Did you know 83% of new traders overlook risk-free starting capital when entering currency markets? That’s like skipping free samples at your favorite store—except here, the “samples” can grow into real profits. In 2025, top trading platforms are rolling out no-strings-attached offers that let you test strategies without emptying your wallet first.

We’ve analyzed dozens of platforms to find the deals that actually work for beginners. Imagine getting extra funds just for signing up—no deposit required. These aren’t gimmicks. They’re springboards designed to help you learn while earning, like training wheels for your trading journey.

Here’s the kicker: Verification now takes under 10 minutes via email. No paperwork shuffle. Just quick access to live markets. And timing matters—these offers evolve faster than TikTok trends. Right now, you’ll find the sweet spot between generous bonuses and flexible terms.

Key Takeaways

- 2025’s best offers require zero upfront deposits

- Instant email verification speeds up market access

- Bonus funds act as risk-free learning tools

- Limited-time deals favor early adopters

- Beginner-friendly platforms dominate this year’s rankings

Understanding Forex Trading and Welcome Bonuses

Think of welcome bonuses as training wheels for your first bike ride through currency markets. These offers give fresh traders breathing room to learn the rules of the road without burning through personal funds. Let’s break down why these deals became the Swiss Army knives of modern trading.

Free Money With Strings Attached?

Platforms like Trading.com hand out no-deposit credits—imagine finding $50 in your account just for signing up. RoboForex takes a different approach, matching your first deposit like a generous relative doubling your birthday cash. Both types share one rule: you can’t withdraw bonus funds until hitting specific trading targets.

From Practice to Profit

Here’s the magic—using bonus cash teaches market rhythms without that gut-churning “this is my rent money” feeling. One client turned $30 in free credits into $900 by mastering stop-loss orders. But remember: Losses can exceed deposits if you treat bonus funds like monopoly money.

Claiming these offers works like unlocking a video game power-up:

- Verify your email (takes 90 seconds)

- Complete mobile confirmation

- Watch your account balance grow

The real win? Learning to navigate leverage and spreads with house money first. Just don’t get cocky—those training wheels come off eventually.

How to Choose the Best Forex brokers with welcome bonus

Choosing your market hub is like selecting a gym membership—you want modern equipment, clear rules, and zero surprise fees. The right combination of security and smooth operation turns beginners into confident traders. Let’s cut through the noise.

Safety Nets Before High Jumps

Regulation isn’t sexy—until you need it. Platforms licensed by top-tier authorities (think SEC or FCA) act like financial seatbelts. One user almost lost $2,000 before realizing their “bonus” required trading 100 lots first. Always check:

- Deposit protection schemes (up to $250k coverage)

- Third-party audits published like concert tour dates

- Clear explanations of how bonus funds convert to cash

Your Digital Trading Cockpit

Clunky platforms are the DMV of finance—frustrating and slow. Test-drive interfaces with these non-negotiables:

- One-click order execution faster than TikTok scrolls

- Customizable charts that don’t require a PhD to decipher

- Risk management tools that auto-save like video games

Pro tip: Deposit verification sometimes feels like untangling headphone wires. Top-rated platforms streamline this with photo-ID uploads that work on first try—no “error 404” nonsense.

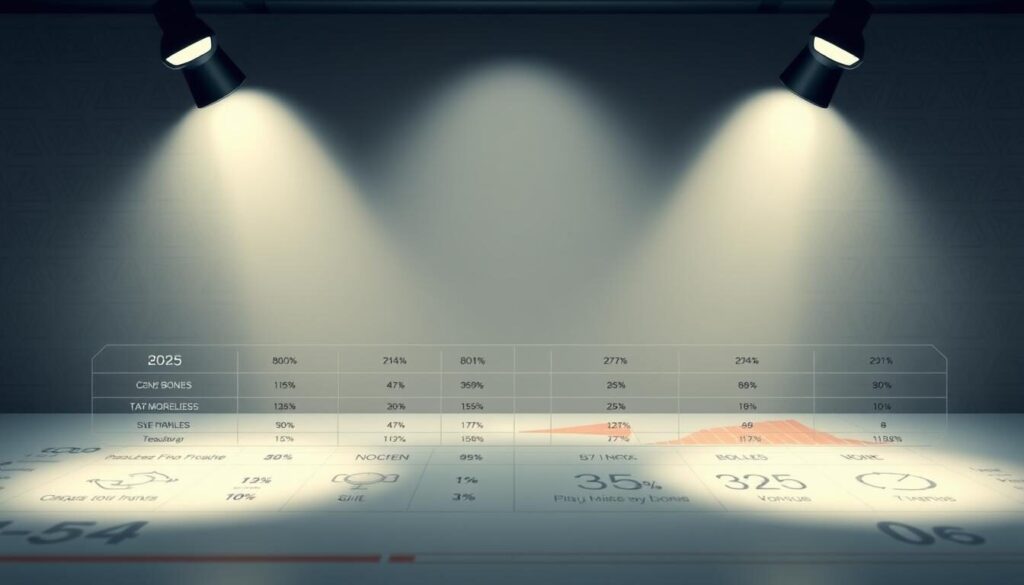

Comparing Bonus Structures Across Leading Brokers

Picture two coffee shops: one gives free samples, the other rewards your prepaid card. That’s the deposit vs. no-deposit dilemma. FBS dishes out a 100% match on first deposits—like doubling your coffee budget if you prepay $100. InstaForex? They’re the barista sliding a free latte across the counter with their $30 sign-up credit.

Deposit Match or Free Samples?

Deposit deals work like gym memberships—commit cash upfront, get extra perks. No-deposit offers? More like trial subscriptions. Here’s the brew:

- FBS requires $50 minimum deposit for 100% bonus (hello, $100 trading fuel)

- InstaForex grants $30 instantly—no credit card needed

- Both require trading 10 lots before cashing out profits

The Fine Print Survival Guide

Those “conditions” everyone skips? They’re the difference between keeping winnings and crying into your keyboard. One trader nearly missed withdrawing $800 because they didn’t notice the 60-day expiration on bonus funds.

Account types matter too. Standard accounts often have simpler rules, while ECN types might exclude bonus eligibility. Always check:

- Trading volume multipliers (3x-10x bonus amounts)

- Withdrawal limits on profits from bonus funds

- Country-specific restrictions (sorry, Nevada residents)

Pro tip: Unread terms are like unopened board game rules—you’ll regret it when someone yells “You can’t do that!” during money moves.

Maximizing Your Trading Experience with Bonus Offers

Leveling up your trading game with bonus cash works like unlocking cheat codes—if you know the button combos. These temporary boosts let you experiment with advanced moves without burning through your own coins. Let’s crack the code.

Strategies for Leveraging Bonus Funds

Start by treating free credits like lab equipment. One trader turned $50 into $300 by testing scalping strategies during London market opens. Their secret? Using 5% max per trade—like betting poker chips one at a time.

Follow this playbook:

- Allocate 70% to proven strategies (your bread and butter)

- Use 20% for testing new indicators (the mad scientist fund)

- Keep 10% as emergency ammo (market mood swings happen)

Risk Management and Trading Volume Requirements

Those volume targets aren’t evil—they’re guardrails. Imagine needing to drive 500 miles before cashing in a free gas card. Platforms often require trading 5x the bonus amount. Track progress like a video game achievement bar.

Pro tip: Set daily loss limits at 15% of your bonus. If the market throws a tantrum, you live to trade another day.

Optimizing Deposits and Withdrawals

Timing your USD moves matters. Deposit during low-fee windows (check platform schedules). Withdrawals? Think of it like catching the last train home—submit requests before 3 PM EST for same-day processing at top-rated platforms.

Avoid these rookie mistakes:

- Ignoring conversion fees on non-USD transactions

- Forgetting bonus expiration dates (set phone reminders)

- Withdrawing too early and losing unlocked profits

Remember: House money spends just like real cash—until the clock runs out. Treat every trade like it’s your own wallet, even when it’s not.

Conclusion

Navigating platform perks feels like following a treasure map—X marks smart choices. Setting up your account wisely? That’s the compass. Those sneaky terms we mentioned? They’re the dotted lines guiding you to keep profits.

Three golden rules for new explorers:

1. Test strategies in demo mode first (like rehearsing a concert in an empty arena)

2. Track currency pairs like checking weather forecasts—daily and curious

3. Compare offers like swiping through dating profiles

Here’s the real talk: markets swing faster than TikTok dance crazes. But as a valued client, your portal comes with withdrawal guardrails and deposit shortcuts.

Your move? Bookmark this guide. Review each platform’s terms like reading a recipe. Start small—even trial credits can build real confidence.

Pro tip: Treat every account like a library book—return it better than you found it. Now go make those markets your playground. Smart currency moves begin with informed choices.