commission Structure and Fees

- Commission: £2.00/€2.00 per side (£4.00/€4.00 round turn)

- Spreads: Raw spreads from 0.0 pips

- Platforms: MT4, MT5

- Minimum Deposit: $100

- Regulation: FCA (UK), CySEC (Cyprus), FSA (Seychelles)

Features of the ECN Environment

- True ECN execution with market depth

- Average execution speed: 0.15 seconds

- No requotes or price manipulation

- Tier-1 regulation through FCA

- Negative balance protection

Tickmill’s Pro account offers traders direct market access with raw interbank spreads plus commission. For UK and European traders wanting the security of local tier-1 regulation combined with competitive costs, Tickmill presents an attractive option.

Open Your Tickmill AccountFP Markets – Leading ECN Broker with Tight Spreads

FP Markets has built a strong reputation for combining low commissions with excellent execution quality, making it a preferred choice for professional traders.

ECN Trading Explained

FP Markets’ Raw ECN account provides direct market access with:

- Commission: $3.00 per side ($6.00 round turn)

- Spreads: Raw spreads from 0.0 pips

- Average execution speed: 40ms

- Minimum Deposit: $100

- Regulation: ASIC, CySEC, FSA

Advantages for High-Frequency Traders

- VPS hosting for algorithmic trading

- Advanced MT4/MT5 plugins

- Autochartist integration

- MAM/PAMM accounts available

- Proprietary copy trading platform

Founded in 2005, FP Markets has a long track record of reliability and innovation. Their $3.00 per side commission rate is $0.50 lower than the industry average, while their 40ms execution speed ranks among the fastest in the industry [DailyForex](https://www.dailyforex.com/forex-brokers/best-forex-brokers/low-commission).

Open Your FP Markets AccountPepperstone – Best for Algorithmic Trading

Pepperstone combines competitive commissions with institutional-grade liquidity and advanced platform options, making it ideal for algorithmic and quantitative traders.

Commission Fees for Different Account Types

- Razor Account: $3.50 per side ($7.00 round turn)

- Standard Account: Spread-only, no commission

- Spreads: Raw spreads from 0.0 pips

- Minimum Deposit: $0 (recommended $200)

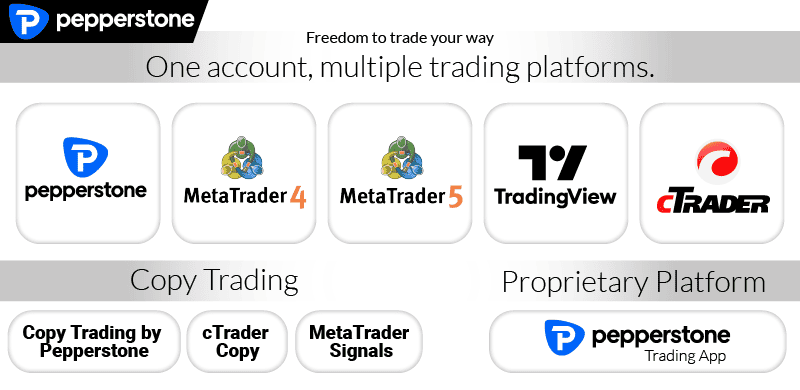

Social Trading Tools and Platforms

- Platforms: MT4, MT5, cTrader, TradingView

- Integration with algorithmic trading tools

- Social copy trading through DupliTrade

- Advanced execution technology

- Institutional-grade liquidity

Pepperstone’s multi-tier regulation (ASIC, FCA, BaFin, CySEC, DFSA) makes it one of the most secure brokers globally. Their commission rates, while not the lowest, are offset by excellent liquidity, exceptional customer service, and a wide range of available trading platforms.

The broker also offers an Active Trader Program with volume-based discounts on commissions for high-volume clients, potentially reducing costs by up to 30% [CompareForexBrokers](https://www.compareforexbrokers.com/reviews/pepperstone-review/).

Open Your Pepperstone AccountIC Markets – Top Choice for Professional Traders

IC Markets combines competitive commissions with institutional-grade liquidity and exceptional execution speeds, making it a preferred choice for professional traders.

IC Markets’ Raw Spread Account vs. Standard Account

| Feature | Raw Spread | Standard |

|---|---|---|

| Commission | $3.50 per side | $0 |

| EUR/USD Spread | From 0.0 pips | From 0.6 pips |

| Total Cost (1 lot) | ~$8.00 | ~$10.00 |

Volume-Based Rebate Programs

IC Markets offers tiered rebates based on monthly trading volume:

- $10M-$50M: 5% commission rebate

- $50M-$100M: 10% commission rebate

- $100M+: 15% commission rebate

This can reduce the effective commission rate for high-volume traders.

IC Markets’ Raw Spread account has consistently ranked as one of the most cost-effective options for active traders. The broker processes over $1 trillion in monthly volume, providing exceptional liquidity and execution quality. For scalpers and high-frequency traders, their lack of order distance restrictions and ultra-fast execution make them particularly attractive [FXEmpire](https://www.youtube.com/watch?v=aXWHCJ3rFwU).

Open Your IC Markets AccountFXTM – Best All-Around Broker with Flexible Pricing

FXTM (ForexTime) offers a unique volume-based commission structure that can be extremely cost-effective for high-volume traders.

Commission Structure and Fees

FXTM’s commission rates are tiered based on monthly trading volume:

- Standard volume: $4.00 per round lot

- High volume: As low as $0.80 per round lot

This volume-based approach makes FXTM particularly attractive for traders who consistently trade larger volumes. Additionally, their Advantage account with $25,000 minimum deposit offers commission-free trading with raw spreads of 0 pips—an exceptional value for traders with sufficient capital [DailyForex](https://www.dailyforex.com/forex-brokers/best-forex-brokers/low-commission).

Dynamic Leverage Options

FXTM offers tiered leverage from 1:25 to 1:2000, depending on account size and regulatory jurisdiction. This flexibility allows traders to optimize their capital efficiency based on their risk tolerance and trading strategy.

Open Your FXTM AccountOther Notable Low-Commission Brokers

While the brokers above represent our top picks, several other providers offer competitive commission structures worth considering:

AvaTrade

- Standard account: Commission-free

- Raw spreads from 0.9 pips

- Fixed or floating spreads

- Regulation: Multiple tier-1

Eightcap

- Commission: AU/USD $3.50 per side

- Raw spreads from 0.0 pips

- TradingView integration

- Regulation: ASIC, SCB

XTB

- Pro account: $3.50 per side

- Raw spreads from 0.1 pips

- No hidden fees

- Regulation: FCA, KNF

Each of these brokers has its strengths and may be better suited to specific trading styles or preferences. We recommend testing multiple brokers through demo accounts before committing real capital.

Regulatory and Security Considerations

While commission costs are important, regulatory protection and fund security should be primary considerations when selecting a forex broker.

Importance of Regulation in Forex Brokers

Regulated brokers are subject to strict oversight, capital requirements, and operational standards that protect client funds and ensure fair trading practices. In contrast, unregulated brokers operate without supervision, potentially exposing clients to fraud, manipulation, or bankruptcy risks.

Common Regulatory Bodies for Forex Brokers

The forex industry is overseen by several key regulatory authorities, each with different rules and standards:

| Regulator | Jurisdiction | Leverage Limits | Key Protections |

|---|---|---|---|

| ASIC (Australian Securities and Investments Commission) | Australia | 1:30 max for retail | Negative balance protection, client fund segregation |

| FCA (Financial Conduct Authority) | United Kingdom | 1:30 max for retail | FSCS compensation up to £85,000, client money rules |

| CySEC (Cyprus Securities and Exchange Commission) | Cyprus/EU | 1:30 max for retail | ICF compensation up to €20,000, MiFID II compliance |

| VFSC (Vanuatu Financial Services Commission) | Vanuatu | No restrictions | Basic oversight, limited investor protection |

| IFSC (International Financial Services Commission) | Belize | No restrictions | Basic oversight, limited investor protection |

In 2025, the regulatory landscape continues to evolve, with tier-1 regulators (ASIC, FCA, CySEC) maintaining strict leverage caps and marketing restrictions implemented in 2018-2021. These measures aim to protect retail traders but may limit trading flexibility [MoneyHub](https://www.moneyhub.co.nz/forex-regulation.html).

How to Verify a Broker’s Regulation Status

Before opening an account, always verify a broker’s regulatory claims by:

- Checking the regulator’s official register (e.g., FCA Register, ASIC Connect)

- Confirming the entity name matches exactly

- Verifying the license number and permissions

- Looking for any regulatory warnings or actions

Remember that some brokers operate multiple entities with different regulations. The entity you’ll be signing up with determines your actual regulatory protection, not the group’s overall claims.

Trading Platforms and Tools

The trading platform you choose can significantly impact your trading experience, execution quality, and ultimately your profitability. Most low-commission brokers offer multiple platform options.

Platform Comparison: MT4 vs. MT5 vs. cTrader

MetaTrader 4

- Established, stable platform

- Extensive EA library

- 9 timeframes

- MQL4 programming

- Ideal for forex focus

MetaTrader 5

- Multi-asset platform

- 21 timeframes

- Economic calendar

- MQL5 programming

- Advanced order types

cTrader

- Modern, intuitive interface

- 26 timeframes

- C# programming (cBots)

- Advanced charting

- Level II pricing

According to our platform comparison research, MetaTrader 4 remains popular with forex-focused traders due to its simplicity and extensive EA ecosystem. MT5 offers more features and multi-asset capabilities, while cTrader provides the most modern interface and excellent execution tools [Axiory](https://www.axiory.com/en/trading-resources/platforms/mt4-vs-mt5-vs-ctrader).

TradingView Integration

A growing trend in 2025 is direct integration with TradingView, allowing traders to execute trades directly from TradingView charts. Several low-commission brokers now offer this capability:

- Fusion Markets

- Pepperstone

- Eightcap

- IC Markets (via partner API)

This integration combines TradingView’s advanced charting capabilities with direct trade execution, eliminating the need to switch between platforms. For technical traders, this can streamline workflow and improve trading efficiency.

How to Choose a Low-Commission Forex Broker

Selecting the right broker requires balancing commission costs with other crucial factors. Here’s a structured approach to making an informed decision:

Factors to Consider

Trading Volume and Activity

Your trading frequency and typical position size should guide your broker selection:

- High-frequency traders (10+ trades per day): Prioritize the absolute lowest commission rates and execution speed

- Moderate traders (1-10 trades per day): Balance commissions with platform features and quality

- Occasional traders (few trades per week): Focus more on reliability and support than marginal commission differences

Types of Accounts

Consider which account structure aligns with your trading style:

- Raw spread + commission: Better for frequent traders, especially on major pairs

- Standard (spread-only): Simpler for beginners or low-frequency traders

- Zero/ECN: Best execution and transparency for serious traders

- Islamic/Swap-free: For traders requiring Shariah compliance

Platforms and Execution Speed

The platform’s capabilities should match your trading requirements:

- Algorithmic traders: Need reliable API, backtesting tools, VPS hosting

- Technical traders: Require advanced charting, indicators, drawing tools

- Mobile traders: Focus on app functionality and stability

Execution speed is critical for short-term strategies; differences of 50-100ms can significantly impact results.

Leverage Options and Risk Management Tools

Consider both available leverage and risk management features:

- Tier-1 regulated brokers (ASIC, FCA, CySEC) cap retail leverage at 1:30

- Offshore regulated brokers may offer up to 1:500 or even 1:2000

- Look for guaranteed stop-loss (may incur fee)

- Check for negative balance protection

- Evaluate margin call and stop-out policies

Understanding the Impact of Low Commissions on Trading Strategy

Lower commission rates can transform the viability of certain trading strategies:

Long-Term Savings

Even small differences in commission rates compound significantly over time. Consider a trader executing 100 round-turn trades monthly at 1 standard lot:

- With Fusion Markets ($4.50/round turn): $450/month or $5,400/year

- With average broker ($7.00/round turn): $700/month or $8,400/year

- Annual savings: $3,000

Scalping vs. Day Trading

Commission impact varies by strategy:

- Scalping (targeting 1-5 pips): Commission costs can consume 20-100% of potential profit

- Day trading (targeting 10-30 pips): Commission costs represent 5-20% of potential profit

- Swing trading (targeting 50+ pips): Commission costs are relatively minor (1-5% of potential profit)

For scalpers especially, the difference between a $4.50 and $7.00 round-turn commission could determine whether a strategy is viable.

Pros and Cons of Low-Commission Forex Brokers

Before making your final decision, consider these advantages and potential trade-offs of choosing brokers with the lowest commissions:

Benefits of Choosing Low-Commission Brokers

- Increased Profitability: Lower costs directly improve trading margins

- Strategy Viability: Makes high-frequency trading approaches more feasible

- Transparency: Many low-commission brokers use ECN models with clear cost structures

- Competitive Edge: In competitive markets, even small cost advantages matter

Possible Trade-Offs with Low-Cost Brokers

- Limited Features: Some discount brokers may offer fewer research tools or platform options

- Reduced Support: Lower-cost operations might have fewer customer service resources

- Higher Minimum Deposits: Some raw spread accounts require higher initial funding

- Complex Fee Structure: Understanding commission + spread costs requires more analysis

Are Low Commissions Always the Best Option for Traders?

While low commissions are important, they shouldn’t be the sole deciding factor. Consider these scenarios where other factors might take precedence:

- New traders may benefit more from educational resources and reliable support than marginal commission savings

- Swing or position traders should focus on overnight holding costs and stability rather than commission rates

- Traders using exotic pairs should prioritize tight spreads and liquidity in those specific instruments

- Algo traders might accept higher commissions for superior API access and execution quality

Are Low-Commissions Always Better Than Zero-Commissions?

This common question requires nuanced understanding. Commission-free (standard account) trading isn’t truly “free”—the broker’s profit is built into wider spreads. For example:

EUR/USD Trade (1 standard lot)

- Raw Spread Account: 0.1 pip spread ($1.00) + $6.00 commission = $7.00 total cost

- Standard Account: 1.0 pip spread ($10.00) + $0 commission = $10.00 total cost

In most cases, the raw spread + commission model offers better value, especially for major pairs and larger trade sizes. However, standard accounts may be more cost-effective for:

- Exotic pairs where raw spreads are naturally wider

- Very small position sizes (micro-lots)

- Traders who value simplicity and predictability

Market Maker vs. ECN Brokers: Understanding the Difference

The broker’s business model—market maker or ECN—fundamentally affects how your trades are executed and the resulting costs.

Market Maker Brokers

How they work:

- Create and display their own bid/ask prices

- Act as direct counterparty to your trades

- Can trade against client positions

- Profit primarily from spread markups

Advantages:

- Fixed, predictable spreads

- No separate commissions

- Often more user-friendly platforms

- Guaranteed liquidity even in volatile markets

Disadvantages:

- Potential conflict of interest

- Wider effective spreads

- Possible price manipulation

- May restrict profitable trading strategies

ECN Brokers

How they work:

- Connect clients to multiple liquidity providers

- Display aggregated market quotes

- Match buyers and sellers without intervention

- Profit from transparent commission fees

Advantages:

- Tightest possible spreads

- No dealing desk intervention

- Price transparency

- Faster execution

Disadvantages:

- Explicit commission charges

- Variable spreads that widen during volatility

- Often less user-friendly platforms

- May have higher minimum deposits

Most low-commission brokers in our comparison operate primarily as ECN or STP (Straight Through Processing) brokers, as this model lends itself to transparent commission-based pricing. However, many brokers offer both market maker and ECN accounts to cater to different trader preferences [Investopedia](https://www.investopedia.com/articles/forex/06/ecnmarketmaker.asp).

Conclusion

Summary of Top Low-Commission Forex Brokers

After thorough analysis of the forex broker landscape in 2025, we can summarize our findings:

- Fusion Markets offers the absolute lowest commission rates at $2.25 per side, combined with competitive spreads and multiple platform options.

- Tickmill provides the best rates for GBP/EUR base currencies at £2.00/€2.00 per side, with solid regulatory coverage through the FCA.

- FP Markets combines a competitive $3.00 per side commission with exceptional 40ms execution speed and extensive trading tools.

- Pepperstone balances $3.50 per side commissions with institutional-grade liquidity and multiple tier-1 regulations.

- IC Markets offers $3.50 per side commissions with volume-based rebates and exceptional execution without order distance restrictions.

For most active forex traders, raw spread accounts with explicit commissions provide better value than standard spread-only accounts, despite the added commission cost.

Final Thoughts on Choosing the Best Forex Broker for Your Needs

When selecting a forex broker, commission rates should be just one factor in your decision-making process. Consider:

- Total trading costs: Spreads + commissions + other fees

- Execution quality: Speed, slippage, and price improvement

- Platform reliability: Uptime, stability, and feature set

- Regulatory protection: Jurisdiction and compensation schemes

- Customer support: Availability, knowledge, and responsiveness

For most traders, the optimal choice will balance cost efficiency with these other crucial factors. We strongly recommend opening demo accounts with multiple brokers to test their platforms, execution, and overall experience before committing real capital.

Key Takeaways for Reducing Trading Costs in Forex

Beyond choosing a low-commission broker, consider these strategies to further optimize your trading costs:

- Select the right base currency: Trading in your account’s base currency eliminates conversion fees

- Focus on major pairs: Major currency pairs typically have the tightest spreads

- Trade during peak liquidity hours: Spreads are typically tighter during overlapping market sessions

- Consider position sizing: Some brokers offer volume-based discounts

- Monitor overnight fees: Swap/financing costs can exceed commission costs for positions held multiple days

- Use limit orders: ECN brokers may allow trading within the spread using limit orders

- Test multiple brokers: Performance and costs vary by instrument and market conditions

By combining a low-commission broker with these cost-optimization strategies, traders can significantly improve their bottom line and trading performance.

Frequently Asked Questions

- What Is the Difference Between Spread and Commission?

- The spread is the difference between the buy (ask) and sell (bid) price of a currency pair, representing an indirect cost of trading. Commission is an explicit fee charged by brokers for executing trades. Spread-only accounts build the broker’s profit into wider spreads, while raw spread accounts charge a separate commission but offer tighter spreads.

- How Do Forex Brokers Calculate Commissions?

- Forex commissions are typically calculated per standard lot (100,000 units) of currency traded. For example, a commission of $3.50 per side means you’ll pay $3.50 when opening a position and another $3.50 when closing it—totaling $7.00 for a complete round-turn transaction. Some brokers adjust commissions based on the notional USD value of the trade, especially for cross-pairs not involving USD.

- Can You Trade Forex Without Paying Commissions?

- Yes, standard accounts offer commission-free trading, but the broker’s profit is built into wider spreads. While no explicit commission is charged, the total cost (spread) is typically higher than the combined spread + commission on raw spread accounts. There’s no such thing as truly “free” trading—brokers must make money through either spreads or commissions.

- Are There Hidden Costs with Low-Commission Brokers?

- Some low-commission brokers may offset their competitive rates with other fees, such as deposit/withdrawal charges, inactivity fees, or wider spreads on less popular pairs. Always check the complete fee schedule, including overnight financing rates, currency conversion fees, and any platform or data charges before opening an account.

- Do Low Commissions Affect Execution Quality?

- Not necessarily. Many top low-commission brokers like Fusion Markets, FP Markets, and IC Markets maintain excellent execution quality with speed under 50ms. However, some discount brokers may compromise on technology infrastructure or liquidity relationships. The best approach is to test execution on a demo account before committing real funds.

- Which Forex Broker Has the Lowest Overall Trading Costs?

- Based on our 2025 analysis, Fusion Markets offers the lowest overall trading costs with a commission of $2.25 per side ($4.50 round turn) and competitive raw spreads. However, the “lowest cost” can vary depending on which currency pairs you trade, your account base currency, and your typical position holding time.

- Are Low Commissions Suitable for All Types of Traders?

- Low-commission accounts are most beneficial for active traders who execute multiple trades per day or use strategies with small profit targets (like scalping). For swing or position traders holding positions for days or weeks, the impact of commission rates is less significant compared to overnight financing costs and spread quality.

- What Is the Minimum Deposit for Low-Commission Brokers?

- Minimum deposits vary widely among low-commission brokers. Fusion Markets and Pepperstone have no minimum deposit requirements, though they recommend starting with at least $200. FP Markets requires $100, Tickmill $100, and FXTM’s commission account requires $500. Generally, ECN/raw spread accounts tend to have higher minimum deposits than standard accounts.

- How Do Commission Rates Vary Between Brokers?

- In 2025, commission rates among top forex brokers range from $2.25 to $5.00 per side per standard lot. Some brokers offer volume-based discounts, where rates decrease as monthly trading volume increases. FXTM, for example, offers rates as low as $0.80 per lot for high-volume traders. Base currency also affects rates—GBP and EUR-based accounts often have different commission structures than USD accounts.

- Can Beginner Traders Benefit from Low Commissions?

- While beginners can benefit from low commissions, they should also consider platform usability, educational resources, and customer support quality. Beginners might find standard (spread-only) accounts easier to understand initially, as they don’t need to calculate separate commission costs. Once comfortable with trading basics, migrating to a raw spread + commission account can reduce costs.

- What Are the Risks of Choosing Brokers with Low Commissions?

- The primary risk is focusing too much on commission rates while overlooking other important factors like regulation, execution quality, and financial stability. Some brokers may offer low commissions but compensate with wider spreads on less popular pairs, higher overnight fees, or poor execution. Always research the broker’s regulatory status and test their platform before depositing significant funds.

- How Does Account Type Affect Commission Rates?

- Most brokers offer multiple account types with different commission structures. Standard accounts typically charge no commission but have wider spreads. Raw/ECN accounts charge explicit commissions but offer tighter spreads. Professional or VIP accounts may offer reduced commissions based on deposit size or trading volume. Some brokers also offer Islamic (swap-free) accounts with slightly modified commission structures to comply with Shariah law.

- Are Low Commissions Available on All Trading Platforms?

- Commission rates are typically consistent across a broker’s supported platforms (MT4, MT5, cTrader) for the same account type. However, some brokers may offer platform-specific promotions or pricing. For example, IC Markets charges $3.50 per side on MT4/MT5 but $3.00 per side on cTrader. Additionally, some brokers offer reduced commissions for trades executed via their proprietary platforms or mobile apps.

- Do Brokers Offering Low Commissions Have Good Customer Support?

- Commission rates and customer support quality aren’t necessarily correlated. Many low-commission brokers like Pepperstone and FP Markets are known for excellent customer service. However, some discount brokers may reduce support services to maintain low fees. Check independent reviews, test response times during demo account use, and verify support hours and available languages before committing.

- What Are Zero-Spread Accounts?

- “Zero-spread” accounts are a marketing term for raw spread accounts where the spread can reach 0.0 pips during ideal market conditions. These accounts always charge commissions, typically $3-$7 per round turn. While the spread may occasionally reach zero on major pairs during high liquidity periods, the average spread is usually 0.1-0.3 pips plus commission.

- Can I Get a No-Commission Account as a Beginner?

- Yes, most brokers offer standard accounts with no explicit commissions. These accounts are often marketed as “commission-free” but have wider spreads that include the broker’s profit margin. For beginners making smaller trades or trading infrequently, these accounts may be appropriate due to their simplicity and transparency in pricing.

- Are There Any Commission-Free Forex Brokers?

- Many brokers offer commission-free trading through standard accounts, but they earn revenue through wider spreads instead. True commission-free trading doesn’t exist, as brokers must profit somehow. Some brokers like AvaTrade focus exclusively on spread-based pricing without explicit commissions. The key is to compare the all-in cost (spread + commission) rather than focusing solely on whether a commission is charged.

- Do Low-Commission Brokers Offer Demo Accounts?

- Yes, virtually all forex brokers, including those with low commissions, offer free demo accounts. These practice accounts let you test the broker’s platforms, execution quality, and pricing structure without risking real money. Demo testing is essential before selecting a broker, as it allows you to verify advertised spreads and execution quality in real-world conditions.

- What Are the Pros and Cons of Trading with Low-Commissions?

- Pros: Lower overall trading costs, better profitability potential for high-frequency strategies, more transparent pricing, and typically better execution through ECN models. Cons: More complex cost calculation (spread + commission), potentially higher minimum deposits, separate charges on each trade, and sometimes fewer integrated tools or educational resources compared to full-service brokers.

- What Is the Difference Between ECN and Market Maker Brokers?

- ECN (Electronic Communication Network) brokers connect traders directly to the interbank market, displaying raw market spreads and charging separate commissions. They don’t trade against clients. Market makers create their own prices, act as counterparties to client trades, and profit from spread markups without explicit commissions. ECN brokers typically offer better execution and transparency but require commissions, while market makers offer simpler pricing but may have conflicts of interest.

- How Do Volume-Based Rebates Work?

- Volume-based rebates reduce commission rates as monthly trading volume increases. For example, IC Markets offers rebates of 5% for $10M-$50M monthly volume, 10% for $50M-$100M, and 15% for over $100M. FXTM’s commission can drop from $4.00 to $0.80 per lot based on volume. These programs benefit high-volume and institutional traders but typically require substantial trading activity to reach meaningful discount tiers.

- What Are the Risks of Using High Leverage?

- While high leverage (above 1:30) can amplify profits, it also magnifies losses and can quickly deplete trading capital. Risks include: margin calls and forced liquidation during minor price movements, increased emotional stress leading to poor decisions, potentially losing more than your deposit without negative balance protection, and developing poor risk management habits. Tier-1 regulators limit retail leverage to 1:30 specifically to protect traders from these risks.

- Are Islamic Accounts Truly Free of Swap Fees?

- Islamic (swap-free) accounts comply with Shariah law by eliminating interest-based overnight fees. However, brokers typically replace these with “administrative fees” after positions are held beyond a certain period (often 5 days). These administrative charges often approximate or exceed conventional swap charges. The structure is modified to comply with Islamic principles technically, but the economic effect is similar to standard accounts.

- How Can I Test a Broker’s Fee Structure Before Opening an Account?

- Open a demo account and execute trades in your typical size, noting the spread when you enter and exit positions, plus any commissions charged. Calculate total costs per trade and compare across different brokers. Some brokers also offer commission calculators on their websites. Additionally, review the full fee disclosure document required by most regulators, which details all possible charges including overnight fees, inactivity fees, and withdrawal costs.

- Which Brokers Offer the Best Trading Platforms?

- Platform quality is somewhat subjective, but in 2025, Pepperstone is recognized for offering the most comprehensive platform selection (MT4, MT5, cTrader, TradingView). IC Markets provides excellent MT4/MT5 customization options and cTrader integration. FP Markets offers advanced MT4/MT5 plugins and Iress for stock trading. Each platform has strengths: MT4 for simplicity and EAs, MT5 for multi-asset access, cTrader for modern interface and execution, and TradingView for advanced charting.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.