Key Takeaways

- Fusion Markets offers the lowest commission rates at just $2.25 per side ($4.50 round-turn)

- Pepperstone and IC Markets provide excellent ECN execution with commissions from $3.50 per side

- FCA-regulated brokers like Tickmill offer £2 per side for GBP-based accounts

- Compare both spreads and commissions when evaluating the total trading cost

- Always test platforms via demo accounts before committing capital

Introduction to Low Commission Forex Trading

What Are Forex Commissions and Why Do They Matter?

Forex commissions are fees charged by brokers for executing your trades in the foreign exchange market. Unlike spreads (the difference between buying and selling prices), commissions are typically fixed amounts charged per lot traded. For active traders—especially those executing multiple trades daily—even small differences in commission rates can dramatically impact overall profitability.

Let’s put this into perspective: if you’re trading 10 standard lots daily (each representing $100,000), a commission difference of just $1 per side means saving $20 per day, or over $5,000 annually, assuming you trade 260 days per year. That’s why finding brokers with the lowest commissions isn’t just about pinching pennies—it’s about preserving a significant portion of your potential profits.

The Importance of Low Commissions in Forex Trading

For high-frequency traders, scalpers, and day traders who capitalize on small price movements, trading costs become especially critical. When your target profit might be just 5-10 pips per trade, paying excessive commissions can be the difference between a profitable strategy and a losing one.

Imagine forex trading is like running a retail store. Your spread is like the markup on products, while commissions are like the credit card processing fees. Just as a store with razor-thin margins needs to negotiate the lowest possible payment processing fees to remain profitable, forex traders with tight profit targets need the lowest possible commissions to keep their strategies viable.

How Commissions Impact Your Trading Profits

Every time you enter and exit a position, commissions eat into your potential returns. Let’s illustrate with a practical example:

A trader using a strategy that generates 15 pips of profit per trade, trading 5 standard lots per position:

| Scenario | Broker A (Commission: $7 round-turn) | Broker B (Commission: $4.50 round-turn) |

|---|---|---|

| Gross Profit (15 pips × 5 lots) | $75.00 | $75.00 |

| Commission Cost (5 lots) | $35.00 | $22.50 |

| Net Profit | $40.00 | $52.50 |

| Profit Difference | -31.3% | +31.3% |

As illustrated above, the lower commission broker provides 31.3% higher net profits from the exact same trading opportunity. Over hundreds of trades, this difference compounds significantly.

Understanding the Difference Between Commissions and Spreads

Before diving deeper into specific brokers, it’s crucial to understand how commissions differ from spreads:

| Feature | Spread | Commission |

|---|---|---|

| Definition | Difference between bid and ask prices | Fixed fee charged per trade or lot |

| Variability | Often variable, widens during volatility | Fixed, regardless of market conditions |

| Transparency | Less transparent, can change without notice | Highly transparent, clearly stated fee |

| Cost Structure | Built into price quote | Added separately to transaction |

| Typical Account Type | Standard accounts (wider spreads, no commission) | ECN/Raw accounts (tighter spreads plus commission) |

As a trader, understanding this distinction is vital. ECN (Electronic Communication Network) accounts typically offer raw interbank spreads with a separate commission, while standard accounts bundle the broker’s profit into wider spreads with no explicit commission. For high-volume traders, the ECN model is often more cost-effective despite the visible commission charges.

Key Factors to Consider When Selecting a Forex Broker with Low Commissions

When evaluating brokers for low commission trading, consider these factors beyond just the headline commission rate:

- Total trading cost (spread + commission)

- Regulatory status and financial security

- Execution quality and speed

- Platform technology and reliability

- Additional fees (deposit/withdrawal/inactivity)

- Customer support quality and availability

- Available trading instruments beyond forex

In the following sections, we’ll analyze the leading low-commission forex brokers of 2025, comparing their offerings across these key factors to help you make an informed decision tailored to your trading needs.

Top Forex Brokers with Lowest Commissions

Based on our comprehensive analysis of commission structures, trading conditions, and overall service quality, here are the top forex brokers offering the lowest commissions in 2025:

Fusion Markets

Overview

Fusion Markets has established itself as the clear leader in low-commission forex trading. Founded with the specific mission of reducing trading costs, this Australian broker combines industry-leading commission rates with competitive spreads and robust platform offerings.

Commission Structure and Pricing

Fusion Markets offers one of the most straightforward and competitive commission structures in the industry:

- Zero Account: $2.25 per standard lot per side ($4.50 round-turn)

- Raw spreads from 0.0 pips on major pairs

- No deposit or withdrawal fees

- No account maintenance fees

- Reasonable overnight financing costs

For traders who prefer a spread-only model, Fusion Markets also offers a Classic Account with no commission and slightly wider spreads.

Account Types Available

Fusion Markets provides two primary account types:

- Zero Account: Raw interbank spreads plus $2.25 commission per side

- Classic Account: No commission with slightly wider spreads

Both accounts feature flexible leverage up to 1:500 (subject to regulatory restrictions), no minimum deposit requirement, and access to all supported trading platforms.

Trading Platforms and Execution

Fusion Markets supports the industry-standard MetaTrader 4 and MetaTrader 5 platforms, along with cTrader for those who prefer its advanced charting and execution capabilities. According to independent research by [CompareForexBrokers](https://www.compareforexbrokers.com/our-methodology/execution-speeds/), Fusion Markets ranks among the top three brokers globally for execution speed, making it particularly suitable for scalpers and high-frequency traders.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

Pepperstone

Overview

Pepperstone is a globally recognized forex and CFD broker known for its high-quality execution, competitive pricing, and exceptional customer service. With multiple regulatory licenses and a strong track record, Pepperstone has become a favorite among both novice and experienced traders.

Commission Structure and Pricing

Pepperstone’s commission structure is competitive, though slightly higher than Fusion Markets:

- Razor Account: $3.50 per standard lot per side ($7.00 round-turn)

- Raw spreads from 0.0 pips on major pairs

- No deposit fees

- Some withdrawal methods may incur small fees

For cTrader users, Pepperstone charges $3.00 per standard lot per side, slightly lower than their MT4/MT5 commission rate.

Account Types Available

Pepperstone offers two main account types:

- Razor Account: Raw spreads plus commission, ideal for active traders

- Standard Account: No commission, wider spreads, suitable for beginners

Both account types feature no minimum deposit requirement, making Pepperstone accessible to traders with varying capital levels.

Trading Platforms and Execution

Pepperstone supports a wide range of trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView integration

Execution quality is a particular strength of Pepperstone, with over 20 liquidity providers ensuring tight spreads and minimal slippage. Their Smart Routing system directs orders to the most optimal liquidity providers in real-time.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

IC Markets

Overview

IC Markets is one of the world’s largest forex brokers by volume, specializing in ECN trading with a focus on professional and institutional traders. Established in Australia, IC Markets has expanded globally and maintains a reputation for tight spreads and excellent execution.

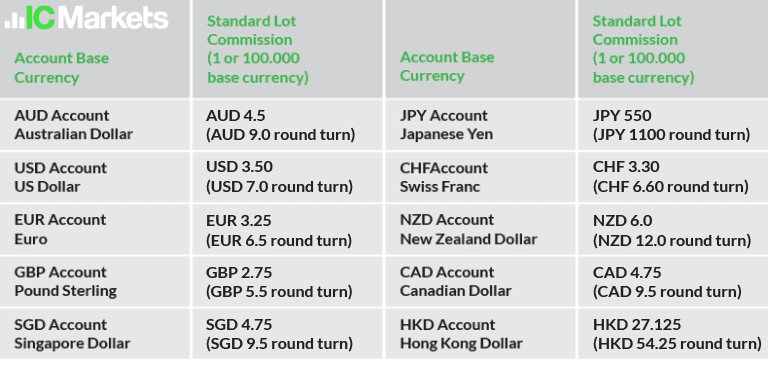

Commission Structure and Pricing

IC Markets offers competitive commission rates, though not the absolute lowest:

- Raw Spread Account: $3.50 per standard lot per side ($7.00 round-turn)

- Raw spreads from 0.0 pips on major pairs

- No deposit fees

- Some withdrawal methods may incur fees depending on region

IC Markets’ Standard Account offers zero commissions with slightly wider spreads, making it suitable for less active traders who prefer a simplified fee structure.

Account Types Available

IC Markets offers three main account types:

- Raw Spread Account (MT4/MT5): Commission-based with raw spreads

- cTrader Account: Commission-based with raw spreads

- Standard Account: No commission, wider spreads

All accounts feature leverage up to 1:500 (subject to regulatory restrictions) and a minimum deposit of $200.

Trading Platforms and Execution

IC Markets supports all major trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

The broker is particularly known for its server infrastructure, with equinix NY4 servers providing ultra-low latency execution—a key advantage for algorithmic traders and scalpers.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

FP Markets

Overview

FP Markets is an established Australian broker with a strong reputation for combining competitive pricing with excellent trading conditions. Known for their technology focus, FP Markets appeals to both newer traders and experienced professionals.

Commission Structure and Pricing

FP Markets offers a competitive commission structure:

- Raw Account: $3.00 per standard lot per side ($6.00 round-turn)

- Raw spreads from 0.0 pips on major pairs

- No deposit fees

- Some withdrawal methods may incur small fees

Account Types Available

FP Markets offers several account types to cater to different trading preferences:

- Raw Account: ECN pricing with commission

- Standard Account: No commission with wider spreads

- Islamic Account: Swap-free option for Islamic traders

The minimum deposit for a standard account is $100, while the Raw account requires a minimum of $100 to start trading.

Trading Platforms and Execution

FP Markets provides access to multiple trading platforms:

- MetaTrader 4

- MetaTrader 5

- Iress Trader (for stocks and equities)

The broker enhances their MT4 and MT5 offerings with 12 additional plugins and features, including advanced charting tools and VPS hosting services. Their ECN execution model delivers minimal slippage and fast order execution.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

Eightcap

Overview

Eightcap is an Australian broker that has gained popularity for its competitive pricing, strong regulatory framework, and focus on trader education. In recent years, they’ve expanded their offering to include a comprehensive range of crypto CFDs alongside traditional forex pairs.

Commission Structure and Pricing

Eightcap’s commission structure is in line with other major ECN brokers:

- Raw Account: $3.50 per standard lot per side ($7.00 round-turn)

- Raw spreads starting from 0.0 pips

- No deposit or withdrawal fees

Account Types Available

Eightcap offers two primary account types:

- Raw Account: Commission-based with tighter spreads

- Standard Account: No commission with wider spreads

Islamic accounts are available upon request, allowing swap-free trading in compliance with Islamic law.

Trading Platforms and Execution

Eightcap supports industry-standard platforms:

- MetaTrader 4

- MetaTrader 5

- TradingView integration

A particular strength is their support for automated trading with tools like Capitalise.ai for strategy automation without coding knowledge.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

How to Choose a Low-Commission Forex Broker

Regulation and Security

When evaluating low-commission brokers, regulation should be your first consideration. A broker’s regulatory status directly impacts your fund security and the protections available to you as a trader.

Major Forex Regulatory Bodies and Their Requirements

- FCA (UK): Requires client fund segregation, maintains the Financial Services Compensation Scheme (FSCS) protecting up to £85,000 per client, and limits retail leverage to 30:1 for major pairs.

- ASIC (Australia): Imposes strict capital requirements, mandates client fund segregation, and limits retail leverage to 30:1 for major pairs since 2021.

- CySEC (Cyprus): Enforces MiFID II rules, provides investor compensation up to €20,000, and follows ESMA leverage restrictions.

Always verify a broker’s regulatory status directly through the regulator’s website. For example, FCA-regulated brokers can be verified through the Financial Services Register.

Trading Platforms and Tools

The trading platform serves as your interface with the markets, so its capabilities directly impact your trading experience and execution quality. When comparing low-commission brokers, consider these platform factors:

MetaTrader 4 vs. MetaTrader 5 vs. cTrader

| Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| User Interface | Classic, simpler | Modern, more complex | Modern, highly customizable |

| Market Types | Forex, CFDs | Forex, CFDs, Stocks, Futures | Forex, CFDs, Cryptos |

| Timeframes | 9 timeframes | 21 timeframes | 26 timeframes |

| Execution Types | Market, Pending | Market, Pending, Exchange | Market, Pending, OCO, DOM |

| Algorithmic Trading | MQL4, EAs | MQL5, EAs | cAlgo, cBots |

| Depth of Market | Limited | Advanced | Comprehensive |

| Best For | Forex traders, EA users | Multi-market traders | ECN traders, scalpers |

Account Types

Standard vs. ECN Accounts

Understanding the difference between standard and ECN accounts is crucial when evaluating low-commission brokers:

| Feature | Standard Account | ECN Account |

|---|---|---|

| Commission Structure | No explicit commission | Fixed commission per lot |

| Spreads | Wider (broker markup) | Raw/tighter (interbank) |

| Order Execution | Often market maker | Direct to liquidity providers |

| Requotes | More common | Less common |

| Slippage | More likely | Typically lower |

| Minimum Deposit | Generally lower | Often higher |

| Best For | Beginners, casual traders | Active traders, scalpers |

Raw Spread Accounts

Raw spread accounts provide direct access to interbank liquidity, giving traders the most competitive spreads available but with a separate commission fee. These accounts are ideal for:

- High-frequency traders who benefit from minimal spreads

- Scalpers targeting small price movements

- Algorithmic traders who need predictable execution

- Professional traders who prefer transparency in fee structure

Islamic (Swap-Free) Accounts

Islamic accounts comply with Sharia law by eliminating overnight swap fees (interest). Instead, brokers may charge alternative administrative fees or slightly higher commissions. These accounts are essential for:

- Muslim traders adhering to Islamic financial principles

- Traders who hold positions for multiple days but want to avoid swap fees

- Long-term position traders with strategies spanning weeks or months

Note that not all low-commission brokers offer Islamic accounts. Among our top picks, FP Markets and Eightcap provide dedicated Islamic account options.

Currency Pairs Offered

The range of available currency pairs varies significantly among brokers. While most offer major pairs (EUR/USD, GBP/USD, USD/JPY) with competitive commissions, the selection of exotic pairs and cross-rates may differ. Consider:

- Fusion Markets: 80+ currency pairs

- IC Markets: 61+ currency pairs

- Pepperstone: 70+ currency pairs

- FP Markets: 63 currency pairs

- Eightcap: 56 currency pairs

If your trading strategy involves specific exotic pairs, verify their availability and commission structure before opening an account.

Minimum Deposit Requirements

Minimum deposit requirements can be a factor for traders starting with limited capital. Among our recommended low-commission brokers:

| Broker | Minimum Deposit |

|---|---|

| Fusion Markets | No minimum |

| Pepperstone | No minimum |

| IC Markets | $200 |

| FP Markets | $100 |

| Eightcap | $100 |

Customer Support and Education

Even with low commissions, quality customer support and educational resources remain important considerations:

- Pepperstone offers excellent 24/5 customer support and extensive educational resources

- IC Markets provides good technical support but more limited educational content

- Fusion Markets offers responsive support but fewer educational materials than some competitors

- FP Markets features strong educational content, particularly for technical analysis

- Eightcap provides solid support with growing educational offerings

If you’re new to forex trading, prioritizing brokers with comprehensive learning resources may be worth considering alongside commission rates.

Additional Costs to Watch Out For

Spreads and Their Impact on Overall Costs

While this article focuses on commissions, spreads remain a significant component of your total trading costs. Even with identical commission rates, brokers may offer different spread levels:

| Broker | EUR/USD Raw Spread (Average) | EUR/USD Standard Account (Average) |

|---|---|---|

| Fusion Markets | 0.0 pips | 0.8 pips |

| Pepperstone | 0.0 pips | 1.0 pips |

| IC Markets | 0.0 pips | 1.0 pips |

| FP Markets | 0.0 pips | 1.0 pips |

| Eightcap | 0.0 pips | 1.0 pips |

Overnight Financing Charges (Swaps)

Positions held overnight incur swap charges based on the interest rate differential between the currency pairs. These charges vary significantly between brokers and can substantially impact profitability for positions held for multiple days.

For example, a long EUR/USD position might incur a daily swap fee of -$0.80 per standard lot at one broker, while another might charge -$1.20 for the same position. For swing traders holding positions for weeks, this difference can add up quickly.

Inactivity Fees and Other Hidden Charges

Some brokers charge additional fees that may not be immediately apparent:

- Inactivity fees (typically after 3-12 months without trading)

- Currency conversion fees when depositing/withdrawing in different currencies

- Processing fees for certain payment methods

- Data subscription fees for advanced market data

Among our recommended low-commission brokers:

- Fusion Markets: No inactivity fees

- Pepperstone: No inactivity fees

- IC Markets: $15 monthly after 3 months inactivity

- FP Markets: $50 after 12 months inactivity

- Eightcap: No inactivity fees

Trading Volume and Activity

Your trading volume and activity level should significantly influence your broker choice. High-frequency traders benefit most from the lowest possible commissions, while occasional traders might prioritize other factors.

Some brokers offer volume-based discounts or rebates for active traders. For instance, FXTM (not in our top 5 but worth mentioning) offers tiered commission rates that decrease as monthly volume increases—from $4.00 per standard lot down to as little as $0.80 for high-volume traders.

Platforms and Execution Speed

Execution speed becomes increasingly important as your trading frequency increases. For scalpers and algorithmic traders, even milliseconds matter. Independent testing by [CompareForexBrokers](https://www.compareforexbrokers.com/our-methodology/execution-speeds/) found that:

- Fusion Markets ranked third-fastest globally for execution

- IC Markets offers ultra-low latency via equinix NY4 servers

- Pepperstone provides consistent execution with minimal slippage

The platform you choose also impacts execution. cTrader typically offers the most advanced execution capabilities, followed by MT5 and MT4.

Understanding the Impact of Low Commissions on Trading Strategy

Long-Term Savings

Let’s calculate the long-term impact of different commission rates on your trading profitability. Consider a moderately active trader executing 100 standard lots monthly:

| Broker | Commission Per Lot (Round-Turn) | Monthly Cost (100 lots) | Annual Cost |

|---|---|---|---|

| Fusion Markets | $4.50 | $450 | $5,400 |

| FP Markets | $6.00 | $600 | $7,200 |

| Pepperstone/IC Markets/Eightcap | $7.00 | $700 | $8,400 |

| Average Industry Rate | $10.00 | $1,000 | $12,000 |

The annual difference between trading with Fusion Markets versus an average industry broker amounts to $6,600—potentially transforming a break-even strategy into a profitable one.

Scalping vs. Day Trading

Your trading style significantly impacts how much commission rates affect your bottom line:

| Trading Style | Average Profit Target | Commission Impact | Best Account Type |

|---|---|---|---|

| Scalping | 1-5 pips | Very High | ECN/Raw with lowest possible commission |

| Day Trading | 10-50 pips | High | ECN/Raw with low commission |

| Swing Trading | 50-200 pips | Moderate | ECN or Standard, depending on swap rates |

| Position Trading | 200+ pips | Low | Standard or swap-free, focus on swap costs |

For scalpers, the difference between a $4.50 and $7.00 round-turn commission represents a substantial percentage of the target profit. With a 5-pip target on EUR/USD (approximately $5 per standard lot), the commission difference of $2.50 equates to 50% of the potential profit.

How to Compare Forex Brokers Based on Commission Fees

The Impact of Commission on Profitability

To understand how commissions impact your trading, consider this practical example:

| Scenario | High Commission ($7.00) | Low Commission ($4.50) |

|---|---|---|

| Trade Size | 1 standard lot | 1 standard lot |

| Win Rate | 50% | 50% |

| Average Win | $20.00 | $20.00 |

| Average Loss | $10.00 | $10.00 |

| Commission Per Trade | $7.00 | $4.50 |

| Expected Value Per Trade | $1.50 | $4.00 |

| Monthly Profit (100 trades) | $150 | $400 |

In this example, the exact same trading strategy produces 167% higher profits with the lower commission broker—highlighting why commission rates matter tremendously for active traders.

How to Calculate Effective Commission Costs

To accurately compare brokers, follow this simple calculation method:

Total Trading Cost Formula:

Total Cost = (Spread in pips × pip value) + (Commission per side × 2)

For example, trading 1 standard lot of EUR/USD:

- Broker A: 0.5 pip spread + $7.00 round-turn commission = $5.00 (spread) + $7.00 = $12.00 total cost

- Broker B: 1.2 pip spread + $4.50 round-turn commission = $12.00 (spread) + $4.50 = $16.50 total cost

Despite Broker B having a lower commission, the total cost is higher due to wider spreads. This illustrates why comparing the combined cost is essential.

Calculating Total Trading Costs

Commission + Spread Formula

For accurate comparison, convert both spreads and commissions to the same unit (typically USD per standard lot):

- Convert spread to dollar value: Spread in pips × $10 per pip (standard lot EUR/USD)

- Add round-turn commission

- Result = total transaction cost per standard lot

Factoring in Lot Sizes and Trade Volume

Commission structures may vary based on lot size. Typically:

- Standard Lot (100,000 units): Full commission

- Mini Lot (10,000 units): 1/10 of standard commission

- Micro Lot (1,000 units): 1/100 of standard commission

For example, Fusion Markets charges $2.25 per standard lot per side, which equates to approximately $0.225 for a mini lot.

Using Cost Calculators Provided by Brokers

Many brokers provide trading cost calculators on their websites. For instance, FOREX.com offers an FX Commission Calculator that computes commission based on trade size. Using these tools allows for precise cost estimation before opening an account.

Independent calculators, such as the BrokerChooser Forex Fee Calculator, can provide unbiased comparisons across multiple brokers.

Pros and Cons of Low-Commission Forex Brokers

Benefits of Choosing Low-Commission Brokers

- Increased Profitability: Lower transaction costs directly improve your bottom line, especially for frequent traders.

- Strategy Viability: Lower commissions make certain strategies viable (like scalping) that would be unprofitable with higher fees.

- Transparent Pricing: Commission-based accounts typically offer raw spreads, providing more transparency than spread-only accounts.

- Improved Execution: ECN/STP models used by most low-commission brokers typically offer superior execution with no dealing desk intervention.

- Institutional-Grade Access: Many low-commission brokers provide direct market access similar to what institutional traders receive.

Possible Trade-Offs with Low-Cost Brokers

- Potentially Higher Minimum Deposits: Some low-commission brokers require higher initial deposits, though this isn’t universal.

- Less Educational Resources: Some discount brokers may offer fewer educational materials compared to full-service brokers.

- Limited Product Range: Some low-cost brokers focus primarily on forex and may offer fewer other asset classes.

- Reduced Customer Support: While not always the case, some discount brokers may provide less comprehensive support.

- Fewer Additional Features: Value-added services like trade signals or premium research might be limited.

Are Low Commissions Always the Best Option for Traders?

While low commissions are beneficial, they’re not the only factor to consider. Different trader profiles may prioritize different aspects:

| Trader Type | Primary Concern | Secondary Concern | Ideal Broker Type |

|---|---|---|---|

| Beginner | Education and support | Platform ease-of-use | Standard account with good education |

| Scalper | Low commission | Fast execution | Lowest possible commission ECN |

| Day Trader | Total trading cost | Platform stability | Low commission ECN with reliable platform |

| Swing Trader | Swap rates | Spread + commission | Broker with competitive swap rates |

| Algorithmic Trader | Execution reliability | Low latency | Broker with VPS hosting and fast servers |

The ideal approach is to prioritize factors based on your specific trading style and needs. For high-frequency traders, commission rates should be a top consideration, while occasional traders might prioritize other factors like platform features or educational resources.

Tips for Maximizing Savings with Low Commission Brokers

Volume-Based Discounts and Rebates

Many brokers offer tiered pricing structures or rebate programs that reward higher trading volumes with reduced commissions:

- Tiered Commission Structures: Commission rates decrease as monthly volume increases

- Loyalty Programs: Points or rewards based on trading activity that can be converted to commission rebates

- VIP Programs: Special rates for traders who maintain high account balances or trading volumes

While our top-rated low-commission brokers already offer competitive flat rates, traders with substantial volume might negotiate even better terms directly with their account managers.

Choosing the Right Account Type for Your Trading Style

Match your account type to your trading style for optimal cost efficiency:

- For high-frequency trading: ECN/Raw accounts with the lowest possible commission

- For moderate trading: Balance commission rates with other features like platform tools

- For overnight positions: Focus on swap rates rather than commission alone

- For beginners: Consider standard accounts until trading volume justifies the ECN model

Remember that the lowest commission isn’t always the most economical choice if other fees or wider spreads offset the savings.

Leveraging Promotional Offers and Bonuses

While rare among regulated brokers, some offer promotional benefits that can effectively reduce your trading costs:

- Commission-free trading periods

- Deposit bonuses that increase your trading capital

- Cashback programs that refund a percentage of your commission costs

- Free VPS hosting for algorithmic traders

Approach promotions cautiously, however. Always read the terms and conditions, as some offers come with trading volume requirements or withdrawal restrictions that may offset the apparent benefits.

Think of forex broker commissions like airline baggage fees. The advertised low price might seem attractive, but the real cost becomes apparent only when you add up all the extras. Just as a savvy traveler compares the all-in cost of flights including baggage and seat selection, a smart trader evaluates the total trading cost including spreads, swaps, and other fees—not just the headline commission rate.

Comparing Low Commission Brokers: A Side-by-Side Analysis

Commission Rates Comparison Table

| Broker | USD Commission (Per Side) | Round-Turn Cost | Min EUR/USD Spread | Total Cost (1 std lot) |

|---|---|---|---|---|

| Fusion Markets | $2.25 | $4.50 | 0.0 pips | $4.50 |

| FP Markets | $3.00 | $6.00 | 0.0 pips | $6.00 |

| Pepperstone | $3.50 | $7.00 | 0.0 pips | $7.00 |

| IC Markets | $3.50 | $7.00 | 0.0 pips | $7.00 |

| Eightcap | $3.50 | $7.00 | 0.0 pips | $7.00 |

Minimum Deposit Requirements Comparison

| Broker | Standard Account | ECN/Raw Account | Demo Account Available |

|---|---|---|---|

| Fusion Markets | No minimum | No minimum | Yes |

| Pepperstone | No minimum | No minimum | Yes (90-day limit) |

| IC Markets | $200 | $200 | Yes |

| FP Markets | $100 | $100 | Yes |

| Eightcap | $100 | $100 | Yes |

Trading Platform Features Comparison

| Broker | MetaTrader 4 | MetaTrader 5 | cTrader | Other Platforms |

|---|---|---|---|---|

| Fusion Markets | ✓ | ✓ | ✓ | None |

| Pepperstone | ✓ | ✓ | ✓ | TradingView |

| IC Markets | ✓ | ✓ | ✓ | None |

| FP Markets | ✓ | ✓ | ✗ | Iress |

| Eightcap | ✓ | ✓ | ✗ | TradingView |

The Future of Forex Commissions: Trends and Predictions

The Impact of Technology on Brokerage Fees

Technological advancements continue to drive down brokerage costs across the financial industry. Several key developments are reshaping commission structures in forex trading:

- Automated Trade Matching: Sophisticated algorithms have reduced the human component in trade execution, lowering operational costs for brokers.

- Cloud Infrastructure: Transition from physical server farms to cloud-based solutions has reduced overhead costs.

- Competition from Fintech Startups: New entrants are challenging established brokers with lean business models and lower fee structures.

- Blockchain Technology: Though still emerging, blockchain-based settlement systems promise to further reduce transaction costs.

As these technologies mature, we can expect continued downward pressure on commission rates, potentially driving industry standards below current leader Fusion Markets’ $2.25 per side rate in coming years.

Regulatory Changes Affecting Commission Structures

Regulatory developments are playing a significant role in shaping broker commission structures:

- Increased Transparency Requirements: Regulators like the FCA and ASIC are pushing for greater fee transparency, making it harder for brokers to hide costs in spreads or other charges.

- Payment for Order Flow (PFOF) Scrutiny: Growing regulatory scrutiny of PFOF practices may impact how some brokers generate revenue, potentially affecting their commission models.

- Capital Requirements: Higher capital requirements imposed by regulators increase operational costs, potentially putting upward pressure on commissions for smaller brokers.

Recent Regulatory Updates (2024-2025)

- FCA (UK): Maintains leverage caps at 30:1 for major pairs for retail traders; the Financial Services Compensation Scheme (FSCS) protects client funds up to £85,000.

- ASIC (Australia): In March 2025, implemented the Derivative Transaction Rules (Reporting) 2024, requiring more precise reporting of forex trades; maintains leverage caps of 30:1 for major pairs.

- CySEC (Cyprus): Has increased audit frequency with over 850 audits conducted in 2024 and issued €2.76 million in fines; maintains alignment with ESMA regulations on leverage and client protection.

Emerging Commission Models in the Forex Industry

The forex industry is witnessing the emergence of alternative commission models:

- Subscription-Based Pricing: Fixed monthly fees in exchange for commission-free trading, similar to models that have gained popularity in stock trading.

- Volume-Tiered Structures: More sophisticated tiered pricing based on trading volume, with rates automatically decreasing as traders reach certain thresholds.

- Bundled Services: Combining trading services with premium features like advanced analytics, trading signals, or education at competitive package prices.

- Revenue Sharing: Models where brokers share a percentage of their spread revenue with active traders, effectively reducing net trading costs.

These evolving models offer traders more options to align their commission structures with their specific trading styles and volume levels. As competition intensifies, we can expect more innovation in this area, giving traders greater flexibility in how they pay for execution services.

Conclusion

Key Takeaways for Choosing a Low-Commission Forex Broker

- Consider the total trading cost (spread + commission) rather than focusing solely on the commission rate

- Match your broker and account type to your specific trading style and frequency

- Verify regulatory status and client fund protection measures

- Test execution quality and platform features through demo accounts before committing

- Watch for hidden fees that can offset savings from low headline commission rates

- Consider volume-based discounts if you’re a high-volume trader

Recap of the Top Low-Commission Forex Brokers

Based on our comprehensive analysis, the top forex brokers offering the lowest commissions in 2025 are:

- Fusion Markets: The overall winner with $2.25 per side commission and competitive spreads

- FP Markets: Strong contender with $3.00 per side and excellent trading conditions

- Pepperstone: Premium option with $3.50 per side, superior execution, and exceptional service

- IC Markets: Institutional-grade execution with $3.50 per side and ultra-tight spreads

- Eightcap: Strong offering at $3.50 per side with excellent crypto CFD options

Final Thoughts on Choosing the Best Forex Broker for Your Needs

While commission rates are important, the best forex broker for your needs depends on your individual trading goals, style, and preferences. A broker offering slightly higher commissions might actually provide better overall value through superior execution, platform features, or customer service.

Take the time to test multiple brokers through demo accounts, evaluating not just their commissions but also their execution quality, platform reliability, and overall trading experience. Remember that even small differences in execution quality can outweigh modest commission savings, particularly for active traders.

The Importance of Ongoing Research in the Dynamic Forex Market

The forex brokerage landscape continues to evolve rapidly, with commission structures, regulatory requirements, and technological capabilities in constant flux. What represents the best value today may change tomorrow as brokers adjust their offerings and new competitors enter the market.

Maintain a practice of periodically reviewing your broker’s performance and comparing it against alternatives. This ongoing evaluation process ensures you’re always getting the best possible value for your trading activity and helps you adapt to changing market conditions and personal trading needs.