Imagine betting on whether avocado toast prices will rise tomorrow without actually buying a single slice. That’s essentially what happens in this $7 trillion global arena where price predictions rule. We’re talking about leveraged positions where tiny market movements create big opportunities – and hidden costs add up faster than streaming service subscriptions.

Think of these platforms as the ultimate middlemen. They profit through the gap between buying and selling prices (like when GlaxoSmithKline shares show 99-101 quotes), plus overnight fees that work like credit card interest on steroids. Some even charge ticket-style commissions – though many now waive these to stay competitive.

Here’s the kicker: when traders stumble, these companies often benefit directly. It’s not malice – just math. Through clever risk management (picture financial Tetris with offsetting positions), they keep the lights on while helping you speculate on everything from tech stocks to oil futures.

Key Takeaways

- Platforms earn through bid-ask spreads like concert ticket service fees

- Overnight financing charges apply to leveraged positions

- Some firms profit when trades go south through hedging strategies

- Commission-free models often hide costs in wider spreads

- Market-making creates liquidity but introduces potential conflicts

Introduction to CFD Trading

Ever wanted to ride the waves of Tesla’s stock price without actually buying shares? That’s the magic carpet ride CFDs offer. Think of it like renting a Lamborghini for a weekend joyride – you get the thrill without the garage headaches.

What Are CFDs?

These financial contracts let traders speculate on price swings like weather forecasters predicting storms. You’re not buying the asset – just betting on its direction. One Reddit user put it best: “It’s like getting paid to predict rain, without needing to own a cloud.”

Overview of Trading Instruments

The menu here beats your favorite food truck. Choose from:

| Asset | Example | Special Sauce |

|---|---|---|

| Stocks | Apple shares | Cash dividends added automatically |

| Indices | S&P 500 | Trade entire markets in one click |

| Forex | EUR/USD | 24/5 trading like a night owl’s paradise |

| Commodities | Crude oil | No physical barrels cluttering your basement |

Brokers keep the lights on through clever fee structures. The spread – that gap between buy/sell prices – works like a movie theater’s popcorn markup. Overnight fees? Those are the interest charges on your financial credit card.

Remember: every position you open is a handshake deal with the platform. They handle the messy ownership stuff while you focus on predicting trends. Just watch those fees – they can nibble at profits like a determined squirrel with your picnic lunch.

Understanding CFDs and Their Structure

Picture this: you’re playing a video game where 1 coin controls 100 in-game dollars. That’s leverage in action – a financial superpower letting traders punch above their weight class. But like any power-up, it comes with strings attached.

Mechanics of Price Speculation

Price moves here work like dominoes. Each tiny tick matters – a 0.5% shift in oil prices could mean dinner money or delivery ramen for a week. Traders bet on these differences without owning barrels or stock certificates. One Reddit regular joked: “It’s like getting paid to predict rainbows – no pot of gold required.”

Markets dance to their own beat. Your job? Spot patterns in the chaos. A $10,000 position might only need $500 upfront – that’s 20:1 leverage. But remember:

| Leverage Ratio | Margin Required | Position Size |

|---|---|---|

| 1:10 | $1,000 | $10,000 |

| 1:50 | $200 | $10,000 |

| 1:200 | $50 | $10,000 |

The Role of Leverage

Leverage turns pocket change into serious plays. But here’s the catch – losses multiply faster than TikTok trends. That $50 controlling $10,000? A 1% drop wipes out your entire margin. Pros treat it like hot sauce: a little enhances flavor, too much ruins the meal.

Risk management becomes your best friend. Setting stop-losses is like wearing a seatbelt – boring until you need it. As markets swing, that delicate balance between ambition and caution separates weekend warriors from consistent performers.

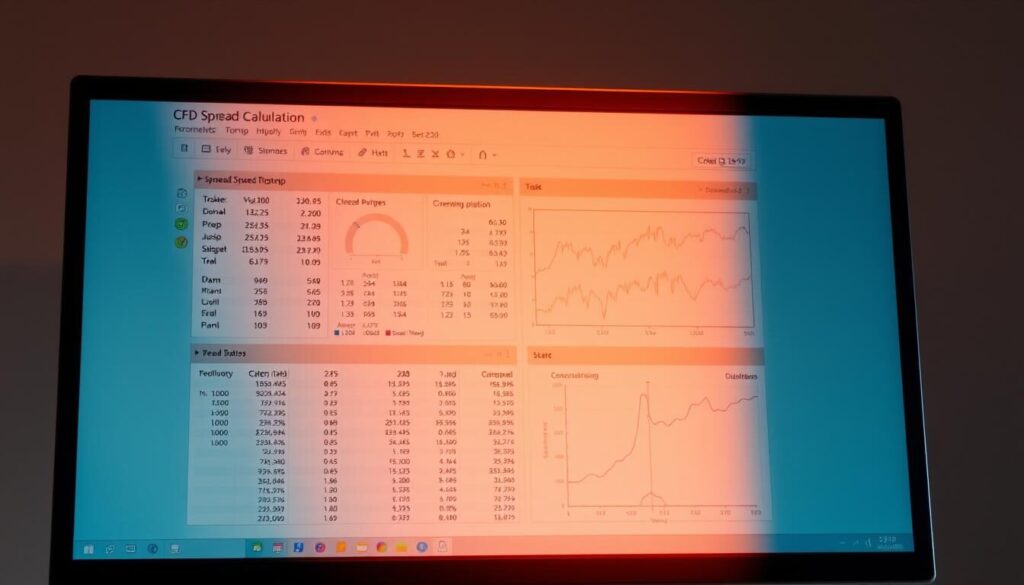

How do CFD brokers make money

Ever notice how concert tickets have those annoying service fees? Trading platforms work similarly – their bread and butter comes from three main taps in the financial plumbing system. Let’s grab our wrenches and see where the money flows.

Revenue Streams: Spreads, Commissions, and Other Fees

That gap between buy/sell quotes? That’s the spread – the platform’s service charge. Take GlaxoSmithKline shares:

| Bid Price | Ask Price | Spread | Your Cost per 100 shares |

|---|---|---|---|

| $99.50 | $99.55 | 0.05% | $5.00 |

| $140.03 | $140.06 | 0.02% | $3.00 |

Commissions sneak in like extra toppings on a pizza order. Some platforms charge 2¢ per share – seems trivial until you’re trading 500 Apple contracts. Overnight fees? Those are the interest charges for borrowing the platform’s money after dark.

Real-World Examples and Calculations

Let’s break it down like a coffee shop receipt:

- 100 GlaxoSmithKline shares @ $99.55 (ask price)

- 0.02% commission = $1.99

- Held overnight? Add $0.85 financing fee

Total platform take: $5 spread + $1.99 + $0.85 = $7.84. Do this 1,000 times daily? Cha-ching – $7,840 in revenue. Suddenly those “tiny” fees look like hungry raccoons at a campsite.

Smart traders watch these numbers like Netflix subtitles. Because in markets, what you don’t see often costs more than what you do.

Spread Costs and Commission Structures

Ever stood in line at two coffee shops comparing latte prices? That’s spread math in real life – except instead of milk foam, we’re talking about the gap between buying and selling prices. This invisible toll booth charges every trader passing through.

Analyzing the Impact of Bid/Ask Spreads

Let’s crack open that coffee analogy. If Stock X shows a bid price of $140.03 (what buyers offer) and an ask price of $140.04 (seller’s minimum), that $0.01 difference is your first obstacle. For 100 shares? That’s $1 disappearing before you even start making money.

Platforms structure these spreads like matryoshka dolls – layers within layers. Major currency pairs often have tighter gaps (EUR/USD at 0.9 pips), while exotic markets widen like highway lanes during rush hour. One Reddit trader joked: “It’s the financial version of ‘convenience fees’ – you’re paying for the privilege to play.”

| Account Type | EUR/USD Spread | Commission | Cost per $10k Trade |

|---|---|---|---|

| Standard | 0.9 pips | $0 | $9.00 |

| Pro | 0.1 pips | $7.00 | $8.00 |

Notice how the “commission-free” option actually costs more? That’s spread economics in action. Active traders doing 50 daily moves could lose $450/month to these gaps – enough for a weekend getaway.

Here’s the secret sauce: research your platform’s fee menu like a food critic. Some blend spreads with overnight charges, others add à la carte commissions. XTB’s Pro account slashes spreads but adds ticket-style fees – perfect for heavy traders, brutal for newbies.

Remember that coffee comparison? A single pip difference might seem trivial – until you’re buying 1,000 cups. In trading CFDs, those tiny gaps become canyons when leverage enters the chat. Watch them like a hawk eyeing its prey.

Additional Fees: Overnight Financing and Hidden Costs

Ever rented a hotel room and found unexpected mini-bar charges? That’s overnight financing in a nutshell – the midnight tax platforms charge for borrowing their money. These fees nibble at your price predictions like mice at a cheese platter, especially when positions stay open past bedtime.

Explaining Financing Charges and Markups

Here’s how the math works: (Position Size × (Interest Rate + Broker Markup)) ÷ 365. Let’s say you’re trading forex with €100,000 on EUR/USD. If the benchmark rate is 5% plus a 2% markup:

| Position | Daily Cost | Weekly Cost |

|---|---|---|

| Long (Buy) | €100,000 × 7% ÷ 365 = €19.18 | €134.26 |

| Short (Sell) | €100,000 × 1% ÷ 365 = €2.74 | €19.18 |

Notice how holding long positions costs seven times more? One Reddit trader grumbled: “It’s like paying interest on a sports car you’re only test-driving.”

Margin usage amplifies these fees. Using 50:1 leverage? Your €2,000 controls €100,000 – but those nightly charges apply to the full amount. Over three months, that’s €1,700 disappearing from your account. Poof!

Hidden costs pile up faster than unread emails. A 0.03% daily fee seems harmless – until it becomes 10.95% annually. Like a leaky faucet dripping dollar bills, these charges quietly influence your bottom line. Watch them closer than your ex’s Instagram stories.

Risk Management Strategies in CFD Trading

Ever seen a trapeze artist work without a safety net? That’s trading without risk controls – thrilling until gravity wins. Smart traders treat their capital like rare vinyl records: handle with care, protect from scratches.

Mitigating Losses with Stop-Loss Orders

Stop-losses are your financial eject button. Imagine buying Tesla shares at $250 – setting a $230 stop is like saying: “I’ll exit this rollercoaster before it loops upside down.” One Reddit user quipped: “My stop-loss is the adult supervision my inner gambler needs.”

Here’s how it works in practice:

| Position Size | Stop-Loss % | Max Loss |

|---|---|---|

| $5,000 | 2% | $100 |

| $10,000 | 1.5% | $150 |

Notice how smaller positions limit damage? It’s like choosing between bandaids and tourniquets.

Best Practices for Margin and Leverage Control

Leverage is fire – useful for cooking, dangerous if mishandled. A 50:1 ratio turns $200 into $10,000 exposure. Fun until markets sneeze. Pros keep leverage under 10:1 – like using oven mitts instead of bare hands.

Three rules for survival:

- Check margin requirements like weather forecasts

- Keep 30% buffer for volatile contract moves

- Review positions weekly – outdated trades age like milk

Time your exits like a subway dancer. Set alerts for key levels, and maintain access to extra funds – because markets move faster than TikTok trends. Remember: protecting capital isn’t boring. It’s what lets you play another day.

Leveraging Technology and Trading Platforms

Remember trading with paper charts and landline phones? Modern platforms are like swapping a bicycle for a jetpack. Today’s tools turn complex market patterns into actionable insights – think weather radar for financial storms.

Utilizing Advanced Trading Tools

MetaTrader’s platforms act like Swiss Army knives for traders. Real-time data streams flow faster than TikTok feeds, while risk calculators work like calorie counters for your positions. One Reddit user marveled: “It’s like having Wall Street analysts whispering in your AirPods.”

These systems shine when tracking indices and shares. Imagine getting live updates on the S&P 500’s heartbeat while monitoring Apple’s stock pulse – all from your smartphone. Key features include:

| Tool | Benefit | Real-World Impact |

|---|---|---|

| Economic calendars | Predict market earthquakes | Avoid trading during Fed speeches |

| Custom alerts | Never miss opportunities | Ping when Bitcoin hits $60k |

| One-click trading | Execute faster than microwave popcorn | Capitalize on flash crashes |

Low commissions become possible through tech efficiency – like streaming movies without DVD rental fees. Platforms trim operational costs using cloud servers, passing savings to users. Mobile apps let you manage capital from soccer practice or the dentist’s chair.

The real magic? Transforming nervous beginners into confident strategists. Automated risk parameters act like training wheels, while historical data replays let you practice trades like guitar chords. Suddenly, complex scenarios feel as manageable as Sunday crossword puzzles.

Regulatory Environment and Market Accessibility

Think of financial regulations as airport security lines – annoying but designed to keep everyone safe. While 93% of countries allow price speculation through these instruments, the U.S. treats them like unaccompanied minors – restricted entry for safety reasons.

Rules of the Game

Regulators play referee in this global arena. The EU caps leverage at 30:1 for retail traders – like speed governors on race cars. Meanwhile, platforms adjust fee percentages like chefs tweaking recipes to meet local tastes. One compliance officer joked: “Our spreadsheets have more rules than Monopoly boards.”

Three key protections shield traders:

- Negative balance protection (your account won’t dip below zero)

- Mandatory risk warnings (like surgeon general labels)

- Transparent data reporting (no hidden ingredients)

Brokers operating under strict jurisdictions must maintain capital reserves like emergency funds – $20 million in the U.S. versus $500k in offshore zones. It’s the difference between staying at a Ritz-Carlton versus a hostel.

| Region | Leverage Limit | Investor Protections |

|---|---|---|

| EU/UK | 30:1 (Forex) | Negative balance shield |

| Australia | 30:1 | Segregated accounts |

| Offshore | 500:1 | Minimal safeguards |

Smart traders use these rules to their advantage. Choosing regulated platforms is like picking seatbelts over speed – boring until you need protection. Your strategy should adapt to local landscapes, because what works in London might crash in Belize.

Conclusion

Putting together the pieces of this financial puzzle reveals a clear picture. Platforms profit through three main channels – the spread’s invisible tax, overnight charges that stack like pancakes, and occasional ticket-style commissions. Every instrument has its quirks, whether you’re trading oil barrels or tech stocks.

Understanding these mechanics transforms you from spectator to strategist. Those tiny price gaps in the underlying asset? They’re the secret sauce in this global marketplace. Hidden fees matter – they’re the popcorn markups of finance, quietly nibbling at returns.

Smart traders treat platforms like GPS navigators. Use their tools, but know the route. Check fee structures like restaurant menus – what’s advertised upfront often hides extra costs in the fine print. Risk management remains your North Star, guiding decisions through volatile markets.

Ready to place your next move? Remember: knowledge about how platforms brokers make money turns the odds in your favor. Whether you’re testing waters or diving deep, CFD trading works best when you see both the forest and the trees.

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn 0 into a

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting

FAQ

Why does the bid-ask spread feel like paying a toll bridge?

Brokers bake their fees into that gap between buy/sell prices. Think of it like concert tickets – you pay slightly more than face value (the “ask”) while sellers get less (the “bid”). That difference? That’s their slice. For example, if Apple shares have a $0.10 spread, every trade chips a little into your potential profit.

Can overnight positions turn into a Netflix subscription I forgot to cancel?

Sort of! Holding trades past market close triggers financing fees – like interest on borrowed money. Platforms like MetaTrader 4 auto-deduct these daily. The longer you hold, the more those charges add up. Pro tip: Check swap rates before bed – it’s cheaper than waking up to surprise fees.

How does leverage turn $100 into a $1,000 rollercoaster ride?

Brokers let you trade bigger positions with less cash upfront (like 10:1 leverage). But here’s the twist: While gains amplify, so do losses. Imagine betting $1,000 on gold with only $100 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s $50 gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.

,000 on gold with only 0 – a 2% drop wipes your capital. It’s adrenaline-packed, but margin calls can end the party fast.

Are stop-loss orders really an "undo button" for bad trades?

Close! They’re more like airbags – they limit damage but don’t prevent crashes. If Tesla stock nosedives, your stop-loss exits at a preset price. But during market gaps (like earnings surprises), it might trigger lower than expected. Still beats watching losses spiral while refreshing your screen.

Do brokers profit when I lose like a casino?

Not exactly. Most use a “market maker” model – they profit from spreads/fees regardless of your outcome. Some platforms (like eToro) hedge trades internally, but regulations like MiFID II require transparency. Your loss is another trader’s gain, not the broker’s direct paycheck.

Why do crypto CFDs have wider spreads than forex?

Volatility’s the culprit. Bitcoin’s price swings make brokers hedge risk by widening spreads – like charging extra for insuring a fireworks stand. Compare EUR/USD’s 0.6 pip spread to Bitcoin’s gap. Less liquid assets (like altcoins) often have even juicier margins for brokers.