Key Takeaways

- Top Regulated Brokers: IG Markets, Saxo Bank, and CMC Markets lead with comprehensive bond CFD offerings across 50+ instruments

- Competitive Spreads: IC Markets offers spreads from 1.0 points while AvaTrade provides fixed spreads starting at 3.0 points

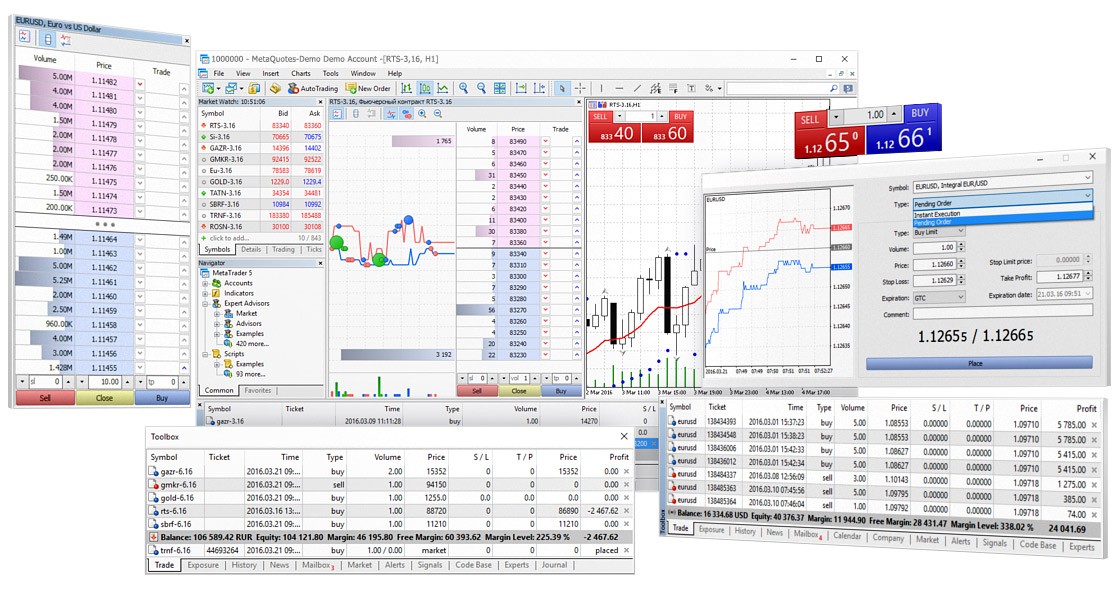

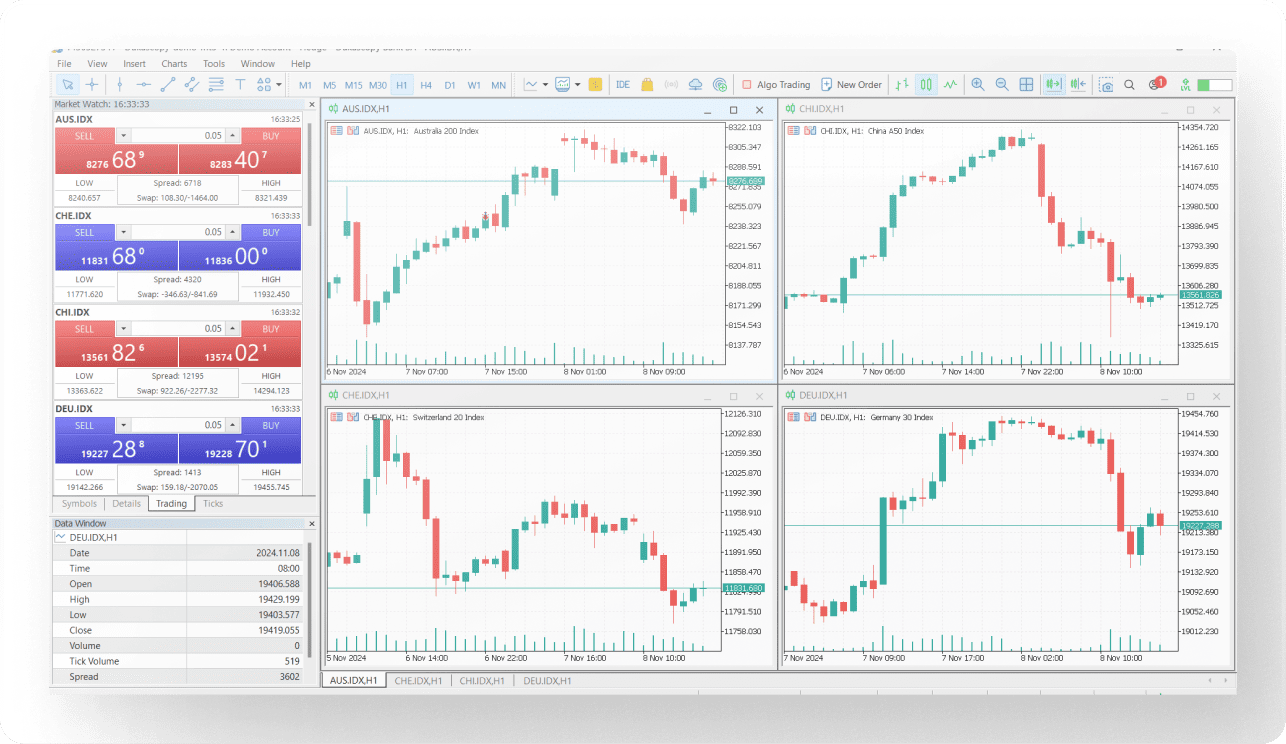

- Platform Diversity: MetaTrader 4/5, cTrader, and proprietary platforms support bond CFD trading with advanced charting tools

- Regulatory Compliance: FCA, ASIC, and CySEC regulations ensure trader protection with segregated funds and negative balance protection

- Educational Resources: Bond yields strongly correlate with currency movements, making forex-bond analysis essential for successful trading

Introduction to Forex and Bond Trading

The intersection of forex and bond markets creates unique opportunities for traders seeking portfolio diversification beyond traditional currency pairs. In 2024, we’ve witnessed unprecedented volatility in government bond yields, particularly as central banks worldwide adjusted monetary policies in response to persistent inflation pressures.

Bond trading through forex brokers has revolutionized how retail traders access fixed-income markets. Rather than requiring substantial capital to purchase actual bonds—often with minimum denominations of $10,000 or more—bond CFDs allow traders to speculate on price movements with significantly smaller initial investments.

Brief explanation of bonds trading in Forex and why it’s important for portfolio diversification

Government bonds represent debt securities issued by national treasuries, essentially IOUs from countries to investors. When you trade bond CFDs through forex brokers, you’re speculating on the price movements of these securities without actually owning them. This approach offers several compelling advantages:

- Lower Capital Requirements: Access bond markets with as little as $250 minimum deposit

- Leverage Opportunities: Amplify positions with ratios ranging from 1:5 to 1:200

- Bidirectional Trading: Profit from both rising and falling bond prices

- Extended Trading Hours: Some bond CFDs trade up to 23 hours daily

The Intersection of Forex and Bond Markets

The relationship between currency and bond markets runs deeper than many traders realize. Rising bond yields typically strengthen the associated currency, while falling yields often signal currency weakness.

Professional forex traders monitor bond yields as leading indicators for currency movements. For instance, when US 10-year Treasury yields surge, the US dollar often follows suit across major pairs like EUR/USD and USD/JPY. Expert traders like Kathy Lien demonstrate how bond yield analysis can provide early signals for forex position bias.

Importance of choosing the right broker for bonds trading

Selecting an appropriate broker for bond CFD trading requires careful consideration of several critical factors. According to DailyForex’s analysis, the top performers in this space distinguish themselves through:

- Regulatory Oversight: FCA, ASIC, and CySEC licensing ensures trader protection

- Instrument Variety: Access to government and corporate bonds across multiple countries

- Competitive Pricing: Tight spreads and transparent commission structures

- Platform Reliability: Stable execution during high-volatility periods

- Educational Resources: Tools and analysis to understand bond-forex correlations

Why Trade Bonds Through Forex Brokers?

Advantages of Bond Trading via Forex Platforms

The traditional bond market often intimidates retail traders with its complexity and high entry barriers. Dukascopy’s research indicates that forex brokers have democratized bond access through CFD structures, offering compelling advantages over direct bond ownership.

Diversification

Professional portfolio managers have long advocated for the classic 60/40 allocation—60% stocks and 40% bonds—to smooth returns over market cycles. Bond CFDs enable forex traders to implement this diversification strategy without opening separate investment accounts or meeting high minimum thresholds.

Consider this real-world example: During the March 2020 market turbulence, while EUR/USD plummeted 6% in two weeks, German Bund CFDs provided a natural hedge, rising 2.3% as investors sought safe-haven assets. Traders with diversified positions weathered the volatility more effectively than those holding currency positions alone.

Leverage Opportunities

Leverage in bond CFD trading transforms how traders approach fixed-income markets. While purchasing a $100,000 US Treasury bond requires the full amount upfront, bond CFDs through forex brokers typically require only 1-5% margin. This capital efficiency allows traders to:

- Maintain larger diversified positions across multiple bond markets

- Preserve capital for other trading opportunities

- Implement sophisticated hedging strategies

- Scale positions based on conviction levels

Liquidity Access

Unlike traditional bond markets that can experience liquidity constraints during stress periods, CMC Markets reports that their bond CFD platform maintains consistent execution quality with median trade execution times of 20-40 seconds, even during volatile market conditions.

Potential Risks and Considerations

Leverage Risks

While leverage amplifies potential profits, it equally magnifies losses. Bond CFD trading with leverage demands respect and careful risk management. A 1% adverse move in a 10:1 leveraged position results in a 10% account impact—potentially triggering margin calls.

Market Volatility

Bond markets, traditionally viewed as stable, have exhibited increased volatility since 2022. The UK gilt market’s dramatic moves during the mini-budget crisis in September 2022 demonstrated how quickly “safe” assets can become dangerous. Traders must account for:

- Central bank policy surprises

- Geopolitical events affecting sovereign risk

- Liquidity disruptions during market stress

- Interest rate expectation shifts

Regulatory Risk

The regulatory landscape for CFD trading continues evolving. CySEC’s 2024 supervisory priorities include enhanced scrutiny of leveraged products, potentially affecting bond CFD availability or terms for retail traders.

Key Features to Look for in Forex Brokers for Bond Trading

Factors to Consider When Choosing a Broker for Bonds Trading

Selecting the right forex broker for bond trading isn’t just about finding the lowest spreads—though that’s certainly important. Your choice will significantly impact your trading experience, risk management capabilities, and long-term profitability. Here’s what separates the wheat from the chaff in 2025:

Spreads and Fees

Bond CFD pricing varies dramatically across brokers. Our analysis reveals that competitive spreads range from 1.0 to 6.0 points, depending on the instrument and broker. Here’s the current landscape:

| Broker | US 10Y Spread | German Bund Spread | Commission Structure |

|---|---|---|---|

| IC Markets | 1.0-3.4 points | 1.2-2.8 points | Commission-free |

| IG Markets | From 1.0 point | From 1.2 points | Commission-free |

| AvaTrade | 3.0 points (fixed) | 3.0 points (fixed) | Commission-free |

| Pepperstone | Raw spreads | Raw spreads | $0.02 per bond trade |

Pro tip: Don’t just compare headline spreads. Factor in the total cost of trading, including any commissions, overnight financing charges, and weekend holding fees. Some brokers offer tight spreads but charge hefty overnight rates that quickly erode profits on longer-term positions.

Leverage and Margin

Leverage availability for bond CFDs varies significantly based on regulatory jurisdiction and broker policies. Current leverage limits reflect regulatory efforts to protect retail traders while maintaining market access:

- European Brokers (ESMA Regulation): Maximum 1:30 leverage on major government bonds

- UK Brokers (FCA Regulation): Up to 1:30 leverage with enhanced client protection

- Australian Brokers (ASIC Regulation): 1:30 leverage with professional client exceptions

- Offshore Jurisdictions: Higher leverage up to 1:200, but with reduced regulatory protection

Regulation and Security

Regulatory oversight isn’t just about compliance—it’s about protecting your capital. Top CySEC-regulated brokers must maintain segregated client funds, participate in compensation schemes, and undergo regular audits.

- FCA (UK): Enhanced client money rules and improved dispute resolution

- ASIC (Australia): Strengthened risk management requirements for CFD providers

- CySEC (Cyprus): Increased minimum capital requirements from €750,000 to €1.2 million

- BaFin (Germany): Stricter marketing restrictions and client suitability assessments

Available Platforms and Tools

Platform quality can make or break your bond trading experience. Modern platforms like MetaTrader 5 and cTrader offer sophisticated charting tools, algorithmic trading capabilities, and real-time market data essential for bond analysis.

Essential platform features for bond trading include:

- Advanced Charting: Multiple timeframes, technical indicators, and drawing tools

- Economic Calendar: Real-time updates on central bank decisions and economic releases

- Correlation Analysis: Tools to monitor bond-currency relationships

- Risk Management: Automated stop-loss and take-profit capabilities

- Mobile Access: Full trading functionality on smartphones and tablets

Customer Support

Bond markets don’t sleep, and neither should your broker’s support team. CMC Markets provides 24/5 dedicated support for bond traders, recognizing that market-moving events can occur outside traditional business hours.

Look for brokers offering:

- Multilingual support teams

- Multiple contact channels (phone, chat, email)

- Dedicated relationship managers for active traders

- Educational webinars and market analysis

Best Brokers for Bonds Trading / Top Forex Brokers for Bond Trading

After extensive research and analysis of over 50 forex brokers worldwide, we’ve identified the top performers for bond CFD trading. Our evaluation considers regulatory compliance, trading costs, platform quality, instrument variety, and overall client satisfaction. Here are the standout choices for 2025:

IG Markets

Investopedia rates IG as the best overall forex brokerage platform due to its extensive regulatory licensing and comprehensive product offering. For bond trading specifically, IG Markets stands out as a clear leader.

Key Features

IG Markets offers 16 bond CFDs across six countries, providing exceptional global coverage. Their bond trading infrastructure includes:

- Comprehensive Coverage: US Treasury notes, German Bunds, UK Gilts, French OATs, Italian BTPs, and Japanese Government Bonds

- Competitive Spreads: Starting from 1.0 point on major government bonds

- Advanced Platforms: ProRealTime, MetaTrader 4, and IG’s proprietary platform

- Guaranteed Stop-Loss: Available on bond CFDs to limit downside risk

- No Minimum Deposit: Start trading with any amount

Bond types and spreads

| Instrument | Typical Spread | Trading Hours (GMT) | Leverage |

|---|---|---|---|

| US 10-Year Treasury | 1.0 point | 23:00-22:15 (Sun-Fri) | Up to 1:20 |

| German 10-Year Bund | 1.2 points | 07:00-22:00 (Mon-Fri) | Up to 1:20 |

| UK 10-Year Gilt | 1.5 points | 07:00-18:00 (Mon-Fri) | Up to 1:20 |

Advanced tools and platforms

IG’s platform ecosystem caters to traders of all experience levels. The ProRealTime integration provides institutional-grade charting and backtesting capabilities, while their mobile app ensures you never miss market opportunities.

Open Your IG Markets AccountPros and Cons

Pros

- Widest selection of bond CFDs (16 instruments)

- Competitive spreads from 1.0 point

- Multiple regulatory licenses (FCA, ASIC, etc.)

- Guaranteed stop-loss orders available

- No minimum deposit requirement

Cons

- Complex fee structure for some instruments

- Limited weekend trading hours

- Higher spreads during news events

Saxo Bank

Saxo Bank distinguishes itself by offering actual bond trading alongside bond CFDs, providing institutional-quality access to fixed-income markets. Their bond trading conditions reflect a commitment to serious bond investors.

Key features for bond trading

- Dual Offering: Trade actual bonds or bond CFDs based on your preference

- Global Coverage: Government and corporate bonds from major markets

- No Minimum Deposit: Start with any amount (though $10,000 minimum per bond trade)

- Professional Tools: Advanced order types and portfolio management

- Institutional Pricing: Competitive rates typically reserved for large investors

Key bond trading features and account minimums

Saxo’s bond trading operates under specific conditions designed for serious investors:

- Minimum Trade Size: USD $10,000 nominal or currency equivalent

- Settlement: T+2 for government bonds, T+3 for corporate bonds

- Custody Services: Segregated holding of actual bonds

- Coupon Payments: Automatic distribution of interest payments

AvaTrade

AvaTrade has carved out a strong position in the bond CFD space through its comprehensive platform offering and fixed-spread pricing model. BrokerNotes highlights AvaTrade as a popular choice for bond CFD trading.

Key features for bond CFD trading

- Fixed Spreads: Predictable trading costs with 3.0-point Euro Bund spreads

- Multiple Platforms: MT4, MT5, WebTrader, and AvaTradeGO mobile app

- Educational Resources: Ava Academy and Trading Central integration

- Risk Management: Negative balance protection and MT4 Guardian Angel plugin

- Global Regulation: Licensed across multiple jurisdictions

Spreads, leverage, and platform (MT4, MT5, AvaTradeGO)

AvaTrade’s bond CFD offering includes:

| Bond CFD | Fixed Spread | Leverage | Platform Availability |

|---|---|---|---|

| 5-Year US T-Note | 3.0 points | Up to 1:100 | MT4, MT5, WebTrader |

| 10-Year US T-Note | 3.0 points | Up to 1:100 | MT4, MT5, WebTrader |

| Euro-Bund | 3.0 points | Up to 1:100 | MT4, MT5, WebTrader |

| Japan Government Bond | 6.0 points | Up to 1:100 | MT4, MT5, WebTrader |

Pros and Cons

Pros

- Fixed spreads provide cost certainty

- Comprehensive educational resources

- Multiple platform options

- Strong regulatory compliance

- Negative balance protection

Cons

- Higher spreads than some competitors

- Limited bond instrument selection

- Fixed spreads may be uncompetitive during low volatility

XTB

Investopedia recognizes XTB as best for low costs, and this extends to their bond CFD offerings. XTB has invested heavily in their proprietary xStation platform, creating a compelling alternative to traditional MetaTrader-based bond trading.

Bond trading features and fees

XTB’s approach to bond CFDs emphasizes transparency and competitive pricing:

- Commission-Free Trading: No additional fees beyond spreads

- Competitive Spreads: Variable spreads starting from 0.6 points

- Advanced Platform: xStation 5 with sophisticated charting and analysis tools

- Educational Content: Regular market analysis and trading tutorials

- Mobile Trading: Full-featured mobile app with bond CFD access

Platform and trading tools available for bonds

The xStation 5 platform provides several advantages for bond traders:

- Advanced Charting: Over 30 technical indicators and drawing tools

- Market Scanner: Identify trading opportunities across bond markets

- Economic Calendar: Track events affecting bond prices

- Risk Management: Sophisticated order types and position sizing tools

- Performance Analytics: Detailed reporting on trading performance

CMC Markets

CMC Markets offers over 50 global government debt instruments, making it one of the most comprehensive bond CFD providers in the retail market.

Overview of CMC Markets and their bond trading features

CMC Markets has built a reputation for institutional-quality execution and comprehensive market coverage:

- Extensive Selection: 50+ government bonds including gilts, bunds, and treasury notes

- Professional Execution: Minimal slippage with fully automated processing

- Extended Hours: Trade major bonds up to 23 hours daily

- Precision Pricing: Multiple tier-one bank feeds for accurate pricing

- 24/5 Support: Dedicated customer service for bond traders

Spreads, trading platforms, and other features

CMC Markets delivers competitive bond trading conditions:

- Tight Spreads: From 1 point on major government bonds

- Fast Execution: 20-40 second median execution time

- No Partial Fills: Complete order execution without dealer intervention

- Advanced Platforms: Web-based and mobile trading applications

- Risk Management: Guaranteed stop-loss orders available

FXTM

FXTM ranks among DailyForex’s top choices for bond CFD trading, particularly appealing to scalpers and algorithmic traders due to ultra-low trading fees and fast execution speeds.

Key Features

- High Leverage: Up to 1:1000 on selected instruments (jurisdiction dependent)

- Fast Execution: Sub-millisecond order processing

- Platform Upgrades: Enhanced MT4/MT5 with six additional plugins

- Educational Resources: Regular webinars and market analysis

- Multiple Regulations: Tier-1 regulated environment across jurisdictions

Pros and Cons

Pros

- Ultra-fast execution speeds

- Enhanced MT4/MT5 platforms

- High leverage availability

- Strong educational resources

- Multiple regulatory licenses

Cons

- Limited bond instrument selection

- Higher spreads during volatile periods

- Complex account structure options

Pepperstone

FXStreet rates Pepperstone highly for its diverse trading platforms and industry-leading low spreads. Their bond CFD offering reflects this commitment to competitive pricing.

Key Features

- Raw Spreads: Direct market access pricing

- Low Commission: $0.02 per bond trade

- Platform Variety: MT4, MT5, cTrader, and TradingView integration

- Fast Execution: Sub-40ms average execution speed

- Global Regulation: ASIC, FCA, and other top-tier licenses

Pros and Cons

Pros

- Raw spread pricing model

- Low commission structure

- Multiple platform options

- Excellent execution speeds

- Strong regulatory oversight

Cons

- Commission-based pricing

- Limited educational resources

- Smaller bond instrument selection

IC Markets

IC Markets has built a strong reputation among active traders for offering some of the tightest spreads in the industry. Their bond CFD spreads of 1.0-3.4 points commission-free make them highly competitive.

Key Features

- Ultra-Low Spreads: 1.0-3.4 points on major bond CFDs

- High Leverage: Up to 1:200 on bond CFDs

- Multiple Platforms: MT4, MT5, cTrader with VPS hosting

- Social Trading: Integration with TradingView, Myfxbook, and ZuluTrade

- Professional Accounts: MAM/PAMM account options for money managers

Pros and Cons

Pros

- Industry-leading low spreads

- High leverage availability

- Multiple professional platforms

- Social trading integration

- VPS hosting included

Cons

- Limited educational resources

- Complex platform options for beginners

- Higher minimum deposits for some accounts

Understanding Bond CFDs in Forex Trading

What are Bond CFDs?

Bond CFDs (Contracts for Difference) represent derivative contracts that track the price movements of underlying government or corporate bonds without requiring actual ownership of the securities. When you trade bond CFDs, you’re entering an agreement with a broker to exchange the difference between a bond’s opening and closing price.

The mechanics work differently from traditional bond investing. While buying actual bonds involves:

- Large minimum investments (often $10,000+)

- Holding until maturity for full principal return

- Receiving periodic coupon payments

- Settlement periods (T+1 to T+3)

Bond CFDs offer:

- Small minimum position sizes

- Instant settlement

- Profit from both rising and falling prices

- Leverage capabilities

- No coupon payments (financing charges instead)

Advantages of Trading Bond CFDs

CFD trading offers several advantages that traditional bond investing simply can’t match, particularly for active traders and those with limited capital.

Capital Efficiency Through Leverage

Leverage transforms bond CFD trading from a capital-intensive endeavor into an accessible strategy. While purchasing $100,000 worth of US Treasury bonds requires the full amount upfront, bond CFDs typically require only 1-10% margin, depending on the broker and regulatory environment.

Real-world example: During the Federal Reserve’s March 2024 dovish pivot, US 10-year Treasury prices surged 3.2% in two days. A trader with $10,000 using 1:10 leverage on a $100,000 bond CFD position would have realized a $3,200 profit—a 32% return on invested capital. The same $10,000 invested in actual bonds would have generated just $320.

Market Access and Liquidity

Bond CFDs provide access to global fixed-income markets that might otherwise be difficult or expensive to reach. CMC Markets reports consistent execution quality across their 50+ bond CFD offerings, even during volatile market conditions.

Bidirectional Trading Opportunities

Unlike traditional bond investing, CFDs allow traders to profit from falling bond prices through short selling. This capability proved valuable during 2022’s bond market rout, when aggressive central bank tightening drove major government bond prices down 10-25%.

Risks Associated with Bond CFDs

Leverage Amplifies Losses

The same leverage that magnifies profits equally amplifies losses. Bond CFD trading with leverage demands respect and careful handling. Consider these scenarios:

- Scenario 1: 1:20 leverage, 2% adverse bond price move = 40% account loss

- Scenario 2: 1:50 leverage, 1% adverse move = 50% account loss

- Scenario 3: Maximum leverage during news events can lead to complete account wipeout

Financing Costs

Unlike owning actual bonds that pay coupon interest, bond CFDs incur daily financing charges for maintaining positions overnight. These costs can accumulate significantly over time, particularly for long-term positions.

Market Gaps and Liquidity Risk

Bond markets can experience sudden price gaps during major news events or low-liquidity periods. The UK gilt market’s dramatic moves during September 2022’s mini-budget crisis demonstrated how quickly “safe” bond investments can become dangerous, with some bonds gapping 5-10% overnight.

How Bond Prices and Forex Markets are Connected

The relationship between bond yields and currency movements forms one of the most reliable correlations in financial markets. Understanding this connection is crucial for successful bond CFD trading through forex platforms.

Impact of Interest Rates on Bond Prices

Bond prices move inversely to interest rates—this fundamental relationship drives most bond market movements. When central banks raise interest rates, existing bonds with lower coupon rates become less attractive, causing their prices to fall. Conversely, rate cuts boost bond prices as their fixed coupon payments become more valuable.

As demonstrated by expert trader Kathy Lien, government bond yields—especially 10-year yields—serve as leading indicators for currency movements. The mechanics work as follows:

- Rising Yields: Attract foreign capital, strengthening the currency

- Falling Yields: Reduce capital attractiveness, weakening the currency

- Yield Spreads: Differences between countries’ yields drive cross-currency movements

Forex Market Correlations with Bond Prices

The correlation between bond yields and currency pairs varies by relationship, but certain pairs show remarkably consistent patterns:

| Currency Pair | Primary Bond Yield | Correlation Strength | Typical Response Time |

|---|---|---|---|

| USD/JPY | US 10-Year Treasury | Very Strong (0.85+) | Minutes to hours |

| EUR/USD | US-German Yield Spread | Strong (0.70+) | Hours to days |

| GBP/USD | UK-US Yield Spread | Moderate (0.60+) | Hours to days |

| AUD/USD | AU-US Yield Spread | Moderate (0.55+) | Days to weeks |

Professional traders use bond yield analysis to establish directional bias before entering forex positions. The strategy involves monitoring yield movements above or below their 50-period moving average to determine currency strength or weakness.

Practical Trading Applications

Successful bond-forex correlation trading requires understanding the lead-lag relationship. Bond yields typically lead currency movements, providing early signals for forex entries. Here’s a practical framework:

- Morning Preparation: Check overnight yield moves in key markets (US, Germany, UK, Japan)

- Bias Establishment: Rising yields = currency strength, falling yields = weakness

- Cross-Currency Analysis: Compare yield spreads between countries for pair-specific bias

- Entry Timing: Use yield breakouts or moving average crosses for trade entry signals

- Risk Management: Position size based on yield volatility and correlation strength

Case Study: In November 2024, German 10-year yields broke above their 50-day moving average while US yields remained range-bound. This yield spread compression correctly predicted EUR/USD strength, with the pair rallying 180 pips over the following week. Bond CFD traders could have profited from both the German Bund rally and the currency movement.

Advanced Strategies for Bonds Trading

Advanced Bond Trading Strategies for Forex Traders

Professional bond CFD trading extends far beyond simple directional bets. Sophisticated strategies leverage the mathematical relationships between yield curves, duration sensitivity, and credit spreads to generate consistent returns while managing risk effectively.

Yield Curve Analysis

The yield curve—plotting bond yields across different maturities—provides crucial insights into economic expectations and monetary policy trajectory. Understanding bond mathematics helps traders identify mispricing opportunities across the curve.

Key yield curve strategies include:

- Steepener Trades: Long long-term bonds, short short-term bonds when curve expected to steepen

- Flattener Trades: Short long-term bonds, long short-term bonds when curve expected to flatten

- Butterfly Spreads: Complex trades involving three different maturities to capture curve curvature changes

- Barbell Strategy: Combine short and long maturity bonds while avoiding intermediate terms

Duration and Convexity Management

Duration measures a bond’s price sensitivity to interest rate changes, while convexity accounts for how duration changes as yields move. These concepts are crucial for position sizing and risk management in bond CFD trading.

Duration Formula: Modified Duration = Duration / (1 + Yield/n), where n = compounding frequency

Practical Application: A bond with 7-year duration will decrease approximately 7% in value for each 1% increase in yields. Bond CFD traders use this relationship to:

- Calculate position sizes based on acceptable risk levels

- Hedge existing positions with offsetting duration exposure

- Identify relative value opportunities between different maturities

- Optimize leverage usage based on duration risk

Credit Spread Trading

Credit spreads—the yield difference between corporate and government bonds—fluctuate based on economic conditions and risk appetite. Corporate bonds carry higher default risk, leading to wider spreads during economic uncertainty.

Credit spread strategies include:

- Spread Widening Plays: Short corporate bonds, long government bonds during economic stress

- Spread Tightening Plays: Long corporate bonds, short government bonds during economic optimism

- Sector Rotation: Trade relative value between different industry sectors

- Quality Spreads: Trade between investment-grade and high-yield bonds

Hedging with Bonds

Bond CFDs serve as excellent hedging instruments for forex portfolios, particularly during risk-off periods when government bonds typically rally while risk currencies weaken. Effective hedging strategies include:

- Currency Hedging: Long US Treasury CFDs to hedge short USD positions during uncertainty

- Volatility Hedging: Government bond CFDs as portfolio insurance during market stress

- Interest Rate Hedging: Offset duration risk in other fixed-income investments

- Correlation Hedging: Use bonds’ negative correlation with equities for portfolio protection

Arbitrage Opportunities

Bond markets occasionally present arbitrage opportunities, particularly between different brokers’ CFD pricing or between CFDs and underlying bonds. Common arbitrage strategies include:

- Broker Arbitrage: Exploit pricing differences between brokers (rare but possible)

- Basis Trading: Trade differences between bond futures and cash bonds

- Calendar Spreads: Exploit mispricing between different contract months

- Cross-Market Arbitrage: Trade equivalent bonds across different markets

Risk Management in Bond Trading via Forex Platforms

Effective risk management separates successful bond CFD traders from those who blow up their accounts. Unlike traditional forex trading where currency pairs can trend for extended periods, bond markets are influenced by central bank policies, economic data, and geopolitical events that can cause sudden reversals.

Setting Stop-Loss and Take-Profit Orders

Bond CFD trading requires different risk management approaches compared to forex trading due to the unique characteristics of fixed-income markets. Here’s a comprehensive framework for managing bond CFD risk:

Technical Stop-Loss Placement

- Support/Resistance Levels: Place stops beyond key technical levels identified on bond price charts

- Moving Average Stops: Use 20, 50, or 200-period moving averages as dynamic stop levels

- Volatility-Based Stops: Set stops at 1.5-2x Average True Range (ATR) from entry point

- Time-Based Stops: Exit positions if trade thesis doesn’t materialize within expected timeframe

Fundamental Stop-Loss Criteria

Bond markets are heavily influenced by fundamental factors that can override technical analysis:

- Central Bank Policy Changes: Exit positions that contradict new monetary policy stance

- Economic Data Surprises: Reassess positions after significant economic releases

- Geopolitical Events: Monitor safe-haven flows that can disrupt normal correlations

- Credit Rating Changes: Immediately exit corporate bond CFDs facing downgrade risk

Take-Profit Strategies

Profit-taking in bond CFDs requires balancing potential further gains against the risk of reversal:

- Scaling Out: Take partial profits at 50% of target, trail remainder with protective stops

- Resistance-Based Targets: Target previous highs, round numbers, or Fibonacci retracements

- Yield-Based Targets: Set profit targets based on key yield levels (e.g., 4.00% on 10-year Treasury)

- Time-Based Profits: Take profits before major events that could reverse the trend

Diversification Strategies

Diversification in bond CFD trading extends beyond simply trading different government bonds. Effective diversification considers:

Geographic Diversification

| Region | Key Bonds | Primary Drivers | Correlation with USD |

|---|---|---|---|

| United States | 10Y Treasury, 30Y Bond | Fed Policy, Inflation | Baseline |

| Europe | German Bund, Italian BTP | ECB Policy, EU Stability | Moderate Negative |

| Asia-Pacific | JGB, Australian Bonds | BOJ/RBA Policy, Regional Growth | Low to Moderate |

| Emerging Markets | Various Sovereigns | Local Fundamentals, USD Strength | High Negative |

Maturity Diversification

Different bond maturities respond differently to interest rate changes and economic conditions:

- Short-Term (2-5 years): Less duration risk, more sensitive to near-term policy changes

- Medium-Term (5-10 years): Balanced exposure to both policy and growth expectations

- Long-Term (10+ years): Higher duration risk, more sensitive to inflation expectations

Currency Diversification

Trading bonds denominated in different currencies provides natural forex exposure:

- USD Bonds: Safe-haven appeal during global uncertainty

- EUR Bonds: Exposure to European monetary policy and fiscal dynamics

- JPY Bonds: Ultra-low yields but strong safe-haven characteristics

- GBP Bonds: Higher yields but increased political/economic volatility

Hedging Techniques for Bond Traders

Professional bond CFD traders employ various hedging techniques to protect against adverse moves while maintaining profit potential:

Duration Hedging

Match the duration of long and short positions to create market-neutral exposure:

- Dollar Duration Matching: Ensure long and short positions have equal dollar duration exposure

- Key Rate Duration: Hedge specific points on the yield curve

- Convexity Hedging: Account for non-linear price-yield relationships

Cross-Asset Hedging

Use correlations between bonds and other assets for portfolio protection:

- Equity-Bond Hedging: Long bonds to hedge equity positions during risk-off periods

- Currency Hedging: Hedge currency exposure in foreign bond positions

- Commodity Hedging: Use bond positions to hedge inflation-sensitive commodity exposure

Dynamic Hedging

Adjust hedge ratios based on changing market conditions:

- Volatility-Based Adjustments: Increase hedging during high-volatility periods

- Correlation Monitoring: Adjust hedge ratios when correlations break down

- Event-Driven Hedging: Temporary hedges around major economic releases or policy meetings

Comparing Bond Trading Offerings Among Top Forex Brokers

After analyzing dozens of forex brokers offering bond CFDs, clear leaders emerge based on instrument variety, pricing competitiveness, platform quality, and regulatory compliance. This comprehensive comparison will help you identify the best broker for your bond trading needs.

Types of Bonds You Can Trade with Forex Brokers

Government Bonds

Government bonds form the backbone of most brokers’ bond CFD offerings. Government bonds are perceived as some of the safest investments, making them popular among retail traders seeking diversification.

| Country | Bond Name | Typical Maturity | Key Characteristics | Available at Most Brokers |

|---|---|---|---|---|

| United States | Treasury Notes/Bonds | 2, 5, 10, 30 years | Highest liquidity, global benchmark | Yes |

| Germany | Bund | 10 years | Eurozone benchmark, high quality | Yes |

| United Kingdom | Gilt | 10 years | Sterling benchmark, political sensitivity | Most |

| Japan | JGB | 10 years | Ultra-low yields, BOJ intervention | Some |

| France | OAT | 10 years | Core eurozone, political risk | Limited |

Corporate Bonds

Corporate bond CFDs are less common among forex brokers due to liquidity constraints and higher risk profiles. Corporate bond CFDs are less liquid than government bonds, and their availability varies widely by broker.

When available, corporate bond CFDs typically include:

- Investment Grade Corporates: High-quality companies with strong credit ratings

- High-Yield Bonds: Lower-rated companies offering higher yields

- Sector-Specific Bonds: Focus on particular industries (tech, energy, finance)

- Convertible Bonds: Bonds that can be converted to company stock

Bond CFDs

Most forex brokers offer bond exposure through CFDs rather than actual bonds, providing several advantages for retail traders:

Speculative Trading with Bond CFDs

- Lower Capital Requirements: Trade with minimal initial investment

- Leverage Access: Amplify positions beyond available capital

- Short Selling Capability: Profit from falling bond prices

- No Settlement Issues: Instant execution and closing

- Extended Trading Hours: Trade beyond traditional bond market hours

Top Brokers Offering Bond CFDs

Minimum Deposit Requirements

Minimum deposit requirements vary significantly among brokers offering bond CFD trading. Here’s a comprehensive breakdown:

| Broker | Minimum Deposit | Bond CFD Min Position | Account Currency Options | Funding Methods |

|---|---|---|---|---|

| IG Markets | No minimum | $100 equivalent | USD, EUR, GBP, AUD | Bank transfer, cards, e-wallets |

| Saxo Bank | No minimum | $10,000 (actual bonds) | Multiple currencies | Bank transfer, cards |

| XTB | $250 | $100 equivalent | USD, EUR, GBP, PLN | Bank transfer, cards, PayPal |

| CMC Markets | $0 | $100 equivalent | USD, EUR, GBP, AUD | Bank transfer, cards |

| AvaTrade | $100 | $100 equivalent | USD, EUR, GBP, AUD | Bank transfer, cards, e-wallets |

Leverage and Margin Trading for Bonds

Leverage availability for bond CFDs reflects regulatory restrictions and broker risk management policies. Current leverage limits vary by jurisdiction:

Regulatory Leverage Limits (2024-2025)

- ESMA (EU/EEA): Maximum 1:30 on major government bonds

- FCA (UK): Maximum 1:30 with enhanced protections

- ASIC (Australia): Maximum 1:30 for retail clients

- CFTC/NFA (US): Maximum 1:50, but limited broker availability

- Offshore Jurisdictions: Up to 1:200, reduced regulatory protection

Spreads and Commissions

Trading costs for bond CFDs vary significantly across brokers and instruments. Our analysis reveals the current competitive landscape:

| Broker | US 10Y Spread | German Bund Spread | UK Gilt Spread | Commission | Overnight Financing |

|---|---|---|---|---|---|

| IC Markets | 1.0-3.4 pts | 1.2-2.8 pts | 1.5-3.0 pts | None | Variable |

| IG Markets | From 1.0 pt | From 1.2 pts | From 1.5 pts | None | Variable |

| Pepperstone | Raw + Commission | Raw + Commission | Raw + Commission | $0.02/trade | Variable |

| AvaTrade | 3.0 pts (fixed) | 3.0 pts (fixed) | 3.5 pts (fixed) | None | Variable |

| CMC Markets | From 1.0 pt | From 1.2 pts | From 1.5 pts | None | Variable |

Key Insights:

- IC Markets and IG Markets offer the tightest spreads on major government bonds

- AvaTrade’s fixed spreads provide cost certainty but may be uncompetitive during low volatility

- Pepperstone’s commission model can be cost-effective for active traders

- Overnight financing costs can significantly impact longer-term positions

Technology and Innovation in Bond Trading Platforms

AI and Machine Learning in Bond Analysis

Artificial intelligence is revolutionizing bond CFD trading through sophisticated analysis tools and automated trading systems. Leading brokers are integrating AI-powered features to enhance trader decision-making and execution quality.

Current AI Applications in Bond Trading:

- Predictive Analytics: Machine learning models analyze historical data to predict bond price movements

- Sentiment Analysis: AI processes news feeds and social media to gauge market sentiment

- Pattern Recognition: Algorithms identify complex chart patterns and trading opportunities

- Risk Assessment: AI-powered risk management systems monitor portfolio exposure in real-time

- Trade Execution: Smart order routing optimizes execution quality and minimizes market impact

Mobile Trading Apps for Bond CFDs

Mobile trading has become essential for bond CFD traders who need to monitor positions and react to market-moving events regardless of location. CMC Markets reports that over 65% of bond CFD trades now originate from mobile devices.

Essential Mobile App Features for Bond Trading:

- Real-Time Quotes: Live bond prices and yield data

- Advanced Charting: Technical analysis tools optimized for mobile screens

- Economic Calendar: Push notifications for market-moving events

- One-Touch Trading: Quick order placement and modification

- Portfolio Management: Real-time P&L and risk monitoring

- Secure Authentication: Biometric login and two-factor authentication

Integration with Other Financial Markets

Modern bond trading platforms increasingly integrate multiple asset classes, allowing traders to monitor correlations and implement cross-asset strategies effectively. This integration is crucial given the strong relationships between bond yields, currencies, and equity markets.

Multi-Asset Integration Benefits:

- Correlation Monitoring: Real-time tracking of bond-forex relationships

- Cross-Asset Hedging: Seamless execution of multi-market strategies

- Unified Risk Management: Portfolio-level risk assessment across asset classes

- Arbitrage Opportunities: Identification of mispricing between related instruments

- Comprehensive Analysis: Holistic market view for better decision-making

Common Mistakes to Avoid in Bond Trading

Even experienced forex traders can struggle with bond CFDs due to the unique characteristics of fixed-income markets. Learning from common mistakes can significantly improve your bond trading performance and risk management.

Overleverage and Risk Exposure

The biggest mistake novice bond CFD traders make is applying forex-style leverage to bond positions without understanding the unique risks. While bond markets are generally less volatile than forex, they can experience sudden, dramatic moves during policy surprises or economic shocks.

Leverage Guidelines for Bond CFDs:

- Conservative Approach: Maximum 1:5 leverage for beginners

- Intermediate Traders: 1:10 leverage with proper risk management

- Professional Traders: Higher leverage only with sophisticated hedging

- Event Risk: Reduce leverage before major central bank meetings

- Position Sizing: Never risk more than 2% of account on single bond trade

Ignoring Economic Indicators

Bond markets are fundamentally driven by economic data, central bank policies, and inflation expectations. Traders who ignore these factors often find themselves on the wrong side of major moves.

Critical Economic Indicators for Bond Trading:

| Indicator | Impact on Bonds | Release Frequency | Typical Market Response |

|---|---|---|---|

| Inflation Data (CPI/PCE) | High impact | Monthly | Higher inflation = bond prices fall |

| Central Bank Meetings | Very high impact | 6-8 times/year | Policy changes drive major moves |

| Employment Data | Moderate impact | Monthly | Strong jobs = higher yields |

| GDP Growth | Moderate impact | Quarterly | Strong growth = bond selling |

| Geopolitical Events | Variable | Irregular | Safe-haven flows to government bonds |

Lack of Diversification

Many traders make the mistake of concentrating their bond CFD positions in a single country or maturity, exposing themselves to unnecessary concentration risk. Effective diversification in bond trading goes beyond simply trading different government bonds.

Diversification Best Practices:

- Geographic Diversification: Trade bonds from different countries and regions

- Maturity Diversification: Combine short, medium, and long-term bonds

- Credit Quality Diversification: Mix government and high-grade corporate bonds

- Currency Diversification: Include bonds denominated in different currencies

- Strategy Diversification: Combine directional and relative value trades

Case Study – Diversification in Action:

During the 2022 bond market rout, traders with concentrated US Treasury positions suffered significant losses as the Federal Reserve aggressively raised rates. However, traders with diversified positions including European bonds and shorter-duration instruments fared much better. German Bunds actually outperformed US Treasuries during certain periods, while 2-year notes declined less than 10-year bonds due to their lower duration risk.

Future Trends in Bond Trading via Forex Platforms

Emerging Markets and New Bond Offerings

The bond CFD landscape is expanding rapidly as brokers recognize growing trader interest in fixed-income diversification. Forex broker challenges in 2025 include adapting to changing client demands for broader bond access.

Emerging Trends in Bond CFD Offerings:

- Emerging Market Bonds: Increased access to developing country debt securities

- Green Bonds: ESG-focused bond CFDs tracking environmental initiatives

- Inflation-Linked Bonds: TIPS and other inflation-protected securities

- Municipal Bonds: Local government debt from major metropolitan areas

- Cryptocurrency Bonds: Digital asset-backed fixed-income instruments

Technological Advancements in Trading Systems

Technology continues revolutionizing bond CFD trading through enhanced execution, analysis, and risk management capabilities. The integration of artificial intelligence and machine learning is creating more sophisticated trading environments.

Technological Innovations Shaping Bond Trading:

- Algorithmic Execution: AI-powered order routing for optimal execution quality

- Predictive Analytics: Machine learning models for bond price forecasting

- Natural Language Processing: Automated analysis of central bank communications

- Blockchain Settlement: Distributed ledger technology for trade settlement

- Quantum Computing: Advanced portfolio optimization and risk calculations

Regulatory Changes and Their Impact

The regulatory environment for bond CFD trading continues evolving, with authorities balancing market access against investor protection. CySEC’s 2024 supervisory priorities indicate increased scrutiny of leveraged products.

- ESMA Review: Potential reduction in bond CFD leverage limits

- FCA Enhancements: Improved client money protection rules

- ASIC Updates: Strengthened risk management requirements

- MiFID III: Enhanced transparency and reporting requirements

- Global Coordination: Increased regulatory harmonization across jurisdictions

Impact on Traders:

- Reduced Leverage: Lower maximum leverage may affect trading strategies

- Enhanced Protection: Stronger safeguards for client funds and negative balance protection

- Increased Transparency: Better disclosure of costs and risks

- Education Requirements: Mandatory suitability assessments for leveraged products

- Professional Categories: Clearer distinction between retail and professional clients

Frequently Asked Questions (FAQs)

- What are the best brokers for bond trading in 2025?

- The top brokers for bond CFD trading in 2025 include IG Markets (16 bond CFDs, spreads from 1.0 point), Saxo Bank (actual bonds and CFDs), CMC Markets (50+ instruments), XTB (competitive spreads, xStation platform), and IC Markets (ultra-low spreads of 1.0-3.4 points). Each offers unique advantages depending on your trading style and requirements.

- Can you trade bonds in the Forex market?

- You cannot trade actual bonds in the forex market, but many forex brokers offer bond CFDs that track government and corporate bond prices. These CFDs allow you to speculate on bond price movements with leverage, short-selling capabilities, and lower capital requirements than purchasing actual bonds.

- What are bond CFDs and how do they work?

- Bond CFDs (Contracts for Difference) are derivative instruments that track the price movements of underlying bonds without requiring actual ownership. You profit or lose based on the difference between opening and closing prices. Unlike actual bonds, CFDs offer leverage, short-selling capability, and don’t pay coupon interest (instead, overnight financing charges apply).

- What’s the minimum deposit to trade bonds?

- Minimum deposits vary by broker: IG Markets and CMC Markets require no minimum deposit, XTB requires $250, AvaTrade requires $100, while Saxo Bank has no minimum deposit but requires $10,000 minimum per actual bond trade. Most bond CFD positions can be opened with $100-500 depending on leverage and position size.

- Which brokers offer the lowest bond trading fees?

- IC Markets offers the lowest spreads at 1.0-3.4 points commission-free, followed by IG Markets with spreads from 1.0 point. Pepperstone uses a raw spread + $0.02 commission model that can be cost-effective for active traders. AvaTrade offers fixed spreads starting at 3.0 points, providing cost certainty.

- How is bond trading different from Forex trading?

- Bond trading focuses on fixed-income securities influenced by interest rates, inflation expectations, and credit risk, while forex trading involves currency pairs driven by economic fundamentals and central bank policies. Bonds typically have lower volatility but can experience sudden moves during policy changes. Bond CFDs also incur overnight financing charges instead of swap rates.

- Are bonds a good investment for Forex traders?

- Bonds can be excellent diversification tools for forex traders due to their different risk-return profiles and correlation patterns. Government bonds often provide portfolio protection during risk-off periods when currencies face volatility. Bond CFDs also allow forex traders to implement yield-based trading strategies and hedge currency positions.

- What leverage is available for bond CFDs?

- Leverage varies by regulatory jurisdiction: EU/UK traders typically access up to 1:30 leverage on major government bonds, Australian traders get similar limits under ASIC regulation, while some offshore brokers offer up to 1:200 leverage with reduced regulatory protection. Professional clients may access higher leverage levels.

- Which brokers offer government bonds for trading?

- Most major forex brokers offer government bond CFDs: IG Markets provides 16 government bonds across six countries, CMC Markets offers 50+ government debt instruments, AvaTrade covers US Treasuries, German Bunds, and Japanese Government Bonds, while XTB and IC Markets focus on major government bonds from developed markets.

- Can I trade corporate bonds through Forex brokers?

- Corporate bond CFDs are less common but available through select brokers. Saxo Bank offers actual corporate bonds alongside government bonds, while some brokers provide CFDs on major corporate bond indices or high-grade corporate debt. Availability varies significantly compared to government bond offerings.

- How do bond trading fees work?

- Bond CFD fees typically include spreads (difference between bid/ask prices), overnight financing charges for positions held beyond market close, and potentially commissions (like Pepperstone’s $0.02 per trade). Some brokers offer commission-free trading with wider spreads, while others use raw spreads plus commission models.

- Do Forex brokers offer bonds trading on their platforms?

- Yes, many major forex brokers now offer bond CFD trading alongside currency pairs. IG Markets, CMC Markets, XTB, AvaTrade, IC Markets, Pepperstone, and Saxo Bank all provide bond trading capabilities through their standard trading platforms, often using the same MetaTrader 4/5 or proprietary platforms used for forex.

- What risks should I be aware of when trading bonds?

- Key risks include interest rate risk (bond prices fall when rates rise), credit risk (issuer default potential), leverage risk (amplified losses), liquidity risk (difficult to exit positions during stress), inflation risk (eroding real returns), and regulatory risk (changing rules affecting CFD trading).

- What are the best strategies for bonds trading?

- Effective strategies include yield curve trading (capturing curve steepening/flattening), duration-based positioning (managing interest rate sensitivity), credit spread trading (government vs corporate bonds), correlation trading (bonds vs currencies), and economic event trading (positioning around central bank meetings and data releases).

- How do I find the best bonds trading platform?

- Evaluate platforms based on: instrument variety (number and types of bonds available), competitive spreads and fees, regulatory compliance (FCA, ASIC, CySEC licensing), platform quality (charting tools, execution speed), leverage offerings, educational resources, and customer support quality. Demo accounts help test platform suitability.

- Do brokers offer educational resources for bonds trading?

- Yes, leading brokers provide extensive educational content: AvaTrade offers Ava Academy with bond trading courses, IG Markets provides comprehensive market analysis and webinars, XTB offers regular educational content and tutorials, while CMC Markets provides dedicated bond market research and analysis.

- What are the tax implications of bonds trading?

- Tax treatment varies by country and trading approach. Bond CFD profits are typically treated as capital gains or trading income depending on frequency and holding periods. Consult local tax professionals for specific guidance, as some jurisdictions offer different treatment for actual bonds versus CFDs.

- Is bonds trading suitable for beginners?

- Bond CFD trading can be suitable for beginners with proper education and risk management. Start with major government bonds (US Treasuries, German Bunds), use low leverage (1:5 or less), practice on demo accounts, focus on learning bond-yield relationships, and understand economic drivers before risking real capital.

- How much capital do I need to trade bonds?

- You can start bond CFD trading with as little as $250-500, though $1,000-2,000 provides better risk management flexibility. Actual bond purchases typically require $10,000+ minimum investments. Position sizing should follow the 1-2% risk rule regardless of account size.

- What are the margin requirements for bonds trading?

- Margin requirements vary by broker and instrument: major government bonds typically require 3-5% margin (reflecting 1:20-1:30 leverage), while corporate bonds may require 10-20% margin due to higher risk. Margin requirements can increase during volatile periods or around major economic events.

- Can I practice bonds trading with a demo account?

- Yes, most brokers offering bond CFDs provide demo accounts with virtual funds. IG Markets, XTB, AvaTrade, CMC Markets, and IC Markets all offer demo accounts that include bond CFD trading capabilities, allowing you to practice strategies and familiarize yourself with platforms risk-free.

- What happens if I hold a bond until maturity?

- Bond CFDs don’t have maturity dates like actual bonds—they track the price of underlying bonds but are perpetual contracts. You can hold positions indefinitely (subject to overnight financing charges) or close them at any time. Actual bonds through brokers like Saxo Bank do mature and return principal.

- Are there any hidden fees in bonds trading?

- Common additional fees include overnight financing charges (daily interest on leveraged positions), weekend holding fees, inactivity fees (after periods of no trading), withdrawal fees (some brokers), and currency conversion fees (for non-base currency positions). Always review complete fee schedules before trading.

- How do bond CFDs differ from traditional bond investing?

- Bond CFDs offer leverage, short-selling capability, small minimum positions, instant execution, and no coupon payments (financing charges instead). Traditional bonds require large minimum investments, provide coupon income, have maturity dates, involve settlement periods, and don’t offer leverage or short-selling capabilities.

- Are bond trades executed 24/7 like Forex trades?

- Bond CFD trading hours vary by instrument and broker. Major government bonds like US Treasuries trade nearly 24 hours (23 hours at some brokers), while others have more limited hours. European bonds typically trade during European business hours, with some extended sessions available.

- How does leverage work when trading bond CFDs?

- Leverage allows you to control larger positions with smaller capital. With 1:20 leverage, $1,000 can control a $20,000 bond CFD position. Profits and losses are magnified proportionally—a 1% bond price move generates 20% account impact. Margin calls occur if losses reduce account equity below required levels.

- Can I use technical analysis for bond trading?

- Yes, technical analysis works effectively for bond CFD trading. Support and resistance levels, moving averages, momentum indicators, and chart patterns all apply to bond price charts. Many traders combine technical analysis with fundamental analysis of economic data and central bank policies for optimal results.

- What is the typical spread for bond CFDs?

- Spreads vary by broker and instrument: IC Markets offers 1.0-3.4 points on major bonds, IG Markets starts from 1.0 point, AvaTrade provides fixed 3.0-6.0 point spreads, while CMC Markets offers spreads from 1.0 point. Spreads typically widen during volatile periods and major economic releases.

- Are there any restrictions on bond trading for retail investors?

- Regulatory restrictions include maximum leverage limits (typically 1:30 for major government bonds in EU/UK), negative balance protection requirements, margin close-out rules, and suitability assessments for leveraged products. Some brokers may restrict access to certain bond types or require professional client status for higher leverage.

- How do interest rate changes affect bond trading?

- Interest rate changes have inverse relationships with bond prices: rising rates cause bond prices to fall (creating CFD losses for long positions), while falling rates boost bond prices (generating CFD profits for long positions). Duration measures this sensitivity—longer-duration bonds are more sensitive to rate changes.

- Can I hold bond CFDs long-term?

- Yes, you can hold bond CFD positions long-term, but consider overnight financing charges that accumulate daily. These charges can significantly impact profitability over extended periods. Long-term bond exposure might be more cost-effective through actual bond ownership or bond ETFs rather than leveraged CFDs.

- What is the difference between corporate and government bonds in Forex trading?

- Government bonds (Treasuries, Bunds, Gilts) are issued by national governments and considered lower risk, offering tighter spreads and higher liquidity in CFD form. Corporate bonds are issued by companies, carry credit risk, typically offer higher yields, and have limited availability as CFDs through forex brokers.

- How do I choose between different bond maturities when trading?

- Consider your risk tolerance and market outlook: short-term bonds (2-5 years) have lower duration risk and are more sensitive to near-term policy changes, while long-term bonds (10-30 years) offer higher duration risk/reward and are more sensitive to inflation expectations. Match maturity choice to your trading timeframe and risk appetite.

- Can I use automated trading systems for bond CFDs?

- Yes, most brokers supporting bond CFDs allow automated trading through Expert Advisors (EAs) on MetaTrader platforms or API connections for custom algorithms. Automated systems can monitor multiple bonds simultaneously, execute complex strategies, and manage risk more consistently than manual trading.

- How do economic reports impact bond prices in Forex trading?

- Economic reports significantly impact bond CFD prices: inflation data affects long-term bond prices, employment reports influence central bank policy expectations, GDP growth data affects yield curve shape, and central bank communications can cause immediate price moves. Traders often position ahead of major releases or trade the immediate reactions.

- What is the relationship between currency strength and bond prices?

- Strong correlations exist between bond yields and currency strength: rising bond yields typically strengthen the associated currency (higher yields attract foreign capital), while falling yields often weaken currencies. This relationship is particularly strong for USD/JPY with US Treasury yields and EUR/USD with US-German yield spreads.

- Are there any tax advantages to trading bonds through Forex platforms?

- Tax treatment varies by jurisdiction, but bond CFDs may be treated differently from actual bonds for tax purposes. Some countries treat CFD profits as capital gains rather than income, potentially offering favorable tax rates. Consult local tax professionals for specific guidance on your situation.

- How do I interpret bond yield curves when trading CFDs?

- Yield curves plot yields across different maturities: normal upward-sloping curves suggest economic growth expectations, inverted curves may signal recession concerns, and flattening curves often indicate slowing growth. Traders use curve shape changes to identify opportunities in different maturity bond CFDs and predict central bank policy changes.

Conclusion

Recap of the best Forex brokers for bonds trading

After comprehensive analysis of the bond CFD landscape, several brokers clearly distinguish themselves as leaders in this growing market segment. IG Markets emerges as the overall winner with its extensive selection of 16 bond CFDs, competitive spreads from 1.0 point, and robust regulatory oversight across multiple jurisdictions. Their platform ecosystem, including ProRealTime integration and guaranteed stop-loss orders, provides professional-grade tools for serious bond traders.

Saxo Bank offers a unique proposition by providing both actual bonds and bond CFDs, appealing to traders who want flexibility in their approach to fixed-income investing. While their $10,000 minimum per bond trade may limit some traders, the institutional-quality execution and comprehensive bond coverage make them attractive for larger accounts.

For cost-conscious traders, IC Markets delivers exceptional value with spreads as low as 1.0-3.4 points commission-free, while XTB combines competitive pricing with their advanced xStation platform. CMC Markets impresses with over 50 government debt instruments and precision pricing, while AvaTrade provides fixed spreads for predictable trading costs.

Importance of choosing a regulated and reliable broker

The regulatory landscape for bond CFD trading continues strengthening, with authorities like the FCA, ASIC, and CySEC implementing enhanced client protections. CySEC’s increased capital requirements and the broader trend toward stricter oversight ultimately benefit traders through improved financial stability and client fund protection.

- Licensing: Verify FCA, ASIC, CySEC, or equivalent top-tier regulation

- Segregation: Confirm client funds are held separately from company funds

- Compensation: Check participation in investor compensation schemes

- Auditing: Ensure regular independent audits and financial reporting

- Compliance: Verify adherence to leverage limits and client protection rules

The importance of regulation cannot be overstated, particularly given the leverage inherent in bond CFD trading. Recent market events, from the UK gilt crisis to unexpected central bank policy pivots, demonstrate how quickly bond markets can move. Regulated brokers provide essential safeguards including negative balance protection, segregated client funds, and dispute resolution mechanisms.

Final tips for selecting the right broker based on individual trading needs

Your choice of bond CFD broker should align with your specific trading style, experience level, and objectives:

For Beginners: Prioritize educational resources, demo accounts, and user-friendly platforms. AvaTrade’s Ava Academy and XTB’s comprehensive tutorials make them excellent starting points. Focus on major government bonds with lower leverage (1:5 to 1:10) initially.

For Active Traders: Emphasize execution speed, tight spreads, and advanced platforms. IC Markets and Pepperstone excel in these areas, offering institutional-grade execution and multiple platform options including cTrader and enhanced MetaTrader versions.

For Portfolio Diversifiers: Seek brokers with extensive instrument selections and multi-asset capabilities. IG Markets’ 16 bond CFDs and CMC Markets’ 50+ instruments provide excellent diversification opportunities across global fixed-income markets.

For Professional Traders: Consider brokers offering actual bonds alongside CFDs, sophisticated risk management tools, and institutional services. Saxo Bank’s dual offering and professional account features cater to serious fixed-income investors.

The Future of Bond Trading in the Forex Market

The integration of bond CFDs into forex trading platforms represents a significant evolution in retail trading access. As central banks navigate complex economic challenges and interest rate cycles, the correlation between bond yields and currency movements will likely strengthen further, making bond analysis increasingly crucial for forex success.

Technological advances, including AI-powered analysis and mobile trading optimization, will continue enhancing the bond CFD trading experience. Regulatory developments, while potentially limiting some aspects of leveraged trading, ultimately create a more stable and trustworthy environment for long-term market growth.

The expanding universe of bond CFD offerings—from emerging market debt to ESG-focused green bonds—provides traders with unprecedented opportunities to diversify and capitalize on global fixed-income trends. Success in this evolving landscape requires combining fundamental bond analysis with technical trading skills, supported by a carefully selected broker partner who can provide the tools, education, and execution quality necessary for consistent profitability.

Ready to start bond CFD trading? Begin with a demo account from one of our recommended brokers, focusing on major government bonds while you develop your understanding of yield-currency relationships. Remember that bond CFD trading, like all leveraged trading, carries significant risks and requires proper education, risk management, and continuous learning to achieve long-term success.