Key Takeaways

- SVG FSA registration is not the same as regulation – brokers are registered, not regulated, offering limited client protection

- New 2023 licensing requirements demand all forex companies show valid licenses from other jurisdictions by March 2023

- Top SVG brokers include Deriv, LiteFinance, Alpari, and AMarkets with varying spreads from 0.0 to 3.0 pips

- High leverage up to 1:3000 available but comes with significantly increased risk exposure

- Banking and payment processing remain challenging for unlicensed SVG entities due to global regulatory tightening

Introduction

In the ever-evolving world of forex trading, choosing the right broker can make the difference between profit and loss. Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) has emerged as a popular jurisdiction for forex brokers, particularly those seeking operational flexibility and favorable regulatory conditions.

However, here’s something most traders don’t realize: SVG FSA doesn’t actually regulate forex brokers in the traditional sense. Instead, it registers them. This distinction is crucial and affects everything from client fund protection to dispute resolution mechanisms.

Think of it this way: If FCA regulation is like having a full security system with alarms, cameras, and 24/7 monitoring, SVG FSA registration is more like having your name on a mailbox—it confirms you exist, but doesn’t guarantee much protection.

This comprehensive guide examines the top SVG FSA registered forex brokers for 2025, analyzing their features, trading conditions, and the unique regulatory landscape they operate within. We’ll also explore the recent regulatory changes that have reshaped the SVG forex landscape and what they mean for traders worldwide.

Understanding SVG FSA Regulation

What is the SVG Financial Services Authority?

The Financial Services Authority of St. Vincent and the Grenadines was established by Parliament to regulate, supervise, and develop the non-bank financial services sector in the country. According to their official website, the FSA is responsible for “the administration and enforcement of and ensuring compliance with the FSA Act and other specified enactments, regulations or guidelines.”

However, when it comes to forex brokers, the situation is quite different from what you might expect. According to industry analysis, SVG-based forex brokers that operate as Limited Liability Companies (LLCs) are able to engage in any legal activity, including forex trading and brokerage, without specific licensing requirements.

Important Clarification

Don’t confuse the SVG FSA with the British FCA (Financial Conduct Authority). These are completely different organizations with vastly different regulatory standards and client protection measures.

Understanding the Role of the SVG FSA

The SVG FSA’s primary functions include:

- Regulating and supervising international and non-bank financial entities

- Ensuring compliance with FSA Act and other relevant laws

- Conducting off-site surveillance and on-site examinations

- Enforcing AML/CFT (Anti-Money Laundering/Counter-Financing of Terrorism) regulations

Key Features of SVG FSA Regulation

Advantages

- No specific forex licensing required

- Fast company registration (2-3 weeks)

- No physical presence requirements

- No local directors needed

- Tax advantages for offshore operations

- High leverage options available

Limitations

- Limited client fund protection

- No compensation schemes

- Difficult banking relationships

- Lower regulatory oversight

- Limited dispute resolution mechanisms

- Perception issues among institutional clients

Registration vs. Regulation

Here’s where many traders get confused. According to recent regulatory updates, until January 6th, 2023, FX trading brokerage activities were not subject to licensing in St. Vincent and the Grenadines. However, due to increasing complaints over FX scams and fraud, SVG has implemented stricter requirements.

Critical Update: 2023 Licensing Changes

As of March 10, 2023, all Business Companies (BCs) and Limited Liability Companies (LLCs) engaging in forex activities in SVG must provide a certified copy of their forex license from either SVG or another recognized jurisdiction. Companies failing to comply face sanctions including cancellation of their registration.

Why Choose an SVG FSA-Regulated Forex Broker?

Advantages of Choosing SVG Regulation

Despite the limitations, there are several reasons why traders might consider SVG FSA registered brokers:

High Leverage Opportunities: SVG brokers often offer leverage ratios up to 1:3000, significantly higher than what’s available from FCA or ASIC regulated brokers, which are typically capped at 1:30 for retail clients in Europe and 1:500 in Australia.

Operational Flexibility: The relaxed regulatory environment allows brokers to offer innovative products and services that might not be permitted in more strictly regulated jurisdictions. This includes exotic trading instruments, unique bonus structures, and flexible trading conditions.

Lower Barriers to Entry: For brokers, SVG offers a cost-effective way to establish operations without the extensive capital requirements and operational burdens associated with Tier-1 regulations.

Tax Benefits

Companies registered in SVG and conducting no business within the jurisdiction are exempt from corporate taxation. This can result in significant operational savings for brokers, which may translate to better spreads and trading conditions for clients.

International Market Access

SVG registration allows brokers to serve clients from multiple jurisdictions where Tier-1 regulation isn’t required or where specific licensing isn’t mandated. This includes many emerging markets and regions with developing regulatory frameworks.

Considerations for Traders

Remember: While SVG registration offers certain advantages, it’s crucial to understand that you’re trading with reduced regulatory protection. Always ensure you’re comfortable with the associated risks and consider diversifying your trading across multiple brokers and jurisdictions.

Top SVG FSA Regulated Forex Brokers

Based on our comprehensive analysis of Traders Union’s 2025 rankings and extensive market research, here are the leading SVG FSA registered forex brokers for 2025:

Deriv

Overview of Deriv

Deriv stands out as one of the most established names in the SVG forex space, with Deriv (SVG) LLC (Company No. 273 LLC 2020) incorporated on February 12th, 2019, and registered in Saint Vincent and the Grenadines. According to their regulatory page, the company operates from their registered office at First Floor, SVG Teachers Credit Union Uptown Building, Corner of James and Middle Street, Kingstown P.O., St Vincent and the Grenadines.

What sets Deriv apart is their multi-jurisdictional approach. While their SVG entity serves international clients, they also maintain regulated entities in Malta (MFSA), Labuan (FSA), British Virgin Islands (FSC), Vanuatu (VFSC), and Mauritius (FSC), providing varying levels of regulatory protection depending on client location.

Trading Platforms and Features

Deriv offers several proprietary platforms alongside traditional options:

- Deriv Trader: Proprietary web-based platform for binary options and multipliers

- MT5: Available for forex, indices, and commodities trading

- Deriv X: Advanced platform for CFD trading

- SmartTrader: Enhanced binary options platform

Leverage and Minimum Deposit

According to trader reviews, Deriv’s key strengths include low and stable spreads from inception, exclusive access to synthetic indices like Volatility 75, Boom 500, and Crash 500, plus responsive 24/7 customer support.

Open Your Deriv AccountLiteFinance

Overview of LiteFinance

LiteFinance operates under multiple jurisdictions, with their SVG entity providing services to international clients. The broker has built a reputation for offering competitive trading conditions and comprehensive educational resources. According to Traders Union analysis, LiteFinance currently holds what they classify as Tier-1 regulation across their various entities, indicating high security standards.

Account Types and Leverage

| Account Type | Min Deposit | Leverage | Spread (EUR/USD) | Commission |

|---|---|---|---|---|

| Classic | $50 | 1:1000 | 1.8 pips | None |

| ECN | $500 | 1:1000 | 0.0 pips | $3.50/lot |

| Cent | $10 | 1:1000 | 1.8 pips | None |

Trading Tools and Platforms

LiteFinance offers MetaTrader 4 and 5, plus their proprietary platform with advanced analytical tools. The broker provides access to over 600 CFDs across multiple asset classes, with automatic withdrawal features for amounts up to $100 per day within 24 hours.

Start Trading with LiteFinanceAlpari

Overview of Alpari

Alpari is a well-established name in the forex industry, operating across multiple jurisdictions including SVG. The broker offers a range of account types designed to accommodate different trading styles and experience levels. According to their official fee structure, Alpari provides competitive commission rates and spreads across their various account offerings.

Spreads and Commission Structure

Standard Account

- Minimum deposit: $1

- EUR/USD spread: from 1.7 pips

- Commission: None

- Leverage: up to 1:1000

ECN Account

- Minimum deposit: $300

- EUR/USD spread: from 0.2 pips

- Commission: $2.5 per lot

- Leverage: up to 1:1000

Alpari’s ECN accounts offer particularly competitive conditions for active traders, with spreads starting from 0.2 pips on major currency pairs and a commission of $2.5 per lot (one side).

Open Alpari AccountAMarkets

Overview of AMarkets

AMarkets has established itself as a technology-focused broker offering high-leverage trading and advanced execution speeds. According to comprehensive analysis, the broker provides execution speeds averaging 35-50ms with maximum speeds reaching 100ms, making it attractive for scalping strategies.

High Leverage Options

Maximum Leverage: 1:3000

AMarkets offers one of the highest leverage ratios in the industry at 1:3000 across all account types. While this provides significant profit potential, it also dramatically increases risk exposure. Always use proper risk management when trading with high leverage.

Account Types and Features

| Feature | Standard | Fixed | ECN | Zero |

|---|---|---|---|---|

| Min Deposit | $100 | $100 | $200 | $200 |

| Execution Speed | ~70ms | ~100ms | 30-50ms | 30-50ms |

| EUR/USD Spread | 0.8-1.3 pips | 3.0 pips | 0.2 pips | 0.0 pips |

| Commission | None | None | $2.5/lot | $2.5/lot |

AMarkets provides access to 44 forex pairs, plus stocks, commodities, and 27 major cryptocurrencies through MT4, MT5, and their proprietary AMarkets App.

Start Trading with AMarketsInstaForex

Overview of InstaForex

InstaForex offers a comprehensive trading environment with access to multiple asset classes and innovative services. According to their platform, the broker provides unique services including PAMM accounts and ForexCopy systems that enable investment in professional traders with potential returns up to 1,000% annually.

Platform Features and Offerings

Trading Platforms

- MetaTrader 4

- MetaTrader 5

- WebTrader (3 interface layouts)

- Mobile applications

Special Services

- PAMM account system

- ForexCopy service

- Micro Forex (0.0001% lots)

- Up to 55% deposit bonuses

Leverage and Deposit Requirements

HFM (HotForex)

Overview of HFM

HFM operates through multiple entities globally, with their SVG entity serving international clients. The broker has gained recognition for its comprehensive trading platforms and competitive conditions. Recent promotional materials from 2025 indicate active operations and ongoing client acquisition efforts in various regions.

Trading Platforms and Tools

Available Platforms:

- MetaTrader 4

- MetaTrader 5

- HFM WebTrader

- Mobile apps (iOS/Android)

- Copy trading platform

- Advanced charting tools

2025 Trading Conditions

Based on recent promotional materials, HFM continues to offer competitive spreads and leverage options. The broker regularly runs trading competitions and loyalty programs, with some promotions offering bonuses and rewards throughout 2025.

Open HFM AccountAdditional Notable SVG FSA Brokers

SimpleFX

- Min Deposit: $0

- Leverage: up to 1:500

- Crypto trading available

- WebTrader platform

Land-FX

- Min Deposit: $300

- ECN accounts available

- Dual regulation (FCA/SVG)

- MT4/MT5 platforms

ForexMart

- Min Deposit: $15

- Leverage: up to 1:3000

- Multiple account types

- CySEC + SVG regulation

Features of SVG FSA Brokers

Trading Platforms Offered

SVG FSA registered brokers typically offer a comprehensive range of trading platforms to accommodate different trading styles and preferences:

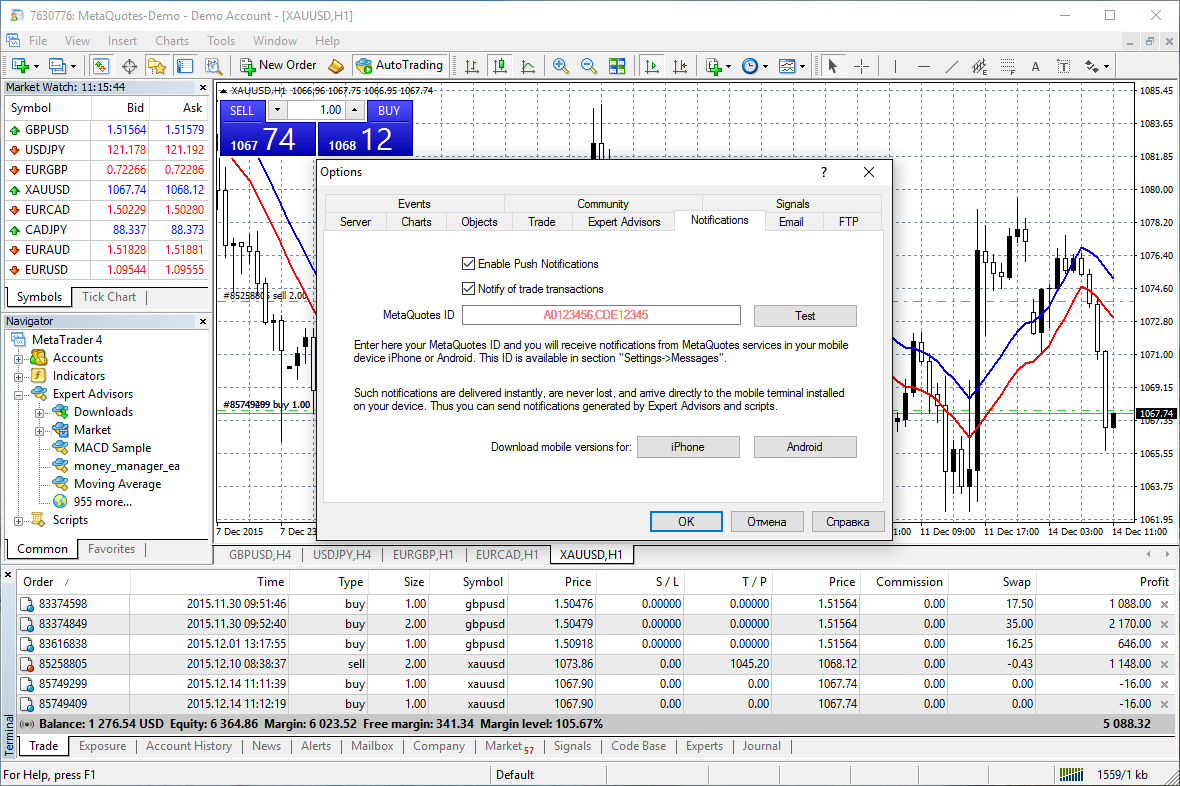

MetaTrader 4

The industry standard for forex trading, offering:

- Advanced charting tools

- Expert Advisors (EAs)

- Custom indicators

- One-click trading

MetaTrader 5

Enhanced platform with additional features:

- Multi-asset trading

- Advanced order types

- Economic calendar

- Market depth display

cTrader

Professional ECN platform featuring:

- Level II pricing

- Advanced charting

- Algorithmic trading

- Risk management tools

Leverage Options

One of the most significant advantages of SVG FSA brokers is their ability to offer high leverage ratios. Here’s a comprehensive comparison:

High Leverage Warning

While high leverage can amplify profits, it also dramatically increases the risk of significant losses. With 1:3000 leverage, a 0.03% adverse move can wipe out your entire account. Always use proper risk management and never risk more than you can afford to lose.

Spreads and Commissions

| Broker | EUR/USD Spread | GBP/USD Spread | Commission (ECN) | Account Type |

|---|---|---|---|---|

| Deriv | 0.5 pips | 0.8 pips | N/A | Standard |

| LiteFinance | 0.0 pips | 0.1 pips | $3.50/lot | ECN |

| Alpari | 0.2 pips | 0.4 pips | $2.50/lot | ECN |

| AMarkets | 0.2 pips | 0.4 pips | $2.50/lot | ECN |

| InstaForex | 3.0 pips | 3.5 pips | N/A | Standard |

| ForexMart | 1.2 pips | 1.8 pips | N/A | Standard |

How to Choose the Best SVG FSA Forex Broker

Key Factors to Consider

Selecting the right SVG FSA broker requires careful evaluation of multiple factors. Here’s our comprehensive framework:

The 5-Point SVG Broker Evaluation Framework

1. Multi-Jurisdiction Regulation

Look for brokers with additional licenses from FCA, ASIC, CySEC, or other Tier-1 regulators.

2. Trading Conditions

Compare spreads, commissions, execution speed, and available leverage across account types.

3. Platform Technology

Evaluate platform stability, features, mobile access, and automation capabilities.

4. Fund Security

Assess fund segregation policies, bank relationships, and withdrawal procedures.

5. Operational Track Record

Research company history, client reviews, and any regulatory actions or warnings.

Due Diligence for Traders

Verification Steps

- Check Registration Status: Verify the broker’s registration with SVG FSA through their official registry

- Confirm Additional Licenses: Look up any claimed Tier-1 regulations on respective regulator websites

- Review Financial Statements: If available, examine audited financial reports for solvency indicators

- Test Customer Support: Contact support with technical questions to assess responsiveness and expertise

- Demo Account Testing: Use demo accounts to evaluate platform performance, execution quality, and features

Red Flags to Watch

🚨 Warning Signs

- Promises of guaranteed returns or unrealistic profit claims

- Pressure tactics for large initial deposits

- Unclear or hidden fee structures

- No demo account availability

- Poor online reviews or regulatory warnings

- Difficulty contacting customer support

- Withdrawal delays or complications

Security and Risks with SVG FSA Brokers

Understanding the Risks of Offshore Regulation

Trading with SVG FSA registered brokers involves specific risks that differ significantly from those associated with Tier-1 regulated entities. Understanding these risks is crucial for making informed decisions about your trading capital.

Regulatory Standards Comparison

| Feature | FCA (UK) | ASIC (AU) | CySEC (CY) | SVG FSA |

|---|---|---|---|---|

| Capital Requirements | £750,000+ | AUD 1M+ | €730,000+ | Minimal |

| Client Fund Segregation | Mandatory | Mandatory | Mandatory | Voluntary |

| Compensation Scheme | £85,000 | AUD 20,000 | €20,000 | None |

| Leverage Limits | 1:30 (retail) | 1:500 | 1:30 (retail) | 1:3000+ |

| Regular Audits | Yes | Yes | Yes | Limited |

Client Protection Measures

The level of client protection varies significantly between jurisdictions. Here’s what you need to know:

Limited Protection with SVG

- No mandatory client fund segregation

- No compensation scheme coverage

- Limited regulatory oversight

- Fewer dispute resolution options

- Variable enforcement capabilities

Enhanced Protection Strategies

- Choose multi-regulated brokers

- Verify fund segregation policies

- Start with smaller deposits

- Monitor withdrawal processing

- Diversify across brokers/jurisdictions

Protecting Your Funds

Best Practices for Fund Security

🛡️ Fund Protection Checklist

- Verify segregated account policies

- Check bank relationships and locations

- Review withdrawal policies and limits

- Test small withdrawals first

- Monitor account statements regularly

- Keep records of all transactions

- Maintain multiple broker relationships

- Never deposit more than you can afford to lose

Legal and Operational Framework

Key Requirements for SVG Forex Brokers

The operational framework for SVG FSA registered brokers has evolved significantly, particularly following the 2023 regulatory updates. According to recent compliance analysis, several key requirements now govern forex operations in the jurisdiction.

AML/CFT Compliance

All SVG FSA entities must now implement comprehensive Anti-Money Laundering and Counter-Financing of Terrorism measures:

Required AML/CFT Procedures

- Customer Due Diligence (CDD): Identity verification on a risk-sensitive basis

- Enhanced Due Diligence: For high-risk customers and PEPs

- Transaction Monitoring: Ongoing surveillance for unusual patterns

- Record Keeping: Maintain detailed transaction records for auditing

- PEP Screening: Political Exposed Persons identification

- Sanctions Checking: Against international sanctions lists

- Suspicious Activity Reports: Filing SARs when required

- Staff Training: Regular AML/CFT awareness programs

Regulatory Updates and Changes

2023 Directive Impact

The March 2023 licensing directive has fundamentally changed the SVG forex landscape. Key changes include:

Mandatory Licensing Requirements

- All Business Companies (BCs) and LLCs engaging in forex must provide certified copies of valid forex licenses

- Licenses can be from SVG or other recognized jurisdictions

- Existing operators had until March 10, 2023 to comply

- Non-compliance results in sanctions including company cancellation

Future Outlook

The regulatory environment in SVG continues to evolve. Based on current trends and industry analysis, we can expect:

- Continued tightening of requirements for unlicensed entities

- Enhanced cooperation with international regulatory bodies

- Stricter AML/CFT enforcement and monitoring

- Potential introduction of formal forex licensing framework

- Greater scrutiny of banking relationships and payment processing

Alternative Jurisdictions

Comparable Offshore Centers

While SVG remains popular, several other jurisdictions offer similar regulatory environments for forex brokers:

Seychelles FSA

- Securities dealer license required

- €50,000 minimum capital

- More structured regulatory framework

- Regular reporting requirements

Vanuatu VFSC

- Securities dealers license

- AUD 50,000 capital requirement

- Established regulatory framework

- Client compensation fund

Mauritius FSC

- Investment dealer license

- Higher capital requirements

- Comprehensive regulatory oversight

- Better banking relationships

Frequently Asked Questions

- Is it safe to trade with SVG FSA-regulated brokers?

- SVG FSA brokers are registered rather than regulated in the traditional sense, which means reduced client protection compared to FCA or ASIC regulated brokers. Safety depends on the individual broker’s practices, additional regulations they hold, and their operational track record. Always conduct thorough due diligence.

- What does “registered broker” mean in SVG FSA regulation?

- Registration with SVG FSA means the company is legally incorporated and registered to operate in Saint Vincent and the Grenadines. However, this doesn’t provide the same level of regulatory oversight, client protection, or compensation schemes found with Tier-1 regulators like FCA or ASIC.

- Can I trust offshore forex brokers?

- Trust in offshore brokers depends on multiple factors including additional regulations they hold, operational history, fund segregation practices, and transparency. Many reputable brokers operate offshore entities while maintaining higher-tier regulations elsewhere. Research thoroughly and start with smaller deposits.

- Are SVG FSA brokers suitable for beginners?

- Beginners may face higher risks with SVG-only regulated brokers due to reduced client protection. New traders should consider brokers with additional Tier-1 regulations, comprehensive educational resources, and demo account access. The high leverage available can be dangerous for inexperienced traders.

- How do I check if a broker is regulated by SVG FSA?

- You can verify SVG FSA registration through their official website or by contacting the authority directly. However, remember that registration doesn’t equal regulation. Also check if the broker holds additional licenses from FCA, ASIC, CySEC, or other reputable regulators.

- Can I open a demo account with an SVG FSA broker?

- Most SVG FSA brokers offer demo accounts to test their platforms and trading conditions. This is essential for evaluating execution quality, platform features, and customer service before committing real funds. Always test thoroughly on demo before live trading.

- What is the minimum deposit required by SVG FSA brokers?

- Minimum deposits vary significantly among SVG brokers. Examples include: Deriv ($5), InstaForex ($10), ForexMart ($15), LiteFinance ($50), and AMarkets ($100). Lower minimums can be attractive but don’t compromise on broker quality for lower entry costs.

- What is the maximum leverage offered by SVG FSA brokers?

- SVG brokers often offer very high leverage, with some providing up to 1:3000 (AMarkets, ForexMart) or 1:1000 (Deriv, LiteFinance, Alpari). While this amplifies profit potential, it also dramatically increases risk. Use high leverage cautiously and implement strict risk management.

- Are there any tax advantages to trading with an SVG FSA broker?

- SVG companies conducting no business within the jurisdiction may be exempt from corporate taxation. However, tax obligations depend on your country of residence and local tax laws. Consult a tax advisor for guidance on reporting trading profits and losses in your jurisdiction.

- How do I file a complaint against an SVG FSA broker?

- Complaints can be filed with the SVG FSA directly through their official website. However, dispute resolution options are more limited compared to Tier-1 regulators. Some brokers may be members of external dispute resolution services like the Financial Commission.

- Can I trade cryptocurrencies with SVG FSA-regulated brokers?

- Many SVG brokers offer cryptocurrency CFDs and some support actual cryptocurrency trading. Examples include Deriv (crypto indices), AMarkets (27 major cryptocurrencies), and others. Check specific broker offerings and ensure you understand the risks of crypto trading.

- Which trading platforms are available with SVG FSA-regulated brokers?

- Most SVG brokers offer MetaTrader 4 and 5, with some providing additional platforms like cTrader, proprietary webtraders, and mobile applications. Platform availability varies by broker, so verify your preferred platform is supported before opening an account.

- Can SVG brokers accept clients globally?

- SVG brokers can generally accept international clients, but many restrict certain jurisdictions (particularly the US, UK, and EU) due to local regulations. Always verify your country is accepted before attempting to open an account.

- How safe are client funds with SVG brokers?

- Client fund safety varies significantly among SVG brokers. Unlike Tier-1 regulated brokers, fund segregation isn’t mandatory. Look for brokers that voluntarily segregate funds, maintain relationships with reputable banks, and provide transparent financial reporting.

- What happens if an SVG broker becomes insolvent?

- SVG doesn’t provide compensation schemes like FCA (£85,000) or ASIC (AUD 20,000). If an SVG-only broker becomes insolvent, recovery of client funds depends on the broker’s fund segregation practices and legal proceedings. This is why many traders prefer multi-regulated brokers.

- Are SVG brokers required to maintain capital requirements?

- SVG doesn’t impose significant capital requirements for forex brokers compared to major regulators. This lower barrier to entry can mean some brokers operate with minimal capital reserves, potentially affecting their ability to meet client obligations during stress periods.

- Do SVG FSA brokers offer negative balance protection?

- Many SVG brokers do offer negative balance protection to prevent clients from losing more than their account balance. However, this isn’t mandated by regulation, so verify this feature is available before trading, especially when using high leverage.

- Can I use Expert Advisors (EAs) with SVG FSA brokers?

- Most SVG brokers support Expert Advisors on MetaTrader platforms, with some offering unlimited EA usage. However, some brokers may have restrictions on certain types of high-frequency trading or scalping EAs. Check the broker’s terms and conditions regarding automated trading.

- What is the typical withdrawal processing time for SVG brokers?

- Withdrawal times vary by broker and payment method. Some like LiteFinance offer automatic withdrawals up to $100 within 24 hours. Generally, expect 1-5 business days for most withdrawal methods, though this can be longer during peak periods or for larger amounts.

- Do SVG FSA brokers charge withdrawal fees?

- Withdrawal fee policies vary significantly. Some brokers like FxPro advertise zero withdrawal fees, while others may charge fixed fees or percentages depending on the withdrawal method. Always check the fee schedule before opening an account.

- Can I hedge positions with SVG FSA brokers?

- Most SVG brokers allow hedging (holding both long and short positions on the same instrument simultaneously). Some offer reduced margin requirements for hedged positions (like AMarkets at 50%). Verify hedging policies as they can vary between brokers.

- What is the difference between Market Execution and Instant Execution?

- Market Execution sends your order to the market at the current price, which may differ from the displayed price due to market movement (slippage possible). Instant Execution attempts to fill at the requested price but may reject the order if the price has moved. Most SVG brokers use Market Execution.

- Are there any restrictions on trading strategies with SVG brokers?

- Trading strategy restrictions vary by broker. Some may prohibit or limit scalping, high-frequency trading, or certain arbitrage strategies. News trading restrictions are also common during high-impact economic releases. Always review the broker’s terms of service.

- Can I transfer funds between trading accounts with the same SVG broker?

- Most SVG brokers allow internal transfers between different account types (Standard, ECN, etc.) or between demo and live accounts. This is typically instant and free, making it convenient for traders using multiple strategies or testing different account types.

- What happens to my trades during market gaps or weekends?

- SVG brokers typically handle weekend gaps similarly to other brokers – positions may open at significantly different prices on Sunday/Monday when markets reopen. Some brokers offer gap protection or limit gap exposure, but this varies by broker and instrument.

- Do SVG FSA brokers provide educational resources?

- Educational resource quality varies widely among SVG brokers. Some like InstaForex and LiteFinance offer comprehensive educational programs, webinars, and market analysis. Others may provide basic resources. Consider educational support as a factor when choosing a broker, especially if you’re a beginner.

- Can I participate in trading competitions with SVG brokers?

- Many SVG brokers regularly host trading competitions with cash prizes, bonuses, or other incentives. HFM, InstaForex, and others frequently run promotional contests. These can be good for practice but remember they often encourage higher risk-taking than normal trading.

- What should I do if I experience technical issues with an SVG broker’s platform?

- Contact the broker’s technical support immediately. Document the issue with screenshots if possible. Most reputable SVG brokers offer 24/7 support through multiple channels (chat, email, phone). Consider having backup broker accounts for continuity during technical problems.

- Are there any limitations on deposit methods with SVG brokers?

- Deposit method availability varies by broker and your location. Common options include bank transfers, credit/debit cards, e-wallets (Skrill, Neteller), and some accept cryptocurrencies. Some methods may have fees or minimum amounts, so check before choosing your funding method.

- How do I calculate position sizes and risk when using high leverage with SVG brokers?

- With high leverage, position sizing becomes critical. Use the formula: Position Size = (Risk Amount ÷ Stop Loss in Pips) ÷ Pip Value. Never risk more than 1-2% of your account per trade, regardless of available leverage. Many brokers provide position size calculators to help with this.

- Can I trade during major news events with SVG brokers?

- Most SVG brokers allow news trading, but may implement temporary restrictions during high-impact events to manage risk. Some may increase margin requirements or spreads during volatile periods. Check your broker’s policy on news trading and be aware of potential execution issues during extreme volatility.

Conclusion

Key Takeaways on SVG FSA Brokers

As we’ve explored throughout this comprehensive guide, SVG FSA registered forex brokers occupy a unique position in the global trading landscape. They offer distinct advantages such as high leverage, operational flexibility, and lower barriers to entry, while simultaneously presenting certain risks due to the lighter regulatory framework.

Benefits of SVG FSA Brokers

- High leverage options up to 1:3000

- Competitive spreads and trading conditions

- Wide range of trading platforms (MT4, MT5, proprietary)

- Lower minimum deposit requirements

- Access to unique instruments like synthetic indices

- Operational flexibility for innovative products

Risks to Be Aware Of

- Limited regulatory oversight and client protection

- No compensation scheme coverage

- Potential challenges with fund segregation

- Banking and withdrawal complications

- Higher risk of operational issues

- Limited dispute resolution mechanisms

Final Recommendations

Based on our analysis of the top SVG FSA brokers for 2025, here are our key recommendations:

💡 Smart Trading with SVG Brokers

1. Choose Multi-Regulated Brokers: Prioritize brokers like Deriv, LiteFinance, and others that maintain additional licenses from FCA, ASIC, or CySEC. This provides an extra layer of protection and operational standards.

2. Start Small and Scale Gradually: Begin with modest deposits to test withdrawal processes, platform performance, and customer service quality. Scale up only after establishing trust and comfort with the broker.

3. Implement Strict Risk Management: The high leverage available with SVG brokers can be dangerous. Never risk more than 1-2% of your account per trade, regardless of available leverage ratios.

4. Diversify Your Broker Relationships: Don’t put all your trading capital with a single SVG broker. Maintain accounts with brokers in different jurisdictions to spread risk.

5. Stay Informed About Regulatory Changes: The SVG regulatory landscape continues to evolve. Keep updated on changes that might affect your broker’s operations or your trading conditions.

Future Outlook

The forex brokerage landscape continues to evolve rapidly, with regulatory changes, technological advances, and shifting market dynamics all playing significant roles. For SVG FSA brokers, we anticipate:

- Increased Regulatory Scrutiny: Following the 2023 licensing requirements, expect continued tightening of oversight and compliance requirements

- Technology Integration: Greater adoption of AI-powered trading tools, advanced analytics, and blockchain-based solutions

- Market Consolidation: Smaller, under-capitalized brokers may struggle with increased compliance costs, leading to market consolidation

- Enhanced Client Protection: Pressure from international bodies may drive improvements in client fund protection and operational standards

- Payment Processing Evolution: Development of new payment solutions to address banking challenges faced by offshore brokers

Remember, successful forex trading isn’t just about finding the right broker—it’s about developing sound trading strategies, implementing proper risk management, and maintaining realistic expectations about market returns.

Ready to Start Trading?

Choose from our top-rated SVG FSA brokers and begin your trading journey with confidence.

Disclaimer: Trading forex and CFDs involves significant risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Regulatory Notice: This article is for informational purposes only and does not constitute investment advice. Always verify a broker’s regulatory status independently and ensure they are authorized to provide services in your jurisdiction before opening an account.