Key Takeaways

- NDD brokers provide direct market access without interference, creating a more transparent trading environment with faster execution.

- ECN brokers like IC Markets and Pepperstone offer the tightest spreads (as low as 0.0 pips) but charge commissions ranging from $4.50 to $7.00 per round lot.

- FCA, ASIC, and CySEC are top-tier regulators that enforce client fund segregation and negative balance protection for NDD brokers.

- cTrader is often preferred over MetaTrader for NDD execution due to its built-in depth of market views and direct connectivity features.

- Scalpers and high-frequency traders benefit most from NDD brokers due to faster execution and no dealer intervention.

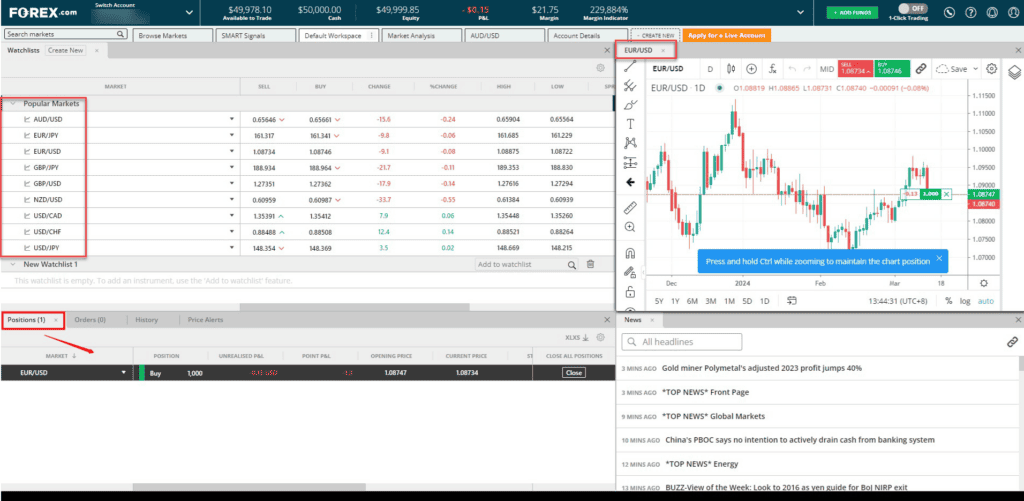

What Are Non-Dealing Desk (NDD) Forex Brokers?

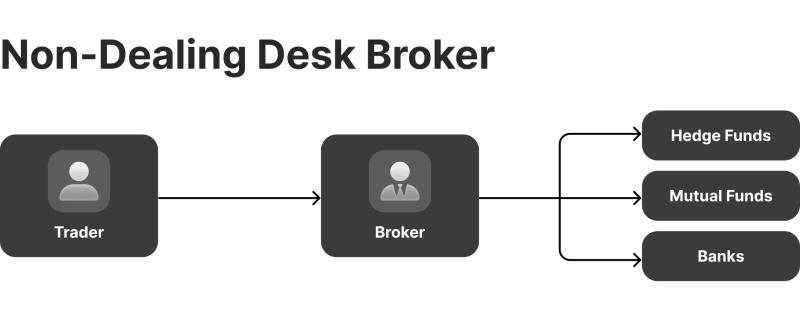

A No Dealing Desk (NDD) broker is a type of forex brokerage that provides traders with direct access to the interbank foreign exchange market without the intervention of a dealing desk. Unlike dealing desk brokers—also known as market makers—NDD brokers don’t take the opposite side of their clients’ trades. Instead, they act as intermediaries that connect traders directly to liquidity providers such as banks and other financial institutions.

Think of NDD brokers as neutral referees in a trading match—they don’t participate in the game themselves but ensure that orders flow smoothly between players (traders) and the actual market. This creates a more transparent trading environment where the broker has no incentive to work against the trader’s interests.

“Imagine forex is like a farmers’ market. With a market maker broker, you’re buying apples through a middleman who sets their own prices. With an NDD broker, you’re buying directly from the farmers (liquidity providers) at the actual market prices—you just pay the broker a small fee for connecting you to them.”

Definition of Non-Dealing Desk Brokers

According to Investopedia, “No Dealing Desk (NDD) refers to a forex trading platform that provides traders with direct access to interbank market rates without any intermediary, ensuring no conflict of interest from the broker.” This means that when you place an order with an NDD broker, it doesn’t pass through an internal dealing desk where it could be manipulated or delayed.

The fundamental characteristic of NDD brokers is their transparency in order execution. They don’t create an artificial market for clients but instead provide a gateway to the actual interbank forex market where major banks and financial institutions trade currencies.

How NDD Brokers Operate

NDD brokers operate by connecting traders directly to liquidity providers in the interbank market. When you place an order with an NDD broker, it’s immediately routed to their network of liquidity providers who compete to fill your order at the best available price. This process ensures that you receive market-determined rates rather than rates set by the broker.

The operational flow of an NDD broker typically works as follows:

- The trader submits an order through the trading platform.

- The broker’s system routes the order directly to liquidity providers (banks, financial institutions) without passing through a dealing desk.

- Liquidity providers compete to fill the order at the best price.

- The order is executed at the best available price, and the trader receives confirmation.

- The broker earns revenue through commissions or small markups on the spread rather than from client losses.

Types of Non-Dealing Desk Brokers

NDD brokers can be categorized into several subtypes based on their execution methods. Understanding these differences is crucial for choosing the right broker for your trading style.

Electronic Communication Network (ECN) Brokers

ECN brokers represent the most sophisticated form of NDD brokers, connecting traders directly to an electronic network where various market participants (banks, other traders, hedge funds) can trade with each other. This creates a true marketplace where buy and sell orders are matched without broker intervention.

Key Features of ECN Brokers

- Direct Market Access: Provides traders with access to the actual interbank market quotes without broker intervention.

- Variable Spreads: Spreads fluctuate based on real market conditions and can tighten to near-zero during high liquidity periods.

- Commission-Based: Rather than marking up spreads, ECN brokers charge a fixed commission per trade, typically around $3.50 to $7.00 per standard lot (round trip).

- Price Transparency: Traders can see the depth of market and available liquidity at different price levels.

- Anonymous Trading: Orders are executed anonymously, with no way to identify who’s on the other side of the trade.

Advantages and Disadvantages of ECN Brokers

| Advantages | Disadvantages |

|---|---|

| Ultra-tight spreads (sometimes as low as 0.0 pips) | Higher commission costs per trade |

| No conflict of interest with the broker | Requires larger trading capital to be cost-effective |

| Faster execution speeds and lower latency | More price volatility and potential slippage during news events |

| True market depth visibility | More complex trading environment for beginners |

| Better for scalping and high-frequency trading | Can be more technically demanding to use |

Straight Through Processing (STP) Brokers

STP brokers automatically process trades without manual intervention but don’t necessarily provide full market depth visibility or direct interaction with other market participants.

How STP Brokers Work

STP brokers route your orders directly to their liquidity providers, typically large banks or other financial institutions. Unlike ECN brokers who create a marketplace for all participants, STP brokers maintain direct relationships with specific liquidity providers who fill client orders.

When you place an order with an STP broker, it’s automatically routed to one or more of their liquidity providers based on which can offer the best execution at that moment. This process happens instantly, with no dealing desk intervention.

Benefits of Trading with STP Brokers

- Balance of Cost and Access: Often less expensive than ECN brokers while still providing direct market access.

- Competitive Pricing: Multiple liquidity providers compete to fill orders, resulting in fair pricing.

- Reduced Conflict of Interest: Brokers don’t take the opposite side of trades but may still have preferred liquidity providers.

- Lower Minimum Deposits: Typically have lower capital requirements than pure ECN brokers.

- Smoother Learning Curve: Generally more accessible for beginners while still offering transparency.

Direct Market Access (DMA) Brokers

DMA brokers provide traders with direct access to the order books of exchanges and liquidity providers. This model is less anonymous than ECN but offers exceptional visibility into market dynamics.

With DMA, traders can see all available prices from liquidity providers and place orders directly into those venues. This gives traders more control over order routing decisions and execution quality.

According to ECN Execution, “DMA brokers are less anonymous than ECN and STP brokers” and require trading accounts with each liquidity provider, but can make trading faster and cheaper for certain strategies.

Key Features to Look for in NDD Forex Brokers

Regulation and Security

When choosing an NDD forex broker, regulation should be your top priority. Regulated brokers must adhere to strict operational standards and financial requirements that protect your funds and ensure fair trading practices.

Importance of Regulatory Bodies

Tier-1 regulators like the Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC) impose strict operational requirements on brokers, including:

- Capital Requirements: FCA and CySEC both require €730,000 in minimum capital, while ASIC demands AU$1,000,000 [MoneyHub].

- Client Fund Segregation: Customer funds must be kept in segregated bank accounts, separate from the broker’s operational funds.

- Negative Balance Protection: Prevents traders from losing more than their account balance during extreme market events.

- Leverage Caps: Limits maximum leverage to 1:30 for retail clients trading major currency pairs to prevent excessive risk.

- Regular Audits: Mandates periodic financial reporting and audits to ensure ongoing compliance and financial stability.

How to Verify Broker Regulation

To verify a broker’s regulatory status:

- Check the regulator’s official website (e.g., FCA Register, CySEC Directory)

- Look for the broker’s license number on their website footer

- Verify that the displayed registration number matches official records

- Confirm the regulatory status is current and not suspended or revoked

Trading Platforms and Tools

The trading platform is your gateway to the market, so choosing an NDD broker with powerful, reliable trading software is essential.

Features of a Good Trading Platform

A high-quality trading platform for NDD execution should include:

- Fast, millisecond-level order execution

- Market depth (Level II) data showing available liquidity

- Advanced charting with multiple timeframes and technical indicators

- Multiple order types (market, limit, stop, OCO)

- One-click trading functionality

- Trade automation capabilities

- Real-time price feeds with minimal latency

- Risk management tools like trailing stops

MT4, MT5, cTrader Platforms

MetaTrader 4

- Industry standard platform

- Wide range of technical indicators

- MQL4 programming for custom indicators

- Extensive EA (Expert Advisor) support

- Mobile trading apps

MetaTrader 5

- Next-generation platform

- Multi-asset trading capabilities

- Advanced timeframes and technical analysis

- Economic calendar integration

- Enhanced backtesting environment

cTrader

- Designed specifically for NDD/ECN execution

- Native Level II market depth

- Detachable charts and workspaces

- Server-side trailing stops

- cAlgo for C# algorithmic trading

According to DailyForex, cTrader has a significant edge over MetaTrader platforms for NDD execution because it was specifically designed for ECN/STP trading with features like sub-millisecond execution and advanced order types.

Proprietary Trading Software

Some NDD brokers offer their own proprietary trading platforms designed to optimize their specific execution model. While these can offer unique features tailored to the broker’s strengths, they may lack the community support and third-party tools available for industry-standard platforms like MT4/MT5 and cTrader.

When evaluating proprietary platforms, consider:

- Execution speed and reliability

- Availability of technical indicators and charting tools

- Mobile and web access options

- Integration with third-party analysis tools

- Algorithmic trading capabilities

Spreads and Commissions

Understanding the cost structure is crucial when choosing an NDD broker, as they typically use different revenue models than market makers.

How NDD Brokers Make Money

Unlike market makers who profit when traders lose, NDD brokers earn revenue through one of two primary models:

- Commission Model: Raw interbank spreads plus a fixed commission per trade (typically $3-7 per standard lot round turn)

- Markup Model: Small markup added to the interbank spread with no separate commission

Most professional traders prefer the commission model as it provides greater transparency and often results in lower overall trading costs, especially for high-volume strategies like scalping.

Spread vs Commission Models

| Model | How It Works | Best For | Example Cost (EUR/USD 1 lot) |

|---|---|---|---|

| Raw Spread + Commission | Direct interbank spreads (can be 0.0 pips) + fixed commission per trade | Scalpers, high-frequency traders | 0.1 pip spread + $3.50 commission = $7.00 |

| Markup Spread (No Commission) | Interbank spread + broker markup (typically 0.5-2.0 pips) | Long-term traders, beginners | 1.2 pip spread = $12.00 |

Swap and Inactivity Fees

Beyond spreads and commissions, NDD brokers may charge additional fees:

- Swap (Rollover) Fees: Interest charged or paid when positions are held overnight, based on interest rate differentials between currencies.

- Inactivity Fees: Charges applied to accounts with no trading activity for an extended period (typically 30-90 days).

- Withdrawal Fees: Some brokers charge for withdrawing funds, particularly for wire transfers or expedited processing.

Top NDD brokers like Fusion Markets, FP Markets, and Pepperstone have transparent fee structures with competitive rates. For example, Fusion Markets charges a round-trip commission of just $4.50 per standard lot with raw spreads starting from 0.0 pips [BestBrokers].

Execution Speed and Latency

For NDD brokers, execution speed is a critical competitive advantage and directly impacts trading results, especially for short-term strategies.

Importance for High-Frequency Traders

Fast execution is particularly vital for:

- Scalpers who capture small price movements

- News traders who need immediate entry after announcements

- Algorithmic traders running automated strategies

- Arbitrage traders exploiting momentary price differences

Even milliseconds of delay can mean the difference between profit and loss in high-frequency trading strategies.

How Fast is the Order Execution with NDD Brokers?

Top NDD brokers today offer execution speeds measured in milliseconds:

- IC Markets: Average execution speed of <40ms

- Pepperstone: Average execution speed of <30ms

- FP Markets: Average execution speed of <100ms

According to the Compare Forex Brokers execution speed tests, “BlackBull Markets, Fusion Markets and Pepperstone were the most consistent performers across the limit order and market order tests,” demonstrating the value these NDD brokers place on execution quality.

Customer Service and Support

Quality customer support is essential when trading with an NDD broker, as technical issues or trading questions may require immediate attention.

Availability of 24/7 Support

The forex market operates 24 hours a day, five days a week, so top NDD brokers provide round-the-clock support through multiple channels:

- Live chat for immediate assistance

- Phone support with global numbers

- Email support with quick response times

- Dedicated account managers for larger accounts

When evaluating a broker’s support, test their response times during different market sessions and assess their technical knowledge on complex topics like order execution and platform features.

Educational Resources for Traders

Leading NDD brokers invest heavily in educational materials to help traders understand market mechanics and trading strategies:

- Webinars and video tutorials

- Trading guides and e-books

- Market analysis and research

- Economic calendars and news feeds

- Demo accounts for practice

Transparent Pricing

Transparency in pricing is a hallmark of reputable NDD brokers. This includes clear disclosure of:

- All trading costs (spreads, commissions, swaps)

- Price sources and liquidity providers

- Execution policies and procedures

- Slippage handling and requotes policy

The best NDD brokers publish their average spreads and execution statistics, allowing traders to make informed comparisons between providers.

Direct Access to Liquidity Providers

A true NDD broker provides direct access to multiple liquidity providers, typically Tier-1 banks and financial institutions. This creates several advantages:

- Deeper liquidity pools for larger trade sizes

- Better pricing through aggregation of multiple sources

- Less chance of slippage during market volatility

- Improved fill rates for limit and stop orders

When evaluating an NDD broker, ask about their liquidity providers and the total number of sources they aggregate. The best brokers connect to 10+ major liquidity providers to ensure optimal pricing and execution.

Top Non-Dealing Desk Forex Brokers

Based on our comprehensive research and analysis of the top 50 search results for “Non-Dealing Desk Forex Brokers,” here are the leading NDD brokers in 2025:

IC Markets – Best for Low Spreads

Key Features and Benefits

- True ECN broker with direct market access

- Ultra-low spreads starting from 0.0 pips on raw accounts

- Advanced trading infrastructure with low latency execution (<40ms)

- Deep liquidity from 25+ providers including tier-1 banks

- Supports high-frequency trading and scalping

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- cTrader

Fees and Spreads

- Raw Spread Account: From 0.0 pips + $3.50 per side ($7.00 round turn)

- Standard Account: From 1.0 pips, no commission

- No deposit or withdrawal fees

Pepperstone – Best for Professional Traders

Key Features and Benefits

- Award-winning NDD execution with price improvement technology

- Heavily regulated by multiple tier-1 authorities (ASIC, FCA, CySEC, BaFin)

- Industry-leading execution speed (<30ms average)

- Excellent customer support with 24/5 multilingual assistance

- Advanced research and analysis tools

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView

Fees and Spreads

- Razor Account: From 0.0 pips + $3.50 per side ($7.00 round turn)

- Standard Account: From 1.0 pips, no commission

- Active Trader Program for volume rebates

FP Markets – Best for Variety of Platforms

Key Features and Benefits

- Multi-platform NDD broker with ECN execution

- Over 10,000 tradable instruments across multiple asset classes

- 12 platform plugins included free of charge

- Regulated by ASIC, CySEC, and other authorities

- Excellent customer service with fast response times

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- cTrader

- Iress (for stock trading)

Fees and Spreads

- Raw Account: From 0.0 pips + $3.00 per side ($6.00 round turn)

- Standard Account: From 1.0 pips, no commission

- Competitive swap rates

BlackBull Markets – Best for Low Spreads

Key Features and Benefits

- ECN/STP execution model with deep liquidity

- Competitive pricing with low spreads and commissions

- New Zealand-based with FSA regulation

- Advanced trading infrastructure with ultra-fast execution

- Transparent trading environment

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- cTrader

Fees and Spreads

- ECN Account: From 0.0 pips + $3.00 per side ($6.00 round turn)

- Standard Account: From 1.0 pips, no commission

- Prime Account: From 0.1 pips + $2.00 per side ($4.00 round turn)

Eightcap – Best for Beginners

Key Features and Benefits

- User-friendly NDD broker suitable for beginners

- Clean, straightforward trading environment

- Excellent educational resources

- Regulated by ASIC and other authorities

- Quick and responsive customer support

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- TradingView

Fees and Spreads

- Raw Account: From 0.0 pips + $3.50 per side ($7.00 round turn)

- Standard Account: From 1.0 pips, no commission

- No deposit fees, some withdrawal fees may apply

FxPro – Best for Multiple Asset Classes

Key Features and Benefits

- NDD/STP execution with no dealing desk intervention

- Multi-asset broker offering forex, stocks, indices, commodities

- Proprietary trading tools and platforms

- Regulated by FCA, CySEC, FSCA, and SCB

- Advanced trading tools and research

Trading Platforms Supported

- MetaTrader 4

- MetaTrader 5

- cTrader

- FxPro Edge (proprietary platform)

Fees and Spreads

- cTrader Account: From 0.3 pips + $4.50 per side ($9.00 round turn)

- MT4/MT5 Account: From 1.2 pips, no commission

- Free deposits, some withdrawal fees may apply

NDD Broker Comparison Table

| Broker | Minimum Deposit | Avg. EUR/USD Spread | Commission (Round Turn) | Platforms | Regulators |

|---|---|---|---|---|---|

| IC Markets | $200 | 0.0 pips (raw) | $7.00 | MT4, MT5, cTrader | ASIC, CySEC, FSA |

| Pepperstone | $0 | 0.0 pips (raw) | $7.00 | MT4, MT5, cTrader, TradingView | FCA, ASIC, CySEC, BaFin, DFSA |

| FP Markets | $100 | 0.0 pips (raw) | $6.00 | MT4, MT5, cTrader, Iress | ASIC, CySEC, FSA |

| BlackBull Markets | $100 | 0.0 pips (raw) | $6.00 | MT4, MT5, cTrader | FSA, FMA |

| Eightcap | $100 | 0.0 pips (raw) | $7.00 | MT4, MT5, TradingView | ASIC, VFSC, SCB |

| FxPro | $100 | 0.3 pips (cTrader) | $9.00 | MT4, MT5, cTrader, FxPro Edge | FCA, CySEC, FSCA, SCB |

How to Choose the Best NDD Broker

Selecting the right NDD broker is a critical decision that can significantly impact your trading success. Here’s a systematic approach to evaluating and choosing an NDD broker that aligns with your trading needs.

Factors to Consider

Trading Style and Needs

Different trading strategies require different broker capabilities:

- Scalpers and High-Frequency Traders: Prioritize ultra-low spreads, commission-based accounts, and execution speed. Look for brokers like IC Markets or Pepperstone that specialize in fast execution.

- Day Traders: Need a balance of competitive pricing, reliable platforms, and good analytical tools. Most NDD brokers are suitable, but those with strong technical analysis capabilities like FP Markets excel here.

- Swing Traders: May benefit from brokers with excellent research and analysis, lower priority on ultra-fast execution. Brokers like FxPro and Pepperstone offer extensive research tools.

- Algorithmic Traders: Require robust API access, stable platforms, and support for automated trading. Look for brokers that support MT4/MT5 EAs or cTrader cBots.

Fees and Commissions

Understand the complete cost structure before committing:

- Compare the total trading cost (spread + commission), not just one component

- Calculate costs for your typical position sizes and holding periods

- Consider overnight swap rates if you hold positions beyond the trading day

- Look for volume-based discounts if you’re a high-volume trader

- Account for any deposit, withdrawal, or inactivity fees

Minimum Deposits and Trading Capital

NDD brokers vary in their minimum deposit requirements:

- Pepperstone: $0 minimum deposit

- FP Markets, BlackBull Markets, Eightcap, FxPro: $100 minimum deposit

- IC Markets: $200 minimum deposit

However, the practical minimum to trade effectively is often higher than the stated minimum. For commission-based ECN accounts, a recommended starting capital is at least $1,000 to ensure commission costs don’t eat into your trading capital too quickly.

Steps to Evaluate Broker Reputation

Reviews and Customer Feedback

Research what other traders say about the broker:

- Read reviews on independent forex sites like ForexBrokers.com, DailyForex, and FXEmpire

- Check forums like Forex Factory and Reddit’s r/Forex

- Look for consistent positive or negative patterns across multiple sources

- Pay attention to comments about withdrawal processing and customer service

Regulatory Compliance

Verify the broker’s regulatory status:

- Check if the broker is regulated by at least one tier-1 authority (FCA, ASIC, CySEC)

- Verify their license on the regulator’s website using the provided license number

- Understand what protections the specific regulator provides (e.g., compensation schemes)

- Be wary of brokers regulated only by offshore authorities with limited oversight

Evaluating Trading Platforms and Technology

Test the broker’s trading platforms thoroughly:

- Open a demo account to test platform stability and features

- Execute trades at different times to test execution speed and reliability

- Try all order types you plan to use in your trading

- Test the mobile app if you plan to trade on the go

- Evaluate available technical indicators and charting tools

Costs: Spreads, Commissions, and Fees

Compare the total cost of trading across different brokers:

| Cost Element | What to Look For | Red Flags |

|---|---|---|

| Spreads | Average and typical spreads during different market sessions | Significantly wider spreads during normal market conditions than advertised |

| Commissions | Fixed vs. variable commission structures | Hidden or undisclosed commissions |

| Swap Rates | Competitive overnight financing charges | Excessively high swap rates compared to market standards |

| Deposit/Withdrawal Fees | Free or low-cost options for funding and withdrawals | High fees or long processing times for withdrawals |

| Inactivity Fees | Reasonable charges after extended inactivity | Aggressive fee structure after short periods of inactivity |

The Importance of Regulation

Strong regulation is crucial for several reasons:

- Fund Protection: Regulated brokers must keep client money in segregated accounts

- Operational Standards: Requirements for financial stability and ethical business practices

- Recourse Options: Formal complaint procedures and potential compensation

- Transparency: Mandated disclosure of fees, risks, and execution policies

- Oversight: Regular audits and reporting requirements

According to MoneyHub, the strongest regulatory protections come from the UK’s FCA (up to £85,000 compensation), followed by CySEC (up to €20,000) and ASIC (which requires segregated accounts but has no compensation scheme).

Benefits and Drawbacks of Trading with NDD Brokers

Advantages

Faster Order Execution

NDD brokers typically offer significantly faster execution compared to dealing desk brokers. Orders are processed automatically and routed directly to liquidity providers without manual intervention, resulting in execution times measured in milliseconds rather than seconds. This speed advantage is critical for strategies like scalping and news trading where entry and exit timing is essential.

No Conflict of Interest

One of the most compelling benefits of NDD brokers is the elimination of inherent conflicts of interest. Unlike market makers who profit when traders lose, NDD brokers earn revenue through commissions or small markups regardless of whether traders win or lose. This creates a more equitable relationship where the broker’s success is tied to trading volume rather than trader failure.

As noted by B2Broker, “Instead of making money from client losses, NDD brokers earn through commissions or small markups on the spread. This aligns their profits with traders’ success, encouraging a fairer trading environment.”

Better Price Transparency

NDD brokers offer greater price transparency by providing direct access to interbank market rates. Traders can see the real bid and ask prices from multiple liquidity providers rather than artificially created quotes. Many NDD platforms also provide Level II market depth data showing the volume of orders at different price levels, giving traders valuable insight into market liquidity and potential support/resistance areas.

Access to Competitive Market Prices

Through their connections to multiple liquidity providers, NDD brokers can offer more competitive pricing than dealing desk brokers. By aggregating quotes from various sources, they ensure traders receive the best available market prices. This can result in tighter spreads, particularly during normal market conditions, and more accurate pricing reflective of true market conditions.

Disadvantages

Higher Spreads for Low Liquidity Pairs

While NDD brokers typically offer excellent spreads on major currency pairs, they may have wider spreads for exotic or less liquid currency pairs. Because these brokers pass on real market conditions, pairs with lower trading volumes naturally have wider bid-ask spreads. Market makers, in contrast, might offer fixed spreads across all currency pairs regardless of underlying market liquidity.

Slippage in High Volatility Markets

NDD brokers are more susceptible to slippage during high volatility periods or major news events. Since orders are executed at the best available market price at the moment of execution, rapid price movements can result in orders being filled at prices different from what was requested. While this reflects true market conditions, it can lead to unexpected execution prices during volatile market periods.

Variable Spreads and Their Impact

Unlike market makers who often offer fixed spreads, NDD brokers typically provide variable spreads that fluctuate based on market conditions. While this can result in extremely tight spreads during liquid market sessions, spreads can widen significantly during major news releases, at market open/close, or during low liquidity periods. This variability makes it more challenging to predict exact trading costs, especially for strategies that rely on consistent spread calculations.

Commission-Based Cost Structure

Most ECN-type NDD brokers operate on a commission-based model, charging a fixed fee per trade in addition to the spread. While the overall trading cost (spread + commission) is often competitive, this structure can be less favorable for traders with smaller position sizes or those who trade very frequently with small profit targets. For small accounts, the fixed commission component can represent a significant percentage of potential profit.

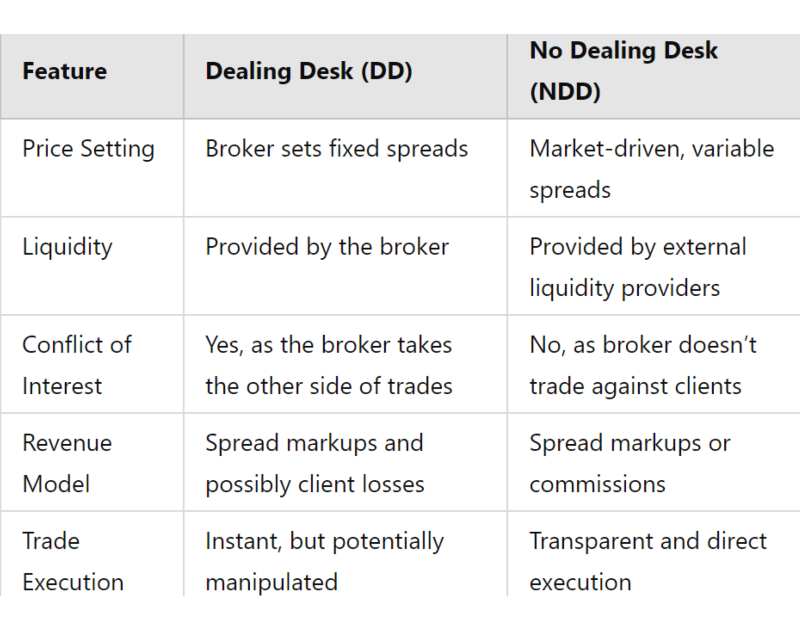

Key Differences Between NDD and Dealing Desk Brokers

Market Execution vs. Broker Intervention

The fundamental difference between NDD and dealing desk brokers lies in the execution model:

- NDD Brokers: Orders are routed directly to liquidity providers with no intervention. The broker never acts as a counterparty to trades but serves purely as an intermediary connecting traders to the market.

- Dealing Desk Brokers: Orders pass through the broker’s internal dealing desk, where the broker may take the opposite side of the trade, acting as a counterparty. The broker can set their own prices rather than passing on interbank rates.

According to AvaTrade, “The execution of traders’ orders occurs in-house” with market makers, while NDD brokers “give their traders direct access to the interbank FX market, where pricing and execution is done by the big banks.”

Trading Conditions and Costs

The execution model directly impacts trading conditions and cost structures:

| Feature | NDD Brokers | Dealing Desk Brokers |

|---|---|---|

| Spreads | Variable, market-dependent | Often fixed, set by the broker |

| Commissions | Usually charge per-trade commission | Typically commission-free |

| Requotes | Less common, market-based execution | More common, especially during volatility |

| Execution Speed | Typically faster, fully automated | Potentially slower due to desk intervention |

| Scalping/Algorithms | Usually permitted and well-supported | May be restricted or discouraged |

Choosing Based on Trading Style and Needs

Different trading approaches may favor different broker types:

- Scalpers and High-Frequency Traders: Generally benefit from NDD brokers due to faster execution, no dealer intervention, and market-based pricing.

- Beginners and Small Accounts: Might find dealing desk brokers more accessible due to lower initial capital requirements, fixed spreads, and no commissions.

- Long-Term Position Traders: May work with either type, as execution speed becomes less critical for longer timeframes.

- News Traders: Often prefer NDD brokers to avoid potential dealing desk interventions during volatile news events.

According to Quadcode, “The degree of openness of the NDD model is among its most important benefits. The possible conflict of interest in the DD model is much reduced because no dealing desk brokers don’t trade against their clients.”

Common Challenges Faced by NDD Forex Brokers

Understanding Market Volatility

NDD brokers face challenges during periods of extreme market volatility:

- Price gaps can occur when market prices change rapidly between order submission and execution

- Liquidity providers may widen their spreads or reduce available volumes

- Order flow imbalances can strain the broker’s execution systems

These challenges can translate to wider spreads and increased slippage for traders during volatile market conditions. Understanding that these issues reflect actual market conditions rather than broker manipulation is important for setting realistic expectations.

Liquidity Risks in Fast-Moving Markets

In rapidly moving markets, NDD brokers may face liquidity challenges:

- Some liquidity providers may temporarily withdraw from the market

- Order sizes available at specific price levels may decrease

- The depth of market can thin out, making large order execution more difficult

The best NDD brokers mitigate these risks by connecting to multiple liquidity sources (10+ providers) to ensure redundancy and maintain execution quality even in challenging market conditions.

Spread Widening During News Releases

Major economic news releases present particular challenges for NDD brokers:

- Spreads can widen significantly seconds before and after high-impact news

- Liquidity can evaporate momentarily as market participants assess the data

- Order execution may slow as systems process surges in trading volume

These effects reflect natural market reactions to uncertainty. Top NDD brokers are transparent about these limitations and implement technological solutions to maintain the best possible execution even during news events.

Risk Management When Trading with NDD Brokers

Managing Leverage and Exposure

NDD brokers often offer high leverage options, making proper risk management essential:

- Most regulated NDD brokers cap retail leverage at 1:30 (Europe, UK, Australia) but may offer higher levels to professional clients

- Higher leverage amplifies both profits and losses, increasing the importance of position sizing

- Use the position size calculator to determine appropriate trade sizes based on account balance and risk tolerance

- Consider using lower leverage than the maximum available to provide a buffer against market volatility

A common rule among professional traders is to risk no more than 1-2% of trading capital on any single position, regardless of the leverage available.

Using Stop-Loss and Take-Profit Orders

Proper order management is crucial when trading with NDD brokers:

- Always use stop-loss orders to define maximum acceptable loss on each trade

- Consider using guaranteed stops (if available) for protection during major news events

- Take advantage of advanced order types like trailing stops to lock in profits

- With NDD brokers, market orders may experience slippage during volatility, so consider using limit orders for entries

Many advanced platforms offered by NDD brokers (particularly cTrader) provide server-side trailing stops that continue working even if your trading terminal loses connection, offering an additional layer of risk protection.

Diversification Strategies

Spreading risk across different instruments and strategies can help manage overall exposure:

- Trade multiple currency pairs with different characteristics

- Consider correlations between instruments to avoid over-concentration

- Mix short-term and longer-term positions to balance different market cycles

- Allocate capital across different strategies rather than relying on a single approach

Many NDD brokers offer multi-asset trading (forex, commodities, indices, stocks), making it easier to implement diversification strategies within a single account.

Trading Strategies Optimized for NDD Brokers

Scalping with NDD Brokers

Scalping involves making numerous small-profit trades throughout the trading day. NDD brokers are particularly well-suited for scalping due to:

- Fast execution speeds with minimal slippage

- Tight spreads on major currency pairs

- Direct market access without dealer intervention

- No restrictions on trading frequency or style

Successful scalping with NDD brokers often involves:

- Trading during high-liquidity periods when spreads are tightest

- Focusing on major currency pairs with minimal spread costs

- Using ECN accounts with raw spreads plus commission for the lowest overall costs

- Implementing automated or semi-automated strategies to capitalize on small price movements

Top NDD brokers for scalping include IC Markets, Pepperstone, and FP Markets due to their ultra-fast execution and competitive pricing.

Day Trading Strategies

Day trading involves opening and closing positions within the same trading day. With NDD brokers, day traders can implement strategies like:

- Breakout Trading: Taking advantage of price movements beyond key support or resistance levels

- Range Trading: Trading bounces between established support and resistance areas

- News Trading: Capitalizing on market volatility following economic releases

- Technical Analysis: Using chart patterns and indicators to identify intraday opportunities

The transparent pricing and direct market access offered by NDD brokers ensure that day traders receive fair execution without broker manipulation, particularly important for strategies relying on precise entry and exit points.

Swing Trading Approaches

Swing trading involves holding positions for several days to capture medium-term price movements. While execution speed is less critical for swing trading than for scalping, NDD brokers still offer advantages:

- Competitive overnight swap rates for positions held multiple days

- Transparent pricing ensuring entries and exits reflect actual market conditions

- Advanced charting and analysis tools for identifying swing opportunities

- No conflict of interest from the broker regarding position direction or duration

For swing trading with NDD brokers, consider:

- Using standard accounts rather than raw/ECN accounts if trading less frequently

- Comparing swap rates between brokers if holding positions overnight is central to your strategy

- Utilizing the broker’s research and analysis tools for market insights

- Setting proper risk management parameters for longer holding periods

Legal and Tax Considerations

Understanding Regulatory Requirements

Trading with NDD brokers involves navigating various regulatory frameworks:

- Different countries have different rules regarding forex trading and broker operations

- Some jurisdictions restrict the maximum leverage available to retail traders

- Certain territories may have specific disclosure requirements or investor protection measures

- Cross-border trading may involve additional compliance considerations

Always ensure that your chosen NDD broker is properly regulated in your jurisdiction or can legally offer services to residents of your country.

Tax Implications of Forex Trading

Forex trading profits may be subject to taxation depending on your location:

- In some countries, forex profits are treated as capital gains

- Other jurisdictions may classify trading as business income, especially for frequent traders

- Tax treatment can differ based on trading frequency, account size, and other factors

- Some regions offer specific tax advantages for certain types of trading

Consult with a qualified tax professional familiar with trading tax regulations in your jurisdiction to understand your specific obligations.

Keeping Records for Tax Purposes

Maintaining thorough trading records is essential for tax compliance:

- Most NDD brokers provide detailed transaction histories and annual statements

- Keep records of all deposits, withdrawals, and transfers

- Document trading costs including spreads, commissions, and swap charges

- Track any deductible expenses related to your trading activities

Many modern trading platforms offered by NDD brokers include reporting tools that can generate the necessary documentation for tax purposes, simplifying the record-keeping process.

Account Types Offered by NDD Brokers

Standard Accounts

Standard accounts are the most common entry-level accounts offered by NDD brokers:

- Usually have lower minimum deposits ($100-200)

- Typically feature spreads with broker markups but no commissions

- Suitable for beginners or those who prefer simpler cost structures

- Often include full platform features but may have some execution limitations

Standard accounts from NDD brokers still route orders to liquidity providers but may add a small markup to the spread rather than charging separate commissions.

ECN Accounts

ECN accounts offer the purest form of no-dealing desk execution:

- Provide direct access to interbank liquidity via an electronic communications network

- Feature raw spreads starting from 0.0 pips plus a fixed commission

- Higher minimum deposits typically required ($500+)

- Designed for active traders, scalpers, and professionals

- Often include advanced features like market depth (Level II) data

Top NDD brokers like IC Markets, Pepperstone, and FP Markets offer ECN accounts with competitive commission structures ranging from $3.00 to $3.50 per side ($6.00 to $7.00 round turn).

Islamic Accounts

Islamic (swap-free) accounts accommodate traders who follow Sharia law:

- No overnight swap fees charged or paid

- Alternative fee structure for positions held overnight

- Usually available across both standard and ECN account types

- May have slightly wider spreads or administration fees to compensate for the lack of swap charges

Most major NDD brokers now offer Islamic account options to cater to the growing number of traders from Muslim countries.

Managed Accounts

Some NDD brokers offer managed account services:

- Professional traders manage your capital based on agreed strategies

- Typically require higher minimum investments ($10,000+)

- Management and performance fees apply

- May use PAMM (Percentage Allocation Management Module) or MAM (Multi-Account Manager) systems

While not exclusive to NDD brokers, managed accounts often benefit from the transparent execution and competitive pricing that NDD models provide.

The Role of Technology in NDD Trading

Liquidity Aggregators and Their Importance

Liquidity aggregation technology is at the core of NDD broker operations:

- Aggregators collect and consolidate price feeds from multiple liquidity providers

- Smart order routing systems direct orders to the best available prices

- Price improvement algorithms can deliver better execution than the displayed quote

- Aggregation depth determines the overall liquidity available to traders

According to B2Broker, “A No Dealing Desk broker relies on aggregation software that connects to multiple liquidity providers. To ensure seamless STP or ECN execution, investing in a high-speed, low-latency bridging solution is critical.”

VPS Hosting for Low Latency

Virtual Private Server (VPS) hosting has become an essential technology for many NDD traders:

- Provides 24/7 uptime for trading algorithms and EAs

- Reduces latency by positioning servers closer to broker data centers

- Eliminates local internet connection issues and computer crashes

- Enables seamless automated trading even when your personal computer is off

Many top NDD brokers like IC Markets, Pepperstone, and FP Markets offer free or discounted VPS hosting for clients who maintain minimum account balances or trading volumes.

For algorithmic traders using NDD brokers, VPS hosting can reduce execution latency by 30-70% compared to running strategies on personal computers, a significant advantage for time-sensitive strategies.

Regulatory Considerations for NDD Forex Brokers

Tier 1 vs. Tier 2 Regulators

Not all regulatory authorities provide the same level of oversight and protection:

- Tier 1 Regulators: Strict oversight, robust client protections, high capital requirements

- Tier 2 Regulators: More moderate oversight, fewer client protections, lower capital requirements

For maximum security, prioritize NDD brokers regulated by tier 1 authorities, especially if trading with significant capital.

Examples of Tier 1 Regulators (e.g., FCA, ASIC, CySEC)

Tier 1 regulators implement comprehensive protections:

- Financial Conduct Authority (FCA): UK regulator requiring €730,000 minimum capital, client fund segregation, and FSCS protection up to £85,000

- Australian Securities and Investments Commission (ASIC): Requires AU$1,000,000 minimum capital, segregated client funds, and negative balance protection

- Cyprus Securities and Exchange Commission (CySEC): Requires €730,000 minimum capital, operates an Investor Compensation Fund protecting up to €20,000 per client

- German Federal Financial Supervisory Authority (BaFin): Strict oversight with significant capital requirements and client protection measures

Examples of Tier 2 Regulators (e.g., FSA, FSCA)

Tier 2 regulators provide more moderate oversight:

- Financial Services Authority (FSA) of Saint Vincent and the Grenadines: Lower capital requirements, fewer restrictions on leverage, minimal operational requirements

- Financial Sector Conduct Authority (FSCA) of South Africa: Moderate oversight with some client protections but less stringent than tier 1 authorities

- Vanuatu Financial Services Commission (VFSC): Offshore regulator with lighter touch regulation and fewer restrictions

- Financial Services Commission (FSC) of Mauritius: Moderate oversight with growing reputation but still less stringent than tier 1

Many reputable NDD brokers maintain licenses from both tier 1 and tier 2 regulators to serve clients globally while offering appropriate protections.

Conclusion

Summary of Key Benefits of Non-Dealing Desk Brokers

NDD brokers offer significant advantages for forex traders:

- Direct market access without broker intervention

- Elimination of conflicts of interest in trade execution

- Transparent pricing reflecting actual market conditions

- Faster execution speeds suitable for various trading strategies

- Support for advanced trading techniques like scalping and algorithmic trading

These benefits create a more level playing field where traders can focus on their strategies without concerns about broker manipulation.

How to Start Trading with a Non-Dealing Desk Broker

Getting started with an NDD broker involves several key steps:

- Research and Selection: Compare multiple NDD brokers based on regulation, costs, platforms, and features

- Account Setup: Complete the broker’s application process, including identity verification

- Funding: Deposit funds using your preferred payment method

- Platform Installation: Download and set up the trading platform (MT4, MT5, cTrader)

- Demo Trading: Practice with a demo account to understand the platform and execution

- Education: Utilize the broker’s educational resources to improve your trading knowledge

- Start Small: Begin with smaller positions until you’re comfortable with the broker’s execution

Final Recommendations

Based on our comprehensive research, here are our top recommendations for NDD forex brokers in 2025:

- Best Overall: Pepperstone – Excellent execution, strong regulation, and comprehensive platform options

- Best for Low Spreads: IC Markets – Ultra-competitive raw spreads and deep liquidity

- Best for Beginners: Eightcap – User-friendly environment with good educational resources

- Best for Platform Variety: FP Markets – Multiple platforms with free add-ons and plugins

- Best for Professional Traders: FxPro – Advanced tools and multi-asset capabilities

- Best Value: Fusion Markets – Lowest commission structure with competitive spreads

Final Thoughts on Choosing the Best NDD Broker for Your Needs

When selecting an NDD broker, prioritize what matters most for your specific trading approach:

- Scalpers and high-frequency traders should focus on execution speed and raw spreads

- Beginners may value educational resources and user-friendly platforms

- Algorithmic traders should look for robust API access and VPS options

- Long-term traders might prioritize swap rates and research tools

Remember that the “best” NDD broker isn’t universal—it’s the one that best aligns with your trading goals, style, and requirements. By understanding the factors outlined in this guide, you can make an informed decision that supports your trading journey.

FAQs

- What is the difference between NDD and ECN brokers?

- NDD (No Dealing Desk) is a broader category that includes both ECN and STP brokers. All ECN brokers are NDD, but not all NDD brokers are ECN. ECN brokers specifically connect traders to an electronic communication network where orders are matched with other participants, while STP (another type of NDD) brokers route orders directly to liquidity providers without necessarily creating a marketplace.

- Are NDD brokers more transparent than market makers?

- Yes, NDD brokers are generally more transparent than market makers. They provide direct access to interbank market rates without intervention, eliminating conflicts of interest. Market makers can set their own prices and may trade against clients, potentially creating situations where the broker benefits from client losses.

- How do NDD brokers make money?

- NDD brokers typically make money through one of two models: 1) charging a fixed commission per trade while providing raw interbank spreads, or 2) adding a small markup to the interbank spread without charging separate commissions. Unlike market makers, their revenue doesn’t depend on traders’ losses but rather on trading volume and activity.

- Can NDD brokers manipulate prices?

- True NDD brokers cannot manipulate prices since they don’t set prices themselves but pass on rates from their liquidity providers. However, they may select which liquidity providers to use or how to aggregate prices. This is why regulation and reputation are important factors when choosing an NDD broker.

- What is the best NDD broker for high-frequency trading?

- For high-frequency trading, brokers with the fastest execution speeds and lowest latency are ideal. Based on our research, IC Markets and Pepperstone consistently rank among the best for high-frequency trading due to their ultra-fast execution infrastructure and competitive pricing for high-volume traders.

- Is there a minimum deposit requirement for NDD brokers?

- Minimum deposit requirements vary by broker. Some NDD brokers like Pepperstone have no minimum deposit, while others typically require $100-200 for standard accounts and $500+ for raw/ECN accounts. However, to trade effectively with an NDD broker, a recommended starting capital is at least $1,000 to ensure commission costs don’t significantly impact your trading.

- Are NDD brokers safe?

- NDD brokers regulated by reputable authorities like FCA, ASIC, or CySEC generally provide high levels of safety through segregated client funds, capital adequacy requirements, and compensation schemes. Always verify a broker’s regulatory status and choose those with tier-1 regulation for maximum protection.

- How do I know if my broker is NDD?

- To determine if a broker is truly NDD, check if they offer variable spreads rather than fixed spreads, look for terms like “ECN” or “STP” in their account types, verify they charge commissions (for ECN accounts), and research their execution model. You can also test their execution by opening a demo account and observing price movements compared to other sources.

- Do NDD brokers offer demo accounts?

- Yes, most reputable NDD brokers offer free demo accounts that allow you to practice trading in a simulated environment with virtual funds. These demo accounts typically provide access to the same platforms and features as live accounts, making them valuable for testing strategies and becoming familiar with the broker’s execution.

- Can I use NDD brokers for scalping?

- Yes, NDD brokers are actually preferred for scalping strategies due to their fast execution speeds, direct market access, and absence of dealer intervention. Most NDD brokers explicitly allow scalping, unlike some market makers who may restrict this trading style due to its potential profitability against their business model.

- What is the difference between ECN and STP Brokers?

- ECN brokers connect traders to an electronic network where orders are matched with other participants (banks, institutions, traders), while STP brokers route orders directly to specific liquidity providers. ECN typically offers more transparency with visible order books and multiple liquidity sources, while STP may have slightly higher spreads but lower commissions.

- Are NDD Forex brokers more expensive than DD brokers?

- NDD brokers typically have a different cost structure rather than being inherently more expensive. They usually charge commissions in addition to raw spreads, which can be more economical for larger trade sizes and frequent trading. DD brokers often have wider but fixed spreads with no commission. For small trade sizes, DD brokers might be cheaper, while for larger volumes, NDD brokers often provide better overall pricing.

- Can beginners trade with Non-Dealing Desk brokers?

- Yes, beginners can trade with NDD brokers, especially those offering user-friendly platforms and educational resources. However, they should be aware of the commission-based cost structure and variable spreads. Some beginners may find the fixed spreads and simpler pricing of dealing desk brokers easier to understand initially, but many NDD brokers now offer standard accounts with simplified pricing for newcomers.

- What are the regulatory bodies for NDD brokers?

- Major regulatory bodies overseeing NDD brokers include the Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), German Federal Financial Supervisory Authority (BaFin), and Financial Sector Conduct Authority (FSCA) in South Africa. Tier-1 regulators like FCA, ASIC, and CySEC provide the strongest client protections.

- Is it possible to have slippage with NDD brokers?

- Yes, slippage can occur with NDD brokers, particularly during high volatility or news events. This happens because NDD brokers execute at the best available market price at the moment of execution, and prices can change between order submission and execution. However, this slippage reflects actual market conditions rather than broker manipulation, and it can be both positive (better price) or negative (worse price).

- What should I look for in the best NDD broker?

- Key factors to consider include strong regulation from tier-1 authorities, competitive trading costs (spreads and commissions), fast and reliable execution, platform options (MT4/MT5/cTrader), quality customer support, additional tools and resources, transparency in operations, and a solid reputation among traders.

- Do NDD brokers offer better spreads?

- NDD brokers typically offer variable spreads that reflect real market conditions. During high liquidity periods, these spreads can be extremely tight (sometimes 0.0 pips on major pairs in raw accounts), potentially better than the fixed spreads of market makers. However, during volatility or low liquidity, NDD spreads can widen significantly. The overall cost must factor in both spreads and commissions to make a fair comparison.

- How fast is the order execution with NDD brokers?

- Leading NDD brokers offer execution speeds measured in milliseconds. For example, Pepperstone reports average execution times under 30ms, while IC Markets reports under 40ms. This speed is crucial for strategies like scalping and news trading where entry and exit timing is critical. Execution speed can vary based on server location, network conditions, and market volatility.

- What are the account types offered by NDD brokers?

- Common account types offered by NDD brokers include Standard (higher spreads, no commission), Raw/ECN (raw spreads plus commission), Professional (enhanced features for high-volume traders), Islamic/Swap-Free (compliant with Sharia law), and Demo accounts. Some brokers also offer specialized accounts for algorithmic trading or managed investments.

- How can I avoid scams when choosing an NDD broker?

- To avoid scams, verify the broker’s regulatory status on the regulator’s official website, research their reputation through independent reviews, start with a small deposit to test withdrawal processes, be wary of unrealistic promises or unusually favorable conditions, check company history and transparency, and look for brokers who are members of compensation schemes that protect client funds.

- Are there any hidden costs with NDD brokers?

- Potential hidden costs to watch for include swap/rollover fees for overnight positions, inactivity fees for dormant accounts, deposit and withdrawal fees, account maintenance fees, and data fees for premium features. Reputable NDD brokers disclose all fees transparently, but always review the full fee schedule before opening an account.

- Do Non-Dealing Desk Brokers Charge Commissions?

- Many NDD brokers, especially those offering ECN accounts, charge commissions on trades in exchange for providing raw interbank spreads. Typical commission rates range from $3 to $7 per standard lot (round turn). Some NDD brokers also offer commission-free accounts with slightly wider spreads that include a built-in markup.

- Are NDD Brokers More Transparent Than Dealing Desk Brokers?

- Yes, NDD brokers are generally more transparent than dealing desk brokers because they don’t create their own market or take positions against clients. They provide direct access to interbank rates, visible execution paths, and clear fee structures. This transparency eliminates the inherent conflict of interest present in the market maker model.

- What Are the Benefits of Trading with a Non-Dealing Desk Broker?

- Key benefits include direct market access, faster execution speeds, no conflict of interest with the broker, transparent pricing reflecting real market conditions, tighter spreads during normal market conditions, support for various trading styles including scalping, and the ability to see market depth (with ECN brokers).

- What Is Slippage, and Why Does It Happen with NDD Brokers?

- Slippage is the difference between the expected price of a trade and the actual executed price. With NDD brokers, slippage occurs because they execute at the best available price at the moment of execution, and market prices can change rapidly between order submission and execution, especially during volatile periods or major news events.

- Are Non-Dealing Desk Brokers Suitable for Automated Trading?

- Yes, NDD brokers are often preferred for automated trading due to their fast execution speeds, reliable price feeds, and support for algorithmic strategies. Many offer API access, VPS hosting, and platforms like MT4/MT5/cTrader that support Expert Advisors and algorithmic trading systems. The predictable execution model also makes backtesting results more reliable.

- How Can I Verify a Broker’s Regulation and License?

- To verify a broker’s regulatory status: 1) Visit the regulator’s official website, 2) Use their public register or search function, 3) Enter the broker’s name or license number, 4) Confirm the license is active and check for any restrictions, 5) Verify the company name and address match the broker’s website, and 6) Check for any regulatory warnings or actions against the broker.

- What Is the Average Spread with a Non-Dealing Desk Broker?

- Average spreads with NDD brokers vary by currency pair and market conditions. For major pairs like EUR/USD, raw/ECN accounts typically offer spreads ranging from 0.0 to 0.3 pips during normal market hours, while standard accounts might range from 0.9 to 1.5 pips. During high volatility or low liquidity, spreads can widen significantly.

- What Are the Risks of Trading with an Unregulated Broker?

- Risks of trading with unregulated brokers include potential fund misappropriation, lack of compensation schemes if the broker fails, absence of oversight regarding fair trading practices, potential price manipulation, difficulty resolving disputes, and possible operational instability due to lower capital requirements. Always prioritize brokers regulated by respected authorities.

- What Is the Best Trading Platform for NDD Brokers?

- For NDD execution, cTrader is often considered optimal as it was specifically designed for ECN/STP trading with features like depth of market visualization, VWAP execution, and level II pricing. However, MetaTrader 4/5 remain popular choices due to their extensive indicator libraries and EA support. The “best” platform depends on individual trading needs and preferences.

Disclaimer

Trading forex carries substantial risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex trading and seek advice from an independent financial advisor if you have any doubts. Past performance is not indicative of future results.