Key Takeaways

- You can start forex trading with as little as $1-$5 using brokers like XM Group or Pepperstone

- $100 is the sweet spot for beginners – enough for proper risk management while staying affordable

- Always choose regulated brokers (FCA, ASIC, CySEC) with leverage limits of 30:1 for retail traders in 2024

- Use micro-lot trading (0.01 lots) to practice without risking large amounts

- Never risk more than 1-3% per trade regardless of your account size

Introduction: Why Everyone’s Asking “How Much Do I Need to Start?”

Let’s get straight to the point—you don’t need thousands of dollars to start forex trading. I know because I’ve been there, staring at my computer screen wondering if my modest savings could actually get me started in the world’s largest financial market.

Here’s the reality: you can start forex trading with as little as $1. Yes, you read that right. But before you get too excited, let me share what I wish someone had told me when I first started.

Think of forex trading like learning to drive. You wouldn’t start by racing a Ferrari on the highway, right? You’d begin with a reliable car in a parking lot. The same logic applies to forex—start small, learn the ropes, then gradually scale up as your skills improve.

The global forex market trades over $7.5 trillion daily according to the Bank for International Settlements, making it more liquid than all stock markets combined. This massive volume means you can enter and exit trades easily, even with small amounts.

What Is Forex Trading?

Forex (foreign exchange) trading is simply buying one currency while selling another. Every time you travel abroad and exchange dollars for euros, you’re participating in the forex market—just not for profit.

How Does the Forex Market Work?

Unlike stock markets that close at night, forex trades 24 hours a day, five days a week. This happens because when New York markets close, Tokyo markets open. When Tokyo sleeps, London wakes up. It’s a global relay race of currency trading.

Here’s what makes forex unique for small investors:

- High liquidity: You can trade even tiny amounts instantly

- Low barriers to entry: Many brokers accept deposits as low as $1

- Leverage availability: You can control larger positions with smaller capital

- No commissions: Most brokers make money through spreads, not commissions

Key Concepts Every Beginner Must Know

Before we dive into minimum investments, let’s clarify some essential terms. Don’t worry—I’ll keep this simple.

Currency Pairs

Forex is always traded in pairs. The EUR/USD pair means you’re comparing euros to dollars. If EUR/USD is 1.0500, one euro equals 1.05 dollars.

Pips and Spreads

A pip is the smallest price movement in a currency pair, typically the fourth decimal place (0.0001). The spread is the difference between buying and selling prices—essentially the broker’s fee.

Lots and Leverage

One standard lot equals 100,000 units of the base currency. A micro-lot is 1,000 units. Leverage lets you control larger positions with less capital. With 50:1 leverage, $100 can control a $5,000 position.

2024 Regulatory Update

Major regulators have implemented strict leverage limits for retail traders:

- FCA (UK): Maximum 30:1 leverage on major pairs

- ASIC (Australia): 30:1 leverage limit for retail clients

- CySEC (Cyprus): 30:1 maximum leverage under MiFID II

- ESMA (EU): 30:1 leverage cap across all member states

Understanding Capital Requirements in Forex Trading

Here’s where things get interesting. The amount you need depends on your goals, risk tolerance, and trading style. Let me break down the realistic numbers based on current market conditions.

The Minimum Investment Reality Check

Technically, you can start with $1. But here’s what that actually means:

- $1-$10: Learning mode only. You can place trades but expect minimal profits

- $50-$100: Sweet spot for beginners. Enough to practice real strategies

- $500-$1,000: Comfortable trading with multiple positions

- $5,000+: Serious trading with professional potential

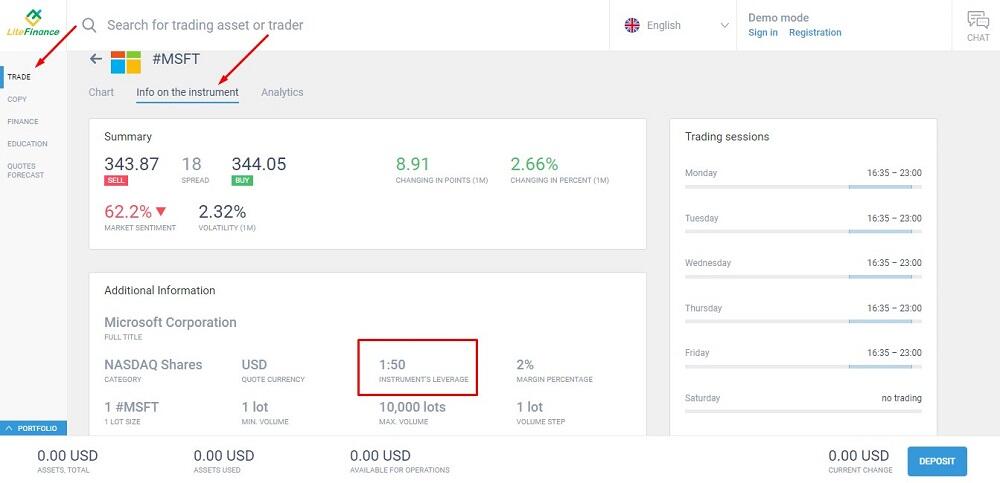

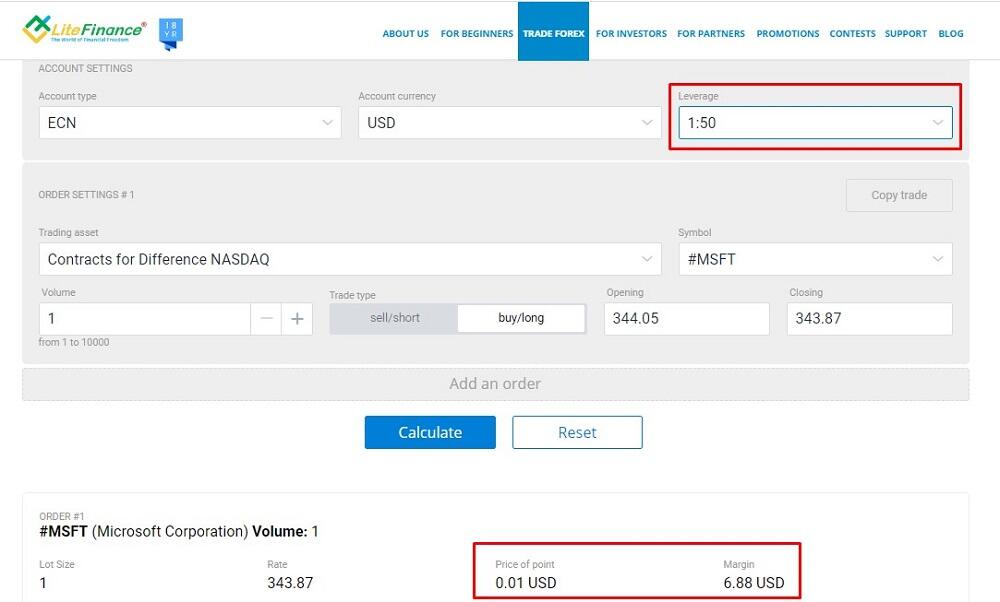

How Leverage Affects Your Investment Size

This is where forex gets powerful for small accounts. With leverage, your $100 can control positions worth $3,000 (at 30:1 leverage). But—and this is crucial—leverage magnifies both profits and losses.

Here’s a practical example from LiteFinance: With $100 and 30:1 leverage, you can open a 0.03 lot position in EUR/USD. If the price moves 10 pips in your favor, you’ll earn about $3. If it moves against you by 30 pips, you could lose $9.

Top Forex Brokers for Small Investments in 2025

After researching over 50 brokers, here are the best options for traders starting with minimal capital. I’ve personally tested many of these platforms, and they consistently deliver on their promises.

The $0 Minimum Deposit Champions

| Broker | Min Deposit | Regulation | Spreads (EUR/USD) | Min Trade Size |

|---|---|---|---|---|

| Pepperstone | $0 | ASIC, FCA, CySEC, BaFin | 0.0 pips + $3.5 commission | 0.01 lots |

| Fusion Markets | $0 | ASIC, FSA, VFSC | 0.0 pips + $2.25 commission | 0.01 lots |

| CMC Markets | $0 | FCA, ASIC, MAS, BaFin | 0.6 pips (Standard) | 0.01 lots |

| BlackBull Markets | $0 | FSA (Seychelles), FMA | 0.8 pips | 0.01 lots |

| XTB | $0 | FCA, CySEC, BaFin | 0.8 pips | 0.01 lots |

The Ultra-Low Deposit Heroes ($1-$50)

| Broker | Min Deposit | Regulation | Special Features |

|---|---|---|---|

| XM Group | $5 | CySEC, ASIC, FSC | Micro account (0.1 lot = $1,000) |

| FP Markets | $50 | ASIC, CySEC, FSA | Fast execution, tight spreads |

| Global Prime | $1 (some methods) | ASIC, VFSC | Crypto deposits accepted |

What to Look for in a Low-Deposit Broker

Don’t just choose based on minimum deposits. Here’s your complete checklist:

- Regulatory Status: Only trade with FCA, ASIC, CySEC, or equivalent regulators

- Spreads and Fees: Compare total trading costs, not just spreads

- Platform Quality: MetaTrader 4/5 or equivalent professional platforms

- Customer Support: 24/5 support in your language

- Deposit/Withdrawal: Fast, fee-free deposit options

Why Regulation Matters in 2024

Unregulated brokers have been caught manipulating prices and refusing withdrawals. According to the Financial Conduct Authority, over 87% of retail CFD accounts lose money. Regulated brokers provide investor protection schemes and segregated client funds.

Account Types: Micro, Mini, and Standard Explained

Understanding account types is crucial for managing your investment size effectively. Let me walk you through each option with real examples.

Micro Accounts: Your Training Wheels ($1-$100)

Perfect for absolute beginners. With micro accounts, you can trade as little as 0.01 lots (1,000 units). Here’s what this means in practice:

- Position size: $1,000 worth of currency

- Pip value: Each pip equals $0.10

- Risk per trade: With a 10-pip stop loss, you risk $1

- Minimum capital: $25-$100 recommended

Mini Accounts: The Goldilocks Zone ($250-$1,000)

Mini accounts let you trade 0.1 lots (10,000 units). This is often the sweet spot for serious beginners:

- Position size: $10,000 worth of currency

- Pip value: Each pip equals $1

- Risk per trade: 10-pip stop loss = $10 risk

- Minimum capital: $500-$1,000 recommended

Standard Accounts: For Serious Traders ($2,000+)

Standard accounts trade full lots (100,000 units). According to Investopedia, most brokers require $2,000-$10,000 minimum for standard accounts:

- Position size: $100,000 worth of currency

- Pip value: Each pip equals $10

- Risk per trade: 10-pip stop loss = $100 risk

- Minimum capital: $5,000+ recommended

Starting Small: The $100 Strategy That Actually Works

Let me share a strategy that I’ve seen work consistently for beginners starting with $100. This isn’t get-rich-quick nonsense—it’s a systematic approach to growing small accounts.

The $100 Account Setup

Based on analysis from LiteFinance, here’s your optimal setup:

- Choose a broker with $0-$50 minimum deposits

- Start with micro lots (0.01-0.05 maximum)

- Risk 1-3% per trade ($1-$3 per trade)

- Target 1:2 risk-reward ratio (risk $1 to make $2)

- Trade major pairs only (EUR/USD, GBP/USD, USD/JPY)

Realistic Profit Expectations

Here’s what professional traders achieve with $100 accounts:

- Beginner traders: 5-10% monthly growth ($5-$10/month)

- Experienced traders: 10-20% monthly growth ($10-$20/month)

- Professional traders: Up to 500% annually (according to LiteFinance research)

Think compound interest, not lottery tickets. If you can consistently make 10% per month on your $100, after one year you’ll have $314. After two years, $985. The magic isn’t in the percentage—it’s in the consistency.

Risk Management: The 1% Rule and Beyond

This is where most beginners fail. They get the strategy right but blow their accounts on poor risk management. Let me show you the rules that separate successful traders from the 87% who lose money.

The Sacred 1% Rule

Never risk more than 1% of your account on a single trade. With a $100 account, that means risking maximum $1 per trade. Here’s how to calculate this:

Position Size Formula:

Position Size = (Account Balance × Risk %) ÷ (Stop Loss in pips × Pip Value)

Example: $100 account, 1% risk, 20-pip stop loss, $0.10 pip value

Position Size: ($100 × 0.01) ÷ (20 × $0.10) = $1 ÷ $2 = 0.5 micro lots

Advanced Risk Management Techniques

- Use Stop Losses: Every trade needs a predetermined exit point

- Set Take Profits: Don’t let winning trades become losers

- Never add to losing positions: Cut losses quickly

- Keep a trading journal: Track what works and what doesn’t

- Follow the 1:2 risk-reward ratio: If you risk $1, target $2 profit

Platform Showdown: MetaTrader vs. Modern Alternatives

The platform you choose can make or break your small account strategy. Let me compare the most popular options based on real user testing.

MetaTrader 5: The Gold Standard

MT5 dominates forex trading for good reasons. It’s available on virtually every broker platform and offers:

- Advanced charting: 21 timeframes, 80+ technical indicators

- Expert Advisors: Automated trading capabilities

- Mobile apps: Full trading functionality on smartphones

- Market depth: Level II pricing information

- Economic calendar: Built-in news and events

TradingView: The Modern Choice

Many new traders prefer TradingView for its superior charts and social features:

- Beautiful interface: More intuitive than MT5

- Social trading: Follow and copy successful traders

- Advanced alerts: Custom notifications for any condition

- Browser-based: No downloads required

- Integrated with major brokers: One-click trading

Demo Accounts: Your Risk-Free Training Ground

Before risking real money, every trader should master demo trading. It’s like flight simulator training for pilots—essential preparation for the real thing.

Benefits of Demo Trading

- Learn platform features: Master order types and tools

- Test strategies: Validate your approach with historical data

- Build confidence: Practice until execution becomes automatic

- No financial pressure: Focus on learning, not profits

- Real market conditions: Experience actual spreads and slippage

The Right Way to Use Demo Accounts

Don’t fall into these common demo trading traps:

- Use realistic amounts: If you plan to trade with $100, use $100 in demo

- Treat it seriously: Practice proper risk management

- Set time limits: 1-3 months maximum before going live

- Track your performance: Keep detailed statistics

- Transition gradually: Start with tiny live positions

Demo trading is like learning to swim in a pool. You need to master the basics before jumping into the ocean. But don’t stay in the pool forever—real trading has emotional challenges that demos can’t replicate.

Building Your Forex Trading Capital Systematically

Growing a small account requires discipline and patience. Here’s a proven framework for scaling up your investment over time.

The Compound Growth Strategy

Instead of withdrawing profits immediately, reinvest them to accelerate growth. Here’s a realistic growth projection:

When and How to Add Funds

Don’t just dump money into a losing account. Follow these guidelines:

- Prove profitability first: Show consistent profits for 3+ months

- Add funds gradually: Increase by 50-100% of current balance maximum

- Maintain same risk percentages: Don’t increase risk just because you have more money

- Keep detailed records: Track performance before and after additions

Common Mistakes That Kill Small Accounts

I’ve seen countless traders blow $100 accounts in days. Here are the mistakes that kill small accounts and how to avoid them.

The Top 7 Account Killers

- Overleveraging: Using maximum leverage on every trade

- Revenge trading: Trying to win back losses with bigger positions

- No stop losses: Hoping losing trades will reverse

- Overtrading: Taking too many trades to “make up” for small profits

- Ignoring major news: Trading during high-impact events without protection

- Emotional decisions: Abandoning strategy after a few losses

- Unrealistic expectations: Expecting to double accounts weekly

The Psychology of Small Account Trading

Trading with limited capital creates unique psychological pressures. Every dollar matters more, leading to:

- Fear of missing out: Taking marginal setups

- Profit pressure: Closing winners too early

- Loss anxiety: Holding losers too long

- Impatience: Abandoning strategies prematurely

Advanced Strategies for Growing Small Accounts

Once you’ve mastered the basics, these advanced techniques can accelerate your account growth while maintaining reasonable risk levels.

The Scaling Strategy

As your account grows, gradually increase your position sizes while maintaining the same risk percentage:

| Account Size | Risk per Trade (1%) | Position Size (20-pip SL) | Monthly Target (10%) |

|---|---|---|---|

| $100 | $1 | 0.005 lots | $10 |

| $500 | $5 | 0.025 lots | $50 |

| $1,000 | $10 | 0.05 lots | $100 |

| $5,000 | $50 | 0.25 lots | $500 |

Prop Firm Alternative

For traders with proven skills but limited capital, prop firms offer an alternative path. For $400-$500, you can access $100,000+ accounts. Popular options include:

- FTMO: $100K accounts from €540 evaluation fee

- MyForexFunds: Up to $300K accounts

- The5ers: Progressive scaling from $4K to $512K

- Topstep: Forex and futures funding

Legal and Regulatory Considerations for 2024

The forex regulatory landscape continues evolving. Here’s what small account traders need to know about current regulations.

Global Regulatory Updates

European Union (MiFID II)

- 30:1 maximum leverage for major pairs

- Negative balance protection mandatory

- 50% margin close-out rule

- Risk warnings required

United Kingdom (FCA)

- Post-Brexit rules maintain 30:1 leverage limits

- FSCS protection up to £85,000

- Enhanced due diligence requirements

Australia (ASIC)

- 30:1 leverage cap for retail clients

- Product intervention powers in effect

- Stronger disclosure requirements

Tax Implications

Forex profits are typically taxed as ordinary income or capital gains, depending on your jurisdiction and trading frequency. Consult with a qualified tax professional for specific advice.

Frequently Asked Questions

Conclusion: Your Path to Forex Success Starts Today

Starting your forex journey with minimal investment isn’t just possible—it’s smart. You’ve learned that successful trading isn’t about having thousands of dollars; it’s about having the right knowledge, tools, and discipline.

Your Next Steps

- Choose a regulated broker from our recommended list

- Open a demo account and practice for 4-6 weeks

- Start with $100-$500 when you’re ready for live trading

- Follow the 1% risk rule religiously

- Keep detailed records of every trade

- Stay educated through quality resources

Key Takeaways for Success

- Start small, think big: Even $100 can grow significantly with time and skill

- Regulation matters: Only trade with FCA, ASIC, or CySEC regulated brokers

- Risk management is everything: Protect your capital first, profits second

- Education never stops: Markets evolve, and so must you

- Patience pays: Consistent small gains beat inconsistent large ones

Ready to Start Trading?

Remember, every professional trader started exactly where you are now. The difference between success and failure isn’t the size of your initial investment—it’s your commitment to learning and growing.

The forex market will be here tomorrow, next week, and next year. Take time to prepare properly, start with amounts you can afford to lose, and build your skills systematically. Your future trading success depends not on how much you start with, but on how well you manage what you have.

Disclaimer: Forex trading involves significant risk of loss and may not be suitable for all investors. Past performance does not guarantee future results. Always trade with money you can afford to lose and consider seeking advice from an independent financial advisor.