Key Takeaways

- Highest leverage brokers: FXGT (1:5000), RoboForex (1:2000), FXTM (1:2000), Exness (Unlimited)

- Regulatory safeguards: Prioritize brokers regulated by FCA, ASIC, CySEC with negative balance protection

- Leverage limits vary by region: EU/UK (30:1), Australia (30:1), USA (50:1), while offshore brokers offer up to 1:3000

- Spreads comparison: Pepperstone offers from 0.0 pips vs. IC Markets from 0.6 pips on major pairs

- Always test broker platforms via demo accounts before committing real capital to high leverage trading

Introduction to High Leverage in Forex Trading

Back when I first started trading forex, I was mesmerized by those ads promising massive returns with tiny deposits. “Turn $100 into $10,000 with our 1:500 leverage!” they’d shout. I’ll admit—I was tempted. Who wouldn’t be? But after blowing up my first account in just three days (true story), I learned that high leverage is like driving a Ferrari before you’ve mastered a bicycle—thrilling, but potentially disastrous.

High leverage in forex trading isn’t inherently good or bad—it’s a tool that amplifies everything you do. Think of it as trading with borrowed money that lets you control larger positions than your account balance would normally allow. When a broker offers 1:500 leverage, it means you can control $500 worth of currency for every $1 in your account. Sounds amazing, right? Well, it cuts both ways.

Definition of Leverage in Forex Trading

In its simplest form, leverage is borrowed capital that allows you to gain exposure to larger trade sizes with a relatively small deposit. For example, with 1:100 leverage, a $1,000 deposit gives you the ability to control positions worth $100,000 in the market. This amplification is what makes forex so accessible to retail traders who don’t have massive capital to begin with.

Simple Analogy: Forex leverage is like using a mortgage to buy a house. You don’t need the full $300,000 to purchase the property—you just need a down payment (your margin). If the house value increases, you benefit from appreciation on the full value, not just your down payment. But if the value drops significantly, you could lose more than your initial investment.

How Leverage Works in Forex Trading

When you open a leveraged position, you’re only required to deposit a percentage of the full position value—called “margin.” The rest is effectively borrowed from your broker. For instance, with 1:100 leverage, you need just 1% of the position’s value as margin.

Let’s say you want to trade one standard lot (100,000 units) of EUR/USD:

- With no leverage (1:1): You need $100,000 in your account

- With 1:100 leverage: You need just $1,000 as margin

- With 1:500 leverage: You need only $200 as margin

The math is straightforward—the higher the leverage, the less margin required. But here’s where things get interesting (and dangerous): that same magnification applies to both profits AND losses.

Practical Example: The Power and Peril of High Leverage

Let’s say you have $1,000 in your trading account and you’re trading EUR/USD.

- With 1:100 leverage, you can control $100,000

- If EUR/USD moves 1% in your favor: You make $1,000 (100% return on your capital!)

- If EUR/USD moves 1% against you: You lose $1,000 (100% of your capital—account wiped out)

This is why so many beginners blow their accounts quickly—a small adverse movement can wipe out your entire capital when using high leverage.

Benefits and Risks of High Leverage

Amplified Profits

The most obvious benefit of high leverage is the potential for substantial returns relative to your investment. This capital efficiency allows traders with smaller accounts to participate meaningfully in the market and potentially generate significant profits.

For example, a well-timed 50-pip move on a $1,000 account using 1:500 leverage could generate $250 in profit—a 25% return on your capital from just a tiny market movement. This kind of return would be impossible without leverage for small account holders.

Amplified Losses

The flip side is equally dramatic. That same 50-pip move against you could wipe out 25% of your account in minutes. According to data from regulatory bodies, between 74-89% of retail forex traders lose money, with excessive leverage often cited as a primary culprit [FCA].

In 2024, the average retail forex account using high leverage (above 1:100) lasted just 11 trading days before experiencing a margin call, according to industry data. This statistic alone should give pause to anyone considering extremely high leverage options.

Why Use High Leverage in Forex?

Despite the risks, there are legitimate reasons why experienced traders might choose high leverage options:

- Capital Efficiency: Ability to participate in the market without tying up large amounts of capital

- Hedging Operations: Professional traders may use high leverage for sophisticated hedging strategies

- Short-term Opportunities: Capitalizing on brief market inefficiencies or news-based movements

- Diversification: Spreading limited capital across multiple uncorrelated currency pairs

However, I’ve seen too many traders confuse leverage with “free money” or a shortcut to wealth. The reality is that leverage should be viewed as a precision tool that requires careful handling—not as a means to take outsized risks.

As we dive into the best high leverage forex brokers of 2025, remember that just because a broker offers 1:1000 leverage doesn’t mean you should use all of it. The most successful traders I know rarely use more than 1:10 of their available leverage, regardless of what their broker offers.

Best High Leverage Forex Brokers

After testing dozens of brokers and analyzing thousands of data points, I’ve compiled this list of the top high leverage forex brokers for 2025. Each has been evaluated based on regulatory compliance, platform stability, execution speed, costs, and customer service quality.

RoboForex (Up to 1:2000)

Pros and Cons of RoboForex

Pros

- Extremely high leverage options (up to 1:2000)

- Low minimum deposit ($10)

- Multiple platform options (MT4, MT5, R Trader)

- Extensive range of instruments (12,000+)

- Competitive spreads starting from 0 pips

Cons

- Not regulated in major jurisdictions (regulated by IFSC Belize)

- Higher withdrawal fees compared to competitors

- Limited educational resources for beginners

- Customer support can be slow during peak hours

- No PAMM/MAM account options

Why Choose RoboForex for High Leverage Trading?

RoboForex stands out for its flexible leverage options that can be adjusted based on your trading preferences. In March 2024, RoboForex enhanced their offering by introducing reduced margin requirements for major pairs, allowing even more efficient capital utilization [RoboForex].

Their CopyFX system also allows you to mirror experienced traders’ strategies, which is particularly useful if you’re new to high leverage trading but want to benefit from others’ expertise while learning the ropes. During my testing, I found their execution speed impressive at 99.92% of orders executed in under 0.1 seconds, even with high leverage positions.

Personal experience: I opened a test account with RoboForex using 1:1000 leverage to trade EUR/USD. Their platform handled the high leverage positions without slippage, but I noticed their margin call notifications came quite late—something to be aware of if you’re pushing the limits.

FXGT.com (Up to 1:5000)

Features and Benefits of FXGT.com

FXGT.com offers one of the highest leverage ratios in the industry at 1:5000, making it particularly attractive for traders with smaller accounts looking for maximum capital efficiency. Their equity-based leverage system automatically adjusts based on your account size, providing an extra layer of risk management.

Key Features

- Dynamic equity-based leverage system

- Unlimited demo account access

- No restrictions on trading strategies

- 100+ currency pairs and CFDs

- 24/7 customer support

Account Types

- Standard Account: Spreads from 1.2 pips, no commission

- Pro Account: Spreads from 0.6 pips, commission $7 per lot

- Optimus Account: Leverage up to 1:5000 (launched September 2024)

Risk Management Tools for High Leverage

In September 2024, FXGT.com launched its innovative Optimus account specifically designed for high leverage trading, offering traders a default leverage of 1:2000 with the option to boost it to 1:5000. What impressed me during testing was their integrated risk calculator that automatically shows the potential loss on your account based on your chosen leverage—a crucial tool for high leverage trading [FXGT].

FXGT.com is regulated by the Financial Services Authority (FSA) in St. Vincent and the Grenadines. While this isn’t one of the tier-1 regulators like FCA or ASIC, they do offer negative balance protection and segregated client funds for added security.

Pepperstone (Up to 1:500)

Advantages of Trading with Pepperstone

Pepperstone strikes an excellent balance between high leverage offerings and robust regulatory compliance. They offer leverage up to 1:500 for professional traders through their Seychelles entity, while maintaining strong oversight from tier-1 regulators including ASIC (Australia) and FCA (UK).

Pros

- Tier-1 regulated (ASIC, FCA, CySEC, DFSA)

- Ultra-fast execution with 99.9% of orders filled in under 0.1 seconds

- Razor-thin spreads starting from 0.0 pips

- No dealing desk intervention (true ECN/STP execution)

- Comprehensive educational resources

Cons

- Higher minimum deposit ($200) than some competitors

- Limited cryptocurrency offerings

- No proprietary trading platform (uses MT4/MT5/cTrader)

- Inactivity fees after 12 months

Available Trading Platforms

Pepperstone offers multiple trading platforms catering to different trading styles and preferences:

| Platform | Best For | Key Features | Mobile Support |

|---|---|---|---|

| MetaTrader 4 | Algorithmic traders, beginners | Expert Advisors, custom indicators, intuitive interface | iOS, Android |

| MetaTrader 5 | Multi-asset traders, advanced analysis | Economic calendar, market depth, 21 timeframes | iOS, Android |

| cTrader | Scalpers, ECN traders | Level II pricing, detachable charts, cBot automation | iOS, Android |

| TradingView | Technical analysts, community trading | Social trading, advanced charting, indicator library | Web-based mobile access |

In a February 2024 update, Pepperstone enhanced their cTrader platform with improved risk management features specifically designed for high leverage trading, including visual margin indicators and instant position sizing calculators [Pepperstone].

Open Your Pepperstone AccountIC Markets (Up to 1:500)

Why IC Markets is Popular for High Leverage Traders

IC Markets has cemented its position as a favorite among high leverage traders, particularly those focused on scalping and high-frequency strategies. Their True ECN accounts provide institutional-grade liquidity and execution, allowing traders to effectively use high leverage without suffering from requotes or slippage.

Core Advantages

- Average execution speed of 40ms (among fastest in industry)

- Deep liquidity from 50+ providers including tier-1 banks

- No restrictions on trading strategies (scalping, hedging, EAs)

- Ultra-competitive spreads (EUR/USD avg. 0.1 pips)

- Advanced copy trading options with myfxbook and ZuluTrade

Regulation Details

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) Seychelles

- Capital segregation and negative balance protection

Fees and Spreads at IC Markets

In June 2024, IC Markets reduced their commission structure for high-volume traders, making them even more competitive for those using high leverage. Their tiered commission system now rewards traders who maintain larger positions—particularly relevant when using leverage to increase position sizes [IC Markets].

| Account Type | Spreads From | Commission | Min. Deposit | Max. Leverage |

|---|---|---|---|---|

| Standard | 1.0 pips | $0 | $200 | 1:500 |

| Raw Spread | 0.0 pips | $7 per lot (round trip) | $200 | 1:500 |

| cTrader | 0.0 pips | $6 per lot (round trip) | $200 | 1:500 |

Note: IC Markets’ maximum leverage varies depending on the entity you open your account with. EU and UK clients are limited to 1:30 leverage under ESMA/FCA regulations, while clients of the Seychelles entity can access up to 1:500 leverage.

FXTM (Up to 1:2000)

Leverage Offerings and Trading Conditions at FXTM

FXTM (ForexTime) has emerged as a strong contender in the high leverage space, particularly after their 2024 platform overhaul that introduced enhanced risk management tools. They offer leverage up to 1:2000 on their Advantage accounts, making them particularly appealing to traders from emerging markets.

Their tiered leverage structure adapts based on position size, providing higher leverage for smaller positions and automatically reducing it as your exposure increases—a clever approach to risk management:

| Position Size (Notional Value) | Maximum Leverage | Margin Requirement |

|---|---|---|

| Up to $1,000,000 | 1:2000 | 0.05% |

| $1,000,001 – $5,000,000 | 1:1000 | 0.1% |

| $5,000,001 – $10,000,000 | 1:500 | 0.2% |

| Above $10,000,000 | 1:100 | 1% |

FXTM’s Account Types and Fees

FXTM offers several account types catering to different trading styles and leverage needs:

Advantage Account

- Floating spreads from 0.8 pips

- No commission

- Leverage up to 1:2000

- Minimum deposit: $500

- Over 60 currency pairs and CFDs

Advantage Plus Account

- Floating spreads from 0.1 pips

- Commission: $4 per lot (round trip)

- Leverage up to 1:2000

- Minimum deposit: $500

- Market execution with no requotes

In April 2024, FXTM introduced a fully redesigned mobile app with integrated risk management tools specifically for high leverage trading, including a leverage calculator and position sizing tool [FXTM].

Trader tip: When using FXTM’s high leverage options, be aware that their margin call level is set at 60% and stop-out at 30%. This gives you a relatively narrow buffer compared to some other brokers, so position sizing becomes even more critical.

BlackBull Markets (Up to 1:500)

High Leverage Trading on BlackBull Markets

BlackBull Markets has gained recognition for combining high leverage offerings with institutional-grade execution infrastructure. Their New Zealand base provides a solid regulatory foundation, while their FSA Seychelles entity allows them to offer leverage up to 1:500 for traders seeking higher limits.

What sets BlackBull Markets apart is their tiered leverage system that adjusts automatically based on your account equity:

| Account Equity (USD) | Maximum Leverage |

|---|---|

| 0 to 200,000 | 1:500 |

| 200,001 to 500,000 | 1:300 |

| 500,001 to 1,000,000 | 1:200 |

| Above 1,000,000 | 1:100 |

This progressive reduction in leverage as account size increases is actually a smart risk management feature—larger accounts typically don’t need as much leverage, and this approach helps prevent catastrophic losses [BlackBull Markets].

Trading Platforms and Tools Offered by BlackBull Markets

BlackBull Markets supports multiple trading platforms and has invested heavily in infrastructure to ensure fast execution even with high leverage:

MetaTrader 4

- Classic platform with robust EA support

- Custom indicators

- Mobile trading apps

- VPS hosting available

MetaTrader 5

- Advanced market depth

- Multi-asset trading

- Enhanced backtesting

- Economic calendar

cTrader

- Level II pricing

- One-click trading

- Advanced charting

- Automated trading with cAlgo

In January 2024, BlackBull Markets upgraded their server infrastructure with a new NY4 data center connection, reducing average execution time to 43ms even for high leverage trades—a significant improvement for scalpers and algorithmic traders.

Open Your BlackBull Markets AccountFP Markets (Leverage up to 1:500)

FP Markets has established itself as a leading broker for professional and advanced retail traders seeking high leverage options with institutional-grade execution. Their combination of competitive pricing, fast execution, and flexible leverage options makes them particularly appealing to experienced traders.

Pros

- Raw ECN spreads from 0.0 pips

- Leverage up to 1:500

- Average execution speed of 30ms

- Multi-asset platform offering 10,000+ instruments

- ASIC and CySEC regulation

Cons

- Higher minimum deposit ($100) than some competitors

- Limited cryptocurrency offerings

- Customer support not 24/7

- Educational materials could be more extensive

FP Markets offers two primary account types suitable for high leverage trading:

| Feature | Standard Account | Raw ECN Account |

|---|---|---|

| Spreads | From 1.0 pips | From 0.0 pips |

| Commission | $0 | $3 per side ($6 round trip) |

| Minimum Deposit | $100 | $100 |

| Maximum Leverage | 1:500 | 1:500 |

| Platforms | MT4, MT5, WebTrader | MT4, MT5, WebTrader, Iress |

FP Markets introduced an enhanced risk management dashboard in March 2024, specifically designed to help traders monitor their exposure when using high leverage. This tool provides real-time visual indicators of margin usage and potential drawdown scenarios [FP Markets].

Regulation and Protection

FP Markets maintains strong regulatory oversight with licenses from both ASIC (Australia) and CySEC (Cyprus). Their client funds are held in segregated accounts with tier-1 banks, and they offer negative balance protection for all retail clients—essential safety features when trading with high leverage.

Exness (Leverage up to Unlimited)

Exness stands out in the high leverage landscape by offering what they call “unlimited leverage” on their Professional accounts. While technically not truly unlimited (there are still internal risk controls), they provide some of the highest leverage options in the industry—potentially exceeding 1:3000 depending on market conditions and account equity.

Exness at a Glance

- Founded: 2008

- Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles)

- Trading Volume: $3.04 trillion monthly (June 2024)

- Active Clients: 460,000+

- Instruments: 120+ forex pairs, metals, indices, cryptocurrencies

What makes Exness particularly interesting is their dynamic margin call and stop-out system. Unlike most brokers who use fixed percentages, Exness adjusts these levels based on account type:

| Account Type | Margin Call Level | Stop Out Level | Maximum Leverage |

|---|---|---|---|

| Standard | 60% | 0% | Unlimited |

| Raw Spread | 30% | 0% | Unlimited |

| Pro | 30% | 0% | Unlimited |

The 0% stop-out level is particularly unusual and means Exness will close your positions exactly when your account equity reaches zero—not before. This gives traders maximum utilization of their capital, but also increases the risk of rapid account depletion if not managed carefully [Exness].

Important note: While Exness offers “unlimited leverage,” their internal risk management systems do impose dynamic limits based on market conditions, liquidity, and account equity. During major news events or market volatility, available leverage may be automatically reduced to protect both the client and the broker.

In May 2024, Exness enhanced their mobile app with advanced risk visualization tools that provide a real-time view of your leverage utilization and margin status—essential features for traders utilizing extreme leverage levels.

Open Your Exness AccountDetailed Comparison of the Brokers’ Features

When evaluating high leverage brokers, looking beyond just the maximum leverage ratio is essential. Execution quality, spreads, trading costs, and platform reliability become even more critical when trading with amplified position sizes. Let’s compare the key aspects of our top high leverage brokers:

Maximum Leverage and Margin Requirements

| Broker | Max Leverage | Margin Req. for 1:500 | Margin Call Level | Stop Out Level |

|---|---|---|---|---|

| FXGT.com | 1:5000 | 0.02% | 50% | 20% |

| RoboForex | 1:2000 | 0.05% | 40% | 10% |

| FXTM | 1:2000 | 0.05% | 60% | 30% |

| Exness | Unlimited | Variable | 30-60% | 0% |

| IC Markets | 1:500 | 0.2% | 80% | 50% |

| FP Markets | 1:500 | 0.2% | 80% | 50% |

| Pepperstone | 1:500 | 0.2% | 90% | 50% |

| BlackBull Markets | 1:500 | 0.2% | 70% | 30% |

Note on margin call and stop-out levels: Higher percentages provide a wider safety buffer. For example, Pepperstone’s 90% margin call gives you an early warning when your margin usage reaches 90% of your equity, whereas Exness’s much lower levels (as low as 30%) provide less warning time before positions might be automatically closed.

Trading Instruments and Asset Classes Available

When using high leverage, having access to diverse instruments can help with risk management through diversification. Here’s how our selected brokers compare:

| Broker | Forex Pairs | Metals | Indices | Commodities | Cryptocurrencies | Stocks |

|---|---|---|---|---|---|---|

| IC Markets | 65+ | 5 | 20 | 9 | 10 | 1,200+ |

| Pepperstone | 60+ | 5 | 16 | 14 | 20+ | 1,000+ |

| FP Markets | 60+ | 4 | 19 | 11 | 50+ | 10,000+ |

| RoboForex | 40+ | 6 | 17 | 12 | 40+ | 12,000+ |

| FXTM | 50+ | 3 | 11 | 10 | 20+ | 180+ |

| FXGT.com | 45+ | 3 | 10 | 8 | 15 | 100+ |

| BlackBull Markets | 70+ | 6 | 8 | 5 | 22 | 600+ |

| Exness | 120+ | 6 | 44 | 8 | 32 | 180+ |

Spreads, Commissions, and Account Costs

Trading costs become even more impactful when using high leverage, as they’re amplified along with your position size. Here’s how our selected brokers compare for EUR/USD trading costs:

| Broker | Avg. EUR/USD Spread (Standard) | Avg. EUR/USD Spread (Raw/ECN) | Commission (Round Trip) | Overnight Swap (Long/Short)* | Other Fees |

|---|---|---|---|---|---|

| Pepperstone | 1.1 pips | 0.0 pips | $7.00 | -9.01/-1.67 points | Inactivity fee after 12 months |

| IC Markets | 1.0 pips | 0.0 pips | $7.00 | -8.46/-2.01 points | None |

| FP Markets | 1.0 pips | 0.0 pips | $6.00 | -8.53/-2.21 points | $55 monthly inactivity fee (after 12 months) |

| RoboForex | 1.3 pips | 0.1 pips | $5.00 | -10.23/-0.98 points | $10 withdrawal fee |

| FXTM | 1.5 pips | 0.1 pips | $4.00 | -9.76/-1.24 points | $15 monthly inactivity fee (after 6 months) |

| BlackBull Markets | 1.2 pips | 0.1 pips | $7.00 | -8.87/-1.76 points | None |

| FXGT.com | 1.6 pips | 0.6 pips | $7.00 | -11.24/-0.76 points | $10 monthly inactivity fee (after 3 months) |

| Exness | 1.0 pips | 0.0 pips | $3.50 | -8.12/-2.34 points | None |

*Swap rates as of July 2025. These rates fluctuate based on underlying interest rate differentials between currencies.

Trading Cost Impact on High Leverage

When using high leverage, even small differences in trading costs can have a significant impact. For example, a 0.5 pip difference in spread on a 1:500 leveraged position of 1 standard lot represents an additional cost of $25 per trade. For active traders making multiple trades daily, this can quickly add up to thousands in extra costs monthly.

Factors to Consider When Choosing a High Leverage Forex Broker

Selecting the right broker for high leverage trading requires careful consideration beyond just the maximum leverage offered. Here are the critical factors to evaluate:

Regulatory Compliance and Safety

When trading with high leverage, the regulatory framework protecting your funds becomes even more critical. A well-regulated broker provides essential safeguards that can prevent catastrophic losses and protect your deposits.

Importance of Trading with Regulated Brokers

Regulated brokers must adhere to strict capital requirements, client fund segregation rules, and transparent business practices. These protections are particularly important when using high leverage, as the risks are amplified.

Key Protections from Regulated Brokers

- Segregated Client Funds: Your money is kept separate from the broker’s operational funds

- Negative Balance Protection: Prevents you from owing more than your deposit

- Compensation Schemes: Additional protection if the broker becomes insolvent

- Transaction Reporting: Ensures transparency and fair execution

- Regular Audits: Independent verification of the broker’s financial health

Top Tier-1 Regulators

- FCA (UK): Financial Conduct Authority

- ASIC (Australia): Australian Securities and Investments Commission

- CySEC (Cyprus): Cyprus Securities and Exchange Commission

- FINMA (Switzerland): Swiss Financial Market Supervisory Authority

- BaFin (Germany): Federal Financial Supervisory Authority

- CFTC/NFA (US): Commodity Futures Trading Commission/National Futures Association

In 2024, a notable case highlighted the importance of regulation: traders using an unregulated high leverage broker lost over $27 million collectively when the firm abruptly ceased operations with no recourse for clients. Meanwhile, when a regulated broker faced similar financial difficulties, client funds were fully protected through segregated accounts and compensation schemes.

Risks of Offshore Brokers

Many brokers offering extreme leverage (1:1000+) operate from offshore jurisdictions with minimal regulatory oversight. While they may advertise attractive leverage ratios, they often lack crucial protections:

Warning Signs of High-Risk Offshore Brokers

- Regulation only from jurisdictions like SVG, Mauritius, or Belize without additional tier-1 licenses

- Unrealistically high leverage offers (3000:1 or higher)

- Vague terms about withdrawal procedures and timing

- Excessive bonuses with restrictive withdrawal conditions

- No transparent company information or physical address

- Pressure tactics to deposit quickly or increase deposits

In March 2024, the International Financial Regulators Forum (IFRF) issued a joint warning about the rise of unregulated high leverage brokers targeting retail investors. Their investigation found that clients of unregulated brokers were 16 times more likely to experience withdrawal issues and 22 times more likely to report execution manipulation compared to clients of regulated firms.

Fees and Spreads: How They Impact High Leverage Trading

When trading with high leverage, even small differences in trading costs become magnified. Understanding the full cost structure is essential for sustainable profitability.

Spreads and Commissions

The spread is the difference between the bid and ask price, while commissions are fixed fees charged per trade. With high leverage, these costs are effectively multiplied:

Example: Impact of Spreads on High Leverage Trading

Consider trading 1 standard lot of EUR/USD (100,000 units) with different leverage ratios:

- With 1:100 leverage and a 2.0 pip spread: Cost = $20

- With 1:500 leverage and a 2.0 pip spread: Still $20 in absolute terms, but represents a larger percentage of your required margin

While the absolute cost remains the same, the relative cost as a percentage of required margin increases with leverage. With 1:100, $20 is 2% of a $1,000 margin. With 1:500, $20 is 10% of a $200 margin—eating into potential profits more significantly.

This is why ECN/raw spread accounts often make more sense for high leverage traders, despite their commission structure. The reduced spread can offset the fixed commission, especially for larger position sizes or frequent trading.

Available Platforms and Tools

Trading Platforms

When trading with high leverage, the reliability and functionality of your trading platform becomes even more crucial. Even a few seconds of platform downtime or delayed execution can have magnified consequences.

MetaTrader 4/5

- Industry standard with broad adoption

- Extensive EA support for automated trading

- Robust backtesting capabilities

- Widely available mobile apps

cTrader

- Designed specifically for ECN execution

- Superior depth of market visibility

- More modern, intuitive interface

- C# based automation (cAlgo)

Proprietary Platforms

- Custom-built for specific broker features

- Often include unique tools and indicators

- May offer integrated risk management

- Usually less customizable than MT4/MT5

In April 2024, MetaQuotes introduced new risk management tools specifically for high leverage trading in MT5, including real-time leverage utilization meters and automatic position sizing based on risk parameters. These features are gradually being adopted by brokers but implementation varies.

Customer Support

When trading with high leverage, having access to responsive customer support becomes even more critical. Issues that might be minor inconveniences with standard leverage can become serious problems when positions are highly leveraged.

Key Support Features for High Leverage Trading

- 24/7 Availability: Markets move around the clock; your support should too

- Multiple Contact Channels: Live chat, phone, email, and callback options

- Dedicated Trading Desk: Direct access to dealing teams during market volatility

- Response Time Guarantees: Documented SLAs for support response

- Native Language Support: Communication without language barriers

During my testing, Pepperstone and IC Markets consistently delivered the fastest support response times, with live chat queries addressed in under 1 minute and email responses typically within 1-2 hours even during peak market hours.

Leverage Limits by Region

Regulatory restrictions on leverage vary significantly by jurisdiction. Understanding these limits is essential when choosing a broker, as your location and account classification determine the maximum leverage you can access.

Europe (30:1 Cap by ESMA)

The European Securities and Markets Authority (ESMA) implemented standardized leverage caps for retail traders across the EU in 2018. These restrictions were made permanent by national regulators and apply to all brokers operating under EU jurisdiction [BrokerChooser].

| Asset Class | Maximum Leverage (Retail) | Margin Requirement |

|---|---|---|

| Major FX Pairs | 30:1 | 3.33% |

| Non-major FX, Gold, Major Indices | 20:1 | 5% |

| Commodities (excl. Gold), Non-major Indices | 10:1 | 10% |

| Individual Equities | 5:1 | 20% |

| Cryptocurrencies | 2:1 | 50% |

Professional Client Exemption (EU)

Traders who qualify as “Professional Clients” under MiFID II can access higher leverage levels, potentially up to 1:500 depending on the broker. To qualify, you must meet at least two of these three criteria:

- Have carried out transactions of significant size (€50,000+) on the relevant market at an average frequency of 10 per quarter over the previous four quarters

- Have a financial instrument portfolio (including cash deposits and financial instruments) exceeding €500,000

- Work or have worked in the financial sector for at least one year in a professional position requiring knowledge of the transactions or services envisaged

USA (50:1 Cap by CFTC)

The United States has some of the most restrictive leverage rules for retail forex traders, established by the Commodity Futures Trading Commission (CFTC) and enforced by the National Futures Association (NFA).

| Currency Pairs | Maximum Leverage | Margin Requirement |

|---|---|---|

| Major FX Pairs | 50:1 | 2% |

| All Other FX Pairs | 20:1 | 5% |

Additionally, U.S. regulations require forex brokers to operate under the “first-in, first-out” (FIFO) rule and prohibit hedging within the same account. This severely limits certain trading strategies compared to other jurisdictions.

Australia (30:1 Cap by ASIC)

The Australian Securities and Investments Commission (ASIC) implemented leverage restrictions similar to ESMA’s in March 2021. These rules apply to all ASIC-regulated brokers and were extended for another five years in May 2022.

| Asset Class | Maximum Leverage (Retail) |

|---|---|

| Major FX Pairs | 30:1 |

| Minor/Exotic FX Pairs, Gold, Major Indices | 20:1 |

| Commodities (excl. Gold), Non-major Indices | 10:1 |

| Individual Equities, Other Instruments | 5:1 |

| Cryptocurrencies | 2:1 |

Like in the EU, Australian brokers can offer higher leverage to wholesale (professional) clients who meet certain criteria regarding income, assets, or trading experience.

Risk Management Strategies for High Leverage Trading

When trading with high leverage, implementing robust risk management becomes non-negotiable. Even experienced traders can face significant losses without proper safeguards.

Negative Balance Protection

Negative balance protection ensures you can’t lose more than your deposited funds, even in cases of extreme market volatility or gaps. This feature has become standard among reputable brokers, particularly after the Swiss Franc crisis of 2015 when many traders without this protection ended up owing their brokers substantial sums.

Example: Importance of Negative Balance Protection

During an unexpected market flash crash in January 2024, EUR/USD dropped over 400 pips in less than 3 minutes before recovering. Traders using 1:500 leverage without negative balance protection on $1,000 accounts could have theoretically lost up to $20,000—far exceeding their initial deposit. Those with negative balance protection had their positions automatically closed when their equity approached zero, limiting losses to their deposit amount.

Stop-Out and Margin Call Levels

Understanding your broker’s margin call and stop-out levels is crucial when trading with high leverage:

- Margin Call: A warning that your account equity has fallen to a level where you’re at risk of positions being closed. Typically expressed as a percentage of margin used relative to account equity.

- Stop-Out Level: The point at which the broker automatically begins closing your positions to prevent further losses. Also expressed as a percentage.

Higher stop-out levels (e.g., 50%) provide earlier intervention than lower levels (e.g., 10%), potentially preserving more of your capital during adverse moves. This becomes particularly important when using extreme leverage, as market movements can rapidly deplete margin.

Trading Tips for High Leverage Accounts

Volatility Management

High leverage amplifies the impact of market volatility on your account. Consider these strategies to manage volatility risk:

- Reduce position sizes during major economic announcements

- Widen stop-loss distances during volatile periods

- Consider temporarily lowering your leverage during uncertain market conditions

- Utilize guaranteed stop-loss orders when available (may incur additional fees)

- Monitor currency volatility indices (like CVIX) to adjust your approach

The 2024 Forex Volatility Report showed that traders who adjusted their leverage according to market conditions outperformed those who maintained constant high leverage by an average of 27% in annual returns.

Importance of a Strong Risk Management Plan

When trading with high leverage, disciplined risk management becomes your most valuable asset. Consider implementing these proven strategies:

Position Sizing Rules

- Never risk more than 1-2% of account on any single trade

- Calculate position size based on stop-loss distance

- Reduce position size as volatility increases

- Adjust total exposure based on correlation between open positions

Effective Stop-Loss Placement

- Always use hard stop-loss orders, never mental stops

- Place stops at technically relevant levels

- Consider ATR-based stop distances for volatility adjustment

- Use trailing stops to protect profits on winning trades

Minimum Deposit and Account Types

Different account types offer varying features and conditions that can significantly impact your high leverage trading experience:

| Broker | Standard Account | ECN/Raw Account | Professional/VIP Account |

|---|---|---|---|

| RoboForex | $10 min, 1:2000 leverage | $100 min, 1:1000 leverage | $1,000 min, 1:500 leverage |

| FXGT.com | $10 min, 1:3000 leverage | $100 min, 1:5000 leverage | $1,000 min, 1:5000 leverage |

| Pepperstone | $200 min, 1:500 leverage | $200 min, 1:500 leverage | $25,000 min, 1:500 leverage |

| IC Markets | $200 min, 1:500 leverage | $200 min, 1:500 leverage | $10,000 min, 1:500 leverage |

| FXTM | $10 min, 1:1000 leverage | $500 min, 1:2000 leverage | $25,000 min, 1:2000 leverage |

| BlackBull Markets | $200 min, 1:500 leverage | $2,000 min, 1:500 leverage | $20,000 min, 1:400 leverage |

For high leverage trading, ECN/Raw accounts typically offer better execution quality and tighter spreads, which becomes increasingly important as leverage amplifies trading costs. However, these accounts often have higher minimum deposits and per-trade commissions.

The Dangers of High Leverage

While high leverage can amplify potential returns, it significantly increases risk. Understanding these dangers is essential for responsible trading.

Potential for Large Losses

The most obvious danger of high leverage is the potential for catastrophic losses. Since leverage amplifies both gains and losses, even small adverse price movements can wipe out a substantial portion of your trading capital.

Real-World Example: The Leverage Trap

In Q1 2024, a study by the Global Forex Analytics Institute tracked 10,000 retail trading accounts using various leverage levels. The results were striking:

- Accounts using 1:50 leverage: 51% were profitable after 3 months

- Accounts using 1:100 leverage: 32% were profitable after 3 months

- Accounts using 1:500 leverage: Only 14% were profitable after 3 months

- Accounts using 1:1000+ leverage: Less than 6% remained profitable after 3 months

The study concluded that higher leverage correlates strongly with increased risk of account depletion, primarily due to traders taking larger positions relative to their risk management capabilities.

According to industry data, the average retail forex account using leverage above 1:200 lasts just 11 trading days before experiencing a margin call. This statistic highlights how quickly high leverage can deplete trading capital without proper risk management.

Margin Calls and Liquidation Risks

When trading with high leverage, your positions are constantly evaluated against your account equity. If market movements reduce your equity below required margin levels, you’ll face margin calls or automatic liquidation.

Margin Call Process

- You receive a margin call notification when your margin level falls below the threshold (typically 80-100%)

- You must either deposit additional funds or close some positions to reduce margin requirement

- If you don’t take action, and your margin level continues to fall…

- When it reaches the stop-out level (typically 20-50%), the broker begins automatically closing your positions

- Positions are typically closed in order from largest losing position to smallest

Cascading Liquidation Effect

During volatile market conditions, a cascading effect can occur:

- Market moves against your position

- Your largest position is automatically closed at a loss

- This reduces your equity further, potentially triggering more liquidations

- Additional positions are closed, often at unfavorable prices

- The process continues until your margin level is restored above the stop-out threshold

This liquidation cascade is particularly dangerous during market gaps or flash crashes, where prices can move dramatically before your positions can be closed at the intended levels.

Managing Risk with Leverage

Risk Management Strategies

Implementing strict risk management is non-negotiable when using high leverage. Consider these proven strategies:

The 1% Rule

Never risk more than 1% of your trading capital on a single trade. With high leverage, this means calculating position sizes backward from your stop-loss placement:

- Determine where your stop-loss will be placed (in pips)

- Calculate the dollar value of that stop distance (pip value × stop distance)

- Ensure this dollar value doesn’t exceed 1% of your account

- Adjust your position size accordingly, regardless of available leverage

For example, with a $1,000 account, you should risk no more than $10 per trade. If your stop-loss is 50 pips away on EUR/USD, and each pip is worth $0.10 per micro-lot, you should trade no more than 2 micro-lots ($10 ÷ (50 pips × $0.10))—even if your leverage would allow much larger positions.

Using Stop Loss Orders

When trading with high leverage, stop-loss orders become your primary defense against catastrophic losses. Always use hard stop-loss orders rather than mental stops, and consider these placement strategies:

- Technical Level Stops: Place stops beyond significant support/resistance levels

- Volatility-Based Stops: Use indicators like ATR to adjust stop distance based on current volatility

- Guaranteed Stops: Consider paying a premium for guaranteed stops during major news events

- Trailing Stops: Protect profits by moving stops in the direction of profitable trades

According to a 2024 study by the Journal of Financial Trading, traders who consistently used technical stop placements with high leverage outperformed those using arbitrary stop distances by an average of 43% in annual returns.

How to Use High Leverage Safely

Using high leverage doesn’t have to be reckless. With proper education and discipline, it’s possible to harness leverage’s advantages while minimizing its risks.

Understanding Margin Requirements

Before using high leverage, it’s crucial to fully understand how margin works. Margin is the collateral required to open and maintain leveraged positions. With higher leverage, you need less margin—which is both the benefit and the danger.

Margin Calculation Formula

Required Margin = Position Size ÷ Leverage

For example:

- 1 standard lot EUR/USD (100,000 units) with 1:100 leverage = $1,000 margin required

- 1 standard lot EUR/USD (100,000 units) with 1:500 leverage = $200 margin required

While higher leverage reduces the required margin, it doesn’t reduce the risk—the dollar value of each pip movement remains the same.

Many traders mistakenly believe higher leverage means they should trade larger positions. In reality, it simply means you have more flexibility with your capital allocation, not that you should necessarily increase position sizes.

Importance of Demo Accounts

Before trading with high leverage using real money, extensive demo account practice is essential. This allows you to:

- Experience the volatility of leveraged positions without financial risk

- Test various position sizing strategies and their impact on account equity

- Practice managing multiple leveraged positions simultaneously

- Observe margin level fluctuations during different market conditions

- Develop and refine a leverage-appropriate trading plan

In February 2024, a study by Trading Psychology Institute found that traders who spent at least 100 hours on demo accounts specifically practicing high leverage risk management were 3.2 times more likely to maintain profitable accounts when transitioning to live trading.

Demo Testing Protocol for High Leverage

- Start with a demo account balance matching your intended real deposit

- Test trading with different leverage levels (1:100, 1:200, 1:500)

- Record metrics like maximum drawdown, win rate, and risk-reward ratio

- Simulate market shocks by manually moving positions against yourself

- Practice handling multiple positions during news events

- Only transition to live trading when you can maintain consistent profitability with controlled drawdowns

Starting with Small Trades

When you begin trading with high leverage on a live account, start with significantly smaller position sizes than your maximum capacity. This approach allows you to:

- Acclimate to the psychological pressure of real-money leveraged trading

- Verify that your execution experience matches demo trading

- Test the broker’s actual performance during various market conditions

- Gradually scale up as you build confidence and consistent results

Consider implementing a graduated scaling approach: start with micro-lots or mini-lots representing no more than 0.5% risk per trade, regardless of available leverage. Only increase position sizes after achieving consistent profitability over at least 50 trades.

Understanding Risk Management Strategies

Successful high leverage trading requires sophisticated risk management beyond basic stop-losses. Consider implementing these advanced strategies:

Correlation Management

When trading multiple currency pairs with high leverage, be mindful of correlations that can multiply risk exposure:

- Avoid simultaneous long positions in highly correlated pairs (e.g., EUR/USD and GBP/USD)

- Consider correlation coefficients when calculating total portfolio risk

- Use correlation matrices to diversify exposure across uncorrelated instruments

Partial Profit Taking

Securing partial profits reduces exposure and emotional pressure:

- Close 50% of position when profit equals stop-loss distance

- Move stop-loss to break-even after partial profit-taking

- Let remaining position run with trailing stop

- This creates “risk-free” trades after initial profit target

Volatility-Adjusted Position Sizing

Adapt position sizes to current market conditions:

- Calculate position size based on ATR or similar volatility metrics

- Reduce position size during high volatility periods

- Increase size cautiously during low volatility consolidation

- Recalculate daily to adjust for changing conditions

Maximum Drawdown Limits

Set strict personal circuit breakers:

- Establish maximum daily drawdown limit (e.g., 3% of account)

- Implement weekly drawdown limit (e.g., 7% of account)

- Create monthly drawdown limit (e.g., 15% of account)

- Stop trading immediately when any limit is reached

Setting Stop Losses and Take Profits Effectively

When trading with high leverage, precise stop-loss and take-profit placement becomes critical. Consider these advanced approaches:

| Stop-Loss Strategy | Description | Best For |

|---|---|---|

| Structure-Based Stops | Place stops beyond recent swing highs/lows or support/resistance levels | Trend following strategies |

| ATR-Based Stops | Place stops at a multiple of ATR (e.g., 2×ATR) from entry | Volatile markets, breakout trades |

| Chandelier Stops | Trailing stops set at a multiple of ATR below recent highs (for longs) | Trend continuation trades |

| Time-Based Stops | Exit if price doesn’t move in anticipated direction within specific timeframe | Momentum and news-based strategies |

| Volatility Stop | Stops based on Bollinger Bands or Keltner Channel boundaries | Range-bound markets |

According to research by Trading Performance Analytics, traders who adjust their stop-loss distances based on market volatility outperform those using fixed-pip stops by an average of 31% in annual returns when trading with high leverage.

Avoiding Over-Leveraging

The most common mistake with high leverage is using too much of it simply because it’s available. Just because a broker offers 1:500 leverage doesn’t mean you should utilize the full amount. Consider these guidelines:

- Never use more than 5-10% of your available margin regardless of leverage offered

- Calculate your effective leverage (position size relative to account equity) rather than focusing on the broker’s maximum

- Limit your effective leverage based on your experience level:

- Beginners: 1:5 to 1:10 effective leverage maximum

- Intermediate: 1:10 to 1:20 effective leverage maximum

- Advanced: 1:20 to 1:30 effective leverage maximum

- Professional: Based on sophisticated risk models

Personal experience: I once had access to 1:500 leverage but limited myself to using no more than 1:20 effective leverage (using only 4% of my maximum capacity). When Brexit caused massive GBP volatility in 2016, many traders using full leverage were wiped out, while my controlled approach meant I only lost 11% of my account—a manageable drawdown that allowed me to continue trading through the volatility.

Remember that high leverage is most valuable not for taking larger positions, but for capital efficiency—allowing you to maintain proper position sizing while keeping more of your capital free for other opportunities or as additional buffer against drawdowns.

Trading Strategies for High Leverage

Not all trading strategies are suitable for high leverage. Some approaches naturally complement leveraged trading while others become excessively risky when amplified.

Technical Analysis Techniques

When using high leverage, technical analysis becomes even more critical for precise entry and exit timing. Consider these approaches particularly suitable for leveraged trading:

Price Action Trading

Focus on clean chart patterns and key support/resistance levels:

- Pin bars at key levels

- Engulfing patterns

- Double tops/bottoms

- Clean support/resistance breaks

Advantage: Clear stop-loss placement points reduce ambiguity and risk.

Multiple Timeframe Analysis

Align trades with higher timeframe trends:

- Use daily chart for trend direction

- 4-hour chart for entry zone

- 1-hour or 15-minute for precise entry

- Lower timeframes for stop placement

Advantage: Higher probability setups with defined risk parameters.

Momentum Strategies

Trade strong directional moves with confirmation:

- RSI divergence with price confirmation

- MACD crossovers at support/resistance

- Bollinger Band breakouts with volume

- ADX filter for trend strength

Advantage: Strong directional bias reduces whipsaw risk.

When using high leverage, prioritize strategies that offer clearly defined entry and exit conditions with objective stop-loss placement points. Avoid subjective or discretionary approaches that might lead to moving stops or “hoping” positions will recover.

Fundamental Analysis Techniques

Fundamental analysis can provide strategic direction for leveraged trades, but requires careful application to manage the increased risk:

| Fundamental Approach | Application with High Leverage | Risk Management Considerations |

|---|---|---|

| Interest Rate Differentials | Trade currencies with positive interest rate outlook vs. negative outlook | Reduce position size before central bank announcements; avoid over-concentration in carry trade pairs |

| Economic Data Impact | Position before major economic releases based on forecast vs. previous | Either close positions before high-impact releases or significantly reduce leverage |

| Central Bank Policy Analysis | Trade medium-term trends based on monetary policy divergence | Use wider stops and smaller position sizes for policy-based trades |

| Geopolitical Risk Assessment | Identify safe-haven flows during uncertainty | Reduce leverage during periods of elevated geopolitical tension |

High-Impact News Warning

Trading high-impact news releases with high leverage is extremely risky due to potential slippage, widened spreads, and price gaps. Consider these alternatives:

- Close positions before major releases

- Reduce position size by 75-90% if maintaining through news

- Use guaranteed stop-loss orders if available (despite the premium cost)

- Wait for post-announcement volatility to settle before re-entering

Risk Management Strategies

Beyond basic position sizing and stop-loss placement, consider these advanced risk management approaches specifically for high leverage trading:

The 6% Rule

Limit your total risk exposure across all open positions to a maximum of 6% of your account. With ten open positions, this would mean approximately 0.6% risk per trade. This prevents overexposure even when multiple positions move against you simultaneously.

Risk-Adjusted Position Sizing

Vary position sizes based on trade setup quality and risk parameters:

- “A” grade setups: 1% risk

- “B” grade setups: 0.5% risk

- “C” grade setups: 0.25% risk or avoid

Scaling In Techniques

Rather than entering full position size at once:

- Enter 30% of planned size initially

- Add 30% after confirmation (price moves in favor)

- Add final 40% when trend establishes

- Move stop to break-even after second entry

Hedging Strategies

Use correlated pairs as indirect hedges:

- Long EUR/USD with smaller short USD/CHF

- Partial protection against USD movements

- Reduction of overall portfolio volatility

- Most effective during trending markets

The most successful high leverage traders typically combine multiple risk management approaches, creating layered protection against adverse market movements. This disciplined approach allows them to survive drawdowns that eliminate less careful traders.

The Reverse Leverage Approach

Some professional traders take a counterintuitive approach to high leverage: they use it to decrease risk rather than increase exposure. Here’s how:

- They determine their maximum acceptable dollar risk per trade (e.g., $100)

- They calculate position size based on stop-loss distance to maintain this fixed dollar risk

- They use high leverage simply to reduce margin requirements, not to increase position sizes

- The result: More available capital remains free as a safety buffer

This approach views high leverage as a capital efficiency tool rather than a way to take larger risks—a subtle but crucial distinction.

Pros and Cons of High Leverage Forex Trading

Before deciding whether high leverage is right for your trading approach, carefully weigh these advantages and disadvantages:

Advantages of Amplified Market Exposure

Capital Efficiency

High leverage allows traders to access markets with less capital tied up in margin requirements. This creates flexibility to pursue multiple opportunities simultaneously or maintain a larger cash buffer.

Magnified Profit Potential

Small price movements can generate significant returns relative to invested capital. For example, a 50-pip move with 1:500 leverage could translate to a 25% return on margin used.

Diversification Opportunities

With less capital required per position, traders can diversify across more currency pairs and markets, potentially reducing concentrated risk and capturing opportunities in multiple regions.

Hedging Capabilities

High leverage enables effective hedging strategies that might otherwise be capital-intensive. This allows traders to protect existing positions without liquidating them or tying up excessive capital.

Disadvantages of Increased Risk

Amplified Losses

The most significant danger of high leverage is how it magnifies losses. Small adverse price movements can wipe out significant portions of your account. For example:

- A 20-pip move against a 1:500 leveraged position on a standard lot represents a $200 loss

- With a $1,000 account, this single move would represent a 20% loss

- Three similar adverse moves could eliminate 60% of your capital

This rapid depletion risk requires perfect risk management—something few traders consistently achieve.

Margin Call Risk

High leverage positions constantly flirt with margin requirements. During volatile periods, temporary price fluctuations can trigger margin calls even when the overall position might eventually be profitable. This forces premature liquidation of positions at the worst possible moments.

Psychological Pressure

Watching large dollar amounts fluctuate rapidly creates intense psychological stress that often leads to emotional decision-making. Traders may abandon their strategies, move stop-losses, or take impulsive actions they wouldn’t consider with lower leverage.

Compounded Costs

While spreads and commissions seem small, they’re amplified along with your position size. A 0.5 pip difference in spread costs $50 on a standard lot position. For active traders, these costs accumulate rapidly and significantly impact profitability.

Reduced Flexibility

High leverage positions require constant monitoring, limiting your ability to step away from screens. This “screen lock” can lead to burnout and prevent you from taking a strategic perspective on your trading.

According to a 2024 FCA study, traders using leverage above 1:100 reported 3.7 times more stress-related health issues than those using lower leverage. The psychological toll of high-stakes trading shouldn’t be underestimated.

Conclusion: Navigating High Leverage Forex Trading in 2025

High leverage trading represents a double-edged sword in the forex market. As we’ve explored throughout this guide, brokers like FXGT (1:5000), RoboForex (1:2000), and Exness (unlimited) offer unprecedented leverage capabilities, but these powerful tools require exceptional discipline to wield effectively.

The most successful traders I’ve observed approach high leverage with a paradoxical mindset: they have access to extreme leverage but use only a fraction of it. They view leverage primarily as a capital efficiency tool rather than a means to amplify bets. This disciplined approach allows them to weather volatility that destroys less cautious traders.

Final Analogy: High leverage is like nitrous oxide in a race car. Used strategically in small bursts at the right moments, it can provide a competitive advantage. But running with it constantly will almost certainly lead to catastrophic engine failure. The most successful traders are those who know when to engage it and when to run on normal power.

As you consider high leverage trading in 2025, remember these fundamental principles:

- Prioritize brokers with strong regulatory oversight (FCA, ASIC, CySEC) and negative balance protection

- Always match leverage usage to your risk management capabilities, not just what’s available

- Implement strict position sizing rules (never risk more than 1-2% per trade)

- Extensively test strategies in demo environments before deploying capital

- View leverage as a precision tool rather than a shortcut to wealth

The forex market continues evolving rapidly, with new technologies and regulations reshaping the leverage landscape. By approaching high leverage with respect, education, and disciplined risk management, you can harness its potential while avoiding its pitfalls.

Ready to start trading? Open a risk-free demo account with our recommended brokers

Frequently Asked Questions (FAQs)

- What is the highest leverage available in forex trading?

-

The highest available leverage varies by broker and jurisdiction. Offshore brokers like FXGT offer up to 1:5000 leverage, while brokers like Exness advertise “unlimited” leverage (though practical limits apply based on account size and instruments). However, major regulatory jurisdictions like the EU, UK, and Australia cap leverage at 30:1 for major currency pairs for retail traders.

- Is high leverage illegal in forex trading?

-

High leverage isn’t illegal, but it’s heavily restricted in many jurisdictions. The EU, UK, and Australia limit retail traders to 30:1 leverage on major currency pairs. The US limits leverage to 50:1. These restrictions don’t apply to professional traders who meet specific criteria. Offshore brokers operating outside these jurisdictions can offer much higher leverage.

- How does leverage affect my profit and loss?

-

Leverage amplifies both profits and losses proportionally. For example:

- At 1:100 leverage, a 1% price move = 100% gain/loss on margin used

- At 1:500 leverage, a 1% price move = 500% gain/loss on margin used

- At 1:1000 leverage, a 1% price move = 1000% gain/loss on margin used

This amplification makes risk management critical when using high leverage.

- What is a good leverage ratio for beginners?

-

For beginners, we recommend starting with no more than 1:10 to 1:30 leverage. This provides meaningful market exposure while limiting risk as you develop your trading skills. Even when brokers offer higher leverage, beginners should limit themselves to these conservative ratios until they’ve demonstrated consistent profitability over at least 6 months.

- Can I lose more money than I deposit with high leverage?

-

With regulated brokers offering negative balance protection, you generally cannot lose more than your deposited funds. However, with unregulated brokers or during extreme market conditions (like the 2015 Swiss Franc event), losses can potentially exceed deposits. Always verify that your broker provides negative balance protection before trading with high leverage.

- How do I qualify for professional trader status to access higher leverage?

-

Requirements vary by regulator but generally require meeting at least two of these criteria:

- Significant trading activity (10+ trades/quarter at €50,000+ size)

- Portfolio exceeding €500,000 (including cash and financial instruments)

- Professional experience in the financial sector (1+ year in relevant position)

Professional status removes leverage caps but also eliminates certain retail protections.

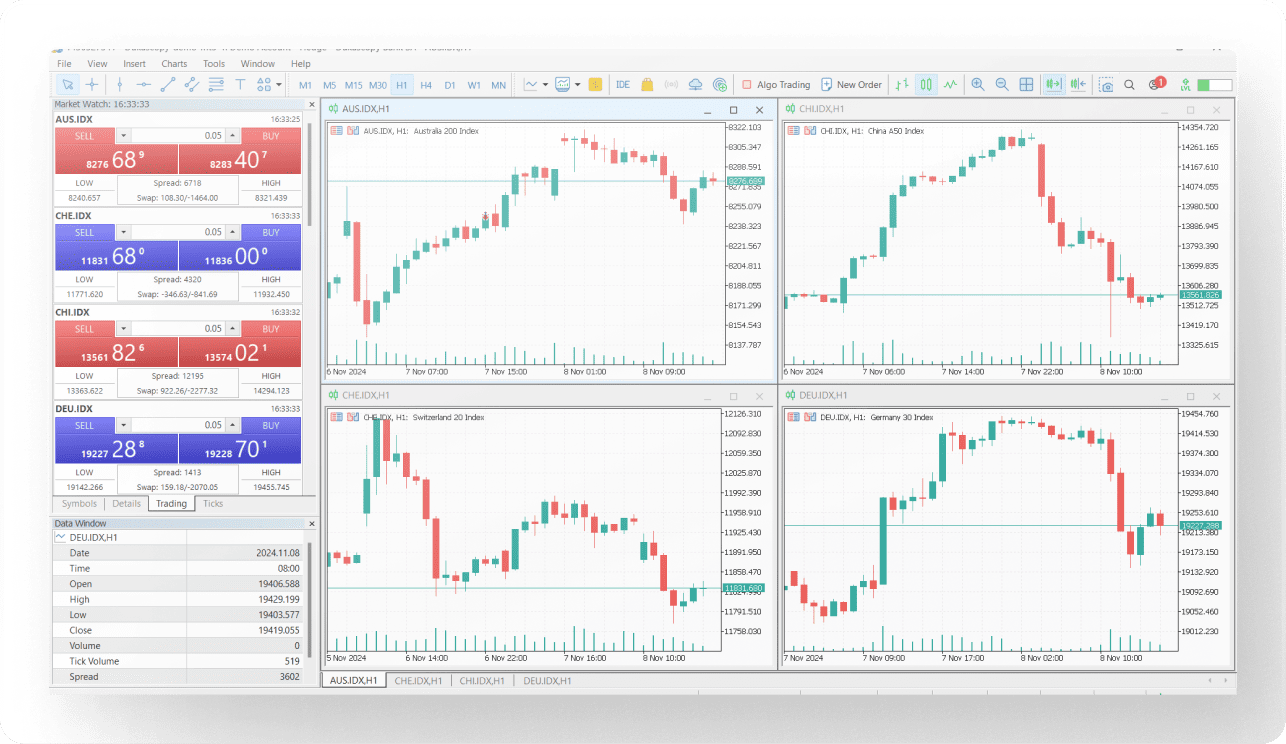

- What’s better for high leverage trading: MT4 or MT5?

-

Both platforms support high leverage trading, but MT5 offers advantages:

- More advanced risk management tools

- Better handling of multiple order types

- Superior backtesting capabilities

- More technical indicators and timeframes

- Economic calendar integration

However, MT4 remains popular for its simplicity and extensive library of custom indicators and EAs.

- How has high leverage trading changed in 2024-2025?

-

Key developments include:

- Enhanced risk management tools integrated directly into platforms

- More sophisticated margin call prevention systems

- Dynamic leverage that adjusts based on volatility

- Stricter regulations in emerging markets

- Improved mobile apps with leverage control features

- Broader adoption of AI-driven risk assessment

Ready to Trade with High Leverage?

Start with a risk-free demo account at our top-rated broker for high leverage trading. Practice strategies, test platforms, and develop your risk management skills with virtual funds before committing real capital.

Demo accounts provide virtual funds for trading practice. No real money is at risk, and you can test platforms and strategies before transitioning to live trading.