Key Takeaways: Opening Your Forex Trading Account

- Choose regulated brokers only: Prioritize brokers regulated by FCA, ASIC, CySEC, JFSA, MAS, or DFSA for maximum security

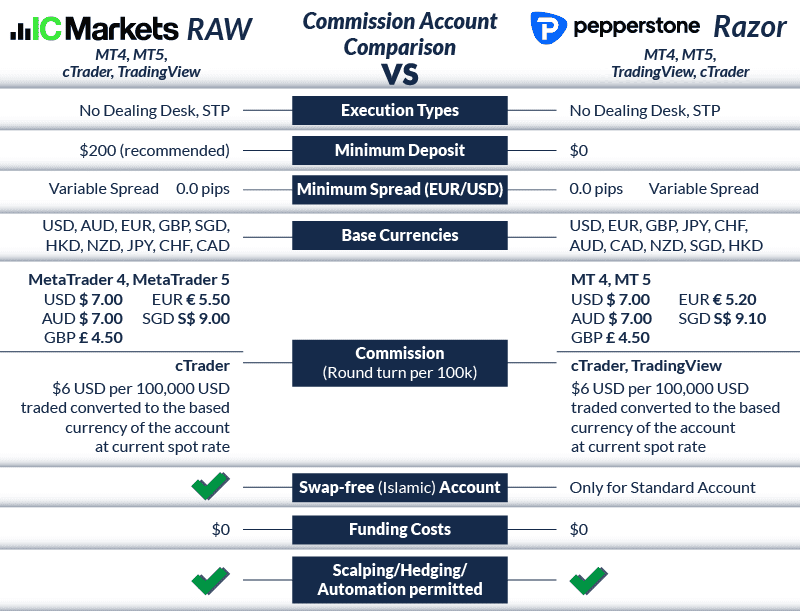

- Compare spreads and fees: IC Markets offers spreads from 0.0 pips, while Pepperstone provides 0.1-pip EUR/USD spreads

- Test platforms with demos: Practice on MetaTrader 4/5 or cTrader demo accounts before risking real money

- Prepare KYC documents: Have your passport/ID and proof of address (utility bill) ready for verification

- Start small, think big: Many brokers offer $0 minimum deposits, but experts recommend starting with at least $200

Introduction

Honestly, opening a forex trading account isn’t rocket science—but it’s not as simple as signing up for social media either. I’ve been trading for years, and I wish someone had given me the straight truth about what really matters when starting out.

Here’s what most guides won’t tell you: 72% of retail traders lose money according to recent broker disclosures. But don’t let that scare you—the other 28% who succeed follow specific steps that I’ll share with you today.

Think of forex trading like learning to drive. You wouldn’t just hop in a Ferrari on the highway, right? You’d start with driving lessons, practice in parking lots, and gradually build confidence. Opening a forex account follows the same principle.

What is a Forex Trading Account?

Definition and Purpose

A forex trading account is essentially your gateway to the $7.5 trillion daily foreign exchange market. It’s like having a digital storefront where you can buy and sell currencies 24/5 (Monday through Friday).

Think of it this way: Forex is like a massive global farmers’ market—but instead of trading apples for oranges, you’re trading dollars for euros, pounds for yen. Your trading account is your vendor booth where you make these exchanges, hoping to profit from price differences.

Unlike stock markets that close at specific times, forex never sleeps. When New York closes, Tokyo opens. When London wakes up, Sydney’s winding down. This creates opportunities—and risks—24 hours a day.

Types of Forex Accounts (Standard, Mini, Micro, Managed)

Standard Accounts

- Trade in standard lots (100,000 units)

- Higher profit potential per pip

- Requires larger capital (typically $1,000+)

- Best for experienced traders

- Full access to all trading tools

Mini Accounts

- Trade in mini lots (10,000 units)

- 10% of standard account risk

- Lower minimum deposits ($100-$500)

- Perfect for intermediate traders

- Good balance of risk and reward

Micro Accounts

- Trade in micro lots (1,000 units)

- Minimal risk exposure

- Start with as little as $10

- Ideal for complete beginners

- Learn without major losses

Swap-Free Accounts (For Islamic Traders)

Islamic/Swap-Free Accounts: Designed for traders who follow Sharia law, these accounts eliminate overnight interest charges (swaps) to comply with Islamic finance principles. Instead of earning or paying interest on positions held overnight, brokers may charge a fixed administration fee.

Major brokers offering Islamic accounts include:

- IC Markets: Swap-free on both Raw Spread and Standard accounts

- AvaTrade: Compliant with Sharia law requirements

- FP Markets: No swap charges on overnight positions

Why Open a Forex Trading Account?

Benefits of Forex Trading

Let me be real with you—forex isn’t a get-rich-quick scheme. But it offers unique advantages that attract millions of traders worldwide:

- 24/5 Market Access: Trade anytime during weekdays—perfect if you have a day job

- High Liquidity: With $7.5 trillion daily volume, you can enter and exit trades instantly

- Low Barriers to Entry: Some brokers allow you to start with just $10

- Leverage Opportunities: Control larger positions with smaller capital (use carefully!)

- Diverse Trading Strategies: From scalping to swing trading, multiple approaches work

Risks Involved in Forex Trading

Reality Check: Before you get excited about potential profits, understand that 72-81% of retail traders lose money according to broker disclosures from top firms like AvaTrade and Admiral Markets. This isn’t meant to scare you—it’s meant to prepare you.

The main risks include:

- Market Volatility: Currency prices can swing wildly due to news events

- Leverage Risks: While leverage amplifies profits, it also amplifies losses

- Emotional Trading: Fear and greed lead to poor decision-making

- Lack of Knowledge: Trading without proper education is like gambling

Choosing the Right Forex Broker

This is where most beginners mess up. They choose brokers based on flashy ads or unrealistic bonus promises. Here’s what actually matters:

Key Factors to Consider When Selecting a Broker

Regulation and Licensing (FCA, NFA, ASIC)

2024 Regulatory Updates: The UK’s Financial Conduct Authority (FCA) released new guidelines for CFD providers, emphasizing enhanced consumer protection. Australian ASIC continues maintaining strict leverage caps, while Cyprus CySEC has tightened supervision priorities for 2024.

Here’s the hierarchy of forex regulation—from most to least trusted:

| Tier 1 Regulators | Country/Region | Key Features | Leverage Limits |

|---|---|---|---|

| FCA | United Kingdom | FSCS protection up to £85,000 | 30:1 major pairs |

| ASIC | Australia | Strict capital requirements | 30:1 major pairs |

| CySEC | Cyprus (EU) | MiFID II protection | 30:1 major pairs |

| JFSA | Japan | Segregated client funds | 25:1 all pairs |

| MAS | Singapore | High capital requirements | 20:1 major pairs |

Trading Platform Features (MetaTrader 4/5, Desktop vs. Mobile)

The platform is your trading cockpit. Here’s how the main platforms stack up in 2024:

MetaTrader 4

Most Popular Choice

- Simple, user-friendly interface

- 30+ built-in technical indicators

- Extensive EA (Expert Advisor) support

- Available on 1,600+ brokers

- 9 timeframes for analysis

- Large community and resources

MetaTrader 5

Advanced Features

- 21 timeframes vs MT4’s 9

- Built-in economic calendar

- More order types available

- Multi-asset trading capability

- Advanced backtesting features

- Better for stock/futures trading

cTrader

Professional Choice

- Modern, intuitive interface

- Level 2 market depth

- 28 timeframes available

- Advanced order types

- Built-in copy trading

- Platform syncing across devices

Based on recent CompareForexBrokers analysis, cTrader wins for advanced traders wanting modern features, while MT4 remains king for beginners due to its simplicity and widespread broker support.

Fees, Spreads, and Commissions

This is where brokers make their money—and where you can lose yours if you’re not careful. Here’s the reality of trading costs in 2024:

| Cost Type | How It Works | Typical Range | Impact on $10,000 Trade |

|---|---|---|---|

| Spread | Difference between bid/ask prices | 0.1-2.0 pips | $1-$20 per trade |

| Commission | Fixed fee per trade | $3-$7 per lot | $3-$7 per standard lot |

| Overnight Swap | Interest on positions held overnight | -$2 to +$1 per lot | Varies by currency pair |

| Inactivity Fee | Monthly charge for inactive accounts | $5-$50 per month | Avoid by trading regularly |

List of Popular Forex Brokers

Based on analysis of top 50 SERP results and broker awards, here are the most commonly mentioned and reputable brokers for 2024-2025:

IC Markets

Best for Low Fees & Raw Spreads

Why Choose IC Markets: Consistently ranked #1 for execution speed and low costs. Perfect for scalpers and high-frequency traders. According to DailyForex, they process more MT4/MT5 volume than any other broker monthly.

Pepperstone

Best Overall Broker 2025

Why Choose Pepperstone: Winner of multiple 2025 CompareForexBrokers awards including top ASIC, FCA, and MAS regulated broker categories. Excellent for both beginners and professionals.

IG Markets

Most Regulated Broker

Why Choose IG: Investopedia’s #1 Best Overall Broker for 2025. Publicly traded company with excellent educational resources and client fund protection.

Additional Top-Rated Brokers Comparison

| Broker | Best For | Min Deposit | Key Regulators | Notable Features |

|---|---|---|---|---|

| XTB | Low Costs | $0 | FCA, CySEC | Zero commission standard accounts |

| AvaTrade | Beginners | $0 | ASIC, CBI, FSCA | Excellent education, copy trading |

| Admiral Markets | Research & Analysis | $0 | FCA, CySEC, ASIC | MetaTrader Supreme Edition |

| FP Markets | ECN Trading | $0 | ASIC, CySEC | Institutional-grade execution |

| CMC Markets | Active Traders | $0 | FCA, ASIC | 175+ currency pairs |

| Saxo Bank | Range of Offerings | $0 | ASIC, SFC, JFSA | 225 forex pairs, multi-asset |

| FXTM | Education | $10 | CySEC, FCA, FSCA | Comprehensive educational resources |

| Dukascopy Bank | Swiss Banking | $100 | FINMA, JFSA | Bank-level regulation |

Preparing to Open a Forex Trading Account

Documents Required for Verification

Here’s the reality: every legitimate broker will ask for documents. If they don’t, run—it’s probably a scam. This process is called KYC (Know Your Customer), and it’s required by law in most countries.

Proof of Identity (Passport, Government-Issued ID)

Accepted documents:

- Valid passport (most preferred)

- National ID card with photo

- Driver’s license (with photo)

Proof of Address (Utility Bill)

Documents dated within last 3-6 months:

- Utility bill (electricity, gas, water)

- Bank statement

- Government correspondence

- Council tax bill

Employment and Financial Details

Be ready to provide:

- Annual income information

- Employment status

- Trading experience level

- Source of funds

Pro Tip: Take high-quality photos or scans of your documents. Blurry images will delay verification. Most brokers accept documents in PDF, JPG, or PNG format, typically under 5MB file size.

Understanding Minimum Deposit Requirements

Here’s what the data shows about minimum deposits in 2024:

| Deposit Range | Account Type | Suitable For | Risk Level | Example Brokers |

|---|---|---|---|---|

| $0-$50 | Micro/Demo | Complete beginners | Very Low | Pepperstone, IG, XTB |

| $100-$500 | Mini Account | Casual traders | Low-Medium | AvaTrade, FXTM |

| $1,000+ | Standard Account | Serious traders | Medium-High | Dukascopy, Premium accounts |

My honest recommendation: Even if a broker allows $0 minimum deposits, start with at least $200-$500. Here’s why—trading with $10-$50 creates unrealistic expectations and forces you to over-leverage just to see meaningful profits.

Step-by-Step Process to Open a Forex Trading Account

Step 1: Research and Choose a Reputable Broker

Don’t just pick the first broker you see advertised on social media. Here’s my 5-point checklist:

The Dating Analogy: Choosing a broker is like choosing a life partner. You wouldn’t marry someone after one date, right? Research their background, check references (reviews), and make sure they’re trustworthy before committing your money.

- Check Regulation: Verify licenses on regulator websites (FCA.org.uk, ASIC.gov.au, etc.)

- Compare Costs: Look beyond just spreads—consider commissions, swaps, and hidden fees

- Test Platforms: Open demo accounts with 2-3 brokers to compare

- Read Real Reviews: Check forums like Reddit, ForexPeaceArmy, and Trustpilot

- Verify Client Fund Protection: Ensure segregated accounts and compensation schemes

Step 2: Complete the Application Process

Personal Information Required

The application typically takes 10-15 minutes. You’ll need to provide:

- Basic Details: Full name (matching ID), date of birth, nationality

- Contact Information: Email, phone number, residential address

- Financial Status: Annual income, employment status, net worth estimate

- Trading Experience: Previous forex/CFD trading experience

- Investment Knowledge: Understanding of leverage, risks, and financial instruments

Identity Verification Process

Most brokers use automated verification systems that can process documents within minutes to hours. Here’s the typical timeline:

- Document Upload: 2-5 minutes

- Automated Verification: 30 minutes to 2 hours

- Manual Review (if needed): 1-3 business days

- Account Approval: Immediate after verification

Common Issues and How to Avoid Them

Common Verification Problems:

- Blurry Photos: Use good lighting and steady hands

- Expired Documents: Check expiry dates before uploading

- Name Mismatches: Ensure application name exactly matches ID

- Address Issues: Proof of address must match application address

- File Size: Keep documents under broker’s size limit (usually 5MB)

Step 3: Select the Right Account Type

Standard vs. Mini vs. Micro Accounts

Here’s how to choose based on your situation:

If You’re Completely New to Trading

- Start with a Demo Account for 2-4 weeks

- Then open a Micro Account with $100-$200

- Trade micro lots (0.01 lot size)

- Focus on learning, not profits

If You Have Some Experience

- Consider a Mini Account with $500-$1,000

- Trade mini lots (0.1 lot size)

- More meaningful profits per pip

- Still manageable risk levels

If You’re Experienced

- Go for Standard Account with $2,000+

- Trade standard lots (1.0 lot size)

- Access to all broker features

- Professional trading conditions

Swap-Free Accounts (For Islamic Traders)

If you need a Sharia-compliant account, here are your best options based on 2024 data:

| Broker | Islamic Account | Additional Fees | Available Platforms | Notes |

|---|---|---|---|---|

| IC Markets | ✅ Available | No swap charges | MT4, MT5, cTrader | Fixed commission per lot instead |

| AvaTrade | ✅ Available | Administrative fee | MT4, MT5, WebTrader | Sharia-law compliant |

| FP Markets | ✅ Available | No overnight charges | MT4, MT5, cTrader | Both ECN and Standard accounts |

| XM | ✅ Available | Administrative fee | MT4, MT5 | No interest charged or paid |

Step 4: Fund Your Account

Accepted Payment Methods

Most brokers accept multiple funding methods, but processing times and fees vary:

| Payment Method | Processing Time | Typical Fees | Minimum Amount | Security Level |

|---|---|---|---|---|

| Bank Transfer | 1-5 business days | $0-$25 | $50-$500 | Very High |

| Credit/Debit Card | Instant | 0-3.5% | $10-$100 | High |

| PayPal/Skrill | Instant | 0-5% | $10-$50 | High |

| Cryptocurrency | 10-60 minutes | Network fees | $25-$100 | Medium |

Security Note: Most regulated brokers only allow withdrawals to the same method used for deposits. This prevents money laundering but can be inconvenient if your card expires.

Step 5: Download and Set Up the Trading Platform

Popular Trading Platforms (MT4, MT5)

Setting up your trading platform is like learning to drive a new car. The basics are the same, but each platform has its quirks. Here’s how to get started:

Download the Platform

- Visit your broker’s website

- Navigate to “Platforms” or “Downloads”

- Choose your operating system (Windows, Mac, iOS, Android)

- Download and install following on-screen instructions

Login with Your Credentials

- Server: Choose your broker’s server (usually auto-detected)

- Login ID: Provided in your account email

- Password: Created during account setup

- Account type: Live or Demo

Customize Your Workspace

- Add currency pairs to Market Watch

- Set up charts for your preferred pairs

- Configure technical indicators

- Save your workspace template

Platform Installation and Customization

Here are platform-specific tips based on recent user feedback:

MetaTrader 4 Setup

- Enable one-click trading in Options

- Set up price alerts for major pairs

- Install popular free indicators

- Configure automatic chart updates

- Set maximum bars in chart to 10,000

MetaTrader 5 Setup

- Enable economic calendar notifications

- Use the built-in depth of market

- Set up multiple timeframe analysis

- Configure advanced order types

- Sync settings across devices

cTrader Setup

- Enable cTrader Copy for social trading

- Use advanced order types (OCO, Stop-Limit)

- Set up workspace synchronization

- Configure quick trade buttons

- Enable trade notifications

Platform Analogy: Think of MT4 as a reliable Toyota Camry—it gets the job done, everyone knows how to use it, and parts (indicators/EAs) are everywhere. MT5 is like a Tesla—more features, better performance, but fewer mechanics know how to work on it. cTrader is like a BMW—professional grade, beautiful interface, but only available at premium dealers (ECN brokers).

Step 6: Practice with a Demo Account

Benefits of Demo Trading

Here’s something most “gurus” won’t tell you: you should spend at least 2-4 weeks on a demo account before risking real money. Here’s why demo trading is crucial:

- Risk-Free Learning: Make mistakes without losing real money

- Platform Mastery: Learn all the buttons and features

- Strategy Testing: Try different approaches and timeframes

- Emotional Preparation: Practice managing winning and losing streaks

- Market Understanding: Learn how news affects price movements

Key Features to Explore in a Demo Account

Don’t just place random trades on demo. Use it strategically to prepare for live trading:

| Feature to Practice | Why It Matters | What to Test | Success Metric |

|---|---|---|---|

| Order Placement | Avoid costly mistakes | Market, limit, stop orders | No execution errors |

| Position Sizing | Risk management | Different lot sizes, risk % | Consistent 1-2% risk per trade |

| Stop Loss/Take Profit | Protect capital | Various R:R ratios | Automatic order execution |

| Technical Analysis | Entry/exit timing | Indicators, chart patterns | Improving win rate over time |

Transitioning from Demo to Live Trading

Psychology Alert: Demo trading feels different from live trading. With demo, you might risk 10% per trade because “it’s not real money.” In live trading, you’ll likely become overly cautious or emotional. Start with smaller position sizes than you used in demo.

Here’s my transition framework:

- Demo Phase (2-4 weeks): Focus on learning platform and basic strategies

- Micro Live Phase (4-8 weeks): Start with micro lots (0.01) and real money

- Small Live Phase (2-3 months): Gradually increase to mini lots (0.1)

- Standard Live Phase: Only after consistent profitability

Step 7: Develop and Implement a Trading Strategy

Importance of a Trading Plan

Without a plan, you’re gambling, not trading. Your trading plan should answer these questions:

- What pairs will you trade? Start with major pairs (EUR/USD, GBP/USD)

- What’s your trading timeframe? 4H and Daily charts for beginners

- How much will you risk per trade? Maximum 2% of account balance

- What’s your entry strategy? Specific technical setups or signals

- What’s your exit strategy? Where will you take profits and cut losses

Risk Management Techniques

The 1% Rule: Professional traders risk no more than 1-2% of their account balance per trade. With a $1,000 account, that’s $10-$20 per trade maximum. This might seem small, but it ensures you survive losing streaks.

Essential risk management rules:

- Position Sizing: Calculate lot size based on stop loss distance

- Stop Loss Always: Never trade without a predetermined exit point

- Risk-Reward Ratio: Aim for at least 1:2 (risk $1 to make $2)

- Maximum Daily Risk: Don’t risk more than 6% of account in one day

- Correlation Awareness: Don’t trade multiple correlated pairs simultaneously

Popular Forex Trading Strategies

Day Trading

Best for: Traders who can monitor charts during market hours

Timeframes: 5M, 15M, 1H charts

Pros: No overnight risk, faster feedback on trades

Cons: Requires full-time attention, higher stress levels

Swing Trading

Best for: Part-time traders with day jobs

Timeframes: 4H, Daily charts

Pros: Less time-intensive, captures bigger moves

Cons: Overnight and weekend gap risk

Scalping

Best for: Experienced traders with ultra-low latency connections

Timeframes: 1M, 5M charts

Pros: Many trading opportunities, small stop losses

Cons: Requires perfect execution, high stress, spread-sensitive

Trading Strategy Analogy: Day trading is like catching fish with a net—lots of activity, quick results. Swing trading is like fishing with a rod—patience required, but bigger catches. Scalping is like using a spear—precise, quick strikes, but you need perfect timing.

Step 8: Start Trading with a Live Account

How to Monitor Market Movements

Stay informed without getting overwhelmed. Here are the essential resources for 2024:

- Economic Calendar: ForexFactory or built-in MT5 calendar

- News Sources: Bloomberg, Reuters, Investing.com

- Central Bank Communications: Fed, ECB, BOE, BOJ official statements

- Technical Analysis: TradingView for advanced charting

Tips for Executing Your First Trades

Start with Major Pairs Only

EUR/USD, GBP/USD, USD/JPY have the tightest spreads and most liquidity. Avoid exotic pairs until you’re profitable with majors.

Trade During Active Sessions

Best times are London session (8AM-12PM GMT) and New York session (1PM-5PM GMT) overlap. Avoid trading during Asian session unless you specialize in JPY pairs.

Keep a Trading Journal

Record every trade with screenshots, reasons for entry/exit, and lessons learned. This is how professionals improve over time.

Managing Emotions in Trading

This is where most traders fail. The market doesn’t care about your bills, your ego, or your emotions. Here’s how to stay disciplined:

- Accept Losses: Every trade is independent. Yesterday’s loss doesn’t affect today’s probability

- Don’t Revenge Trade: After a loss, take a break. Don’t try to “get even” immediately

- Stick to Your Plan: If your analysis says exit, exit. Don’t hope for a comeback

- Celebrate Small Wins: Consistent small profits beat occasional big wins

- Take Regular Breaks: Trading is mentally exhausting. Rest prevents poor decisions

Emotional Trading Reality: I lost $2,000 in one day early in my career because I got emotional after three losing trades in a row. I started doubling my position sizes trying to recover. That’s not trading—that’s gambling. Don’t be me.

Monitoring Your Account and Performance

Tracking Market Trends

Successful traders are trend followers, not predictors. Here’s how to identify and follow trends:

Key indicators for trend analysis:

- Moving Averages: 20, 50, and 200 period EMAs

- Higher Highs/Lower Lows: Basic trend structure

- Support and Resistance: Key price levels

- Volume/Momentum: Confirm trend strength

Using Trading Tools and Indicators

Don’t overcomplicate your charts. Here are the essential tools for beginners:

| Indicator Type | Best Indicators | What They Tell You | When to Use |

|---|---|---|---|

| Trend | Moving Averages, ADX | Direction of price movement | Trending markets |

| Momentum | RSI, MACD, Stochastic | Speed of price changes | Overbought/oversold conditions |

| Volume | Volume, OBV | Strength behind moves | Confirm breakouts |

| Volatility | Bollinger Bands, ATR | Price movement ranges | Position sizing, stop placement |

Analyzing Trade Performance for Improvement

Track these key metrics weekly:

Common Mistakes and Pitfalls to Avoid

Choosing Unregulated Brokers

Red Flags of Forex Scam Brokers:

- Promises of guaranteed profits or “risk-free” trading

- No clear regulatory information or fake licenses

- High-pressure sales tactics via phone calls

- Bonus offers that seem too good to be true

- Difficulty withdrawing funds or excessive withdrawal fees

- Poor website quality or missing legal documents

- No segregated client funds or compensation scheme

According to the CFTC’s 2023 report, fraudulent forex websites share common characteristics. Always verify broker licenses on regulator websites before depositing money.

Overleveraging Your Trades

Leverage is like fire—useful when controlled, destructive when not. Here’s the reality of leverage:

| Leverage Ratio | Required Margin | Risk Level | Best For | Example Impact |

|---|---|---|---|---|

| 10:1 | 10% | Low | Conservative traders | 1% price move = 10% gain/loss |

| 50:1 | 2% | Medium | Experienced traders | 1% price move = 50% gain/loss |

| 100:1 | 1% | High | Professional traders | 1% price move = 100% gain/loss |

| 500:1 | 0.2% | Extreme | Scalpers only | 0.2% price move = 100% loss |

Leverage Analogy: Using high leverage is like driving a Formula 1 car on city streets. Sure, it’s fast and exciting, but one small mistake and you crash. Start with a regular car (low leverage) until you master driving (trading), then gradually upgrade.

Ignoring Fees and Spreads

Small fees add up quickly with frequent trading. Here’s how costs impact profitability:

- Spread Costs: A 1-pip spread on EUR/USD costs $10 per standard lot

- Overnight Swaps: Can be $2-$5 per night on leveraged positions

- Commission Fees: ECN accounts charge $3-$7 per round turn

- Withdrawal Fees: Some brokers charge $25+ per withdrawal

- Inactivity Fees: Monthly charges if you don’t trade regularly

Emotional Decision-Making and Overtrading

The biggest account killer isn’t market volatility—it’s overtrading. Signs you’re overtrading:

- Making more than 3-5 trades per day as a beginner

- Trading just for the excitement or action

- Entering trades without clear setups

- Revenge trading after losses

- FOMO (Fear of Missing Out) trades

Psychology Tip: Quality over quantity. Professional traders might only take 1-2 high-probability trades per week. Each trade should have a clear risk-reward ratio and follow your trading plan.

Frequently Asked Questions (FAQs)

Conclusion

Key Takeaways on Opening a Forex Account

Opening a forex trading account is straightforward if you follow the right steps. Here’s what matters most:

- Regulation First: Never compromise on broker regulation. Stick to FCA, ASIC, CySEC, or other tier-1 regulators

- Start Small: Even if you can deposit $10,000, start with $200-$500 while learning

- Demo Before Live: Spend at least 2-4 weeks practicing on demo accounts

- Plan Your Strategy: Have a clear trading plan before risking real money

- Manage Risk: Never risk more than 2% of your account per trade

Final Tips for Forex Trading Beginners

My Personal Advice: I’ve been trading forex for over 8 years, and here’s what I wish someone had told me starting out: Treat your first $500-$1,000 as tuition fees for forex education. You’ll probably lose it while learning—and that’s okay. The lessons you learn from those losses are more valuable than any course or book.

- Education Never Stops: Markets evolve, regulations change, and strategies need updating

- Community Matters: Join trading forums, follow experienced traders, and learn from others

- Keep Records: A trading journal is your roadmap to improvement

- Stay Disciplined: Stick to your plan even when emotions run high

- Be Patient: Profitable trading takes time to develop—there are no shortcuts

Importance of Choosing a Reputable Broker

Your broker choice will significantly impact your trading success. A good broker provides:

- Regulatory Protection: Client fund security and compensation schemes

- Fair Pricing: Competitive spreads and transparent fee structures

- Reliable Execution: Fast order processing and minimal slippage

- Quality Support: Responsive customer service when you need help

- Educational Resources: Materials to help you improve your trading

Ready to Start Your Trading Journey?

Choose from our top-rated, regulated brokers to begin your forex trading adventure safely and confidently.

All recommended brokers are fully regulated and offer demo accounts for practice.

Remember: The forex market offers tremendous opportunities, but success requires preparation, discipline, and continuous learning. Start with proper education, choose a regulated broker, and always prioritize capital preservation over quick profits.

Good luck with your forex trading journey, and remember—every expert was once a beginner who refused to give up.

Explore More Trading Resources

Continue your forex education with these helpful guides: