Key Takeaways

- Eightcap ranks #1 overall CFD broker for 2025 with widest market coverage and ultra-low spreads

- Pepperstone excels for MT4 Forex trading with 0.0 pip spreads and top-tier regulation (FCA, ASIC, CySEC)

- IC Markets offers the lowest tested spreads: 2.2 pips GBP/JPY, 18 pips gold, 3 pips crude oil

- FP Markets provides best cTrader experience with 0.1 pip average spreads and $6 commission per round-turn

- Always verify broker regulation through official websites—prioritize FCA, ASIC, CySEC, and NFA licenses

Introduction to MetaTrader and CFD Trading

Honestly, picking a MetaTrader CFD broker isn’t rocket science—but it’s not exactly child’s play either. Think of it like choosing a new smartphone. You want something reliable, feature-packed, and reasonably priced, right? That’s exactly what we’re doing here, except instead of apps and camera quality, we’re looking at spreads, regulation, and trading tools.

What is MetaTrader?

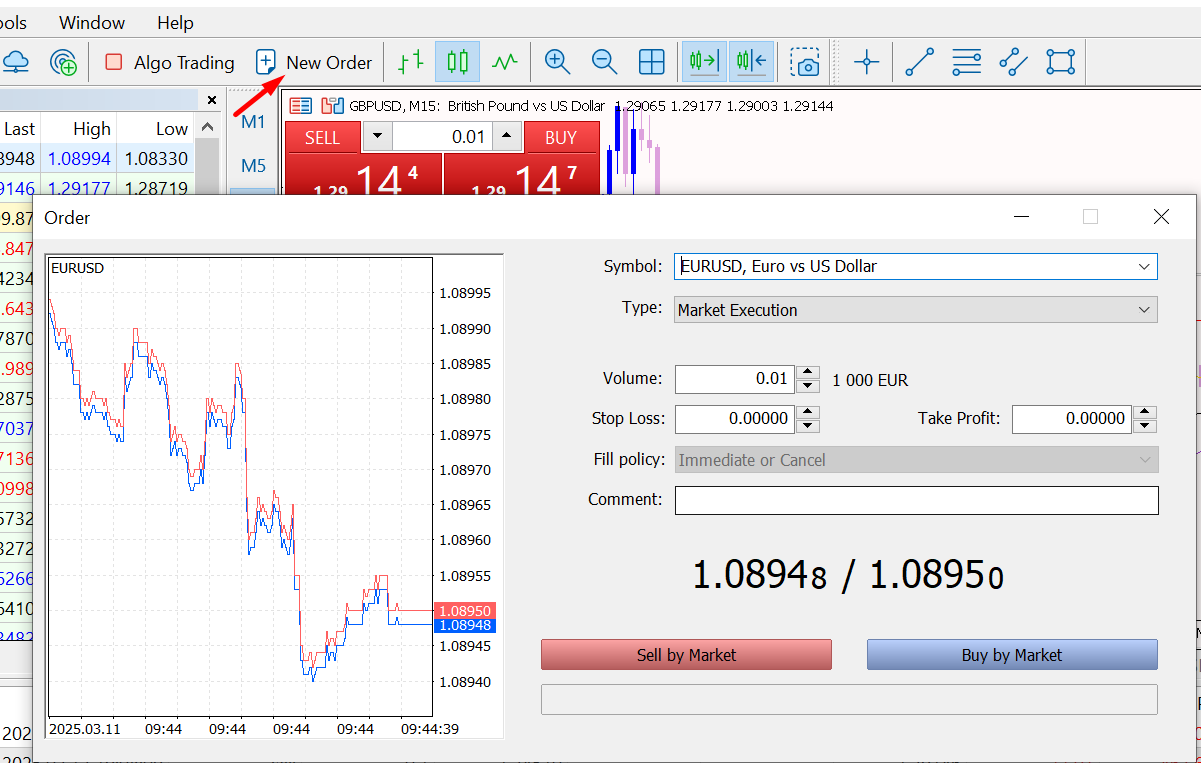

MetaTrader is the Swiss Army knife of trading platforms. Developed by MetaQuotes Software, it’s the go-to platform for millions of traders worldwide. Whether you’re scalping the EUR/USD during London session or swing trading indices, MetaTrader has got your back.

Here’s the thing—MetaTrader isn’t just one platform. It’s actually two main versions: MT4 and MT5. Both are free to use, but your broker needs a proper license from MetaQuotes to offer it. That’s your first red flag check: if a broker offers “MetaTrader” but it looks sketchy, they might not be legit.

MetaTrader 4 (MT4) vs. MetaTrader 5 (MT5)

This is where things get interesting. MT4 came first and became the gold standard for forex trading. It’s like that reliable Toyota Camry—not flashy, but it gets the job done every single time. MT5 is the newer, more advanced version—think Tesla Model S with all the bells and whistles.

Key Features of MetaTrader 4

- Simplicity: Clean, intuitive interface that won’t overwhelm beginners

- Expert Advisors (EAs): Automated trading robots—set it and forget it

- Custom Indicators: Thousands available from the community

- One-Click Trading: Fast execution when seconds matter

- Mobile Apps: Trade from anywhere with iOS/Android apps

Advantages of MetaTrader 5

- More Asset Classes: Stocks, futures, options—not just forex

- Advanced Order Types: 6 pending orders vs MT4’s 4

- Economic Calendar: Built-in news and events

- Depth of Market: See order book levels

- Faster Backtesting: Multi-threaded strategy testing

What is CFD Trading?

CFD stands for Contract for Difference—fancy name for a simple concept. You’re essentially making a bet on whether an asset’s price will go up or down, without actually owning the asset. It’s like betting on a horse race, but instead of horses, you’re betting on Apple stock, gold prices, or currency movements.

Here’s what makes CFDs attractive: leverage. Instead of needing $10,000 to trade Apple stock, you might only need $500 as margin (with 20:1 leverage). The catch? Your profits AND losses are magnified by the same ratio.

Why Trade CFDs with MetaTrader?

Simple—it’s the perfect marriage of functionality and flexibility. MetaTrader gives you professional-grade tools while CFDs give you access to global markets with small capital requirements. Plus, you can go long or short, which means you can profit whether markets are rising or falling.

Benefits of Trading CFDs on MetaTrader

Leverage and Margin

Let’s talk about leverage—the double-edged sword of CFD trading. Think of it as borrowed money from your broker. If you have $1,000 and use 10:1 leverage, you can control $10,000 worth of positions. Sounds great, right? Well, here’s the reality check: if the market moves 1% against you, you lose $100 (10% of your account), not $10.

According to recent FXEmpire data, leverage limits have been tightened across major jurisdictions:

- FCA (UK): Maximum 30:1 for major forex pairs

- ASIC (Australia): 30:1 for major forex, 20:1 for minor forex

- CySEC (Cyprus): Similar to FCA limits

- Offshore brokers: Often offer up to 500:1 (higher risk)

Access to Global Markets

This is where CFDs really shine. With one account, you can trade:

- Forex pairs: EUR/USD, GBP/JPY, and 60+ others

- Stock indices: S&P 500, FTSE 100, DAX, Nikkei

- Individual stocks: Apple, Tesla, Amazon, Google

- Commodities: Gold, silver, oil, natural gas

- Cryptocurrencies: Bitcoin, Ethereum (where permitted)

Risk Management Tools

MetaTrader’s risk management tools are your best friends in CFD trading. Here’s what you absolutely need to know:

- Stop Loss: Automatic exit when losses reach a preset level

- Take Profit: Lock in gains at your target price

- Trailing Stops: Move your stop loss as profits increase

- Position Sizing: Risk only 1-2% of your account per trade

How to Choose the Best MetaTrader CFD Broker

Key Factors to Consider When Selecting a Broker

Regulation and Safety

This is non-negotiable. I’ve seen too many traders lose their shirts with unregulated brokers. Here’s your priority list for 2025:

- FCA (UK): Financial Conduct Authority

- ASIC (Australia): Australian Securities and Investments Commission

- CySEC (Cyprus): Cyprus Securities and Exchange Commission

- BaFin (Germany): Federal Financial Supervisory Authority

- FINMA (Switzerland): Swiss Financial Market Supervisory Authority

Fees and Spreads (Trading Costs and Fees)

This is where brokers make their money—and where you can lose yours if you’re not careful. Based on our latest testing, here’s what you should expect:

Top 10 MetaTrader CFD Brokers in 2025

1. Eightcap

Overview

Eightcap takes the crown as the best overall CFD broker for 2025. This Australian-based broker has been quietly building an empire since 2009, and frankly, they’ve nailed the formula: wide market access, competitive pricing, and rock-solid regulation.

Key Features and Benefits

- Market Coverage: 10,000+ instruments including shares, forex, indices, commodities, and crypto CFDs

- Platform Suite: MT4, MT5, cTrader, and TradingView integration

- Execution Speed: Average execution time under 50ms

- Educational Resources: Comprehensive trading academy and market analysis

Pros & Cons

Pros

- Widest range of tradeable instruments

- Ultra-competitive spreads and commissions

- Multiple tier-1 regulatory licenses

- Excellent customer service

Cons

- Limited cryptocurrency selection

- No proprietary trading platform

Fees and Spreads

Eightcap’s Raw Account offers spreads from 0.0 pips with a commission of $3.50 per standard lot per side. Their Standard Account features spreads from 1.0 pips with no commission.

Regulation

Triple-regulated by FCA (UK), ASIC (Australia), and CySEC (Cyprus)—giving traders maximum protection and global accessibility.

Start Trading with Eightcap2. Pepperstone

Overview

Pepperstone has been my go-to recommendation for MT4 forex trading since 2010. They’ve built their reputation on razor-sharp spreads and lightning-fast execution. If you’re serious about forex CFDs, Pepperstone should be on your shortlist.

Key Features and Benefits

- Forex Specialist: 70+ currency pairs with institutional-grade pricing

- Smart Trader Tools: Autochartist, Economic Calendar, Market Analysis

- Copy Trading: Social trading via multiple platforms

- API Trading: Advanced algorithmic trading support

Pros & Cons

Pros

- Industry-leading forex spreads (0.0 pips)

- Second-fastest execution speeds globally

- Comprehensive educational resources

- Award-winning customer service

Cons

- Higher fees on non-forex instruments

- Limited stock CFD selection

Fees and Spreads

According to Pepperstone’s latest pricing, their Razor Account features:

- EUR/USD: From 0.0 pips + $3.50 commission per lot per side

- GBP/USD: From 0.1 pips + commission

- Gold: From 0.20 pips + commission

Regulation

Pepperstone holds licenses from ASIC (Australia), FCA (UK), CySEC (Cyprus), BaFin (Germany), DFSA (Dubai), and SCB (Bahamas)—one of the most comprehensive regulatory footprints in the industry.

Open Your Pepperstone Account3. IC Markets

Overview

IC Markets processes more MetaTrader volume than any other broker globally. That’s not marketing fluff—that’s pure fact. When you’re handling that much volume, you need serious infrastructure, and IC Markets delivers.

Key Features and Benefits

- Volume Leader: Highest monthly MT4/MT5 trading volume globally

- Raw Spreads: Institutional-grade pricing from tier-1 liquidity providers

- cTrader Integration: Advanced algorithmic trading platform

- No Trading Restrictions: Scalping and high-frequency trading allowed

Pros & Cons

Pros

- Proven track record with high-volume traders

- Lowest tested spreads in our research

- Excellent for algorithmic trading

- No restrictions on trading strategies

Cons

- Higher minimum deposit for some accounts

- Limited educational resources

Fees and Spreads

Based on FXEmpire’s testing, IC Markets delivered the lowest spreads:

- GBP/JPY: As low as 2.2 pips

- Gold: 18 pips

- Crude Oil: 3 pips

Regulation

IC Markets Global is regulated by the Seychelles Financial Services Authority (FSA) under license SD018, with client funds held in segregated accounts with top-tier banking institutions.

Start Trading with IC Markets4. FP Markets

Overview

FP Markets is the broker’s broker—the one professionals choose when they need reliability above all else. With a Trust Score of 89/99 from ForexBrokers.com, they’ve earned their stripes through consistent performance and transparent pricing.

Key Features and Benefits

- Platform Variety: MT4, MT5, cTrader, TradingView, and Iress suite

- Professional Tools: Autochartist, FX Blue, Trader Toolbox add-ons

- Copy Trading: Social trading portal plus MetaTrader Signals

- Market Depth: 10,000+ CFD instruments

Pros & Cons

Pros

- Ultra-competitive Raw ECN pricing

- Multiple tier-1 regulatory licenses

- Excellent for professional traders

- Advanced algorithmic trading support

Cons

- Complex fee structure across platforms

- Limited cryptocurrency offerings

Fees and Spreads

FP Markets’ Raw ECN account delivers exceptional value:

- EUR/USD: 0.1 pips average (0.8 pips all-in with commission)

- Commission: $6 per round-turn lot ($3 per side)

- Minimum Deposit: Just $50 for Raw ECN access

Regulation

ASIC (Australia) and European MiFID licensing provide comprehensive regulatory coverage with segregated client funds and negative balance protection.

Open Your FP Markets Account5. Tickmill

Overview

Tickmill is the beginner’s best friend. According to Investopedia’s 2025 analysis, they offer the best combination of low costs, educational support, and user-friendly features for new traders.

Key Features and Benefits

- Micro Lots: Start trading with as little as 0.01 lots

- Educational Hub: Comprehensive trading courses and webinars

- Customer Support: 24/5 multilingual support team

- Low Minimums: $100 minimum deposit across all account types

Pros & Cons

Pros

- Perfect for beginners

- Excellent educational resources

- Competitive Raw Account pricing

- Strong regulatory oversight

Cons

- Limited advanced trading tools

- Smaller instrument selection

Fees and Spreads

- Raw Account: From 0.0 pips + $3 commission per lot per side

- Classic Account: From 1.6 pips, no commission

- Crypto CFDs: No commission, tight spreads, 24/7 trading

Regulation

Highly regulated by FSA (Seychelles), DFSA (Dubai), FCA (UK), CySEC (Cyprus), and FSCA (South Africa)—comprehensive global coverage.

Start Trading with Tickmill6. AvaTrade

Overview

AvaTrade has been around since 2006, and they’ve perfected the art of trader education. If you’re the type who wants to understand the ‘why’ behind every trade, AvaTrade’s educational ecosystem is unmatched.

Key Features and Benefits

- Educational Excellence: Trading Central integration, comprehensive courses

- Platform Choice: MT4, MT5, AvaTrade Web, AvaTradeGO mobile

- Automated Trading: Expert Advisors, DupliTrade, ZuluTrade integration

- Market Analysis: Daily market insights and trading signals

Pros & Cons

Pros

- Outstanding educational content

- Global regulatory presence

- Comprehensive automated trading options

- Excellent mobile trading experience

Cons

- Higher spreads on some instruments

- Limited advanced charting tools

Account Types and Minimum Deposit

$100 minimum deposit across all account types, with spread-based pricing model. No commission charges, but spreads are typically higher than ECN-style accounts.

Open Your AvaTrade Account7. XTB

Overview

XTB is one of the largest publicly-traded brokers in the world, and they’ve built their reputation on transparency and innovation. While they’re known for their proprietary xStation platform, their MetaTrader offering is solid for CFD traders.

Key Features and Benefits

- Stock Exchange Listed: Public company with transparent financials

- Platform Innovation: xStation 5 and MetaTrader 4 options

- Market Research: In-house analysis team and market insights

- Investment Options: CFDs and ETFs under one roof

Pros & Cons

Pros

- Publicly traded, transparent operations

- Strong European regulation

- Excellent educational resources

- Competitive pricing structure

Cons

- Limited MetaTrader customization

- Focus on proprietary platform over MT

Fees and Spreads

XTB operates on a spread-based model with no commissions on most CFDs. EUR/USD spreads typically start from 1.1 pips during peak hours.

Regulation

FCA (UK), KNF (Poland), and CySEC (Cyprus) regulation provides comprehensive European coverage with investor protection schemes.

Start Trading with XTB8. IG Markets

Overview

IG is the grandfather of CFD trading—they literally invented the concept back in 1974. With nearly 50 years of experience and a reputation for innovation, IG remains a top choice for serious CFD traders.

Key Features and Benefits

- Market Leadership: World’s #1 CFD provider by volume

- Instrument Variety: 17,000+ markets including weekend trading

- Platform Options: MT4, IG Trading Platform, mobile apps

- Advanced Features: ProRealTime charts, L2 Dealer platform

Pros & Cons

Pros

- Largest CFD market selection globally

- Award-winning platforms and tools

- Excellent educational resources

- Strong regulatory track record

Cons

- Higher minimum deposits

- Complex fee structure

Fees and Spreads

IG operates on a spread-based model with competitive pricing on major instruments. EUR/USD spreads from 0.6 pips, with additional financing charges for overnight positions.

Regulation

FCA (UK) regulation with additional licenses in Australia, Singapore, and other major jurisdictions. Client funds protected by Financial Services Compensation Scheme (FSCS).

Open Your IG Account9. Admirals (formerly Admiral Markets)

Overview

Admirals has been refining their MetaTrader offering since 2001, and it shows. They’re particularly strong for traders who want advanced MetaTrader features without the complexity of multiple platforms.

Key Features and Benefits

- MetaTrader Expertise: Advanced MT4 and MT5 customizations

- Educational Excellence: Comprehensive trading education program

- Platform Enhancements: MetaTrader Supreme Edition add-ons

- Market Access: Forex, stocks, indices, commodities, crypto CFDs

Pros & Cons

Pros

- MetaTrader specialists with 20+ years experience

- Excellent educational resources

- Advanced platform add-ons included

- Strong European regulation

Cons

- Higher spreads on some instruments

- Limited platform variety

Account Types and Minimum Deposit

Trade.MT4 and Trade.MT5 accounts from €100 minimum deposit. Zero.MT4 and Zero.MT5 accounts offer commission-free trading with slightly wider spreads.

Start Trading with Admirals10. FXTM

Overview

FXTM (ForexTime) has built a solid reputation as a global trading provider with a focus on MetaTrader platforms and educational excellence. They’re particularly strong in emerging markets while maintaining European regulatory standards.

Key Features and Benefits

- Platform Suite: MT4, MT5, and mobile applications

- Copy Trading: FXTM Invest social trading platform

- Educational Hub: Comprehensive trading education and market analysis

- Global Reach: Services in 190+ countries

Pros & Cons

Pros

- Strong global presence and reputation

- Comprehensive educational resources

- Multiple account types for different needs

- Competitive pricing on major instruments

Cons

- Limited advanced trading tools

- Higher fees on some account types

Account Types and Minimum Deposit

Standard Account from $10, Advantage Account from $500 with zero spreads and commissions on stock CFDs, ECN Zero from $200 with raw spreads plus commission.

Start Trading with FXTMMetaTrader Broker Comparison

Fee Structure Comparison

| Broker | EUR/USD Spread | Commission | All-in Cost | Min. Deposit |

|---|---|---|---|---|

| Eightcap | 0.0 pips | $3.50/lot | 0.7 pips | $100 |

| Pepperstone | 0.0 pips | $3.50/lot | 0.7 pips | $0 |

| IC Markets | 0.1 pips | $3.50/lot | 0.8 pips | $200 |

| FP Markets | 0.1 pips | $3.00/lot | 0.7 pips | $50 |

| Tickmill | 0.0 pips | $3.00/lot | 0.6 pips | $100 |

Regulation and Compliance Comparison

| Broker | Primary Regulators | Client Protection | Max Leverage |

|---|---|---|---|

| Eightcap | FCA, ASIC, CySEC | FSCS, ASIC Compensation | 30:1 (FCA), 500:1 (Offshore) |

| Pepperstone | ASIC, FCA, CySEC, BaFin | FSCS, ASIC Compensation | 30:1 (FCA), 500:1 (Offshore) |

| IC Markets | ASIC, FSA (Seychelles) | Segregated Accounts | 500:1 |

| FP Markets | ASIC, CySEC | ASIC Compensation | 30:1 (EU), 500:1 (International) |

| Tickmill | FCA, CySEC, FSCA | FSCS, CIF | 30:1 (FCA), 500:1 (Offshore) |

MetaTrader 4 vs MetaTrader 5 for CFD Trading

Key Differences Between MT4 and MT5

This is the million-dollar question every CFD trader faces. MT4 vs MT5—which one should you choose? Here’s the honest truth: both platforms are excellent, but they serve different purposes.

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, Futures, Options |

| Timeframes | 9 timeframes | 21 timeframes |

| Order Types | 4 pending orders | 6 pending orders |

| Technical Indicators | 30 built-in | 38 built-in |

| Programming Language | MQL4 | MQL5 (faster, more advanced) |

| Hedging | Yes | Limited (netting system) |

| Depth of Market | No | Yes |

| Economic Calendar | No | Yes |

Which Platform is Better for CFD Trading?

Choose MT4 if you:

- Focus primarily on forex CFDs

- Prefer the classic, proven interface

- Use hedging strategies

- Want access to more Expert Advisors

- Value simplicity over advanced features

Choose MT5 if you:

- Trade multiple asset classes (stocks, futures, etc.)

- Want more timeframes and order types

- Use advanced algorithmic strategies

- Need the economic calendar integration

- Prefer the netting position system

Advanced Trading Strategies with MetaTrader

Scalping Strategies

Scalping is like being a day trader on steroids—you’re in and out of positions within minutes, sometimes seconds. For scalping to work with CFDs, you need three things: tight spreads, fast execution, and a broker that doesn’t restrict your trading style.

Based on our broker analysis, the best scalping-friendly brokers are:

- IC Markets: No restrictions, institutional-grade execution

- Pepperstone: 0.0 pip spreads, sub-50ms execution

- FP Markets: Raw ECN pricing, cTrader compatibility

Algorithmic Trading Strategies

This is where MetaTrader really shines. Expert Advisors (EAs) can monitor the markets 24/7, execute trades based on your criteria, and remove emotion from your trading decisions. Popular EA strategies for CFD trading include:

- Grid Trading: Places buy/sell orders at predetermined intervals

- Martingale Systems: Doubles position size after losses (high risk)

- Trend Following: Rides momentum using moving averages and breakouts

- Mean Reversion: Exploits price returns to average levels

Managing Risk in CFD Trading on MetaTrader

Setting Stop Losses and Take Profits

This is Trading 101, but I’m amazed how many traders skip this step. Every CFD position should have a stop loss—no exceptions. Here’s how to set them effectively in MetaTrader:

- Fixed Pip Stop: Set stops at predetermined pip distances

- Support/Resistance Stops: Place stops beyond key chart levels

- ATR-Based Stops: Use Average True Range for dynamic stops

- Trailing Stops: Lock in profits as positions move in your favor

Position Sizing and Risk-Reward Ratios

The math is simple: never risk more than 1-2% of your account on a single CFD trade. If you have a $10,000 account, your maximum risk per trade should be $100-200. Use MetaTrader’s position size calculator to determine your lot size based on your stop loss distance.

Security Measures and Data Protection

Protecting Your Trading Account

Your MetaTrader account is only as secure as your weakest link. Here’s your security checklist:

- Two-Factor Authentication: Enable 2FA on your broker account

- Strong Passwords: Use unique, complex passwords for each account

- Regular Updates: Keep MetaTrader and your device updated

- Secure Networks: Avoid public WiFi for trading

- Account Monitoring: Review statements regularly for unauthorized activity

Broker Security Protocols

Reputable brokers implement multiple security layers:

- Segregated Accounts: Client funds held separately from broker’s operational funds

- Encryption: SSL/TLS encryption for all data transmission

- Negative Balance Protection: Cannot lose more than your deposit (in regulated jurisdictions)

- Regular Audits: Independent verification of client fund security

Common Mistakes to Avoid

Ignoring Risk Management

I’ve seen traders blow up $50,000 accounts in a single day because they ignored basic risk management. The CFD market doesn’t care about your mortgage payment or your kid’s college fund. Set your stops, stick to your position sizing rules, and live to trade another day.

Excessive Leverage

Just because your broker offers 500:1 leverage doesn’t mean you should use it. High leverage is like driving a Formula 1 car in city traffic—technically possible, but probably not a good idea. Start with conservative leverage (10:1 or 20:1) and increase gradually as you gain experience.

Chasing Losses

This is the fastest way to turn a small loss into a large one. When you’re down, the temptation to “double down” and recover quickly is overwhelming. Don’t do it. Accept the loss, analyze what went wrong, and move on to the next opportunity.

Future Trends in MetaTrader and CFD Trading

Technological Advancements

The CFD trading landscape is evolving rapidly. Here are the key trends shaping 2025 and beyond:

- AI Integration: Machine learning algorithms for market analysis and trade execution

- Cloud Computing: Browser-based platforms with desktop-level functionality

- Mobile-First Design: Advanced mobile apps with full trading capability

- Social Trading: Copy trading platforms integrated with MetaTrader

- Cryptocurrency CFDs: Expanded crypto offerings as regulation clarifies

Regulatory Changes

According to Finance Magnates’ 2025 CFD Markets Outlook, regulatory pressures are intensifying globally:

- Stricter Marketing Rules: Enhanced disclosure requirements for CFD advertising

- Capital Requirements: Higher capital requirements for CFD providers

- Product Intervention: Potential further restrictions on leverage and marketing

- Consumer Protection: Enhanced negative balance protection and risk warnings

FAQs

- What is the difference between CFDs and traditional trading?

- CFDs are derivatives that track the price of an underlying asset without requiring you to own it. Traditional trading involves buying and selling actual assets. CFDs offer leverage, the ability to go short, and access to global markets with smaller capital requirements.

- What is the minimum deposit required for MetaTrader CFD brokers?

- Minimum deposits vary significantly: Pepperstone ($0), FP Markets ($50), Tickmill ($100), IC Markets ($200). However, for effective CFD trading with proper risk management, consider starting with at least $1,000.

- Is MetaTrader 5 better than MetaTrader 4 for CFD trading?

- MT5 offers more asset classes, timeframes, and advanced features, making it better for multi-asset CFD trading. MT4 remains excellent for forex CFDs and has more Expert Advisors available. Choose based on your specific trading needs.

- How do I manage risk when trading CFDs on MetaTrader?

- Use proper position sizing (1-2% risk per trade), always set stop losses, diversify across different markets, and never risk money you can’t afford to lose. MetaTrader’s risk management tools include stop losses, take profits, and trailing stops.

- Can I trade cryptocurrencies with MetaTrader CFD brokers?

- Yes, most MetaTrader CFD brokers offer cryptocurrency CFDs including Bitcoin, Ethereum, and other major coins. However, crypto CFDs typically have higher spreads and margin requirements compared to traditional forex CFDs.

- Are MetaTrader brokers regulated?

- Reputable MetaTrader brokers are regulated by major financial authorities. Always verify regulation through official regulator websites. Priority regulators include FCA (UK), ASIC (Australia), CySEC (Cyprus), and BaFin (Germany).

- How do I set up a demo account on MetaTrader?

- Most brokers offer free demo accounts. Visit your chosen broker’s website, complete the demo account application, download MetaTrader, and log in using your demo credentials. Demo accounts typically provide $10,000-$100,000 in virtual funds.

- What fees should I expect with MetaTrader brokers?

- Common fees include spreads (0.0-2.0 pips), commissions ($3-7 per lot), overnight financing charges, and potential inactivity fees. Raw/ECN accounts typically offer lower spreads but charge commissions per trade.

- How does leverage work with MetaTrader brokers?

- Leverage allows you to control larger positions with smaller capital. For example, 100:1 leverage means $1,000 can control $100,000 worth of positions. Higher leverage increases both potential profits and losses proportionally.

- Which MetaTrader broker offers the best mobile trading experience?

- Pepperstone, Eightcap, and FP Markets consistently rank highest for mobile trading, offering full-featured MT4/MT5 mobile apps with advanced charting, one-click trading, and comprehensive account management capabilities.

- How do I use Expert Advisors on MetaTrader?

- Download EAs from the MetaTrader Market, MQL5 community, or third-party providers. Install them in your MetaTrader installation folder, restart the platform, drag the EA onto your chart, configure settings, and enable automated trading.

- What are the best MetaTrader brokers for beginners?

- Tickmill, AvaTrade, and Eightcap are excellent for beginners, offering comprehensive educational resources, low minimum deposits, user-friendly platforms, and responsive customer support to help new traders get started.

- What types of assets can I trade with MetaTrader brokers?

- MetaTrader CFD brokers typically offer forex pairs, stock indices, individual stocks, commodities (gold, silver, oil), cryptocurrencies, and bonds. Asset availability varies by broker and your location due to regulatory restrictions.

- How secure is my data on MetaTrader platforms?

- MetaTrader uses advanced encryption protocols, and reputable brokers implement additional security measures including two-factor authentication, segregated accounts, and regular security audits. Always choose regulated brokers for maximum protection.

- Can I use MetaTrader brokers for long-term investing?

- While possible, CFDs are generally designed for short-to-medium term trading due to overnight financing charges. For long-term investing, consider actual stock purchases rather than CFDs to avoid ongoing financing costs.

- How do brokers make money from CFDs?

- Brokers profit through spreads (difference between bid/ask prices), commissions on trades, overnight financing charges, and potentially through acting as market makers. Understanding broker revenue models helps you choose the most cost-effective option.

- Are CFDs legal in all countries?

- No, CFD regulations vary significantly by jurisdiction. CFDs are banned in the United States for retail traders, restricted in Belgium, and heavily regulated in the EU, UK, and Australia. Always check local regulations before trading.

- What are the tax implications of CFD trading?

- CFD profits are typically taxed as capital gains or business income, depending on your jurisdiction and trading frequency. Consult with a qualified tax professional familiar with your local laws for specific guidance on CFD taxation.

- How do I protect myself from CFD trading scams?

- Only trade with regulated brokers, verify licenses through official regulator websites, avoid promises of guaranteed profits, be wary of unsolicited trading advice, and never share your login credentials with third parties.

- What is the difference between a market maker and an ECN broker for CFDs?

- Market makers provide liquidity and may trade against clients, potentially creating conflicts of interest but offering fixed spreads. ECN brokers connect you directly to liquidity providers, offering raw spreads plus commission but with potentially more transparent pricing.

- How often are CFD prices updated on MetaTrader?

- CFD prices are updated in real-time as underlying market prices change. Update frequency depends on market volatility and your broker’s technology infrastructure. Most reputable brokers provide updates within milliseconds of market movements.

- What happens if a CFD broker goes bankrupt?

- Regulated brokers must keep client funds in segregated accounts, separate from their operational funds. In bankruptcy, client funds should be returned to traders. Additional protection may be available through compensation schemes (FSCS, ASIC, etc.).

- Can I hedge my positions when trading CFDs?

- Yes, CFDs allow hedging strategies. You can open opposite positions in the same or correlated instruments to reduce risk. However, consider the costs of maintaining multiple positions and ensure your broker allows hedging strategies.

- Are there any restrictions on CFD trading during major economic events?

- Some brokers may increase margin requirements, widen spreads, or temporarily halt trading during high-impact news events to manage risk. These restrictions are typically temporary and disclosed in the broker’s terms and conditions.

- How do corporate actions affect CFDs on stocks?

- Stock CFDs are typically adjusted for corporate actions like dividends, stock splits, and mergers. Dividend payments are usually credited or debited to your account based on your position direction. Specific treatment varies by broker.

- How do I withdraw funds from a MetaTrader account?

- Log into your broker’s client portal (not MetaTrader directly), navigate to the withdrawal section, select your preferred method (bank transfer, card, e-wallet), enter the amount, and submit your request. Processing times vary by method and broker.

- How does automated trading work on MetaTrader?

- Automated trading uses Expert Advisors (EAs) – programs that monitor markets and execute trades based on predefined criteria. Enable the “AutoTrading” button in MetaTrader, attach an EA to your chart, configure settings, and the EA will trade automatically.

- How do I switch between MetaTrader 4 and MetaTrader 5?

- You’ll need separate accounts for MT4 and MT5 as they’re different platforms. Contact your broker to open an account for the desired platform, download the appropriate MetaTrader version, and transfer funds between accounts if needed.

- What are the risks of CFD trading?

- CFD trading risks include: leverage amplifying losses, market volatility, overnight financing costs, counterparty risk if your broker fails, regulatory changes affecting trading conditions, and the psychological challenges of managing leveraged positions.

- How do I choose between different account types?

- Consider your trading frequency, typical position sizes, and preferred cost structure. Raw/ECN accounts offer tighter spreads but charge commissions, suitable for frequent traders. Standard accounts have wider spreads but no commissions, better for occasional traders.

- What’s the difference between demo and live trading?

- Demo accounts use virtual money and may have different execution speeds, spreads, and psychological pressure compared to live trading. While excellent for learning, demo results don’t guarantee live trading success due to emotional factors and potential execution differences.

Conclusion

Summary of Top MetaTrader CFD Brokers

After extensive research and testing, here are our top picks for 2025:

- Eightcap: Best overall for market variety and competitive pricing

- Pepperstone: Unbeatable for forex CFD trading with institutional-grade execution

- IC Markets: Highest volume, lowest spreads, perfect for professional traders

- FP Markets: Best for cTrader and automated trading strategies

- Tickmill: Ideal for beginners with excellent education and support

Final Thoughts on MetaTrader CFD Trading

CFD trading on MetaTrader platforms offers incredible opportunities, but success requires discipline, proper risk management, and choosing the right broker. Remember, the flashiest marketing doesn’t always equal the best trading conditions.

Here’s my parting advice: Start with a demo account, focus on learning proper risk management before chasing profits, and always trade with regulated brokers. The markets will always be there tomorrow, but your trading capital needs to be protected today.

Ready to start your CFD trading journey?

Choose from our top-rated brokers and begin with a risk-free demo account